Professional Documents

Culture Documents

Oil & Gas Magazines With Top 50 Powerful Names in ME

Uploaded by

George V ThomasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oil & Gas Magazines With Top 50 Powerful Names in ME

Uploaded by

George V ThomasCopyright:

Available Formats

THE POWER

NEWS, DATA AND ANALYSIS FOR THE MIDDLE EASTS ENERGY PROFESSIONALS

January 2013

Vol. 9 Issue 01

KURDISH PAYOUT DELIGHT | OPEC LEADERSHIP FOCUS | SHELF DRILLINGS$1BN RIG SWOOP | YEMEN PIPELINE SABOTAGE

PROFILED:

THE FIFTY MOST INFLUENTIAL DECISION MAKERS

SHAPING THE REGIONAL UPSTREAM BUSINESS

Downhole wire free monitoring

solutions under the microscope

WIRELESS WIZARDRY

Oileld power plant suppliers

look to electrifying year ahead

GENERATION GAME

Exclusive: Glasspoint Solar

on Oman EOR project

CRYSTAL CLEAR

n

Worlds largest feet

of workover rigs and

pulling hoists

n

Comprehensive

manufacturing program

n

International distribution

network

n

Remote monitoring

of feld operations

n

Industry-renowned

safety record

Rig and Hoist

Services

Safety and effciency

big time

almansoorikey.biz

CONTENTS

www.arabianoilandgas.com January 2013 Oil&Gas Middle East 1

JANUARY 2013

18 POWER GENERATION

A look into the trends that are

shaping the power generation

market for upstream exploration

and production companies and

what this means for 2013.

26 WIRELESS WONDERS

In this months technology focus,

Tendekas Garth Naldrett and Tor

Inge Asen, explore the benets

and the future of wireless tech-

nology in downhole monitoring

systems.

REGULARS

05 REGIONAL NEWS

15 IN DEPTH

24 OFG GALLERY

65 PROJECTS

72 THE BIG PICTURE

32 POWER 50 LIST

Check out the upstream oil and

gas industrys 50 biggest players

for 2012 and how their power

and decisions will shape the in-

dustry outlook next year.

58 CABLE MANAGEMENT

Cable production market leaders

discuss the technology and

movements in the cable industry

with insight into how the rms

are adapting to the regional

economic environment.

62 RULES OF THE SEA

Find out how DNVs new rule

book clears the water when it

comes to the industrys compli-

cated technical standards for

quality and safety.

32

18

62

58

LWD Resistivity Images

Help Place Horizontal

Well 100% in Zone

MicroScope high-resolution resistivity

images identifed dips, faults, and

fractures along the lateral section

of a PetroChina well, increasing

geosteering accuracy and improving

reservoir understanding. With clear

identifcation of structural features,

the 810-m section was drilled

100% in zone. Better reservoir

understanding allowed optimized

completion design, thus enhancing

production.

RESISTIVITY- AND IMAGING-

WHILE-DRILLING SERVICE

MicroScope

Read the case study at

slb.com/MicroScope

M

i

c

r

o

S

c

o

p

e

i

s

a

m

a

r

k

o

f

S

c

h

l

u

m

b

e

r

g

e

r

.

2

0

1

3

S

c

h

l

u

m

b

e

r

g

e

r

.

1

2

-

D

R

-

0

3

4

4

12_dr_0344_microscope_3rdpg_ogme_ad.indd 1 12/17/12 4:26 PM

2 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

COMMENT

Registered at Dubai Media City

PO Box 500024, Dubai, UAE

Tel: 00 971 4 444 3000, Fax: 00 971 4 444 3030

Web: www.itp.com

Offices in Dubai & London

ITP Business Publishing Ltd

CEO Walid Akawi

Managing Director Neil Davies

Managing Director ITP Business Karam Awad

Deputy Managing Director Matthew Southwell

Editorial Director David Ingham

Editorial

Energy Group Editor Daniel Canty

Tel: +971 4 444 3255 email: daniel.canty@itp.com

Assistant Editor Lionel Mok

Contributors Ventures Middle East, RigZone, Adam Lane, Jyotsna

Ravishankar

Advertising

Advertising Director Andrew Parkes

Tel: +971 4 444 3283 email: andrew.parkes@itp.com

Sales Manager Chris Kyriakou

Tel: +971 4 444 3173 email: christopher.kyriakou@itp.com

Sales Manager Samer Alloush

Tel: +971 4 444 3173 email: samer.alloush@itp.com

Business Development Manager, Saudi Arabia Rabih Naderi

Studio

Group Art Editor Daniel Prescott

Designer Rey Delante

Photography

Chief Photographer Jovana Obradovic

Senior Photographers Isidora Bojovic, Efraim Evidor

Staff Photographers Lester Ali, George Dipin, Juliet Dunne,

Murrindie Frew, Verko Ignjatovic, Shruti Jagdesh, Stanislav Kuzmin, Mosh

Lafuente, Ruel Pableo, Rajesh Raghav

Production & Distribution

Group Production & Distribution Director Kyle Smith

Deputy Production Manager Matthew Grant

Production Coordinator Radomir Medojevic

Managing Picture Editor Patrick Littlejohn

Image Editor Emmalyn Robles

Distribution Manager Karima Ashwell

Distribution Executive Nada Al Alami

Circulation

Head of Circulation & Database Gaurav Gulati

Marketing

Head of Marketing Daniel Fewtrell

Events Manager Michelle Meyrick

ITP Digital

Director Peter Conmy

Digital Publishing Director Ahmad Bashour

Tel: +971 4 444 3549, email: ahmad.bashour@itp.com

Sales Manager, B2B Digital Riad Raad

Tel: +971 4 444 3319, email: riad.raad@itp.com

ITP Group

Chairman Andrew Neil

Managing Director Robert Serafin

Finance Director Toby Jay Spencer-Davies

Board of Directors K.M. Jamieson, Mike Bayman, Walid Akawi,

Neil Davies, Rob Corder, Mary Serafin

Circulation Customer Service

Tel: +971 4 444 3000

Certain images in this issue are available for purchase.

Please contact itpimages@itp.com for further details or visit www.itpimages.com

Printed by Atlas Printing Press

Subscribe online at www.itp.com/subscriptions

The publishers regret that they cannot accept liability for error or omissions contained

in this publication, however caused. The opinions and views contained in this publication

are not necessarily those of the publishers. Readers are advised to seek specialist advice

before acting on information contained in this publication which is provided for general

use and may not be appropriate for the readers particular circumstances.

The ownership of trademarks is acknowledged. No part of this publication or any part

of the contents thereof may be reproduced, stored in a retrieval system or transmitted

in any form without the permission of the publishers in writing. An exemption is hereby

granted for extracts used for the purpose of fair review.

F

ar from consigning the filthiest fuels to

the slag heap of history, all the reports

which drew on global energy trends at

the end of 2012 show that old King Coal is

far from dead, and his kingdom is rapidly

expanding.

Indeed, unless there is a major shift in

either policy, or more effectively, prices, coal

will actually overtake oil as the worlds domi-

nant energy source as soon as 2017.

Whilst commentators around the

world scoffed at the irony of Decembers

climate change talks taking place in Doha,

the worlds undisputed gas capital, more

balanced observers were pointing to the fact

that the countries embracing gas as their

future fuel of choice have made the greatest

strides towards meeting emissions targets.

Of the fossil fuels it is by far the cleanest.

In the US, shale gas development has had

a number of transformative effects on the

energy landscape. Energy intensive indus-

tries such as petrochemicals and manufac-

turing have seen a resurgence in investment

as US companies have seen a competitive

advantage creep back into domestic produc-

tion. On a more global note, those countries

which are building capacity in gas-fuelled

Perception shift underway

Oil and gas no longer the bogeymen as coal bounces back

To subscribe to the magazine, please visit: www.ArabianOilandGas.com

Published by and 2013

ITP Business Publishing, a member of the

ITP Publishing Group Ltd. Registered

in the B.V.I. under Company

Registration number 1402846.

The return of coal as a dominant global fuel is taking the heat off of anti-oil & gas campaigns the world.

Audited by: BPA Worldwide.

Audited Average Monthly Circulation: 8,016

(Jan June 2012)

power stations, or investing in LNG termi-

nals and signing long term supply agree-

ments will have another ace up their sleeve.

The two fastest growing coal consuming

economies will be India and China. Neither

have the expertise or patience to undertake

a shale gas or renewable energy revolution

in time to meet demand.

The more other countries wean their

power supplies off coal and oil, the less

chance they will have to scrap it out on the

global spot markets with China and India for

resources in the decades to come. Surely a

sensible strategy if ever I heard one.

The Middle East is best placed selling

its oil and harnessing its gas to meet local

demands. This is nothing new. Dolphin has

been transporting Qatari gas to the UAE

and Oman for years now, and more mega-

projects such as the Shah field development

in Abu Dhabi are underway.

One thing is certain in 2013. Compa-

nies which can make gas projects come on

stream quicker, cheaper and safer look set

for a prosperous year, here and abroad.

Daniel Canty, Group Editor

Email: Daniel.Canty@ITP.com

GETTY IMAGES

GREEN ENERGY IS ALL

AROUND YOU. YOU JUST NEED

TO KNOW WHERE TO LOOK.

Clients are looking for green energy solutions with high reliability, low maintenance and maximum

efciency. Dresser-Rand has considerable experience in steam turbine systems for combined cycle,

cogeneration and waste-to-energy, among other applications. Our turbine generator sets feature

rugged designs and produce power for pulp and paper, sugar, hydrocarbon and process industries,

as well as universities and municipalities. If your vision is to develop clean, renewable energy, turn

to Dresser-Rand and see what we have to offer.

www.dresser-rand.com

The Americas: (Intl +1) 713-354-6100 / EMEA: (Intl +33) 2-35-25-5225

Asia-Pacic: (Intl +60) 3-2093-6633 / info@dresser-rand.com

CompressorsTurbo & Recip / Steam Turbines / Gas Turbines / Engines / Control Systems / Expanders

Bringing energy and the environment into harmony.

ENGINEERING

EXCELLENCE. SIMPLY.

At Ramboll, we provide solutions that shape communities

around the world. Our close to 10,000 dedicated specialists

provide state-of-the-art engineering, design and consultancy

services within Buildings, Transport, Environment, Energy,

Oil & Gas and Management Consulting. Our global reach builds

on a signicant presence in Northern Europe, Russia, India and

the Middle East.

WWW.RAMBOLL.COM

LEAD NEWS

January 2013 Oil&Gas Middle East 5 www.arabianoilandgas.com

Shelf Drilling buys 38 rigs

Dubai-based firm snaps up billion dollar fleet of shallow water rigs in year-end deal

Shelf Drilling Holdings has

acquired 38 shallow-water rigs

from Transocean Limited for

$1.05 billion.

The purchase includes 37

jackup rigs, a swamp barge

and the associated services, of

which two are based in the UAE

another five in Saudi Arabia and

five in Egypt.

The company will immedi-

ately assume operation of seven

of the rigs while the remaining

30 rigs will operate under transi-

tional agreements with Transo-

cean.

The company aims to assume

full control of the entire fleets

operations during 2013.

This transaction improves

Transoceans long-term compet-

Shelf Drillings $1.05 billion deal with Transocean includes the purchase of 37 jackup rigs, a swamp barge and the associated services from the ME and around the world.

Dubai-based Shelf Drilling is

a newly-formed company which

will provide shallow water

drilling services.

The company is sponsored

equally by Castle Harlan,

CHAMP Private Equity, and

Lime Rock partners, it has oper-

ations in Egypt, Saudi Arabia,

Angola, Italy, Nigeria and parts

of South East Asia.

Transocean specializes in

deepwater and harsh environ-

ment drilling services and oper-

ates a fleet of 82 mobile offshore

drilling units consisting of 48

high-specification jackups.

The transaction was effected

pursuant to the terms of

the agreements signed on 9

September, 2012.

itiveness by effectively reposi-

tioning the company as a more

focused operator of high-specifi-

cation drilling equipment, said

Steven Newman, President and

CEO of Transocean.

The $1.05 billion includes

approximately $855 million

in cash, subject to working

capital and other closing adjust-

ments and $195 million in

seller financing which comes

in the form of preference

shares issued by an affiliate of

ShelfDrilling.

Transocean will provide

various transition support

services to Shelf Drilling for a

period of time subsequent to the

closing of the transaction.

We are exclusively focused

on shallow water drilling, and

we will seek to build a sustain-

able business that continues

to grow to become the jackup

drilling contractor of choice for

our customers, employees and

investors, said David Mullen,

CEO of Shelf Drilling.

We intend to build on our

workforces industry-leading

track record of safety and oper-

ational excellence to allow us

to build long-term relation-

ships with our customers and

suppliers, he continued.

I have been extremely

encouraged by the response

from our employees and

customers following the initial

announcement of the transac-

tion, he said.

6 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

REGIONAL NEWS

El Badris OPEC tenure extended

Cartel settles for stability for the year ahead backing Sec Gen for a further 12 months

At a recent conference in

Vienna, the Organization of the

Petroleum Exporting Coun-

tries (OPEC) elected HE Hani

Abdulaziz Hussain, Minister

of Oil of the State of Kuwait, as

President of the Conference

for one year and extended the

tenure of HE Abdalla Salem

El-Badri as Secretary General

for a period of one year. Both

terms will come into effect

starting January 1, 2013.

The conference also

reviewed the oil market outlook

as presented by the Secre-

tary General, in particular the

projections for supply/demand

in 2013.

Price volatility was cited as

a weakness throughout 2012,

mostly a reflection of increased

levels of speculation in the

commodities markets, exacer-

bated by geopolitical tensions

and laterally, exceptional

weather conditions.

According to a statement by

OPEC the biggest challenge

HE Abdalla Salem El-Badri, will remain secretary general of OPEC throughout 2013.

Qatargas 3 to deliver 2MTA of LNG.

crude in 2013 is expected to

contract to 29.7 mb/d.

The conference has decided

to maintain the current produc-

tion level of 30.0 mb/d, and

agreed that if necessary,

member countries would take

steps to ensure market balance

and reasonable price levels for

producers and consumers.

The conference appointed

Mr Yasser M. Mufti, Saudi

Arabian Governor for OPEC, as

Chairman of the Board of Gover-

nors for the year 2013, Dr Ali

Obaid Al Yabhouni, the United

Arab Emirates Governor for

OPEC, as Alternate Chairman

and HE Dr Abdel Bari Ali

Al-Arousi, Minister of Oil and

Gas of Libya and Head of its

Delegation, as Alternate Presi-

dent, for the same period with

effect from 1 January 2013.

The conference approved the

budget for 2013 and set the date

for its next ordinary meeting to

convene again in Vienna on 31

May 2013.

Qatargas signs LNG sales agreement with PTT

Qatargas has signed a long-

term LNG Sales and Purchase

Agreement (SPA) between

Qatar Liquefied Gas Company

Limited 3 (Qatargas 3) and

PTT Public Company Ltd. of

Thailand.

Qatargas 3 will deliver two

million tonnes per annum

(MTA) of LNG for a period of

20 years beginning from 2015.

The agreement marks PTTs

first long-term LNG SPA.

facing global oil markets in

2013 is uncertainty surrounding

the global economy, with

the fragility of the Euro-zone

remaining a major concern.

Such downward pres-

sures have outweighed supply

concern arising from geopo-

litical factors, said HE Abdul-

Kareem Luaibi Bahedh,

Minister of Oil of Iraq and Presi-

dent of the Conference

The Conference also pointed

out that, although world oil

demand is forecast to increase

slightly during the year 2013,

this is likely to be more than

offset by the projected increase

in non-OPEC supply and that

projected demand for OPEC

G

e

t

t

y

I

m

a

g

e

s

Qatari LNG continues to

play a key role in helping coun-

tries around the world improve

the diversity of their energy

supplies. We are very happy

that our discussions with PTT

regarding a long term agree-

ment have come to fruition.

We look forward to a strong

and enduring partnership

with PTT, he said Khalid Bin

Khalifa Al-Thani, chief execu-

tive officer of Qatargas.

Petrofac conrms

$11.6 bn backlog

Strong orders from Saudi

Arabia, Abu Dhabi and Algeria

helped Petrofac announce an

expected 15% rise in profit and

a backlog almost $1 billion

greater than it was at the end

of 2011. Despite a number of

bidding processes extending

into next year, we have secured

an order intake in the year to

date of US$5.3 billion, said

Ayman Asfari, group CEO.

GETTY IMAGES

REGIONAL NEWS

January 2013 Oil&Gas Middle East 7 www.arabianoilandgas.com

Yemen pipeline attacked

Operator confirms sabotage on overland gas pipeline to Balhaf

Yemen LNG has confirmed the

sabotage of the 38 inch gas pipe-

line that links the block 18 to

the Balhaf terminal on the Gulf

of Aden.

The sabotage occurred at

00.35 hrs on 16th December,

2012 at 173 km north of Balhaf.

As the countrys largest-ever

industrial investment (budg-

eted around US$ 4.5 billion), the

decision to launch the Yemen

LNG project in August 2005 was

an important milestone for both

the Government of Yemen and

the Yemen LNG shareholders,

but safe and continuous opera-

tion has evaded the operators

over the past year.

The proven gas reserves are

sufficient to produce and export

6.7 million metric tonnes of LNG

per annum (mmtpa) for at least

the next 20 years to its long-

term customers in the North

American and South Korean

markets and potentially also to

new customers in the future.

The reserves within the

Yemen LNGs 38 inch gas pipeline was sabotaged on December 16, 173km north of Balhaf.

Schlumberger has bought GeoKnowledge.

Schlumberger buys Norwegian software rm

Schlumberger has acquired-

Norwegian-based oil and gas

software services company,

GeoKnowledge.

The companys GeoX suite

is used for exploration prospect

risk, resource and value assess-

ment by companies worldwide.

The combination of GeoX

Software with the Petrel* E&P

software platform will enable

us to provide our customers

with fully integrated solu-

Marib area which are currently

dedicated to the project include

9.15 trillion cubic feet (TCF) of

proven reserves with 1TCF allo-

cated for use in the domestic

market, and an additional 0.7

TCF of probable reserves. The

domestic gas will be trans-

ported through a spur line

to Maabar which is centrally

located in a mountainous region

of the country.

Yemen LNG is providing an

opportunity for Yemeni citizens

to develop a range of special-

ised skills in engineering and

business disciplines enhancing

opportunities for local investors

to expand and compete at an

international level.

G

e

t

t

y

I

m

a

g

e

s

tions for assessment of explo-

ration and risk and probabil-

istic resource evaluations,

said Tony Bowman, president

of Schlumberger Information

Solutions.

Core software product devel-

opment will continue to be in

Oslo, Norway, where most of the

30 GeoKnowledge employees

are based. The company also

has offices in Houston, Texas,

and Kuala Lumpur, Malaysia.

HIGHLIGHTS

Tethys Oil in Oman has seen asset

production increase to14,981bpd.

Test production in November

amounted to 449,425 barrels of oil,

with Tethys share of production

before government take amounting

to 30% or 134,828 barrels. The tests

were carried out on the wells in

Saiwan East and Farha South.

ExxonMobil released its Outlook

for Energy report describing the

companys view of the worlds

energy market. The report states

that oil, gas and coal will constitute

c.80% of the total energy mix in

2040, with natural gas overtaking

coal. Energy demand will be 30%

higher in 2040 compared to 2010.

Ernst & Youngs Oil & Gas Global

Capital Condence Barometer

revealed that only 27% of oil and

gas executives feel that the global

economy is improving, a sharp de-

cline from the 55% from six months

before. 61% of oil and gas respond-

ents believe the global downturn

will last at least another year, sug-

gesting that the economic recovery

is taking longer than expected.

GlassPoint Solar has closed its

Series B nancing round to raise

approximately $26 million from a

number of investors including Shell

(See News In Depth on page 15).

Tethys hits production record in Oman.

GETTY IMAGES

8 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

REGIONAL NEWS

Unique Maritime snaps up Wellube

Sharjah headquartered Unique Welllube is wholly acquired after best revenue year ever

Unique Maritime Group, an

international integrated turnkey

subsea and offshore solution

provider, has acquired Unique

Wellube FZC, a specialist engi-

neering company.

The subsidiary provides

engineering services to

all sectors of the industry

throughout the region and over-

seas both onshore and offshore,

topside and subsea.

The services include hot

tapping, under pressure leak

sealing and pipeline rehabili-

tatio, as well as a complete suite

of related maintenance.

The management expertise,

financial stability and determina-

tion of the Group senior manage-

ment team to grow the business

globally now truly provides

a springboard to build upon

what has already been Unique

Wellubes most successful year

ever in terms of both revenue

generation and expansion,

said Graham McKay, general

manager of sales at Unique

Graham McKay, general manager of sales at Unique Welllube.

Simon Hateld, CEO at WesternZagros.

berg DP System and Seaflex

flexible buoyancy products.

2012 has been Unique

Wellubes biggest year to date

with over a 40% increase in

revenue from prior year, said

McKay. A number of projects

happened in 2012 the most

significant of which was a sub

sea, hot tap and line stop opera-

tion to replace a 4.5 km section

of 12 pipeline which connects

two satellite platforms, this

operation had to be undertaken

whilst the remaining pipeline at

either platform remained pres-

surized and in operation, he

added.

The company has managed

to do well and projects further

growth throughout 2013 despite

the global financial crisis.

UMGs ability to help a

client reach peak productivity,

improve cost controls and

minimize downtime through

keeping a plant and opera-

tions running has been in high

demand.

WZ and Talisman celebrate giant discovery

WesternZagros Resources

and Talisman are preparing to

complete the Kurdamir-2 well

after finishing an additional

cased-hole test in the Oligocene.

Talisman and WesternZa-

gros have agreed that further

tests of shallower zones in the

Oligocene reservoir are unnec-

essary and are now working to

realize the maximum oil produc-

tion potential from the Oligo-

cene reservoir in Kurdamir-2.

Welllube. The newly acquired

service company will continue

to operate from the groups

headquarters in Sharjah and

its operational support bases in

Qatar and West Africa.

UMG supplies and inte-

grates marine, survey and

diving equipment to meet client

requirements. Its product and

service range includes the

design and manufacture of air,

mixed gas and saturation diving

equipment, marine winches,

certified man-rider winches and

subsea equipment.

UMG recently released

a wide range of products,

including the Trelleborg prod-

ucts, EMCE Winches, Kongs-

This second cased hole test

in the Oligocene further rein-

forces our view that Kurdamir

is a giant discovery, said

Western Zagros CEO, Simon

Hatfield. It is apparent that the

intervals tested have excellent

permeability and, with optimally

designed well completions to

isolate the gas cap, are expected

to yield oil production rates

far in excess of the currently

constrained rates.

Rig count booming

on Iraq E&P activity

The Global rig count for

November 2012 has fallen to

3,460 from 3,683 year-on-year.

The Middle East regional

count rose sharply from 308 to

394 over the year, however this

was primarily caused by the

inclusion of Iraq into the survey.

16 rigs were added to Africas

count in the like-for-like annual

summary, while Latin America

saw a 24 rig count decline.

jotun.com

74 Jotun companies represented in more than 80

countries. 39 production facilities globally. Uniform

standard of global service.

In the Middle East and North Africa our Technical Sales teams in the UAE, Qatar, Bahrain, Kuwait,

Oman, Saudi Arabia, Egypt, Yemen, Algeria, Syria, Iran and Iraq will be pleased to assist you with

any coating solutions.

Please visit our web site for contact information.

Global Experience

Local Presence

Our advanced coatings provide protection

for Oil & Gas Industry projects worldwide

10 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

REGIONAL NEWS

Kurdistan operators collect pay

Operators in KRG areas confirm receipt of overdue payments from regional Government

The Kurdistan Regional Govern-

ment (KRG) has this month

paid its outstanding payments

to a number of companies oper-

ating in the Kurdistan Region.

The KRG has paid DNO

International ASA, Dana Gas

and Genel Energy Plc. for their

exploration and production

work.

Dana Gas confirmed that it

has received $120 million for

its joint venture, of which it

will retain its 40% share of $48

million, with the remaining 60%

to be paid to its partners.

We are pleased to receive

this payment and are working

with the Kurdistan Regional

Government to further address

the outstanding receivables,

said Rashid Al-Jarwan, execu-

tive director and acting chief

executive officer of Dana Gas.

DNO International ASA has

also confirmed that it received

a payment of $160 million

from the KRG. The company

will transfer $44 million to its

Bijan Mossavar-Rahmani, executive chairman of DNO International ASA.

Dr. Adel Khalid Al-Sabeeh, chairman.

also confirmed that TTOPCO

has received $160 million in

partial payment for historic

export revenues from the

Taq Taq field in the Kurdistan

Region.

Genel Energys share of the

payment is $88 million.

The payments from the KRG

were given after the regional

government and the federal

government of Iraq struck an

agreement in September to

settle a dispute over payments

after the KRG agreed to continue

exports and the federal govern-

ment agreed to pay foreign

companies working there.

There was some concern-

over payments particularly in

October when Genel announced

that it would halt exports if it did

not receive payments in a timely

manner.

Payments were made in

early October and exports

from the KRG continued to rise

throughout the remainder of

the year.

Dana Gas board agrees on Sukuk renancing

Dana Gas will refinance its $1

billion Sukuk which matured

at the end of October this year.

The transaction will reduce

outstanding debt to $850 million

through a $70 million cash pay

down and cancellation of $80

million owned by the company.

The remaining $850 million

will be split into two $425 million

tranches. One will be an ordi-

nary Sukuk and the other, a

convertible Sukuk, each with a

partner Genel Energy Plc.

DNO International execu-

tive chairman, Bijan Mossavar-

Rahmani, echoed the senti-

ments saying We are pleased

to receive this latest payment as

we continue to increase produc-

tion capacity at Tawke and

develop our other Kurdistan

discoveries.

Previous payments to DNO

International were received in

September 2011 for $60 million

and June 2011 for $104 million,

bringing the total received from

Baghdad for exports to $280

million.

In addition to the $44 million

received on its behalf by DNO

International, Genel Energy has

G

e

t

t

y

I

m

a

g

e

s

5-year maturity to ensure long-

term financing. The average

profit rate of the two new

Sukuks is 8%, a slight rise from

the existing Sukuk profit rate

of 7.5%.

We believe that the terms

being announced today repre-

sent a comprehensive, long-

term solution which balances

the interests of all stakeholders,

said Dr. Adel Khalid Al-Sabeeh,

chairman of the board.

Wartsila to deliver

LNG powered PSV

Marine solutions and services

provider, Wartsila, has been

contracted for its ship design

services and power and propul-

sion system services for an

LNG powered Platform Supply

Vessel.

The company will deliver a

vessel of Wartsila VS4411 LNG

PSV design to be owned and

operated by Siem Offshore on a

charter contract for Total.

REGIONAL NEWS

January 2013 Oil&Gas Middle East 11 www.arabianoilandgas.com

Abu Dhabi National Energy

Company PJSC (TAQA) has

acquired a 53.2% interest in the

Atrush block in the Kurdistan

region of Iraq from General

Exploration Partners, Inc., an

affiliate of Aspect Holdings.

Carl Sheldon, chief executive

officer of TAQA, said: Atrush

is a highly prospective block in

a new growth area with signifi-

cant upside potential.

This entry into a pure

exploration play demonstrates

how TAQA is leveraging its

experience as an operator of

complex oil and gas assets. It

fits our strategy to build on the

UAEs strong bilateral bonds

in the Middle East and North

Africa (MENA), and to become

an operator of scale in the

markets we choose to compete

in, said Sheldon.

The acquisition of the block

which TAQA aims to operate is

expected to close in December

2012, subject to consent by the

Carl Sheldon is the chief executive officer of Abu Dhabis TAQA.

partners and the Kurdistan

Regional Government.

David Cook, executive officer

and head of oil & gas, said: The

addition of Atrush to TAQAs oil

and gas portfolio is perfectly in

line with our growth strategy.

This opportunity builds on our

capabilities, and underscores

our ability to evolve TAQAs

operating position in the MENA

region.

The acquisition closely

follows TAQAs disposal of its

stake in WesternZagros. TAQA

purchased 74 million common

shares in WesternZagros for

a total of CDN$46.6 million

in October 2011 and sold its

interest in a single block trade

prior to the opening of the

TSX Venture Exchange on 30

November for a total consid-

eration of CDN$85.1 million.

Prior to the disposal, TAQA

held 17.98% of WesternZa-

gros issued and outstanding

common shares.

TAQA buys up

Atrush interest

TAQA takes majority interest in KRG block

OGME11122012.pdf 1 11/12/2012 12:06:26

12 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

REGIONAL NEWS

FEI delivers onsite drill analyzer

The QEMSCAN Wellsite system reduces turnaround by conducting onsite drill core tests

FEI has delivered the

QEMSCAN WellSite analysis

system to Kirk Petrophysics

who will use it to provide onsite

analysis of drill cores in oil and

gas drilling operations.

The technology will reduce

analytical turnaround from

several days or weeks to just a

few hours after the drill cores

are retrieved from the core

barrels or sidewall coring tools.

Our QEMSCAN WellSite

systems are now used in the

petroleum industry, not only to

evaluate drill cuttings in mud

logging units, but also for onsite

analysis of core samples, said

Paul Scagnetti, vice president

and general manager of FEIs

Natural Resources Business

Unit.

The automated mineralogy

capability provided by the

QEMSCAN WellSite solution is

designed to increase the speed

and accuracy of our core anal-

ysis.

In addition to microscopic

mineralogy information, it can

also provide two-dimensional

porosity measurements and

textural detail for lithological

classification, which is valu-

able characterization informa-

tion, said Jean-Valery Garcia,

managing director of Kirk

Petrophysics. Jean-Valery Garcia, managing director of Kirk Petrophysics.

High Performance Fabric Building Solutions

Tensioned membrane structures available immediately

from our Bahrain inventory.

Learn how Sprung can save you time and money at sprung.com/oilgas A Better Way to Build

Telephone

00973 17730838

REGIONAL NEWS

January 2013 Oil&Gas Middle East 13 www.arabianoilandgas.com

Kentz wins fresh Iraq contracts

$55 million orders from new contracts commit Kentz to four more busy years in Iraq

Kentz Corp., the holding

company of Kentz engineering

and construction group, has

been awarded three individual,

reimbursable, service contracts

in Iraq with a total value approx-

imately $55 million, through

its Technical Support Services

business unit.

Kentz will be working on

both new and existing upstream

facilities, based in the Basra and

Baghdad areas.

Kentz will provide services

over the next three to four

years to oversee development

of in-plant process facilities

and infrastructure to produc-

tion capacity of approximately

250,000 bpd of oil and 300

million standard cubic feet of

gas.

The scope of services to

be provided include project

management, front end engi-

neering, procurement and

installation supervision support

for three oil and gas facilities.

Mike Murphy, chief oper-

ating officer of Technical

Support Services for Kentz.

commenting on the contracts,

said, Iraq has the third largest

proven oil reserves in the world

and Kentz is well positioned to

support key clients through

in-country resources and a

proven track-record of delivery, Mike Murphy, COO for Kentz Corp.

backed up by a global supply

network of engineering and

procurement resources.

We are delighted to have

been awarded a succession of

new contracts in Iraq, which

underpin our continued focus on

the Middle East region and the

opportunity that we highlighted

to the market, he added.

The company already has a

general enegineering contract

with Lukoil in the West Qurna of

Iraq to provide civil designs for

earthworks including well pads,

piling and foundation design for

rigs and installations and for

designing and upgrading roads

and canal crossings.

C

M

Y

CM

MY

CY

CMY

K

Oil and gas december 2 OL.pdf 1 12/12/2012 14:35:48

Global reach with service local to you.

Setting

standards

worldwide

The Ferguson Group has over 30 years

experience as a leading specialist in providing

high-quality DNV 2.7-1 / EN12079 certied

containers, refrigeration containers and

accommodation solutions to the offshore

energy sector. Our global eet is available

from bases local to you - when you need it.

With a reputation for quality, safety and customer

care, the Ferguson Group sets the standard for offshore

containers and accommodation modules.

ME/0001/Jan13

Ferguson Middle East FZE, JAFZA Views - LOB 18, 14th Floor, Ofce 1401,

PO Box 17898, Dubai, UAE. Tel: +971 4 886 54 99

Email: info@ferguson-me.com www.ferguson-group.com

middle

east FZE

NEWS IN DEPTH

January 2013 Oil&Gas Middle East 15 www.arabianoilandgas.com

NEWS IN DEPTH

As Glasspoint's Oman project completes

construction, supermajor Shell steps

up with minority ownership stake

G

lassPoint Solar, widely

regarded as the leader

in solar enhanced oil

recovery (EOR), an-

nounced in December it had

closed a US$26 million Series

B financing round.

The round included partici-

pation from a new strategic

investor, Royal Dutch Shell

plc group, as well as leading

energy investors Rock-

Port Capital,Nth Power and

Chrysalix Energy Venture

Capital, an existing investor.

The funding is a key next step

to future large-scale deploy-

ment of GlassPoints solar

steam technology in EOR

projects around the world.

GlassPoints unique design

Shell's $26m

Solar Stake

eration in regions of the world

where gas is a scarce and

expensive commodity. The

natural gas that is saved and

not burned for EOR applica-

tions can be used for higher

value applications such as

power generation, desalina-

tion, industrial development

and exported as LNG.

We are delighted that Shell

and some of Silicon Valleys

most prominent energy inves-

encloses parabolic troughs

inside a glasshouse structure,

which protects the system

from high winds and seals

the solar collectors from dust,

dirt, sand and humidity.

The protected environment

enables the use of ultralight,

low-cost reflective materials

and automated washing equip-

ment, further reducing costs

and water use.

Furthermore, GlassPoint

steam generators are

designed to use the same

low-quality boiler water as

once-through steam genera-

tors, the industrys current

best practices, eliminating the

need for costly water pretreat-

ment.

Thermal EOR is a proven

technique to facilitate the

recovery of heavy oil that

is too thick to pump to the

surface using conventional

means. High-pressure steam is

injected underground in order

to raise the temperature of the

oil and change its consistency

from that of molasses to that

of water. Normally, the steam

is generated by burning very

large amounts of natural gas,

but in the GlassPoint system,

the steam is generated by

concentrating sunlight onto

pipes that contain water. This

approach to EOR may signif-

icantly reduce the amount

of natural gas used for EOR,

which is an important consid-

Glasspoint solar EOR technology

projects in California and Oman

have impressed investors.

7 MW

Glasspoint has recently nished

construction phase of a 7MW

solar EOR pilot in Oman.

Source: Glasspoint

16 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

NEWS IN DEPTH

tors chose to participate in

this round of funding, said

Rod MacGregor, CEO of

GlassPoint. We believe this

investment validates our busi-

ness and technical approach

of creating solar solutions

specifically for the oil and gas

industry.

Geert van de Wouw, Fund

Manager, Shell Technology

Ventures, said: Our deci-

sion to invest in GlassPoint

is further underpinned by

the extensive definition and

assessment work undertaken

by Petroleum Development

Oman (PDO), a joint venture

between the Government of

Oman, Shell, Total and Partex,

with a 7 MW solar project field

pilot in Oman.

Van de Wouw added:

The collaboration with

GlassPoint and PDO repre-

sents an exciting opportunity

to leverage an innovative tech-

nology which aims to use the

full potential of solar power

in the oil and gas industry.

We are looking forward to

the outcome of the solar trial

which, if successful, can help

to optimize oil recovery and

avoid the use of valuable

natural gas in Thermal EOR

projects. At GlassPoint we

believe in creating in-country

value wherever we do busi-

ness, said Rod MacGregor,

CEO of GlassPoint. To

support our projects we

aim to create local facto-

ries generating employment

and demand for local goods

and services like steel and

aluminum.

GlassPoint unveiled the

first commercial solar EOR

project at a 100-year old oil

field operated by Berry Petro-

leum in California in 2011.

The company has recently

completed contstruction and

begun commissioning and

testing at 7 MW field trial

project in Southern Oman

together with PDO.

Speaking exclusively

to Oil & Gas Middle East

in December MacGregor

revealed the Oman project

finished construction phase a

couple of months ago and has

been going through commis-

sioning, due to be operation-

ally complete, on time this

month.

2012 has been a hugely

exciting year for Glasspoint.

Obviously there is the project

in Oman which is very

exciting, but also its become

increasingly clear from the

conversations were having in

the region that EOR is going

to play a hugely significant

role in oil production of the

Middle East.

Kuwait and Bahrain

have now joined the EOR

bandwagon, and of course

Oman is already there. It is

now common and accepted

knowledge that thermal

EOR is going to play an

ever increasing role in the

Middle Eastern picture, said

MacGregor.

Another thing which is

emerging is, with the excep-

tion of Qatar, a gas crisis in

many countries as demand

expands quicker than new

supply, and that situation is

broadly going to persist.

Its essentially the perfect

storm for us, as heavy oil

production requires steam,

in an environment where gas

is becoming more scarce,

and there is an abundance of

sunshine. The combination is

almost perfect for our solu-

tion, and the regional poten-

tial is huge, he said.

Sheikh Mohammed Al Maktoum.

Harold Hyun-Suk Oh, WEF President and DEWA chief HE Mohammed Al Tayer.

G

e

t

t

y

I

m

a

g

e

s

Rod MacGregor, Glasspoint CEO.

The Glasspoint parabolic troughs are housed in a greenhouse to increase thermal efciency and keep dust at bay.

18 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

POWER GENERATION

M

anufacturers and

service providers

for temporary power

generation for up-

stream E&P activities say that

most oil and gas companies

remained focused on updating

and retaining existing products

in their fleet rather than procure

new equipment throughout

2012, a trend expected to con-

tinue through this year.

For upstream clients the con-

tinuous supply of power is abso-

lutely vital. In a way, the spe-

cific nature of supplying power

to upstream or offshore plants

means firms have to ensure

products are top spec, as the

alternative a major power out-

age simply isnt an option.

The major point to be con-

sidered is the reliability and

uninterrupted supply of power,

said Mostafa Al-Guezeri, presi-

dent, ABB Transmission &

Distribution. A failure of power

cant be afforded, because it

GENERATION

GAME

Fixed and mobile power generation

specialists talk to Oil & Gas Middle East

about the trends dominating upstream

project power provision

January 2013 Oil&Gas Middle East 19 www.arabianoilandgas.com

POWER GENERATION

could lead to stoppage of off-

shore oil or gas exploration

process and result at least in

significant decrease of indus-

trial productivity and major loss

in revenue. Additionally the

space constraints are a chal-

lenge for power generation in

an offshore facility for exam-

ple. Al-Guezeri explains ABB

employs a resolute approach in

the power generation segment

to optimise customised solu-

tions, which have been

devel-

oped

on the basis of experience and

know-how developed over dec-

ades. In power and water pro-

duction and distribution pro-

cesses, we are capable of pro-

viding everything related to

the electrical (at all voltage lev-

els), control, instrumentation,

communication aspect of the

generation process, plant man-

agement and optimization solu-

tions either as a turnkey solu-

tion or stand-alone packages.

Selectively, we also provide

mechanical balance of plant

including civil scope for the

power generation plant, he

added.

Terry McGuire, gen-

eral manager of power

and industrial, Famco (Al-

Futtaim Auto & Machinery and

Co) explains how the last few

years have witnessed a paradig-

matic shift in behaviour within

the power transmission field:

The market is becoming more

challenging due to the current

economic situation the influx

of low-cost product and the fact

that contracting companies are

maintaining instead of replac-

ing existing stock. The trend

previously was to replace gen-

erator sets after three years,

whereas now, maintenance pro-

grammes are becoming more

prevalent, he said.

Another trend according to

Al-Guezeri is utilising hybrid

power to ensure consistent

power supply, in the event of

maintenance to the plant. Tem-

porary power is practically only

for smaller production capac-

ity. Smaller engines are less

efficient than larger machines.

Unless it is in a remote area far

away from a grid/network, tem-

porary power generation solu-

tions may not be a viable solu-

tion. Considering the efficiency

and OPEX of such plants we

foresee more usage of hybrid

power plants using solar. Cur-

rently ABB is one of the world

leaders in providing turn-

key solutions for such power

plants.

As a result, McGuire iden-

tifies rental companies, con-

tracting companies and then

exports as the strongest sec-

tor within the power generation

and transmission market.

There has still been some

encouraging signs in the mar-

ket over in 2012, and in the

second-half in particular. Most

recently, Malaysias Petronas

issued a tender for the con-

struction of a major gas-fired

power plant at the Gharraf

oil field in southern Iraq. The

Terry McGuire, general manager of power and industrial, Famco.

The trend previously was to

replace generator sets after

three years, whereas now,

maintenance programmes

are becoming more

prevalent

Terry McGuire, general manager, Famco

20 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

POWER GENERATION

approaches this: ABB takes

safety very seriously, we con-

tinue to be a technology driven

company so our research and

development are focused on

developing the equipment and

systems without compromis-

ing on safety. Our products go

through numerous tests for

fitness and suitability for the

application. ABB has developed

specific applications for this and

it is a default feature in Distrib-

uted Control Systems (DCS)

and Programmable Logic Con-

trollers (PLC) system and

solutions.

But it is not just safety that

presents a challenge to compa-

nies in the power transmission

sector. A significant amount

of the electricity generated in

power stations never reaches its

intended destination because

of losses that occur during its

transmission and distribution.

ABB as a result has developed

technology to increase the

efficiency of the power supply

system, optimising power gen-

eration, facilitating the reliable

transmission of large amounts

of power with minimal losses,

and working to monitor, regu-

lated and improve distribution

networks.

Even more so, there are less

tangible challenges facing the

sector, which have less to do

with the energy efficiency, and

everything to do with adapting

to changing customer habits,

as has been noted with the shift

to maintenance programmes

as opposed to procuring new

stock.

This hasnt prevented

McGuire looking at wider mar-

kets outside the UAE. We have

an authorised distribution ship

for Himoinsa in Qatar with

plans to expand across the Gulf

region. Also we have author-

ised a distribution ship for Yan-

mar in Qatar, Oman and the

African region.

ABB is pursuing a similar

GCC-wide policy and is also

looking further afield even.

ABB is committed to devel-

oping and deploying the lat-

est technologies to make cus-

tomers more competitive by

enhancing power capacity,

increasing reliability, improving

energy efficiency and lowering

environmental impact. We are

actively present in all Middle

East countries and we expect

major power projects com-

ing up there. And we do work

with major developers and EPC

companies in the Iraq market.

We have done EPC projects in

the northern part of Iraq, said

Al-Guezeri.

We have the technology

to provide the electrical infra-

structure and we have a long-

term vision to serve the region

with increasing localisation. We

have an amazing heritage of

development and innovation in

power technologies and at the

same time we are leaders in

industrial automation and elec-

120MW captive power plant

will provide power to upstream

activities by the end of 2014.

In September, the state

operator, Kuwait Oil Company

(KOC) awarded a $200 million

lump-sum engineering procure-

ment and construction (EPC) to

Petrofac for a new power distri-

bution network in the north of

Kuwait. Petrofac will build three

substation buildings and lay

around 900 kilometres of cables

to connect the substations to the

electrical distribution system

(ESPS) network.

An ESPS network efficates

the flow of crude oil from a res-

ervoir or wellhead when natural

pressure is insufficient to force

oil to the surface. Upon comple-

tion in 2015, the new project will

provide a more robust power

supply in support of the devel-

opment of the onshore oil fields

in the north of the emirate.

Such examples of supplying

power generating equipment to

energy installations bring with

it inherent safety concerns.

Al-Guezeri clarifies how ABB

UAE oil storage facilities at Fujairah require upstream rated power generators during maintenance.

Ali Al Barrak of Saudi Electric Co.

The major point to be

considered is the reliability

and uninterrupted supply of

power

Mostafa Al-Guezeri, president, ABB Transmission & Distribution

BAUER KOMPRESSOREN GCC FZE, P.O Box 261413, Unit # AF07, Jebel Ali Free Zone, Dubai, UAE, Phone +971-4-886 0259, Fax +971-4-886 0260

SYSTEMS SERVICE TRAINING WORLDWIDE

[ BREATHING AIR COMPRESSOR SOLUTIONS ]

World renowned for reliability and durability, BAUER is recognized

as the foremost innovative designer and manufacturer of high pres-

sure compressors. Included in our product line are breathing air

compressors capable of operation in a 50 C ambient with CO and

H2S monitors. With additional focus on operator safety, we offer a

full range of Containment Fill Stations to guard against cylinder rup-

ture. Our sales and service network can provide you local support

with genuine spare parts available in kit form according to mainte-

nance intervals or repair required.

More information under www.bauer-kompressoren.de

WE CAN FILL YOUR NEEDS!

trust in the system solutions from BAUER.

MARINER 320-E3/D

22 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

POWER GENERATION

$200 MILLION

Petrofac, the international oil & gas service provider, has been awarded a

US$200 million lump-sum engineering, procurement and construction (EPC)

contract by Kuwait Oil Company (KOC) for a new power distribution network

in North Kuwait. The project was awarded following a competitive tender

and will be completed in 24 months.

trical grid software applications.

This combination is very valua-

ble for our customers to provide

complete solution, he added.

Employing such solutions

for the upstream sector often

requires operating in remote

and isolated locations. To that

end, ABB utilise off-grid solu-

tions; based on the power

requirement round the clock on

such locations, where custom-

ised solutions need to be devel-

oped. Such solutions in the com-

panys portfolio include solar,

wind, diesel generation and

wave power.

The allure of oil & gas, be

it from a political or financial

driver means there will be no

end of upstream oil & gas pro-

jects launched in the region over

the coming years the issue of

the third round of licenses in

Iraq was announced in early

October is a case in point. As

was the announcement by KOC

in November that it planned to

invest $56 billion on domestic oil

and gas projects over the next

five years to meet rising global

demand. It said that oil produc-

tion capacity will rise to 3.65

million barrels per day by 2020,

up from 3 million currently.

In a note to investors, Reuters

reported that Brent oil price

was to average $121/bl in 2013,

and forecast an average of $120/

bl in 2014. No doubt social and

political unrest as seen in 2012

and its threat for 2013 will keep

upward pressure on prices.

Lastly, with these rising oil

and gas prices, not to mention

an ever increasing population,

however, the question will inevi-

tably rise of renewable or other

alternative sources of energy

as those in the market look

to secure energy sources for

the plethora of major projects

underway in the region it is

understood that Saudi Arabia

itself needs 31,000 MW of addi-

tional power generating capac-

ity by 2020. Going forward,

new approaches to power gen-

eration, be it solar or combined-

cycle technology could be ask-

ing the next big questions, and

firms such as ABB, Siemens

and GE Oil & Gas will have to

provide the answers.

Power demands at remote site locations or on offshore rigs require extremely high availability requirements. Reliability is key for drilling ops.

Offshore jack-up rigs require huge and reliable power plants.

The Emerson logo is a trademark and a service mark of Emerson Electric Co. 2013 Emerson Electric Co.

Smart Well Management from Emerson puts protective eyes and ears

in the field even when no-one is around. Now, instead of managing well

pad inspections and maintenance by calendar and possibly missing a shut-in

hundreds of kilometres away, even your most remote wells can tell you when

they need attention with time to respond. This means better production

performance, greater utilisation of your field personnel and mitigating safety

risks to them in hazardous and remote locations. If you want your personnel

focussed on the highest value problems, making a difference every time they

go into the field, then visit www.EmersonProcess.com/SmartField

or e-mail mea.marcom@Emerson.com

Production wells scattered across several thousand square kilometres.

And one is going to shut-in tomorrow.

If only I knew which one

115883 ins4_ItsPossible_Cups_OGME.indd 1 06/12/2012 15:36

24 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

OIL FIELD GET TOGETHER

The ever-popular Oil Field Get Together was brought

to you by vehicle specialist Kamaz Export and Ruths

Chris Steak House as a busy 2012 drew to an end

DUBAI OFG

T

he Ruths Chris Steak House

monthly Oil Field Get-togethers

at the restaurants Middle East

HQ in The H hotel Dubai is

proving the must-attend event for the

UAEs oil proffessionals. The Oil Field

Get-together kicked up another notch

in late November, with a whole host

of industry stalwarts battering down

the doors at Ruths Chris Steak House

to enjoy great food and company, and

1

2 3

FACTS AND STATS

Location: Ruths Chris Steak

House in the newly renamed H

hotel (formerly the Monarch)

Attendees: 100

OIL FIELD GET TOGETHER

January 2013 Oil&Gas Middle East 25 www.arabianoilandgas.com

a raft of networking opportunities. The

event, sponsored by Kamaz Export, con-

tinues to set the bar for local industry net-

working events. Most of the regions key

upstream companies sent representatives,

and many competitors found themselves

waxing lyrical about market conditions in

a convivial and relaxed setting.

The main reason for the sponsorship

was obviously to promote our brand, the

best way to do that in Dubai is through

social networking the OFG event is an

excellent format to convey your sales mes-

sage in a relaxed informal atmosphere,

said Adrain Hockley, matrketing director

at Kamaz Export.

The event is extremely well organised

and is becoming a must go to event on the

Oil & Gas industry calender. The location

and food are also very good indeed. We

have had nothing but positive feed back

from the event, added Hockley.

4

5

6

7

8

9

WHOS WHO AT THE DUBAI OIL

FIELD GET TOGETHER?

1 Timur Khayrutdinov of sponsor Kamaz with

Romika Fazeli (In Red) with the team from RF

Event & Model Management.

2 Faisal Naseeb and Azmat Rana of KHF

Trading.

3 Lucy Atherton of GT Fairway and Sarah

Mather of Taylor Wessing.

4 Muhammed Ali, Rafail V Gafeev,Timur

Khayrutdinov, Adrian Hockley, Kamaz.

5 Hamdan Mohamed Al Morshedi, chairman

of the Arab Business Club.

6 Cem Monur, Freudenberg Oil & Gas with

guest.

7 Timur Khayrutdinov and Adrian Hockley of

sponsor Kamaz.

8 Romika Fazeli (centre) with the team from

RF Event & Model Management.

9 RJade Tregilgas of Upstream Global Recruit-

ment, Simon Geering of Baker Hughes

with Kathy Geering, managing director at

Upstream Global Recruitment.

26 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

TECH FOCUS

Tendekas Garth Naldrett and Tor Inge sen explore the

implications for operators of adopting wireless technology

for downhole monitoring

THE WIRELESS

WAY AHEAD

January 2013 Oil&Gas Middle East 27 www.arabianoilandgas.com

TECH FOCUS

T

he trend of increasing

wellbore complexity for

extended reservoir con-

tact, and greater reser-

voir heterogeneity, are demand-

ing improved monitoring and

control solutions. Traditionally

the only option has been the de-

ployment of a cabled system

but this limits the application of

intelligent well technology to

new installations or workovers.

In any case, cabled systems are

not always possible in new in-

stallations, especially where the

completion is discontinuous, and

slim hole or monobore comple-

tions may not allow cables to be

deployed along the tubing string.

Wireless technology is prov-

ing a more flexible alternative

to addressing the issues of per-

manent downhole monitoring.

One product, Tendekas wire-

less gauge, which has been suc-

cessfully deployed in the North

Sea, allows real time flowing bot-

tom hole pressure (FBHP) to

be efficiently transmitted to sur-

face, an attractive option for wells

where the cabled gauge system

has failed, or was not initially

installed. Originally designed to

3.5, the company has produced

a 2.25 version which has trialled

successfully in the North Sea

and is expected to have a wider

global appeal

sion proved effective. Even if

the well starts to significantly

deplete while the wireless

downhole gauge is installed the

gauge itself will modify its pres-

sure pulsing method to ensure

a detectable pulse train is trans-

mitted to surface.

The wireless gauge is una-

ble to transmit signals in a non-

flowing or shut-in well because

a flow regime is required to pro-

duce the pressure pulses. The

tool can record PBU (pressure

build up) data during shut-in

periods, and once well produc-

tion is restarted the stored data

can be transmitted to surface.

During this actual installation,

there were periods of shut in

while surface maintenance was

conducted. The tool success-

fully recognized the shut in

BENEFITS OF WIRELESS

TECHNOLOGY

The system transmits data from

the lower completion to the sur-

face via pressure pulses. A novel

tool design allows the wells pro-

duction to be partially choked

for a very short time to cre-

ate a pressure pulse, which is

detectable on the surface pres-

sure gauge. The wells energy

is used to transmit data to sur-

face, thereby reducing power

consumption, and the system

requires no additional surface

installation or pickup, since an

existing tubing head pressure

gauge can be used to detect

the pulse train. For most opera-

tors, the system can be deployed

by a single intervention, allow-

ing highly accurate data to be

sourced almost instantaneously

for a fraction of the cost of a re-

completion.

Compared with a memory

gauge system, it allows data to

be collected in real time and

provides a continuous confir-

mation of operation. The gauge

can be set in blank pipe, giving

optimal freedom for installation

depth, and it can be installed as

close to the producing interval as

required.

A significant benefit of using

pressure pulse transmission is

the ease of installation. No ret-

rofitting of topside equipment is

required, and many of the tech-

nical and contractual

issues when

introduc-

ing

a new monitoring system are

avoided.

SUCCESSFUL

DEPLOYMENT

A major operator in the North

Sea retrofitted the 3.5 wireless

pressure and temperature gauge

at 2,200m in a low pressure (32

bar) gas well offshore Norway.

The existing wellhead pressure

sensor was used to capture the

wireless signal and extract the

data, therefore no extra infra-

structure was required.

The application was espe-

cially challenging as the well

was a marginal producer and

the wellhead pressure had large

background pressure variations

due to the limited well deliver-

ability. Despite these condi-

tions, pressure pulse transmis-

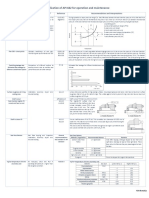

Figure 1: Comparisons of topside decoded data to Wireless Gauge internal

log and third party memory gauge.

P decoded

(Wireless gauge)

P Internal log

(Wireless gauge)

P (Omega mem-

ory gauge)

Pressure comparisons

17.05.2009 06.07.2009 25.08.2009 14.10.2009 03.12.2009 17.05.2009 13.03.2009

Date

P

r

e

s

u

r

e

(

b

a

r

)

60

58

56

54

52

50

48

46

44

42

Wireless technology is

proving a more exible

alternative to addressing the

issues of permanent downhole

monitoring and is increasingly

an attractive option

28 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

TECH FOCUS

events and entered its power

saving hibernation mode. When

the well resumed production,

the technology re-activated itself

and the first telegrams transmit-

ted following the restart, gave

accurate shut in pressure data

to surface.

Figure 1 (on page 27) shows

a comparison between the top-

side wellhead decoded data and

the data sent from the tool itself.

A third party memory gauge was

installed as back-up below the

wireless gauge to confirm pres-

sure readings. It shows the read-

ings to be accurate.

This application, and two oth-

ers undertaken at the time, dem-

onstrated that the system func-

tions not only in oil wells, but

also in gas wells and wells with a

high gas/oil ratio. It was demon-

strated that the wireless gauge

could function in wells with slug

flow and high levels of pres-

sure/noise variations on sur-

face. During shut in periods the

tool successfully recorded the

shut in data and transmitted it

to surface when production was

resumed. The 2.25 version of

the gauge was recently success-

fully tested in another gas well in

the North Sea.

WIDE RANGING

APPLICATION

The downhole pressure tem-

perature gauge can operate in

water injection wells, where a

back pressure is created instead

on the injection fluid, which gen-

erates a pressure pulse train on

the surface.

A recent development in the

wireless technology products

now also allows the measure-

ment of injection rate. By meas-

uring the pressure drop across a

modified venturi an accurate flow

rate can be calculated. Flow loop

testing has verified the method

is extremely accurate when used

in single phase fluids, such as

with water injection applications.

This allows the gauge to be run

between injection intervals,

reporting on the pressure, tem-

perature and rate split between

zones. The information is then

transmitted to the surface using

wireless telemetry.

ACTIVATION SYSTEMS

The susceptibility of downhole

mechanical pressure counting

activation mechanisms to debris

ingress has resulted in numer-

Wireless-tech provides effective data transfers to and from bottomhole.

ous in-well failures of these sys-

tems. Using a built in pressure

transducer, the wireless tech-

nology is able to detect pressure

pulses from the surface. Unlike

mechanical systems, which

become jammed when covered

in debris, electronic systems

are still able to register pressure

changes applied from surface

even through a few meters of

barite or other wellbore debris.

Furthermore electronic systems

are fully programmable to detect

a pressure sequence that cannot

be accidentally created in nor-

mal operations. In the event of

pressure pulse transmission not

reaching the tool the electron-

ics can be programmed to acti-

vate at a preset time interval.

The final backup is an acoustic

pickup, which receives a signal

from a downhole tool hundreds

of meters away.

Two systems have been

developed based on the surface

to bottom hole wireless commu-

nication. The first allows the

opening of a completion plug

without intervention. The devel-

opment was driven by an oper-

ating company struggling to

recover completion plugs after

high pressure stimulation from

above. It is suspected the high

differential pressure across the

plug causes sufficient deforma-

tion for the completion plug to

become permanently attached

to the nipple profile. In the

replacement wireless system,

rather than recovering the com-

pletion plug, the wireless plug

The downhole pressure

temperature gauge can operate

in water injection wells, where

a back pressure is created

instead on the injection uid,

which generates a pressure

pulse train on the surface

2.2 KM

A client in the North Sea

successfully deployed a Tendeka

wireless sensor at 2,200 metres

and a pressure of 32 bar.

Engineered Lost Circulation Material Cures

2,000-bbl Mud Loss in Carbonate Reservoir

Losseal* pill, a unique blend of fbers and sized solids, helped a South American operator

reduce nonproductive time, costs, and risks caused by severe circulation losses.

In one well it cured mud losses of 2,000 bbl, enabling the operator to drill to TD

and cement without further losses or an extra trip.

Read the case study at

slb.com/Losseal

*Mark of Schlumberger. 2013 Schlumberger. 12-CE-0038

FAMILY OF REINFORCED

COMPOSITE MAT PILLS

Losseal

30 Oil&Gas Middle East January 2013 www.arabianoilandgas.com

TECH FOCUS

Unlike mechanical systems, electronic varients register pressure changes through thick debris and wont get jammed.

opens its flow ports in response

to the programmed signature,

allowing production or injection

to take place across the device.

This not only saves the single

wireline run to recover the plug,

but a potentially large fishing

operation for plugs that have

become permanently fixed to

the nipple profile.

The second wireless activa-

tion system provides a remote

firing signal for downhole bar-

rier plugs, providing a reliable

alternative to the suppliers

mechanical ratchet style activa-

tion. Downhole barrier plugs

are especially susceptible to

debris since any fallout while

running the upper completion

ends up on top of the barrier

plug and around its mechani-

cal activation port. The wire-

less pressure monitoring sys-

tem does not suffer from these

problems. It has a substantially

charged pressure chamber

which is released to activate

the barrier plug on receipt of

the appropriate signaling from

surface.

INFLOW CONTROL

The latest developments in wire-

less technology now allow these

systems to operate inflow con-

trol valves. This will bring with

it a change in the way operating

companies design, test, stimu-

late and operate maximum res-

ervoir contact wells. Locations

that could not previously be con-

trolled can now be using wireless

signaling. Combing lower com-

pletion technology, incorporat-

ing zonal isolation packers and

inflow control devices, with that

of the wireless downhole devices

allows new methods of reservoir

inflow control to be developed.

As each wireless inflow control

valve is autonomous no cabling

is required between devices,

allowing a large cost saving in

control lines and downhole con-

nectors. Drillers are also offered

more flexibility in rotating the

completion while running in hole

without risking damage to exter-

nally strapped control lines.

CONCLUSION

The wireless retrofittable down-

hole pressure and tempera-

ture gauge provides a reliable

and cost-effective alternative to

cabled systems, and avoids the

need for a workover for installa-

tion. Data can be transmitted to

and from the wireless devices,

allowing operation in a monitor-

ing or control scenario.

Wireless telemetry is equally

effective for transmitting data

from bottom hole to surface,

or from surface to bottom hole.