Professional Documents

Culture Documents

Restaurant: RTN 581.5p

Uploaded by

api-2546691450 ratings0% found this document useful (0 votes)

350 views2 pagesOriginal Title

1079943 20140617

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

350 views2 pagesRestaurant: RTN 581.5p

Uploaded by

api-254669145Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Momentum

Relative Strength (%)

1m -1.3%

3m -20.9%

1yr +7.1%

Volume Change (%)

10d v 3m +0.31%

Price vs... (%)

52w High -20.5%

50d MA -9.43%

200d MA -5.85%

7 Piotroski F-Score

7.69 Altman Z2-Score

1053 72% B+

Health Trend

Bankruptcy Risk

Earnings Manipulation Risk

Magic Formula Score

RTN 581.5p 11.5 2.0%

Restaurant

Market Cap

Enterprise Value

Revenue

Position in UK Edition

1.14bn

1.19bn

579.6m

391st

Value

Quality

Momentum

StockRank

45

95

79

84

Zoom

Jul '13 Sep '13 Nov '13 Jan '14 Mar '14 May '14

500

600

700

400

2005 2010

1w 1m 6m YTD 1y 3y 5y All

vs.

market

vs.

industry Growth & Value

12m Forecast Rolling

PE Ratio (f) 17.5

PEG Ratio (f) 1.75

EPS Growth (f) 11.1 %

Dividend Yield (f) 2.84 %

Valuation (ttm)

Price to Book Value 5.30

Price to Tang. Book 6.03

Price to Free Cashflow 54.4

Price to Sales 1.97

EV to EBITDA 11.0

Margin of Safety (beta)

27%

-7%

-2%

-74%

Broker Target

Relative to Sector

Graham Formula

Stability Value (EPV)

Screens Passed

RTN doesn't qualify for our screens.

Find out why: View Checklists

vs.

market

vs.

industry Quality

Return on Capital 26.4 %

Return on Equity 28.7 %

Operating Margin 12.9 %

Balance Sheet Income Statement Cashflow

Last ex-div: 18th Jun, paid: 9th Jul more...

Financial Summary

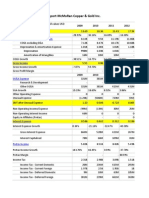

Year End 29th Dec 2008 2009 2010 2011 2012 2013 2014E 2015E CAGR / Avg

Revenue m 416.5 435.7 465.7 487.1 532.5 579.6 636.7 706.1 +6.8%

Operating Profit m 53.9 52.8 58.6 49.3 66.4 74.9 +6.8%

Net Profit m 32.2 37.3 40.1 34.4 48.2 56.2 61.3 68.9 +11.8%

EPS Reported p 16.1 18.8 20.1 17.2 24.1 28.0 +11.6%

EPS Normalised p 16.3 17.3 20.2 17.8 24.1 28.0 30.7 34.6 +11.5%

EPS Growth % +10.4 +6.2 +16.8 -11.6 +35.0 +16.3 +9.80 +12.5

PE Ratio x 20.4 18.6 16.5

PEG x 2.08 1.48 1.66

Profitability

Operating Margin % 12.9 12.1 12.6 10.1 12.5 12.9 +12.2%

ROA % 12.2 13.0 10.7 13.9 14.8

ROCE % 25.6 24.8 26.7 21.2 26.1 26.4 +25.1%

ROE % 35.6 30.8 22.8 28.3 28.1 +29.1%

Cashflow

Op. Cashflow ps p 30.3 30.9 33.6 37.6 42.4 48.8 +10.0%

Capex ps p 23.4 15.9 16.0 23.2 27.4 38.3 +10.4%

Free Cashflow ps p 6.84 15.0 17.6 14.5 15.0 10.5 +8.9%

Dividends

Dividend ps p 7.70 8.00 9.00 10.5 11.8 14.0 15.4 17.1 +12.7%

Dividend Growth % +6.21 +3.90 +12.5 +16.7 +12.4 +18.6 +9.70 +11.2

Dividend Yield % 2.46 2.69 3.00

Dividend Cover x 2.10 2.35 2.23 1.64 2.04 2.00 2.00 2.02

Balance Sheet

Cash etc m 5.47 2.83 2.74 10.2 12.9 7.31 +6.0%

Working Capital m -66.1 -68.1 -66.5 -62.6 -65.3 -80.2

Net Fixed Assets m 250.7 254.8 259.6 269.1 293.8 337.5 +6.1%

Net Debt m 81.8 69.7 50.0 44.7 39.1 45.1 -11.2%

Book Value m 93.6 115.9 144.7 157.3 183.8 216 +18.2%

Average Shares m 199.5 198.1 199.5 200.1 200.5 200.9 +0.2%

Book Value ps p 47.6 58.7 72.5 78.5 91.8 107.6 +17.7%

B+

Liquidity (ttm)

Curr. Ratio 0.31

Quick Ratio 0.26

Interest Cov. 39.4

Efficiency (ttm)

Asset Turnover 1.53

Rec's Turnover 81.2

Stock Turnover 95.1

Other Ratios

Leverage (ttm) total ex intang

Gross Gearing % 24.3 27.6

Net Gearing % 20.9 23.8

Cash / Assets % 1.83

vs.

market

vs.

industry Recent History

Latest interim period (ended 29th Dec '13) vs. prior year

Sales Growth 6.50 %

EPS Growth 16.7 %

3yr Compound Annual Growth Rate

Sales Growth 7.56 %

EPS Growth 11.5 %

DPS Growth 15.9 %

Graphical History Current Fiscal Year 2014

Revenue

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

500m

600m

700m

800m

Net Profit

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

40m

50m

60m

70m

80m

Normalised EPS

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

20

30

40

PE Ratio Range

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

0

20

40

Dividend Yield

Range

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

0

5

10

Stockopedia 2014-06-17,08:49:19

Home Page News Releases Investor Relations Executives Products/Services

No. of Shareholders: 0

Last Annual December 29th, 2013

Last Interim December 29th, 2013

Shares in Issue 200,647,143

ISIN GB00B0YG1K06

Sector Consumer Cyclicals

Industry Hotels & Entertainment Services

Index FTSE 350 Act , FTSE Lower Yield , FTSE

250 Mid , FT350 Trav&leis ,

Exchange London Stock Exchange (Full)

Eligible

for

an ISA? a SIPP?

The Restaurant Group plc (TRG) is engaged in the operation of restaurants and pub

restaurants. The Company operates 422 restaurants and pub restaurants. Its principal trading

brands are Frankie & Bennys, Chiquito and Garfunkels and it also operates a Pub restaurant

business as well as a Concessions business which trades on over 60 sites, at United

Kingdom markets. Its Frankie & Bennys offers American and Italian style with food and drink.

Directors: Andrew Page (CEO) 54, Stephen Critoph (FID) 52, Alan Jackson (NEC) 69, Simon Cloke (NID) 45,

Sally Cowdry (NID) , Tony Hughes (NID) 65,

No. of Employees: 12,295

Address 5-7 Marshalsea Road, LONDON, SE1

1EP, United Kingdom

Web http://www.trgplc.com

Phone +44 20 31175001

Contact Robert Morgan (Secy.)

Auditors Deloitte LLP

RTN Share Price Performance

RTN Share Price

GBp

581.5p

Day's Change

11.5 2.0%

Traded 8:12am Minimum 15 min delayed NMS: 3.00k

Volume

15,398

Bid - Ask

579.5 - 582.0

Low - High

573.0 - 581.5

Spread

43bps

Avg Vol (3m)

273,769

Open - Close

579.0 - 570.0

12m Range

562.5 - 716.0

Beta

0.77

More

Latest RTN News Announcements (delayed)

15th May Result of AGM

15th May Holding(s) in Company

15th May AGM Statement

7th May Notification of Transactions of Directors/Persons

22nd Apr Holding(s) in Company

17th Apr Partial disposal of interest in Living Ventures

Upcoming RTN Events

Wednesday 18th June, 2014

Dividend For RTN.L

Monday 25th August, 2014 (Estimate)

Interim 2014 Restaurant Group PLC Earnings Release

Recent

Hotels & Entertainment Services

Consumer Cyclicals

Industry Peer Group

Profile Summary

RTN Quote

Use of our data service is subject to express Terms of Service. Please see our full site disclaimer for more details. In particular, it is very important to do your own research (DYOR) and seek professional advice

before making any investment based on your own personal circumstances. Please note that the information, data and analysis contained within this stock report: (a) include the proprietary information of

Stockopedia's third party licensors and Stockopedia; (b) should not be copied or redistributed except as specifically authorised; and (c) are not warranted to be complete, accurate or timely. You should

independently research and verify any information that you find in this report. Stockopedia will not be liable in respect of any loss, trading or otherwise, that you may suffer arising out of such information or any

reliance you may place upon it. Past performance is no guarantee of future results. The value and income derived from investments may go down as well as up. Stockopedia 2014.

Broker Forecasts

29th Dec 2014 29th Dec 2015

Price Target: 722.7 (+26.81% above Price) Net Profit EPS DPS Net Profit EPS DPS

Est. Long Term Growth Rate: +11.0% () (p) (p) () (p) (p)

Consensus Estimate 61.3m 30.7 15.4 68.9m 34.6 17.1

1m Change +99.8k - - +178k - -

3m Change -46.3k +0.28 +0.042 +73.7k +0.48 -0.036

14 Brokers

Broker Consensus Trend

2

0

1

4

E

P

S

Jun

2013

Aug

2013

Oct

2013

Dec

2013

Feb

2014

Apr

2014

Jun

2014

30

30.5

31

1 week

1 year

-10% 0% 10% 20%

Young & Co's Brewe

Compare vs RTN

Spirit Pub

Compare vs RTN

Young & Co's Brewe

Compare vs RTN

Enterprise Inns

Compare vs RTN

Marston's

Compare vs RTN

Domino's Pizza

Compare vs RTN

J D Wetherspoon

Compare vs RTN

Restaurant

Compare vs RTN

Stockopedia 2014-06-17,08:49:19

You might also like

- Hazardous Waste Treatment & Disposal Revenues World Summary: Market Values & Financials by CountryFrom EverandHazardous Waste Treatment & Disposal Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Momentum Growth & Value: (F) (F) (F) (F)Document3 pagesMomentum Growth & Value: (F) (F) (F) (F)api-254669145No ratings yet

- First Resources 4Q12 Results Ahead of ExpectationsDocument7 pagesFirst Resources 4Q12 Results Ahead of ExpectationsphuawlNo ratings yet

- Colgate, 4th February, 2013Document10 pagesColgate, 4th February, 2013Angel BrokingNo ratings yet

- RMN - 0228 - THCOM (Achieving The Impossible)Document4 pagesRMN - 0228 - THCOM (Achieving The Impossible)bodaiNo ratings yet

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- GSK Consumer: Performance HighlightsDocument9 pagesGSK Consumer: Performance HighlightsAngel BrokingNo ratings yet

- Technics Oil & Gas: 3QFY12 Results ReviewDocument4 pagesTechnics Oil & Gas: 3QFY12 Results ReviewtansillyNo ratings yet

- Results Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYDocument9 pagesResults Came in Line With Our Estimates. We Are Upgrading Our Recommendation To BUYÁngel Josue Aguilar VillaverdeNo ratings yet

- GSK ConsumerDocument10 pagesGSK ConsumerAngel BrokingNo ratings yet

- GSK ConsumerDocument10 pagesGSK ConsumerAngel BrokingNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- LNT, 25th JanuaryDocument15 pagesLNT, 25th JanuaryAngel BrokingNo ratings yet

- HT Media, 1Q FY 2014Document11 pagesHT Media, 1Q FY 2014Angel BrokingNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Colgate 2QFY2013RUDocument10 pagesColgate 2QFY2013RUAngel BrokingNo ratings yet

- Rs 490 Hold: Key Take AwayDocument5 pagesRs 490 Hold: Key Take AwayAnkush SaraffNo ratings yet

- Shriram City Union Finance: Healthy Growth, Elevated Credit Costs HoldDocument9 pagesShriram City Union Finance: Healthy Growth, Elevated Credit Costs HoldRohit ThapliyalNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- First Global: DanoneDocument40 pagesFirst Global: Danoneadityasood811731No ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- Crompton Greaves: Performance HighlightsDocument12 pagesCrompton Greaves: Performance HighlightsAngel BrokingNo ratings yet

- Big C Supercenter: Tough Year AheadDocument10 pagesBig C Supercenter: Tough Year AheadVishan SharmaNo ratings yet

- Glaxosmithkline Pharma: Performance HighlightsDocument11 pagesGlaxosmithkline Pharma: Performance HighlightsAngel BrokingNo ratings yet

- Singapore Company Focus: HOLD S$3.70Document9 pagesSingapore Company Focus: HOLD S$3.70LuiYuKwangNo ratings yet

- Jagran Prakashan Result UpdatedDocument11 pagesJagran Prakashan Result UpdatedAngel BrokingNo ratings yet

- Dabur India Result UpdatedDocument12 pagesDabur India Result UpdatedAngel BrokingNo ratings yet

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocument1 page3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234No ratings yet

- Jagran Prakashan: Performance HighlightsDocument10 pagesJagran Prakashan: Performance HighlightsAngel BrokingNo ratings yet

- Bank of BarodaDocument12 pagesBank of BarodaAngel BrokingNo ratings yet

- Colgate Result UpdatedDocument10 pagesColgate Result UpdatedAngel BrokingNo ratings yet

- Britannia 1QFY2013RU 140812Document10 pagesBritannia 1QFY2013RU 140812Angel BrokingNo ratings yet

- GSK Consumer, 21st February, 2013Document10 pagesGSK Consumer, 21st February, 2013Angel BrokingNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- Prime Focus - Q4FY12 - Result Update - Centrum 09062012Document4 pagesPrime Focus - Q4FY12 - Result Update - Centrum 09062012Varsha BangNo ratings yet

- SUN TV Network: Performance HighlightsDocument11 pagesSUN TV Network: Performance HighlightsAngel BrokingNo ratings yet

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkNo ratings yet

- TCS, 1Q Fy 2014Document14 pagesTCS, 1Q Fy 2014Angel BrokingNo ratings yet

- Tech Mahindra 4Q FY13Document12 pagesTech Mahindra 4Q FY13Angel BrokingNo ratings yet

- DMX Technologies 3Q13 results above expectations on higher salesDocument4 pagesDMX Technologies 3Q13 results above expectations on higher salesstoreroom_02No ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Aventis Pharma: Performance HighlightsDocument10 pagesAventis Pharma: Performance HighlightsAngel BrokingNo ratings yet

- TM 4QFY11 Results 20120227Document3 pagesTM 4QFY11 Results 20120227Bimb SecNo ratings yet

- Yes Bank: Performance HighlightsDocument12 pagesYes Bank: Performance HighlightsAngel BrokingNo ratings yet

- Persistent, 29th January 2013Document12 pagesPersistent, 29th January 2013Angel BrokingNo ratings yet

- Federal Bank: Performance HighlightsDocument11 pagesFederal Bank: Performance HighlightsAngel BrokingNo ratings yet

- Reliance Communication Result UpdatedDocument11 pagesReliance Communication Result UpdatedAngel BrokingNo ratings yet

- Adventa - 9MFY10 Results Review 20100928 OSKDocument4 pagesAdventa - 9MFY10 Results Review 20100928 OSKPiyu MahatmaNo ratings yet

- Britannia, 18th February, 2013Document10 pagesBritannia, 18th February, 2013Angel BrokingNo ratings yet

- Infosys: Performance HighlightsDocument15 pagesInfosys: Performance HighlightsAtul ShahiNo ratings yet

- INDIA Pharma Wyeth Q4FY12 Result updateDocument4 pagesINDIA Pharma Wyeth Q4FY12 Result updateSwamiNo ratings yet

- Tata MotorsDocument5 pagesTata Motorsinsurana73No ratings yet

- Ascendas Reit - DaiwaDocument5 pagesAscendas Reit - DaiwaTerence Seah Pei ChuanNo ratings yet

- GSK Consumer, 2Q CY 2013Document10 pagesGSK Consumer, 2Q CY 2013Angel BrokingNo ratings yet

- GRVY Compustat ReportDocument15 pagesGRVY Compustat ReportOld School ValueNo ratings yet

- Deutsche VerificationDocument1 pageDeutsche VerificationtobyallchurchNo ratings yet

- Ays 082914 3331 PDFDocument18 pagesAys 082914 3331 PDFFabian R. GoldmanNo ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- ITC Result UpdatedDocument15 pagesITC Result UpdatedAngel BrokingNo ratings yet

- Prob RecDocument1 pageProb Recapi-254669145No ratings yet

- MoneyweekDocument7 pagesMoneyweekapi-254669145No ratings yet

- FtseindexrtnuploadDocument1 pageFtseindexrtnuploadapi-254669145No ratings yet

- Mtecednote29 1 15Document7 pagesMtecednote29 1 15api-254669145No ratings yet

- TowermadnessDocument7 pagesTowermadnessapi-254669145No ratings yet

- SECTION 2: Property Rights of A Partner Article 1810. The Property Rights of A Partner AreDocument3 pagesSECTION 2: Property Rights of A Partner Article 1810. The Property Rights of A Partner ArePat EspinozaNo ratings yet

- Volkswagen A G Situation Analysis Final 2Document19 pagesVolkswagen A G Situation Analysis Final 2HarshitAgrawalNo ratings yet

- Difference Between BCG and GE Matrices (With Comparison Chart) - Key DifferencesDocument12 pagesDifference Between BCG and GE Matrices (With Comparison Chart) - Key DifferencesNaman Bajaj100% (1)

- AAPL v. Sri Lanka (Dissenting Opinion)Document12 pagesAAPL v. Sri Lanka (Dissenting Opinion)Francisco José GrobNo ratings yet

- 150 Richest Indonesians - June 2016 - GlobeAsiaDocument62 pages150 Richest Indonesians - June 2016 - GlobeAsiaIndraTedjaKusumaNo ratings yet

- Partnerships Formation - RevisedDocument10 pagesPartnerships Formation - RevisedBerhanu ShancoNo ratings yet

- Deloitte Issue 2 2019 M&ADocument38 pagesDeloitte Issue 2 2019 M&ADylan AdrianNo ratings yet

- SEC v. Griffithe Et Al.Document23 pagesSEC v. Griffithe Et Al.sandydocsNo ratings yet

- Mother DairyDocument16 pagesMother DairyMano VikasNo ratings yet

- Disini StartUpGuide InteractiveDocument19 pagesDisini StartUpGuide InteractiveDammy VegaNo ratings yet

- CACF Annual ReportDocument16 pagesCACF Annual Reportcn_cadillacmiNo ratings yet

- Nielsen Sri Lanka 2016 ReviewDocument37 pagesNielsen Sri Lanka 2016 ReviewSameera ChathurangaNo ratings yet

- Group 5 Honey Care - Case SummaryDocument4 pagesGroup 5 Honey Care - Case SummaryAndi MarjokoNo ratings yet

- Lista Empresas PanamaPapers PDFDocument8 pagesLista Empresas PanamaPapers PDFChristopher André DíazNo ratings yet

- RJR Nabisco Pre-Bid Valuation AnalysisDocument13 pagesRJR Nabisco Pre-Bid Valuation AnalysisMohit Khandelwal100% (1)

- Acctg 11-1 Gbs For Week 11Document5 pagesAcctg 11-1 Gbs For Week 11Ynna Gesite0% (1)

- 05 ALCAR ApproachDocument25 pages05 ALCAR ApproachVaidyanathan Ravichandran100% (2)

- Wooden Furniture Manufacturing Project ReportDocument62 pagesWooden Furniture Manufacturing Project Reporttanuja 3cc100% (2)

- Analysis of Luxury Airlines Emirates and LufthansaDocument34 pagesAnalysis of Luxury Airlines Emirates and LufthansaMilena Marijanović IlićNo ratings yet

- Stewart Resume 2017Document2 pagesStewart Resume 2017Andrew StewartNo ratings yet

- Rental Property WorkSheetDocument6 pagesRental Property WorkSheetExactCPANo ratings yet

- Roshan AnnualDocument19 pagesRoshan AnnualFaiz Ullah RasoolyNo ratings yet

- Tax Lumbera Income Tax TranscriptDocument4 pagesTax Lumbera Income Tax Transcriptchibi_carolNo ratings yet

- Future HedgingDocument29 pagesFuture HedgingChRehanAliNo ratings yet

- As-22 Accounting For Taxes On Income - Brief NoteDocument5 pagesAs-22 Accounting For Taxes On Income - Brief NoteKaran KhatriNo ratings yet

- CH 14 SimulationDocument85 pagesCH 14 SimulationaluiscgNo ratings yet

- BKM Chapter 3 SlidesDocument41 pagesBKM Chapter 3 SlidesIshaNo ratings yet

- Examples of Inherent RiskDocument6 pagesExamples of Inherent Riskselozok1No ratings yet

- Trade CreditDocument6 pagesTrade CreditkoolyarNo ratings yet

- Baseball Stadium Financing SummaryDocument1 pageBaseball Stadium Financing SummarypotomacstreetNo ratings yet