Professional Documents

Culture Documents

Phase 2

Uploaded by

api-257082110Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phase 2

Uploaded by

api-257082110Copyright:

Available Formats

Phase 2 - Twenty something, young adulthood

I will start this Phase at 23 years old. In this phase I have finished University and have taken up

a full time Job. I need to find a home for myself and I will now be supporting only myself.

What is your income potential?

I will be working For BMF in Sydney. BMF is an advertising agency, direct marketer promotional

agency, media company and digital shop all rolled into one. For this company I will specialise in

cinematography and will work in various areas of the company, e.g. music video production, tv

commercial production, general film production and more. The Average income for work based

on cinematography is A$102 000 (indeed, 2014). As being new Im expecting a yearly income of

A$80 000 before tax. Tax on this income of A$80 000 is $17 547 plus 37c for each A$1 over

A$80 000. Therefore my income after tax will be A$ 62 453 or A$1 201 a week (Australian

taxation office, 2013). Because of these taxes royalty can be paid.

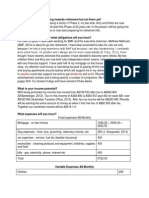

What expenses will you incur as a consequence of work?

Traffic will be bad from Freshwater to the city so if I cant drive in the fast lane with others, I will

take a bus to work. This transport expense will lead to at least A$30 a week in bus fares.

Work expenses, yearly A$

2006 Toyota Hiace $18 990 (carsales, 2014)

bus fares $1560

total 20550

note: The car will be bought with my savings.

Where will you live and what will it cost?

I will be renting a house in Graham ave, freshwater for A$1100 a week with 3 others (Domain,

2014). We will split the rent between the four of us, therefore each person will have to pay $275

a week, A$14 300 a year. The bond will also be split so that its $1100 each. The house has 4

beds, two bathrooms, one parking, rumpus room and garden. Its close to the beach, park and

shops but is far away from work.

Establishment costs (A$)

Bond 4 400

furniture 1000

telephone/utilities connections 170

total 550 4 13250 -shared expenses

Weekly variable expenses A$ (split between flatmates)

bills- electricity, gas etc 100

telephone 30

internet + mobile phone 100

necessities - cleaning products and

equipment, toiletries and food

170

rent (fixed expense) 1100

total 1500 4 35

What additional financial obligations will you have and why?

weekly expenses (A$)

car expenses - fuel, insurance,

registration etc

100

clothes 20

transport fees 30

social and recreational e.g movies, dinning

out

225

impulse buying 125

total 500

Yearly budget (A$)

Income 62 453

expenses (not including establishment costs

and car)

47 060

yearly savings 15 393

savings in total $215 401

savings after car and establishment costs 195 018.5

savings after 10 years 353 938

This money will be used as my savings plan.

What could go wrong and who can help?

If had a bad credit rating from my previous phase I could still get a loan from the bank by asking

my parents or a friend with a good credit rating to be my guarantor.

If I can't pay off my loans, repossession will take place on mine or my guarantors possessions.

For help, I can visit MoneySmart, a government website that can provide me with:

Charities and emergency help

help with debts

help with legal issues

help with housing

government assistance and concessions

free financial counsellors

fair trading contacts

(ASIC, 2014)

To avoid being over committed Ill be taking the weekend off and will make sure I leave time in

the week for relaxing and friends.

You might also like

- RflectDocument4 pagesRflectapi-257082110No ratings yet

- BibliographyDocument6 pagesBibliographyapi-257082110No ratings yet

- Hannahjune 5Document1 pageHannahjune 5api-257082110No ratings yet

- Hannahjune 3Document1 pageHannahjune 3api-257082110No ratings yet

- Juddmahalo 1Document1 pageJuddmahalo 1api-257082110No ratings yet

- Judd Mahalo5Document1 pageJudd Mahalo5api-257082110No ratings yet

- Judd Mahalo4Document1 pageJudd Mahalo4api-257082110No ratings yet

- Hannahjune 6Document1 pageHannahjune 6api-257082110No ratings yet

- Hannahjune 4Document1 pageHannahjune 4api-257082110No ratings yet

- Hannahjune 2Document1 pageHannahjune 2api-257082110No ratings yet

- Kate Upton6Document1 pageKate Upton6api-257082110No ratings yet

- Kate Upton5Document1 pageKate Upton5api-257082110No ratings yet

- Judd Mahalo6Document1 pageJudd Mahalo6api-257082110No ratings yet

- Judd Mahalo2Document1 pageJudd Mahalo2api-257082110No ratings yet

- Judd Mahalo3Document1 pageJudd Mahalo3api-257082110No ratings yet

- Kate Upton3Document1 pageKate Upton3api-257082110No ratings yet

- Kate Upton1Document1 pageKate Upton1api-257082110No ratings yet

- Kate Upton4Document1 pageKate Upton4api-257082110No ratings yet

- Kate Upton2Document1 pageKate Upton2api-257082110No ratings yet

- Ashish Banjit4Document1 pageAshish Banjit4api-257082110No ratings yet

- Ashish Banjit5Document1 pageAshish Banjit5api-257082110No ratings yet

- Ashish Banjit6Document1 pageAshish Banjit6api-257082110No ratings yet

- Ashish Banjit2Document1 pageAshish Banjit2api-257082110No ratings yet

- Ashish Banjit3Document1 pageAshish Banjit3api-257082110No ratings yet

- Phase 3Document3 pagesPhase 3api-257082110No ratings yet

- Phase 4Document3 pagesPhase 4api-257082110No ratings yet

- Ashish Banjit1Document2 pagesAshish Banjit1api-257082110No ratings yet

- Phase 5Document2 pagesPhase 5api-257082110No ratings yet

- Phase 1Document3 pagesPhase 1api-257082110No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Biosphere Reserves of IndiaDocument4 pagesBiosphere Reserves of IndiaSrinivas PillaNo ratings yet

- Hlimkhawpui - 06.06.2021Document2 pagesHlimkhawpui - 06.06.2021JC LalthanfalaNo ratings yet

- The Sanctuary Made Simple Lawrence NelsonDocument101 pagesThe Sanctuary Made Simple Lawrence NelsonSulphur92% (12)

- JPM The Audacity of BitcoinDocument8 pagesJPM The Audacity of BitcoinZerohedge100% (3)

- 5 6271466930146640792Document1,225 pages5 6271466930146640792Supratik SarkarNo ratings yet

- National University's Guide to Negligence PrinciplesDocument35 pagesNational University's Guide to Negligence PrinciplesSebin JamesNo ratings yet

- Benito Mussolini - English (Auto-Generated)Document35 pagesBenito Mussolini - English (Auto-Generated)FJ MacaleNo ratings yet

- Immigration and Exploration of The USADocument6 pagesImmigration and Exploration of The USAТетяна МешкоNo ratings yet

- Bosona and GebresenbetDocument8 pagesBosona and GebresenbetJOHNKNo ratings yet

- Annexure ADocument7 pagesAnnexure ABibhu PrasadNo ratings yet

- Lec 2 IS - LMDocument42 pagesLec 2 IS - LMDương ThùyNo ratings yet

- Mitul IntreprinzatoruluiDocument2 pagesMitul IntreprinzatoruluiOana100% (2)

- Biswajit Ghosh Offer Letter63791Document3 pagesBiswajit Ghosh Offer Letter63791Dipa PaulNo ratings yet

- Lecture Law On Negotiable InstrumentDocument27 pagesLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Heiter Skelter: L.A. Art in The 9o'sDocument2 pagesHeiter Skelter: L.A. Art in The 9o'sluis_rhNo ratings yet

- UKG Monthly SyllabusDocument4 pagesUKG Monthly Syllabusenglish1234No ratings yet

- Self Concept's Role in Buying BehaviorDocument6 pagesSelf Concept's Role in Buying BehaviorMadhavi GundabattulaNo ratings yet

- Achieving Excellence Guide 3 - Project Procurement LifecycleDocument27 pagesAchieving Excellence Guide 3 - Project Procurement LifecycleMoath AlhajiriNo ratings yet

- EXAMENUL DE BACALAUREAT 2008 Proba Orală La Limba EnglezăDocument2 pagesEXAMENUL DE BACALAUREAT 2008 Proba Orală La Limba EnglezăMar ConsNo ratings yet

- Case No. 23 - Maderada Vs MediodeaDocument3 pagesCase No. 23 - Maderada Vs MediodeaAbbyAlvarezNo ratings yet

- Unit Ii GSS I B.edDocument41 pagesUnit Ii GSS I B.edshekhar a.p0% (1)

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocument3 pagesCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemNo ratings yet

- Risk Register 2012Document2 pagesRisk Register 2012Abid SiddIquiNo ratings yet

- UntitledDocument1,422 pagesUntitledKarinNo ratings yet

- Ex For Speech About The ObesityDocument3 pagesEx For Speech About The ObesityJenniferjenniferlalalaNo ratings yet

- Ancient Civilizations - PACKET CondensedDocument23 pagesAncient Civilizations - PACKET CondensedDorothy SizemoreNo ratings yet

- Listof Licenced Security Agencies Tamil NaduDocument98 pagesListof Licenced Security Agencies Tamil NadudineshmarineNo ratings yet

- Ancient Egypt - Basic NeedsDocument3 pagesAncient Egypt - Basic NeedsSteven Zhao67% (9)

- Pedagogy of Teaching HistoryDocument8 pagesPedagogy of Teaching HistoryLalit KumarNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)