Professional Documents

Culture Documents

SPDR Barclays Capital Short Term Corporate Bond ETF 1-3Y

Uploaded by

Roberto Perez0 ratings0% found this document useful (0 votes)

60 views2 pagesSPDR Barclays Capital Short Term Corporate Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the 1-3 Year Corporate Bond Index. The Index includes publicly issued u.s. Dollar denominated corporate issues with a remaining maturity of greater than or equal to 1 year and less than 3 years. The Index is market capitalization weighted and the securities in The Index are updated on the last business day of each month.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSPDR Barclays Capital Short Term Corporate Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the 1-3 Year Corporate Bond Index. The Index includes publicly issued u.s. Dollar denominated corporate issues with a remaining maturity of greater than or equal to 1 year and less than 3 years. The Index is market capitalization weighted and the securities in The Index are updated on the last business day of each month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views2 pagesSPDR Barclays Capital Short Term Corporate Bond ETF 1-3Y

Uploaded by

Roberto PerezSPDR Barclays Capital Short Term Corporate Bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the 1-3 Year Corporate Bond Index. The Index includes publicly issued u.s. Dollar denominated corporate issues with a remaining maturity of greater than or equal to 1 year and less than 3 years. The Index is market capitalization weighted and the securities in The Index are updated on the last business day of each month.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

SCPB

SPDR

Barclays Capital Short

Term Corporate Bond ETF As of 09/30/2011

INDEX TICKER

LF99TRUU

INTRADAY NAV TICKER

SCPBIV

KEY FEATURES

Tax-efficient*

Liquidity

Low turnover

Low cost

FUND INCEPTION DATE

12/16/2009

OBJECTIVE

The SPDR Barclays Capital Short Term Corporate Bond

ETF seeks to provide investment results that, before fees

and expenses, correspond generally to the price and

yield performance of the Barclays Capital U.S. 1-3 Year

Corporate Bond Index. Our apporach is designed to

provide portfolios with low portfolio turnover, accurate

tracking, and lower costs.

Ordinary brokerage commissions may apply.

ABOUT THIS BENCHMARK

The Barclays Capital U.S. 1-3 Year Corporate Bond Index is

designed to measure the performance of the short term

U.S. corporate bond market. The Index includes publicly

issued U.S. dollar denominated corporate issues that have

a remaining maturity of greater than or equal to 1 year and

less than 3 years, are rated investment grade (must be

Baa3/BBB- or higher using the middle rating of Moody's

Investor Service, Inc., Standard & Poor's, and Fitch

Rating), and have $250 million or more of outstanding

face value. In addition, the securities must be Securities

and Exchange Commission ("SEC") registered, denomi-

nated in U.S. dollars, fixed rate and non-convertible. The

Index includes only corporate sectors. The corporate

sectors are Industrial, Utility, and Financial Institutions,

which include both U.S. and non-U.S. corporations. The

following instruments are excluded from the Index:

structured notes with embedded swaps or other special

features; private placements; floating rate securities; and

Eurobonds. The Index is market capitalization weighted

and the securities in the Index are updated on the last

business day of each month.

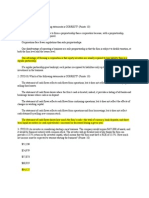

PERFORMANCE

FUND BEFORE TAXES FUND AFTER TAXES

TOTAL RETURN INDEX (%) MARKET VALUE (%) NAV (%) PRE-LIQUIDATION (%) POST-LIQUIDATION (%)

QTD -0.43 -0.33 -0.56 -0.71 -0.36

YTD 1.30 1.27 0.96 0.56 0.63

ANNUALIZED

1 YEAR 1.54 1.50 1.13 0.46 0.74

3 YEAR 7.20 N/A N/A N/A N/A

5 YEAR 5.03 N/A N/A N/A N/A

SINCE FUND INCEPTION 3.09 2.40 2.12 1.47 1.43

(%)

GROSS EXPENSE RATIO 0.1245

Unless otherwise noted all information contained herein is that of the SPDR Barclays Capital Short Term Corporate Bond ETF.

In general, ETFs can be expected to move up or down in value with the value of the applicable index. Although ETF shares may be bought and sold on

the exchange through any brokerage account, ETF shares are not individually redeemable from the Fund. Investors may acquire ETFs and tender them

for redemption through the Fund in Creation Unit Aggregations only. Please see the prospectus for more details.

*Passive management and the creation/redemption process can help minimize capital gains distributions.

After-tax returns are calculated based on NAV using the historical highest individual federal marginal income tax rates and do not reflect the impact of

state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown are

not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

These investments may have difficulty in liquidating an investment position without taking a significant discount from current market value, which can

be a significant problem with certain lightly traded securities.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

Distributor: State Street Global Markets, LLC, member FINRA, SIPC, a wholly owned subsidiary of State Street Corporation. References to State Street

may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus

or summary prospectus which contains this and other information, call 1-866-787-2257 or visit www.spdrs.com.

Read it carefully.

Bond funds contain interest rate risk (as interest rates rise bond prices usually fall); the risk of issuer default; and infation risk.

Non-diversifed funds that focus on a relatively small number of stocks/issuers tend to be more volatile than diversifed funds

and the market as a whole.

"SPDR" is a registered trademark of Standard & Poor's Financial Services LLC ("S&P") and has been licensed for use by State Street Corporation.

STANDARD & POOR'S, S&P, S&P 500 and S&P MIDCAP 400 are registered trademarks of Standard & Poor's Financial Services LLC. No financial

product offered by State Street Corporation or its affiliates is sponsored, endorsed, sold or promoted by S&P or its affiliates, and S&P and its affiliates

make no representation, warranty or condition regarding the advisability of buying, selling or holding units/shares in such products. Further limitations

and important information that could affect investors' rights are described in the prospectus for the applicable product.

Definitions: Pre-liquidation represents returns after taxes on distributions, assuming shares were not sold. Post-liquidation represents the return

after taxes on distributions and the sale of fund shares. Market Value is determined by the midpoint between the bid/offer prices as of the closing

time of the New York Stock Exchange (typically 4:00PM EST) on business days. NAV is the market value of a mutual fund's and ETFs total assets,

minus liabilities, divided by the number of shares outstanding. Intraday NAV is calculated and published throughout the trading day. It is based on the

last trade price of each holding listed in the basket used for creation and redemption including estimated cash amounts. This value is used to provide an

intraday relationship between the basket of securities representing the ETF and the market price of the ETF. Index Average Yield to Worst (YTW): A

portfolio weighted average of the lowest Internal Rate of Return based on a calculation of yield to call for all possible call dates and the yield to maturity.

Real Adjusted Duration - A measure of the percentage price change of an inflation linked security associated with a change in real interest rates. 30

Day SEC Yield (Standardized Yield) - An annualized yield that is calculated by dividing the investment income earned by the fund less expenses over

the most recent 30-day period by the current maximum offering price.

Date of First Use: October 2011

Expiration Date: 01/20/2012

20111013/15:15

SPDR

Barclays Capital Short Term Corporate Bond ETF As of 09/30/2011

CHARACTERISTICS

30 DAY SEC YIELD 1.68%

INDEX AVERAGE YIELD TO WORST 2.11%

MODIFIED OPTION-ADJUSTED DURATION 1.84

NUMBER OF HOLDINGS 510

KEY FACTS

BLOOMBERG SPDR

TICKER SYMBOL SCPB

CUSIP 78464A474

PRIMARY BENCHMARK

Barclays Capital U.S. 1-3 Year

Corporate Bond Index

INVESTMENT MANAGER SSgA Funds Management, Inc.

DISTRIBUTOR State Street Global Markets, LLC

TOP SECTORS (%)

CORPORATE - INDUSTRIAL 49.42

CORPORATE - FINANCE 43.38

CORPORATE - UTILITY 6.58

CASH 0.61

TOP HOLDINGS COUPON MATURITY DATE FUND WEIGHT (%)

GENERAL ELEC CAP CORP 4.8 05/01/2013 1.07

CITIGROUP INC 6.5 08/19/2013 0.91

CREDIT SUISSE NEW YORK 5 05/15/2013 0.84

GOLDMAN SACHS GROUP INC 5.25 10/15/2013 0.81

GENERAL ELECTRIC CO 5 02/01/2013 0.79

WELLS FARGO & COMPANY 5.25 10/23/2012 0.73

CITIGROUP INC 5.5 04/11/2013 0.72

CELLCO PART/VERI WIRELSS 7.375 11/15/2013 0.69

GENERAL ELEC CAP CORP 2.8 01/08/2013 0.68

JPMORGAN CHASE & CO 5.375 10/01/2012 0.66

SCPB

You might also like

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezNo ratings yet

- Ishares JPMorgan USD Emerging Markets Bond FundDocument2 pagesIshares JPMorgan USD Emerging Markets Bond FundRoberto PerezNo ratings yet

- Amundi Etf Global Emerging Bond Markit IboxxDocument3 pagesAmundi Etf Global Emerging Bond Markit IboxxRoberto PerezNo ratings yet

- Ishares Iboxx $ Investment Grade Corporate Bond FundDocument2 pagesIshares Iboxx $ Investment Grade Corporate Bond FundRoberto PerezNo ratings yet

- Amundi Etf Euro InflationDocument3 pagesAmundi Etf Euro InflationRoberto PerezNo ratings yet

- Amundi Etf Euro CorporatesDocument3 pagesAmundi Etf Euro CorporatesRoberto PerezNo ratings yet

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezNo ratings yet

- Ishares Iboxx $ High Yield Corporate Bond FundDocument2 pagesIshares Iboxx $ High Yield Corporate Bond FundRoberto PerezNo ratings yet

- Vanguard Long-Term Government Bond ETF 10+Document2 pagesVanguard Long-Term Government Bond ETF 10+Roberto PerezNo ratings yet

- SPDRDocument268 pagesSPDRRoberto PerezNo ratings yet

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezNo ratings yet

- Vanguard Intermediate-Term Government Bond 3-10YDocument2 pagesVanguard Intermediate-Term Government Bond 3-10YRoberto PerezNo ratings yet

- Vanguard Short-Term Government Bond ETF 1-3YDocument2 pagesVanguard Short-Term Government Bond ETF 1-3YRoberto PerezNo ratings yet

- Product Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ADocument1 pageProduct Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ARoberto PerezNo ratings yet

- SPDR ETF Fixed Income Characteristics Guide 10.31.2011Document5 pagesSPDR ETF Fixed Income Characteristics Guide 10.31.2011Roberto PerezNo ratings yet

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezNo ratings yet

- SPDR Barclays Capital Intermediate Term Treasury ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Treasury ETF 1-10YRoberto PerezNo ratings yet

- Ishares Barclays 10-20 Year Treasury Bond FundDocument0 pagesIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezNo ratings yet

- SPDR Barclays Capital High Yield Bond ETF (JNK)Document2 pagesSPDR Barclays Capital High Yield Bond ETF (JNK)Roberto PerezNo ratings yet

- Vanguard Short-Term Corporate Bond ETF 1-5YDocument2 pagesVanguard Short-Term Corporate Bond ETF 1-5YRoberto PerezNo ratings yet

- Ishares Barclays 1-3 Year Treasury Bond FundDocument0 pagesIshares Barclays 1-3 Year Treasury Bond FundRoberto PerezNo ratings yet

- Vanguard Intermediate-Term Corporate Bond ETF 5-10YDocument2 pagesVanguard Intermediate-Term Corporate Bond ETF 5-10YRoberto PerezNo ratings yet

- SPDR Barclays Capital Long Term Corporate Bond ETF 10+YDocument2 pagesSPDR Barclays Capital Long Term Corporate Bond ETF 10+YRoberto PerezNo ratings yet

- Lyxor ETF Iboxx Liquid High Yield 30Document2 pagesLyxor ETF Iboxx Liquid High Yield 30Roberto PerezNo ratings yet

- Vanguard Long-Term Corporate Bond ETF 10+Document2 pagesVanguard Long-Term Corporate Bond ETF 10+Roberto PerezNo ratings yet

- SPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YRoberto PerezNo ratings yet

- Ishares Barclays 3-7 Year Treasury Bond FundDocument0 pagesIshares Barclays 3-7 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 7-10 Year Treasury Bond FundDocument0 pagesIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 20+ Year Treasury Bond FundDocument0 pagesIshares Barclays 20+ Year Treasury Bond FundRoberto PerezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Additional Exam FM QuestionsDocument36 pagesAdditional Exam FM QuestionsDanial FahimNo ratings yet

- Financial Mathematics Specimen ExamDocument7 pagesFinancial Mathematics Specimen ExamRishi KumarNo ratings yet

- Financial Management Solved MCQs (500Document60 pagesFinancial Management Solved MCQs (500Muzaffar IqbalNo ratings yet

- Moly Corp Valuation Study CaseDocument18 pagesMoly Corp Valuation Study CaseRafael Belo100% (4)

- Granzo DLL Genmathmath11 Week6Document7 pagesGranzo DLL Genmathmath11 Week6KIMBERLYN GRANZONo ratings yet

- Sample Questions Midterm 1213Document18 pagesSample Questions Midterm 1213Mei-e Loh0% (1)

- UBS Wealth Insights 2013 E2B Booklet FinalDocument21 pagesUBS Wealth Insights 2013 E2B Booklet FinalGuozheng ChinNo ratings yet

- Chapter 17Document14 pagesChapter 17TruyenLeNo ratings yet

- CEFA BrochureDocument33 pagesCEFA BrochureJohnNo ratings yet

- Answers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalDocument220 pagesAnswers: L1CF-TBB207-1412 - Medium Lesson 2: Costs of The Different Sources of CapitalJoel Christian MascariñaNo ratings yet

- Portfolio Management and Invesrment AnalysisDocument3 pagesPortfolio Management and Invesrment AnalysisGyan PokhrelNo ratings yet

- Ten Year Treasury YieldsDocument1 pageTen Year Treasury YieldsCLORIS4No ratings yet

- Investment Assignment - A1Document17 pagesInvestment Assignment - A1Joyin OyeludeNo ratings yet

- Question Paper Security Analysis (MB331F): July 2008Document16 pagesQuestion Paper Security Analysis (MB331F): July 2008Jatin GoyalNo ratings yet

- Exam Focused Revision Notes May 2009: Strategic Level CimaDocument84 pagesExam Focused Revision Notes May 2009: Strategic Level Cimamk59030100% (1)

- 2021 CFA LII Mock Exam 2 - AM Session Maria Cadler Case StudyDocument35 pages2021 CFA LII Mock Exam 2 - AM Session Maria Cadler Case StudyMUHAMMAD SAFWAN AHMAD MUSLIMNo ratings yet

- Ch17 Bond Yields and Prices Ch18 Bonds - Analysis and StrategyDocument47 pagesCh17 Bond Yields and Prices Ch18 Bonds - Analysis and StrategyCikini MentengNo ratings yet

- Luxembourg Holdco More Tax Fraud by KPMGDocument37 pagesLuxembourg Holdco More Tax Fraud by KPMGkpmgtaxshelter_kpmg tax shelter-kpmg tax shelterNo ratings yet

- INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFDocument4 pagesINVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT 17th Dec, 2020 PDFVidushi ThapliyalNo ratings yet

- Finance Cheat SheetDocument2 pagesFinance Cheat SheetMarc MNo ratings yet

- Bond and Equity ValuationDocument18 pagesBond and Equity Valuationclassmate0% (1)

- SIP Report On Equity ResearchDocument56 pagesSIP Report On Equity ResearchAkshay Gour57% (7)

- Convertible Securities An Investors Guide. 2nd Edition October 2001 Jeremy Howard Michael O ConnorDocument79 pagesConvertible Securities An Investors Guide. 2nd Edition October 2001 Jeremy Howard Michael O ConnorMax MustermannNo ratings yet

- Valuing Bonds: Principles of Corporate FinanceDocument46 pagesValuing Bonds: Principles of Corporate Financesachin199021No ratings yet

- AI and Financial MarketsDocument232 pagesAI and Financial MarketsPriscilla Philip WilliamNo ratings yet

- Kieso IFRS TestBank Ch14Document39 pagesKieso IFRS TestBank Ch14Ivern Bautista100% (1)

- HSBC Repacks Issuer ServicesDocument5 pagesHSBC Repacks Issuer ServicesDavid CartellaNo ratings yet

- Fi515 Test 2Document4 pagesFi515 Test 2joannapsmith33No ratings yet

- Shophouse: Singapore'S Architectural GemDocument7 pagesShophouse: Singapore'S Architectural GemTHAN HANNo ratings yet

- Profitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisDocument8 pagesProfitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisAhmed RazaNo ratings yet