Professional Documents

Culture Documents

Basel Norms

Uploaded by

GsnrAdsenseGudimetlaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel Norms

Uploaded by

GsnrAdsenseGudimetlaCopyright:

Available Formats

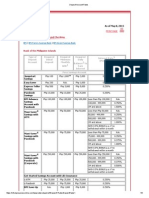

Basel Norms: What are Basel banking norms?

(Basel-III, Basel-II,

Basel- I). Short Notes on Basel Banking Norms.

The Basel Committee on Banking Supervision (BCBS) provides a forum for regular cooperation on banking

supervisory matters. Its objective is to enhance understanding of key supervisory issues and improve the quality

of banking supervision worldwide.

Currently there are 27 member nations in the committee. Basel guidelines refer to broad supervisory standards

formulated by this group of central banks- called the Basel Committee on Banking Supervision (BCBS).

What are Basel norms?

Basel is a set of standards and practices developed for global banks to ensure that they maintain adequate capital

to withstand periods of economic strain. It is a comprehensive set of reform measures designed to improve the

regulation, disclosures and risk management within the banking sector.

Basel I

In 1988, BCBS introduced capital measurement system called Basel capital accord, also called as Basel 1. It

focused almost entirely on credit risk. It defined capital and structure of risk weights for banks. The minimum

capital requirement was fixed at 8% of risk weighted assets (RWA). RWA means assets with different risk

profiles. For example, an asset backed by collateral would carry lesser risks as compared to personal loans,

which have no collateral. India adopted Basel 1 guidelines in 1999.

Basel II

In 2004, Basel II guidelines were published by BCBS, which were considered to be the refined and reformed

versions of Basel I accord. The guidelines were based on three parameters. Banks should maintain a minimum

capital adequacy requirement of 8% of risk assets, banks were needed to develop and use better risk

management techniques in monitoring and managing all the three types of risks that is credit and increased

disclosure requirements. Banks need to mandatorily disclose their risk exposure, etc to the central bank. Basel II

norms in India and overseas are yet to be fully implemented.

Basel III

In 2010, Basel III guidelines were released. These guidelines were introduced in response to the financial crisis

of 2008. A need was felt to further strengthen the system as banks in the developed economies were under-

capitalized, over-leveraged and had a greater reliance on short-term funding. Also the quantity and quality of

capital under Basel II were deemed insufficient to contain any further risk. Basel III norms aim at making most

banking activities such as their trading book activities more capital-intensive. The guidelines aim to promote a

more resilient banking system by focusing on four vital banking parameters viz. capital, leverage, funding and

liquidity.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- FiiDocument1 pageFiiGsnrAdsenseGudimetlaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Non-Performing Asset (NPA)Document1 pageA Non-Performing Asset (NPA)GsnrAdsenseGudimetlaNo ratings yet

- Short Notes On NABARDDocument1 pageShort Notes On NABARDGsnrAdsenseGudimetlaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ru PayDocument1 pageRu PayGsnrAdsenseGudimetlaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- CtsDocument1 pageCtsGsnrAdsenseGudimetlaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Banking LawsDocument2 pagesBanking LawsGsnrAdsenseGudimetlaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Basic Saving Banks AccountDocument1 pageBasic Saving Banks AccountGsnrAdsenseGudimetlaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- ASBA: What Is ASBA? - ASBA Facility, ASBA Procedure, Who Can Apply For ASBA?Document1 pageASBA: What Is ASBA? - ASBA Facility, ASBA Procedure, Who Can Apply For ASBA?GsnrAdsenseGudimetlaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Marginal Standing Facility (MSF) Rate-Definition/Meaning of Marginal Standing Facility (MSF) by Reserve Bank of India (RBI) - What Is MSF?Document1 pageMarginal Standing Facility (MSF) Rate-Definition/Meaning of Marginal Standing Facility (MSF) by Reserve Bank of India (RBI) - What Is MSF?GsnrAdsenseGudimetlaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Effect of Rbi GuidelinesDocument1 pageEffect of Rbi GuidelinesGsnrAdsenseGudimetlaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- RTGS. What Is RTGS? Short Notes On Real-Time Gross Settlement (RTGS) - All About Real-Time Gross Settlement (RTGS)Document1 pageRTGS. What Is RTGS? Short Notes On Real-Time Gross Settlement (RTGS) - All About Real-Time Gross Settlement (RTGS)GsnrAdsenseGudimetlaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- New Microsoft Office Excel WorksheetDocument62 pagesNew Microsoft Office Excel WorksheetGsnrAdsenseGudimetlaNo ratings yet

- Chief Ministers & Governors of Indian States: S. No State and U.T. Chief Minister GovernorDocument2 pagesChief Ministers & Governors of Indian States: S. No State and U.T. Chief Minister GovernorGsnrAdsenseGudimetlaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Micro, Small and Medium EnterprisesDocument1 pageMicro, Small and Medium EnterprisesGsnrAdsenseGudimetlaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- States UTs and CapitalsDocument2 pagesStates UTs and CapitalsKrishnamurthy MahamkaliNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Banking AwarenessDocument42 pagesBanking AwarenessGsnrAdsenseGudimetlaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Banking AwarenessDocument42 pagesBanking AwarenessGsnrAdsenseGudimetlaNo ratings yet

- Surya Curriculum Vitae34Document2 pagesSurya Curriculum Vitae34GsnrAdsenseGudimetlaNo ratings yet

- New Microsoft Office Excel WorksheetDocument62 pagesNew Microsoft Office Excel WorksheetGsnrAdsenseGudimetlaNo ratings yet

- 0 - Key To Bank VivaDocument54 pages0 - Key To Bank VivaTariqul IslamNo ratings yet

- Indus Motor Company Limited List of Shareholders As of 30-06-2021Document440 pagesIndus Motor Company Limited List of Shareholders As of 30-06-2021Hamza AsifNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Report On Recruitment of Life Advisors Bharti AXADocument84 pagesReport On Recruitment of Life Advisors Bharti AXAmegha140190No ratings yet

- Annuity CommissionsDocument18 pagesAnnuity CommissionsScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- UML DiagramDocument29 pagesUML DiagramDIVAGARRAJANo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Board of Director Fiduciary DutiesDocument3 pagesBoard of Director Fiduciary DutiesShan WsNo ratings yet

- Salary Slip PanchabDocument6 pagesSalary Slip Panchabapi-3847330100% (1)

- Report Income Protection and Educational PlanningDocument4 pagesReport Income Protection and Educational PlanningSyai GenjNo ratings yet

- HDFC Life Annual Report 10-11Document162 pagesHDFC Life Annual Report 10-11Dasari Chandra Kanth ReddyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- BPI Deposit Account RatesDocument5 pagesBPI Deposit Account Ratesparekoy1014No ratings yet

- ZZZZDocument109 pagesZZZZnikhils88No ratings yet

- Vero Profin Professional Indemnity GlossaryDocument9 pagesVero Profin Professional Indemnity GlossaryMichel DNo ratings yet

- 213 Keppel Cebu Vs Pioneer InsuranceDocument3 pages213 Keppel Cebu Vs Pioneer InsuranceHarry Dave Ocampo PagaoaNo ratings yet

- SSSForm Retirement ClaimDocument3 pagesSSSForm Retirement ClaimMark JosephNo ratings yet

- 4s-Logistics 2011-11 12Document8 pages4s-Logistics 2011-11 12rickreddiNo ratings yet

- JMGS1 - Recollected Questions of Exam Held in Feb-2016Document4 pagesJMGS1 - Recollected Questions of Exam Held in Feb-2016Anonymous Ey8uMU5nNo ratings yet

- Master BudgetDocument6 pagesMaster BudgetPia LustreNo ratings yet

- Firm Infrastructure Risk Management Human Resources Technologic Al Developme NTDocument3 pagesFirm Infrastructure Risk Management Human Resources Technologic Al Developme NTPrincessNo ratings yet

- Dic. Rom-EnglDocument175 pagesDic. Rom-EngltucurinaNo ratings yet

- Rbi ThesisDocument51 pagesRbi ThesisAnil Anayath100% (8)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Batch 17 1st Preboard (P1) No AnswerDocument6 pagesBatch 17 1st Preboard (P1) No AnswerAngelica manaoisNo ratings yet

- S. 604 Federal Reserve Sunshine Act - Senate Contact InfoDocument5 pagesS. 604 Federal Reserve Sunshine Act - Senate Contact InfojofortruthNo ratings yet

- Statement May 2018Document5 pagesStatement May 2018tpsroxNo ratings yet

- Bank Statement Template 1 - TemplateLabDocument1 pageBank Statement Template 1 - TemplateLabAida BrackenNo ratings yet

- Sales and Receipts CycleDocument45 pagesSales and Receipts Cyclewhitehorse123100% (2)

- Updates On Buy Back Offer (Company Update)Document52 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Performance Evaluation of Bancassurance - Bankers POV PDFDocument10 pagesPerformance Evaluation of Bancassurance - Bankers POV PDFcrescidaNo ratings yet

- Steps For EfpsDocument3 pagesSteps For EfpsMarites Domingo - PaquibulanNo ratings yet

- IIBF Vision July 2019Document8 pagesIIBF Vision July 2019Rakesh KumarNo ratings yet

- GE 04 OL Teaching Part 2-1Document11 pagesGE 04 OL Teaching Part 2-1Jose BenaventeNo ratings yet

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)