Professional Documents

Culture Documents

Conservative Composite - 1QTR 2014

Uploaded by

jai6480Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conservative Composite - 1QTR 2014

Uploaded by

jai6480Copyright:

Available Formats

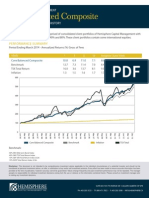

HEMISPHERE CAPITAL MANAGEMENT

Conservative Composite

PERFORMANCE SUMMARY AND HISTORY

The Conservative Composite is comprised of consolidated client portfolios of Hemisphere Capital Management where

equity is less than 15% of the asset mix. These portfolios provide capital preservation, modest income, and low risk to

clients.

PERFORMANCE SUMMARY

Period Ending March 2014 - Annualized Returns (%) Gross of Fees

YEARS

10

Inception (June/1993)

Conservative Composite

3.8

4.0

4.9

4.8

5.6

Benchmark

1.8

3.7

3.8

4.3

5.3

Inflation

1.3

1.5

1.6

1.7

1.7

350

300

250

200

150

100

50

0

Dec 13

Jun 13

Dec 12

Jun 12

Dec 11

Jun 11

Dec 10

Jun 10

Dec 09

Jun 09

Dec 08

Jun 08

Dec 07

Jun 07

Dec 06

Jun 06

Benchmark

Dec 05

Jun 05

Dec 04

Jun 04

Dec 03

Jun 03

Dec 02

Jun 02

Dec 01

Jun 01

Dec 00

Jun 00

Dec 99

Jun 99

Dec 98

Jun 98

Dec 97

Jun 97

Dec 96

Jun 96

Dec 95

Jun 95

Dec 94

Jun 94

Dec 93

Jun 93

Conservative Composite

Inflation

Benchmark:

June 1993 - December 2002

60% DEX Short-Term Bond Indices

40% T-bill 91 days

January 2003 - Current

80% DEX Short-Term Bond Indices

20% DEX Mid-Term Bond Indices

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

CONSERVATIVE COMPOSITE

PERFORMANCE HISTORY

1Q

3Q

4Q

YTD

Gross Fee

1.1%

4.6%

5.7%

Net Fee

1.0%

4.1%

5.1%

Benchmark

1.8%

3.0%

4.9%

3.4%

-0.2%

0.7%

Year

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Gross Fee

-1.3%

2Q

-1.0%

# of

Port

Year

2006

2007

1Q

2Q

3Q

4Q

YTD

Gross Fee

1.5%

-0.5%

2.2%

1.1%

4.4%

Net Fee

1.3%

-0.7%

1.9%

0.9%

3.4%

Benchmark

0.1%

0.9%

2.3%

0.6%

3.9%

Gross Fee

0.9%

-0.2%

1.2%

1.2%

3.2%

Net Fee

-1.6%

-1.2%

3.2%

-0.4%

-0.2%

Net Fee

0.7%

-0.4%

0.9%

1.0%

2.2%

Benchmark

-1.9%

-0.3%

3.2%

0.8%

1.8%

Benchmark

1.0%

-0.6%

1.9%

2.8%

5.1%

Gross Fee

2.2%

2.7%

0.9%

3.3%

9.3%

Gross Fee

1.9%

1.0%

-0.2%

1.1%

3.9%

Net Fee

2.0%

2.6%

0.8%

3.3%

8.9%

Net Fee

1.6%

0.8%

-0.5%

0.9%

2.7%

Benchmark

2.2%

0.3%

1.0%

3.1%

6.6%

Gross Fee

2.1%

2.5%

2.3%

1.3%

8.5%

Net Fee

1.8%

2.2%

2.0%

1.0%

7.3%

2008

Benchmark

3.6%

2.3%

3.2%

3.2%

12.8%

Gross Fee

1.3%

3.8%

1.3%

3.7%

10.5%

Net Fee

1.3%

3.8%

1.3%

3.6%

10.3%

Benchmark

0.6%

1.9%

4.0%

1.1%

7.8%

Gross Fee

-0.1%

1.9%

2.3%

0.6%

4.7%

Net Fee

-0.3%

1.7%

2.1%

0.4%

4.0%

Net Fee

0.6%

1.2%

2.1%

0.6%

4.5%

Benchmark

0.4%

2.2%

1.4%

0.5%

4.6%

Benchmark

0.7%

2.0%

2.0%

-0.4%

4.3%

Gross Fee

1.7%

1.0%

2.3%

1.4%

6.5%

Gross Fee

0.6%

1.2%

1.1%

1.2%

4.2%

Net Fee

1.5%

0.8%

2.1%

1.3%

5.8%

Net Fee

0.3%

0.9%

0.8%

1.0%

3.0%

Benchmark

1.1%

0.9%

2.3%

1.2%

5.6%

Gross Fee

1.0%

0.3%

0.9%

-0.1%

2.1%

2009

2010

2011

2012

Benchmark

2.1%

0.9%

2.0%

0.3%

5.3%

Gross Fee

0.9%

1.5%

2.4%

0.8%

5.7%

Benchmark

0.2%

1.8%

3.0%

0.8%

5.8%

Gross Fee

1.1%

-0.4%

1.4%

0.8%

2.9%

Net Fee

0.9%

-0.6%

1.2%

0.6%

2.2%

Net Fee

0.9%

0.1%

0.7%

-0.3%

1.4%

Benchmark

1.1%

0.1%

0.8%

0.6%

2.8%

Gross Fee

1.4%

1.1%

1.7%

2.0%

6.3%

Net Fee

1.2%

0.9%

1.5%

1.8%

5.6%

Net Fee

1.4%

-0.6%

0.7%

1.4%

2.9%

Benchmark

1.7%

1.8%

1.7%

2.8%

8.3%

Benchmark

1.0%

-1.0%

0.6%

0.7%

1.3%

Gross Fee

2.1%

0.9%

2.2%

1.9%

7.4%

Gross Fee

1.8%

Net Fee

1.9%

0.7%

1.9%

1.7%

6.4%

Net Fee

1.6%

Benchmark

1.5%

2013

2014

Benchmark

0.0%

1.3%

0.8%

0.3%

2.4%

Gross Fee

1.6%

-0.5%

0.8%

1.6%

3.6%

Benchmark

1.2%

1.6%

3.7%

0.2%

6.8%

Gross Fee

0.4%

1.2%

2.1%

1.7%

5.5%

Net Fee

0.2%

1.0%

1.9%

1.5%

4.6%

Benchmark:

Benchmark

0.3%

2.0%

1.3%

0.9%

4.5%

Gross Fee

0.1%

2.6%

1.7%

2.0%

6.5%

June 1993 - December 2002

60% DEX Short-Term Bond Indices

40% T-bill 91 days

Net Fee

-0.1%

2.4%

1.5%

1.8%

5.7%

Benchmark

0.8%

2.8%

1.1%

2.1%

6.8%

Gross Fee

2.8%

-1.0%

2.0%

2.4%

6.2%

10

January 2003 - Current

80% DEX Short-Term Bond Indices

20% DEX Mid-Term Bond Indices

Net Fee

2.6%

-1.2%

1.8%

2.2%

5.4%

Benchmark

1.4%

-0.6%

1.9%

2.2%

4.9%

Gross Fee

1.9%

2.8%

1.3%

0.8%

7.0%

Net Fee

1.7%

2.5%

1.1%

0.6%

6.0%

Benchmark

0.8%

1.9%

-0.4%

0.4%

2.7%

# of

Port

6

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

You might also like

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite - 4QTR 2012-5Document2 pagesConservative Composite - 4QTR 2012-5Jason BenteauNo ratings yet

- Core Balanced Composite - 2QTR 2014Document2 pagesCore Balanced Composite - 2QTR 2014jai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite 2QTR 2013Document2 pagesCore Balanced Composite 2QTR 2013Jason BenteauNo ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Canadian Value Fund 1QTR 2012Document2 pagesCanadian Value Fund 1QTR 2012Jason BenteauNo ratings yet

- Q2 2013 Market UpdateDocument57 pagesQ2 2013 Market Updaterwmortell3580No ratings yet

- NielsenDocument17 pagesNielsenCanadianValue0% (1)

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- Wah Seong 4QFY11 20120223Document3 pagesWah Seong 4QFY11 20120223Bimb SecNo ratings yet

- Security Analysis and Portfolio ManagementDocument48 pagesSecurity Analysis and Portfolio Managementmanishsingh6270No ratings yet

- Fidelity Investment Managers: All-Terrain Investing: November 2010Document26 pagesFidelity Investment Managers: All-Terrain Investing: November 2010art10135No ratings yet

- 4Q08 Conference Call PresentationDocument17 pages4Q08 Conference Call PresentationJBS RINo ratings yet

- Deloitte GCC PPT Fact SheetDocument22 pagesDeloitte GCC PPT Fact SheetRakawy Bin RakNo ratings yet

- BIMBSec - TM 1QFY12 Results Review - 20120531Document3 pagesBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecNo ratings yet

- TM 4QFY11 Results 20120227Document3 pagesTM 4QFY11 Results 20120227Bimb SecNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- REITs WatchlistDocument9 pagesREITs WatchlistKhriztopher PhayNo ratings yet

- Company Visit Q1 11 ThaiDocument49 pagesCompany Visit Q1 11 ThaiMeghna GuptaNo ratings yet

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNo ratings yet

- IT Sector Update: Demand Improvement Key for UpsideDocument20 pagesIT Sector Update: Demand Improvement Key for UpsidePritam WarudkarNo ratings yet

- ANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESDocument145 pagesANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESWaqas NawazNo ratings yet

- Meritor DownloadDocument68 pagesMeritor DownloadShubham BhatiaNo ratings yet

- MR RIC EmergingMarketsEquityFund A enDocument2 pagesMR RIC EmergingMarketsEquityFund A enabandegenialNo ratings yet

- Nomura Global Quantitative Equity Conference 435935Document48 pagesNomura Global Quantitative Equity Conference 435935Mukund Singh100% (1)

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Tat Hong Research 26 AprDocument4 pagesTat Hong Research 26 AprmervynteoNo ratings yet

- Macquarie Atlas - March 2017Document5 pagesMacquarie Atlas - March 2017Kunqi ZhangNo ratings yet

- 5 TomCollier SPEE Annual Parameters SurveyDocument20 pages5 TomCollier SPEE Annual Parameters SurveymdshoppNo ratings yet

- Layoffs Slowing But 27 States Show Higher UnemploymentDocument4 pagesLayoffs Slowing But 27 States Show Higher UnemploymentValuEngine.comNo ratings yet

- Performance Data in Philippine Peso (PHP)Document1 pagePerformance Data in Philippine Peso (PHP)Teresa Dumangas BuladacoNo ratings yet

- P.G.Apte International Financial Management 1Document67 pagesP.G.Apte International Financial Management 1NeenaBediNo ratings yet

- Fact Sheet MT PR UscDocument2 pagesFact Sheet MT PR Uscdonut258No ratings yet

- SSI Feasibility Study SampleDocument116 pagesSSI Feasibility Study SampleAJi AdilNo ratings yet

- Wilmar International: Outperform Price Target: SGD 4.15Document4 pagesWilmar International: Outperform Price Target: SGD 4.15KofikoduahNo ratings yet

- 36ONE Fact Sheets SeptemberDocument3 pages36ONE Fact Sheets Septemberrdixit2No ratings yet

- Done PDFDocument1 pageDone PDFMatthew RiveraNo ratings yet

- KPMG Budget BriefDocument52 pagesKPMG Budget BriefAsad HasnainNo ratings yet

- Eclectica Agriculture Fund Feb 2015Document2 pagesEclectica Agriculture Fund Feb 2015CanadianValueNo ratings yet

- Gds Two Pager 2011 DecDocument2 pagesGds Two Pager 2011 DecridnaniNo ratings yet

- 2013-5-22 First Resources CIMBDocument27 pages2013-5-22 First Resources CIMBphuawlNo ratings yet

- 4Q11 Earnings Release: Conference Call PresentationDocument23 pages4Q11 Earnings Release: Conference Call PresentationMultiplan RINo ratings yet

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocument62 pages2010 May - Morning Pack (DBS Group) For Asian StocksShipforNo ratings yet

- Transnet Annual Report 2003 - 2004Document126 pagesTransnet Annual Report 2003 - 2004cameroonwebnewsNo ratings yet

- 2014 09 September Monthly Report TPOIDocument1 page2014 09 September Monthly Report TPOIValueWalkNo ratings yet

- Adventa - 9MFY10 Results Review 20100928 OSKDocument4 pagesAdventa - 9MFY10 Results Review 20100928 OSKPiyu MahatmaNo ratings yet

- 2013-3-22 SREITs Roundup 2203131Document12 pages2013-3-22 SREITs Roundup 2203131phuawlNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- HSBCDocument9 pagesHSBCMohammad Mehdi JourabchiNo ratings yet

- Allan Gray Equity Fund: BenchmarkDocument2 pagesAllan Gray Equity Fund: Benchmarkapi-217792169No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Canadian Value Fund - 2QTR 2014Document2 pagesCanadian Value Fund - 2QTR 2014jai6480No ratings yet

- Canadian Value Fund - 3QTR 2013Document2 pagesCanadian Value Fund - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Canadian Value Fund 2QTR 2012Document2 pagesCanadian Value Fund 2QTR 2012jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Nemalux BrochureDocument15 pagesNemalux Brochurejai6480No ratings yet

- 09 Elms Quiz - ArgDocument3 pages09 Elms Quiz - ArgKim Andrew Duane C. RosalesNo ratings yet

- Ecm & DCMDocument114 pagesEcm & DCMYuqingNo ratings yet

- Security Market in India An OverviewDocument30 pagesSecurity Market in India An OverviewChiragDahiyaNo ratings yet

- Equity market strategies and risksDocument5 pagesEquity market strategies and risksTrần Phương AnhNo ratings yet

- Comparison Between Some Debt Equity & Mutual FundsDocument20 pagesComparison Between Some Debt Equity & Mutual FundsJayesh PatelNo ratings yet

- Msci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual PerformanceDocument3 pagesMsci India Value Index (Inr) : Cumulative Index Performance - Price Returns Annual Performancekishore13No ratings yet

- Unit Five: Relevant Information and Decision MakingDocument39 pagesUnit Five: Relevant Information and Decision MakingEbsa AbdiNo ratings yet

- NBAD GCC Fund Term SheetDocument12 pagesNBAD GCC Fund Term SheetgaceorNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses Maher 11th Edition Test BankDocument18 pagesManagerial Accounting An Introduction To Concepts Methods and Uses Maher 11th Edition Test Bankjenniferrodriguezbjigndfckz100% (47)

- Risk Management in Banks 2Document56 pagesRisk Management in Banks 2Aquib KhanNo ratings yet

- 4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsDocument2 pages4th Trim Bonds+and+Stocks+Valuation+-+Practice+QuestionsSiraj MohiuddinNo ratings yet

- High-Frequency Trading, Order Types, and The Evolution of The Securities Market StructureDocument31 pagesHigh-Frequency Trading, Order Types, and The Evolution of The Securities Market StructuretabbforumNo ratings yet

- Capital Budgeting Techniques: NPV, IRR, PaybackDocument2 pagesCapital Budgeting Techniques: NPV, IRR, PaybackSanjit SinhaNo ratings yet

- Case2 Group2Document11 pagesCase2 Group2Yang ZhouNo ratings yet

- Multiple Choice Questions: Answer: B. Wealth MaximisationDocument20 pagesMultiple Choice Questions: Answer: B. Wealth MaximisationArchana Neppolian100% (1)

- 31-The Forex GambitDocument6 pages31-The Forex Gambitlowtarhk100% (1)

- ECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDocument7 pagesECMT2130: Semester 2, 2020 Assignment: Geoff Shuetrim Geoffrey - Shuetrim@sydney - Edu.au University of SydneyDaniyal AsifNo ratings yet

- CH 12Document41 pagesCH 12Corliss KoNo ratings yet

- Pengalaman Penjamin Emisi: Periode 2014 - 2018Document52 pagesPengalaman Penjamin Emisi: Periode 2014 - 2018Chim ChimmyNo ratings yet

- Star Health - RHPDocument474 pagesStar Health - RHPsaurabhNo ratings yet

- Cost of Capital: Understanding How Companies Finance ProjectsDocument8 pagesCost of Capital: Understanding How Companies Finance ProjectsJem VicenteNo ratings yet

- Trading and Information Sources: Jeff Stickel Luke Whitworth Nikhil Shah Corinne Sibly Rohini Vagarali Mike WebbDocument25 pagesTrading and Information Sources: Jeff Stickel Luke Whitworth Nikhil Shah Corinne Sibly Rohini Vagarali Mike WebbsaleemwebsignNo ratings yet

- Asset Management RatiosDocument5 pagesAsset Management RatiosJhon Ray RabaraNo ratings yet

- Statement of Cash Flows Quiz Set ADocument5 pagesStatement of Cash Flows Quiz Set AImelda lee0% (1)

- ECO231Document11 pagesECO231Jesse QuartNo ratings yet

- Pattern, Price and Time - Using Gann TheoryDocument29 pagesPattern, Price and Time - Using Gann TheoryRohitOhri44% (9)

- SFAD Final Term Report - E-InteriorsDocument16 pagesSFAD Final Term Report - E-Interiorsstd32794No ratings yet

- Translate InggrisDocument2 pagesTranslate Inggrisniapa123zzzNo ratings yet

- A Study On HDFC Mutual FundDocument88 pagesA Study On HDFC Mutual FundSagar Paul'gNo ratings yet

- Report Petro ItauDocument11 pagesReport Petro ItauQuatroANo ratings yet