Professional Documents

Culture Documents

Value Added Tax Short Notes Hand Book

Uploaded by

Mayurdhvajsinh JadejaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Added Tax Short Notes Hand Book

Uploaded by

Mayurdhvajsinh JadejaCopyright:

Available Formats

Aman Singhal aman.singhal326@gmail.

com

VALUE ADDED TAX

VAT RATES AS PER WHITE PAPER:

0%

1%

4%

12.5%

SALES:

Inter-state trade

CST @2% if sale to registered dealer.

Normal VAT rate applicable if sale to unregistered dealer or consumer.

Intra-state trade

VAT rate as applicable except if goods are exempted from taxation.

If exempted then no tax.

Export

Not Taxed.

PURCHASE:

Inter-state purchase

No input of CST paid. Forms part of cost.

Intra-state purchase

Input credit of VAT paid if goods not used in production of tax-exempted goods.

Import

No credit of tax paid. Tax forms part of cost.

INPUT CREDIT:

Credit of VAT paid on purchase.

No credit of CST paid on purchase.

Can deduct from VAT liability i.e., VAT collected on sales.

Deduction series = First VAT then CST.

Export- Claim Refund.

CST paid cant be recovered but CST collected can be settled from available input credit.

Balance input credit of VAT can be carried forward.

1

Aman Singhal aman.singhal326@gmail.com

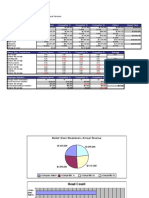

CASE I CASE II CASE III CASE IV

INPUT 10,000 10,000 10,000 10,000

COLLECTED VAT= 6,000

CST= 2,000

VAT= 10,000

CST= 2,000

VAT= 12,000

CST= 2,000

VAT= 8,000

CST= 2,000

Case-I

Input Available= Rs.10,000

Less: VAT collected= Rs.6,000

Balance= Rs.4,000

Less: CST= Rs.2000

C/f Input= Rs.2000

Case-II

Input Available= Rs.10,000

Less :VAT collected= Rs.10,000

Balance= NIL

CST Payable= Rs.2,000

Case-III

Input Available= Rs.10,000

Less: VAT collected= Rs.12,000

VAT Payable= Rs.2,000

CST Payable= Rs.2,000

Case-IV

Input Available= Rs.10,000

Less CST collected= Rs.2,000

Balance= Rs.8,000

Less: VAT Payable Rs.8,000

In above four cases procedure followed in CASE IV is wrong as first we have to settle output

VAT and then CST.

2

Aman Singhal aman.singhal326@gmail.com

FORMAT:

Trading Entity:

Purchase

Add: Expenses

Add: Profit

Add: TAX

#

Invoice value

COST VAT Paid (Input Available)

Xxx

xxx

Xxx

**

xxx

Xxx

xxx

Tax Payable= Tax Collected

Input Available

Balance

xxx

xxx

Xxx

Balance can be negative as well as positive.

Positive balance shows VAT Payable

Negative balance shows Input carried forward.

**

If purchased from other state then no input available. CST will be included in cost of

purchases.

#

If sold within the state then VAT if sold outside state then CST.

Manufacturing Entity:

Purchase

Add: Expenses

Add: Profit

Add: Excise duty

Add: TAX

#

Invoice value

COST VAT Paid (Input Available)

Xxx

xxx

Xxx

**

xxx

Xxx

Xxx

xxx

xxx

**

If purchased from other state then no input available. CST will be included in cost of

purchases.

#

If sold within the state then VAT if sold outside state then CST.

Excise only if given in ques.

3

Aman Singhal aman.singhal326@gmail.com

SOME POINTS TO REMEMBER:

Implemented from 1

st

April,2005.

Drawn from entry 54 List II of Seventh Schedule of constitution of India.

Kelkar Committee proposed.

Eligible purchase- purchase for the purpose of sale, resale of goods within the state, outside

state or export. Capital goods used in the production of taxable goods.

2% will be deducted from Input VAT credit in case inter-state branch transfer.

Input credit on capital goods in 24/36 installments. By default 36 installments.

We follow destination principal for VAT.

Three variants of VAT: Gross Product Variant; Income Variant; Consumption Variant. In

Gross Product Variant input available only on input goods not on capital goods. In Income

Variant input available on input goods and proportionate VAT credit on depreciation on

capital goods. In Consumption variant input available on both input as well as capital goods.

Methods of VAT calculation: Addition; Invoice; Subtraction.

Compulsory registration after gross sales of Rs.5/10 Lakhs.

Persons involving in trade other than intra-state trade have to compulsorily register

themselves without considering gross sales.

TIN (Tax payer identification Number) number- 11 digit numerical first 2 digits State code

used by Union Ministry of Home Affairs.

Quarterly or monthly return.

Self-assessment by tax payer.

ILLUSTRATIVE EXAMPLE:

Raw material A purchased from Delhi for Rs.50,000 + VAT@ 12.5%

Cost of material Rs.50,000 Input available= Rs.6,250

Raw material B purchased from Mumbai for Rs.40,000 + CST@ 2%

Cost of material Rs.40,800 Input available= Rs.0

Machinery Purchased for Rs.1,00,000 + VAT@ 12.5%

Depreciation 20% SLM.

Expenses= Rs.50,000

Profit= 20% on cost.

4

Aman Singhal aman.singhal326@gmail.com

Gross Product Variant:

Raw Material A

Raw Material B

Depreciation (20% of 1,12,500)

Expenses

Profit@ 20%

Total

50,000

40,800

90,800

22,500

1,13,300

50,000

1,63,300

32,660

1,95,960

Income Variant:

Raw Material A

Raw Material B

Depreciation (20% of 1,00,000)

Expenses

Profit@ 20%

Total

50,000

40,800

90,800

20,000

1,10,800

50,000

1,60,800

32,160

1,92,960

Consumption Variant:

Raw Material A

Raw Material B

Depreciation (20% of 1,00,000)

Expenses

Profit@ 20%

Total

50,000

40,800

90,800

20,000

1,10,800

50,000

1,60,800

32,160

1,92,960

For Detailed discussion- refer Value Added Tax [VAT]

Input credit available= Rs.6,250 i.e.,

paid on purchase of material A.

Input credit available= Rs.8,750 i.e.,

paid on purchase of material A + 12.5%

of depreciation of machinery.

Input credit available= Rs.6,597 i.e.,

paid on purchase of material A +

12500/36. Input credit of machinery in

36 Installments (can be 24 also).

5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Guja - Raif'F0Rest: ManualDocument26 pagesThe Guja - Raif'F0Rest: ManualMayurdhvajsinh JadejaNo ratings yet

- CCC Result BMJDocument12 pagesCCC Result BMJMayurdhvajsinh JadejaNo ratings yet

- DO IT YOURSELF Guide PDFDocument81 pagesDO IT YOURSELF Guide PDFNARINDERNo ratings yet

- Introduction, Concepts and Overview of Financial Attest Audit ManualDocument47 pagesIntroduction, Concepts and Overview of Financial Attest Audit ManualMayurdhvajsinh JadejaNo ratings yet

- Cga Orders Implementation of Pay Fixation Orders in Terms of The Honble Cat Principal Bench New Delhis Order Dated 6th March 2017Document1 pageCga Orders Implementation of Pay Fixation Orders in Terms of The Honble Cat Principal Bench New Delhis Order Dated 6th March 2017Mayurdhvajsinh JadejaNo ratings yet

- Ethics Paper RASDocument22 pagesEthics Paper RASMayurdhvajsinh JadejaNo ratings yet

- BMSG Joining InstructionsDocument10 pagesBMSG Joining InstructionsMayurdhvajsinh JadejaNo ratings yet

- Empanelled Hospitals Under RSBY in GujaratDocument67 pagesEmpanelled Hospitals Under RSBY in GujaratMayurdhvajsinh JadejaNo ratings yet

- Where Does The Gender Mainstreaming Strategy Come From?Document2 pagesWhere Does The Gender Mainstreaming Strategy Come From?Luiza BouharaouaNo ratings yet

- ICISA Noida CalenderDocument1 pageICISA Noida CalenderMayurdhvajsinh JadejaNo ratings yet

- Lab Tech FSL 10.07.2016Document1 pageLab Tech FSL 10.07.2016Mayurdhvajsinh JadejaNo ratings yet

- Divisional Accountant 21-01-2017 AKDocument4 pagesDivisional Accountant 21-01-2017 AKMayurdhvajsinh JadejaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Bmsgirls Admission FormDocument4 pagesBmsgirls Admission FormMayurdhvajsinh JadejaNo ratings yet

- Duties and Powers of Sub Divisional OfficerDocument5 pagesDuties and Powers of Sub Divisional OfficerMayurdhvajsinh Jadeja33% (3)

- EL Form Central GovernmentDocument2 pagesEL Form Central GovernmentMayurdhvajsinh Jadeja67% (3)

- BMSGDocument2 pagesBMSGMayurdhvajsinh JadejaNo ratings yet

- Dairy ProjectDocument13 pagesDairy ProjectpradipsdNo ratings yet

- Dairy Farming: Nsic Project ProfilesDocument3 pagesDairy Farming: Nsic Project Profilesrengachen100% (3)

- 6 Environmental Behaviorism PDFDocument79 pages6 Environmental Behaviorism PDFnty32No ratings yet

- Sunday School-AMS 1Document1 pageSunday School-AMS 1Mayurdhvajsinh JadejaNo ratings yet

- 008 VGL 0831108Document1 page008 VGL 0831108varunvnNo ratings yet

- Asst Tribal Dev 18-12-2016Document22 pagesAsst Tribal Dev 18-12-2016Mayurdhvajsinh JadejaNo ratings yet

- Dairy Farming All One Should Know To Start WithDocument7 pagesDairy Farming All One Should Know To Start WithMayurdhvajsinh JadejaNo ratings yet

- 50 Cows PR PDFDocument3 pages50 Cows PR PDFMayurdhvajsinh JadejaNo ratings yet

- Lab Tech Model Paper 2Document11 pagesLab Tech Model Paper 2Mayurdhvajsinh JadejaNo ratings yet

- Chief Officer 09-04-2017Document8 pagesChief Officer 09-04-2017Mayurdhvajsinh JadejaNo ratings yet

- Final Selection DYSO DYMAMDocument22 pagesFinal Selection DYSO DYMAMMayurdhvajsinh JadejaNo ratings yet

- Forensic MCQ 2Document14 pagesForensic MCQ 2Mayurdhvajsinh JadejaNo ratings yet

- Forensic MCQ 1 PDFDocument13 pagesForensic MCQ 1 PDFMayurdhvajsinh Jadeja100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PutnamDocument60 pagesPutnamThat is my name I am not a shy political animalNo ratings yet

- Sample Coaching AgreementDocument2 pagesSample Coaching AgreementAmit DashNo ratings yet

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDocument4 pagesGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshNo ratings yet

- Competitive Market Benchmark Analysis For Financial ServicesDocument2 pagesCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857No ratings yet

- Rights and ObligationsDocument5 pagesRights and ObligationsAmace Placement KanchipuramNo ratings yet

- Account Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham NamdevNo ratings yet

- Role of Internal Auditors in Fraud PreventionDocument19 pagesRole of Internal Auditors in Fraud Preventionanita.pariharNo ratings yet

- 2013 Annual Report EditorialDocument55 pages2013 Annual Report EditorialbabydreaNo ratings yet

- Problems Faced in Marketing of Foreign Goods by Multinational CompaniesDocument7 pagesProblems Faced in Marketing of Foreign Goods by Multinational Companiesdipabali chowdhuryNo ratings yet

- SIP1018 Kotak - CDRDocument1 pageSIP1018 Kotak - CDRNikesh MewaraNo ratings yet

- 2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing ModelDocument51 pages2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing Model'Osvaldo' RioNo ratings yet

- Relative Purchasing Power Parity Relative Purchasing Power ParityDocument2 pagesRelative Purchasing Power Parity Relative Purchasing Power ParityMohammad HammoudehNo ratings yet

- A4A COVID Impact Updates 58Document26 pagesA4A COVID Impact Updates 58ajayprakash1000No ratings yet

- 15-Minute Retirement Plan FINALDocument23 pages15-Minute Retirement Plan FINALUmar FarooqNo ratings yet

- Lancaster Engineering IncDocument2 pagesLancaster Engineering IncMamunoor RashidNo ratings yet

- Assignment 2 Anul 1 Id - Tos - Nivel LicentaDocument4 pagesAssignment 2 Anul 1 Id - Tos - Nivel LicentaCostache DanielaNo ratings yet

- Jhurzel Anne S. Aguilar BSBA MM-2105: Personal Income/expenses of The HeirsDocument4 pagesJhurzel Anne S. Aguilar BSBA MM-2105: Personal Income/expenses of The HeirsJESTONI RAMOSNo ratings yet

- 2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFDocument20 pages2014 12 Mercer Risk Premia Investing From The Traditional To Alternatives PDFArnaud AmatoNo ratings yet

- Global Economy-Cheat SheetDocument3 pagesGlobal Economy-Cheat SheetjakeNo ratings yet

- NIFTY 50 Report For The WeekDocument52 pagesNIFTY 50 Report For The WeekDasher_No_1No ratings yet

- CHAPTER 5 ChurrositeaDocument21 pagesCHAPTER 5 ChurrositeademiNo ratings yet

- Coursera Financial Aid Answers (Sal) AdDocument2 pagesCoursera Financial Aid Answers (Sal) AdAnkit SarkarNo ratings yet

- PRO0750 Smart Value Income Plan BrochureDocument10 pagesPRO0750 Smart Value Income Plan BrochureJignesh PatelNo ratings yet

- Wallstreetjournal 20221214 TheWallStreetJournalDocument32 pagesWallstreetjournal 20221214 TheWallStreetJournalmadmaxberNo ratings yet

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- Sold By: Tax InvoiceDocument1 pageSold By: Tax Invoiceneerajkori932No ratings yet

- Personal Finance SyllabusDocument5 pagesPersonal Finance SyllabusRaymond DiazNo ratings yet

- The Credit Channel Is An Enhancement Mechanism For Traditional Monetary PolicyDocument2 pagesThe Credit Channel Is An Enhancement Mechanism For Traditional Monetary PolicyigrinisNo ratings yet

- Top 20 Corporate Finance Interview Questions (With Answers) PDFDocument19 pagesTop 20 Corporate Finance Interview Questions (With Answers) PDFDipak MahalikNo ratings yet

- 2021 - MSMT (McDonald's) - Promo Mechanics - 0620Document4 pages2021 - MSMT (McDonald's) - Promo Mechanics - 0620kheriane veeNo ratings yet