Professional Documents

Culture Documents

059 Spouses Rabat v. PNB

Uploaded by

Aquino, JP0 ratings0% found this document useful (0 votes)

394 views2 pagesCREDIT TRANSACTIONS DIGEST

Original Title

059 Spouses Rabat v. Pnb

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCREDIT TRANSACTIONS DIGEST

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

394 views2 pages059 Spouses Rabat v. PNB

Uploaded by

Aquino, JPCREDIT TRANSACTIONS DIGEST

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

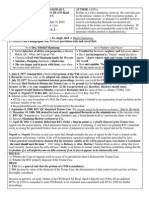

CREDIT CASE DIGEST AY 13-14 | G01

059 SPOUSES FRANCISCO and MERCED RABAT v. PNB

G.R. No. 158755 June 18, 2012

TOPIC: Extrajudicial Foreclosure Conduct of Sale

PONENTE: BERSAMIN, J.

FACTS:

1. Parties are before the court a second time. First case: PNB v. Rabat, decided in Nov. 15, 2000, G.R. Np. 134406. Facts

are based on above mentioned case.

2. Aug. 25, 1979: Spouses Rabat (RABATS) applied, and were granted a loan by PNB on 01/14/80, a medium term loan of

Php4M, to mature in 3 years.

3. January 28, 1980: (1) RABATS signed a credit agreement; (2) executed a real estate mortgage over 12 parcels of land.

4. Loan stipulation states interest = 17% per year, plus service charge, and penalty of 3% on amount unpaid or not

renewed when due.

5. September 25, 1980: RABATS executed an Amendment of the Credit Agreement to increase interest rate from 17 to

21%. Also executed another real estate mortgage on 9 parcels of land located in Davao Oriental (agricultura, commercial,

and residential) as additiona security for their Php4M loan.

6. Loans of RABATS reached total amount of Php3,517,380, due 3/14/83, evidenced by several PNs.

7. RABATS failed to pay their outstanding balance when it became due.

8. July 24, 1986: PNB responded with a denial to request of RABAT for extension of time for settlement. PNB have a

deadline of until 4/30/86 for settlement, which they sent to address at Wilson St, San Juan, MM.

9. PNB filed for extrajudicial foreclosure of mortgage executed by RABATS.

10. Parcels of land were sold at Public auction, with PNB as highest bidder at Php3,874,800.

11. Proceeds were inadequate to satisfy entire obligation, so PNB sent additional demand letters to RABAT (2 at Wilson,

San Juan on 11/15/90, and 8/30/91, and another at Davao Oriental)

12. PNB filed with RTC of Manila a complaint for a sum of money, due to failure by RABATS to settle obligation which had

already amounted to Php14,745,398.25 (with interest, penalties, and other charges).

13. RABATS: (1) admitted loan availments and default in payment, but (2) assailed validity of the auction sales, for want

of notice to them before and after the foreclosure sales.

14. RABATS also claim: (1) They have been residents of Mati, Davao Oriental since 1970-present; (2) received nor heard

about the foreclosure proceedings, in spite of PNBs claim of publication in San Pedro Times; (3) Latter is not a

newspaper of general circulation; (4) bid price was grossly inadequate and unconscionable; (5) accumulated interest and

penalty charges were invalid because properties were sold in 87, but PNB waited till 92 to file the case. Therefore, they

should not be made to suffer payment of interest and penalty charges from May 87 to present, because such would

allow PNB to profit from its questionable scheme

15. RTC dismissed the complaint; Auction sales of the properties were set aside, and PNB was ordered to reconvey to

RABATS the remaining properties after sufficient sale of properties to satisfy the obligation.

16. PNB appealed to CA, which upheld RTCs decision for nullification of foreclosure sales.

17. PNB appealed to SC (G.R. No. 134406). SC granted petition. Case was remanded to CA to DECIDE on the basis of the

errors raised by petitioner PNB in its brief. CA amended its decision, resolving errors assigned by PNB, but still affirmed

RTC decision. On MR, however, CA found for PNB.

18. RABATS moved for reconsideration, but was denied, hence appeal by them to SC.

ISSUE: (1) W/N the inadequacy of PNBs bid price renders the forced sale of the properties invalid; (2) W/N PNB was

entitled to recover any deficiency from the RABATS.

HELD: (1) NO; SC ruled against spouses Rabat. Auction bid was valid. (2) YES; PNB is entitled to recover from the RABATS.

CREDIT CASE DIGEST AY 13-14 | G01

RATIO:

1. The mode of forced sale utilized by petitioner was an extrajudicial foreclosure of real estate mortgage which is

governed by Act No. 3135, as amended. Law reveals nothing to the effect that there should be a minimum bid price or

that the winning bid should be equal to the appraised value of the foreclosed property or to the amount owed by the

mortgage debtor. What is clearly provided is that a mortgage debtor is given the opportunity to redeem the foreclosed

property "within the term of one year from and after the date of sale." In the case at bar, other than the mere

inadequacy of the bid price at the foreclosure sale, respondent did not allege any irregularity in the foreclosure

proceedings nor did she prove that a better price could be had for her property under the circumstances.

2.PNBs bid price of P 3,874,800.00 not outrageously low as to be shocking to the conscience. Bid price was almost equal

to both the P 4M applied for by RABATS, to the total sum of P 3,517,380.00 of their actual availment from PNB.

3.In Bank of the Philippine Islands, etc. v. Reyes: unlike in an ordinary sale, inadequacy of the price at a forced sale is

immaterial and does not nullify a sale since, in a forced sale, a low price is more beneficial to the mortgage debtor for it

makes redemption of the property easier.

4.Hulst v. PR Builders: *G+ross inadequacy of price does not nullify an execution sale. In an ordinary sale, for reason of

equity, a transaction may be invalidated on the ground of inadequacy of price, or when such inadequacy shocks ones

conscience as to justify the courts to interfere; such does not follow when the law gives the owner the right to redeem as

when a sale is made at public auction, upon the theory that the lesser the price, the easier it is for the owner to effect

redemption. When there is a right to redeem, inadequacy of price should not be material because the judgment

debtor may re-acquire the property or else sell his right to redeem and thus recover any loss he claims to have

suffered by reason of the price obtained at the execution sale. Thus, respondent stood to gain rather than be harmed

by the low sale value of the auctioned properties because it possesses the right of redemption. x x x

SECOND ISSUE:

1.PNB was legally entitled to recover the penalty charge of 3% per annum and attorneys fees equivalent to 10% of the

total amount due. The documents relating to the loan and the real estate mortgage showed that the Spouses Rabat had

expressly conformed to such additional liabilities; hence, they could not now insist otherwise. To be sure, the law

authorizes the contracting parties to make any stipulations in their covenants provided the stipulations are not contrary

to law, morals, good customs, public order or public policy. Equally axiomatic are that a contract is the law between the

contracting parties, and that they have the autonomy to include therein such stipulations, clauses, terms and conditions

as they may want to include.

2. Inasmuch as the Spouses Rabat did not challenge the legitimacy and efficacy of the additional liabilities being charged

by PNB, they could not now bar PNB from recovering the deficiency representing the additional pecuniary liabilities that

the proceeds of the forced sales did not cover.

3.Prudential Bank v. Martinez,

23

the fact that the mortgaged property was sold at an amount less than its actual market

value should not militate against the right to such recovery.

CASE LAW/ DOCTRINE: Inadequacy of the bid price at a forced sale, unlike that in an ordinary sale, is immaterial and

does not nullify the sale; in fact, in a forced sale, a low price is considered more beneficial to the mortgage debtor

because it makes redemption of the property easier.

The inadequacy of the bid price in an extrajudicial foreclosure sale of mortgaged properties will not per se invalidate the

sale. Additionally, the foreclosing mortgagee is not precluded from recovering the deficiency should the proceeds of the

sale be insufficient to cover the entire debt.

You might also like

- 76 Tolentino vs. LataganDocument1 page76 Tolentino vs. LataganJemNo ratings yet

- Tuazon v. Rosario-SuarezDocument1 pageTuazon v. Rosario-Suarez1234567890No ratings yet

- 7.de Vera v. Pelayo 335 SCRA 281 PDFDocument5 pages7.de Vera v. Pelayo 335 SCRA 281 PDFaspiringlawyer12340% (1)

- Assigned Possession Cases - September 27Document11 pagesAssigned Possession Cases - September 27Sunnie Joann EripolNo ratings yet

- Aliens barred from owning Philippine landDocument2 pagesAliens barred from owning Philippine landKarina GarciaNo ratings yet

- 5suntay V KeyserDocument2 pages5suntay V KeyserTristan HaoNo ratings yet

- Statute of Frauds Inapplicable to Partially Executed Verbal Contract of SaleDocument1 pageStatute of Frauds Inapplicable to Partially Executed Verbal Contract of Saleanon_71222979No ratings yet

- 248 SCRA 511 Amatan Vs AujeroDocument2 pages248 SCRA 511 Amatan Vs AujeroNikko SterlingNo ratings yet

- Hacienda Luisita land reform caseDocument13 pagesHacienda Luisita land reform caseCyrus100% (1)

- Sps Herrera V CaguiatDocument1 pageSps Herrera V CaguiatAnonymous hS0s2moNo ratings yet

- Civil Rev Rabanes DigestDocument5 pagesCivil Rev Rabanes DigestCG WitchyNo ratings yet

- CASE DIGEST Isaguirre Vs de LaraDocument2 pagesCASE DIGEST Isaguirre Vs de LaraErica Dela CruzNo ratings yet

- Reyes Vs TuparanDocument3 pagesReyes Vs Tuparanfermo24No ratings yet

- PNB Vs CADocument3 pagesPNB Vs CALea AndreleiNo ratings yet

- Criminal Procedure JurisdictionDocument15 pagesCriminal Procedure JurisdictionJosephine Regalado MansayonNo ratings yet

- San Lorenzo Development Corp vs. CADocument5 pagesSan Lorenzo Development Corp vs. CABea CapeNo ratings yet

- Pichel vs. ALonzoDocument1 pagePichel vs. ALonzoJosine ProtasioNo ratings yet

- Firestone Vs CADocument2 pagesFirestone Vs CAHoward TuanquiNo ratings yet

- Consti 2 Midterm Cases - Set 2 (Ch. 5. Police Power and Ch. 6. Eminent Domain)Document4 pagesConsti 2 Midterm Cases - Set 2 (Ch. 5. Police Power and Ch. 6. Eminent Domain)Michelle Escudero FilartNo ratings yet

- Gan Tion vs. CADocument1 pageGan Tion vs. CAVEDIA GENONNo ratings yet

- Laureana Cid V JavierDocument2 pagesLaureana Cid V JavierFaith Imee RobleNo ratings yet

- 8 Villamar Vs Mangaoil DigestDocument2 pages8 Villamar Vs Mangaoil DigestJoshua Janine LugtuNo ratings yet

- 3 Central Pangasinan Electric Coop Onc. v. NLRCDocument1 page3 Central Pangasinan Electric Coop Onc. v. NLRCJustineNo ratings yet

- Dimal Vs PeopleDocument14 pagesDimal Vs PeopleKim Laurente-AlibNo ratings yet

- PROPERTY MIDTERMS REVIEWDocument23 pagesPROPERTY MIDTERMS REVIEWRowen PalmaNo ratings yet

- Land Sale Dispute Between Buyers Resolved in Favor of CorporationDocument3 pagesLand Sale Dispute Between Buyers Resolved in Favor of CorporationRham VillanuevaNo ratings yet

- Ong Chua v. Carr - Art. 1359Document2 pagesOng Chua v. Carr - Art. 1359Ash MangueraNo ratings yet

- SVENDSEN v. PEOPLE: Accused Not Guilty of BP Blg 22 Due to Lack of Proof of Receipt of Dishonor NoticeDocument2 pagesSVENDSEN v. PEOPLE: Accused Not Guilty of BP Blg 22 Due to Lack of Proof of Receipt of Dishonor NoticeErika Bianca ParasNo ratings yet

- DEMAND Gonzales JurisprudenceDocument13 pagesDEMAND Gonzales JurisprudenceMa. Berna Joyce M. SilvanoNo ratings yet

- Miranda Vs TuliaoDocument7 pagesMiranda Vs TuliaoMaj VillarNo ratings yet

- Civil Law Bar Exam Answers Page 1Document2 pagesCivil Law Bar Exam Answers Page 1NFNLNo ratings yet

- Fiestan v. CA upholds extrajudicial foreclosureDocument2 pagesFiestan v. CA upholds extrajudicial foreclosureJoshua ReyesNo ratings yet

- Pangan Vs GatbaliteDocument7 pagesPangan Vs GatbaliteMaria Jennifer Yumul BorbonNo ratings yet

- Modomo V Sps LayugDocument5 pagesModomo V Sps LayugKaren Joy MasapolNo ratings yet

- Mareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionDocument1 pageMareja Aña G. Arellano Engreso V Dela Cruz G.R. No. 148727 Bar QuestionMareja ArellanoNo ratings yet

- Commercial Law, Professors Sundiang and Aquino) : Common Form of Bill of ExchangeDocument11 pagesCommercial Law, Professors Sundiang and Aquino) : Common Form of Bill of ExchangeLizzy WayNo ratings yet

- Toyota Shaw vs Court of Appeals Rules No Perfected Sales ContractDocument2 pagesToyota Shaw vs Court of Appeals Rules No Perfected Sales Contractda_sein32No ratings yet

- Dizon v. Dizon: Petitioners: Respondents: DoctrineDocument2 pagesDizon v. Dizon: Petitioners: Respondents: DoctrineShaneena KumarNo ratings yet

- Sales AssignmentDocument3 pagesSales AssignmentDANICA FLORESNo ratings yet

- Republic V Bibonia DigestDocument2 pagesRepublic V Bibonia DigestHeart NuqueNo ratings yet

- Cases AccessionDocument37 pagesCases AccessionDi ko alamNo ratings yet

- Malabanan v. Republic of The Philippines en Banc G.R. No. 179987, 3 September 2013Document11 pagesMalabanan v. Republic of The Philippines en Banc G.R. No. 179987, 3 September 2013herbs22225847No ratings yet

- Gabelo vs. CaDocument2 pagesGabelo vs. CaSherwin Anoba CabutijaNo ratings yet

- Victoria No Magat vs. Medialdea (206 Phil 341)Document5 pagesVictoria No Magat vs. Medialdea (206 Phil 341)Fides DamascoNo ratings yet

- G.R. No 212107Document6 pagesG.R. No 212107AJ QuimNo ratings yet

- LUIS PICHEL vs. PRUDENCIO ALONZODocument1 pageLUIS PICHEL vs. PRUDENCIO ALONZOamareia yapNo ratings yet

- Piedad V Sps GuriezaDocument2 pagesPiedad V Sps GuriezaJed MacaibayNo ratings yet

- Spouses Fuentes Vs RocasDocument7 pagesSpouses Fuentes Vs RocasJuan Carlo CastanedaNo ratings yet

- Supreme Court upholds trial and conviction in absentiaDocument2 pagesSupreme Court upholds trial and conviction in absentiaBergancia marizbethNo ratings yet

- Supreme Court of the Philippines Ruling on Rescinded Cassava Processing Equipment ContractDocument5 pagesSupreme Court of the Philippines Ruling on Rescinded Cassava Processing Equipment ContractManilyn Beronia PasciolesNo ratings yet

- 10 Alfonso vs. Court of AppealsDocument2 pages10 Alfonso vs. Court of AppealsJemNo ratings yet

- Richards v. Washington Terminal Co., 233 U.S. 546 (1914)Document8 pagesRichards v. Washington Terminal Co., 233 U.S. 546 (1914)Scribd Government DocsNo ratings yet

- Esguerra vs. CA (Final Digest)Document2 pagesEsguerra vs. CA (Final Digest)analynNo ratings yet

- 13) People v. Dijan, 383 SCRA 15Document5 pages13) People v. Dijan, 383 SCRA 15Nurlailah AliNo ratings yet

- EUGENIO DOMINGO, Et. Al. Vs CADocument2 pagesEUGENIO DOMINGO, Et. Al. Vs CAamareia yapNo ratings yet

- Differences Between Lease and TenancyDocument3 pagesDifferences Between Lease and TenancyQis Balqis RamdanNo ratings yet

- Espano v. CA, G.R. No. 120431, April 1, 1998Document2 pagesEspano v. CA, G.R. No. 120431, April 1, 1998Enid SevilleNo ratings yet

- Metropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestDocument3 pagesMetropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestNullus cumunisNo ratings yet

- PNB Recovers Deficiency from Rabats Despite Foreclosure SaleDocument22 pagesPNB Recovers Deficiency from Rabats Despite Foreclosure Salenaomi_mateo_4No ratings yet

- 27 Suico v. PNBDocument2 pages27 Suico v. PNBKevin HernandezNo ratings yet

- Muslim Code Thesis SourcesDocument6 pagesMuslim Code Thesis SourcesAquino, JPNo ratings yet

- L L S L: Abor AW AND Ocial EgislationDocument8 pagesL L S L: Abor AW AND Ocial EgislationMarie CecileNo ratings yet

- 024 - Transpo - Adzuara v. CA and PeopleDocument3 pages024 - Transpo - Adzuara v. CA and PeopleAquino, JP100% (1)

- 061 HYATT v. GOLDSTAR (Additional Case)Document3 pages061 HYATT v. GOLDSTAR (Additional Case)Aquino, JPNo ratings yet

- 001 SAMAHAN Sa HANJIN Shipyard v. BLRDocument5 pages001 SAMAHAN Sa HANJIN Shipyard v. BLRAquino, JPNo ratings yet

- 354 Professional Services v. Agana (2007, 2008, 2010)Document6 pages354 Professional Services v. Agana (2007, 2008, 2010)Aquino, JPNo ratings yet

- ANCF vs Heirs LachicaDocument3 pagesANCF vs Heirs LachicaAquino, JPNo ratings yet

- Political LawDocument15 pagesPolitical LawViner VillariñaNo ratings yet

- 021 Philippine Veterans Bank v. Callangan - SRCDocument3 pages021 Philippine Veterans Bank v. Callangan - SRCAquino, JPNo ratings yet

- Piercing Corporate Veil DoctrineDocument3 pagesPiercing Corporate Veil DoctrineAquino, JP50% (2)

- 028 Sterling v. BayerDocument5 pages028 Sterling v. BayerAquino, JPNo ratings yet

- 001 SAMAHAN Sa HANJIN Shipyard v. BLRDocument5 pages001 SAMAHAN Sa HANJIN Shipyard v. BLRAquino, JPNo ratings yet

- 003 Paul Lee Tan v. Paul SycipDocument3 pages003 Paul Lee Tan v. Paul SycipAquino, JPNo ratings yet

- 004 LC - Bpi v. de RenyDocument3 pages004 LC - Bpi v. de RenyAquino, JPNo ratings yet

- 024 - Transpo - Adzuara v. CA and PeopleDocument3 pages024 - Transpo - Adzuara v. CA and PeopleAquino, JP100% (1)

- Delivery of Instrument Key to LiabilityDocument3 pagesDelivery of Instrument Key to LiabilityAquino, JPNo ratings yet

- 059 in RE WILFREDO S. TorresDocument2 pages059 in RE WILFREDO S. TorresAquino, JPNo ratings yet

- 001 SAMAHAN Sa HANJIN Shipyard v. BLRDocument5 pages001 SAMAHAN Sa HANJIN Shipyard v. BLRAquino, JPNo ratings yet

- 114 Heirs of Intac v. CADocument4 pages114 Heirs of Intac v. CAAquino, JPNo ratings yet

- Philippine Steam Navigation Co. interrogation of officersDocument2 pagesPhilippine Steam Navigation Co. interrogation of officersAquino, JPNo ratings yet

- Burden of ProofDocument3 pagesBurden of ProofAquino, JPNo ratings yet

- Judicial separation granted for NOVERAS due to 1+ year separationDocument4 pagesJudicial separation granted for NOVERAS due to 1+ year separationAquino, JPNo ratings yet

- 053 Kramer v. CA and Trans-AsiaDocument2 pages053 Kramer v. CA and Trans-AsiaAquino, JPNo ratings yet

- 152 Sergio Amonoy Vs Sps. GutierrezDocument2 pages152 Sergio Amonoy Vs Sps. GutierrezAquino, JPNo ratings yet

- Sources For US v. Nicaragua ReportDocument1 pageSources For US v. Nicaragua ReportAquino, JPNo ratings yet

- 052 Abangan v. Abangan (Supra)Document2 pages052 Abangan v. Abangan (Supra)Aquino, JPNo ratings yet

- 002 Elcano v. HillDocument2 pages002 Elcano v. HillAquino, JPNo ratings yet

- 089 Maninang v. CADocument2 pages089 Maninang v. CAAquino, JPNo ratings yet

- Vienna Convention On The Law of The TreatiesDocument16 pagesVienna Convention On The Law of The TreatiesAquino, JP100% (1)

- InterviewDocument6 pagesInterviewTaki MeijerNo ratings yet

- Resolution No. 8-2021 Elected BhraoDocument3 pagesResolution No. 8-2021 Elected BhraoBARANGAY MOLINO II100% (1)

- Bangsamoro Basic LawDocument36 pagesBangsamoro Basic LawMary Louisse RulonaNo ratings yet

- GENERAL BULLETIN 202 - 2020 - Vice Principal (Admin) Performance Appraisal With Descriptors VIIDocument13 pagesGENERAL BULLETIN 202 - 2020 - Vice Principal (Admin) Performance Appraisal With Descriptors VIIDane SinclairNo ratings yet

- Political ObligationDocument17 pagesPolitical ObligationRISHI RAJNo ratings yet

- Leadership Outcomes Inventory SolcDocument12 pagesLeadership Outcomes Inventory Solcapi-254318887No ratings yet

- The Meaning of Raksha BandhanDocument1 pageThe Meaning of Raksha Bandhanzahid shaikhNo ratings yet

- MR MS Gsdmsfi Preliminary Pageant Guidelines and MechanicsDocument3 pagesMR MS Gsdmsfi Preliminary Pageant Guidelines and MechanicsNick Clison TabsingNo ratings yet

- Data Protection Trustmark Certification by IMDADocument14 pagesData Protection Trustmark Certification by IMDASTBNo ratings yet

- Islamic - Ethics-Pronciples N Scope PDFDocument9 pagesIslamic - Ethics-Pronciples N Scope PDFaryuNo ratings yet

- Ethical Issues Social ResponsibilityDocument14 pagesEthical Issues Social ResponsibilityappletamuNo ratings yet

- NLRC Rules of Procedure 2011Document236 pagesNLRC Rules of Procedure 2011John Sowp MacTavishNo ratings yet

- Wisdom Inherent in The Establishment of Daily PrayerDocument314 pagesWisdom Inherent in The Establishment of Daily PrayerkehtarmNo ratings yet

- Inocencio Rosete v. The Auditor GeneralDocument2 pagesInocencio Rosete v. The Auditor GeneralRJ Nuñez100% (1)

- Pötscher W. Theophrastos, Peri EusebeiasDocument197 pagesPötscher W. Theophrastos, Peri EusebeiasalverlinNo ratings yet

- Evolution of Leadership Training in the Royal NavyDocument13 pagesEvolution of Leadership Training in the Royal Navyjoethompson007No ratings yet

- Pinner Wood Staff Handbook 2009-10Document18 pagesPinner Wood Staff Handbook 2009-10msheldrake4851No ratings yet

- Belief System EssayDocument2 pagesBelief System Essayapi-194648552No ratings yet

- Notes On Sen - S Idea of JusticeDocument19 pagesNotes On Sen - S Idea of JusticeEm Asiddao-Deona100% (1)

- Communism, Communist MusicsDocument19 pagesCommunism, Communist MusicsJustin CookNo ratings yet

- Gracewood ElementaryDocument4 pagesGracewood ElementaryJeremy TurnageNo ratings yet

- 1 Contract Labour Act, 1970Document29 pages1 Contract Labour Act, 1970Satish SinhaNo ratings yet

- Engineering Ethics Theories ExplainedDocument43 pagesEngineering Ethics Theories ExplainedIgnatius TanNo ratings yet

- Dissertation FinalDocument228 pagesDissertation FinalCynthia V. MarcelloNo ratings yet

- Cagayan HymnDocument2 pagesCagayan HymnRonel FillomenaNo ratings yet

- Copleston Aristotle PoliticsDocument7 pagesCopleston Aristotle Politicsapi-3702038No ratings yet

- Booking 03 28Document9 pagesBooking 03 28Bryan FitzgeraldNo ratings yet

- Evangelista v. Abad SantosDocument2 pagesEvangelista v. Abad SantosCourtney TirolNo ratings yet

- Understanding Culture, Society, and PoliticsDocument200 pagesUnderstanding Culture, Society, and PoliticsFenn86% (7)

- Digital Detox Reality British English Upper Intermediate Advanced Group PDFDocument3 pagesDigital Detox Reality British English Upper Intermediate Advanced Group PDFMagyarosi Szabo ZsuzsannaNo ratings yet