Professional Documents

Culture Documents

Tugas 5 - Inventory

Uploaded by

Muhammad Rochim0 ratings0% found this document useful (0 votes)

46 views11 pagesTugas 5 - Inventory

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTugas 5 - Inventory

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views11 pagesTugas 5 - Inventory

Uploaded by

Muhammad RochimTugas 5 - Inventory

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 11

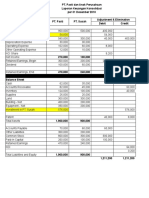

Cost Method-INV PT PUAN & Subsidiary

Consolidated Financial Statement

per December 31, 2010

debit credit

Income Statement

Sales 1,000,000 650,000 400,000 1,250,000

Dividend Income 51,000 51,000 -

COGS (600,000) (390,000) 10,000 400,000 (600,000)

Deprecation expense (37,000) (30,000) 1,000 (66,000)

Operating expense (170,000) (85,000) (255,000)

Other operating expense (53,000) (25,000) 5,000 (83,000)

Net Income 191,000 120,000 246,000

NCI Expense 17,400 (17,400)

Consolidated Net Income 191,000 120,000 228,600

Beginning R/E 330,000 150,000 150,000 330,000

Dividend (100,000) (60,000) 60,000 (100,000)

Ending R/E 421,000 210,000 458,600

Balance Sheet

Cash 65,000 50,000 115,000

Account Receivable 55,000 45,000 40,000 60,000

Dividend Receivable 51,000 51,000 -

Inventory 80,000 50,000 10,000 120,000

Supplies 14,750 5,000 19,750

Land 300,000 230,000 35,000 565,000

Building 200,000 100,000 1,000 10,000 291,000

Equipment 200,000 150,000 350,000

Investment in SANTI 340,000 340,000 -

Patent 25,000 5,000 20,000

Total Assets 1,305,750 630,000 1,540,750

Account Payable 140,750 40,000 40,000 140,750

Dividend Payable 60,000 51,000 9,000

Other Liabilities 144,000 120,000 264,000

Capital Stock 600,000 200,000 200,000 600,000

Retained Earnings 421,000 210,000 458,600

NCI Equity 60,000 68,400

8,400

Total Liabilities + OE 1,305,750 630,000 985,400 985,400 1,540,750

Consolidated

Financial Statement

Accounts PT PUAN PT SANTI

adjustment & elimination

Investment Cost 340,000

FV Net Asset (340.000/0,85) 400,000

BV Net Asset 350,000

Excess Value 50,000

Alokasi

Land 35,000

Building (10,000)

Patent 25,000

50,000

JURNAL ELIMINASI

Capital Stock 200,000

Beginning R/E 150,000

Land 35,000

Patent 25,000

Building 10,000

Investment in SANTI 340,000

NCI Equity 60,000

Dividend Income 51,000

Dividend 51,000

Dividend Payable 51,000

Dividend Receivable 51,000

Building 1,000

Deprecation expense 1,000

Other operating expense 5,000

Patent 5,000

NCI Expense 17,400

NCI Equity 8,400

Dividend 9,000

* 15% (120.000+1000-5000)

Total COGS 390,000

From other 40,000

350,000

End Inventory 50,000

Purchase from PUAN 400,000

Sales 400,000

COGS 400,000

COGS 10,000

Inventory 10,000

Account Payable 40,000

Account Receivable 40,000

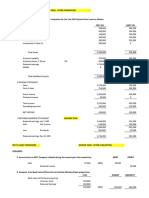

Cost Method-INV PT PASTI & Subsidiary

Consolidated Financial Statement

per December 31, 2010

debit credit

Income Statement

Sales 900,000 500,000 400,000 1,000,000

Dividend Income 54,000 54,000 -

COGS (540,000) (300,000) 40,000 400,000 (480,000)

Deprecation expense (30,000) (30,000) (60,000)

Operating expense (102,000) (60,000) (162,000)

Other operating expense (12,000) (10,000) 8,000 (30,000)

Net Income 270,000 100,000 268,000

NCI Expense 9,200 (9,200)

Consolidated Net Income 270,000 100,000 258,800

Beginning R/E 300,000 200,000 200,000 300,000

Dividend (100,000) (60,000) 60,000 (100,000)

Ending R/E 470,000 240,000 458,800

Balance Sheet

Cash 62,000 35,000 97,000

Account Receivable 82,000 45,000 60,000 67,000

Inventory 124,000 100,000 40,000 184,000

Supplies 26,000 20,000 46,000

Land 300,000 300,000 600,000

Building 400,000 200,000 600,000

Equipment 330,000 200,000 530,000

Investment in SUSAH 576,000 576,000 -

Patent 40,000 8,000 32,000

-

Total Assets 1,900,000 900,000 2,156,000

Account Payable 70,000 60,000 60,000 70,000

Other Liabilities 300,000 200,000 500,000

Common Stock 800,000 300,000 300,000 800,000

Paid in Capital 260,000 100,000 100,000 260,000

Retained Earnings 470,000 240,000 458,800

NCI Equity 64,000 67,200

3,200

Total Liabilities + OE 1,900,000 900,000 1,211,200 1,211,200 2,156,000

Consolidated

Financial Statement

Accounts PT PASTI PT SUSAH

adjustment & elimination

Investment Cost 576,000

FV Net Asset 640,000

BV Net Asset 600,000

Excess Value 40,000

Alokasi

Patent 40,000

40,000

JURNAL ELIMINASI

Common Stock 300,000

Paid in Capital 100,000

Beginning R/E 200,000

Patent 40,000

Investment in SUSAH 576,000

NCI Equity 64,000

Dividend Income 54,000

Dividend 54,000

Other operating expense 8,000

Patent 8,000

NCI Expense 9,200

NCI Equity 3,200

Dividend 6,000

* 10% (100.000-8000)

Total COGS 300,000

End Inventory 100,000

Purchase from Pasti 400,000

Sales 400,000

COGS 400,000

COGS 40,000

Inventory 40,000

Account Payable 60,000

Account Receivable 60,000

Cost Method-INV PT PASTI & Subsidiary

Consolidated Financial Statement

per December 31, 2011

debit credit

Income Statement

Sales 1,000,000 600,000 380,000 1,220,000

Dividend Income 72,000 72,000 -

COGS (600,000) (360,000) 48,000 420,000 (588,000)

Deprecation expense (30,000) (30,000) (60,000)

Operating expense (102,000) (80,000) (182,000)

Other operating expense (12,000) (15,000) 8,000 (35,000)

Net Income 328,000 115,000 355,000

NCI Expense 10,700 (10,700)

Consolidated Net Income 328,000 115,000 344,300

Beginning R/E 470,000 240,000 280,000 28,800 458,800

Dividend (120,000) (80,000) 80,000 (120,000)

Ending R/E 678,000 275,000 683,100

Balance Sheet

Cash 72,000 50,000 122,000

Account Receivable 92,000 50,000 60,000 82,000

Inventory 104,000 120,000 48,000 176,000

Supplies 26,000 35,000 61,000

Land 470,000 300,000 770,000

Building 400,000 200,000 600,000

Equipment 330,000 200,000 530,000

Investment in SUSAH 576,000 28,800 604,800 -

Patent 32,000 8,000 24,000

-

Total Assets 2,070,000 955,000 2,365,000

Account Payable 82,000 60,000 60,000 82,000

Other Liabilities 250,000 220,000 470,000

Common Stock 800,000 300,000 300,000 800,000

Paid in Capital 260,000 100,000 100,000 260,000

Retained Earnings 678,000 275,000 683,100

NCI Equity 67,200 69,900

2,700

Total Liabilities + OE 2,070,000 955,000 1,319,500 1,319,500 2,365,000

Consolidated

Financial Statement

Accounts PT PASTI PT SUSAH

adjustment & elimination

JURNAL PENYESUAIAN

Kenaikan RE

Investment in SUSAH 36,000

Beginning R/E 36,000

Amortisasi

Beginning R/E 7,200

Investment in SUSAH 7,200

JURNAL ELIMINASI

Common Stock 300,000

Paid in Capital 100,000

Beginning R/E 240,000

Patent 32,000

Investment in SUSAH 604,800

NCI Equity 67,200

Dividend Income 72,000

Dividend 72,000

Other operating expense 8,000

Patent 8,000

NCI Expense 10,700

NCI Equity 2,700

Dividend 8,000

* 10% (115.000-8000)

End Inventory 120,000

Total COGS 360,000

Beginning Inventory (100,000)

Purchase from Pasti 380,000

Sales 380,000

COGS 380,000

COGS 48,000

Inventory 48,000

Account Payable 60,000

Account Receivable 60,000

Eliminasi Unrealized Profit

Beginning R/E 40,000

COGS 40,000

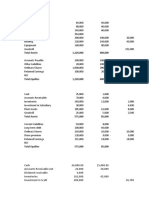

Cost Method-INV-upstream PT PAPAN & Subsidiary

Consolidated Financial Statement

per December 31, 2010

debit credit

Income Statement

Sales 246,000,000 200,000,000 200,000,000 246,000,000

Dividend Income 18,000,000 18,000,000 -

Cost of Sales (164,000,000) (120,000,000) 14,400,000 200,000,000 (98,400,000)

Deprecation expense (18,200,000) (9,000,000) 2,000,000 (25,200,000)

Interest expense (5,900,000) (3,000,000) (8,900,000)

Other operating expense (15,900,000) (18,000,000) 14,000,000 (47,900,000)

Net Income 60,000,000 50,000,000 65,600,000

NCI Expense 2,360,000 (2,360,000)

Consolidated Net Income 60,000,000 50,000,000 63,240,000

Beginning R/E 249,500,000 49,500,000 49,500,000 249,500,000

Dividend (80,000,000) (20,000,000) 20,000,000 (80,000,000)

Ending R/E 229,500,000 79,500,000 232,740,000

Balance Sheet

Cash 27,650,000 8,700,000 36,350,000

Account Receivable 25,000,000 15,000,000 15,000,000 25,000,000

Inventory 36,000,000 48,000,000 14,400,000 69,600,000

Other Current Assets 46,700,000 9,000,000 55,700,000

Land 216,800,000 97,300,000 314,100,000

Building 214,000,000 274,000,000 20,000,000 468,000,000

Acc. Depreciation-Building (102,500,000) (7,400,000) 2,000,000 (107,900,000)

Equipment 134,400,000 35,900,000 170,300,000

Acc. Depreciation-Equipment (25,000,000) (13,000,000) (38,000,000)

Investment in SANI 404,550,000 404,550,000 -

Patent 70,000,000 14,000,000 56,000,000

Total Assets 977,600,000 467,500,000 1,049,150,000

Account Payable 15,000,000 19,100,000 15,000,000 19,100,000

Other Liabilities 23,500,000 18,900,000 42,400,000

8% Bonds Payable 309,600,000 309,600,000

Capital Stock 400,000,000 350,000,000 350,000,000 400,000,000

Retained Earnings 229,500,000 79,500,000 232,740,000

NCI Equity 44,950,000 45,310,000

360,000

Total Liabilities + OE 977,600,000 467,500,000 735,260,000 735,260,000 1,049,150,000

Consolidated

Financial Statement

Accounts PT PAPAN PT SANI

adjustment & elimination

Investment Cost 404,550,000

FV Net Asset 449,500,000

BV Net Asset 399,500,000

Excess Value 50,000,000

Alokasi

Building (20,000,000)

Patent 70,000,000

50,000,000

JURNAL ELIMINASI

Capital Stock 350,000,000

Beginning R/E 49,500,000

Patent 70,000,000

Building 20,000,000

Investment in SANI 404,550,000

NCI Equity 44,950,000

Dividend Income 18,000,000

Dividend 18,000,000

Acc. Depreciation-Building 2,000,000

Deprecation expense 2,000,000

Other operating expense 14,000,000

Patent 14,000,000

NCI Expense 2,360,000

NCI Equity 360,000

Dividend 2,000,000

* 10% (50.000.000-14.000.000+2.000.000-14.400.000)

Total COGS 164,000,000

End Inventory 36,000,000

Purchase from SANI 200,000,000

Sales 200,000,000

Cost of Sales 200,000,000

Cost of Sales 14,400,000

Inventory 14,400,000

Account Payable 15,000,000

Account Receivable 15,000,000

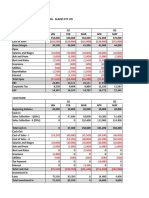

Cost Method-INV-upstream PT PAPAN & Subsidiary

Consolidated Financial Statement

per December 31, 2011

debit credit

Income Statement

Sales 436,500,000 300,000,000 300,000,000 436,500,000

Dividend Income 36,000,000 36,000,000 -

Cost of Sales (291,000,000) (180,000,000) 18,000,000 314,400,000 (174,600,000)

Deprecation expense (18,200,000) (9,000,000) 2,000,000 (25,200,000)

Interest expense (5,900,000) (3,000,000) (8,900,000)

Other operating expense (15,900,000) (28,000,000) 14,000,000 (57,900,000)

Net Income 141,500,000 80,000,000 169,900,000

NCI Expense 6,440,000 (6,440,000)

Consolidated Net Income 141,500,000 80,000,000 163,460,000

Beginning R/E 229,500,000 79,500,000 92,460,000 16,200,000 232,740,000

Dividend (100,000,000) (40,000,000) 40,000,000 (100,000,000)

Ending R/E 271,000,000 119,500,000 296,200,000

Balance Sheet

Cash 57,650,000 18,700,000 76,350,000

Account Receivable 45,000,000 24,000,000 24,000,000 45,000,000

Inventory 45,000,000 68,000,000 18,000,000 95,000,000

Other Current Assets 46,700,000 13,300,000 60,000,000

Land 350,000,000 97,300,000 447,300,000

Building 214,000,000 274,000,000 20,000,000 468,000,000

Acc. Depreciation-Building (122,500,000) (8,700,000) 4,000,000 (127,200,000)

Equipment 263,200,000 35,900,000 299,100,000

Acc. Depreciation-Equipment (275,500,000) (15,000,000) (290,500,000)

Investment in SANI 404,550,000 16,200,000 420,750,000 -

Patent 56,000,000 14,000,000 42,000,000

Total Assets 1,028,100,000 507,500,000 1,115,050,000

Account Payable 24,000,000 19,100,000 24,000,000 19,100,000

Other Liabilities 23,500,000 18,900,000 42,400,000

8% Bonds Payable 309,600,000 309,600,000

Capital Stock 400,000,000 350,000,000 350,000,000 400,000,000

Retained Earnings 271,000,000 119,500,000 296,200,000

NCI Equity 1,440,000 46,750,000 47,750,000

2,440,000

Total Liabilities + OE 1,028,100,000 507,500,000 918,540,000 918,540,000 1,115,050,000

Consolidated

Financial Statement

Accounts PT PAPAN PT SANI

adjustment & elimination

JURNAL PENYESUAIAN

Kenaikan RE

Investment in SANI 27,000,000

Beginning R/E 27,000,000

Amortisasi

Beginning R/E 10,800,000

Investment in SANI 10,800,000

JURNAL ELIMINASI

Capital Stock 350,000,000

Beginning R/E 79,500,000

Patent 56,000,000

Acc. Depreciation-Building 2,000,000

Building 20,000,000

Investment in SANI 420,750,000

NCI Equity 46,750,000

Dividend Income 36,000,000

Dividend 36,000,000

Acc. Depreciation-Building 2,000,000

Deprecation expense 2,000,000

Other operating expense 14,000,000

Patent 14,000,000

NCI Expense 6,440,000

NCI Equity 2,440,000

Dividend 4,000,000

* 10% (80.000.000-14.000.000+2.000.000+14.400.000-18.000.000)

Total COGS 291,000,000

End Inventory 45,000,000

Beginning Inventory (36,000,000)

Purchase from SANI 300,000,000

Sales 300,000,000

Cost of Sales 300,000,000

Cost of Sales 18,000,000

Inventory 18,000,000

Account Payable 24,000,000

Account Receivable 24,000,000

Eliminasi Unrealized Profit tahun sebelumnya

Beginning R/E 12,960,000

NCI Equity 1,440,000

Cost of Sales 14,400,000

You might also like

- P02-Working Cash Advance Request FormDocument30 pagesP02-Working Cash Advance Request FormVassay KhaliliNo ratings yet

- CMA - Case Study Blades PTY LTDDocument6 pagesCMA - Case Study Blades PTY LTDRizaNurfadliWirasasmitaNo ratings yet

- CMA - Case Study Blades PTY LTDDocument6 pagesCMA - Case Study Blades PTY LTDRizaNurfadliWirasasmita67% (3)

- Law of Contract: Prepared ByDocument50 pagesLaw of Contract: Prepared Bymusbri mohamed98% (44)

- Geoffrey Moore Core Vs Context PDFDocument39 pagesGeoffrey Moore Core Vs Context PDFBinod RImal100% (1)

- SHS Applied - Entrepreneurship CG PDFDocument7 pagesSHS Applied - Entrepreneurship CG PDFPat Che Sabaldana88% (8)

- QUIZ in Marketing Research For PracticeDocument4 pagesQUIZ in Marketing Research For Practicemeenumathur100% (1)

- Ezulwini Reinsurance Company ProfileDocument17 pagesEzulwini Reinsurance Company ProfileAnonymous fuLrGAqg100% (2)

- Production Planning and Inventory ManagementDocument31 pagesProduction Planning and Inventory ManagementramakrishnaNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Statement of CIDocument4 pagesStatement of CIMarvin CaliwaganNo ratings yet

- Solusi Inventory Downstream-UpstreamDocument19 pagesSolusi Inventory Downstream-UpstreamKurrniadi AndiNo ratings yet

- BA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsDocument23 pagesBA 118.3 Module 2 - Lesson 2 and 3 - Consolidating Financial StatementsRed Ashley De LeonNo ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Conso FS LessonDocument54 pagesConso FS Lessondbpcastro8No ratings yet

- BA 118.3 Module 2 Post and Sage AnswersDocument18 pagesBA 118.3 Module 2 Post and Sage AnswersRed Ashley De LeonNo ratings yet

- Adv AssignmentDocument3 pagesAdv AssignmentBromanineNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Soal KK QUIZ Versi EkuitasDocument5 pagesSoal KK QUIZ Versi EkuitasmraliyahNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- chp3 Practice Problem 1Document1 pagechp3 Practice Problem 1api-557861169No ratings yet

- Singapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice QuestionsDocument6 pagesSingapore Institute of Management UOL International Programme AC2091 Financial Reporting Session 6: Associates Practice Questionsduong duongNo ratings yet

- Tugas AKL1Document4 pagesTugas AKL1Yandra Febriyanti0% (1)

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Extra Session 2 (30 Sept 2022) Spreadsheet (CH 3)Document2 pagesExtra Session 2 (30 Sept 2022) Spreadsheet (CH 3)georgius gabrielNo ratings yet

- Problem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Document6 pagesProblem 1: P Company and Subsidiary Consolidated Working Paper Year Ended December 31, 2017Vincent FrancoNo ratings yet

- Workpaper Advanced Accounting 2Document2 pagesWorkpaper Advanced Accounting 2gabiNo ratings yet

- Entry For The AcquisitionDocument5 pagesEntry For The AcquisitionEnalem OtsuepmeNo ratings yet

- C. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Document1 pageC. Pilar Corporation and Subsidiary Working Paper For Consolidated Financial Statement December 31,2017Shaira GampongNo ratings yet

- Master Budgeting - Blades Pty LTDDocument14 pagesMaster Budgeting - Blades Pty LTDAdi KurniawanNo ratings yet

- Tugas Adv2Document13 pagesTugas Adv2Widodo MohammadNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- FV of Consideration BV Excess of FV Over BV Assigned To Tradenames Property&Equipment Patent GoodwillDocument6 pagesFV of Consideration BV Excess of FV Over BV Assigned To Tradenames Property&Equipment Patent GoodwillĐỗ Kim ChiNo ratings yet

- Business Combination - EM Sample ProblemDocument32 pagesBusiness Combination - EM Sample ProblemJohn Stephen PendonNo ratings yet

- Solution To R Haque Associates ProblemDocument8 pagesSolution To R Haque Associates ProblemHasanNo ratings yet

- Advanced Financial Individual Project - Keating FinalDocument36 pagesAdvanced Financial Individual Project - Keating FinalAshleyNo ratings yet

- Afar-Chapter 3 AssignmentDocument38 pagesAfar-Chapter 3 AssignmentJeane Mae BooNo ratings yet

- P3-28, 20, 21, 22Document8 pagesP3-28, 20, 21, 22jyraEB9390No ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- PT Ortu PT Bocah Comprehensive Income RP RPDocument8 pagesPT Ortu PT Bocah Comprehensive Income RP RPNcim PoNo ratings yet

- Generales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Document12 pagesGenerales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Kirstelle VelezNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- AbusocmDocument4 pagesAbusocmPrince PierreNo ratings yet

- Problem16 5acctgDocument2 pagesProblem16 5acctgAleah kay BalontongNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Randall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Document5 pagesRandall Corporation and Sharp Company Consolidation Worksheet December 31, 20X7Diane MagnayeNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Advanced Accounting 3Document1 pageAdvanced Accounting 3Tax TrainingNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Net Working Capital Current Assets - Current LiabilitiesDocument11 pagesNet Working Capital Current Assets - Current LiabilitiesRahul YadavNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Cash Flow Pr. 16-1ADocument1 pageCash Flow Pr. 16-1AKearrion BryantNo ratings yet

- PERSIJADocument10 pagesPERSIJAricoananta10No ratings yet

- CH 4 Comprehensive ProblemDocument5 pagesCH 4 Comprehensive ProblemLNo ratings yet

- Accounting Fundamentals PracticeDocument9 pagesAccounting Fundamentals PracticealitohdezsalNo ratings yet

- FV Differential: Amortization TableDocument17 pagesFV Differential: Amortization TableBeenish JafriNo ratings yet

- Assignment 5Document17 pagesAssignment 5Beenish JafriNo ratings yet

- Consolidation WorksheetDocument1 pageConsolidation WorksheetJean Kathyrine ChiongNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- CHP 2AnalysisInterpretationofAccountsDocument5 pagesCHP 2AnalysisInterpretationofAccountsalpeshmahto2004No ratings yet

- Start-Up Costs Start-Up Assets: Emergency Funds MiscellaneousDocument4 pagesStart-Up Costs Start-Up Assets: Emergency Funds MiscellaneousJudith Atienza HugoNo ratings yet

- DONE BA 118.3 Module 2 Quiz 1answer KeyDocument8 pagesDONE BA 118.3 Module 2 Quiz 1answer KeyRed Ashley De LeonNo ratings yet

- Forever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecemberDocument4 pagesForever Young Campsite Projected Trading Profit & Loss Account For The Period Ended 31St DecembermwauracoletNo ratings yet

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- P ChartDocument21 pagesP ChartSumit Patil100% (1)

- Penerapan Prinsip Mengenal Nasabah Pada Bank Perkreditan Rakyat Berdasarkan Pbi Nomor 12/20/PBI/2010Document14 pagesPenerapan Prinsip Mengenal Nasabah Pada Bank Perkreditan Rakyat Berdasarkan Pbi Nomor 12/20/PBI/2010WardaNo ratings yet

- Fyp ProjectDocument5 pagesFyp ProjectUsman PashaNo ratings yet

- CB Consumer MovementDocument11 pagesCB Consumer Movementbhavani33% (3)

- Graduate School BrochureDocument2 pagesGraduate School BrochureSuraj TaleleNo ratings yet

- National IncomeDocument4 pagesNational IncomeLawrenceNo ratings yet

- Prog Announcment 201112Document140 pagesProg Announcment 201112Wahab VohraNo ratings yet

- MCS in Service OrganizationDocument7 pagesMCS in Service OrganizationNEON29100% (1)

- Final Financial Accounting (Pulkit)Document14 pagesFinal Financial Accounting (Pulkit)nitish_goel91No ratings yet

- Managing The Operation FunctionsDocument13 pagesManaging The Operation FunctionsJoseph ObraNo ratings yet

- RACI - Future To Be PDFDocument1 pageRACI - Future To Be PDFAndrianus LontengNo ratings yet

- VAT Transfer PostingDocument1 pageVAT Transfer PostingabbasxNo ratings yet

- ReviewerDocument27 pagesReviewerJedaiah CruzNo ratings yet

- 17 Safety InventoryDocument47 pages17 Safety Inventorymishrakanchan 2396No ratings yet

- Tax - Cases 1-15 - Full TextDocument120 pagesTax - Cases 1-15 - Full TextNoel RemolacioNo ratings yet

- The Basics: Statement of Assets, Liabilities, and Net Worth: What Is A Saln?Document7 pagesThe Basics: Statement of Assets, Liabilities, and Net Worth: What Is A Saln?Ren Irene D MacatangayNo ratings yet

- 8963 36Document37 pages8963 36OSDocs2012No ratings yet

- Rent Receipt With Stamp - PDFDocument1 pageRent Receipt With Stamp - PDFSAI ANURAGNo ratings yet

- G O Ms No 281Document3 pagesG O Ms No 281HashimMohdNo ratings yet

- List of HW Transporters May 2020 For PostingDocument41 pagesList of HW Transporters May 2020 For Posting2020dlb121685No ratings yet

- Commitment To Independence by Internal Auditors The Effects of Role Ambiguity and Role ConflictDocument27 pagesCommitment To Independence by Internal Auditors The Effects of Role Ambiguity and Role ConflictArfiraNo ratings yet

- Know Your TcsDocument8 pagesKnow Your TcsRocky SinghNo ratings yet