Professional Documents

Culture Documents

Verra, Vicmar M. Sept.28 0659pm

Uploaded by

Vic Verra0 ratings0% found this document useful (0 votes)

34 views116 pagesall topics about microeconomics

Copyright

© © All Rights Reserved

Available Formats

PPSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentall topics about microeconomics

Copyright:

© All Rights Reserved

Available Formats

Download as PPSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views116 pagesVerra, Vicmar M. Sept.28 0659pm

Uploaded by

Vic Verraall topics about microeconomics

Copyright:

© All Rights Reserved

Available Formats

Download as PPSX, PDF, TXT or read online from Scribd

You are on page 1of 116

Presented by:

Verra, Vicmar M. BSBA-OM BAOM 202

Presented to:

Ms. Abigael C. Medina-Miranda

CHAPTER 1

o commodity or service being in a short supply,

relative to its demand

o It pertains to the limited availability of economic

resources relative to societys unlimited demand for

goods and services.

o A science that deals with the management of

scarce resources.

o It is simply scarcity and choice.

Greek roots

oikos - household

nomus - system or management

Oikonomia or oikonomus - management of

household

The study of economics was generally founded in

order to address the issue of resource allocation

and distribution, in response to scarcity.

Ceteris Paribus means all other things held

constant or else equal.

This assumption is used as a device to analyze the

relationship between two variables while the other

factors are held unchanged.

Birth of Economic Theory:

Adam Smith

Father of

Economics

his book, Wealth

of the Nations is

known as the

bible in

economics

John Stuart Mill

developed the basic

analysis of the political

economy

Leon Walras

- the general economic system.

Alfred Marshall

- his book Principles in Economics

- his concept of marginalism

John Maynard

Keynes

His influential book,

The General Theory

of Employment,

Interest and Money

John Hicks

His analysis of the IS-

LM model

simply answers the question

what is.

Positive Economics

answers the question what

should be.

Normative Economics

1. What to produce?

2. How to produce?

3. How much to produce?

4. For whom to produce?

Economics is considered the queen of all

social sciences.

o Business Management

o History

o Finance

o Physics

o Sociology

o Psychology

o Efficiency

Refers to productivity and proper allocation of economic

resources.

o Equity

Means justice and fairness.

o Effectiveness

Means attainment of goals and objectives.

oTo understand the Society

oTo understand Global Affairs

oTo be an Informed Voter

o Wealth

-anything that has functional value.

o Consumption

-direct utilization of the available goods and

services.

o Production

-the formation by firms of an output.

o Exchange

-process of trading goods or services for

money.

o Distribution

-process of allocating scarce resources.

Deals with the

individual

decisions of

units of the

economy.

Involved in

understanding the

behavior of the

society as a whole.

o Land

Refers to all natural resources.

o Labor

Any form of human effort exerted in the production.

o Capital

Man-made goods used in the production.

o Entrepreneurship

An economic good that commands a price.

Opportunity Cost refers to the foregone value of the next

best alternative.

o Consumption

The basic decision problem that the consumers must always deal

with in their day to day activities.

o Production

Generally a concern of producers.

o Distribution

Primarily addressed to the government.

o Growth over Time

The last basic decision problem that a society or nation must deal

with.

o Traditional Economy

A subsistence economy.

o Command Economy

The manner of production is dictated

by the government.

o Market Economy

Factors of production are owned and controlled

by individuals.

o Socialism

Key enterprises are owned by the state.

o Mixed Economy

A mixture of market system and the command

system.

CHAPTER 2

o Wet Market

Is where people usually buy vegetables, meat etc.

o Dry Market

Is where people buy shoes, clothes, or other dry

goods.

It is where buyers and sellers meet and their transaction takes

place.

It implies three things:

o desire to possess a thing

o the ability to pay for it

o willingness in utilizing it

Quantity of a good or service

that people are ready to buy at

a given price.

It states that if price goes up, the quantity

demanded will go down. Conversely, if

price goes down, the quantity demanded

will go up.

A table that show the relationship of prices and the

specific quantities demanded at each f these prices.

It is a graphical representation showing the

relationship between price and the quantities

demanded per time period.

It shows the relationship between demand for a

commodity and the factors that determine this

demand.

QD = f (own price, income, price of related goods, etc.)

o Change in Quantity Demanded

There is change in quantity demanded if the

movement is along the same demand curve.

o Change in Demand

There is a change in demand if the entire

demand curve shifts to the right side

resulting to an increase in demand.

o Taste or preferences

o Changing incomes

o Occasional or seasonal products

o Population change

o Substitute goods

o Expectations of future prices

Quantity of goods or services that firms

are ready and willing to sell at a given

price within a period of time.

It states that if the price of a good or service

goes up, the quantity supplied for such good

or service will also go up; if the price goes

down the quantity supplied also goes down.

It is schedule listing the various prices of

a product and the specific quantities

supplied at each of these prices.

It is a graphical representation showing the

relationship between the price of the product

and the quantity supplied per time period.

A form of mathematical notation that link

the dependent variable (Qs) with various

independent variables which determine

quantity supplied.

Qs = f (own price, number of sellers, price of

factor inputs, technology, etc.)

o Change in Quantity Supplied

There is a change in quantity supplied if the

movement is along the same supply curve.

o Change in Supply

There is a change in supply when the entire

supply curve shifts rightward or leftward.

o Optimization in the use of factors of

production

o Technological change

o Future expectations

o Number of sellers

o Weather conditions

o Government policy

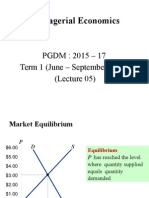

Refers to the meeting of supply and demand.

Pertains to a balance that exists when quantity

demanded equals quantity supplied.

The price agreed by the seller to offer its good

or service for sale and for the buyer to pay for it.

o Surplus

Quantity supplied is more than the

quantity demanded.

o Shortage

Quantity demanded is higher than

supplied.

o Floor Price

It is the legal minimum price imposed by

the government.

o Price Ceiling

It is the legal maximum price imposed

by the government.

Equation System:

o Demand Equation: QD = a bP

o Supply Equation: Qs = -c + dP

o Equilibrium Condition: QD = QS

o 3 equations & unknowns: (QD,QS,P)

Chapter 3

Measures the responsiveness of one

variable to a certain change of another

variable.

Elasticity = percentage change in variable X

percentage change in variable Y

Elastic Inelastic

Unitary

elasticity

Perfectly

elastic

Perfectly

inelastic

Measures the percentage change in

quantity with respect to percentage in price.

measures the responsiveness of the quantity

demanded with respect to its price.

Price Elasticity of Demand = Q2 Q1 P1

P2 P1 Q1

ARC = Q2 Q1 (P1 + P2)/2

P2 P1 (Q1 + Q2)/2

Measures the responsiveness of

quantity demanded in response to a

change in income.

y = %Qd

%y

TYPES OF GOODS

INCOME ELASTICITY

COEFFICIENT

Normal Good Positive elasticity (>0)

Inferior Good Negative elasticity (<0)

Normal, Luxury good Positive elasticity (>1)

Normal, Necessity good Positive elasticity (<1)

measures the responsiveness of quantity

demanded of a good to a change in the

price of another good.

xy = %Qdx

%Py

Chapter 4

o One who demands goods and services.

o Objective is to maximize satisfaction given the

limited budget.

o King in the capitalist or free-market economy.

Consumer sovereignty refers to power to

determine what is produced since consumer are

the ultimate purchasers of goods and services.

o satisfy the needs and wants of consumers

In order to earn profits.

o referred as passive agents simply obey

the wishes and desires of consumers

o Goods refer to

anything that provides

satisfaction to the

needs, wants and

desires of the

consumer.

o Services are any

intangible economic

activities that

contribute to the

satisfaction of human

wants.

These are the goods that yield satisfaction directly

to any consumer. These are primarily sold for

consumption.

These are goods that satisfy the

basic needs of man.

Essential or necessity

goods

Those which men may do without,

but are used to contribute to

comfort and well-being.

Luxury goods

It has value attached to it and a

price has to be paid for its use.

Economic good

Satisfy everyones needs without

paying for it

Free good

Determined

by age,

income,

gender,

occupation,

customs and

tradition.

Tastes

Are the

choices

made by

consumers

as to which

products or

services to

consume.

Preferences

o It is the name, term or symbol given to a

product by a supplier in order to

distinguish his offering from that of similar

products supplied by competitors.

Self-

actualization

needs

Esteem needs

Social needs

Safety needs

Physiological needs

o Utility refers to the satisfaction or pleasure

that an individual or consumer gets from the

consumption of a good or service

purchased.

o Utility theory explains how our satisfaction

or utility as consumer decline when we try

to consume more and more of the same

good at a particular point in time.

The additional satisfaction

that an individual derives

from consuming an extra

unit of a good or service.

Marginal

utility

The total satisfaction derives

from the consumption of a

given quantity of a good or

service.

Total

utility

This law states that as a consumer gets more

satisfaction in the long-run, he experiences a

decline in his satisfaction for goods and

services.

Marginal utility is simply the change in total utility

divided by the change in quantity.

MU = TU

Q

The difference between the total amount that we

are willing and able to pay and the total amount

that we actually pay.

Chapter 5

o Refers to any economic activity, which

combines the four factors of production.

o It is the process of converting inputs into

outputs.

Natural resources represent the gift of

nature to our productive processes.

Land

Mental and physical ability used in the

production of goods and services.

Labor

Goods that are used in the production

of other goods and services.

Capital

resources

One who manages the factors of

production.

Entrepreneur

o These are commodities and services

that are used to produce goods and

services.

Fixed inputs

Components of production

which do not change

Variable inputs

Changeable resources in

the production

o Are the various useful goods and services

that result from the production process.

Body of knowledge applied to how goods

are produced.

Utilizes more

labor resources

than capital

resources.

Labor

intensive

Utilizes more capital

resources than labor

resources.

Capital

intensive

Short run

Period of time so

short that there is

at least one fixed

input

Long run

Period of time so

long that all inputs

are considered

variable.

Known as the

planning horizon.

o The functional relationship between

quantities of inputs used in the production

and outputs to be produced.

Qdress = f(fabrics, sewing machine,

sewer, thread, buttons, etc.)

Total product

Total output

produced after

utilizing the fixed

and variable

inputs.

Marginal

product

Extra output

produced by 1

additional unit of

that input while

other inputs are

held constant.

Average

product

Total product

divided by total

units of input

used.

o Holds that we will get less and less extra

output when we add additional amount of

an input while holding other inputs fixed.

Constant

return to scale

A change in all inputs leads to a proportional change

in output

Increasing

return to scale

Also called economies of scale

An increase in all inputs leads to a more than

proportional increase in the level of output.

Decreasing

return to scale

A balanced increase in all inputs leads to a less than

proportional increase in total output

o Cost refers to all expenses acquired

during the production of goods or services.

Profit = Sales Costs

or

Profit = Total Revenue Total Costs

Explicit and

implicit costs

Explicit costs

Payments to non-

owners of a firm for

their resources.

Implicit costs

Opportunity costs

of using resources

owned by the firm.

Fixed

cost

Expenses which

are spent for the

use of fixed factors

of production.

Sometimes called

sunk costs

Variable

costs

Expenses which

change as a

consequence of a

change in quantity

of output produced.

Total fixed cost (TFC)

Costs that do not vary as output varies and that must be

paid even if output is zero.

Total variable cost (TVC)

Costs that are zero when output is zero and vary as

output increases(decreases).

Total cost (TC)

The sum of total fixed cost and total variable cost at each

level of output.

TC = TFC +TVC

AFC = FC / Q

Average

fixed cost

AVC = VC / Q

Average

variable cost

ATC = TC / Q

Average

total cost

o The cost of producing one additional unit

of output.

MC = TVC

Q

Defined as the difference that arises

when a firms total revenue is greater

that of its total cost.

The process by which a firm

determines the price and output level

that returns the greatest profit.

Chapter

7

o A classification system for the key traits of

a market, including the number of firms,

the similarity of the products they sell, and

the ease of entry into and exit from the

market share.

o A market structure characterized by:

a large number of small firms

homogenous product

very easy entry or exit from the

market

o The opposite extreme of perfect competition.

o Market structure characterized by:

a single seller or producer

a unique product

impossible entry into the market

o A type of market structure characterized by:

many small firms

differentiated products

easy market entry and exit

o A market structure characterized by:

few sellers

homogenous or differentiated

products

difficult market entry

o A market situation comprising one seller and only one buyer.

o A market condition with a significant degree of seller

concentration and a significant degree of buyer concentration.

o A market situation in which there are only two buyers but many sellers.

o A subset of oligopoly describing a market situation in which thee

are only two suppliers.

o A form of buyer concentration, that is, a market situation in

which a single buyer confronts many small suppliers.

Chapter

10

International trade

is defined as the exchange of

Goods and services among

countries.

Differences in a countrys resources

Natural resources

Labor resources

Capital stock

Differences in Tastes and Preferences

Differences in Relative Costs of Production

o This principle explains why trade will still

take place even though a country is able

to produce both goods efficiently.

o A country is said to have a comparative

advantage when it has either higher

relative efficiency or lower opportunity

costs.

Defined as the rate at which exports can be

exchanged for imports.

In terms of prices, it is also defined as the ratio

of export price index to import price index.

High transport as well as

handling costs might eliminate

potential gains from

specialization and trade

Limitations

of

Specialization

and Trade

There is some degree of immobility to

the factors of production.

They risk adverse impacts to the economy when prices of

exports fall below the desired level.

There must be adequate demand to support the production.

Refers to the shielding of domestic

industries from foreign competition through

the use of trade barriers.

Tax levied on imports and it could be in the form

of either a specific tax or an ad valorem tax.

tariff

Usually given by the government to local

producers to increase local production.

subsidies

Refers to the limit in which quantity of a certain

product cold enter the country in a given year.

quota

Subtle forms of protectionism that a country could

impose to protect its domestic industries

Administrative barriers

Has the ability to cause black market for foreign

exchange to form in in the country.

Exchange controls

Complete bans on certain import products.

embargoes

o Protectionism of Infant industry

Infant industry is an industry which has not realized its full

potential but could gain economies of scale or comparative

advantage in the future.

o Diversification

o Prevention of Dumping

Dumping is the export of a countrys goods to another market at

a price below average or production cost.

o Protect Employment

o Correction of Temporary Deficit in the Balance of

Payments (BOP)

BOP shows the annual inflow and outflow of foreign currencies.

Protecting Key Industries

Political Motivations

Social and Moral Reasons

Chapter 12

The act of levying a tax that is the

process or means by which the

sovereign, through its law-making

body, raises income to defray the

necessary expenses of the

government.

to raise revenue to the government to cover

its own expenditure on the provision of social

services

as an instrument of fiscal policy in regulating

the level of total spending in the economy

to alter distribution of income and wealth

to control volume of imports into the country

Taxes are used by the government

for a variety of purpose.

Taxes levied by

government on the

income and wealth

received by

households and

businesses

Direct

taxes

Taxes levied by

government on

goods and

services

Indirect

taxes

Taxes that place a greater burden on those best

able to pay and little or no burden on the poor

Taxes that place an equal burden on the rich,

the middle class, and the poor.

Taxes that fall heavily on the poor than on the

rich.

The Basic Principles of Taxation

basic concepts by which a government is

meant to be guided in designing and

implementing an equitable taxation regime

Taxes should be

just enough

Adequacy

Taxes should be

spread over as

wide as possible to

all sectors of the

population or

economy

Broad

basing

Taxes should

be

coordinated

Compatibility

Taxes should be

enforced in a

manner that

facilitates

voluntary

compliance to

the maximum

extent

Convenience

Tax revenue from a

specific source should

be dedicated to a

specific purpose only

when there is a direct

cost-and-benefit link

between tax source and

expenditure.

Earmarking

Tax collection

efforts of

government

should not cost

an inordinately

high percentage

of tax revenues

Efficiency

Taxes should

equally burden

all individuals

and entities in

similar

economic

circumstances

Equity

Taxes should not favor

any one group or sector

over another, and should

not be designed to

interfere with or influence

individual decision

making.

Neutrality

Collection of taxes should

reinforce their inevitability and

regularity

Predictability

Tax exemptions must only be

for specific purposes and for a

limited period

Restricted

exemptions

Tax assessment and

determination should be easy

to understand by an average

taxpayer

Simplicity

proposed by Jean

Jacques Rouseau, Jean

Baptiste Say and John

Stuart Mill

states that taxation

should be levied

according to an

individuals ability to pay

usually the basis for

progressive taxation

Ability to

pay principle

developed by Thomas

Hobbes, John Locke

and Hugo Grotius

proposes that taxation

should be levied

broadly in relation to

the benefits that

people receive in

public services

Benefit

approach

proposed mainly by

the Physiocrats

Proposes that the

major duty of a tax

system is to analyze

the effect of a

particular tax on the

distribution of tax

welfare

Tax

incident

approach

A tax on a persons income, emoluments,

profits arising from property, practice of

profession, conduct of trade or business or

on the pertinent items of gross income

specified in the Tax Code of1997

You might also like

- As of 050120 - Essential Wedding Package 2020-21Document2 pagesAs of 050120 - Essential Wedding Package 2020-21Vic VerraNo ratings yet

- Mae Ungcad EconomicsDocument141 pagesMae Ungcad EconomicsVic VerraNo ratings yet

- Governor's Drive, General Trias, Cavite Contact Number: (046) .484.8091 To 94 Website: WWW - Lpu.edu - PHDocument1 pageGovernor's Drive, General Trias, Cavite Contact Number: (046) .484.8091 To 94 Website: WWW - Lpu.edu - PHVic VerraNo ratings yet

- Development Trust of Barangay JavaleraDocument9 pagesDevelopment Trust of Barangay JavaleraVic VerraNo ratings yet

- Questions: " - ! You're Stepping On My Foot." (Expressing Pain) A. B. C. D. EDocument7 pagesQuestions: " - ! You're Stepping On My Foot." (Expressing Pain) A. B. C. D. EVic VerraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- (A) Explain How The Incidence of An Indirect Tax Depends On The Price Elasticity of Demand and The Price Elasticity of Supply. (10 Marks)Document4 pages(A) Explain How The Incidence of An Indirect Tax Depends On The Price Elasticity of Demand and The Price Elasticity of Supply. (10 Marks)anamNo ratings yet

- ElasticityDocument10 pagesElasticityAbegail OcampoNo ratings yet

- Level I of CFA Program 1 Mock Exam June 2020 Revision 1Document75 pagesLevel I of CFA Program 1 Mock Exam June 2020 Revision 1JasonNo ratings yet

- A Dashboard For Online PricingDocument22 pagesA Dashboard For Online PricingAsh SitaramNo ratings yet

- Module 3 Elasticity of DemandDocument6 pagesModule 3 Elasticity of DemandAbhinab GogoiNo ratings yet

- MBA-105 Question PaperDocument9 pagesMBA-105 Question PaperTushar JaiswalNo ratings yet

- Assignment Week 1Document10 pagesAssignment Week 1victoriabhrNo ratings yet

- FORD MOTOR COMPANY v. FUJIKURA LTD. and FUJIKURA AUTOMOTIVE AMERICA LLCDocument39 pagesFORD MOTOR COMPANY v. FUJIKURA LTD. and FUJIKURA AUTOMOTIVE AMERICA LLCsahmed_anNo ratings yet

- Monopoly: Meaning, Definitions, Features and CriticismDocument11 pagesMonopoly: Meaning, Definitions, Features and CriticismShah AlamNo ratings yet

- Lecture 5 - Market Equlibrium and Concept of Elasticity of Demand and Its ApplicationDocument80 pagesLecture 5 - Market Equlibrium and Concept of Elasticity of Demand and Its ApplicationnivecNo ratings yet

- Summary Chapter 4Document5 pagesSummary Chapter 4Lalit SoniNo ratings yet

- 2011 AP Microeconomics ExamsDocument47 pages2011 AP Microeconomics ExamsjoshNo ratings yet

- Managerial Economics Topic 5Document65 pagesManagerial Economics Topic 5Anish Kumar SinghNo ratings yet

- Demand AnalysisDocument73 pagesDemand AnalysisSuganya VenurajNo ratings yet

- WK 3Document42 pagesWK 3Shivarni KumarNo ratings yet

- Home Assignment On Elasticity of DemandDocument3 pagesHome Assignment On Elasticity of DemandSk Ahasanur Rahman 1935043681No ratings yet

- Applied Economics 1st Quarter TestDocument2 pagesApplied Economics 1st Quarter TestdhorheeneNo ratings yet

- Pertemuan 4Document38 pagesPertemuan 4M Arif IlyantoNo ratings yet

- Marketing in TourismDocument24 pagesMarketing in TourismYulvina Kusuma PutriNo ratings yet

- Effect of TaxDocument2 pagesEffect of TaxrudraarjunNo ratings yet

- Kelloggs Edition 6 Full Case StudyDocument2 pagesKelloggs Edition 6 Full Case Studynarenmadhav100% (1)

- JAIBB 97th 2023 103. - Principles of Economics POEDocument3 pagesJAIBB 97th 2023 103. - Principles of Economics POERanjan GhoshNo ratings yet

- ch4 - Demand ElasticityDocument6 pagesch4 - Demand ElasticityAhmed DabourNo ratings yet

- Assignement 1-Calculating The Impact of Price Change On SoftDocument3 pagesAssignement 1-Calculating The Impact of Price Change On Softparth limbachiyaNo ratings yet

- BBA IB Revised Syllabus - 24.062019Document33 pagesBBA IB Revised Syllabus - 24.062019Atharva ShahaneNo ratings yet

- Applied Economics PPT Module 4Document26 pagesApplied Economics PPT Module 4Jiell Renon VigiliaNo ratings yet

- Review Questions - OVWL 2023Document8 pagesReview Questions - OVWL 2023zitkonkuteNo ratings yet

- Sol 61Document11 pagesSol 61Navin GolyanNo ratings yet

- 3.1. Elasticity and Its ApplicationDocument26 pages3.1. Elasticity and Its ApplicationSamantha Cinco100% (2)

- PomDocument63 pagesPomAllen Fourever50% (2)