Professional Documents

Culture Documents

Introduction

Uploaded by

shahidsarkCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction

Uploaded by

shahidsarkCopyright:

Available Formats

Banco Real:

Banking on

Sustainability

Case Analysis

Submitted to:

Dr. Ayesha Afzal

Submitted by:

Harris Khurram

Muhammad Shahid

Rana Noraiz

Malik Sultan Haider

Awais Haider

Shariq Hanif

Introduction

Being the 4

th

largest privately owned bank in Brazil and number 15 on the list of

brazils most admired companies, Banco Real had to play an important role and live

up to the expectations president Lula had from private sector. With the advent of the

sustainability theme, Banco Real had ventured into socio-environmental screening for

credit analysis, environmentally focused products, micro-finance, socio-environmental

tests for suppliers, internal reduction of waste and recycling, and workforce diversity.

Trouble in paradise: Problems of the

Brazilian economy

After attaining its independence in 1822, brazil quickly emerged as south Americas

leading economic power. However, 1980s saw a plethora of problems, such as

declining Real growth, runway inflation, unserviceable foreign debt and lack of policy

direction, besetting the economy. Environmental deficiencies, poor transportation

network and bureaucracy were breathing down the publics neck. Homicide rate was

50 per 100,000 residents and drug cartels were expanding their influence.

Banking sector:

Brazilian banking sector was divided among:

Federally owned banks

State owned banks

Brazilian controlled banks

Foreign controlled banks

During the 1980s, inflation was rampant with levels in excess of 200% leading to

banks becoming increasingly becoming dependent on float revenues. This resulted in

two consolidation efforts by the government. In 1994, Plano Real was introduced

which was aimed at reducing inflation by using inflation rate as an anchor. The second

effort came in response to the worldwide recession that forced the government to

identify institutions with problems and ask them to hand over their control to

government.

Banco Real:

Banco Real was a well-established financial group that traced back its origins to 1925.

During the wave of consolidation in the Brazilian economy, Banco Real was acquired

by ABN AMRO S.A. this acquisition posed a new problem of creating a new and

stronger culture in the organization administering its effective implementation.

The change process:

Banco Real wanted value creation by fostering a new model of growth aiming at

satisfying both customers and specific ethical & environmental standards. It decided

to focus on customer stressing relationship rather than transaction. The bank boasts a

positive track record in terms of CSR action, programs and policies. Banco created the

education and sustainable development department which was responsible for

education and training.

The management explained that it was seriously committed to economic, social,

environmental development of stakeholders, employees, clients, suppliers and society

at large. Its commitment was reaffirmed through the expansion of loan via

microfinance program which the bank argued was the most important instrument to

stimulate economic and social development. Banco Real divided its activities in

different categories, such as micro finance, ethical funds, socio environmental

financing, social and cultural investment, ecoefficieny and suppliers. These all support

Banco Reals main objective of customer satisfaction and specific ethical and

environmental standards.

Banco Real adopted the corporate social and environmental responsibility approach

because it was the way forward and it aligned with the new course the organization

wanted to take. The bank could have stuck with the traditional banking approach of

gathering deposits and making loans to large organizations that promised safer returns

but it would have been counterproductive for the economy already in shambles and

the acquisition of Banco Real by ABN AMRO would have failed to generate useful

results for the acquirer.

Measuring the success of Banco Real:

Risks present opportunities; competitive advantages that can reposition an

organization and place it in an entirely new spectrum. BANCO REAL, one of Brazils

top five largest privately owned banks, is among those leading financial institutions to

have chosen a distinct pathway by placing corporate social responsibility at the center

of all their business activities. Their business model has revolutionized the South

American banking industry, demonstrating to others how an organization can be

profitable while maintaining an ethical attitude.

At a time when several other acquisitions were taking place in the banking sector,

competition was strong. Many of their bigger competitors did not only have a better

technological infrastructure, but also stronger brand recognition. At the same time,

poverty combined with a poor infrastructure, a high level of income disparity, and

increasing environmental deficiencies afflicted the country although Brazil was

defined as one of South Americas leading emerging economies. Mr. Barbosa

believed there is limited value in succeeding in a country which does not enjoy the

same success itself. Given the competitive landscape in the industry and the huge

societal problems, he knew it was possible to establish a new bank; a bank that would

not only be distinguished from its competitors, but, most importantly, one that would

have a new identity that could transform the society. Such a bank would be respected

and admired by all its stakeholders, not only its investors. Inspired by the vision of

creating a new bank for a new society, Mr. Barbosa and other senior executives of

the bank believed they could succeed by doing the right things, the right way. This

entailed developing strategies that centered on corporate social responsibility. They

wanted to move beyond mere philanthropy, and intended to demonstrate that it was

possible to be profitable and at the same time create value for the society. Their

emphasis on value creation led them to introduce the bank of value concept in 2001.

Like most unexplored pathways, this one was also filled with many uncertainties.

Nevertheless, although there was some initial resistance, most senior executives,

including Mr. Barbosa and Ms. Pinto, stuck to the new way of doing business, as they

believed this was the right thing to do. This was contrary to the old way, which

emphasized transactions, while the new way meant focusing more on the type and

quality of the customer relationships. For their vision to be successfully carried out,

the relevant senior executives knew it was crucial to establish an internal team

dedicated to ensuring that corporate social responsibility would be ingrained in all

their business activities. Consequently, a committee was appointed to discuss and

develop ways that could bring about the desired change, while work groups from

various areas of the bank carried out the implementation of the projects. In 2002, the

committee created under the bank-of-value concept was divided into three

committees: management, market, and social action. While the management

committee was responsible for eco-efficiency, employee diversity, and suppliers, the

market committee was focused on the products, customers, and credit risk analysis.

The social action committee was accountable for social investment and community

involvement.

A crucial step had been taken by appointing committees that would serve to integrate

the banks new business model. However, before aiming to transform the outer world,

the management knew they had to change the company from within. The banks

business processes were therefore started analyzed and redesigned to make them more

socio environmentally sustainable. In 2001, BANCO REAL introduced their 3Rs

Eco efficiency program (reduction, re-utilization, and recycling). Most of the banks

efforts to reduce its environmental footprint were primarily focused on reducing water

and energy consumption, and the usage of recycled resources, such as paper, batteries,

and ink used for their printing devices. Through these initiatives, the energy

consumption was reduced by 12 per cent during the last three years; currently,

approximately 90 per cent of all the paper used is derived from recycled paper.

A key determinant to creating a better bank for a better society was to mobilize

others to adopt more sustainable practices. The management knew that alone they

would not be as successful, but by sharing corporate social responsibility with others,

they could come closer to making their vision a Reality. This meant, for example, that

the bank would only engage with those customers who shared the same principles,

otherwise those principles would be meaningless. Consequently, the bank screened

out those customers whose activities would pose high socio-environmental risks. This

process generated much resistance at first, as many managers thought the bank would

lose a significant client base and their assets would decline.

Financially, Banco Real is facing its fair share of ups and downs. Their deposit base

has drastically increased by 284% from 2000-2004 with net profits showing an

increase of almost 91%. However the banks ROE and ROA have dropped over the

years indicating that it has been inefficient in using its deposits to generate profits.

Key elements of change:

Change process in the company was initiated by two very different type of events one

positive and other negative. There was a filthy and abandoned alley close to the bank

which was home of thugs and drug dealers. The bank took responsibility of

transforming the alley and constructed new pavement and a garden. The basic idea

behind this initiative was that the whole world could be changed, if every person takes

the responsibility of transforming the place next door.

On the negative side, an employee of the bank sold a long term bond to a 70 year old

person which would not mature for decades. From that point onwards, the

organization felt the need to change its inner culture and decided that it was better to

lose a deal than losing a relationship.

In the new approach Bank of value corporate social responsibility was placed at the

center of the business activities to make an impact. Company believed that this new

approach could be beneficial not only in terms of profit but also in terms of creating

value for their customers and society. In accordance to their Bank of Value

approach two new campaigns were introduced which were a new bank for a new

society and Bank of Your Life. President and other managers of the bank believed

they could succeed by Doing the right things, the right way. Although this concept

was applauded by 80% of the employees but some thought it was practically

impossible as you cant give everything to everyone.

To move forward with their Socio-Environmental approach Bank introduced first

Socio-Environmental product Ethical Mutual Funds in 2001. This was an equity

fund comprised of companies that practiced sound corporate governance and

integrated economic-financial and socio-environmental considerations. Over 3 years

after its launch the ethical mutual fund was composed of stock from 25 companies,

had R$75 million under management and had a 159.5% return since its inception.

Although the funds asset was still a fraction of the R$29.4 billion managed by the

company, it showed that investment in the socio-environmentally responsible

companies could pay off in long run.

In addition to this, bank saw a market in financing projects to improve socio-

environmental performance. Hence Socio-environmental financial products were

introduced and different lines of financing were introduced for corporate customers

and consumers. Moreover, company managed to gain the World Bank loan pool of

US$51 million to lend for socio-environmental and corporate governance

improvements. Company also started to give small loans to very poor people for

income-generating self-employment projects under Micro-finance. By doing this

company also tapped into a new market.

In the next step of change process, company involved its suppliers in their social

responsibility programs. Idea was to combine companies into mutual learning process.

So as a result in 2003, new guidelines for supplier relationships were defined and

supplies were asked to sign terms of service declaring that they know the banks

policies and are willing to follow them.

To implement the change process effectively there was a need to shape the culture

inside the bank. So company introduced two campaigns The 3Rs and Diversity.

Activities such as Environmental Week and Diversity Day were launched to stress the

importance of these campaigns. Overall, a bank culture was formed that was based on

employee participation, creativity, employee development, and focus on

communication. Company also involved its customers in its change process.

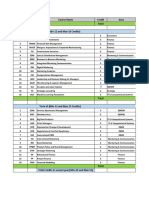

Change

Involvement

of

Employees

Supplier

Relationships

Socio-

Environmental

Approach

Customer's

Involvement

Value

Creation

Approach

The wheel of change represents all the aspects of the change process that was initiated

in Banco Real.

Barriers to change

After the acquisition, the bank integrated a new element that resulted in the tuning of

the whole organization in order to incorporate that change. That new element was the

value creation on which they were emphasizing. Banco Real had to unfreeze their

existing state, bring in the change, and refreeze. Handling social and environmental

risk was crucial for Banco Real because failure in this regard could have cost them

with both reputation and financially. In adapting to the changes being shaped, Banco

Real was availing the new opportunity but was facing the threat by giving some room

to its competitors to capture the market share Banco Real have had.

Some barriers mentioned in the article are:

The bank had to walk away from the clients that were posing social and

environmental risks. Hence some clients were lost due to the strong

commitment of Banco Real. This did pose a threat but the bank projected itself

as an organization that wouldnt hesitate going to any level required in order to

meet their goals.

Incorporating socio-environmental matters into the companys wasnt easy as

well. All the financial statements couldnt be accounted for as financial

statements were not often audited in Brazil.

Social matters such as child labor or compliance with regulations were hard to

prove. Not all aspects can be monitored and proved.

Large corporations werent happy with them being audited and Banco Real

would only work with the organizations clearing the audits as followers of

socio-environmental organization. The leaders couldnt do a thing because the

corporations were humongous.

In 2001 Banco Real launched ethical mutual fund which resulted against them

as people thought of ethical fund being the only fund meeting ethical standards.

The problem was never sorted at all.

The Banco Real was always conveying their goals through demonstration by

themselves, by following ethical standards but there were loop hole between

them and their suppliers. Around 30% payments werent made to its suppliers

due to mere lack of discipline.

Banco Reals leaders had decided that the bank would be customer focused

thus emphasizing more on relationship building than anything else. But some

executives thought of it as impossible business strategy. According to them it

wasnt feasible to give everything to everyone.

7 skills of change leaders

Turning in to the environment

It was accomplished as they had excellent leadership group who found out the

opportunities and then decided what to aspire. Not only did they changed themselves

but also motivated and encouraged everyone involved with them including clients.

Kaleidoscope thinking, stimulating breakthrough ideas

This was practiced by leaders. In fact it was due to this that they came up with the

concept Banco de Valor that formed the basic goal.

Setting the theme

This skill was present in the leaders and they used this in encouraging and motivating

their employees and fellow staff. Not only did they adopt social responsibility, they

also convinced some clients in adopting it too.

Enlisting backers and supporters

A great deal of the work of innovation and change is to reach deeply into, across and

outside the organization to identify key influencers and get them interested and

supportive. Certainly they had used this skill.

Developing the dream, nurturing the working team

The leaders involved the working force in achieving the goal of the organization and

empowered them where needed so that their confidence is build up.

Mastering the difficult middles, persisting and preserving

The leaders had this skill almost 50%. At times they took steps out of the box in

solving the problems but at other times problems were left unresolved.

Celebrating accomplishments

Making everyone a hero wasnt clearly observed in Banco Real. Since

accomplishments werent shown nothing can be said about this one.

What the future holds for Banco Real:

To put the ambitions formulated in specific policies into practice, the bank needs to

devote considerable attention and resources to capacity building, training, motivating

and rewarding its employees. All employees involved need to be trained with regard

to the social and environmental issues related to the sectors. Specific attention should

be paid to internalizing the banks mission and specific goals by employees.

Additionally, a sustainable human resources policy attracts, stimulates and rewards

people who are able to contribute to the banks mission and sustainability goals most

effectively. Banco shouldnt give its employees (including Board members) bonuses

for mere quantity of business achieved, margins and short-term profits. Rather it

should reward employees who seriously work on the implementation of the banks

policies. The bonus system should integrate sustainability and longer time horizons

and attribute positive value to prudent decision making. The bank should also move

towards sector wide implementation of the corporate social responsibility guidelines

in coordination with the government agencies and NGOs. This would help in shaping

up the banking sector for further improvement and transparency.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Banco RealDocument17 pagesBanco Realshahidsark100% (1)

- Tesco 14 FullDocument4 pagesTesco 14 FullBilal SolangiNo ratings yet

- IMNU HimasnhuPatel Anand Rathi Internship ReportDocument57 pagesIMNU HimasnhuPatel Anand Rathi Internship ReportHimanshu Patel33% (3)

- Od Intervention With Case StudiesDocument13 pagesOd Intervention With Case StudiesArushi Kaul75% (8)

- Accounts TestDocument3 pagesAccounts TestAMIN BUHARI ABDUL KHADERNo ratings yet

- IKEA's Global Marketing StrategyDocument3 pagesIKEA's Global Marketing StrategyJacky Nguyen0% (1)

- Pepsi ChangDocument2 pagesPepsi ChangshahidsarkNo ratings yet

- B. If The Objective Is To Maximize The Discount Show That The LP Model IsDocument5 pagesB. If The Objective Is To Maximize The Discount Show That The LP Model IsshahidsarkNo ratings yet

- Graphical Solutions of Linear InequalitiesDocument6 pagesGraphical Solutions of Linear InequalitiesshahidsarkNo ratings yet

- Empty Feasible Region Maximize Z 8x-3y SubjectDocument4 pagesEmpty Feasible Region Maximize Z 8x-3y SubjectshahidsarkNo ratings yet

- Economic Problems of Pakistan: UnemploymentDocument7 pagesEconomic Problems of Pakistan: UnemploymentshahidsarkNo ratings yet

- GroupsDocument1 pageGroupsshahidsarkNo ratings yet

- Service Sector of PakistanDocument2 pagesService Sector of Pakistanshahidsark100% (1)

- Presidential Decree No 442Document10 pagesPresidential Decree No 442Eduardo CatalanNo ratings yet

- TPM PresentationDocument40 pagesTPM PresentationRahul RajpalNo ratings yet

- Electrocomponents - RS Group - Investor - Event - 2022 - Presentation - 30.03.2022Document105 pagesElectrocomponents - RS Group - Investor - Event - 2022 - Presentation - 30.03.2022sydubh72No ratings yet

- Designing Successful Go To Market SrategiesDocument21 pagesDesigning Successful Go To Market Srategiessaurav_edu67% (3)

- Literature ReviewDocument3 pagesLiterature ReviewRohan SharmaNo ratings yet

- Org. and ManagementDocument3 pagesOrg. and Managementvirginia taguiba0% (1)

- AISAN CanopyDocument46 pagesAISAN CanopyAmirul AdamNo ratings yet

- Operations and Supply Chain Management B PDFDocument15 pagesOperations and Supply Chain Management B PDFAnonymous sMqylHNo ratings yet

- FDI in The Indian Retail SectorDocument4 pagesFDI in The Indian Retail SectorE D Melinsani ManaluNo ratings yet

- PJMT Dismas Assignment 3Document10 pagesPJMT Dismas Assignment 3Tony Joseph100% (1)

- Personal Statement - ISEGDocument2 pagesPersonal Statement - ISEGMirza Mohammad AliNo ratings yet

- CAMEL NCP Tuesday FinalDocument83 pagesCAMEL NCP Tuesday FinalJoel LampteyNo ratings yet

- Electives Term 5&6Document28 pagesElectives Term 5&6GaneshRathodNo ratings yet

- Aon Profile 2020Document16 pagesAon Profile 2020phanapa100% (1)

- Group 6 Environmental ScanningDocument9 pagesGroup 6 Environmental Scanningriza may torreonNo ratings yet

- Draft Railway BenchmarksDocument94 pagesDraft Railway BenchmarksEvarist Edward100% (1)

- Soal Uts Abm 2 - Sesi 1Document2 pagesSoal Uts Abm 2 - Sesi 1alyaa rabbaniNo ratings yet

- Fort Erie Customs BrokersDocument2 pagesFort Erie Customs BrokersdaverobNo ratings yet

- Software Requirement Specification - Tariq KhanDocument18 pagesSoftware Requirement Specification - Tariq Khansun.developer72270% (1)

- Resumo Cientifico ITIL Niveles de MadurezDocument11 pagesResumo Cientifico ITIL Niveles de MadurezscapasNo ratings yet

- ICAEW - Accounting 2020 - Chap 2Document56 pagesICAEW - Accounting 2020 - Chap 2TRIEN DINH TIENNo ratings yet

- Fedex Supply Chain Global SuccessDocument2 pagesFedex Supply Chain Global SuccessEldho RoyNo ratings yet

- Is Enhanced Audit Quality Associated With Greater Real Earnings Management?Document22 pagesIs Enhanced Audit Quality Associated With Greater Real Earnings Management?Darvin AnanthanNo ratings yet

- Transfer of Property Sale of Goods ActDocument16 pagesTransfer of Property Sale of Goods Actdikshit91vishalNo ratings yet

- 4global Capital Market 2Document11 pages4global Capital Market 2roseNo ratings yet