Professional Documents

Culture Documents

Accounting KPI Guide

Uploaded by

ch_yep0 ratings0% found this document useful (0 votes)

1K views5 pagesThis document outlines various key performance indicators (KPIs) for accounting management. It discusses accounts payable KPIs, such as average monetary value of invoices outstanding and creditor days. It also covers accounts receivable KPIs, including total monetary value of overdue invoices and debtor days. Finally, it lists general accounting KPIs like gross profit, operating income, net profit margin, and cash flow. In total, it identifies over 30 different financial metrics that are useful for measuring and analyzing accounting performance.

Original Description:

KPI

Original Title

Accounting Kpi

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various key performance indicators (KPIs) for accounting management. It discusses accounts payable KPIs, such as average monetary value of invoices outstanding and creditor days. It also covers accounts receivable KPIs, including total monetary value of overdue invoices and debtor days. Finally, it lists general accounting KPIs like gross profit, operating income, net profit margin, and cash flow. In total, it identifies over 30 different financial metrics that are useful for measuring and analyzing accounting performance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views5 pagesAccounting KPI Guide

Uploaded by

ch_yepThis document outlines various key performance indicators (KPIs) for accounting management. It discusses accounts payable KPIs, such as average monetary value of invoices outstanding and creditor days. It also covers accounts receivable KPIs, including total monetary value of overdue invoices and debtor days. Finally, it lists general accounting KPIs like gross profit, operating income, net profit margin, and cash flow. In total, it identifies over 30 different financial metrics that are useful for measuring and analyzing accounting performance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

Accounting KPI

Accounting KPIs in key performance indicators of accounting management

I/ Accounts payable KPI

These KPIs include ones about Accounts payable management.

Free Downloads

Accounts Payable

Answer interview job question

Accounts payable KPI

Accounts payable KPIs in key performance indicators of accounting management

1. Average monetary value of invoices outstanding

2. Total sum of monetary value of outstanding invoices.

3. Invoicing processing costs

4. Number of invoices outstanding in measurement period.

5. Percentage of invoices disputed.

6. Average monetary value of overdue invoices.

7. Total monetary value of overdue invoices.

8. Accounts Payable

9. Money owed (payable) to suppliers for goods or services purchased on credit that must be paid

within a year.

10. Number of overdue invoices i.e. invoices that have not been paid before their payment date.

11. Discounts Lost : Cost of passing up discount by paying invoice after discount period.

12. Creditor days: Creditor days is the average time that a company takes to pay its creditors.

13. Average cycle time (e.g. in days) to resolve invoice errors.

14. Percentage of electronic invoices.

15. Percentage of low value invoices

16. Percentage of invoices under query.

17. % of invoices requiring special payment

18. Percentage of payable invoices that have not been matched to a purchase order.

19. % effectiveness in payables management

20. Accounts Payable Turnover

21. This ratio shows how many times in one accounting period the company turns over (repays)

its accounts payable to creditors.

22. Days Payable: This ratio shows how many days it takes to pay accounts payable.

II/ Accounts receivable KPI

These KPIs include ones about Accounts receivable management.

Accounts receivable KPI

Accounts receivable KPI

Types of Accounts receivable KPIs

1. Total monetary value of overdue invoices.

2. Sum of monetary value of unsettled i.e. unpaid invoices.

3. Average monetary value of unsettled i.e. unpaid invoices.

4. Number of overdue invoices i.e. invoices that have not been paid before their payment date.

5. Number of unsettled i.e. unpaid invoices.

6. Debtor days: Debtor days is a measure of the average time payment takes.

7. Percentage of electronic invoices.

8. Percentage of bad debts against invoiced revenue.

9. Accounts Receivable Collection Period: This reveals how many days it takes to collect all

accounts receivable. Fewer days means the company is collecting more quickly on its accounts.

10. Accounts Receivable Turnover: This ratio shows the number of times accounts receivable are

paid and reestablished during the accounting period.

11. Costs of processing invoices.

12. Receivables against Product, Region, Sales office: This KPI is to analyse the outstanding

receivables, and Overdue receivables and Payables for Product wise, Region wise, Sales Office,

Purchase Office.

13. Number of invoices outstanding in measurement period.

14. Average monetary value of invoices outstanding.

15. Total sum of monetary value of outstanding invoices.

16. Average monetary value of overdue invoices.

III/ General Accounting KPIs

1. Operating income: Operating Income equals Gross Profit minus SG&A Expenses. It is the

income from current operations.

2. Gross profit: Gross Profit equals Revenue minus Cost of Goods Sold. It identifies the amount

available to cover other operating expenses.

3. Gross profit margin: Gross Profit Margin equals Gross Profit divided by Revenue, expressed

as a percentage.

4. Cost of goods sold (COGS): Cost of Goods Sold includes all expenses directly associated with

the production of goods or services the company sells (such as material, labor, overhead, and

depreciation). It does not include SG&A.

5. Operating margin: Operating Margin equals Operating Income divided by Revenue, expressed

as a percentage.

6. Goodwill: Goodwill is an accounting term used to reflect the portion of the book value of a

business entity not directly attributable to its assets and liabilities.

7. Total Assets: Total Assets are everything of value that is owned by a company.

8. Accounts Payable: Money owed (payable) to suppliers for goods or services purchased on

credit that must be paid within a year.

9. Long-Term Debt: Long-Term Debt represents the amount of borrowings due more than one

year from the date of the balance sheet.

10. Total Liabilities: Total liabilities represent the sum of all monetary obligations of a business

and all claims creditors have on its assets.

11. Cumulative Annual Growth Rate (CAGR):

12. Cash Flow Return on Investments (CFROI): This is similar to ROI, but the only difference is

CASH is used inplace of Profit.

13. SG&A expenses: Selling, General, and Administrative Expenses include all salaries, indirect

production, marketing, and general corporate expenses.

14. Net profit margin: Net Profit Margin equals the Total Net Income divided by Revenue,

expressed as a percentage.

15. Shares Outstanding: Shares Outstanding is the outstanding number of shares of the class of

common stock that is most actively traded.

16. Total Equity: Total Equity equals Preferred Stock Equity + Common Stock Equity.

17. Total Current Assets: Total Current Assets equals Cash and Equivalents + Receivables

+ Inventories + Other Current Assets.

18. Other Current Assets: Other Current Assets includes prepayments, deferred charges, and

amounts (other than trade accounts) due from parents and subsidiaries.

19. Inventories: Inventories is merchandise bought for resale or supplies and raw materials

purchased for use in revenue producing operations.

20. Net Receivables: Net Receivables are amounts owed to the company, net of any provisions

for bad debts.

21. Cash: Cash consists of cash and may include cash-like items such as short-term investments

that can be quickly converted to cash.

22. Net Change in Cash: Net Change in Cash is the difference between the Cash and Cash

Equivalents at the beginning of the reporting period minus the amount at the end of the

reporting period.

23. Common Stock Equity: Common Stock Equity is the amount of shareholders equity

attributable to common stock.

24. Preferred Stock Equity: Preferred Stock Equity is the amount of shareholders equity

attributable to the preferred stock issued by the parent company.

25. Other Noncurrent Liabilities: The liabilities that are not assigned to Long-Term Debt or

deferred Income Taxes.

26. Short-Term Debt: Short-Term Debt represents the amount of borrowings (principal and

interest) that must be paid in the near future.

27. Other Noncurrent Assets: Assets that are not assigned to Net Fixed Assets or intangibles.

28. Total Current Liabilities: Total Current Liabilities equals Accounts Payable + Short-Term

Debt + Other Current Liabilities.

29. Other Current Liabilities: Other Current Liabilities includes all other liabilities not assigned

to Short-Term Debt or Accounts Payable.

30. Net Fixed Assets: Net Fixed Assets are the assets of a company that are of a relatively

permanent nature and are not intended for resale, such as property, plants, and equipment.

You might also like

- Financial KPIs SamplesDocument4 pagesFinancial KPIs Samplesch_yepNo ratings yet

- Leave Policy of MetroDocument8 pagesLeave Policy of MetrovklovelyNo ratings yet

- Employee Evaluation FormDocument3 pagesEmployee Evaluation FormDonalyn AquinoNo ratings yet

- Finance SopDocument46 pagesFinance SopOsman Zaheer100% (1)

- Assessment C - Peformance ReportDocument2 pagesAssessment C - Peformance ReportAashish thapaNo ratings yet

- (Print On Your Business Letterhead) : Private and ConfidentialDocument1 page(Print On Your Business Letterhead) : Private and ConfidentialmsoresumeNo ratings yet

- Kra & Kpi For Sales PersonDocument1 pageKra & Kpi For Sales PersonLucy AnajwalaNo ratings yet

- Fixed Asset AuditsDocument8 pagesFixed Asset AuditsnabihaNo ratings yet

- Finance Kpi Encyclopedia Preview PDFDocument5 pagesFinance Kpi Encyclopedia Preview PDFNikolina OrlovićNo ratings yet

- SOP RecruitmentDocument43 pagesSOP Recruitmentambi lameNo ratings yet

- Sample KPI and KRA ManualDocument10 pagesSample KPI and KRA ManualpraveenpraveenkuNo ratings yet

- Accounting Manager Job DescriptionDocument2 pagesAccounting Manager Job DescriptionthephaiduongNo ratings yet

- SOP Petty CashDocument5 pagesSOP Petty Cashkumanqatar100% (2)

- Petty Cash ReportDocument1 pagePetty Cash ReportAziz Khan LodhiNo ratings yet

- Employee Performance Evaluation Form (HOD, Supervisor)Document3 pagesEmployee Performance Evaluation Form (HOD, Supervisor)ShoTeR KSAzZ100% (1)

- Financial Procedures 2008Document39 pagesFinancial Procedures 2008lisaconnollyNo ratings yet

- In Support of Management's Goals and Objectives: Key Performance Indicators Consolidated - 2019Document34 pagesIn Support of Management's Goals and Objectives: Key Performance Indicators Consolidated - 2019ichu73No ratings yet

- Termination of employment due to unexplained absenceDocument1 pageTermination of employment due to unexplained absenceAllenNo ratings yet

- Exit Clearance Form PDFDocument1 pageExit Clearance Form PDFAlexandraNo ratings yet

- CAPEX Form v1Document1 pageCAPEX Form v1Jessica DensingNo ratings yet

- Cash AdvanceDocument1 pageCash AdvanceAriawan Hasnan100% (1)

- JD of The Chief Financial OfficerDocument6 pagesJD of The Chief Financial OfficerSampatmaneNo ratings yet

- ACCOUNTS Manager JD KPI KRADocument3 pagesACCOUNTS Manager JD KPI KRACA AMIT JAIN50% (2)

- Fixed Asset Acquisition FormDocument1 pageFixed Asset Acquisition Formkamran1983No ratings yet

- GL - AnalystDocument4 pagesGL - Analystajaysir3No ratings yet

- Emp Clearance FormDocument1 pageEmp Clearance FormRham Tristein HeartfillaNo ratings yet

- Charts of AccountsDocument7 pagesCharts of Accountszindabhaag100% (1)

- Employee Expense Reimbursement ProceduresDocument3 pagesEmployee Expense Reimbursement Proceduresneha ahujaNo ratings yet

- Sample Bookkeeping Engagement Letter PDFDocument3 pagesSample Bookkeeping Engagement Letter PDFGayathri JagadeeshNo ratings yet

- Bizmanualz Construction Management Policies and Procedures SampleDocument5 pagesBizmanualz Construction Management Policies and Procedures SampleHoque Anamul0% (1)

- Absence Request FormDocument1 pageAbsence Request FormAnkush DeoreNo ratings yet

- 1 Payroll-SopDocument12 pages1 Payroll-SopbhanupalavarapuNo ratings yet

- Basics of Salary GradesDocument4 pagesBasics of Salary GradesedrialdeNo ratings yet

- Job Description Form: IST Down Major Performance Objectives OR Expectations From THE PostDocument1 pageJob Description Form: IST Down Major Performance Objectives OR Expectations From THE PostEzaz SyedNo ratings yet

- Financial KPIs and Performance MeasurementDocument48 pagesFinancial KPIs and Performance MeasurementAlan ChengNo ratings yet

- Employee Promotion Proposal Form - AmranDocument2 pagesEmployee Promotion Proposal Form - AmranTanvir Raihan Tanna100% (2)

- PERFORMANCE EVALUATION EdwardDocument3 pagesPERFORMANCE EVALUATION EdwardAuditingTeam LCNo ratings yet

- Leave Application Form-2Document4 pagesLeave Application Form-2api-3741191No ratings yet

- SCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch PlantDocument4 pagesSCRIBD - Memo On Observation of Inventories and Fixed Assets Count For Batch Plantalejandroctay100% (1)

- Exit Interview Form - Sample 1Document1 pageExit Interview Form - Sample 1workosaur100% (3)

- Difference Between KRA and KPIDocument2 pagesDifference Between KRA and KPIAbhijit A JagtapNo ratings yet

- Performance Evaluation HandbookDocument8 pagesPerformance Evaluation Handbooknairdna89No ratings yet

- SOP For Container Deposits Refund ProcessDocument20 pagesSOP For Container Deposits Refund ProcessThana BalanNo ratings yet

- Cash AdvanceDocument2 pagesCash AdvanceMatths Apoche100% (2)

- KPI Form Template - AFIQDocument4 pagesKPI Form Template - AFIQAhmadWakEncikNo ratings yet

- Worldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Document13 pagesWorldwide Gift and Entertainment Policy - ENGLISH - 06!03!2013Sarvesh AhluwaliaNo ratings yet

- Finance PolicyDocument8 pagesFinance PolicynayanavspNo ratings yet

- Asset Disposal/Move Form: Select One of The Following Disposal/move Actions and Complete All Information in The SectionDocument1 pageAsset Disposal/Move Form: Select One of The Following Disposal/move Actions and Complete All Information in The SectionSAMDNo ratings yet

- Travel Policy, Expense Claim & ReimbusementDocument4 pagesTravel Policy, Expense Claim & ReimbusementTinsuNo ratings yet

- Financial Process Flow DiagramDocument1 pageFinancial Process Flow DiagramTDAMU88No ratings yet

- KPI-KRA Legal DepartmentDocument4 pagesKPI-KRA Legal Departmentichu73No ratings yet

- Key Role Areas and Key Performance Indicators of Procurement ExecutiveDocument2 pagesKey Role Areas and Key Performance Indicators of Procurement ExecutiveDayal100% (17)

- Finance Manager Job DescriptionDocument10 pagesFinance Manager Job DescriptionAbegail Dazo50% (2)

- Template For Accounting ManualDocument4 pagesTemplate For Accounting ManualKent TacsagonNo ratings yet

- Office Boy Hourly ChecklistDocument3 pagesOffice Boy Hourly ChecklistAbhijeet MohiteNo ratings yet

- Personnel Requisition Form TemplateDocument1 pagePersonnel Requisition Form Templatekomal janiNo ratings yet

- Accounting Policies and Procedures Rev 030110Document50 pagesAccounting Policies and Procedures Rev 030110Soehermanto Dody100% (1)

- Financial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)Document7 pagesFinancial Statements - I Class 11 Notes CBSE Accountancy Chapter 9 (PDF)yashwini2827No ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- FA 1st AssignmentDocument6 pagesFA 1st AssignmentMuhammad AyazNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Food Court Business PlanDocument21 pagesFood Court Business Plansaurabh100% (2)

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- What-If Analysis TemplateDocument18 pagesWhat-If Analysis TemplateorangotaNo ratings yet

- Fire Extinguisher InstructionDocument1 pageFire Extinguisher Instructionch_yepNo ratings yet

- Fire Extinguisher Training Manual v2 1Document12 pagesFire Extinguisher Training Manual v2 1ch_yep100% (1)

- Discounted Dividend Valuation USDocument9 pagesDiscounted Dividend Valuation USch_yepNo ratings yet

- Production KPIs Document Management Innovation Logistics WarehouseDocument15 pagesProduction KPIs Document Management Innovation Logistics Warehousech_yepNo ratings yet

- Sales KpisDocument8 pagesSales Kpisch_yepNo ratings yet

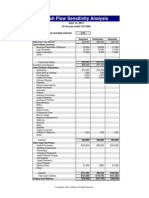

- Cash Flow Sensitivity AnalysisDocument1 pageCash Flow Sensitivity Analysisch_yepNo ratings yet

- 2011 MIR Asian Brochure Lo-ResDocument4 pages2011 MIR Asian Brochure Lo-Resch_yepNo ratings yet

- Sensitivity Analysis of ProfitDocument8 pagesSensitivity Analysis of Profitch_yepNo ratings yet

- Accounting KPI GuideDocument5 pagesAccounting KPI Guidech_yepNo ratings yet

- AccountsQ&a 2010Document36 pagesAccountsQ&a 2010ch_yepNo ratings yet

- Microsoft Academy Return On Investment (ROI) White Paper CalculatorDocument3 pagesMicrosoft Academy Return On Investment (ROI) White Paper Calculatorch_yepNo ratings yet

- Form Phm2 - Central KitchenDocument38 pagesForm Phm2 - Central Kitchench_yepNo ratings yet

- ROI Calculator USDocument35 pagesROI Calculator USch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Apology For Not Crediting PaymentDocument2 pagesApology For Not Crediting Paymentch_yepNo ratings yet

- Ver. Per Month USDocument30 pagesVer. Per Month USch_yepNo ratings yet

- ROI Calculator USDocument35 pagesROI Calculator USch_yepNo ratings yet

- How To Identify Food Trends White PaperDocument11 pagesHow To Identify Food Trends White Paperch_yepNo ratings yet

- Payroll Calculator USDocument21 pagesPayroll Calculator USch_yepNo ratings yet

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- Doing Cafe Business in ChinaDocument9 pagesDoing Cafe Business in Chinach_yepNo ratings yet

- Registration checklist under Franchise ActDocument1 pageRegistration checklist under Franchise Actch_yep0% (1)

- Market Your Idea White PaperDocument18 pagesMarket Your Idea White Paperch_yepNo ratings yet

- FAR. DIAGNOSTIC RESULTSDocument28 pagesFAR. DIAGNOSTIC RESULTSMitch MinglanaNo ratings yet

- FinalDocument58 pagesFinalelluvites100% (2)

- INVESTMENTSDocument27 pagesINVESTMENTSJao FloresNo ratings yet

- 5.1 - AUDIT ON RECEIVABLES (Problems)Document10 pages5.1 - AUDIT ON RECEIVABLES (Problems)LorraineMartinNo ratings yet

- What Is Culture - 7 Aspects of CultureDocument42 pagesWhat Is Culture - 7 Aspects of CultureSharmaine Francisco60% (5)

- 6-8-9 PoaDocument62 pages6-8-9 PoaSai NguyễnNo ratings yet

- Special Transaction AssignmentDocument2 pagesSpecial Transaction Assignment수지No ratings yet

- Audit 2 (T) - Topic2A SasaDocument27 pagesAudit 2 (T) - Topic2A SasaEleonora VinessaNo ratings yet

- Summer Project Training ReportDocument41 pagesSummer Project Training ReportVikas BhanotNo ratings yet

- Working Capital Management Exercise 1Document4 pagesWorking Capital Management Exercise 1Nikki San GabrielNo ratings yet

- FAR - Level 1 TestDocument3 pagesFAR - Level 1 TestRay Joseph LealNo ratings yet

- Financial Accounting 4Th Edition Spiceland Solutions Manual Full Chapter PDFDocument67 pagesFinancial Accounting 4Th Edition Spiceland Solutions Manual Full Chapter PDFhauesperanzad0ybz100% (6)

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Types of Major AccountsDocument27 pagesTypes of Major AccountsLala dela Cruz - FetizananNo ratings yet

- 11 Statement of Cash FlowDocument15 pages11 Statement of Cash FlowLlyod Francis LaylayNo ratings yet

- Activity Ratios: By: Rabindra GouriDocument9 pagesActivity Ratios: By: Rabindra GouriRabindra DasNo ratings yet

- Evosys Fso Fusion Financials V 1.1Document28 pagesEvosys Fso Fusion Financials V 1.1kforkotaNo ratings yet

- Chap 3 PDFDocument8 pagesChap 3 PDFJohanna VidadNo ratings yet

- Account Receivable Process Flow v2Document1 pageAccount Receivable Process Flow v2Marie ManuelNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- CASH VS ACCRUAL ACCOUNTINGDocument7 pagesCASH VS ACCRUAL ACCOUNTINGNhel AlvaroNo ratings yet

- Financial Performance Analysis of Three Tyre CompaniesDocument36 pagesFinancial Performance Analysis of Three Tyre Companieseshu67% (3)

- A Study of Receivable Management Sample 2Document64 pagesA Study of Receivable Management Sample 2Mayur R. KoliNo ratings yet

- ch18, IFRS 15Document107 pagesch18, IFRS 15Bayan KttbNo ratings yet

- Chap 11-13Document29 pagesChap 11-13K60 Triệu Thùy LinhNo ratings yet

- Northern Cpa Review: First Pre-Board ExaminationDocument13 pagesNorthern Cpa Review: First Pre-Board ExaminationKim Cristian MaañoNo ratings yet

- Chart of AccountsDocument15 pagesChart of AccountsPopeye AlexNo ratings yet

- Understanding The Balance SheetDocument38 pagesUnderstanding The Balance Sheetravisankar100% (1)

- Calculating Financial Ratios and FiguresDocument27 pagesCalculating Financial Ratios and Figuresanks0909100% (2)

- Work CapitalDocument153 pagesWork CapitalMinie KimNo ratings yet