Professional Documents

Culture Documents

10 Chapter 2

Uploaded by

Ali Ahmed0 ratings0% found this document useful (0 votes)

17 views36 pagesBIFR - Chapter 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBIFR - Chapter 2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views36 pages10 Chapter 2

Uploaded by

Ali AhmedBIFR - Chapter 2

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 36

CHAPTER 2

CORPORATE SICKNESS AND REHABILITATION

2.1 Introduction

Industrial sickness has emerged as a significant problem in all market

economies. At an elementary level industrial sickness refers to an industrial or

manufacturing firm performing systematically worse than the average, not

covering its fixed cost and frequently reneging on its debt repayment obligations

(Pawha and Puliani, 2000, 500). This happens when the rate of return on investment

of the concern is lower than the cost of capital used for the investment. It arises

out of weak financial structure andlor chronically inefficient use of factors of

production andlor market positioning. Its outcome is the locking up of scarce

investable funds in sub-optimal activities and acts as a major deterrent to industrial

growth.

In India and elsewhere in the third world the problem of industrial

sickness is more severe compared to the developed and industrialised nations since

such economies with their well established social security system can easily

absorb the economic disturbances like retrenchment etc., brought about by the

Chapter 2 20

closure of industrial units. It is pervasive across ownership (public or private

sector), industries, states and scale (small, medium and large). This chapter aims

at examining the various aspects of sickness in the Indian industrial scene in two

sections. The first section contains definitions and the causes of industrial

sickness and the second section deals with the dimension of industrial sickness in

India and the role of different agencies in reviving sick industrial units.

2.2 Section 1

2.2.1 Industrial Sickness-Definitions

There are a number of definitions of industrial sickness based on different

norms such as generation of surplus, liquidity, solvency, amount and period of

irregularities in operation etc. In order to have a clear idea about the different

aspects of industrial sickness the various definitions given by various authorities

are mentioned briefly.

' The State Bank of India (SBI) study team in its report on Small Industrial

Advances (1975), defined a sick industrial unit as a unit which fails to generate

adequate internal surpluses on a continuing basis and dependr; for its survivaI

on frequent infusion of external fina~tcid help, thereby it brings about serious

disequilibrium in its financial structure. '

ii. The Reserve Bank of India (RBI) defined a sick industrial unit as a unit, which

has incurred cash losses for one year and in the judgment of the bank, it is

likely to continue to incur cash losses for the current year as well as the

following year and which has an imbalance in the financial structure, such as

current ratio of less t hm I : I and worsening debit-equity ratio.'

' Vide circular, DBOD, No: CAS, D.C. 133/C 446 (SIU) 76 dated 26' hovernber

1976, RBI, Bombay.

Chapter 2 2 1

iii. The National Institute af Bank Management (NIBM) defined sick units as

those where the operations result in continuous losses affecting the borrowing

potential almost permanently. 3,

iv. The National Council of Applied Economic Research (NCAER) defined

sickness in terms offinancial viability consisting of fhree independent elements

of equal emphasis and weight viz., profiaabils'fy, Iiquidity and solvency

represented by cash profit or loss, net working cupdtul, and networth

respectively. When all the parameters show positive Fgures, #he unit's

financial viability will be sound; where one of the parameters shows negative

figure, the unit could be a case of incipient sickness; where all the rkree

parameters show negative figures, the unit may be termed us sick.'

v. The Industrial Credit and Investment Corporation of India (ICICI) defined a

sick industrial unit as one whose flnaneial viability is threatened by adverse

factors present and continuing. The adverse factors might relute to

management market, fiscal burden, labour relation, or aql other. When the

impact of these factors reaches a point where a company begins to incur cash

losses or leading to erosion of its hnd r there is n threat to its financial

viability.

vi. The Sick Industrial Companies (Special Provisions) Act, 1985 defines a Sick

industrial Company as an industrial company (being a company registered for

not less than f i ve years), which has at the end of any financial year

accumulated losses equal to or exceeding its entire ne t w~r t h. ~

3Biswasroy et a1( 1 990), 19.

"bi d.

'Srivastava and Y adav ( I 986), 10.

h

Section 3(1)(0) of the Sick Industrial Companies (Specid Provisions) 'Act, 1985 as

quoted by Pahwa H.P.S. and M. Puliani in Sick Industries and BIFR (2000), 30.

Chapter 2 22

b

From the above definitions it is clear that no single definition is

comprehensive enough to be accepted universally. Almost all the definitions are

from the point of view of financing agencies and they describe the position of

sickness in financial terms only. Sickness has also a qualitative aspect and none of

them tries to see what sickness means to the employees, to the investors or to the

society. In this context, the description of sick industrial units by Biswasroy et a1

(1990, 20) seems more relevant and apt to cite. Accordingly, a sick unit is on

unhealthy unit to a common man, a proJit postponing unit to an investor, a

discouraging unit to an industrialist, a source of industrial problems to the

Government, a victim of technological change to a technocrat, a bad employer 60

workers and a source of wastage of technical and human resources to the

2.2.2 Causes of Industrial Sickness

There is no single cause for corporate sickness; indeed the variety seems

staggering. Sickness may come as the result of any type of bottleneck in any area

and of any level of operation and the reasons differ from industry ta industry in the

economy and Erom firm to firm in a given industry. These causes may be generally

classified into two viz.. internal causes and external causes.

Internal causes arise due to anomalies in the various hnctional areas such

as finance, production, marketing and personnel and are within the control of the

firm7. The external causes of sickness arise from changes in environment and are

beyond the control of the management. These changes may arise due to

government legislation or due to certain economic, political and international

factors. Inadequate credit facilities, unfavourable investment climate, shortage of

1

Desai (1980), Pawar (1981), Bidani and Mitra (19821, Dixit (1984), Sinha (1984),

Srivastava and Yadav (1986), Biswasroy (1990) and Khan (1990j highlighted the various causes

of industrial sickness elaborately.

Chapter 2 23

raw materials and power, import restrictions, labour unrest, market recession,

global competition, heavy taxation and obsolete technology are generally

considered as the major extemal causes of sickness. An RBI study8 for the period

ending March 1998 revealed that 50.4 percent of industrial sickness is caused by

internal factors comprising shortcomings in project appraisal (7.3 percent),

technical feasibility, economic viability and project management deficiencies

(43.1 percent). External factors which are beyond the control of the

promoters/managers of the units concerned accounted for the remaining 49.6

percent of the major causes of sickness.

A survey of the companies reported to the BIFR up to March 1998

revealed that financial problems in 34.5 percent cases, production and technical

problems in 21.4 percent cases, managerial problems in 20 percent cases,

marketing problems in 15.3 percent cases and the government policies in 8.8

percent cases were the reasons for their sickness.'

As far as the causes of industrial sickness are concerned, the above-

mentioned factors can jointly and severally be attributed. In the majority of cases

no single factor can be identified as the sole reason of sickness, the causes come in

groups. For example, in the case of M/S Transformers and Electricals Kerala

~ t d " the main causes for sicknew were low capacity utilisation, high cost of raw

materials, low productivity, excess personnel, high interest burden, shortage of

working capital and high turnover of top management personnel. Similarly, in the

'BIFR Performance Review (1 998),20.

9

Rl FR Performance Review ( 1 998), 1 7

"M/S Transformers and Electricals Kerala Ltd (TELK) was established in 1963 to

manufacture transformers and transformer components to cater to the needs of the State

Electricity Boards. The entry of multi-national companies into the market with better technology,

product range, price, service and delivery affected the performance of the company. The

company made a report to the BIFR in May 1995 and a rehabilitation scheme was implemented

w.e.f. 1" January 1998. But the rehabilitation scheme failed within two years of its

implementation due to the heavy losses incurred by the company. Pp 158- 17 1.

Chapter 2 24

case of M/S South India Wire Ropes ~ t d " the main causes of sickness were lack

of discipline in financial management, working capital deficiency, inadequate

modernisation and replacement of plant and machinery, high cost of quality raw

materials, non co-operative work force and managerial problems. These findings

are in congruence with Argenti ( 1 977, 47)'s observation that industrial sickness

can be attributed to several factors working simultaneously.

2.3 Section 2

2.3.1 Dimension of Industrial Sickness in India

Industrial sickness has emerged as a bane of Indian economy resulting in

the closure of many enterprises every year creating large-scale unemployment and

loss of investment ultimately slowing down the wheels of economic progress of

the nation. It was first noticed with concern in mid sixties, which also coincided

with the period of industrial stagnation. A few hundred units in some of the

traditional industries such as Cotton Textiles, Jute and Sugar became sick.

Inadequate replacements and modernisation of plant and machinery were the

reasons for sickness. But its magnitude has been increasing at a steady rate since

then.

The total number of sick industrial units increased from 24550 units in

December 1980 to180597 units by the end of March 2002. 'Shis points out that the

number of sick industrial units increased more than seven times during the period.

The amount of institutional credit locked up in them increased more than 14 times

from Rs. 1809 crores to Rs.26065 crores during the same period. The dimension of

industrial sickness both in the small and large-scale sectors is given in Table 2.1. The

diagrammatic representation of sicWweak units in the SSI Sector and the Non-SSI

"~romoted in 1961, M/S South lndia Wire Ropes Ltd (SIWR) is the largest

manufacturer of steel wire ropes in South India. The company incurred losses continuously

since 1985-86 and it was reported to the BIFR in October 1987. The rehabilitation scheme

sanctioned by the BIFR codd not be implemented properly due to the non co-operation of the

participating agencies. The BIFR decided to wind up the company in 1995. Pp 233-243.

Chapter 2 25

Sector are shown separately in Fig. 2.1 and Fig. 2.2 respectively and the amount of

institutional funds locked up in sick units in Fig. 2.3.

Table 2.1 :- Dimension of Industrial Sickness in India

(Rs. in crores)

March

2000

March

200 1

March

2002

Total

24550

119606

221094

223809

247924

240700

258952

271206

264750

237400

--

224012

309013

Total

1809

4271

9353

10768

11534

13134

136%

13739

13749

13787

15682

t 9464

SSI Sick

Units

306

1071

2427

2792

3101

3443

3680

3547

3722

3609

A -

3856

4314

Non SSI

Weak

Units

814

876

813

657

591

476

418

420

.--,.

446

435

-,

Source: RBI Report on Trend and Progress of Banking in India (various issues).

304235

249630

177336

Units

Non SSI

Sick

Units

1401

1823

1455

1461

1536

1867

1909

1915

1956

1948

2030

2357

Period

December

1980

December

1985

March

1990

March

1991

March

1 992

Mm h

1993

March

1994

March

1995

March

19%

March

1997

March

1998

March

1 999

Institutional

Non SSI

Sick

Units

1503

3200

4539

5106

5787

7901

8152

8740

8823

8614

9862

13114

Number of

SSI

23 49

1 17783

218825

22 1472

245575

238 1 76

256452

268815

262376

235032

221536

30622 1

2742

2928

2880

Finance

Non SSI

Weak

Units

2387

2870

2646

1790

1864

1452

1204

1564

1964

2036

422

389

381

307399

252947

180597

4608

4506

4819

16748

18478

17591

2299

2793

3655

23655

25777

26065

Chapter 2

Fig: 2.1:- SSI Sick Units

Year

pi s aEi q

Fig: 2.2:- NonSSl SickMleak Units

year IS ~ S S I Sickkeak units (

Chapter 2

Fig: 2.3 Institutional Funds insick Units

Year

I H SSI Sick Units Non SSI Sick Units I

It can be seen that the incidence of sickness is more in the small-scale

(SSI) sector than in the large-scale sector. The total number of sick units in the

SSI sector increased by 7.7 times from 23 149 units in December 1980 to 177336

units by March 2002 and the amount of bank credit locked up in them increased

more than 15.7 times from Rs.306 crores to Rs. 4819 crores during the same

period. In the non-SS1 sector the number of sicklweak units increased by 2.3

times from 1401 units to 3261 units and the amount of bank credit locked up in

them increased more than 14 times fiorn Rs.1503 crores to Rs.21246 crores

between December 1980 and March 2002. This shows that the total number of

sicWweak units in the non-SSI sector was only 1.8 percent of the total number of

sickjweak units but the non-SSI sector accounted for more than 8 1.5 percent of the

institutional credit locked up in sicklweak units.

Chapter 2

2.3,2 Role of Different Agencies in Reviving Sick Industrial Units

Corporate sickness has emerged as a significant problem in many market

economies. Growing competition and ever changing international economic

development often led to high incidence of corporate failure in developed market

economies. The incidence of closure tends to be high in industries characterised

by fierce competition and in industries with high degree of obsolescence. In the

U.K., one in five firms listed on the stock exchanges turns sick, and of these, only

one in four manages a successfbl turnaround." In the U.S. one in four companies

listed on the stock exchanges had turned sick, and only a third of those that got

sick recovered." Hawever, these economies with their well-established social

security system can easily absorb the economic disturbances brought about by

the closure of industrial units. But developing economies with their limited

resources cannot afford their productive resources turning non-operational due to

industrial sickness. Rehabilitation is the only remedy available for the industrial

undertakings, which have already become sick and are on the verge of virtual

collapse (Srivastava and Yadav, 1986,206).

The growing incidence of industrial sickness in India and the resource

blocked in sick unitsI4 made it imperative that solutions are to be found to

I 2

Stuart Slatter, Corporate recovery: Successful Turnaround Sfrategies und their

Implementation as quoted by Khandwalla, P.N., in Effective Turnaround of Sick

Enterprises, ( 1989), I .

' '~ibeault, D., Chrporate Turnaround: How Managers Turn Losers into

Winners, as quoted by Khandwalla, P.N., in Fffective Turnaround of Sick Enterprises,

( 1989), I .

I 4 ~he number of sick industrial units increased from 20651 to 180597 between

December 1978 and March 2002 and the amount of bank credit locked up in them

increased from Rs. 901 crores to Rs. 26065 crores during the same period.

Chapter 2 29

rehabilitate sick units and to overcome the problem of widespread sickness in

industrial scene. The following paragraphs review the measures taken by the

Government, the Reserve Bank of India (RBI) and the All India Financial

Institutions (AIFIs) in reviving sick industrial units in the country.

2.3.3 Government Measures in Reviving Sick Industrial Units

In the sixties the Government perceived corporate sickness as a threat to

employment of labour force; hence it resorted to takeover of the units closed by

making necessary amendments to the Industries (Development and Regulation)

Act, 195 1 , It worked well since the number of units becoming sick was negligible.

The depressed and reccessionary industrial climate experienced by the country

during the late sixties resulted in a number of industrial units becoming sick

especially in the Northeastern region and in and around Calcutta. At this juncture,

the Government came out with a conscientious and well-defined policy of

establishing an institution to act as a reconstruction agency for the revival of sick

industrial units and the Industrial Reconstruction Corporation of India (IRCI) was

established in April 197 1. Nevertheless the magnitude of industriai sickness has

been increasing at a steady pace along with industrial development. Taking

serious note of the adverse impact of industrial sickness on production and

employment the Government and the RBI have been constantly trying to bring

down the incidence of sickness in industry by taking suitable remedial measures.

The objective of such measures was to revive the sick enterprises. Further, the

Government has made certain policy announcements on sick industrial units from

time to time. The various policy measures taken by the government before the

enactment of the Sick Industrial Companies (Special Provisions) Act, 1985 to

revive sick industrial units are discussed broadly under the following heads.

i. SoA Loan Scheme

ii. Industrial Policy 1977

Chapter 2

iii. Merger Policy 1977

iv. Policy Guidelines on Sick Units 1 978

v. Policy Statement 1980

vi. New Strategy 198 1 and

vii. Conversion of the IRCI into the TRBI in 1984.

i. Soft Loan Scheme

The Soft Loan Scheme for modernisation was introduced in November

1976 for five selected industries viz., cotton textiles, jute, cement, sugar and

specified engineering industries. The basic objective of the scheme was to provide

financial assistance on concessional terms to the weaker units for modernisation,

replacement and renovation of their old plant and machinery. The scheme was

operated by the Industrial Development Bank of India (IDBI) in collaboration with

the Industrial Finance Corporation of India (IFCI) and the Industrial Credit and

Investment Corporation of India (ICICP). The IFCI was the lead institution for

sugar and jute industries, the IDBI for cotton and cement industries and the ICICI

for engineering industries. Loans under the Soft Loan Scheme were provided on

concessional terms not only in regard to the rate of interest but also in regard to

other provisions such as the promoters' contribution, debt-equity ratio, initial

moratorium and repayment period. All types of industrial concerns such as

proprietary, partnership, private and public limited companies were eligible for

assistance under this scheme, But preference was given to the units promoted by

technicians or entrepreneurs and projects in backward areas.

The industrial unit should have been in operation for at least 10 years to

be eligible for assistance under the Soft Loan Scheme. The plant and machinery

proposed to be replaced should have been in use for more than 10 years. The 10

years criterion was relaxable if the project aimed at increase in exports, import

substitution, energy saving and anti-poilution measures.

Chapter 2 3 1

Under the Soft Loan Scheme the units were classified into three groups

'weak', 'not so week' and 'better off units' (Srivastava and Yadav 1986, 207).

Assistance to 'weak' units was given at a concessiond rate of 7.5 percent while

the concessional part was reduced in the case of 'not so weak' and 'better off

units on a grading scale depending upon the financial position of the units.

The scheme was modified in January 1984 and renamed as Soft Loan

Scheme for Modemisation. All the categories of industries were eligible to receive

financial assistance under the new scheme. The modified scheme reduced the

interest rate from 12.5 percent to 1 1.5 percent for loans up to Rs. 4 crores.

The industry-wise sanctions and disbursements under the Soft Loan

Scheme by the IDBI, IFCI and the IClCI between 1976-77 and 1984-85 are given

in Table 2.2 and its diagrammatic representation in Fig. 2.4. The industry-wise

classification of the total number of units assisted under the Soft Loan Scheme up

to 31 March 1985 is given in Fig. 2.5

Table 2.2:- Financial Assistance Sanctioned and Disbursed under the Soft Loan Scheme (Rs. in lakhs)

1

198 1-82

I

1982-83

I

1 983 -84

I 1984-85 1

Total

I

lndustry

Textiles

Cement

Total 53 6586 0 79 10950 1964 103 19815 5858 106 17759 11166 81 14430 13362

Industry

Textiles

Cement

Sugar

Jute

Engineering

Others

Total

1976-77

Source: IDBI Operational Statistics 1984 - 85, P69.

Disbur-

sements

0

0

1977-78

No

33

5

No

73

4

8

4

17

0

106

No

43

1

San-

ctions

2159

2217

1978-79

San-

ctions

10837

6117

1534

724

3145

0

22357

San-

ctions

4934

515

No

70

2

Disbur-

sements

8727

1045

1345

561

3055

0

14733

Disbur-

sements

5892

961

1111

217

2145

0

10326

No

40

2

0

0

22

0

64

Disbur-

semen&

583

436

1979-80

San-

ctions

4405

710

0

0

5433

0

10548

N~

36

3

3

1

4

2

49

San-

ctions

11012

2600

1980-81

Disbur-

sements

5192

2637

Disbur-

sements

3217

834

No

63

4

No

42

5

San-

ctions

9391

2300

995

229

870

150

13935

Sari-

ctions

11585

1168

Disbur-

sements

3990

734

407

134

1609

0

6874

Disbur-

sements

3446

972

82

344

1109

1297

7250

No

26

3

3

1

10

25

68

No

426

29

43

28

156

27

709

San-

ctions

6760

1090

San-

ctions

11468

1554

180

55

1497

18627

33381

Disbur-

sement

8968

1073

San-

ctions

72551

18271

7449

5418

27295

18777

149761

Disbur-

sements

40015

8692

5335

1 926

14268

1297

71533

Fig: 2.4:- Assistance Under Soft toan Scheme

40000 -

35000 -

30000 -

-- 25000 -

C

g 20000 -

4 15000 -

10000 -

5000 -

0 I

CY 0

?

3 zi$garn

? Z F Z ?

Year

1s Sanctions . Disbursements (Rs. in labs) 1

f

Fig: 2.5:- Sick Un'b Assisted Under Soft Loan

Scheme

27

\

ff mrn \ 1 I

426

A

[B Textiles M Cement Sugar .Jute Engineering . Omers I

Chapter 2 3 4

Table 2.2 shows that 709 industrial units were given assistance under the

Soft Loan Scheme up to 31 March 1985 and the cumulative sanctions and

disbursements under the scheme amounted to Rs. 1497.6 1 crores and Rs.7 15.33

crores respectively.

The Sol? Loan Scheme could not make any impact on curbing the

industrial sickness in the country. The number of sick industrial units increased

nearly five times from 20651 units to 98487 units between June 1978 and 1985."

ii. Industrial Policy 1977

Industrial sickness, for the first time found a specific mention in the

industrial policy statement laid before the Parliament in December 1977. The

policy statement announced that taking over of the management of the sick units

would be resorted to selectively and only after careful examination of the steps

required to revive the units. This was a major deviation from the earlier policy

measures. In the past, whenever there were possibilities of closure of a unit the

response from the Government was to bring the management under the Industries

(Development and Regulation) Act, 195 1.

iii. Merger Policy 1977

In 1977 the Union Government evolved a scheme of merger of sick units

with healthy ones with a view to reviving sick industrial units. In the Finance Act,

1977 the Government introduced certain fiscal concessions whereby a healthy unit

taking over a sick unit was allowed to carry forward and set off the accumulated

losses and unabsorbed depreciation of the latter against its own tax

However, it was stipulated that the merger should be in public interest and the sick

company taken over should have employed staff numbering more than 100 and it

15

Biswasroy and Misra (1 992), 503.

I6

Section 72-A of the Income Tax Act, 196 1 .

Chapter 2 3 5

should have assets of more than Rs.50 lakhs. These two conditions were

applicable to both MRTP and non-MRTP companies.

iv. Policy Guidelines on Sick Units 1978

The Government Policy of 1978 on sick industries recognised that revival

of a sick unit cannot be the responsibility of any single agency and that it can be

achieved effectively only by sharing the responsibility by the Central Government,

State Governments, Financial Institutions, the Reserve Bank of India and the

management itself. The policy emphasised the need for a closer and more vigilant

involvement of financial institutions in units with management of doubtful

competence or integrity. For this purpose the policy statement announced that

financial institutions would set up a group of professional directors jointly, to be

nominated to the Board of the above said companies. This group would report to

the financial institutions on measures that should be taken in order to prevent the

units falling sick. In the case of industrial units, which were already sick, the

policy advocated rehabilitation through the joint efforts of the state government

and financial institutions, which have provided financial and managerial support,

with suitable restructuring of the management. Tt also announced that a special

authority under the Income Tax Act, 1961 would examine proposals for the

merger of sick units with healthy ones. The steps under the Industries

(Development and Regulation) Act, 1951 like take over etc., would be considered

only when the above courses of action have failed. A major decision that the 1978

policy statement announced was not to return to the same management the units,

which had been taken over under the Industries (Development and Regulation)

Act.

v. Policy Statement 1980

The policy statement issued by the Government of India in 1980 also

reiterated that resort to takeover the management of a sick unit under the

Chapter 2 36

Industries (Development and Regulation) Act, 195 1 would be only in exceptional

cases on the ground of public interest where other means for the revival of sick

industrial undertakings are not considered feasible.

vi. New Strategy 1981

In June 198 1, the Union Industry Minister announced a new strategy for

sick industrial units, which aimed at preventing sickness in industry, quick

rehabilitation of sick units and an early decision on the future of sick units. The

major feature of the strategy was the provision that units employing over 1000

persons or having an investment of Rs.9 cores or more in fixed assets should be

nationalised, in case the Reserve Bank of India, the financial intuitions, arid the

state governments were unable to prevent the growing sickness in sick units. This

would however be subject to three considerations. A sick unit would be

nationalised provided that

i. the line of production is critical to the economy

i i . the unit has been functioning as a mother unit with large ancillary linkage

and

iii. its closure would cause substantial dislocation and throw out of employment of

such a large number of persons that it would not be possible to provide alternative

jobs to them.

The nationalisation of inherently non-viable units was not favoured in the

new strategy. It emphasised the need for the concerned administrative ministry to

satisfy itself regarding the viability of the unit before a decision was taken to

nationalise it.

An examination of these broad features of the new strategy aimed at

curing industrial sickness revealed that it completely left out small-scale sector

units from its scope even though sickness among these units was by no means

insignificant.

Vii. Conversion of the IRCI into the IRBI in 1984

The Industrial Reconstruction Corporation of India (IRCI) was

established in April 1971 as a specialised financial institution to promote and

operate schemes for industrial development and in particular to provide financial

assistance for the reconstruction and rehabilitation of sick industrial units. Up to

March 1984, the IRCI provided fmancial assistance to 242 units and the

cumulative sanctions and disbursements were Rs.266 crores and Rs.184.9 crores

re~pcctively.'~ The Corporation also provided credit facilities to various state level

institutions like State Financial Corporations (SFCs) to help rehabilitation of sick

small-scale units. But the financial assistance provided by the Corporation was not

sufficient to curb industrial sickness in the country. At this juncture, the

Government of India established a high power statutory body with an autonomous

status by converting the lRCI into a statutory corporation, the Industrial

Reconstruction Bank of India (IFU31) in 1984 to function as the principal credit and

reconstruction agency for industrial revival and to co-ordinate similar works of

other institutions engaged in the revival of industries. The IRBI's hnctions would

cover not only reconstruction assistance to sick units but also development

assistance combined with merchant banking. The IRBI was empowered to take

over the sick industrial units under its assistance far the purpose of managing and

running them, leasing them out or selling them as running concerns or preparing

schemes for reconstruction by scaling down the liabilities with the approval of the

Central Government. It was also empowered to take certain decisions in

conformity with MRTP and FERA rules so as to permit large multi-national

houses to participate in reconstruction plans for sick units and to expedite the

cases of amalgamation. The financial assistance sanctioned and disbursed by the

"~rivastava and Yadav ( 1986), 220.

IRBl between 1984-85 and 1996-97 along with their percentage change are

presented in Table 2.3

Table 2.3:- Financial Assistance Provided by the IRBl

(Rs. in crores)

Table 2.3 shows that the total assistance sanctioned and disbursed by the

[RBI up to 3 1 March 1997 amounted to Rs. 4600.5 crores and Rs. 2764.2 crores

Growth Rate

("/. )

NA

23.7

39.7

7.6

14.3

21.1

9.1

--

20.3

- 0.7

2.6

1 10.8

32.9

4.0 -

P38.

respectively.

Disbursements

I Rs)

54.8

67.8

94.7

101.9

1 16.5

141.1

153.9

185.2

183.9

188.6

397.6

528.6

549.6

in india 1998-99,

The enactment of SICA, 1985 and the setting up of the Board for

Growth Rate

( %)

NA

- - - -32.1

98.0

25.3

12.0

-29.8

- - -

60.1

18.3

6.0

44.7

82.7

15.3

-9.1

Development ~ a z i n ~

Year

1984 - 85

1985 - 86

--

1986 - 87

1987 - 88

1988 - 89

1989 - 90

1990 - 91

1991 - 92

1992 - 93

1993 - 94

1994 - 95

1995 - 96

1996 - 97

Source: IDBl

Industrial and Financial Reconstruction (BIFR) under it as the single agency

Sanctions

( Rsl

1 10.8

75.2

148.9

186.5

208.8

146.6

234.7

277.7

294.3

425.8

777,9

897.3

816.0

Report on

responsible for the rehabilitation of sick industrial units in the non-SSI sector

made the role of the IRBI in rehabilitating sick industrial units irrelevant and as

sequel to that the Government of India decided to convert it into a full fledged all

purpose financial institution. Accordingly, the IRBl was incorporated as a

government company in March 1997 under the name, the Industrial Investment

Bank of India Ltd (IIBI).

2.3.4 Role of the Reserve Bank of India in Curbing Industrial Sickness

In the context of safety of funds lent as also the impact on the profitability

of banks, apart from the implications from the point of the larger socio economic

objectives of sustaining/increasing production and employment, the emergence,

towards the middle of the seventies, of the phenomenon of 'sickness' in a

significant way in industrial units financed by banks and term lending institutions

was a matter of concern for the Reserve Bank and the Government of India.

Banking and term lending institutions through their intimate knowledge of the

working of the industrial units financed by them can play a helpful and positive

role in arresting industrial sickness and reviving potentially viable sick units. The

Reserve Bank coordinates the efforts of' banks, financial institutions and

government agencies in the rehabilitation of such units.

The first organised effort to tackle the problem was made when the RBI

organised a seminar on sick industrial units in April 1976. As an outcome of the

seminar, the RBI created a Sick Industrial Undertaking CeH in 1976 in its

Department of Operations and Development. The cell has taken the following

steps in the direction of rehabilitating sick industrial units.

(a) Reorientation of the attitude and approach of commercial banks in dealing with

the problem of sick industries so that the larger social objectives are not lost

sight of by them.

(b) Building up within the banks necessary organisational framework and

expertise to pay specialised attention to sick industries.

Chapter 2 40

(c) Furnishing guidelines equipping the banks to identify the sickness at an early

stage and to take corrective action.

(d) To monitor the performance of commercial banks in identifying the sick units

and coordinate the efforts of governments, banks and fmancial institutions in

rehabilitating the potentially viable sick units.

The Reserve B& oversees the performance of banks in identifying sick

industrial units, and taking appropriate remedial action with a view to nursing

them back to health. Towards this end, the RBI directed the commercial banks in

November 1976 to hrnish it with a quarterly statement showing particulars of all

sick units enjoying aggregate credit limit of Rs.1 crore and above from the

banking system.

The RBI had also directed the commercial banks to create a 'Sick

Industrial Undertakings Cell' in the H.O. and Regional Offices of each Bank to

watch the position of sick industrial units on an ongoing basis. The cell was

required to find reasons for sickness and to ascertain whether the unit is viable and

if so to determine the various steps necessary for its rehabilitation. For the

detection of sickness at an incipient stage, the RBI introduced a health code

system to categorise various borrowal accounts regarding the quality of accounts

for better monitoring and for facilitating preventive action where necessary. The

RBI also initiated steps for the co-ordination between the commercial banks and

term lending institutions in the formulation and implementation of rehabilitation

packages. To avoid the time lag between the formulation of the final rehabilitation

package and its implementation banks were asked to ensure that the package

proposals were sent to the RBI sufficiently in advance of the date of the joint

meeting fixed to examine the same and take final view thereon.

Since cases of incipient sickness were not being reported by banks either

to the RBI or Central Government, commercial banks were advised that where any

medium or large unit employing 1000 or more persons financed by them was

Chapter 2 41

likely to become actually sick, a report thereon giving broad particulars of the unit

should be promptly made to the union Ministry of FinanceMinistry of Industry.

The standing co-ordination committee was appointed in January 1979

following the recommendations of the inter-institutional group (Bhucher

Committee) to consider the issues pertaining to co-ordination between banks and

term lending institutions. The committee was reconstituted under the chairmanship

of Shri. A. Ghosh, the then Deputy Governor, the RBI in August 1983. The aim

of the committee was to provide a standing forum for sorting out inter-institutional

problems, relating to term lending in the light of experience gained in the past and

review the involvement of banks and term lending institutions in extending credit

besides dealing with and sharing of information on term credit and any other

issues that may be referred to it.

State level inter-institutional committees had been constituted and started

functioning early in 1980 in almost all the states and union territories with the

representatives of the RBI, banks, term lending institutions, the state government

and state level institutions to serve as a forum for exchange of information and

discussion on the problems faced by the sick small and medium scale industrial

units. The RBI acted as the convener and these committees, dealt with the

problems pertaining to co-ordination between banks and financial institutions,

provision of adequate infrastructure facilities to industrial units and general

problems relating to grant of credit to such units.

In view of the growing incidence of sickness in the industrial sector the

RBI in February 1985 advised the chairmen and chief executives of commercial

banks to take all possible measures to minimise the rising incidence of sickness in

their advances portfolio. The need for detection of sickness at an early stage and

for undertaking studies to determine the viability as well as formulation of the

package programme for rehabilitation of potentially viable units without loss of

time was reiterated. T h e RBI advised the commercial banks to set up a small task

force comprising senior officials to have a detailed critical review of each of the

large sick units for determining the potential viability and the need for coming to

an early decision on the desirability of rehabilitation and evolving acceptable

package of rehabilitation of the viable unit. While over-seeing the institutional

efforts in industrial rehabilitation wherever it became necessary to intervene and

guide in individual cases the Reserve Bank took the initiatives for convening

meeting of the fmancing banks and term lending institutions to discuss the

problems of the units, find solutions and secure co-ordination.

The RBI also directed the commercial banks to classify the sick units

under their portfolios in to two categories viz., potentially viable and non viable

and to provide supportive measures to potentially viable sick units, putting them

under special nursing programme. 'The sick units put under the nursing programme

were eligible fbr relaxations in margin, concession in the rate of interest,

amortisation of past interest dues and rescheduling of repayment instalments in the

case of term loans.

Out of 180597 sicklweak units (as on 3 1-07-02) the banks identified only

4836 units as viable, 169351 units as non-viable and in the case of 64 10 units viability

was not decided. Among the 4836 units identified viable only 793 units were put

under the nusing programme by banks. The total number of sicldweak units

classified according to their viability position and the units put under the nursing

programme between 1991 and 2002 are given in Table 2.4.

Table 2.4:- Viability Position of Sicktweak Industrial Units

I

.As on 3 l March

I 1991 1992 1993 1 1994 1996 1997 1 2000 2001 1 2002 i

---- --t-

-- I i -1 I 7- t- --

-1

I SSI Sick Units:

I Potentiall> \-iablc. units

' Son-viable unit 167374

I Viabilii) not decided 2334 3029 2723 5607 5784 5798 3216 16336

'

' '

13219 1 11066

-1 otal

[.;nits under yursing Programme

Yon-SSI Sick Units:

Putentiallq ~' iable units

I Non-~ iablc units 7 0 ) 724 \ 828 I 8681 944l - 9 8 1 1 10701 1563 I I605 ,

t - t-

Viabilit? not decided

'

224 , 235 : 378 ( 365 3 88 417 1 567 ; 830 ; 3 -61

,

1 1 I

I

! Total 14611 5 3 I867 1909! 1956; 1948. 20301 2357 2742; 2928 2880i

I

7-

b i t s under Nursing Programme 34-1 -101 4 , 454 4 1 2 3 5 6 3 1 1 1 30 6 2 13

] Non-SSI Weak Ltnits:

I

I

274

, 57 71 ' 74 74

-

I Potentiall! viable units

( Non-\ iablc units 194

1 Viabilit) nut decided 144 106 1 122 I

T o ~ l 876 8 13 657 ; 591 4 18 I 420 '

-7-

1 Units under Nursing Progi-anme r 234 1 218 156 131 68 1 63 [ 59 I 43 i 17 1 16

Source: RBI Trends and Progress of Banking in India (Various issues). Note: Dala regarding 1994-95 not provided.

221572 ,

13224

534

233575 238176 256.152 262376

13829 117218

577

235032

1 1376

66 1

: 10539 1 1026

' 221 536

13063

676 4 10

306221

621 / 550 ' 493

12759

349 \ 339

304235 249630

269

177336

621 , 663 753

Chapter 2

The RBI has laid down certain parameters for aid to sick units. These are

to be followed by banks and financial institutions, which are likely to set at rest

some of the controversies and vexed issues thereby accelerating the pace of revival

of sick units. These parameters are:

k Interest reduction on term loans should not be more than 2 percent of

prevailing rates charged by bankslfmancial institutions.

B Interest @, 10 percent should be charged on funded interest (subject to

annual review).

P Fresh cash inputs required for meeting part of overdue statutory liabilities,

pressing creditors etc., might be shared by participating banks and

fmancial institutions on equal basis.

> Further, cash losses till breakeven and margin for working capital be borne

by financial institutions and where non-financial institutions are involved

such requirement shall be met by the IRBI.

> interest in fresh working capital shall be charged at prevailing commercial

rate. Interest, at a lower rate on such advances may be charged if

concession from State Government is available.

Tu Rehabilitation programme should have an upper limit of seven years, and

10 years in certain special and deserving cases.

> Promoter's contribution in cases involving change of management or

professional management should be 15 percent of additional long-term

requirements and in other cases, 20 percent and such funds should be

interest free.

b Banks and financial institutions should share cost of rationalisation of

labour.

> On sick units turning the corner, sacrifices made by banks and financial

institutions could be recouped from fbture profit and cash accruals.

Alternatively, there may be provision for equity participation.

Chapter 2

2.3.5 Recent Measures

The Central Government and the RBI have initiated a number of

measures for the revival of sick industrial units as well as for the prevention of

incidence of sickness. The guidelines issued by the RBI to scheduled commercial

banks during 1990's are outlined below.

i. Banks have been advised to adopt a single window concept for lending under

consortium arrangements for both sick and weak units.

ii. Banks have been advised to gear up their organisational machinery for taking

effective measures to detect sickness at the incipient stage and to take

appropriate remedial measures.

iii. In the event of a unit in an industrial group becoming sick, banks have been

advised to impress upon the group to come forward with concrete proposals to

assist the unit.

iv. It has been re-emphasised that the participation by banks in the rehabilitation

packages is mandatory.

v. A definite time frame for implementation of the packages should form a part of

the draft package submitted to the BEFR. This has been introduced to eschew

any tendency to deiay on the part of the involved agencies.

vi. A nodal monitoring agency (the lead bank) for monitoring the implementation

of the rehabilitation package would be designated and the name of the agency

would be indicated in the draft package submitted to the BIFR.

vii. In the context of the all round increase in lending rates the RBI parameters on

interest rates for various facilities under rehabilitation packages in respect of

non-SST sicldweak industrial units have been revised

viii. While drawing up rehabilitation packages for non-SSI sickiweak units, the

banks are required to ensure that the promoters' contribution is maximised. A

minimum of 20 percent in the cases involving change in management,

professionaVtechnocrat management and 30 percent in other cases should be

insisted upon.

ix. In order to ease the debt burden of sick units the banks and institutions have

been given the option, on the basis of their commercial judgment, to convert

pardwhole of the unpaid interestjtem loans into equitdquasi equity under the

rehabilitation package sanctioned by them.

2.3.6 Role of Development Banks in Rehabilitating Sick Units

All India Development Banks like the Industrial Development Bank of

India (IDBI), the Industrial Finance Corporation of India (IFCI) and the Industrial

Credit and Investment Corporation of India Limited (ICICI) have been providing a

variety of customised financial products to suit the varied needs of the corporates.

They have established separate departments for looking into sick problem cases in

their portfolios and have taken keen interest in the revival and rehabilitation of

such units. The sick industrial units directly financed by them were put under a

nursing programme and given assistance for modemisation and rehabilitation. As

on 3 1 March 200 1 , there were 698 companies directly financed by the IDBI, IFCI

and the IClCI reported to the BIFR. They are classified industrial-wise and given

in Table 2.5 and its diagrammatic representation in Fig. 2.6.

Table 2.5:-

pi%q

1 Food Products

2 Textiles

3 Paper and Paper Products

4 Chemicals and Chemical Products 13.0

5 Fertilisers 1.9

6 Cement 32 4.6

Basic Metal and Metal Products

Electronics and Electrical Equipment

Machinery

Transport Equipment

Other Industries

L - 1 - I'otal 1 698 1 100.0 -- 1

Source: IDBI Report on Development Banking in India-2000-0 1 , - PI 32.

Chapter 2

Fig2.6:- Sick Units Fi nanad by IDBI,IFCI and lClCl

a Food pmducts

.Terdass

Pwerrwrdpaper

pr&c)s

Rubber and rubber

ma

Chemicals and

chemical producls

D Machinery

F d l i

D M

DBaPicm!tdmdmetd

ma

~ E l e ~ W~ k a md

eiectricalesuipment

T m p a t equipment

. Other mduslrk

Table 2.5 shows that the largest number of sick units was reported in the

Textile industry. There were 166 reported cases in the Textile industry and they

accounted for 23.8 percent of the total number of cases reported. The lowest

number of reported cases was in the Rubber and Rubber Products industry (only

five companies).

Chapter 2

2,3.6*1 The Industrial Development Bank of India

The Industrial Development Bank of India (IDBI) had been playing an

important role in rehabilitating sick industrial units fmanced by it. lDB1

established a Rehabilitation Finance Division (RFD) in February 1976 to deal with

matters relating to rehabilitation of sick units viz., identification of the causes of

sickness, assessment of rehabilitation needs, formulation of appropriate measures

in consultation with other participating institutions and banks, close monitoring of

sick units and periodical evaluation of the impact of rehabilitation measures. The

Division made use of the services of experts like technologists, economists and

financial analysts to bring about the desired results.

The Soft Loan Scheme for modemisation was introduced in November

1976 for five selected industries viz., cotton textiles, jute, cement, sugar and

specified engineering industries. The scheme was operated by the IDBI in

collaboration with the lFCI and the ICICI, The scheme provided financial

assistance at concessional terms to weak units for modernisation, replacement and

renovation of old plant and machinery. -The scheme was modified in I984 to cover

all industries.

IDBI has also formulated schemes for rehabilitation of sick units in the

small-scale sector also. For this purpose a Soft Loan Assistance Fund was created

for funding the nursing of sick units. Tn 1986, the lDBI created a Small lndustries

Development Fund to provide financial assistance to the small-scale sector not

only for development, expansion and modernisation but also for the rehabilitation

of small-scale sick industrial units. The Small Industries Development Bank of

Lndia (SIDBI), a wholly owned subsidiary of the lDBI was established in April

1 990 to takeover the outstanding portfolio and activities of the I DBl pertaining to

the small-scale sector.

IDBI has been providing financial assistance for the rehabilitation of sick

industrial units directly financed by it. It also provided financial assistance for the

modernisation of industrial units, which in turn might have saved many companies

from sickness. The total financial assistance and the assistance sanctioned by the

lDB1 for the rehabilitation of sick units and modemisation purposes are given in

Table 2.6.

,-

Cumulative 224220.4 17441.3

up to 3 1/3/0 1

Source: IDBl Report on Development Banking in India, 1 990-9 1, 1 994-95, 2000-0 1.

Table 2.6:- Financial Assistance Provided by IDBI

Percentage

to Total

0

0

0

0.50

0.5 1

0.58

0.74

"- --

0.36

0.11

0.0 1

(Rs. in crores)

.-

15984.7 -13.1 726.8 4.5 28.3 0.18

1996-97 13993.5 -12.5 3 007.1 7.2 7.6 0.06

1997-98 22082.8 57.8 871.5 3.9 3.3 0.00

Assistance for

Modernisation

1060.3

25 I . b

406.5

450.6

-

852.8

1414.7

--

19115.9

Percentage

to Total

0

5.5

7.7

10.2

11.6

22.5

29.0

-

Year

Up to March

1986

1986-87

1987-88

1988-89

1989-90

1993-9 1

199 1-92

Assistance for

Rehabilitation

196.6

0

0

22.3

37.2

36.7

45.8

'I'oral Assistance

Sanctioned

20227.1

4587.6

5302.5

4408.4

7324.8

6277.9

6570.0

1992-93

1993-94

Percentage

Increase

0

0

15.6

-16.9

66.2

-14.3

4.7

9345.2

12214.9

34.2

14.0

42.2

30.7

1994-95 18394.5 30.6 1977.7 10.4 2.2

1234.5

1631.4

13.2

13.4

Up to 31 March 2000, the IDBI has sanctioned an amount of Rs.

224220,4 crores; including Rs. 1 744 1.3 crores for modernisation of industrial units

and Rs. 559 crores for rehabilitation of sick units. This shows that only a nominal

share of .25 percent of the total assistance sanctioned was provided for the

rehabilitation of sick industrial units. This was quite inadequate when compared

to the growing incidence of industrial sickness in the co~nt r y' ~.

The Board for Industrial and Financial Reconstruction (BIFR) appointed

IDBI as an Operating Agency in May 1987. Since then it has been playing a

pivotal role in rehabilitating sick industrial units in the medium and large sectors

by associating itself with the BIFR. Up to 31July 2000, lDBI was appointed as

Operating Agency in 507 references by the BI FR' ~.

2.3.6.2 The Industrial Finance Corporation of India

The Industrial Financial Corporation of India (IFCI) had shown keen

interest in reviving sick industrial units under its portfolio through various

schemes. The IFCI was the lead institution for Jute and Sugar industries under the

Soft Loan Scheme introduced in November 1976 for the modernisation of five

selected industries. It has been providing assistance at concessional rates under the

Soft Lorn Scheme and has set up a Modernisation Cases Cell to give its undivided

attention to the processing of cases under the scheme. In order to monitor the cases

of sick industrial units financed by the corporation, a Problems Cases Department

was also set up. This department, in consonance with the government policy was

actively involved in rehabilitation, changes in management, approval of schemes

of merger and arrangements of settlement of dues based on certain relief and

concessions.

'"he number of sick industrial units increased by 15 times from 20651 units in 1978 to

30622 1 units in 1 999.

"BIFR records.

Chapter 2 5 1

IFCI has also been providing financial assistance for rehabilitation and

modernisation of industrial wits. The total assistance sanctioned by IFCI and the

assistance provided for rehabilitation and modernisation purposes are given in

Table 2.7.

Table 2.7:- Financial Assistance Provided by lFCI

1999-00 2376.2 0 94.9

Source: IDBI Report on Development Banking in India 1992-93, 1 995-96 and 1 999-00

-- ?.

The cumulative assistance sectioned by IFCI up to March 2000 amounted

to Rs.47074 crores, in which Rs. 210.8 crores was provided for rehabilitation of

sick industrial units and Rs.5652.20 crores for modernisation purposes. This

shows that only 0.45 percent of the total advances sanctioned by the corporation

-- . ,-

were provided for rehabilitation of sick units and it was quite inadequate when

(Rs. in crores)

Modernisationl

Balancing

Equipment

456.8

385.7

Rehabilitation

Assistance

74.2

2 1.5

Year

Cumulative up to

March 1988

1988-89

Total Sanctions

45 1 7.7

1635.5

Chapter 2 52

compared to the mounting fund requirements for the rehabilitation of sick units.

Of course the funds provided by the corporation for the modernisation of industrial

units might have saved many companies from sickness.

With the establishment of the BIFR under the SICA, 1985 IFCI has been

actively associating with it in rehabilitating medium and large-scale sick units.

The BIFR appointed IFCI as an Operating Agency in May 1987 and was allotted

3 1 I up to 3 1 July 2000.

2.3.6.3 The Industrial Credit and Investment Corporation of India Ltd

The Industrial Credit and Investment Corporation of India Ltd (ICICI) has

been playing an active role in monitoring the overall performance of units assisted

by it and launched a number of schemes to deal with the ever-growing problem of

industrial sickness in such units. It has been providing financial assistance for

rehabilitation of sick industrial units and for the modernisation of industrial units

by upgrading their technology, which might have saved many industrial units from

sickness.

lCICI has been acting as an Operating Agency since May 1987 for the

rehabilitation of sick companies reported to BIFR. As on 31 July 2000, the

corporation was appointed as Operating Agency in 263 cases.' '

The total assistance sanctioned and the assistance provided for

rehabilitation and modernisation purposes by the IClCl between 1988-89 and

1999-00 are given in Table 2.8.

2 0 ~ ~ ~ ~ records.

2'ibid.

Chapter 2

I

Total 1 169432.0 1 574.0 / 22638.4 1

Table 2.8 Assistance Provided by ICICI

(Rs. in cmres)

1. I I I 1

Source: IDBI Report on development Banking in India, 1991 -92, 1994-95 and 1999-00.

Year

1988-89

1989-90

1990-9 1

199 1-92

lCICI has sanctioned a total assistance of Rs.169432 crores between

1988-89 and 1999-00, which included Rs.22638.4 crores for the modernisation of

industrial units and Rs.574 crores for the rehabilitation of sick industrial units.

This shows that the involvement of ICICI in rehabilitating sick industrial units was

not encouraging. Only a nominal share of 0.34 percent of the total assistance

sanctioned was earmarked for the rehabilitation of sick units.

Total Sanctions

1532.2

1947.7

2709.6

4094.9

Rehabilitation

15.4

12.1

15.1

20.2

Modernisat ion/

Balancing

Equipment

248.1

312.1

476.4

--

281.8

Chapter 2 54

Thus it is seen that the number of industrial units falling prey to the

malady of industrial sickness every year has been increasing at a steady rate. The

amount of loan funds of Financial Institutions locked up in sick units has also

increased substantially causing not only wastage of resources but also affecting the

healthy growth of the industrial economy. The Government, the RBI and the

Financial institutions have taken various measures to curb this menace but most of

them were not effective. This has paved the way for the enactment of the Sick

Industrial Companies (Special Provisions) Act, 1985 and the establishment of the

Board for Industrial and Financial Reconstruction (BIFR) under the Act as a single

agency to deal with the problem of industrial sickness in the medium and large

industrial sector.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ad Copy That SellsDocument58 pagesAd Copy That SellsMonica Istrate100% (21)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Securities Dealers and Brokers From MamDocument7 pagesSecurities Dealers and Brokers From MamRica Angela Manahan MillonteNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Business Studies Chapter 19 NotesDocument2 pagesBusiness Studies Chapter 19 NotesMuhammad Faizan RazaNo ratings yet

- VT-2 Codes and StandardsDocument29 pagesVT-2 Codes and StandardsMirza Safeer Ahmad100% (1)

- List of Halal and HaramDocument14 pagesList of Halal and HaramMohd AliNo ratings yet

- Shampooing & Cond. DrapingDocument22 pagesShampooing & Cond. DrapingAli Ahmed100% (3)

- Answers To Practice Set I: AR RentalsDocument13 pagesAnswers To Practice Set I: AR RentalsDin Rose Gonzales100% (1)

- Australian/New Zealand Standard: Wet Area MembranesDocument7 pagesAustralian/New Zealand Standard: Wet Area MembranesGopi KrishnanNo ratings yet

- Oum Docs (Gos)Document6 pagesOum Docs (Gos)Mbade NDONGNo ratings yet

- Heparin Sodium USPDocument1 pageHeparin Sodium USPAli AhmedNo ratings yet

- Outlook 2007 ShortcutDocument4 pagesOutlook 2007 ShortcutAli AhmedNo ratings yet

- COA ClonazepamDocument1 pageCOA ClonazepamAli AhmedNo ratings yet

- 5 DR Farhat MoazamDocument9 pages5 DR Farhat MoazamAjit Govind SonnaNo ratings yet

- SpeechesDocument2 pagesSpeechesAli AhmedNo ratings yet

- History of Cabot-SanmarDocument1 pageHistory of Cabot-SanmarAli AhmedNo ratings yet

- Cab o Sil M 5p MsdsDocument8 pagesCab o Sil M 5p MsdsAli AhmedNo ratings yet

- Rehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Document30 pagesRehabilitation Under Sick Industrial COMPANIES (Special Provisions) ACT, 1985Ali AhmedNo ratings yet

- Outlook 2010 ShortcutDocument3 pagesOutlook 2010 ShortcutAli AhmedNo ratings yet

- Heparin Sodium PH - Eur. DRAFTDocument1 pageHeparin Sodium PH - Eur. DRAFTAli AhmedNo ratings yet

- Ramadan The Month of Fasting (Tamil) : For More Information, ContactDocument2 pagesRamadan The Month of Fasting (Tamil) : For More Information, ContactAli AhmedNo ratings yet

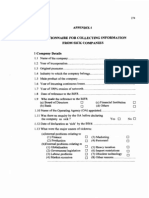

- Questionnaire Information From Sick Companies: For CollectingDocument6 pagesQuestionnaire Information From Sick Companies: For CollectingAli AhmedNo ratings yet

- Performance of Sick Companies Reported To The: and HasDocument39 pagesPerformance of Sick Companies Reported To The: and HasAli AhmedNo ratings yet

- 16 BibliographyDocument7 pages16 BibliographyAli AhmedNo ratings yet

- 09 Chapter 1Document18 pages09 Chapter 1Ali AhmedNo ratings yet

- 12 Chapter 4Document33 pages12 Chapter 4Ali AhmedNo ratings yet

- Of Diagrams And: List ChartsDocument1 pageOf Diagrams And: List ChartsAli AhmedNo ratings yet

- Acknowledgements: I Take Sincere in SuccessfulDocument2 pagesAcknowledgements: I Take Sincere in SuccessfulAli AhmedNo ratings yet

- List Abbreviations: AAI Appellate FinancialDocument1 pageList Abbreviations: AAI Appellate FinancialAli AhmedNo ratings yet

- Islamic ArtDocument8 pagesIslamic ArtAli AhmedNo ratings yet

- 225,226, Msds Isolan Gi 34 eDocument8 pages225,226, Msds Isolan Gi 34 eAli AhmedNo ratings yet

- Fffectivenes.s Of: The Rehabilitation SchemesDocument1 pageFffectivenes.s Of: The Rehabilitation SchemesAli AhmedNo ratings yet

- List of Tables: Description No India Details Companies byDocument3 pagesList of Tables: Description No India Details Companies byAli AhmedNo ratings yet

- 05 - Table of ContentsDocument6 pages05 - Table of ContentsAli AhmedNo ratings yet

- Caste and Social Hierarchy Among Indian MuslimsDocument16 pagesCaste and Social Hierarchy Among Indian MuslimsAli Ahmed100% (1)

- Scanning A Document & and Making A PDF in Adobe AcrobatDocument2 pagesScanning A Document & and Making A PDF in Adobe AcrobatAli AhmedNo ratings yet

- AN Evaluation of The Effectiveness of The Rehabilitation Schemes of The BifrDocument1 pageAN Evaluation of The Effectiveness of The Rehabilitation Schemes of The BifrAli AhmedNo ratings yet

- De: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolDocument6 pagesDe: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolJONNo ratings yet

- Individual Assignment - Customer Relationship ManagementDocument15 pagesIndividual Assignment - Customer Relationship ManagementBING JUN HONo ratings yet

- Introducción A Las MicrofinanzasDocument21 pagesIntroducción A Las MicrofinanzasNitzia VazquezNo ratings yet

- Ch01 TB RankinDocument9 pagesCh01 TB RankinAnton VitaliNo ratings yet

- Cs2353 Cse Ooad 2marksDocument19 pagesCs2353 Cse Ooad 2marksVjay NarainNo ratings yet

- PCS Director at A Glance - ADocument1 pagePCS Director at A Glance - Aapi-26006864No ratings yet

- ArcGIS For AutoCADDocument2 pagesArcGIS For AutoCADsultanNo ratings yet

- NHDCadDocument12 pagesNHDCadJeshiNo ratings yet

- Ch01HullOFOD9thEdition - EditedDocument36 pagesCh01HullOFOD9thEdition - EditedHarshvardhan MohataNo ratings yet

- Eos-Voting-Disclosure-Q2-2015 EmpresasDocument78 pagesEos-Voting-Disclosure-Q2-2015 EmpresasEdgar salvador Arreola valenciaNo ratings yet

- Oakley v. TMart - ComplaintDocument22 pagesOakley v. TMart - ComplaintSarah BursteinNo ratings yet

- Arrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupDocument2 pagesArrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupPR.comNo ratings yet

- GST - Most Imp Topics - CA Amit MahajanDocument5 pagesGST - Most Imp Topics - CA Amit Mahajan42 Rahul RawatNo ratings yet

- Amazon July Seller InvoiceDocument4 pagesAmazon July Seller InvoiceShoyab ZeonNo ratings yet

- PR2 Group 1Document3 pagesPR2 Group 1Deborah BandahalaNo ratings yet

- SEC Whistleblower Submission No. TCR1458580189411 - Mar-21-2016Document39 pagesSEC Whistleblower Submission No. TCR1458580189411 - Mar-21-2016Neil GillespieNo ratings yet

- Production and Total Quality ManagementDocument17 pagesProduction and Total Quality ManagementFalguni MathewsNo ratings yet

- Short Form Agreement Between Client and Architect: Document EightDocument2 pagesShort Form Agreement Between Client and Architect: Document EightEppNo ratings yet

- Final Exam SampleDocument11 pagesFinal Exam SampleFelixEternityStabilityNo ratings yet

- Pipes and Tubes SectorDocument19 pagesPipes and Tubes Sectornidhim2010No ratings yet

- Partnering To Build Customer Engagement, Value, and RelationshipDocument32 pagesPartnering To Build Customer Engagement, Value, and RelationshipSơn Trần BảoNo ratings yet

- ILO Declaration For Fair GlobalisationDocument7 pagesILO Declaration For Fair GlobalisationjaishreeNo ratings yet

- Working Capital Management in Sirpur PaperDocument82 pagesWorking Capital Management in Sirpur Paper2562923No ratings yet