Professional Documents

Culture Documents

Tax Remedies

Uploaded by

igorotknight0 ratings0% found this document useful (0 votes)

352 views3 pagesTax Remedies

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax Remedies

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

352 views3 pagesTax Remedies

Uploaded by

igorotknightTax Remedies

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

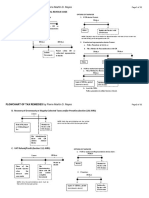

ANNEX A:

COMPARATIVE TABLE OF TAX REMEDIES

NIRC TCC LOCAL TAX REAL PROPERTY TAX

I. Government:

A. To Effect Collection of Tax:

1. Tax Lien (Sec. 219)

2. Compromise (Sec. 2!)

". A.) #istraint $ act%al or constr%ctive

(Sec. 2&'2()

).) Lev* (Sec. 2+ ))

!. Civil Action (Sec. 22)

&. Criminal Action (Sec. 22, 221, 229)

-. .orfeit%re of /ropert* (Sec. 21&)

+. S%spension of )%siness 0perations

in 1iolation of 1at.

(. Enforcement of A2ministrative .ine.

). To Cancel Tax Lia3ilit*:

1. A3atement (Sec. 2!)

C. /rescription of 4i56t to Assess an2

Collect Taxes:

1. Assessment of t6e Tax: 7it6

Commissioner of Internal 4even%e.

a.) " *rs. $ from filin5 of ret%rn or 2ate

prescri3e2 3* la8, 86ic6ever is

t6e later 2ate (Sec. 2")

3.) 1 *rs. $ 86en 1.) no ret%rn is file2

2.) t6e ret%rn is false or fra%2%lent

8it6 intent to eva2e t6e tax. (from

2iscover*) (Sec. 222)

I. Government:

A. To Effect Collection of Tax:

1. Tax Lien (Sec. 12! TCC)

2. 4e2%ction of c%stoms

2%ties9compromise $ s%3:ect to

approval of Sec. of .inance (Sec.

+9, 2"1- TCC)

". Civil Action (Sec. 12! TCC)

!. Criminal Action

&. Sei;%re, Searc6, Arrest (Sec. 22&,

221, 2211 TCC)9 forfeit%re (Sec.

2&" TCC)

). To Cancel Tax Lia3ilit*

1. A3atement $ re2%ction or non'

imposition of c%stoms 2%ties on

certain importe2 materials. (Sec.

1+1'1+( TCC)

C. /o8er9A%t6orit* to assess an2 collect all

la8f%l reven%e from importe2 articles

an2 all ot6er 2%ties, fees, c6ar5es, fines

an2 penalties accr%in5 %n2er TCC is

8it6 Commissioner of C%stoms. (SEC

-2 TCC)

< =ote: A%tomatic appeal $ if t6e collector

ren2ers 2ecision a2verse to t6e 5overnment, it

8ill 3e a%tomaticall* elevate2 to t6e

Commissioner. If affirme2 3* t6e latter,

2ecision s6all 3e revie8e2 a%tomaticall* 3* t6e

Secretar* of .inance. If 8it6in " 2a*s from

I. Government:

A. To Effect Collection of Tax:

1. Tax Lien (Sec. 1+" LGC)

2. A.) #istraint (Sec 1+& LGC)

).) Lev* (Sec. 1+& LGC)

". Civil action (Sec. 1(" LGC)

!. /%rc6ase of propert* 3* local

5overnment %nits for 8ant of 3i22er

(Sec. 1(1 LGC)

/ropert* 2istraine2 not 2ispose2

8it6in 12 2a*s from 2ate of

2istraint'consi2ere2 sol2 to t6e local

5overnment (Sec. 1+& LGC)

). To Cancel Tax Lia3ilit*

- >a* 5rant tax exemptions 3%t ma* not

con2one or remit taxes (Sec. 192, 19"

LGC)

C. /rescriptive /erio2 of Assessment an2

Collection

1.Assessment:

a.) & *ears $ from t6e 2a* t6e* 3ecome

2%e (Sec. 19! LGC)

3.) 1 *rs. $ in case of fra%2 or intent to

eva2e pa*ment of taxes from

2iscover* of fra%2 or intent to eva2e

pa*ment (Sec. 19! LGC)

I. Government:

A. To Effect Collection of Tax:

1. Tax Lien (Sec. 2!-, 2&1 LGC)

2. A.) #istraint (Sec. 2&! LGC)

).) Lev* (Sec. 2&! LGC)

". Civil action $ formal 2eman2 not

re?%ire2 (Sec. 2-- LGC)

!. /%rc6ase of propert* 3* local

treas%rer for 8ant of 3i22er (Sec.

2-" LGC)

). To Cancel Tax Lia3ilit*.

- Con2onation or re2%ction of tax 3*

/resi2ent or remission of tax 3* t6e

San55%nian (Sec. 2++, 2+- LGC)

C. /rescriptive /erio2 of Collection

1. Collection:

a.) & *rs. $ from t6e 2ate t6e* 3ecome

2%e (Sec. 2+ LGC)

3.) 1 *rs. $ in case of fra%2 or 8it6

intent to eva2e pa*ment from t6e

2iscover* of fra%2 or intent to eva2e

pa*ment (Sec. 2+ LGC)

Page A-1

NIRC TCC LOCAL TAX REAL PROPERTY TAX

2. Collection of Tax:

a.) & *rs. $ from assessment or 8it6in

perio2 for collection a5ree2 %pon

in 8ritin5 3efore expiration of t6e &

*r. /erio2 (Sec. 222)

3.) 1 *rs. $ 8it6o%t assessment in

case of false or fra%2%lent ret%rn

8it6

intent to eva2e tax or fail%re to file

ret%rn (Se. 222)

". Criminal Lia3ilit*:

a.) & *rs. $ from commission or

2iscover* of violation, 86ic6ever

is later (Sec. 2(1)

=ote: T6e s%spension of prescriptive perio2

%n2er Sec. 22".

II. Taxpa*er:

1. A2ministrative

A.) )efore /a*ment:

1. /rotest $ filin5 a petition for

reconsi2eration or reinvesti5ation

8it6in " 2a*s from receipt of

assessment (Sec. 22().

2. Enterin5 into a compromise (Sec.

2!)

).) After /a*ment:

1. .ilin5 claim for ref%n2 or tax cre2it

$ 8it6in 2 *ears from 2ate of

pa*ment re5ar2less of an*

s%pervenin5 ca%se (Sec. 229)

=ote t6e s%spension of t6e 2 *ears perio2

(/ana* Electric Co. vs Collector >a* 2(,

receipt of 2ecision 3* t6e Commissioner or

Secretar* of .inance, no 2ecision is ren2ere2,

2ecision %n2er 2"&1 TCC)

II. Taxpa*er

1. /rotest $ a. An* importer or

intereste2 part* if 2issatisfie2 8it6

p%3lis6e2 val%e 8it6in 1& 2a*s from

2ate of p%3lication

3. Taxpa*er $ 8it6in 1&

2a*s from assessment. /a*ment

%n2er protest is necessar* (Sec.

2"(, 221 TCC)

2. 4ef%n2 $ a3atement or 2ra83ac@

(Sec. 1+1'1+( TCC)

2. Collection

a.) & *rs. $ from 2a* of assessment 3*

a2ministrative or :%2icial action (Sec.

19! LGC)

=ote t6e s%spension of prescriptive perio2 of

assessment an2 collection (Sec. 19! #

LGC)

local 5overnment ma* appeal to co%rts from

a2verse 2ecision of san5%nian on p%rel*

le5al iss%e.

II. Taxpa*er

1. A2ministrative

1./rotest $ 8it6in - 2a*s from receipt of

assessment (Sec. 19& LGC)

' pa*ment %n2er protest not

necessar*

2./a*ment A s%3se?%ent ref%n2 or tax cre2it

$ 8it6in 2 *rs. from pa*ment of tax to

local treas%rer (Sec. 19- LGC)

< =ote t6e s%spension of prescriptive

perio2 (Sec. 2+ LGC)

II. Taxpa*er

1. A2ministrative

1. /rotest $ pa*ment %n2er protest is re?%ire2

- 8it6in " 2a*s to provincial, cit*,

or m%nicipal treas%rer

2. 4ef%n2 or tax cre2it $ 8it6in 2 *ears from

t6e 2ate t6e tax pa*er is entitle2 t6ereto (Sec.

2&" LGC)

Page A-2

NIRC TCC LOCAL TAX REAL PROPERTY TAX

19&()

=ote t6at pa*ment %n2er protest is not

necessar*

=ote t6at t6e taxpa*er is 5iven t6e ri56t of

re2emption 8it6in 1 *ear from t6e 2ate of

sale or forfeit%re (Sec. 21& =I4C)

2. B%2icial

A.) Civil Action $

1. Appeal $ 8it6in " 2a*s from

receipt of 2ecision on t6e protest

or from t6e lapse of 1( 2a*s

inaction

of t6e Commissioner to t6e CTA.

(Sec. 22()

2. Action to contest forfeit%re of

c6attel (Sec. 2"1)

2. Action for 2ama5es. (Sec. 22+)

).) Criminal Action $

1. A5ainst errin5 )I4 0fficials an2

emplo*ees.

2. In:%nction $ 86en t6e CTA in its

opinion t6e collection 3* )I4 ma*

:eopar2i;e taxpa*er. Co%rt ma*

re?%ire 2eposit of an amo%nt or

s%ret* 3on2 for not more t6an

2o%3le t6e amo%nt. (Sec. 1 4A

112&)

< Settlement of an* sei;%re 3* pa*ment

of fine or re2emption s6all not 3e allo8e2

in an* case 86ere importation is

a3sol%tel*

pro6i3ite2 or t6e release 8o%l2 3e

contrar* to la8 (Sec. 2"+ TCC)

". Appeal $ 8it6in 1& 2a*s to

Commissioner after notification 3*

collector of 6is 2ecision (Sec. 2"1"

TCC)

- 7it6in " 2a*s from

receipt of 2ecision of t6e

Commissioner or

Secretar* of .inance to

t6e CTA (Sec. 2!" TCC,

Sec. + 4A 112&)

!. Action to ?%estion t6e le5alit* of

sei;%re

&. A3an2onment (Sec. 1(1 TCC)

< 4i56t of re2emption $ 1 *r. .rom t6e 2ate of

sale or from t6e 2ate of forfeit%re (Sec. 1(1

LGC)

1. Appeal $ an* ?%estion on constit%tionalit*

or le5alit* of tax or2inance 8it6in "

2a*s from effectivit* t6ereof to Secretar*

of B%stice (Sec. 1(+ LGC)

2. Co%rt action $ 8it6in " 2a*s after receipt

of 2ecision of lapse of - 2a*s of

Secretar* of B%sticeCs inaction (Sec. 1(+

LGC)

- 8it6in " 2a*s from

receipt 86en protest of

assessment is 2enie2

(Sec. 19& LGC)

- if no action is ta@en 3* t6e

treas%rer in ref%n2 cases

an2 t6e t8o *ear perio2 is

a3o%t to lapse (Sec. 19&

LGC)

- if reme2ies availa3le 2oes

not provi2e plain, spee2*

an2 a2e?%ate reme2*.

". Action for 2eclarator* relief

!. In:%nction $ if irrepara3le 2ama5e 8o%l2

3e ca%se2 to t6e taxpa*er an2 no

a2e?%ate reme2* is availa3le.

4e2emption of real propert* (Sec. 2-1 LGC)

2. B%2icial

1. Appeal $ 8it6in - 2a*s from assessment

of provincial, cit* or m%nicipal assessor

to L)AA (Sec. 22- LGC)

- 8it6in " 2a*s from receipt of

2ecision of L)AA to C)AA (Sec. 2"

LGC)

- in case of 2enial of ref%n2 or cre2it,

appeal to )AA as in protest case

(Sec. 2&" LGC)

2. Co%rt Action $ appeal of C)AACs 2ecision

to S%preme Co%rt 3* certiorari.

". S%it assailin5 vali2it* of taxD recover* of

ref%n2 of taxes pai2 (Sec. -! /# !-!).

!. S%it to 2eclare invali2it* of tax 2%e to

irre5%larit* in assessment an2 collection

(Sec. -! /# !-!).

&. S%it assailin5 t6e vali2it* of tax sale (Sec.

(" /# !-!)

Page A-3

You might also like

- Mamalateo Taxation ReviewerDocument2 pagesMamalateo Taxation ReviewerLucky Finds20% (5)

- Notes On Tax Remedies of The Government and TaxpayersDocument74 pagesNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Part I: Concept of Tax AdministrationDocument22 pagesPart I: Concept of Tax AdministrationShiela Marie Sta AnaNo ratings yet

- Philippine Tax Terms DefinedDocument2 pagesPhilippine Tax Terms DefinedJeypee Motley GarciaNo ratings yet

- Revenue Regulations No. 10-2012 overviewDocument18 pagesRevenue Regulations No. 10-2012 overviewFrancis Puno100% (2)

- Tax Remedies Digest CompilationDocument22 pagesTax Remedies Digest Compilationmadotan100% (2)

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- Lecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateDocument65 pagesLecture Guide Notes: Guide Notes: Taxation I General Principles of Taxation Taxation: An Inherent Power of The StateKristian ArdoñaNo ratings yet

- REYES Bar Reviewer On Taxation II (v.3)Document164 pagesREYES Bar Reviewer On Taxation II (v.3)Glory Be93% (14)

- Taxpayer's checklist for TRAIN law changesDocument6 pagesTaxpayer's checklist for TRAIN law changesChrislynNo ratings yet

- Domondon Tax Q&ADocument54 pagesDomondon Tax Q&AHelena Herrera0% (1)

- Tax Remedies and AdditionsDocument7 pagesTax Remedies and AdditionsVic FabeNo ratings yet

- TAXATION REMEDIESDocument63 pagesTAXATION REMEDIESLoueljie AntiguaNo ratings yet

- Tax+Remedies Nirc 2011 AteneoDocument103 pagesTax+Remedies Nirc 2011 AteneoGracia Jimenez-CastilloNo ratings yet

- Tax 2 - DST, ExciseDocument11 pagesTax 2 - DST, ExciseDINARDO SANTOSNo ratings yet

- Tax2 - Ch1-5 Estate Taxes ReviewerDocument8 pagesTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)

- Taxation Law Updates by Atty. OrtegaDocument21 pagesTaxation Law Updates by Atty. Ortegavillanueva9guapster9100% (1)

- TAXATION QUESTIONS & ANSWERSDocument49 pagesTAXATION QUESTIONS & ANSWERSMarc ToresNo ratings yet

- Taxation LawDocument70 pagesTaxation LawJing Goal Merit100% (1)

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- TAXREV SANTOSsyllabusDocument7 pagesTAXREV SANTOSsyllabusJoma CoronaNo ratings yet

- PM Reyes Bar Reviewer On Taxation I (v.3)Document158 pagesPM Reyes Bar Reviewer On Taxation I (v.3)irvinvelasquez0731100% (2)

- Atty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMDocument374 pagesAtty. Cleo D. Sabado-Andrada, Cpa, Mba, LLMIra Francia AlcazarNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- Case Digest Atty CabaneiroDocument11 pagesCase Digest Atty CabaneiroChriselle Marie DabaoNo ratings yet

- Digested 13 18Document13 pagesDigested 13 18Tokie TokiNo ratings yet

- Taxation LawDocument10 pagesTaxation LawflorNo ratings yet

- Nirc 1997Document348 pagesNirc 1997drdacctgNo ratings yet

- Flowchart Remedies of A TaxpayerDocument2 pagesFlowchart Remedies of A TaxpayerRab Thomas BartolomeNo ratings yet

- Lakas Atenista Notes JurisdictionDocument8 pagesLakas Atenista Notes JurisdictionPaul PsyNo ratings yet

- Recent Supreme Court and CTA Tax DecisionsDocument144 pagesRecent Supreme Court and CTA Tax DecisionsFender Boyang100% (1)

- Creba Vs Romulo TaxDocument3 pagesCreba Vs Romulo TaxNichole LanuzaNo ratings yet

- Tax Remedies Final 4 SlidesDocument35 pagesTax Remedies Final 4 SlidesMisterpogi TalagaNo ratings yet

- Tax Remedies and ProceduresDocument2 pagesTax Remedies and ProceduresEqui TinNo ratings yet

- Nirc (Codal)Document247 pagesNirc (Codal)Jierah Manahan0% (1)

- Senior Citizen and PWD Benefits ActDocument8 pagesSenior Citizen and PWD Benefits ActAngelica Nicole TamayoNo ratings yet

- Sopep DraftDocument57 pagesSopep DraftJolo BonaNo ratings yet

- Tax Remedies Comparison NIRC, TCC, Local Tax, Real Property TaxDocument3 pagesTax Remedies Comparison NIRC, TCC, Local Tax, Real Property Taxares_aguilarNo ratings yet

- Revenue RegulationsDocument13 pagesRevenue RegulationsErika AvedilloNo ratings yet

- Republic of The Philippines AppealsDocument14 pagesRepublic of The Philippines AppealsJm CruzNo ratings yet

- Tax 1 Income Tax Syllabus 2013 - LucenarioDocument10 pagesTax 1 Income Tax Syllabus 2013 - LucenarioNoel Christian LucianoNo ratings yet

- Tax Remedies Comparison Table NIRC, TCC, LGC, RPTDocument3 pagesTax Remedies Comparison Table NIRC, TCC, LGC, RPTStacy Liong BloggerAccountNo ratings yet

- Tax1 Dimaampao Lecture NotesDocument61 pagesTax1 Dimaampao Lecture NotesSui100% (1)

- CIR Vs Central Luzon DrugDocument1 pageCIR Vs Central Luzon DrugDPMPascua100% (5)

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Budget 2020 AnalysisDocument39 pagesBudget 2020 AnalysisCA Siddharth ParakhNo ratings yet

- CA INTER INCOME TAX MCQ'S PART 1Document33 pagesCA INTER INCOME TAX MCQ'S PART 1Roshinisai VuppalaNo ratings yet

- Exercising of OptionDocument3 pagesExercising of OptionaaosarlbNo ratings yet

- Mind MapsDocument12 pagesMind MapsLoueli IleuolNo ratings yet

- BIR Form 1702 (November 2011)Document18 pagesBIR Form 1702 (November 2011)Jecon BonsucanNo ratings yet

- Supreme Court rules on local government units' share of national taxesDocument21 pagesSupreme Court rules on local government units' share of national taxesHannah Keziah Dela CernaNo ratings yet

- CGB Supplement 2014 - RemediesDocument4 pagesCGB Supplement 2014 - RemediesrodgermatthewNo ratings yet

- Formula, Rates and Due Dates READocument21 pagesFormula, Rates and Due Dates REAKaren Balisacan Segundo Ruiz100% (2)

- CPWA CODE 51-100 (Guide Part 3) PDFDocument15 pagesCPWA CODE 51-100 (Guide Part 3) PDFshekarj67% (3)

- Clearlake Planning Commission - Metcalf VarianceDocument5 pagesClearlake Planning Commission - Metcalf VarianceLakeCoNewsNo ratings yet

- 201455200239Amendments-F.a. 2013 - For UplaodingDocument7 pages201455200239Amendments-F.a. 2013 - For UplaodingvishalniNo ratings yet

- Annual Income Tax ReturnDocument19 pagesAnnual Income Tax ReturnMarjorie BetchaydaNo ratings yet

- Syllogisms 101Document5 pagesSyllogisms 101igorotknightNo ratings yet

- Insurance CodeDocument20 pagesInsurance CodeigorotknightNo ratings yet

- Rules & Guidelines To Mediation & JDRDocument11 pagesRules & Guidelines To Mediation & JDRigorotknightNo ratings yet

- Update On Taxpayers Rights Remedies VicMamalateoDocument53 pagesUpdate On Taxpayers Rights Remedies VicMamalateoNimpa PichayNo ratings yet

- ROGER THOMAS, Defendant Below-Appellant, v. STATE OF DELAWARE, Plaintiff Below-Appellee.Document2 pagesROGER THOMAS, Defendant Below-Appellant, v. STATE OF DELAWARE, Plaintiff Below-Appellee.igorotknightNo ratings yet

- 09 Taxation Cut and PasteDocument83 pages09 Taxation Cut and PasteigorotknightNo ratings yet

- G.R. No. 123206Document6 pagesG.R. No. 123206igorotknightNo ratings yet

- UP Bar Reviewer 2013 - Legal and Judicial EthicsDocument71 pagesUP Bar Reviewer 2013 - Legal and Judicial EthicsPJGalera100% (38)

- Chapter 7, Adr Act of 2004 Lecture OutlineDocument25 pagesChapter 7, Adr Act of 2004 Lecture OutlineigorotknightNo ratings yet

- Outline Lecture Domestic Arbitration - PPDocument39 pagesOutline Lecture Domestic Arbitration - PPigorotknight100% (1)

- 2014 Bar Examinations Questionnaires - TaxationDocument13 pages2014 Bar Examinations Questionnaires - TaxationHornbook RuleNo ratings yet

- Bureau of Internal Revenue: Deficiency Tax AssessmentDocument9 pagesBureau of Internal Revenue: Deficiency Tax AssessmentXavier Cajimat UrbanNo ratings yet

- ADR ReviewerDocument29 pagesADR ReviewerferosiacNo ratings yet

- Relevant UNCLOS ProvisionsDocument6 pagesRelevant UNCLOS ProvisionsChe Gu QinNo ratings yet

- REHABILITATIONDocument6 pagesREHABILITATIONigorotknightNo ratings yet

- Preliminarytips TAXATIONDocument9 pagesPreliminarytips TAXATIONigorotknightNo ratings yet

- 01barops Corp 1to84Document86 pages01barops Corp 1to84igorotknightNo ratings yet

- UPSolid2010PoliticalLawPre Week - UnlockedDocument50 pagesUPSolid2010PoliticalLawPre Week - UnlockedigorotknightNo ratings yet

- 09 Taxation Cut and PasteDocument85 pages09 Taxation Cut and PasteigorotknightNo ratings yet

- Legal MedicineDocument64 pagesLegal MedicineMarivic Soriano100% (10)

- ADR ReviewerDocument29 pagesADR ReviewerferosiacNo ratings yet

- Right to information and recognized restrictionsDocument143 pagesRight to information and recognized restrictionsAlyza Nina VianneNo ratings yet

- In Come Tax Tables Annex BDocument9 pagesIn Come Tax Tables Annex BigorotknightNo ratings yet

- ADR ReviewerDocument2 pagesADR ReviewerMigz SolimanNo ratings yet

- POLITICAL LAW 1-8Document142 pagesPOLITICAL LAW 1-8schating2No ratings yet

- Preweek TaxationDocument13 pagesPreweek TaxationigorotknightNo ratings yet

- LTD Digest CasesDocument4 pagesLTD Digest CasesMichael Ang SauzaNo ratings yet

- Who Owns Boyle HeightsDocument32 pagesWho Owns Boyle HeightslvilchisNo ratings yet

- Tenancy Agreement TemplateDocument16 pagesTenancy Agreement TemplateKishore Kumar SugumaranNo ratings yet

- I. Land Reform vs. Agrarian ReformDocument10 pagesI. Land Reform vs. Agrarian ReformKIM COLLEEN MIRABUENA100% (2)

- Introduction To Property Management-LatestDocument28 pagesIntroduction To Property Management-LatestMaritoni MercadoNo ratings yet

- LECTURE NOTES (Arch. Eduardo F. Bober, JR.)Document5 pagesLECTURE NOTES (Arch. Eduardo F. Bober, JR.)Joyce Rachelle VizcondeNo ratings yet

- Note For Internship ....Document256 pagesNote For Internship ....suraj gulipalliNo ratings yet

- Letter To Hochul On Good CauseDocument3 pagesLetter To Hochul On Good CauseNew York Daily NewsNo ratings yet

- Chapter 3 Multiple Choice Questions / Page 1Document7 pagesChapter 3 Multiple Choice Questions / Page 1Navleen Kaur100% (1)

- Agreement of Lease: Ms. Manager,, - Satellite Town Branch RAWALPINDIDocument5 pagesAgreement of Lease: Ms. Manager,, - Satellite Town Branch RAWALPINDIRehanNo ratings yet

- COL Housing (Renewal)Document2 pagesCOL Housing (Renewal)SRNo ratings yet

- Tenancy AgreementDocument20 pagesTenancy Agreementtai100% (1)

- Fl-1104 Ajman Tasdeeq ContractDocument2 pagesFl-1104 Ajman Tasdeeq ContractJamal Rkh33% (3)

- Case Digests - Property Set 1Document10 pagesCase Digests - Property Set 1imXinYNo ratings yet

- Deed of Donation CabiaoDocument3 pagesDeed of Donation CabiaoJholo AlvaradoNo ratings yet

- Oyo Scale of FeesDocument19 pagesOyo Scale of FeesKola Samuel100% (1)

- Landlord - Tenant Part 1 Spring 2017Document7 pagesLandlord - Tenant Part 1 Spring 2017Facu BernardoNo ratings yet

- Real Estate Exam Study GuideDocument53 pagesReal Estate Exam Study Guideitzmsmichelle100% (3)

- Concurrent EstateDocument11 pagesConcurrent EstatesNo ratings yet

- Property & Land Law GuideDocument5 pagesProperty & Land Law GuideSabiithaNo ratings yet

- Transfer of PropertyDocument5 pagesTransfer of PropertyVishrut KansalNo ratings yet

- Rent AgreementDocument5 pagesRent AgreementDibyendu_gNo ratings yet

- Property Cheat SheetDocument2 pagesProperty Cheat SheetMark Michael StrageNo ratings yet

- Ennins TX - Code of OrdinancesDocument492 pagesEnnins TX - Code of Ordinancescivil.jdriveroincNo ratings yet

- Carmel Towers Briefings 2011Document32 pagesCarmel Towers Briefings 2011Kyle RosenkransNo ratings yet

- Refrigerator Rental AgreementDocument1 pageRefrigerator Rental AgreementNams CollectNo ratings yet

- 2BHK House Rental AgreementDocument4 pages2BHK House Rental AgreementNehaNo ratings yet

- Land Contract Validity Regardless of FormDocument68 pagesLand Contract Validity Regardless of FormCreamy ClaveroNo ratings yet

- Introduction of IprDocument3 pagesIntroduction of Iprgaurav singhNo ratings yet

- Rental ApplicationDocument2 pagesRental ApplicationbarrettjlbNo ratings yet