Professional Documents

Culture Documents

Revenue Audit Manual2

Uploaded by

Jitendra Vernekar0 ratings0% found this document useful (0 votes)

88 views5 pagesRevenue audit manual

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentRevenue audit manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views5 pagesRevenue Audit Manual2

Uploaded by

Jitendra VernekarRevenue audit manual

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Material Prepared by Smt. M.

Janaki Devi,AAO(Customs), PDA(Central), Hyderabad

REVENUE AUDIT MANUAL

The wing at CAG office is known by Revenue Audit Wing. The wing

is headed by Principal Director who reports to Deputy C&AG who in turn

reports to C&AG of India. The PD is assisted by a team of

Director(Customs), Sr. Administrative Officers (Customs) and sectional staff

in discharging duties.

Functions of Revenue Audit Wing (Customs):-

1. The Principal Director functions as Principal Audit Officer and are

vested with the responsibility of preparing annual audit report, which

after approval of C&AG is submitted to the President of India for

being laid before both Houses of Parliament.

2. Draft paras on Customs and also draft Review Report on Performance

received from the field offices are vetted at HQrs and issued as draft

audit paragraphs (DAP) and draft review report to the Ministry of

Finance or Commerce as the case may be for their comments. Based

on the Ministrys reply, Audit Reports (Compliance and Performance)

are prepared. The Audit Reports are duly signed by P D (Customs)

and countersigned by CAG of India and submitted to the President of

India through the Ministry of Finance, who causes them to be laid on

table of both the houses of Parliament every year preferably during

budget session.

3. CRA wing at HQrs coordinates customs audit work in the field offices

which includes issue of directions/instructions for audit planning,

execution and reporting, etc. Topics for review type of DPs on

Material Prepared by Smt. M.Janaki Devi,AAO(Customs), PDA(Central), Hyderabad

systems defects and recurring failures are identified and guidelines for

undertaking the systems review on the subject.

4. PD (Customs) may consider attending some of the meetings of the

conferences of Commissioners of Customs convened by CBEC.

5. Tripartite meetings: In case of difference of opinion on interpretation

of legal points arising between the CAGs office and Ministry, on

points of law involved in audit objections and resolved in Tripartite

meetings held in the Ministry of Law.

6. Technical inspections of CRA wing of field offices are conducted on

rotational basis by HQrs inspection team.

7. Association with Public Accounts Committee: After the report is laid

on the table of the Parliament, the PAC takes up the report for

discussion, identify the topics/issues for oral discussion.

8. Organising seminars and workshops: Periodical seminars/workshops

on customs matters are organized by HQrs office with the help of field

offices.

Field formations:-

The audit of receipt is conducted in the field under the overall

supervision of AG/PDA (Central) having state wise jurisdictional charge of

the area under Customs Commissionerates. CRA wing functions under the

charge of a Group Officer supported by field inspection parties. The field

parties visit the commissionerate offices, preventive units, etc and conduct

audit of customs receipts. The audit of expenditure relating to these offices

is also simultaneously conducted by the CRA parties. In major

commissionerates, the CRA also carries out concurrent test audit of bills of

entry and shipping bills at the customs houses.

Material Prepared by Smt. M.Janaki Devi,AAO(Customs), PDA(Central), Hyderabad

Besides, the Customs commissionerates, the CRA wing also insects

records at various offices of the Director General of Foreign Trade (DGFT),

the Development Commissioner under the Ministry of Commerce, the

Director, STP, etc.

In addition, every year, CRA wing also undertakes performance audit

reviews on topics/schemes as per HQrs directions.

Concurrent Audit:- Objection are issued in the form of Test Audit Memos

under the signature of SAO/AO, incharge of concurrent audit to the

jurisdictional incharge through the internal audit department and

acknowledgement obtained. The Audit Memos should bear running serial

numbers and kept in record. Receipt of documents for audit from customs

house and their return after audit are watched through a register called Key

Register. The Audit Memos issued are watched through a Register of Test

Audit Memos, which is submitted to the Branch Officer and Group Officer

every month for review.

Local Audit:-

All objections in the form of Audit Queries/Half Margins under the signature

of SAO/AO, incharge of the party should be issued to the jurisdictional in

charge of Customs. The objections which could not be settled on the spot

during the course of audit should be drafted in the Local Audit Report

(LAR). The LAR should contain three parts:-

Part I:_ Inroductory

Part II A:- Should contain all Major Irregularities noticed in current audit

which is likely to find a place in the Audit Report of CAG.

Part II B:- Should contain paras which are not required to be pursued

through Part IIA of the LAR

Material Prepared by Smt. M.Janaki Devi,AAO(Customs), PDA(Central), Hyderabad

Part III:- Minor objections ( less than 10000).

All objections should be entered in Objection Book and closed every

month and submitted.

Draft LAR should be prepared by the AAO and reviewed by the

SAO/AO, incharge of the party. Before submitting it to HQrs section, the

cases should be discussed with the concerned Asst. Commissioner in case of

Division or Superintendent. The fact of discussion should be mentioned in

the lar. LAR should be issued within 5 days of completion of audit to HQrs

section. The report should be vetted by AAO, then AO/SAO at local HQrs

and approved by the Group Officer. The complete and neatly typed report

should be issued to the concerned officer with a copy to AC/DC, Customs

within one month from the date of completion of audit. A Register of LAR

should be maintained.

Objection Book:- All objections should be entered in the OB. It should be

closed every month under the signature of SAO and reviewed by Group

Officer.

PDP (MI) register:- All Potential Draft Paras/Major Irregularities are entered

in the register and only those cases which are converted into Statement of

Facts or dropped on approval of PDA should be cleared from the PDP

register. Should be submitted on 10

th

of every month to the GO/PDA for

their review.

SOF register:- All Statement of Facts may be forwarded to the department

for confirmation of facts within 6 weeks. Based on the SOF and

departments comments, draft paragraphs are processed. If the para is not fit

to be developed as DP based on the reply of the department, the case may be

removed from the SOF register. The register is to be putup to PDA by 10

th

of every month.

Material Prepared by Smt. M.Janaki Devi,AAO(Customs), PDA(Central), Hyderabad

Returns to HQrs office:- (Authority:- HQrs circular No. 1/2011-Customs /

No.240/85/RA-INDT-Cus/2011 dated 2.9.2011.

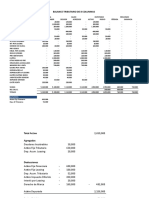

Sl.No. Name of returns Periodicity

1. Half yearly performance report April and October

2. Objections accepted and not converted into

DPs

April (Annual)

3. Statement of objections for which first replies

have not been received within six months of

issue

April and October

4. Assurance Memo October 15

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Homestead DeclarationDocument3 pagesHomestead DeclarationBob Richards100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Estafa Complaint AffidavitDocument5 pagesEstafa Complaint AffidavitPrinting Panda100% (5)

- Trusts SubjectguideDocument266 pagesTrusts SubjectguideFinal Flash50% (2)

- Notes On Quantum MechanicsDocument397 pagesNotes On Quantum MechanicsBruno Skiba100% (3)

- Accounting Standard IcaiDocument867 pagesAccounting Standard IcaiKrishna Kanojia100% (2)

- Roads & BridgesDocument66 pagesRoads & BridgesvivekranjanjamNo ratings yet

- Audit of ContractsDocument26 pagesAudit of ContractsSarvesh Khatnani100% (2)

- Audit of ContractsDocument26 pagesAudit of ContractsSarvesh Khatnani100% (2)

- PASEI v. DrilonDocument2 pagesPASEI v. Drilonkathrynmaydeveza100% (3)

- Chess Teaching ManualDocument303 pagesChess Teaching Manuallavallee2883No ratings yet

- Article 13Document4 pagesArticle 13Shorya SubhluxmiNo ratings yet

- Autonomous Bodies ManualDocument116 pagesAutonomous Bodies ManualJitendra Vernekar0% (1)

- 20957handbk Auditing Pro VolII2010Document610 pages20957handbk Auditing Pro VolII2010Jitendra Vernekar100% (1)

- Crimes Comitted by Public Officers (Article 203-245)Document2 pagesCrimes Comitted by Public Officers (Article 203-245)Genevieve Penetrante100% (1)

- NakshatraDocument18 pagesNakshatraJitendra Vernekar100% (1)

- Petition For Land Valuation and Payment of Just CompensationDocument7 pagesPetition For Land Valuation and Payment of Just Compensationdundeeyo100% (2)

- Planetary WarDocument7 pagesPlanetary WarJitendra VernekarNo ratings yet

- Gonzalo v. TarnateDocument5 pagesGonzalo v. TarnateFrances Ann TevesNo ratings yet

- The Beginner's GameDocument212 pagesThe Beginner's GameMthunzi DlaminiNo ratings yet

- The Beginner's GameDocument212 pagesThe Beginner's GameMthunzi DlaminiNo ratings yet

- Digest Republic vs. IacDocument1 pageDigest Republic vs. IacJoseph Gaviola100% (2)

- Companies Act 2013 Ready Referencer 13 Aug 2014Document150 pagesCompanies Act 2013 Ready Referencer 13 Aug 2014AvaniJainNo ratings yet

- Dress Bolero SetDocument8 pagesDress Bolero SettinitzazNo ratings yet

- Companies Act 2013 in Brief Section WiseDocument21 pagesCompanies Act 2013 in Brief Section WiseJitendra VernekarNo ratings yet

- Highlights - ICAIDocument20 pagesHighlights - ICAIvishalchitlangyaNo ratings yet

- GFR2005Document167 pagesGFR2005Jitendra VernekarNo ratings yet

- DictionaryDocument625 pagesDictionaryJitendra Vernekar0% (1)

- Major Events BreakdownDocument16 pagesMajor Events Breakdownnajeebcr9100% (1)

- C Programming FaqDocument432 pagesC Programming FaqharshabalamNo ratings yet

- Hanuman Chalisa With Meaning in EnglishDocument11 pagesHanuman Chalisa With Meaning in Englishamitpratapsingh007No ratings yet

- Notes To Capital Work-In-progressDocument3 pagesNotes To Capital Work-In-progressJitendra VernekarNo ratings yet

- Audit of Autonomous Bodies 551Document35 pagesAudit of Autonomous Bodies 551Jitendra VernekarNo ratings yet

- Annual Report 13-14 EngDocument30 pagesAnnual Report 13-14 EngJitendra VernekarNo ratings yet

- ICAI Accounting StandardsDocument347 pagesICAI Accounting Standardsarinroy100% (1)

- Air (Prevention and Control of Pollution) Act, 1981 PDFDocument35 pagesAir (Prevention and Control of Pollution) Act, 1981 PDFJay KothariNo ratings yet

- House Division - ControversyDocument3 pagesHouse Division - ControversyJitendra VernekarNo ratings yet

- Hanuman Chalisa With Meaning in EnglishDocument11 pagesHanuman Chalisa With Meaning in Englishamitpratapsingh007No ratings yet

- Is There Something Made by Man That Approaches The Beauty of Nature? Perhaps Music!Document44 pagesIs There Something Made by Man That Approaches The Beauty of Nature? Perhaps Music!Grizzly GroundswellNo ratings yet

- Government ReceiptsDocument164 pagesGovernment Receiptsbharanivldv9No ratings yet

- PersonsDocument1 pagePersonsDowie M. MatienzoNo ratings yet

- General Condition: LaborDocument2 pagesGeneral Condition: Laborเจียนคาร์โล การ์เซียNo ratings yet

- Consumer Welfare Fund Application FormDocument9 pagesConsumer Welfare Fund Application FormMinatiBindhaniNo ratings yet

- Sales 1Document29 pagesSales 1I.F.S. VillanuevaNo ratings yet

- PALAGANAS Ojt FormDocument3 pagesPALAGANAS Ojt FormJornalyn PalaganasNo ratings yet

- RTO New Application FormDocument4 pagesRTO New Application FormCui KunchiNo ratings yet

- Financing Corp Vs TeodoroDocument6 pagesFinancing Corp Vs TeodoroDexter CircaNo ratings yet

- Balance Tributario de 8 ColumnasDocument5 pagesBalance Tributario de 8 ColumnasGerardo ManriquezNo ratings yet

- Regulation 2 (D) of The Dock Workers (Safety, Health and Welfare) Regulations, 1990Document4 pagesRegulation 2 (D) of The Dock Workers (Safety, Health and Welfare) Regulations, 1990DaveNo ratings yet

- PNR - Non-Core PropertyDocument2 pagesPNR - Non-Core PropertyIa Dulce F. AtianNo ratings yet

- 001 - 2006 - Arbitration Law-1 PDFDocument27 pages001 - 2006 - Arbitration Law-1 PDFkrishnakumariramNo ratings yet

- G.R. No. L-41182-3 April 16, 1988 Sevilla vs. CADocument7 pagesG.R. No. L-41182-3 April 16, 1988 Sevilla vs. CArodolfoverdidajrNo ratings yet

- Second Division: VICENTE C. PONCE, Petitioner, vs. ALSONS CEMENT CORPORATION, and FRANCISCO M. GIRON, JR., RespondentsDocument14 pagesSecond Division: VICENTE C. PONCE, Petitioner, vs. ALSONS CEMENT CORPORATION, and FRANCISCO M. GIRON, JR., RespondentsSamNo ratings yet

- Air France v. CA (1983)Document10 pagesAir France v. CA (1983)8111 aaa 1118No ratings yet

- OCA Circular No 35 08 PDFDocument2 pagesOCA Circular No 35 08 PDFAlan Jay CariñoNo ratings yet

- 694 Supreme Court Reports Annotated: Confederation of Citizens Labor Unions vs. NorielDocument6 pages694 Supreme Court Reports Annotated: Confederation of Citizens Labor Unions vs. Norielangela lindleyNo ratings yet

- Sample Landmarks Famous Sights WorksheetsDocument8 pagesSample Landmarks Famous Sights WorksheetsKarim ZerroukiNo ratings yet

- Chetan Devendra SharmaDocument3 pagesChetan Devendra SharmaDeval BrahmbhattNo ratings yet

- IRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromDocument4 pagesIRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromMarco AbreuNo ratings yet

- Baseco v. PCGG - CaseDocument1 pageBaseco v. PCGG - CaseRobehgene Atud-JavinarNo ratings yet