Professional Documents

Culture Documents

Bonneau

Uploaded by

Choudhry JawadCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bonneau

Uploaded by

Choudhry JawadCopyright:

Available Formats

Bonneaus Company

Introduction:

Bonneaus Company was an organization involved in the business of selling Sunglasses. The Business

was seasonal, due to which there was low Profit during that season however, in order to overcome this

weakness the companys management decided to enter into a non-prescription reading glasses industry

by acquiring Pennsylvania Optical, which was located in Reading. This acquisition was viewed as a one

which would enable it to start selling a Product which had less seasonal fluctuation and also the

acquisition would deliver the benefit of obtaining revenue and marketing synergies. Subsequently, the

firm was acquired and the benefits were obtained as intended, helping the company to double its Sales

over the years.

Recently, the company had 25 years of Success due to which it had a mass marketing approach to

appeal to large segment of customers. However, as the company move on with its success, it set its eyes

on a new acquisition target known by the name of Foster Grant Corporation.

Foster Grant Corporation was not only involved in the business of selling Sunglasses but it also

manufactured them along with the Production of Plastic Material.

For this transaction, the company decided to use the same Bank for financing it however, as it was a

complex situation, so the company had to decide about the Offer Price and the feasibility of obtaining

finance from the bank.

Benefits of Acquiring Foster Grant Corporation:

Acquiring Foster Grant Corporation would yield the following benefits:

1. By acquiring the company, it would be able to obtain the valuable assets of the company which

were as follows:

a. The brand name of the company was considered highly valuable in the glasses industry.

b. The technical division in the company had the highest quality and efficient Production.

c. It had a low cost Producing manufacturing facility.

d. It holds a number of Patent rights, which give to access to a number of good quality

technologies responsible for the Production of good quality Products.

e. It Sales and services division was very good.

f. It had one of the best human resources with good qualification, experiences and

commitment.

2. With the acquisition of this target, the company can exploit the following opportunities:

a. The company can expand and increase sales in the areas of Sunglasses, Reading glasses and

technical Products.

b. It can also expand into international location for sale.

Recommendation about the Investment and Financing:

According to the Calculations made in Appendices, two methods for valuation were applied, First the

liquidation method would value the company on the basis of how much its asset would be sold off if the

company was to be liquidated, and Secondly, the Cash flow based method discounted the future earning

from the operation to arrive at a value which would be calculated on the basis of if the company was to

be a going concern.

The results were obtained as follows:

Liquidation value: 9 million

Cash flow value: 7 million

Thus, it could be seen that Liquidation value was higher than the Cash flow value however, as the

company intends to acquire it for a purpose of earning cash flow from its operations, so it should be

acquired for a Price of 7 million.

Similarly, the sensitivity analysis of Sales and Operating Profit margin was carried out and it was

determined that the Sales were the most risky factor as it had a very low sensitivity to the Value of the

company.

In addition to that, the technical feasibility of taking the loan was also considered and it was assume that

if the company was to be acquired for at 9 million, so how it could affect the leverage level of the

organization and it was concluded that if it was acquired while taking a loan then the debt to equity

would rise from 16% to 50%, hence making it not feasible for the company to take the loan and also it

could be seen from its operations, which were not that much profitable in order to bear the expenses of

interest commitment.

Overall, the acquisition promises some Profitable Outlook however, the acquisition should be partly

financed with some private Equity.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- p11Document5 pagesp11Choudhry JawadNo ratings yet

- British and American Financial Terms Here Are Some of The Main Differences Between British and American Financial TerminologyDocument2 pagesBritish and American Financial Terms Here Are Some of The Main Differences Between British and American Financial TerminologyChoudhry JawadNo ratings yet

- Impact of Gas Shortage in PakistanDocument194 pagesImpact of Gas Shortage in PakistanChoudhry JawadNo ratings yet

- Enterprise Resource PlanningDocument44 pagesEnterprise Resource PlanningChoudhry JawadNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Joyful Living: (Based On Chapter 13: Advaitananda Prakaranam of Panchadashi of Sri Vidyaranya Swami)Document11 pagesJoyful Living: (Based On Chapter 13: Advaitananda Prakaranam of Panchadashi of Sri Vidyaranya Swami)Raja Subramaniyan100% (1)

- Manju Philip CVDocument2 pagesManju Philip CVManju PhilipNo ratings yet

- Obat LasaDocument3 pagesObat Lasaibnunanda29No ratings yet

- Product Catalog 2016Document84 pagesProduct Catalog 2016Sauro GordiniNo ratings yet

- Learning Online: Veletsianos, GeorgeDocument11 pagesLearning Online: Veletsianos, GeorgePsico XavierNo ratings yet

- Raychem Price ListDocument48 pagesRaychem Price ListramshivvermaNo ratings yet

- Body Scan AnalysisDocument9 pagesBody Scan AnalysisAmaury CosmeNo ratings yet

- SIM5320 - EVB Kit - User Guide - V1.01 PDFDocument24 pagesSIM5320 - EVB Kit - User Guide - V1.01 PDFmarkissmuzzoNo ratings yet

- Hotel Design Planning and DevelopmentDocument30 pagesHotel Design Planning and DevelopmentTio Yogatma Yudha14% (7)

- K Series Parts List - 091228Document25 pagesK Series Parts List - 091228AstraluxNo ratings yet

- E-banking and transaction conceptsDocument17 pagesE-banking and transaction conceptssumedh narwadeNo ratings yet

- Febrile SeizureDocument3 pagesFebrile SeizureClyxille GiradoNo ratings yet

- AJK Newslet-1Document28 pagesAJK Newslet-1Syed Raza Ali RazaNo ratings yet

- Grade 10Document39 pagesGrade 10amareNo ratings yet

- Masonry Brickwork 230 MMDocument1 pageMasonry Brickwork 230 MMrohanNo ratings yet

- Seminar #22 Vocabury For Speaking PracticeDocument7 pagesSeminar #22 Vocabury For Speaking PracticeOyun-erdene ErdenebilegNo ratings yet

- LAC-Documentation-Tool Session 2Document4 pagesLAC-Documentation-Tool Session 2DenMark Tuazon-RañolaNo ratings yet

- Tugas B InggrisDocument6 pagesTugas B Inggrisiqbal baleNo ratings yet

- Guidelines 2.0Document4 pagesGuidelines 2.0Hansel TayongNo ratings yet

- CHB 2Document15 pagesCHB 2Dr. Guruprasad Yashwant GadgilNo ratings yet

- Dell EMC VPLEX For All-FlashDocument4 pagesDell EMC VPLEX For All-Flashghazal AshouriNo ratings yet

- Mythic Magazine 017Document43 pagesMythic Magazine 017William Warren100% (1)

- ThesisDocument250 pagesThesislax mediaNo ratings yet

- Wsi PSDDocument18 pagesWsi PSDДрагиша Небитни ТрифуновићNo ratings yet

- Mama Leone's Profitability AnalysisDocument6 pagesMama Leone's Profitability AnalysisLuc TranNo ratings yet

- Fiery Training 1Document346 pagesFiery Training 1shamilbasayevNo ratings yet

- CHEM206 Answers 1Document3 pagesCHEM206 Answers 1Shiro UchihaNo ratings yet

- IT SyllabusDocument3 pagesIT SyllabusNeilKumarNo ratings yet

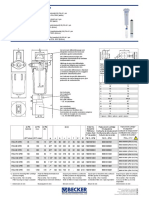

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- Quality CircleDocument33 pagesQuality CircleSudeesh SudevanNo ratings yet