Professional Documents

Culture Documents

Financial Inclusion

Uploaded by

Deepshikha GoelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Inclusion

Uploaded by

Deepshikha GoelCopyright:

Available Formats

Financial Inclusion-case study

Financial Inclusion is a need which has been capturing the attention of the governments and

policy makers all over the world. It is a process by which banking services as well as other

financial services can be extended to the poorest of the poor in a country. There can be multiple

levels of financial inclusion. Banks have at one end the high end customers for whom they are

offering wide range of products & services. At the other end there are customers having only the

savings bank accounts & withdrawal facilities.

Governments have followed different approaches to achieve financial inclusion .The US

government expanded the scope of financial inclusion through statutory enactments. e.g.

Community Reinvestment Act. In France, it is a statutory right of every individual to have a bank

account. Internationally Financial Inclusion has a wider perspective, a mere current & saving

account holdings cannot be an accurate indicator for the financial inclusion.

A financial inclusion taskforce in UK identified three priority areas namely

1) Access to banking

2) Access to affordable credit

3) Access to advisory services.

UK has established a financial inclusion fund for removing financial exclusion. A post office

card account has been created for people who are unable to access basic bank account.

Community Advance Finance initiative was introduced to promote financial literacy among

people. Housing Reimbursement Act in US prohibits discrimination by banks against low &

moderate income households. Financial Inclusion leads to an increase in opportunities for

employment by availing bank finances and other services and generates higher income. On the

other hand, studies conducted revealed that financial exclusion can lead to income inequalities

& consequent social unrest. Financial Exclusion is also believed to be resulting in higher

incidence of crime & increased unemployment.

Where does India stand in this regard? The index of Financial Inclusions puts India at the 50

th

rank in the world. According to NSSO only 34% of the population has an easy and complete

access to financial services & banking facilities.The present system of bank lending in India

depends mostly on collaterals submitted by borrowers. A poor person with a low income has no

scope of providing collateral. Further, the banks have to meet the financial targets, therefore they

focus on larger accounts. Small businessmen in many villages and the general public there do not

have easy access to basic facility of remittances of money. This results in higher handling cost

and need for cash transactions.

The concept of Financial Inclusion started as early as 1969 when Government of India

nationalized major private sector banks. The branch expansion policy of the Reserve bank of

India helped the cause of social banking & mass banking. For the first time, deviation was made

from class banking to mass banking. Banks were also required to lend 40% of their advances to

priority sector consisting of small scale industries, ST, SC persons, women entrepreneurs, small

transport operators, village artisans & craftsman etc. Out of this 40%, 18% is meant for

agriculture related financing to poor farmers directly and indirectly. Even foreign banks

operating in India are required to finance 32% of their advances to priority sector and export

Later , RBI announced that housing loans up to 20 lakhs to borrowers would also be included as

forming part of priority sector advances.. The shortfall in this amount, if any has to be deposited

with NABARD towards Rural Infrastructure Development Fund(RIDF). As NABARD pays very

low interest for such deposits banks necessarily have to take efforts to fulfill their priority sector

lending targets. These measures have helped Financial Inclusion of the poor people to a great

extent.

The Regional Rural Bank Act came into force in 1975. As per this Act, a number of Grameen

Banks were established for making use of the commercial banking expertise for rural

development Sponsoring bank usually a public sector bank contributed 50% of the paid up

capital.Government of India contributed 35% while the State Government in which the Grameen

banks were established contributed 15% of the paid up Capital. The sponsoring banks were

mostly nationalized banks & SBI Group banks Even though most of the Regional Rural Banks

are in loss their ability to reach to poor people in rural areas cannot be under estimated.

Therefore, the recommendation of the committee on financial inclusion appointed by

Government for merger of the Regional rural banks has to be viewed in the right perspective..

Surely, that is the way to reach out to more poor people by offering banking services.

NABARD has also been contributing to the task of financial inclusion by helping the

Microfinance Institutions through their special fund. The Business correspondent model is

helping commercial banks & Regional Rural Banks to extend banking services to a large number

of villagers. The NGOs and SHGs play an important role in this model.

In order to promote financial inclusion faster ,commercial banks were advised by the RBI to

open No Frills accounts. with minimum KYC norms to poor people Even though banks

opened these accounts ,there is no perceptible improvement in banking operations .Many no

frills accounts are remaining dormant .As such Government & the RBI felt the necessity for

Financial Inclusion as major criteria for consideration while issuing licenses to the new

commercial banks..Further, Government of India appointed a committee under Dr. C

Rangarajan former Governor of RBI to make suitable recommendations for the promotion of

financial inclusion. The committee has recommended a target oriented approach to reach out to

the poor people. The committee also pointed out that 16 crore people use India Post with

savings account which gives India Post a great opportunity to offer banking services to the rural

population. The 13

th

Finance Commission under the Chairmanship of Shri. Vijay Kelkar has

proposed a budget of Rs.3,000 crore for providing incentives to people enrolling for the UID

project promoted by Government of India. The UID project will be useful to the banking sector

as well to extend their financial benefits to the rural masses under the Direct Cash Benefit

Transfer Schemes. Cash incentives may be provided by the government through the smart card

issued by banks under the UID schemes to enable the farmers to obtain financial facilities

directly. It will prevent the misuse of funds by the middlemen & reduce corruption in the system

The core banking solutions offered by the banks helps the urban customers to operate their

accounts from any of their networked branches. Banks can now explore Cloud computing

facilities to reduce the cost of extending Core banking to rural areas..

Despite all these efforts there is a wide gap between what is done and what needs to be done

According to NSSO out of the 90 lacs households in India only 45 lakhs have an access to the

banking services at present. Even among the different states, there is a wide disparity in the

coverage of financial services.The northern region consisting of Haryana, Chandigarh have a

high average of 84% while Bihar has a low coverage of 33% and Nagaland a meager 21%.So

any attempt at Financial Inclusion will have to take into account the removal of such wide

disparities. Financial inclusion and aggressive bank marketing will have to go hand in hand.

Marketing strategies have to be evolved afresh by banks. There is a great potential for capturing

new customers which requires an innovative approach in the delivery mechanism. Banks have

got to combine insurance facilities, remittances facilities, lending facilities under one umbrella to

enlist more depositors in rural areas. Village Community Centers may also be involved by the

banks in spreading financial literacy amongst the villagers which should include basic

information about banks, cheques, ATMs, Credit Cards etc. Banks may like to enlist voluntary

support from Civil Society organizations, SHGs,NGOs,MFIs , state & central governments

departments of Social welfare for achieving the target for Financial Inclusion. RBI may play a

proactive role in the process.

Questions:-

.1. Why Financial Inclusion is necessary? How is it achieved by UK&USA?

2. What are the efforts made by Reserve Bank of India in this regard so far?

3. Do you think committee approach will help?

4. What are your suggestions for improving Financial Inclusion through innovations?

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Exam PracticeDocument13 pagesExam PracticeDeepshikha Goel100% (1)

- Solved ProblemsDocument32 pagesSolved ProblemsDeepshikha GoelNo ratings yet

- G20 New Delhi Leaders' DeclarationDocument37 pagesG20 New Delhi Leaders' DeclarationNDTV100% (1)

- FCI CaseDocument9 pagesFCI CaseDeepshikha GoelNo ratings yet

- Rbi Bulletin October 2013Document140 pagesRbi Bulletin October 2013vijaythealmightyNo ratings yet

- TO 2019-INTERVIEW MADE EASY Part A PDFDocument30 pagesTO 2019-INTERVIEW MADE EASY Part A PDFSonali Dulwani100% (1)

- Digitizing Rural Value Chains in India Intellecap ReportDocument58 pagesDigitizing Rural Value Chains in India Intellecap ReportUmang AgarwalNo ratings yet

- FinTech Lending in Indonesia - PWC ReportDocument34 pagesFinTech Lending in Indonesia - PWC ReportmayurNo ratings yet

- Is Sustainability Talk A Distraction From What Really MattersDocument3 pagesIs Sustainability Talk A Distraction From What Really MattersDeepshikha GoelNo ratings yet

- NSDL Case StudyDocument3 pagesNSDL Case StudyDeepshikha Goel100% (1)

- Folk Exam Questions - Chapter 9: SolutionDocument4 pagesFolk Exam Questions - Chapter 9: SolutionDeepshikha GoelNo ratings yet

- Final MergedDocument19 pagesFinal MergedDeepshikha GoelNo ratings yet

- CH 04Document3 pagesCH 04Deepshikha GoelNo ratings yet

- Porters StrategyDocument14 pagesPorters StrategyDeepshikha Goel100% (1)

- Indian Financial SystemDocument57 pagesIndian Financial SystemJayat RathoreNo ratings yet

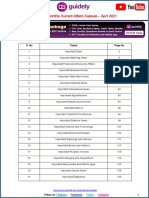

- Important Monthly Current Affairs Capsule - April 2021: TelegramDocument138 pagesImportant Monthly Current Affairs Capsule - April 2021: Telegramyerra likhitaNo ratings yet

- A Study of Comparative Analysis of Regional Rural Banks in India'Document83 pagesA Study of Comparative Analysis of Regional Rural Banks in India'Pranav PasteNo ratings yet

- Key Issues and Models in Branchless Banking in The PacificDocument28 pagesKey Issues and Models in Branchless Banking in The PacificPacific Private Sector Development InitiativeNo ratings yet

- Essay For BankDocument6 pagesEssay For BankkhalidaiubNo ratings yet

- A Policy Response To Indian Micro Finance CrisisDocument49 pagesA Policy Response To Indian Micro Finance CrisisNarasimhulu PolisettyNo ratings yet

- Factors Affecting Financial Inclusion: A Case Study of PunjabDocument5 pagesFactors Affecting Financial Inclusion: A Case Study of PunjabSaumya SarkarNo ratings yet

- Achievements of Digital IndiaDocument6 pagesAchievements of Digital Indiakandpalrainey60No ratings yet

- 1238 3595 1 PBDocument14 pages1238 3595 1 PBWao wamolaNo ratings yet

- E J Info Sys Dev Countries - 2018 - Kim - Mobile Financial Services Financial Inclusion and Development A SystematicDocument17 pagesE J Info Sys Dev Countries - 2018 - Kim - Mobile Financial Services Financial Inclusion and Development A SystematicBryce JobsNo ratings yet

- Stratgic Manegment Assignment Nov 2023 Case AnalysisDocument11 pagesStratgic Manegment Assignment Nov 2023 Case AnalysisWeldu GebruNo ratings yet

- Final FormatDocument34 pagesFinal FormatJed ÑeroNo ratings yet

- FINAL REPORT MF Study CMED1425011540Document79 pagesFINAL REPORT MF Study CMED1425011540ziad saberiNo ratings yet

- IFI Report 2021Document188 pagesIFI Report 2021Bethmi Mithara Jayawardena Arambawatte RodrigoNo ratings yet

- Various Factors Affecting Access To Financial ServicesDocument14 pagesVarious Factors Affecting Access To Financial ServicessonamNo ratings yet

- Dinesha P T Bio DataDocument23 pagesDinesha P T Bio DataptdineshaNo ratings yet

- Financial Literacy Framework - 20770114Document24 pagesFinancial Literacy Framework - 20770114Sanjay KNo ratings yet

- IDFC Limited BankDocument7 pagesIDFC Limited BankSecret AgentNo ratings yet

- Ijse 05 2017 0194Document23 pagesIjse 05 2017 0194Sajid Mohy Ul DinNo ratings yet

- A Compre Hensive Proje CT Re PortDocument126 pagesA Compre Hensive Proje CT Re PortKAUSHLESH CHOUDHARYNo ratings yet

- Financial Inclusion School PresentationDocument16 pagesFinancial Inclusion School PresentationpraxieNo ratings yet

- Financial Literacy Project Final FileDocument70 pagesFinancial Literacy Project Final Fileaddusaiki9999No ratings yet

- Dipali Rangpariya Reseach PaperDocument8 pagesDipali Rangpariya Reseach PaperchthakorNo ratings yet

- Position Paper ExampleDocument3 pagesPosition Paper ExampleRamy Joy MorquianosNo ratings yet

- UNCDF Myanmar Towards Gender-Smart Microfinance Product Development and Enterprise LendingDocument44 pagesUNCDF Myanmar Towards Gender-Smart Microfinance Product Development and Enterprise LendingYar LayNo ratings yet

- Eldomiaty Et. Al (2020)Document12 pagesEldomiaty Et. Al (2020)Leonardo VelizNo ratings yet