Professional Documents

Culture Documents

Ishares JPMorgan USD Emerging Markets Bond Fund

Uploaded by

Roberto PerezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ishares JPMorgan USD Emerging Markets Bond Fund

Uploaded by

Roberto PerezCopyright:

Available Formats

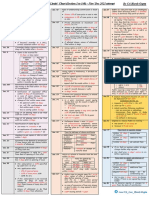

EMB

Data as of September 30, 2011

iShares JPMorgan USD Emerging

Markets Bond Fund

Fund Details

Ticker EMB

Inception Date 12/17/07

Management Fees 0.60%

Acquired Fund Fees & Expenses

0.00%

Total Annual Fund Operating

Expenses

0.60%

IOPV Ticker EMB.IV

IOPV, or Indicative Optimized Portfolio Value, is a

calculation disseminated by the stock exchange that

approximates the Fund's NAV every fifteen seconds

throughout the trading day.

CUSIP 464288281

Stock Exchange NYSE Arca

Net Assets $3.06 Billion

Effective Duration ^ 7.02 Years

Wt Avg Maturity ^^ 11.61 Years

# of Holdings 96

"Acquired Fund Fees and Expenses" reflect the

Fund's pro rata share of the indirect fees and

expenses incurred by investing in one or more

acquired funds, such as mutual funds, business

development companies or other pooled investment

vehicles. Acquired Fund Fees and Expenses are

reflected in the prices of the acquired funds and

thus included in the total returns of the Fund.

Index Characteristics

Effective Duration ^ 7.33 Years

# of Holdings 183

^ Effective Duration is a measure of the potential

responsiveness of a bond or portfolio price to small parallel

shifts in interest rates. Effective Duration takes into account

the possible changes in expected bond cash flows due to

small parallel shifts in interest rates.

^^ Weighted Average Maturity is the mean of the remaining

term to maturity of the underlying bonds in a portfolio or

index.

Fund Description

The iShares JPMorgan USD Emerging Markets Bond Fund seeks results that correspond generally to the

price and yield performance, before fees and expenses, of the JPMorgan EMBI Global Core Index (the

Index).

Index Description

The Index is a broad, diverse U.S. dollar denominated emerging markets debt benchmark which tracks

the total return of actively traded external debt instruments in emerging market countries. The

methodology is designed to distribute the weights of each country within the Index by limiting the weights

of countries with higher debt outstanding and reallocating this excess to countries with lower debt

outstanding. The Index may change its composition and weighting monthly upon rebalancing. The Index

includes both fixed and floating-rate instruments issued by sovereign and quasi-sovereign entities from

index-eligible countries. Quasi-sovereign entities are entities whose securities are 100% owned by their

respective governments or subject to a 100% guarantee that does not rise to the level of constituting the

full faith and credit by such governments. Only those instruments which: (i) are denominated in U.S.

dollars; (ii) have a current face amount outstanding of $1 billion or more; (iii) have at least two years until

maturity; (iv) are able to settle internationally through Euroclear or another institution domiciled outside

the issuing country; and (v) have bid and offer prices that are available on a daily and timely basiseither

from an inter-dealer broker or JPMorganare considered for inclusion into the Index.

Fund Performance History As of September 30, 2011

Quarter 1 Year 3 Year 5 Year 10 Years

Since Fund

Inception

Fund -2.10% -0.05% 11.00% n/a n/a 6.92%

Index -2.00% 0.70% 11.78% n/a n/a 7.68%

After Tax Held n/a -1.77% 8.84% n/a n/a 4.91%

After Tax Sold n/a -0.03% 8.14% n/a n/a 4.70%

Market Price Returns -2.49% -0.37% 10.62% n/a n/a 6.95%

The performance quoted represents past performance and does not guarantee future results.

Investment return and principal value of an investment will fluctuate so that an investor's shares,

when sold or redeemed, may be worth more or less than the original cost. Current performance

may be lower or higher than the performance quoted. Performance data current to the most recent

month end may be obtained by calling toll-free 1-800-iShares (1-800-474-2737) or by visiting

www.iShares.com.

After Tax Held Returns represent return after taxes on distributions. Assumes shares have not been sold.

After Tax Sold Returns represent the return after taxes on distributions and the sale of fund shares.

Returns are average annualized total returns, except those for periods of less than one year, which are

cumulative. Market returns are based upon the midpoint of the bid/ask spread at 4:00 PM Eastern time

(when NAV is normally determined for most iShares Funds), and do not represent the returns you would

receive if you traded shares at other times.

Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes

are unmanaged and one cannot invest directly in an index. After-tax returns are calculated using the

historical highest individual federal marginal income tax rates and do not reflect the impact of state and

local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those

shown. The after-tax returns shown are not relevant to investors who hold their fund shares through

tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

FOR MORE INFORMATION, VISIT WWW.ISHARES.COM OR CALL 1-800 ISHARES (1-800-474-2737)

Not FDIC Insured No bank guarantee May lose value

Top Ten Holdings

PHILIPPINES (REPUBLIC OF) 4.35%

TURKEY (REPUBLIC OF) 3.74%

TURKEY (REPUBLIC OF) 3.65%

RUSSIAN (FEDERATION OF) 3.61%

BRAZIL (FEDERATIVE

REPUBLIC OF)

2.97%

PERU (THE REPUBLIC OF) 2.69%

INDONESIA (REPUBLIC OF) 2.59%

PETRONAS CAPITAL LTD. 2.56%

COLOMBIA (REPUBLIC OF) 2.46%

MEXICO (UNITED MEXICAN

STATES)

2.15%

Holdings are subject to change.

Maturity Breakdown

1 - 5 years 13.17%

5 - 10 years 43.88%

10 - 15 years 2.35%

15 - 20 years 12.29%

20 - 25 years 12.48%

25+ years 12.34%

Holdings by Country

Brazil 8.12%

Turkey 7.38%

Mexico 6.97%

Philippines 6.75%

Russian Federation 6.42%

Colombia 5.37%

Indonesia 4.94%

United States 4.87%

Peru 4.00%

Other 43.76%

Other countries include: Poland 3.73%, South Africa 3.34%, Lebanon 3.12%,

Venezuela 2.73%, Kazakhstan 2.69%, Ukraine 2.65%, Malaysia 2.56%, Hungary

2.51%, Panama 2.38%, Argentina 2.11%, Uruguay 2.09%, Lithuania 2.02%, Croatia

(Hrvatska) 1.82%, Chile 1.21%, Netherlands 1.02%, Iraq 1.00%, Virgin Islands

(British) 0.97%, Sri Lanka 0.89%, Ireland 0.85%, Bulgaria 0.64%, Dominican Republic

0.56%, Cote D'Ivoire (Ivory Coast) 0.55%, Luxembourg 0.53%, Egypt 0.49%, Vietnam

0.48%, El Salvador 0.48%, Belarus 0.35%

Holdings are subject to change.

Credit Ratings

S&P/Moody's S&P/ Moody's

AAA/Aaa 0.00%/3.74%

AA+/Aa1 2.72%/0.00%

AA/Aa2 0.00%/0.00%

AA-/Aa3 0.00%/0.78%

A+/A1 0.78%/0.44%

A/A2 0.44%/3.73%

A-/A3 6.29%/2.60%

BBB+/Baa1 4.31%/16.81%

BBB/Baa2 22.46%/6.56%

BBB-/Baa3 24.29%/17.72%

BB+/Ba1 4.94%/10.13%

BB/Ba2 15.64%/14.47%

BB-/Ba3 1.17%/1.65%

B+/B1 6.95%/2.36%

B/B2 2.02%/3.87%

B-/B3 0.35%/0.35%

Not Rated 6.22%/13.35%

Other 1.44%/1.44%

S&P CCC+, CCC, CCC-, CC, C, CI, R, SD, D

and Moody's Caa1, Caa2, Caa3, Ca and C rating

categories are not displayed due to "0.00%" holdings.

Ratings are measured on a scale that generally ranges from AAA (S&P

highest) or Aaa (Moody's highest) to D (S&P lowest) or C (Moody's

lowest).

Agency and Government consists of securities that are issued by the

U.S. Treasury or U.S. Government Agencies and are not rated by S&P

or Moody's.

"Other" applies to securities for which ratings are not available.

The iShares Funds ("Funds") are distributed by SEI Investments Distribution Co. ("SEI"). BlackRock Fund Advisors ("BFA") serves as the investment advisor to the

Funds. BFA is a subsidiary of BlackRock Institutional Trust Company, N.A., neither of which is affiliated with SEI.

Investing involves risk, including possible loss of principal.

Bonds and bond funds will decrease in value as interest rates rise. International investments may involve risk of capital loss from unfavorable fluctuation in currency

values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened

risks related to the same factors as well as increased volatility and lower trading volume.

J.P. Morgan is a servicemark of JPMorgan Chase & Co. and has been licensed for use by BlackRock Institutional Trust Company, N.A. The iShares Funds are not

sponsored, endorsed, issued, sold or promoted by JPMorgan Chase & Co. This company does not make any representation regarding the advisability of investing in

the Funds. Neither SEI, nor BlackRock Institutional Trust Company, N.A., nor any of their affiliates, are affiliated with the companies listed above.

Carefully consider the iShares Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be

found in the Funds' prospectuses, which may be obtained by calling 1-800-iShares (1-800-474-2737) or by visiting www.iShares.com. Read the

prospectus carefully before investing.

2011 BlackRock Institutional Trust Company, N.A. All rights reserved. iShares

is a registered trademark of BlackRock Institutional Trust Company, N.A.

BlackRock

is a registered trademark of BlackRock, Inc. All other trademarks, servicemarks or registered trademarks are the property of their respective owners.

i

S

-

3

5

9

7

-

1

0

1

0

i

S

-

E

M

B

-

F

0

9

1

1

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Laws Essentials of Financial Management v7Document186 pagesLaws Essentials of Financial Management v7hshshdhd100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Stock ValuationDocument18 pagesStock ValuationDianne MadridNo ratings yet

- QuestionnairesDocument181 pagesQuestionnairesanon-280595100% (3)

- 04 - 05 - Option Strategies & Payoff'sDocument66 pages04 - 05 - Option Strategies & Payoff'sMohammedAveshNagoriNo ratings yet

- Gamma ScalpingDocument3 pagesGamma Scalpingprivatelogic33% (3)

- Investment BooksDocument2 pagesInvestment Bookssreekanth reddyNo ratings yet

- Company Law Limits - Nov 2021Document3 pagesCompany Law Limits - Nov 2021Udaykiran BheemaganiNo ratings yet

- MTN Operativa-Hsbc Holdings PLC CompletDocument23 pagesMTN Operativa-Hsbc Holdings PLC CompletfranviNo ratings yet

- Ishares Iboxx $ High Yield Corporate Bond FundDocument2 pagesIshares Iboxx $ High Yield Corporate Bond FundRoberto PerezNo ratings yet

- Amundi Etf Global Emerging Bond Markit IboxxDocument3 pagesAmundi Etf Global Emerging Bond Markit IboxxRoberto PerezNo ratings yet

- Amundi Etf Euro CorporatesDocument3 pagesAmundi Etf Euro CorporatesRoberto PerezNo ratings yet

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezNo ratings yet

- Amundi Etf Euro InflationDocument3 pagesAmundi Etf Euro InflationRoberto PerezNo ratings yet

- Ishares Barclays Aggregate Bond FundDocument2 pagesIshares Barclays Aggregate Bond FundRoberto PerezNo ratings yet

- Vanguard Intermediate-Term Government Bond 3-10YDocument2 pagesVanguard Intermediate-Term Government Bond 3-10YRoberto PerezNo ratings yet

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezNo ratings yet

- Ishares Iboxx $ Investment Grade Corporate Bond FundDocument2 pagesIshares Iboxx $ Investment Grade Corporate Bond FundRoberto PerezNo ratings yet

- SPDR ETF Fixed Income Characteristics Guide 10.31.2011Document5 pagesSPDR ETF Fixed Income Characteristics Guide 10.31.2011Roberto PerezNo ratings yet

- SPDR Barclays Capital Short Term Corporate Bond ETF 1-3YDocument2 pagesSPDR Barclays Capital Short Term Corporate Bond ETF 1-3YRoberto PerezNo ratings yet

- SPDR Barclays Capital Intermediate Term Treasury ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Treasury ETF 1-10YRoberto PerezNo ratings yet

- Product Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ADocument1 pageProduct Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ARoberto PerezNo ratings yet

- SPDRDocument268 pagesSPDRRoberto PerezNo ratings yet

- Vanguard Intermediate-Term Corporate Bond ETF 5-10YDocument2 pagesVanguard Intermediate-Term Corporate Bond ETF 5-10YRoberto PerezNo ratings yet

- Vanguard Short-Term Government Bond ETF 1-3YDocument2 pagesVanguard Short-Term Government Bond ETF 1-3YRoberto PerezNo ratings yet

- Vanguard Long-Term Government Bond ETF 10+Document2 pagesVanguard Long-Term Government Bond ETF 10+Roberto PerezNo ratings yet

- Vanguard Short-Term Corporate Bond ETF 1-5YDocument2 pagesVanguard Short-Term Corporate Bond ETF 1-5YRoberto PerezNo ratings yet

- SPDR Barclays Capital High Yield Bond ETF (JNK)Document2 pagesSPDR Barclays Capital High Yield Bond ETF (JNK)Roberto PerezNo ratings yet

- Lyxor ETF Iboxx Liquid High Yield 30Document2 pagesLyxor ETF Iboxx Liquid High Yield 30Roberto PerezNo ratings yet

- SPDR Barclays Capital Long Term Corporate Bond ETF 10+YDocument2 pagesSPDR Barclays Capital Long Term Corporate Bond ETF 10+YRoberto PerezNo ratings yet

- SPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YDocument2 pagesSPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YRoberto PerezNo ratings yet

- Vanguard Long-Term Corporate Bond ETF 10+Document2 pagesVanguard Long-Term Corporate Bond ETF 10+Roberto PerezNo ratings yet

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Document2 pagesSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezNo ratings yet

- Ishares Barclays 20+ Year Treasury Bond FundDocument0 pagesIshares Barclays 20+ Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 10-20 Year Treasury Bond FundDocument0 pagesIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 7-10 Year Treasury Bond FundDocument0 pagesIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 1-3 Year Treasury Bond FundDocument0 pagesIshares Barclays 1-3 Year Treasury Bond FundRoberto PerezNo ratings yet

- Ishares Barclays 3-7 Year Treasury Bond FundDocument0 pagesIshares Barclays 3-7 Year Treasury Bond FundRoberto PerezNo ratings yet

- Chapter 9-STOCK VALUATION-FIXDocument33 pagesChapter 9-STOCK VALUATION-FIXFirman HPSNo ratings yet

- Q4 Fact Sheet 2020Document4 pagesQ4 Fact Sheet 2020ogunfowotesegun35No ratings yet

- InflationDocument11 pagesInflationZakaria ZrigNo ratings yet

- 858pm24.miss. Caroline Priyanka Koorse & Dr.S.Kavitha PDFDocument8 pages858pm24.miss. Caroline Priyanka Koorse & Dr.S.Kavitha PDFRushabNo ratings yet

- What Is Equity MarketDocument2 pagesWhat Is Equity MarketVinod AroraNo ratings yet

- Bombay Stock ExchangeDocument18 pagesBombay Stock Exchangethe crashNo ratings yet

- FCCB PPT 1233754920898381 2Document14 pagesFCCB PPT 1233754920898381 2rajan2778No ratings yet

- E51 Curswap Eur UsdDocument2 pagesE51 Curswap Eur UsdkoushikNo ratings yet

- Francisco Partners CaseDocument32 pagesFrancisco Partners CaseJose M Terrés-NícoliNo ratings yet

- One Mobikwik Systems Limited: (Please Read Section 32 of The Companies Act, 2013)Document411 pagesOne Mobikwik Systems Limited: (Please Read Section 32 of The Companies Act, 2013)manmath91No ratings yet

- Jesse Lauriston LivermoreDocument4 pagesJesse Lauriston LivermoreJoseph JofreeNo ratings yet

- Watch ListDocument5 pagesWatch Listkapil vaishnavNo ratings yet

- Stock Market IndicesDocument15 pagesStock Market Indicesarco1234No ratings yet

- 11 Business Studies Notes Ch07 Sources of Business Finance 02Document10 pages11 Business Studies Notes Ch07 Sources of Business Finance 02vichmega100% (1)

- Extreme Value Hedging PDFDocument2 pagesExtreme Value Hedging PDFJudithNo ratings yet

- Bangladesh Securities and Exchange CommissionDocument6 pagesBangladesh Securities and Exchange CommissionTanvir Hasan SohanNo ratings yet

- An Assignment of Stock Exchange & Portfolio Management: Topic: - International Bond MarketDocument18 pagesAn Assignment of Stock Exchange & Portfolio Management: Topic: - International Bond MarketashishNo ratings yet

- Fin Mar Ce 910Document29 pagesFin Mar Ce 910moriary artNo ratings yet

- Morgan Stanley Sued by Us Govt and Also Merrill Lynch-Read Both HereDocument254 pagesMorgan Stanley Sued by Us Govt and Also Merrill Lynch-Read Both Here83jjmackNo ratings yet

- Sebi GuidelinesDocument20 pagesSebi GuidelinesShalini TripathiNo ratings yet

- Investment Banking QP - PGDM - TRIM 3Document6 pagesInvestment Banking QP - PGDM - TRIM 3SharmaNo ratings yet

- Shares: Prepared By: R.AnbalaganDocument10 pagesShares: Prepared By: R.AnbalaganKishan SinghNo ratings yet