Professional Documents

Culture Documents

October 18, 2007

Uploaded by

Madhav .S. ShirurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

October 18, 2007

Uploaded by

Madhav .S. ShirurCopyright:

Available Formats

October 18, 2007

Telecom Company Report

Reliance Communication

Outperformer Rs 737 Sensex: 18,716

Jaspreet Singh

(9122) 6632 2217

JaspreetSingh@PLIndia.com Spreading its Wings

Nishna Biyani

(9122) 6632 2259

NishnaBiyani@PLIndia.com We initiate coverage on Reliance Communication (Rcom) with an

Overweight rating and a price target of Rs856, which is 21x FY10

Key Figures (Rs m) earnings of the company. We expect Rcom to report an EPS CAGR of

Y/e Mar ’07 ’08E ’09E ’10E

37.7% over FY07-10. Over the next few quarters, we expect the

Net Sales 144,683 192,692 259,636 328,853 company to unlock value in its consolidated global data and voice

EBITDA 57,210 80,586 110,472 143,709 business. Moreover, we expect the company to throw up a surprise in

PAT 31,639 49,463 64,650 87,970 the wireless segment by cornering a higher incremental market share

PAT Gr. (%) 442.6 56.3 30.7 36.1

over the next two years.

EPS (Rs) 15.5 22.9 30.0 40.8

Key Ratios (%) Highlights

Y/e Mar ’07 ’08E ’09E ’10E

EBITDA Mar. 39.5 41.8 42.5 43.7 ■ Market share of wireless subscribers is expected to improve by 190bps

to 19.7% over the next three years. Introduction of sub-US$20

RoCE 10.4 12.3 14.7 18.2

handsets with multiple features and increase in coverage from 54%

RoE 18.3 18.7 18.8 20.4

to 90% by FY10, is likely to trigger a growth in the company's market

share.

Valuations (x)

Y/e Mar ’07 ’08E ’09E ’10E ■ Although we are assuming the global segment to contribute flat 15-

PER 47.7 32.2 24.6 18.1 17% overall EBITDA over the next two to three years, but the market

EV / Sales 10.6 8.6 6.4 5.0 could be in for a positive surprise, as the company has been aggressive

EV / EBITDA 26.8 20.5 15.0 11.5 in setting a robust, cost efficient integrated data and voice

MCap / Sales 10.4 8.3 6.1 4.8 infrastructure through new capacities and acquisition.

■ At the CMP of Rs737, the stock trades at a PER of 18.1x, EV/Sub of

Key Data US$459 and at an EV/E of 11.5x FY10E earnings. The valuation gap

Bloomberg Code : RCOM@IN between its nearest peer has narrowed down substantially with Bharti

Reuters Code : RLCM.BO Airtel trading at 20.4x PER and EV/E of 12.2x FY10E.

Shareholding Pattern (%)

Promoters : 66.8

Foreign : 13.6

Inst./non-Promoters : 10.1

Public & Others : 9.5 Stock price performance

Price Relative to Sensex (%)

800 Relaince Communictions Rel. to Sensex (%) - RHS 60

1 month : 15.8

50

3 months : 9.1 700

40

12 months : 52.5 600 30

(Rs)

Shares Outstanding : 2,045m 500 20

Market Cap : Rs 1,507,597m 10

400

$ 37,975m 0

Average Volume 300 (10)

Oct-06

Nov-06

Dec-06

Jan-07

Feb-07

Mar-07

Apr-07

May-07

Jun-07

Jul-07

Aug-07

Sep-07

Oct-07

(3 months) : 8.2m shares

(Price as on October 17, 2007)

Reliance Communication – Spreading its Wings

Table of Contents

Investment Highlights .............................................................. 3

Increased geographic reach to trigger subscriber growth ................................... 3

Sub-US$20-25 handsets to corner cost sensitive subscribers ................................ 3

Only Indian player to successfully operate CDMA / GSM ..................................... 4

Value unlocking over coming months .................................................................... 5

Listing of global data and voice entity ............................................................ 5

Development of SEZ at DAKC ........................................................................ 5

BPO Business ........................................................................................... 5

Investment Risks .................................................................... 6

Lower than expected gain in incremental market share ..................................... 6

Cost inefficiencies in operating dual network (GSM & CDMA) ............................... 6

Effective distribution model & after sales service .............................................. 6

Valuation & Outlook ............................................................... 7

Business Segments ................................................................. 8

Wireless ........................................................................................................ 8

Global Segment ............................................................................................. 11

Broadband ................................................................................................... 13

Tower Business .............................................................................................. 15

Company Background ........................................................... 16

Financials .......................................................................... 17

Tables & Charts

Table 1: Improvement in market share by 190bps ........................................................... 3

Chart 1: Judicious pricing and a range of options drive CDMA growth ................................. 4

Table 2: Market share where Rcom operates CDMA & GSM services ................................... 4

Chart 2: Future Triggers .......................................................................................... 5

Chart 3: Wirless Market Share of Key Operators ........................................................... 6

Table 3: Rcom vs Bharti’s key performing matrix ............................................................ 7

Chart 4: 1yr forward PE Band Chart ........................................................................... 7

Table 4: Current available low cost handsets ................................................................ 8

Chart 5: Wireless traffic/day (M mins) ......................................................................... 8

Chart 6: Low penetration in rural India to throw up huge growth opportunity ..................... 9

Chart 7: Increased coverage to drive net subscriber additions ........................................ 10

Chart 8: Composition of VAS revenue ......................................................................... 10

Chart 9: Volume in NLD showing mins per subscriber ..................................................... 11

Chart 10: Expanding FLAG’s global network ................................................................. 12

Chart 11: International bandwidth growing at 50% CAGR ................................................. 12

Chart 12: Global Ethernet data market by 2010 ............................................................ 13

Chart 13: Growth in buildings covered at 53% CQGR over last 8 quarters ............................ 14

Table 5: Actual Internet & Broadband subscriber base ................................................... 14

Chart 14: Projected Internet subscriber base by TRAI ................................................... 14

Table 6: Capex plans ............................................................................................. 15

Chart 15: Leveraging the fully integrated service platform .............................................. 16

2 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Investment Highlights

Increased geographic reach to trigger subscriber growth

Rcom plans to increase its population coverage to about 90% by FY10 from its

current level of 52-54%. The company is aggressively focusing to enter towns with

population of about 20,000 and more. It currently covers 10,000 towns and has

identified 12,000 others towns and plans to extend coverage to these as well by

FY08.

The company is also aggressively expanding operations in eight GSM circles by

setting up around 17 million lines at a cost of US$740m. This is likely to increase

its coverage of 800 towns to over 6,000 towns by FY08. Although GSM spectrum

allocation in remaining 16 circles is likely to be a major driver, we have not entirely

factored this into our estimation of subscriber growth. We expect Rcom to improve

its wireless subscriber market share by 190bps to 19.7% over the next three years

on the back of increased coverage and aggressive bundling plans.

Improvement in wireless Table 1: Improvement in market share by 190bps (Subscribers in M)

market share by 190bps to FY07 FY08E FY09E FY10E

19.7% by FY10E Bharti Airtel 37 61 87 113

% Market Share 22.9 24.1 24.4 24.7

Rcom 29 47 69 90

% Market Share 17.8 18.5 19.3 19.7

IDEA 14 24 34 45

% Market Share 8.6 9.4 9.6 9.8

Tata Teleservices 16 24 33 42

% Market Share 9.9 9.5 9.3 9.2

Hutch + BPL 28 47 68 87

% Market Share 17.0 18.4 18.9 19.0

BSNL 27 34 42 51

% Market Share 16.9 13.4 11.9 11.1

Total Wireless Subscribers (M) 162 255 357 459

Total Population (M) 1,123 1,168 1,215 1,263

Penetration (%) 14.5 21.8 29.4 36.3

Source: Company Data, PL Research

Attracting cost sensitive Sub-US$20-25 handsets to corner cost sensitive subscribers

subscribers by offering feature

Rcom currently offers Classic handsets at a price point as low as Rs777. The

rich handsets at Rs999

company is now focusing on introducing more sub-US$20 handsets to corner a

larger share of rural subscribers, who are relatively more cost sensitive than their

urban counterparts. The company has sold over 10 million Classic handsets and

has recently launched a colour handset for Rs999, which is the lowest price point

at which a colour mobile handset is currently available.

October 18, 2007 3 of 20

Reliance Communication – Spreading its Wings

Entry level handsets are Chart 1: Judicious pricing and a range of options drive CDMA growth

available for as low as US$20

Entry level CDMA Handset Prices (US$) No. of CDMA Handset Models (RHS)

160 146 70

140 60

120 50

100

78 40

80 67

30

60

40 39

33 20

40 25 20

20 10

0 0

1HFY04 2HFY04 1HFY045 2HFY05 1HFY06 2HFY06 1HFY07 2HFY07

Source: Company Data, PL Research

Only Indian player to successfully operate CDMA / GSM

Rcom has been successful in the six circles where it offers both CDMA and GSM

services. We believe the company should see a smooth transition over the next

few years to the preferred GSM technology, if it gets additional spectrum beyond

the current eight circles. It has invited bids from international players like Ericsson,

Huawaei & ZTE for about 75 million GSM lines in the remaining 15 circles. Leveraging

on its existing CDMA infrastructure and streamlining its operational cost for dual

network offering shall help Rcom to easily rollout operations in new circles.

Sucessfully operating dual Table 2: Market share where Rcom operates CDMA & GSM services (Subs. in M)

networks (both CDMA & GSM) CIRCLES Rcom Bharti BSNL Tata Total

in 6 circles Calcutta 1.49 1.33 0.76 0.98 6.09

Market share (%) 24.5 21.8 12.5 16.1

West Bengal 1.42 1.30 1.09 0.46 6.52

Market share (%) 21.7 20.0 16.7 7.1

MP 2.85 2.00 1.39 0.59 8.93

Market share (%) 31.9 22.4 15.6 6.6

Himachal Pradesh 0.34 0.68 0.50 0.09 1.67

Market share (%) 20.5 40.6 29.7 5.6

Orissa 0.87 1.26 0.81 0.32 3.62

Market share (%) 24.0 34.8 22.3 8.7

Bihar 3.20 3.11 1.24 0.68 7.80

Market share (%) 41.0 39.9 16.0 8.8

Total Subscribers 10.17 9.68 5.79 3.13 34.64

Total Mkt Share (%) 29.4 28.0 16.7 9.0

Source : TRAI, AUSPI, Company Data, PL Research Figures as on End August ‘07

4 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Value unlocking over coming months

Listing of global data and voice entity

Rcom is in the process of divesting a small stake in Flag Telecom (Flag), wholly-

owned subsidiary, in the current fiscal to PE investors or venture capitalists. This

Future triggers include global

will be followed by global listing of Flag Telecom. Funds raised through this

listing of Flag Telecom,

divestment will be deployed for the expansion of Next Generation Network (NGN).

development of its 45 acre

Infocom City as a SEZ &

scaling of its BPO business by Development of SEZ at DAKC

external client servicing

Rcom has received approval from the Maharashtra Industrial Development

Corporation (MIDC) for the development of its proposed 45-acre SEZ, which is part

of the larger 135-acre campus at Dhirubhai Ambani Knowledge City (DAKC). This

facility is expected to host around 30-40 IT and business process outsourcing

(BPO) companies.

BPO Business

Rcom currently operates a BPO at the DAKC campus, which caters to all ADAG

Group companies (Rcom, Reliance Energy, Reliance Capital, etc). It has a headcount

of 8,000 employees (working in two shifts), which is one of the largest in India at

a single location. The company has a similar facility at Chennai (with over 300

employees) and is exploring ways to expand its BPO business by external client

servicing. Future value unlocking by demerging this business seems likely.

Chart 2: Future Triggers

Reliance ADA Group Public

66% 34%

Reliance Future Triggers - Value Unlocking

Communications

95% 100% 100%

Reliance Telecom Flag Reliance DTH /

Infrastructure Telecom Telecom SEZ BPO

IPTV

Limited

Unlocking

Value

through

Global

Listing

Source: Company Data, PL Research

October 18, 2007 5 of 20

Reliance Communication – Spreading its Wings

Investment Risks

Lower than expected gain in incremental market share

The wireless segment is quite competitive with around 6-8 operators in every

circle. Any aggressive stance by an operator can substantially lower estimated

incremental market share of subscriber addition. To match the competitor's price

point, another player could reduce its prices till it becomes a vicious circle. Rcom

is also susceptible to any such development, which may increase its subscriber

acquisition cost.

Aggressive tariffs by Chart 3: Wirless Market Share of Key Operators

competitors can lead to lower

than expected incremental Bharti RCOM Total Idea Tata Teleservices Hutch + BPL BSNL

market share 25.0%

23.0%

21.0%

19.0%

17.0%

15.0%

13.0%

11.0%

9.0%

7.0%

5.0%

Jan-06

Feb-06

Jun-06

Nov-06

Dec-06

Mar-06

Apr-06

May-06

Jul-06

Aug-06

Sep-06

Oct-06

Jan-07

Feb-07

Mar-07

Apr-07

May-07

Jun-07

Jul-07

Aug-07

Source: TRAI, AUSPI, PL Research

Cost inefficiencies in operating dual network (GSM & CDMA)

Rcom will be operating dual networks, post spectrum allocation, in other circles.

This shall require additional resources to operate the alternate technology. Any

cost ineffectiveness may result in higher operating costs, thus hitting margins

directly. Subsidy to existing subscribers to shift to GSM cannot be ruled out.

Key challenges include setting Effective distribution model & after sales service

up of effective distribution

channel & after sales service

With Rcom's expansion in coverage of small towns and cities underway, a proper

distribution model is essential. Not only handsets, the company also has to plan

for effective collection points and improve after sales service. Any inefficiency on

these fronts could result in higher costs and a subsequent decline in margin going

forward.

6 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Valuation & Outlook

We believe Rcom is poised to emerge as a key beneficiary in the Indian wireless

story. With a projected subscriber base of 90.4m in FY10, we expect an EPS growth

of 39% CAGR and revenue growth of 31% CAGR over FY07-10. At the CMP of Rs737,

the stock trades at a PER of 18.1x, EV/Sub of US$459 and at an EV/E of 11.5x

FY10E earnings, while Bharti Airtel trades at 20.4x PER, EV/Sub of US$500 and EV/

E of 12.2x FY10E. We initiate coverage on Rcom with an Overweight rating and a

target price of Rs856, which is 21x FY10 earnings.

Table 3: Rcom vs Bharti’s key performing matrix

Reliance Communication Bharti Airtel

FY07 FY08E FY09E FY10E CAGR (%) FY07 FY08E FY09E FY10E CAGR (%)

Revenues (Mn) 144,683 192,692 259,636 328,853 31.1 184,202 268,350 345,143 415,426 30.8

EBIDTA (Mn) 57,210 80,586 110,472 143,709 35.5 74,407 108,529 140,089 175,184 32.7

opm (in %) 39.5 41.8 42.5 43.7 40.4 40.4 40.6 42.2

PAT (Mn) 31,639 49,463 64,650 87,970 40.1 40,621 64,663 83,571 102,731

EPS (Rs) 15.5 22.9 30.0 40.8 37.7 21.4 34.1 44.1 54.2 35.8

EV/EBIDTA (x) 26.8 20.5 15.0 11.5 28.7 20.0 15.5 12.2

PER (x) 47.7 32.2 24.6 18.1 51.5 32.4 25.0 20.4

EV/Sub (US$) 1,323 877 602 459 1,423 893 661 500

\Wireless Subs (Mn) 29 47 69 90 45.6 37 61 87 113 44.2

ARPU (Rs) 359 343 322 300 (5.8) 428 371 330 302 (10.9)

MOU (Mins) 487 494 520 530 2.8 458 470 478 491 2.3

Rcom can throw up a surprise on its global network, as it has been aggressively

setting up a robust, cost efficient integrated data and voice infrastructure through

capacity additions and acquisition. Hiving off its tower business into a new company

is likely to further help it in streamlining infrastructure sharing space with enhanced

tenancy ratio. Further, value unlocking by venturing into the BPO space (for external

clients) and development of an SEZ park (for IT & BPO players) could act as other

triggers in the coming few months.

Chart 4: 1yr forward PE Band Chart

1,200

1,000 34x

800 26x

600

(Rs)

19x

400

10x

200

0

Apr-06

Jun-06

Aug-06

Oct-06

Dec-06

Feb-07

Apr-07

Jun-07

Aug-07

Oct-07

Dec-07

Feb-08

Source: MetaStock, PL Research

October 18, 2007 7 of 20

Reliance Communication – Spreading its Wings

Business Segments

Wireless

Bundling of handsets working Cheap handsets - Luring the cost conscious

good with overall sales of

With handset prices falling to an average of Rs1,400 to Rs1,800, we expect at

classic handsets well over 10

least 200 million mobile phones and subscribers coming from tier 2 & 3 towns in

million units

the next three years. Attractive schemes introduced by Rcom (which bundles handset

with a wireless connection) at prices as low as Rs777, has been a key success

factor in increasing subscription. It is due to these efforts and the introduction of

innovative schemes since 2002 that has enabled the company to sell 10 million

handsets so far.

Table 4: Current available low cost handsets

Segment Features Cost

Youth Segment FM Radio capable phone Rs 1888

Medium Segment Colour handset Rs 999 & Rs 1234

Economy segment Entry level handset Rs 777, Rs 888 & Rs 999

Source: Company Data, PL Research

Leading handset Leading manufacturers like Nokia and Motorola are setting up plants in India with

manufacturers setting up their capacities of a million handsets every month. Relatively new manufacturers like

shop floors in India to further Samsung and LG are also setting up similar plants in Gurgaon and Pune respectively.

bring down handset costs With such large handset manufacturing capacities coming up in India, with a focus

on low cost handsets, we expect handset prices to come down below the US$20

levels and thus attract cost conscious subscribers.

High MOU to maintain revenue growth & absorb fall in tariffs

Revenue growth is expected to be robust with additional subscribers compensating

for dilution in average revenue per user (ARPU). We believe that ARPU is likely to

decline due to marginal decline in subscribers. High minutes of use (MOU) and

increased usage are likely to absorb the fall in tariff.

Chart 5: Wireless traffic/day (M mins)

1,800 Wireless Traffic/day ARPU (RHS) 370

1,600 360

1,400 350

340

1,200

(mn mins)

330

1,000

(Rs)

320

800

310

600

300

400 290

200 280

0 270

FY07 FY08E FY09E FY10E

Source: Company Data, PL Research

8 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Low penetration in rural India - The next phase of growth

The overall wireless penetration in India is around 19%, which is amongst one of

the lowest wireless penetration in all developing economies. With major operators

looking to expand their coverage in the next 20,000 key tier 2 & 3 towns, an

increase in India's rural tele-density to 5% from the current 2% may not be far off

the mark. The government, through the Universal Service Obligation (USO) fund,

is also working on various subsidy models for rolling out telecom towers and

New town rollouts to improve

broadband services in rural India.

wireless penetration from 19%

to 36% over the next 3 years Rcom is aggressively focusing to enter towns with population in excess of 20,000.

The company has identified 12,000 such towns and plans to expand from the

current 10,000 towns it covers to around 22,000 towns by FY08. It is also expanding

operations in eight GSM circles from its current coverage of 800 towns to over

6,000 towns by FY08.

Chart 6: Low penetration in rural India to throw up huge growth opportunity

Assam

North Eastern States

Jammu & kashmir

Orissa

Bihar The next

Himachal pradesh

Rajasthan phase of

West Bengal

Madhya Pradesh subscriber

Haryana

UP West growth

UP East

Punjab

Kerala

Tamilnadu

Karnataka

Andhra Pradesh

Gujarat

Maharashtra

Chennai

Kolkatta

Delhi

Mumbai

0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 90.0%

Source: TRAI, AUSPI, Company Data, PL Research

Rural India needs are focussed The biggest challenge for wireless penetration in rural India is setting up of a

towards low connection distribution channel, which is used for selling handsets and as an appropriate

charges, cheaper tariffs & collection center, to improve after sales services. Uninterrupted power supply is

wider coverage another major hindrance, as power cuts are frequent. Availability of diesel is yet

another problem where gensets need to be up and running to ensure continuity in

coverage. Rural India's needs are focused on a handset with connection, availability

of easy payment options, low connection charges, cheap incoming and outgoing

rates, better voice clarity, range of services and wide coverage.

The first phase of subscriber growth was affordability driven. The current phase

focuses more on geographical reach and visibility.

October 18, 2007 9 of 20

Reliance Communication – Spreading its Wings

Increased coverage would Chart 7: Increased coverage to drive net subscriber additions

result in 8 million plus

500

subscriber growth rate for the Take off

First Phase

450 Affordability

next 3 years

400

New Town Rollouts -

Subscribers (in million)

350 Targeting Tier II & III

300

Lifelong Plans

250

200 Next

Micro Prepaid

150 Phase

Geographi

100 Reliance Calling Party Pays

Entry/Monsoon

50

Rs 16/ Min <Rs 1/ Min

0

FY97 FY98 FY99 FY00 FY01 FY02 FY03 FY04 FY05 FY06 FY07 FY10E

Source: DOT, PL Research

Value-added services likely to grow at 45% CAGR

Share of value-added services (VAS) in total ARPU is around 5-7% for Rcom. The

mobile music market in India consists of polyphonic ring tones, ring back tones

and full track mobile downloads. The mobile music market in India recorded 50%

YoY growth on the back of more than 190 million subscribers. The overall VAS

market is around Rs30bn and is expected to grow at a CAGR of 45% over the next

three years to Rs90bn. We expect the share of VAS to rise to 8-10% of ARPU in the

next three years.

VAS contribution to overall Chart 8: Composition of VAS revenue

ARPU expected to increase

from 5-7% currently to 8-10% Others

3% Games & Data

by FY10E

P2P 7%

40%

P2A & A2P

15%

Ringtones

35%

P2P Person To Person SMS

RingTones Mono, Poly, True Tones & inclusive of caller Ring back tones

P2A & A2P Person to application & Application to person, inclusive of contests, news &

updates

Games Game downloads, wallpaper & logos

Others MMS & other subscriptions

Source: ISMAI, PL Research

10 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Global Segment

Global segment environment quite competitive

Rcom's global business margin is lower as compared to Bharti or VSNL due to its

high revenue comprising of voice segment, which is currently quite competitive.

The carrier market has been shrinking in the last two years, though volumes have

picked up substantially. This reflects the competitive environment in this space.

The key driver for increasing volume is to have wide network coverage in both

wireline and wireless segments.

Wider network coverage Chart 9: Volume in NLD showing mins per subscriber

resulting in higher use of

NLD / Subscriber 6,000 NLD Mins in Mn NLD Mins / Sub / Month (RHS) 65

5,000 60

4,000

55

3,000

50

2,000

1,000 45

0 40

Q1FY07 Q2FY07 Q3FY07 Q4FY07 Q1FY08

Source: Company Data, PL Research

Launch of calling cards in other high-density NRI markets

While majority of the calls are made to and from the US/Canada and gulf regions,

where tariffs were reduced substantially; calls to other high-density NRI markets

are also on the increase. Rcom is further looking to launch Reliance Passport

(global calling card) in other untapped high-density NRI markets in the next two

years. Currently, it has a customer base of 1.2 million as on June 2007, which has

grown by 100% YoY. This segment will primarily cater to markets where tariffs are

competitive and backhaul connectivity holds the key to increasing customer base.

Increasing coverage to 90% of Flag: unlocking value through overseas listing

world population

Rcom is increasing its global connectivity through NGN that connects 12 countries

in the Middle-East, East Africa and the Mediterranean to the rest of the world

through Flag Telecom. This would require a capital outlay of US$1.5bn over the

next three years. This project would make Flag the largest fully undersea cable

system operator, reaching 90% of the world's population.

October 18, 2007 11 of 20

Reliance Communication – Spreading its Wings

Chart 10: Expanding FLAG’s global network

Source: Company Data

US$1.5bn expansion planned Flag Telecom can be seen as a "Global Carrier's Carrier". Its target customer base

for Falcon Network is the international wholesale broadband market comprising of established carriers

or major incumbents. Its revenues are either from short-term leases or indefeasible

rights of use (IRU). Currently, Flag is focusing more on IRUs to part finance its

US$1.5bn NGN. Revenue from IRU deals are normally spread across the span of the

contract with about 20% upfront payment as pre-built commitments.

Further, surprises could come in the form of some aggressive pre-sale agreements

of NGN capacity. Flag has a total undersea cable line of 65,000km as on date and

an additional 55,000km NGN is under construction. Following the expansion, Flag

would be able to cater to 50 of the largest telecom markets from the current 30.

The company's current capacity for carriage and data transfer is roughly 3.2 tera

bytes. The growing presence of broadband access has enabled the development of

new and high bandwidth applications, particularly video. Video is now the primary

driver of internet traffic growth, including YouTube, iTunes online store, and

especially, video delivered via peer-to-peer applications such as BitTorrent. As

broadband penetration continues to increase, and new bandwidth intensive

applications emerge, wholesale network demand will remain strong.

Use of international Chart 11: International bandwidth growing at 50% CAGR

bandwidth growing since 2002

8 Used international bandwidth(Tbps) Annual growth (RHS) 80%

7 70%

6 60%

5 50%

4 40%

3 30%

2 20%

1 10%

0 0%

2002 2003 2004 2005 2006

Source: Telegeography, PL Research

12 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Flag plans to list in overseas market after diluting a minority stake. While it is

very early to arrive at a valuation, we expect it to report US$280m-300m revenue

in CY08.

Rcom to leverage the Yipes acquisition to leverage Flag's global assets going forward

acquisition of Yipes by rolling

its products & services in Rcom acquired Yipes Communication (Yipes), an Ethernet service provider in 14

other markets advanced metros of the US, in an all cash deal of US$300m in Q2FY08. Yipes

currently caters to the high growth Ethernet market of the US through its 22,000km

optic fibre network. Its products range across financial, legal, healthcare &

government verticals. Rcom is planning to rollout Yipes' products and services in

Europe, Middle-East, Asia and India on Flag's global network. This is likely to help

address the approximately US$25bn global Ethernet market by 2010. Yipes had a

turnover of approximately US$100m, with about 50% gross operating margin for

FY07.

Chart 12: Global Ethernet data market by 2010

Source: Company Data

Broadband

Still in a nascent stage

Ramping up buildings Rcom is ramping up its broadband and wireline business at a brisk pace. It has

connected via network at a continuously been increasing its network coverage, which stands at around

brisk pace 1,00,000km at the end of June 2007, and continues to further ramp-up wiring of

new buildings. Data services is expected to grow exponentially in both enterprise

and consumer segments. Rcom has been targeting enterprise data services

segment and trying to leverage on its first mover advantage in the top 30 metros,

where it has over 20,000 route km of optic fibre.

October 18, 2007 13 of 20

Reliance Communication – Spreading its Wings

Chart 13: Growth in buildings covered at 53% CQGR over last 8 quarters

Inter City Metro optic fibre connectivity (km) No. of Buildings connected via network (RHS)

120,000 700,000

100,000 600,000

500,000

80,000

400,000

60,000

300,000

40,000

200,000

20,000 100,000

0 0

Q1FY06

Q2FY06

Q3FY06

Q4FY06

Q1FY07

Q2FY07

Q3FY07

Q4FY07

Q1FY08

Source: Company Data, PL Research

Overall broadband growth in India has been dismal. The government is focusing

on increasing broadband coverage throughout India by providing subsidies through

the USO Fund.

Table 5: Actual Internet & Broadband subscriber base

Subscribers (in m) Mar-05 Mar-06 Mar-07

Internet 5.55 6.94 9.27

Broadband 0.18 1.35 2.34

Wireless Internet(through mobile handsets) 0 0 31.3

Total 5.73 8.29 42.91

Actual broadband subscriber Source : TRAI, PL Research

growth not meeting the set

targets by TRAI Chart 14: Projected Internet subscriber base by TRAI

45 Internet Subscribers Broadband subscribers

40

35

30

25

(mn)

20

15

10

5

0

2005 2007E 2010E

Source: TRAI, PL Research

14 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Tower Business

Tower entity listing at arms length

Reliance Telecom Infrastructure (RTIL) currently has 14,000 towers, which it plans

to scale up to 37,000 by FY08. Of these, 2,500 towers are incapable of infrastructure

sharing. In addition to these 14,000 towers, Rcom has secured 8,982 sites under

the USO tendering process. The company doesn't have to pay rent for these sites

for five years and also enjoys subsidy on radio frequency instruments. Collectively,

Rcom would have access to over 45,000 towers and a total of 50,000 BTS by FY08.

Earlier in July 2007, Rcom had sold 5% equity stake in RTIL to institutional investors

for a consideration of US$337m (Rs14bn) after having arrived at an equity value

of US$6.75bn for its tower business. Going forward, Rcom plans to divest a minority

stake (about 20-24%) and list RTIL as an independent company.

Infrastructure sharing a boon - Increased coverage at minimum

Infrastructure sharing to rollout time

result in increased coverage

at minimum rollout time

Inactive infrastructure constitutes around 60% of the overall tower capex. Sharing

towers help operators in not only reducing capital investment but also help facilitate

faster network rollouts. It becomes all the more attractive when prospective target

subscribers are from tier 2 & 3 towns, which are relatively low on ARPU.

Capex plans

Rcom has maintained its capex guidance of around US$4.5bn for FY08E. The table

below illustrates segment-wise guided capex.

Table 6: Capex plans

Wireless US$2.5bn Includes GSM Network Expansion of

US$740m & laying 30000 km of optic Fibre

intracity connectivity

Tower US$1.5bn Planned 23000 tower-base expansion

Global US$400m Includes Next generation network

expansion

Yipes Acquisition US$300m Offers Ethernet services in US

less RTIL 5% stake sale Proceeds US$ 337m Stake sale to 7 Institutional investors

Total Net Capex US$4.36bn

October 18, 2007 15 of 20

Reliance Communication – Spreading its Wings

Company Background

Reliance Communications Ltd. is the flagship company of Anil Dhirubhai Ambani

Group (ADAG). It is involved in telecom services covering mobile and fixed line

telephony. Other non-voice businesses include broadband, national and international

long distance services and data services, along with an exhaustive range of value-

added services and applications.

Rcom has a pan-India integrated (wireless and wireline) network that covers over

10,000 towns and 3,00,000 villages. It owns and operates one of the largest next

generation IP-enabled connectivity infrastructure, comprising over 1,65,000km

of fibre optic cable systems in India, the US, Europe, Middle-East and Asia-Pacific

regions. Its subsidiary, FLAG Telecom owns the world's largest private undersea

cable system, spanning 65,000km, and connects top business center's in developed

and emerging markets across six continents.

Chart 15: Leveraging the fully integrated service platform

Source: Company Data

16 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Financials

Key Assumptions

Y/e March FY07 FY08E FY09E FY10E

Wireless Division

1. Subscriber addition trends

Monthly Net additions (in m) 0.73 1.51 1.80 1.80

Total Subscribers End of period (in m) 28.96 47.12 68.77 90.37

% Market Share of net Additions 13.24 19.60 21.24 21.09

2. Avg. Rev. per user (ARPU in Rs) 359 343 322 300

3. Minutes of use per subscriber (MOU) 487 469 437 445

Broadband Segment

Average Wireline Subscribers (in mn) 0.40 0.73 1.04 1.44

Average Revenue per Line (in Rs) 2,375 1,915 1,805 1,627

Global Segment

NLD Traffic Carried (in Mn mins) 17,012 25,567 35,015 43,768

ILD Traffic Carried (in Mn mins) 5,550 6,719 8,093 9,308

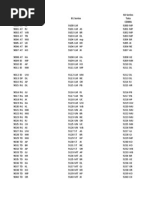

Segmental Breakup & Income Statement (Rs m)

Y/e March FY06 FY07 FY08E FY09E FY10E

Revenue

Wireless 73,640 107,276 156,639 224,118 286,452

Global 51,860 51,771 53,390 60,533 75,342

Broadband 5,130 11,442 16,850 22,470 28,088

Others 3,200 3,872 4,090 4,090 4,295

Less: Inter-segmental (26,167) (29,677) (38,277) (51,575) (65,324)

Net Revenue 107,664 144,683 192,692 259,636 328,853

Expenditure

Access charges & License fee 40,404 37,823 44,377 58,418 72,348

Network Opns cost 15,346 16,738 20,320 28,257 36,174

Employee cost 8,394 9,080 10,676 13,937 17,429

SG&A expenses 18,167 23,833 36,733 48,552 59,193

Total Operational Expenses 82,311 87,473 112,107 149,164 185,144

Improvement in margins on EBITDA 25,353 57,210 80,586 110,472 143,709

back of operating economies EBIDTA Margin (%) 23.5 39.5 41.8 42.5 43.7

kicking in Other Income 1,391 - - - -

Net interest 3,215 7 (555) 3,881 (4,438)

Depreciation & Amortisation 16,987 24,654 28,616 37,625 47,031

EBIT 9,757 32,557 51,970 72,847 96,677

PBT 6,542 32,549 54,014 68,966 101,115

Excep. & non-recurring items 374 303 - - -

Total Tax 337 609 4,567 8,400 13,145

Effective Tax Rate (%) 5.2 1.9 8.5 12.2 13.0

PAT 5,831 31,639 49,463 64,650 87,970

EBIDTA Margin Segmentwise (%)

Wireless 30.6 37.1 39.3 39.3 39.6

Global 12.4 24.6 25.0 25.5 27.0

Broadband 15.0 45.4 47.0 48.0 50.0

October 18, 2007 17 of 20

Reliance Communication – Spreading its Wings

Balance Sheet (Rs m)

Y/e March FY06 FY07 FY08E FY09E FY10E

Sources of Funds

Share capital 10,223 10,223 10,454 10,788 10,788

Reserves and surplus 107,196 219,083 288,074 378,762 461,805

Total shareholder's fund 117,419 229,306 298,528 389,550 472,592

Minority interest 96 56 91 126 176

Total loan funds 103,332 174,383 144,383 104,383 144,383

Total 220,863 403,772 443,003 494,059 617,152

Application of Funds

Fixed Assets

Gross Block 228,295 349,442 506,348 661,148 801,148

Less: Dep & impairment 47,573 55,926 84,542 122,167 169,198

Net Block 180,722 293,516 421,806 538,981 631,950

CWIP 31,305 36,907 54,800 40,000 40,000

Goodwill 2,237 26,588 - - -

Investments 22,163 77,114 38,557 25,062 50,124

Current Assets

Inventories 4,075 4,821 5,062 5,315 5,581

Debtors 16,808 18,316 26,013 28,560 39,462

Other current assets 765 13,884 14,855 15,895 17,008

Cash & cash equivalents 37,995 72,006 43,256 13,457 25,617

Loans & advances 23,668 22,103 20,998 19,948 22,940

Total current assets 83,310 131,130 110,185 83,176 110,609

Current Liabilties & Provisions

Current liabilties 79,584 114,334 125,767 132,055 145,261

Provisions 19,291 47,149 56,579 61,105 70,271

Total current liabilties & prov 98,874 161,482 182,346 193,160 215,531

Net current assets (15,564) (30,352) (72,161) (109,984) (104,923)

Total 220,862 403,772 443,003 494,059 617,152

Cash Flow (Rs m)

Y/e March FY07 FY08E FY09E FY10E

Net cash flow from Operations 71,087 119,316 139,895 125,502

Net cash flow from Investing (206,916) (112,119) (130,201) (169,990)

Net cash flow from Financing 172,077 (35,948) (39,456) 55,218

Net (Dec)/Inc in cash 36,248 (28,751) (29,762) 10,730

Opening cash equivalents 37,995 72,006 43,256 13,457

Closing cash equivalents 72,006 43,256 13,457 25,617

18 of 20 October 18, 2007

Reliance Communication – Spreading its Wings

Key Ratios

Y/e March FY07 FY08E FY09E FY10E

Return Ratios (%)

RoCE 10.4 12.3 14.7 18.2

RoE 18.3 18.7 18.8 20.4

Growth (%)

Sales 34.4 33.2 34.7 26.7

EBITDA 125.7 40.9 37.1 30.1

PAT 442.6 56.3 30.7 36.1

EPS 442.6 48.2 30.7 36.1

Liquidity

Current ratio 0.81 0.60 0.43 0.51

Acid test ratio 0.78 0.58 0.40 0.49

Per Share Ratios (Rs)

EPS 15.5 22.9 30.0 40.8

BV 112.2 138.4 180.6 219.0

CEPS 27.5 36.2 47.4 62.6

DPS 0.5 1.0 1.5 2.0

FCPS (5.3) (44.8) (17.5) (2.3)

Margins (%)

EBITDA 39.5 41.8 42.5 43.7

PAT 21.9 25.7 24.9 26.8

Tax Rate 1.9 8.5 12.2 13.0

Valuations (x)

PER 47.7 32.2 24.6 18.1

P/CEPS 26.8 20.4 15.6 11.8

P/BV 6.6 5.3 4.1 3.4

EV/EBITDA 26.8 20.5 15.0 11.5

EV/Sales 10.6 8.6 6.4 5.0

Market Cap/Sales 10.4 8.3 6.1 4.8

Others (as a % of net sales)

Access charges & license fees 26.1 23.0 22.5 22.0

Network operation cost 11.6 10.5 10.9 11.0

Employee cost 6.3 5.5 5.4 5.3

SG&A expenses 16.5 19.1 18.7 18.0

October 18, 2007 19 of 20

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India.

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

PL’s Recommendation Scale

BUY : > 15% Outperformance to BSE Sensex Outperformer : 5 to 15% Outperformance to Sensex

Market Performer : -5 to 5% of Sensex Movement Underperformer : -5 to -15% of Underperformace to Sensex

Sell : <-15% Relative to Sensex

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information

and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken

as an offer to sell or a solicitation to buy or sell any security. The information contained in this report has been obtained from sources that are considered to be reliable.

However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any

responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein. Recipients of this

report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or

otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/

advisor. Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal

or engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication. We may from time to

time solicit or perform investment banking or other services for any company mentioned in this document.

You might also like

- Lecturing (With PowerPoint)Document25 pagesLecturing (With PowerPoint)Madhav .S. ShirurNo ratings yet

- Rho Chi's Prescription For SuccessDocument24 pagesRho Chi's Prescription For SuccessMadhav .S. ShirurNo ratings yet

- Computer-Assisted Language LearningDocument14 pagesComputer-Assisted Language LearningMadhav .S. ShirurNo ratings yet

- Education and The Workforce: Delmarva in The Rural-Urban ContextDocument16 pagesEducation and The Workforce: Delmarva in The Rural-Urban ContextMadhav .S. ShirurNo ratings yet

- Presentation by Ambuja CementDocument35 pagesPresentation by Ambuja CementMadhav .S. ShirurNo ratings yet

- Shannon LizerDocument29 pagesShannon LizerMadhav .S. ShirurNo ratings yet

- Malathi Subramanian - Anupama Saxena - Prospects For Rural Women in IndiaDocument13 pagesMalathi Subramanian - Anupama Saxena - Prospects For Rural Women in IndiaMadhav .S. ShirurNo ratings yet

- Tenders DemoDocument24 pagesTenders DemoMadhav .S. ShirurNo ratings yet

- Kart Hi KeyDocument3 pagesKart Hi KeyMadhav .S. ShirurNo ratings yet

- Http://Pakistanmba - Jimdo.com For Downloading This Report and For More Projects, AssignmentsDocument9 pagesHttp://Pakistanmba - Jimdo.com For Downloading This Report and For More Projects, AssignmentsMadhav .S. ShirurNo ratings yet

- QuickTime and A TIFF (Uncompressed) Decompressor Are Needed To SeeDocument23 pagesQuickTime and A TIFF (Uncompressed) Decompressor Are Needed To SeeMadhav .S. ShirurNo ratings yet

- Part IV - Who Was Mary Magdalene?Document24 pagesPart IV - Who Was Mary Magdalene?Madhav .S. ShirurNo ratings yet

- Campus Financing Strategies For Carbon ReductionDocument12 pagesCampus Financing Strategies For Carbon ReductionMadhav .S. ShirurNo ratings yet

- Mary MagdalenDocument46 pagesMary MagdalenMadhav .S. ShirurNo ratings yet

- CogenerationDocument18 pagesCogenerationMadhav .S. ShirurNo ratings yet

- Society of Actuaries Annual MeetingDocument26 pagesSociety of Actuaries Annual MeetingMadhav .S. ShirurNo ratings yet

- 14-Sharp Shifts Raise KaineDocument3 pages14-Sharp Shifts Raise KaineMadhav .S. ShirurNo ratings yet

- 14-Sharp Shifts Raise KaineDocument3 pages14-Sharp Shifts Raise KaineMadhav .S. ShirurNo ratings yet

- Aegis Emba 07-09Document21 pagesAegis Emba 07-09Madhav .S. ShirurNo ratings yet

- 028 Combined New Hlth05Document29 pages028 Combined New Hlth05Madhav .S. ShirurNo ratings yet

- Madhav Shirur WSJDocument5 pagesMadhav Shirur WSJMadhav .S. ShirurNo ratings yet

- Company ProfileDocument33 pagesCompany ProfileMadhav .S. ShirurNo ratings yet

- Retail SectorsDocument2 pagesRetail SectorsMadhav .S. ShirurNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Human Resource Management HR Practices of Two Organizations Airtel & Vodafone Profile of Airtel & VodafoneDocument15 pagesHuman Resource Management HR Practices of Two Organizations Airtel & Vodafone Profile of Airtel & Vodafoneaashis8355No ratings yet

- Customer Satisfaction Towards JioDocument7 pagesCustomer Satisfaction Towards JioRanjit Jacob100% (1)

- Raj Kumar Reliance JIODocument77 pagesRaj Kumar Reliance JIOlekha ahlawatNo ratings yet

- Report FinalDocument162 pagesReport Finalsheenapathak7033No ratings yet

- Vodafone mobile bill for Rs. 634.84Document1 pageVodafone mobile bill for Rs. 634.84Himansu Kumar SahooNo ratings yet

- Advertising Presentation Vodafone ZooZooDocument14 pagesAdvertising Presentation Vodafone ZooZoolathifullalNo ratings yet

- Organisation Structure of Air Tel: Sri. - BBM Degree College, GulbargaDocument49 pagesOrganisation Structure of Air Tel: Sri. - BBM Degree College, GulbargaManjunath@1160% (1)

- International Roaming Rates and Providers GuideDocument7 pagesInternational Roaming Rates and Providers GuidejosblacanNo ratings yet

- An Analysis of Recruitment and Selection at AirtelDocument90 pagesAn Analysis of Recruitment and Selection at AirtelApoorva JainNo ratings yet

- All Call Query (Acq) Query On Release (Qor) Call DropbackDocument31 pagesAll Call Query (Acq) Query On Release (Qor) Call DropbackAnurag MishraNo ratings yet

- Bajaj Finance - Upto 50K SalaryDocument142 pagesBajaj Finance - Upto 50K Salarysekhar_g5332No ratings yet

- Consumerism and Competition Law: An Analysis of the Jio IssueDocument34 pagesConsumerism and Competition Law: An Analysis of the Jio IssueraaziqNo ratings yet

- Intro - /bharti Airtel, Formerly Known As Bharti Tele-Ventures LimitedDocument8 pagesIntro - /bharti Airtel, Formerly Known As Bharti Tele-Ventures Limitedaminiff100% (1)

- Update - Reliance Jio - The Game Changer - December 2018Document5 pagesUpdate - Reliance Jio - The Game Changer - December 2018NLDFNANo ratings yet

- Retail Management Case StudyDocument81 pagesRetail Management Case StudyBabita Antil0% (1)

- 90 Series 91 Series 92 Series Tata CdmaDocument40 pages90 Series 91 Series 92 Series Tata CdmaritzofficeNo ratings yet

- LIST HRDocument27 pagesLIST HRAvdhesh ShuklaNo ratings yet

- Banking PDF DownloadDocument94 pagesBanking PDF DownloadVetrivelNo ratings yet

- VIL Begins OperationsDocument6 pagesVIL Begins OperationsSunil JainNo ratings yet

- BSNLDocument25 pagesBSNLSaurabh G100% (5)

- Vodafone-Idea Merger and Verizon's Acquisition of Vodafone Assets AnalyzedDocument14 pagesVodafone-Idea Merger and Verizon's Acquisition of Vodafone Assets Analyzed1005Ritushree GoswamiNo ratings yet

- SWOT Analysis On Jio: StrengthDocument3 pagesSWOT Analysis On Jio: StrengthAmal Raj SinghNo ratings yet

- Executive Summary: Organization Study at BHARTI AIRTELDocument54 pagesExecutive Summary: Organization Study at BHARTI AIRTELLalkar GompatilNo ratings yet

- Analysis of Telecommunication Sector Performance and Status in India Using Tableau (1P17MB080) Part 2Document26 pagesAnalysis of Telecommunication Sector Performance and Status in India Using Tableau (1P17MB080) Part 2FráñcisNo ratings yet

- World's GPRS APN List: More Information About GPRS User Name, Password and Apn, Please Refer To Your Telecom. CO., LTDDocument11 pagesWorld's GPRS APN List: More Information About GPRS User Name, Password and Apn, Please Refer To Your Telecom. CO., LTDAlfi SanNo ratings yet

- 3G Economic TimesDocument1 page3G Economic Timeslokesh2983No ratings yet

- A Study On Stress Related Problem Faced by The EmployeesDocument96 pagesA Study On Stress Related Problem Faced by The EmployeesPallavi SelvarajNo ratings yet

- Idea Cellular LTDDocument495 pagesIdea Cellular LTDlijeshchandran100% (1)

- Project ReportDocument37 pagesProject Reportsmart_neo24100% (2)

- Mobile NDocument15 pagesMobile NckmmrhNo ratings yet