Professional Documents

Culture Documents

Best Pharma Stocks To Buy PDF

Uploaded by

jitesh.dhawanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Best Pharma Stocks To Buy PDF

Uploaded by

jitesh.dhawanCopyright:

Available Formats

April10,2014

Pharmaceuticals

InstitutionalEquities

IndiaResearch

QUARTERLYPREVIEW

KeyHighlightsoftheQuarter

Mar14QtrlyPAT

InRs.Mn

Karvy Thedomesticformulationsmarkethasbeenimprovingmonthonmonthandhas

shown a positive growth for the last couple of months. Select companies such as

Sun,Lupin,Ipca,AlembicandIndocowillcontinuetooutperform.

Ranbaxy

1637

Rupee movement: Rupee depreciation will continue to help export oriented

Cadila

2502 pharmacompaniesinthisquarter.Ithasdepreciatedby13.8%YoYoverQ4FY13

Lupin

5100 and appreciated by 0.75 % QoQ over Q3FY14. Yen has depreciated 2% YoY,.

Dr.ReddysLabs

5496 however,onprecedingquarteryenappreciationhasbeen3.7%.

Domesticformulations:IPMgrowthfor4QFY14(Jan14+Feb14)isat6.6%YoY,

Source:KarvyInstitutionalResearch

Companies that have witnessed higher than industry growth in 2M are Sun

Pharma (+17.8%), Torrent (+15.7%), Zydus Cadila (+5.9%), Ipca (+26.6%), DRL

(+4.5%),Cipla(+5.5%),Lupin(+12.4%),andAlembicPharma(+12.1%).

USmarket:Overall,therewere21ANDAapprovalsintheUSmarket.Lupinhas

MajorchangesinTargetPrice(TP) gotmaximum5approvalsinourspace,ZydusCadilahas4approvalswhileDRL

New

% and Sun Pharma has got 3 approvals each. In midcaps, Ipca Labs has received 2

Rating

TP Change approvalswhileAlembicandUnichemhavealsogot1approvaleach.

SunPharma

AlembicPharma

13157

BUY

346

44.6

IpcaLab

HOLD

871

3.4

CadilaHC

HOLD

1120

Lupin

BUY

1110

Cipla

SELL

394

BUY

3024

SELL

588

14.1

BUY

1596

7.0

SELL

2283

26

DrReddys

ResultExpectations

Weexpect23.2%YoYimprovementinrevenuesforQ4FY14forcompaniesinour

7.7 space. Revenue growth for Sun Pharma (+48.9% YoY), Lupin (+21% YoY) and

4.2 Cadila Healthcare is at (+20.3% YoY). Net Profit growth for the companies (ex

2.4 Ranbaxy)willbetothetuneof15.5%forthequarter.

3.9 RatingChange&RevisionofPriceTarget:WerolloverourtargetpricetoFY16E

asagainstDec15Eearlierformajorityofthecompanies.WeintroduceFY16Enos

forTorrentPharma,DivisLabsandAlembicPharmaandrolloverourtargetprice

toFY16E.WeupgradeourmultipleforCadilaHCfrom18xto18.5xduetobetter

visibility.

Wefactorrevenuegrowthof18%forFY16EforTorrentPharmaonthebackofa

13.8 % growth in domestic formulations and US clockingagrowth of 23 %.With

EBDITAMat20%andEPSgrowthat13.8%whichdoesnotincludeamortization

ofgoodwill,wecontinuewithourSELLratingonthestockwithapricetargetofRs

588 based on 15x FY 16E. In Divis, the USFDA approval will pave for regulated

salesinFY15E,thefullimpactwillbeseeninFY16Ewitharevenuegrowthof20

% and margins of 40 %. With EPS of Rs 88.5 we roll over to FY 16E with a price

targetofRs1596basedon18xFY2016EandcontinueourBUYratingonthestock.

WeupgradeourratingonAlembicPharmatoBUYwithatargetpriceofRs346

basedon15xFY16Eduetoaseriesopportunitieswhichareexpectedtounfoldin

FY15E and FY16E. We upgrade our EPS estimates for FY15E by 3 % to Rs 138.3

and by 8% to Rs 151.2 for FY16E for Dr Reddys Labs on account of inclusion of

opportunities. We upgrade our price target by 3.9 % to Rs 3024 based on 20x

FY16E.OnaccountofclosureofbuybackbyGSKPharmaPlc,wereduceourtarget

price for GSK Pharma India by 26 % to Rs 2283 based on 30x CY 2015E which

impliesadividendyieldof4.8%duetosaleofThaneplantbeingdistributedinthe

formofdividend

Valuation&Recommendations

TorrentPharma

DivisLabs

GSKPharma

Source:KarvyInstitutionalResearch

ChangeinRating

Old

New

AlembicPharma

HOLD

BUY

Sanofi

HOLD

UR

DrReddys

HOLD

BUY

SELL

UR

Ranbaxy

Source:KarvyInstitutionalResearch

AnalystsContact

RahulSharma

02261844310

rahul.sharma@karvy.com

WelikeSunPharma,DrReddylabs&LupininthelargecapspacewhileUnichem

LabsandIndocoRemediesremainsourtoppickinthemidcapcapspace.

April10,2014

Pharmaceuticals

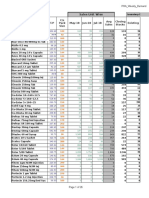

Mar14QuarterlyEstimates

Mar14E

Mar13

Dec13

YoY(%)

QoQ(%)

Comment

SunPharmaceuticalInds.Ltd.(SUNPINEQUITY,BUY,CMP:Rs.630,TP:Rs.684,Mcap:Rs1305bn)

Sales(Rsmn)

45,958

30,870

43,124

48.9

6.6

EBITDA(Rsmn)

19,625

12,754

20,009

53.9

(1.9)

42.8

41.5

46.7

PBT(Rsmn)

19,038

12,814

20,235

48.6

(5.9)

PAT(Rsmn)

13,157

10,116

15,310

30.1

(14.1)

EBITDAmargin(%)

Domesticformulationsgrowat20%YoY.USbusiness

willgrowby64%toRs29bncomparedtoRs17.8bnin

Q4FY13.Doxil,Cymbalta,TemodarandDesvenlafaxine

tocontributeinthisquarter.

Marginstoremainhigheronyoyby130bps

Dr.ReddysLaboratoriesLtd.(DRRDINEQUITY,BUY,CMP:Rs.2624,TP:Rs.3024,Mcap:Rs446bn)

Sales(Rsmn)

36,065

33,394

35,338

8.0

2.1

9,470

8,917

9,940

6.2

(4.7)

26.3

26.7

28.1

PBT(Rsmn)

7,529

7,845

8,706

(4.0)

(13.5)

PAT(Rsmn)

5,496

5,704

6,185

(3.6)

(11.1)

EBITDA(Rsmn)

EBITDAmargin(%)

Revenue growth is likely to be 8 %YoY. Generics

growthof31%YoYandPSAIdegrowthof45%YoY.US

generics market growth of 48%YoY Dacogen,

Divaloproex, Vidaza and Sumatriptan would be

incremental revenue drivers. While Europe will show

flatgrowth,Russiaisexpectedtogrow20%YoY

MarginsarelikelytoremainmarginallylowerYoYdue

tohigerSG&AandR&D.

RanbaxyLabs(RBXYINEQUITY,UR,CMP:Rs.467,Mcap:Rs189bn)

Sales(Rsmn)

28,554

25,005

28,940

14.5

1.4

2,380

1,905

2,703

24.9

(12.0)

8.3

7.6

9.3

PBT(Rsmn)

1731

1,670

(603)

3.7

(387)

PAT(Rsmn)

1,637

1,257

(1,589)

30.2

(203)

EBITDA(Rsmn)

EBITDAmargin(%)

Weexpectthecompanytowitnessflatgrowthindollar

terms.USwillclocklowergrowthduetoToansaissue.

LATAM region will see growth of 10%. Absorica

continuestodowellwithmktshareof22%.

MarginstodeclineonQoQbasisduetoToansaissue.

Forexgainonaccountofderivativesandloanstothe

tuneofRs1.3bn

Lupin(LPCINEQUITY,BUY,CMP:Rs.973,TP:Rs.1110,Mcap:Rs436bn)

Sales(Rsmn)

EBITDA(Rsmn)

EBITDAmargin(%)

31,051

25,674

30,220

20.9

2.8

7,930

6,403

7,733

23.8

2.5

25.5

24.9

25.6

PBT(Rsmn)

7,400

5,042

7,379

46.8

0.3

PAT(Rsmn)

5,100

3,897

4,762

30.9

7.1

DomesticgrowthforLupinwillbeat14%YoYwhileUS

businesswillgrowby28%YoY.Trizivir,Duloxetineand

Zymaxid would be incremental revenue drivers. Japan

shoulddobetteronQoQ.

Margins will be maintained QoQ due to better

realizationsandscaleinnicheproducts.

GlaxoSmithKlinePharmaceuticalsLtd.(Standalone)(GLXOINEQUITY,SELL,CMP:2545,TP:Rs2283,Mcap:Rs216bn)

Sales(Rsmn)

6373

6369

6373

0.1

0.0

(29.9)

(0.6)

EBITDA(Rsmn)

1175

1676

1182

EBITDAmargin(%)

18.4

26.3

18.6

PBT(Rsmn)

1945

2404

1603

(19.1)

21.4

PAT(Rsmn)

1313

1690

1169

(22.3)

12.4

NegativeimpactofNLEMpolicycontinuesduetohigh

exposuretoNLEMlisteddrugs.

EBITDAmarginsareloweronYoYonthebackof

NLEMpolicy.Profitshigherduetodividendreceipt.

CadilaHealthcareLtd.(CDHINEQUITY,HOLD,CMP:Rs.1015,TP:Rs.1120,Mcap:Rs208bn)

Sales(Rsmn)

19,395

16,119

18,716

20.3

3.6

3,774

2,864

2,951

31.8

27.9

19.5

17.8

15.8

PBT(Rsmn)

3,102

2,170

2,394

43.0

29.6

PAT(Rsmn)

2,502

2,625

1,858

(4.7)

32.2

EBITDA(Rsmn)

EBITDAmargin(%)

Domestic formulations to grow by 6.3%YoY. US

revenue growth of 70% YoY to provide a fillip to

domesticwoes. Frenchbusiness isexpectedtogrowby

10%YoY.

EBITDAMhigherby170bpsduetolowcompetition

opportunities.

SanofiIndiaLimited:(Standalone)(SANLINEQUITY,UR,CMP:Rs.2943,Mcap:Rs68bn)

Sales(Rsmn)

4,316

3,881

4,883

11.2

(11.6)

EBITDA(Rsmn)

834

720

1,139

15.8

(26.8)

EBITDAmargin(%)

19.3

18.6

23.3

PBT(Rsmn)

707

657

1,018

7.6

(30.6)

PAT(Rsmn)

477

444

927

7.5

(48.5)

Sanofisalestogrowat11%YoYowingtolowerbase

MarginswillmoveupduetosavingsinGrossMargins

April10,2014

Pharmaceuticals

IpcaLabsLtd.(IPCAINEQUITY,HOLD,CMP:Rs.820,TP:Rs.871,Mcap:Rs103bn)

Sales(Rsmn)

8072

6717

8245

20.2

(2.1)

EBITDA(Rsmn)

2019

1423

2089

41.9

(3.3)

25

21.2

25.3

PBT(Rsmn)

1754

1255

1808

39.8

(3.0)

PAT(Rsmn)

1289

754

1391

71.0

(7.3)

EBITDAmargin(%)

Domestic formulations to grow at 15% yoy. Exports

formulationstogrowby28%duetostrongperformance

ininstitutionalandGenericBusiness.

MarginsimprovedYoYduetolowerCOGS

TorrentPharmaceuticalsLtd.(TRPINEQUITY,SELL,CMP:Rs.559,TP:Rs.588,Mcap:Rs95bn)

Sales(Rsmn)

9,992

8,420

10,150

18.7

(1.6)

EBITDA(Rsmn)

1,963

1,680

2,150

16.8

(8.7)

19.6

20

21.2

PBT(Rsmn)

1,678

1,670

1,880

0.5

(10.8)

PAT(Rsmn)

1,292

1,110

1,580

16.4

(18.2)

EBITDAmargin(%)

Domestic Formulations to grow by 15 % YoY. In

Exports, US will witness growth of 112% YoY due to

bettertractioninCymbalta

Marginsarelowerduetogreatercostpush

Cipla.(CIPINEQUITY,SELL,CMP:Rs.401,TP:Rs.394,Mcap:Rs322bn)

Sales(Rsmn)

25448

19667

25808

29.39

(1.39)

EBITDA(Rsmn)

4564

4095

4673

11.46

(2.33)

EBITDAmargin(%)

17.9

22.9

18.1

PBT(Rsmn)

3444

3720

3952

(7.41)

(12.85)

PAT(Rsmn)

2461

2676

2843

(8.02)

(13.43)

Domestic market is expected to grow at 15% YoY this

Quarter,exportstogrowby42%.

MarginswillbeloweronYoYduetohigherstaffcost

andoverheads.

DivisLabsLtd.(Standalone)(DIVIINEQUITY,BUY,CMP:Rs.1361,TP:Rs.1596,Mcap:Rs181bn)

Sales(Rsmn)

7,890

6,513

6,893

21.2

14.5

EBITDA(Rsmn)

3,265

2,524

2,878

29.4

13.4

41.4

38.8

41.8

PBT(Rsmn)

3,086

2,391

2,721

29.1

13.4

PAT(Rsmn)

2,407

1,818

2,190

32.4

9.9

EBITDAmargin(%)

CustomsSynthesisandGenericstogrowat20%YoY.

Marginsarehigheronthebackofhighergrossmargins

andlowerpowercost.

UnichemLabs(Standalone)(ULINEQUITY,BUY,CMP:Rs.220,TP:Rs.311,Mcap:Rs20bn)

Sales(Rsmn)

2,656

2,435

2,649

9.1

0.3

EBITDA(Rsmn)

495

418

481

18.3

2.8

EBITDAmargin(%)

18.6

17.2

18.2

PBT(Rsmn)

414

348

407

19.0

1.6

PAT(Rsmn)

320

310

742

3.3

(56.8)

Domestic formulations to witness growth of 13%YoY.

Exports to degrow by 1.5%YoY mainly due to 7% de

growthinformulations.

MarginsareexpectedtoimproveQoQduetosavingsin

staffcostandoverheads.ProfitslowerQoQduetosale

ofplanttoMylaninQ3FY14

AlembicPharma(ALPMINEQUITY,BUY,CMP:Rs.277,TP:Rs.346,Mcap:Rs52bn)

Sales(Rsmn)

4,655

3,781

4,856

23.1

(4.1)

EBITDA(Rsmn)

987

621

1,022

59.0

(3.4)

EBITDAmargin(%)

21.2

16.5

21.1

PBT(Rsmn)

829

552

888

50.2

(6.6)

PAT(Rsmn)

647

437

659

48.1

(1.9)

Exports formulations to see high growth of 75 % YoY

due to Telmisartan HCTZ launch, while domestic

formulationwillgrowat12.5%YoY.

MarginswillbeflatQoQ

IndocoRemediesLtd.(INDRINEQUITY,BUY,CMP:Rs.137,TP:Rs.200,Mcap:Rs13bn)

Sales(Rsmn)

1932

1590

1878

21.5

2.9

EBITDA(Rsmn)

304

254

299

19.5

1.8

EBITDAmargin(%)

15.7

16

15.9

PBT(Rsmn)

202

143

181

41.9

11.9

PAT(Rsmn)

160

129

141

24.4

13.2

Export formulation to grow by 22% YoY while

Domesticformulationgrowthwillbeat18%YoY.

Marginstoremainsteadyonaqoqbasis

Source:KarvyInstitutionalResearch

April10,2014

Pharmaceuticals

EstimatesRevision

Pharmaceuti

cals

Dr.Reddys

Lab

Revenues(Rsmn)

Old

EBITDA(Rsmn)

New

Old

PAT(Rsmn)

New

Old

New

FY15E

FY16E

FY15E

FY16E

FY15E

FY16E

FY15E

FY16E

FY15E

FY16E

FY15E

FY16E

148,046

158,459

151,183

165,366

36,459

37,120

37,344

39,505

22,852

23,808

23,563

25,724

23,003

28,290

4,415

4,896

6,280

2,905

3,287

4,355

Alembic

21,673

Source:KarvyInstitutionalResearch

ChangeinEstimates

We upgrade our FY15E Revenues, EBDITA and profits for Alembic Pharma on

account of limited competition opportunities of Telmisartan HCTZ, Metprolol

SuccinateandCymbalta.WeintroduceFY16Eestimatesafterincorporatingthese

opportunities. We roll over our price target to FY16E and upgrade the stock to

BUYwithapricetargetofRs346basedon15xFY2016E.

WeupgradeourrevenuesforDrReddysby2%toRs151bnforFY15Edueto

incorporationofLunestaandNamendawhileupgradeourrevenuesby4.4%toRs

1.65bnforFY16EduetoincorporationofDoxil,NamendaandAloxi.Weupgrade

ourEPSestimatesforFY15Eby3%toRs138.3andby8%toRs151.2forFY16Efor

Dr Reddys Labs. We upgrade our price target by 3.9% to Rs 3024 based on 20x

FY16E.

OnaccountofclosureofbuybackbyGSKPharmaPlc,wereduceourtargetprice

forGSKPharmaIndiaby26%toRs2283basedon30xCY2015Ewhichimpliesa

dividendyieldof4.8%duetosaleofThaneplantbeingdistributedintheformof

dividend.

April10,2014

Pharmaceuticals

ValuationSummary

CompanyName

CMP

TP

Up/

(Rs)

(Rs)

Down%

FY14E

FY15E

FY16E

FY14E

FY15E

FY16E

FY14E

FY15E

FY16E

FY14E

FY15E

FY16E

FY14E

FY15E

FY16E

Buy

277

346

24.9

18,614

23,003

28,290

3,623

4,896

6,280

11.9

17.4

23.1

23.4

15.9

12.0

14.6

10.5

7.7

UR

2,943

UR

18,089

20,177

22,467

3,979

4,470

4,870

104.1

115.3

131.8

28.3

25.5

22.3

16.4

13.9

12.3

Cadila

Healthcare

Hold

1,015

1,120

10.3

71,949

88,537

100,074

12,187

16,721

18,671

39.9

53.0

60.0

25.4

19.2

16.9

18.2

13.2

11.7

Cipla

SELL

401

394

(1.7)

101,257

116,179

130,652

21,801

24,512

26,439

17.5

19.4

21.3

23.0

20.7

18.8

15.0

13.0

11.8

DivisLabs

Buy

1,361

1,596

17.3

25,624

31,656

38,035

10,655

13,110

15,154

62.7

74.1

88.5

21.7

18.4

15.4

16.7

13.1

10.9

Dr.ReddysLabs

Buy

2,624

3,024

15.2

133,428

151,183

165,366

34,289

37,344

39,505

130.8

138.5

151.2

20.1

18.9

17.4

13.1

11.7

10.6

GlaxoSmithKline

Pharma*

Sell

2,545

2,283

(10.3)

25,462

26,973

30,178

5,221

6,208

7,930

56.2

62.6

76.1

45.3

40.7

33.5

37.4

31.5

24.6

Indoco

Remedies

Buy

137

200

46.2

7,372

9,038

12,218

945

1,388

2,446

4.4

9.8

16.7

31.0

14.0

8.2

13.4

8.9

4.8

IpcaLabs.

Hold

820

871

6.3

33,264

38,134

44,632

8,218

9,454

10,770

36.0

47.2

54.4

22.8

17.4

15.1

13.3

11.5

9.9

Buy

973

1,110

14.0

112,760

135,388

154,380

28,690

34,994

40,299

38.8

46.2

55.0

25.1

21.1

17.7

15.2

12.1

10.2

RanbaxyLabs

UR

467

136,561

135,891

144,018

10,620

11,056

14,254

(16.0)

6.6

11.9

71.0

39.3

22.9

22.7

17.6

SunPharma.

Buy

630

684

8.6

165,941

191,849

357,296

73,340

82,915

100,926

25.6

28.2

30.4

24.6

22.4

20.7

16.8

14.3

14.2

TorrentPharma

Sell

559

588

5.1

39,022

52,082

61,546

7,423

10,432

12,369

29.9

34.4

39.2

18.7

16.2

14.3

12.8

11.2

9.3

UnichemLabs

Buy

220

311

41.4

11,827

14,122

17,060

1,908

2,664

3,530

13.6

18.3

25.7

16.2

12.0

8.6

10.0

7.3

5.2

AlembicPharma

SanofiIndia*

LupinLabs.

Rating

Source:Company,KarvyInstitutionalResearch

Revenue(Rsmn)

EBITDA(Rsmn)

EPS(Rs)

PE(x)

EV/EBITDA(x)

StockRatings

Buy

Hold

Sell

:

:

:

AbsoluteReturns

>15%

515%

<5%

Forfurtherenquiriespleasecontact:

research@karvy.com

Tel:+912261844300

INSTITUTIONAL SALES

Celine Dsouza: +91 22 61844341; celine.dsouza@karvy.com

Edelbert Dcosta: +91 22 61844302; edelbert.dcosta@karvy.com

DisclosuresAppendix

Analystcertification

Thefollowinganalyst(s),whois(are)primarilyresponsibleforthisreport,certify(ies)thattheviewsexpressedhereinaccuratelyreflect

his(their)personalview(s)aboutthesubjectsecurity(ies)andissuer(s)andthatnopartofhis(their)compensationwas,isorwillbe

directlyorindirectlyrelatedtothespecificrecommendation(s)orviewscontainedinthisresearchreport.

Disclaimer

TheinformationandviewspresentedinthisreportarepreparedbyKarvyStockBrokingLimited.Theinformationcontainedhereinis

based on our analysis and upon sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness

thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments

discussed or recommended in this report may not be suitable for all investors. Investors must make their own investment decisions

basedontheirspecificinvestmentobjectivesandfinancialpositionandusingsuchindependentadvice,astheybelievenecessary.While

actinguponanyinformationoranalysismentionedinthisreport,investorsmaypleasenotethatneitherKarvynorKarvyStockBroking

nor any person connected with any associate companies of Karvy accepts any liability arising from the use of this information and

viewsmentionedinthisdocument.

The author, directors and other employees of Karvy and its affiliates may hold long or short positions in the above mentioned

companies from time to time. Every employee of Karvy and its associate companies are required to disclose their individual stock

holdingsanddetailsoftrades,ifany,thattheyundertake.Theteamrenderingcorporateanalysisandinvestmentrecommendationsare

restrictedinpurchasing/sellingofsharesorothersecuritiestillsuchatimethisrecommendationhaseitherbeendisplayedorhasbeen

forwardedtoclientsofKarvy.AllemployeesarefurtherrestrictedtoplaceordersonlythroughKarvyStockBrokingLtd.Thisreportis

intendedforarestrictedaudienceandwearenotsolicitinganyactionbasedonit.Neithertheinformationnoranyopinionexpressed

hereinconstitutesanofferoraninvitationtomakeanoffer,tobuyorsellanysecurities,oranyoptions,futuresnorotherderivatives

relatedtosuchsecurities.

KarvyStockBrokingLimited

InstitutionalEquities

OfficeNo.702,7thFloor,HallmarkBusinessPlaza,Opp.GurunanakHospital,Mumbai400051

RegdOff:46,RoadNo4,StreetNo1,BanjaraHills,Hyderabad500034.

KarvyStockBrokingResearchisalsoavailableon:BloombergKRVY<GO>,ThomsonPublisher&Reuters.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Merck and Co Value Chain AnalysisDocument20 pagesMerck and Co Value Chain AnalysisMalika SainiNo ratings yet

- Pharmaceutical Industry of PakistanDocument67 pagesPharmaceutical Industry of PakistanTahir shahNo ratings yet

- PM1911 SmartPharmaDocument24 pagesPM1911 SmartPharmaPiyush OjhaNo ratings yet

- List of Pharma Companies With Email IDDocument2 pagesList of Pharma Companies With Email IDPriti Tiwari73% (11)

- Pharma - MumbaiDocument27 pagesPharma - MumbaiBusiness100% (1)

- Role of HR in 0916Document28 pagesRole of HR in 0916jitesh.dhawanNo ratings yet

- Manager - Transitions & Consulting: Job Description: PeoplestrongDocument3 pagesManager - Transitions & Consulting: Job Description: Peoplestrongjitesh.dhawanNo ratings yet

- Manager-HR Business Partner: Page 1 of 3Document3 pagesManager-HR Business Partner: Page 1 of 3jitesh.dhawanNo ratings yet

- Manager SR Manager - HR and IR (Haridwar)Document2 pagesManager SR Manager - HR and IR (Haridwar)jitesh.dhawanNo ratings yet

- Manager International OpsDocument1 pageManager International Opsjitesh.dhawanNo ratings yet

- JD HR Location Head Hyderabad C2Document3 pagesJD HR Location Head Hyderabad C2jitesh.dhawanNo ratings yet

- JD HR Location Head Hyderabad C2Document3 pagesJD HR Location Head Hyderabad C2jitesh.dhawanNo ratings yet

- Manager-HR Business Partner: Page 1 of 3Document3 pagesManager-HR Business Partner: Page 1 of 3jitesh.dhawanNo ratings yet

- Top Stock PicksDocument22 pagesTop Stock Picksjitesh.dhawanNo ratings yet

- Best Pharma Stocks PDFDocument11 pagesBest Pharma Stocks PDFjitesh.dhawanNo ratings yet

- Regional - HR (North)Document3 pagesRegional - HR (North)jitesh.dhawanNo ratings yet

- Lemon Duo 335Document41 pagesLemon Duo 335jitesh.dhawanNo ratings yet

- Best Pharma Stocks PDFDocument11 pagesBest Pharma Stocks PDFjitesh.dhawanNo ratings yet

- Samples of Great ResumeDocument7 pagesSamples of Great Resumejitesh.dhawanNo ratings yet

- Lebs 103Document23 pagesLebs 103Harish MeenaNo ratings yet

- Optimize Emule ConnectionDocument1 pageOptimize Emule Connectionjitesh.dhawanNo ratings yet

- CH 1 PDFDocument20 pagesCH 1 PDFManishNishadNo ratings yet

- Cant See Secure SitesDocument1 pageCant See Secure Sitesjitesh.dhawanNo ratings yet

- DR Reddy'sDocument28 pagesDR Reddy'sAbhinandan BoseNo ratings yet

- Vaccination Status BSC ProgramDocument6 pagesVaccination Status BSC ProgramDedray Marsada HernandezNo ratings yet

- Stock PH 28-3-2022Document72 pagesStock PH 28-3-2022ariniNo ratings yet

- P 2Document12 pagesP 2Uday kumarNo ratings yet

- Classroom Set-Up Food Vaccine FrequencyDocument5 pagesClassroom Set-Up Food Vaccine FrequencyLuke Edward PanganibanNo ratings yet

- The Ultimate Guide To Pharmaceutical Quality ManagementDocument27 pagesThe Ultimate Guide To Pharmaceutical Quality ManagementDennis StwnNo ratings yet

- Trump Legal CBD OilDocument9 pagesTrump Legal CBD OilChiefJustice Middleton100% (1)

- M.Pharm/B.Pharm Final Year Projects (Final Projects 2030)Document7 pagesM.Pharm/B.Pharm Final Year Projects (Final Projects 2030)Subhram Kumar PandaNo ratings yet

- GR N RegisterDocument95 pagesGR N RegisterShashi PrasadNo ratings yet

- Alumni PDF HubDocument14 pagesAlumni PDF HubasanyogNo ratings yet

- Competing Through Capabilities: Group Assignment Case Study: Mankind PharmaDocument2 pagesCompeting Through Capabilities: Group Assignment Case Study: Mankind PharmaRN’s Food ‘N’ Travel VlogsNo ratings yet

- World Preview 2016-EvaluatepharmaDocument34 pagesWorld Preview 2016-Evaluatepharmasunxiaodong11100% (1)

- Attock Demand Week 4Document26 pagesAttock Demand Week 4Salman PervaizNo ratings yet

- Alkilator: Antineuroplastik No Golongan/derivat Nama Generik BSO/kekuatan Sediaan Nama Dagang /pabrikDocument10 pagesAlkilator: Antineuroplastik No Golongan/derivat Nama Generik BSO/kekuatan Sediaan Nama Dagang /pabrikIkfi LailaNo ratings yet

- List of Solvent Recovery Units in The State of APDocument5 pagesList of Solvent Recovery Units in The State of APsaakittuNo ratings yet

- Resposta SabesprevDocument36 pagesResposta SabesprevAnonymous BXkdJv5LzcNo ratings yet

- Generic, Paten, Dan Nama PabrikDocument5 pagesGeneric, Paten, Dan Nama PabrikHirzam EcanNo ratings yet

- The Price of Medicines in Jordan: The Cost of Trade-Based Intellectual PropertyDocument11 pagesThe Price of Medicines in Jordan: The Cost of Trade-Based Intellectual PropertyPonchi PonchiNo ratings yet

- Lupin and SPILDocument7 pagesLupin and SPILsunil kaushikNo ratings yet

- Director Healthcare Technology Marketing in Philadelphia PA Resume Robin SametDocument3 pagesDirector Healthcare Technology Marketing in Philadelphia PA Resume Robin SametRobinSametNo ratings yet

- Syn 3 - Roche and Tamiflu-SG3Document29 pagesSyn 3 - Roche and Tamiflu-SG3Yani RahmaNo ratings yet

- DSMB ConflIct InterestDocument9 pagesDSMB ConflIct Interestejm jensenNo ratings yet

- GROUP-8 Term PaperDocument16 pagesGROUP-8 Term PaperJammigumpula PriyankaNo ratings yet

- CustomersDocument56 pagesCustomersrajeev_snehaNo ratings yet

- Usfda-Generic Drug User Fee Act - A Complete ReviewDocument15 pagesUsfda-Generic Drug User Fee Act - A Complete ReviewijsidonlineinfoNo ratings yet