Professional Documents

Culture Documents

Analysis of Sbi P. Loan

Uploaded by

gurjit20Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Sbi P. Loan

Uploaded by

gurjit20Copyright:

Available Formats

Do you have an account with SBI bank?

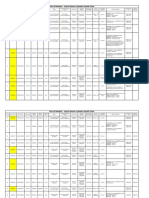

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B. NO

80

20

80

20

TOTAL

100

100

INTERPRETATION:

Among 100 respondents 80 are SBI Customers and have different accounts and have transactions

in SBI Bank.

A.YES B. NO

8

0

2

0

0

10

20

30

40

50

60

70

80

P

E

R

C

E

N

T

A

G

E

PARTICULARS

, which are the Personal Banking products you deal with SBI (Savings Account).

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

80

20

80

20

TOTAL

100

100

INTERPRETATION:

80% of the customers have got savings account in SBI Bank and remaining 20% of them use

other accounts.

A.YES B. NO

8

0

2

0

0

10

20

30

40

50

60

70

80

P

E

R

C

E

N

T

A

G

E

PARTICULARS

, which are the Personal Banking products you deal with SBI (Auto Loan).

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

23

77

23

77

TOTAL

100

100

INTERPRETATION:

23% of the respondents have taken Auto Loan. There are fewer respondents in case of fixed

deposit because it is kept for long time, which will be fixed.

A.YES B. NO

2

3

7

7

0

10

20

30

40

50

60

70

80

P

E

R

C

E

N

T

A

G

E

P AR TI CULAR S

, which are the Personal Banking products you deal with SBI (Home Loan).

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

14

86

14

86

TOTAL

100

100

INTERPRETATION:

Only 14% of the respondents have borrowed for Loan for Construction of Home, i.e. Home

Loan.

A.YES B. NO

1

4

8

6

0

10

20

30

40

50

60

70

80

90

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

which are the Personal Banking products you deal with SBI (Education Loan)

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

2

98

2

98

TOTAL

100

100

INTERPRETATION:

Few of them i.e. 2% have taken education loan in SBI Bank and remaining have either deposited

or borrowed loan for some other purpose.

A.YES B. NO

2

9

8

0

10

20

30

40

50

60

70

80

90

100

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

, which is the Personal Banking products you deal with SBI (Debit Card [ATM Card])

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

71

29

71

29

TOTAL

100

100

INTERPRETATION:

There are 71% of the customer who are using Debit cards and 29% of them dont use Debit card.

A.YES B. NO

7

1

2

9

0

10

20

30

40

50

60

70

80

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

. Which are the Personal Banking products you deal with SBI (Credit Card).

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B.NO

24

76

24

76

TOTAL

100

100

INTERPRETATION:

There are 24% of the customer who are using Credit cards and 76% of them dont use other

cards.

A.YES B. NO

2

4

7

6

0

10

20

30

40

50

60

70

80

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

The factors that made you to become a part of the SBI (Convenience)

PARTICULARS

FREQUENCY

PERCENTAGE

Very good

Good

Ok

Bad

Very bad

41

26

39

0

1

41

26

39

0

1

Total

Missing system

80

20

80

20

TOTAL 100 100

INTERPRETATION:

The main factor for some customer is Convenience where 41% of them have said Very Good,

26% have said Good and remaining i.e. 39% said it Ok and remaining 1% said very badly.

Very

good

Good Ok Bad Very bad

4

1

2

6

3

9

0

1

0

5

10

15

20

25

30

35

40

45

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

The factors that made you to become a part of the SBI (Service)

INTERPRETATION:

36% Respondents have said that the service is the first factor which made them to open account

in SBI Bank. The other 28% of them have said good for the service given, 12% have said its Ok,

and 4% of them have said Bad.

Very

good

Good Ok Bad Very bad

3

6

2

8

1

2

4

0

0

5

10

15

20

25

30

35

40

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Very good

Good

Ok

Bad

Very bad

36

28

12

4

0

36

28

12

4

0

Total

Missing system

80

20

80

20

TOTAL 100 100

The factors that made you to become a part of the SBI (Interest Rates).

INTERPRETATION:

The Interest rate is Very Good for 25%, 30% have said its Good ,23% have said Ok ,and

Remaining 2% have said Bad.

Very

good

Good Ok Bad Very bad

2

5

3

0

2

3

2

0

0

5

10

15

20

25

30

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Very good

Good

Ok

Bad

Very bad

25

30

23

2

0

25

30

23

2

0

Total

Missing system

80

20

80

20

TOTAL 100 100

The factors that made you to become a part of the SBI (Loan facilities).

INTERPRETATION:

The Loan facility is also the factor, which influenced to transact with SBI Bank, and 39% have

said is Ok, 20% respondents have said Good ,18% have said it as Very Good and remaining 3%

have said Bad.

Very

good

Good Ok bad Very bad

1

8

2

0

3

9

3

0

0

5

10

15

20

25

30

35

40

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Very good

Good

Ok

bad

Very bad

18

20

39

3

0

18

20

39

3

0

Total

Missing system

80

20

80

20

TOTAL 100 100

The Transactions done in SBI are

INTERPRETATION:

13% of the respondents say that the transactions are Moderate, 63% is quick and remaining 4%

say it as slow.

Quick Moderate Slow

6

3

1

3

4

0

10

20

30

40

50

60

70

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Quick

Moderate

Slow

63

13

4

63

13

4

Total

Missing system

80

20

80

20

TOTAL 100 100

How will you get to know about SBI Personal Banking facilities or the offers?

INTERPRETATION:

The Products and Offers of SBI Bank are known through Newspapers which we can see in the

above bar diagram 61%, from News Paper, 7% from Websites, TV advertisement is 6% and 6%

from Any Other i.e. Personal Approach.

News

paper

Website TV-

advertise

ments

Any

other

6

1

7

6

6

0

10

20

30

40

50

60

70

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

News paper

Website

TV-advertisements

Any other

61

7

6

6

61

7

6

6

Total

Missing system

80

20

80

20

TOTAL 100 100

How frequently you use the Personal Banking products. (Savings A/c)

PARTICULARS

FREQUENCY

PERCENTAGE

Weekly

Monthly

Quarterly

Yearly

35

45

0

0

35

45

0

0

Total

Missing system

80

20

80

20

TOTAL 100 100

INTERPRETATION:

35% of the respondents who are having Savings Account in SBI Bank visit weekly and 45% visit

monthly.

Weekly Monthly Quarterly Yearly

3

5

4

5

0

0

0

5

10

15

20

25

30

35

40

45

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

How frequently you use the Personal Banking products (Home Loan)

PARTICULARS

FREQUENCY

PERCENTAGE

Weekly

Monthly

Quarterly

Yearly

Others

0

6

6

2

66

0

6

6

2

66

Total

Missing system

80

20

80

20

TOTAL 100 100

INTERPRETATION:

Some of the respondent who are having Home Loan in SBI Bank said that they will visit Yearly

to pay the interest which is 2%, 6% of the respondent said they will visit Quarterly and

remaining 6% Monthly.

Weekly Monthly Quarterly Yearly

0

6

6

2

0

1

2

3

4

5

6

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

How frequently you use the Personal Banking products (Education Loan)

PARTICULARS

FREQUENCY

PERCENTAGE

Weekly

Monthly

Quarterly

Yearly

Others

0

0

1

1

78

0

0

1

1

78

Total

Missing system

80

20

80

20

TOTAL 100 100

INTERPRETATION:

The respondents of Education Loan visit SBI Bank Quarterly or Yearly on the basis of terms and

conditions.

Weekly Monthly Quarterly Yearly

0

0

1

1

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

How frequently you use the Personal Banking products (Debit Card)

INTERPRETATION:

64% respondent who are having Debit Card in SBI Bank use it weekly, 6% of them use monthly

and remaining 1% of them use quarterly.

Weekly Monthly Quarterly Yearly

6

4

6

1

0

0

10

20

30

40

50

60

70

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Weekly

Monthly

Quarterly

Yearly

Others

64

6

1

0

9

64

6

1

0

9

Total

Missing system

80

20

80

20

TOTAL 100 100

How frequently you use the Personal Banking products (Credit Card)

INTERPRETATION:

4 % of SBI customers use Credit Card weekly and 17% of them use monthly and 3% of them use

quarterly.

Weekly Monthly Quarterly Yearly

4

1

7

3

0

0

2

4

6

8

10

12

14

16

18

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Weekly

Monthly

Quarterly

Yearly

Others

4

17

3

0

56

4

17

3

0

56

Total

Missing system

80

20

80

20

TOTAL 100 100

How do you feel Interest rate of SBI PERSONAL products Borrowings?

INTERPRETATION:

19% of the respondents say that the interest on Borrowings is Moderate and 61% of them say

interest rate is good.

Good Moderate Poor

6

1

1

9

0

0

10

20

30

40

50

60

70

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Good

Moderate

Poor

61

19

0

61

19

0

Total

Missing system

80

20

80

20

TOTAL 100 100

How do you rank SBI Personal Banking Products?

INTERPRETATION:

The SBI customer Rank the SBI products as shown in the above chart. 26% of them say the

PERSONAL products of SBI are good, 50% rank them as Best, 3% rank it as Moderate and

remaining 1% rank them as poor.

Best Good Moderate Poor Very poor

5

0

2

6

3 1

0

0

5

10

15

20

25

30

35

40

45

50

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

PARTICULARS

FREQUENCY

PERCENTAGE

Best

Good

Moderate

Poor

Very poor

50

26

3

1

0

5O

26

3

1

0

Total

Missing system

80

20

80

20

TOTAL 100 100

Are you interested to transact with SBI PERSONAL products?

PARTICULARS

FREQUENCY

PERCENTAGE

A.YES

B. NO

99

1

99

2

TOTAL 100 100

INTERPRETATION:

Among the respondent 99% said they wish to transact or deal with personaling products of SBI

bank and 1% of them said dont want to open account.

A.YES B. NO

9

9

1

0

10

20

30

40

50

60

70

80

90

100

P

E

R

C

E

N

T

A

G

E

P ARTI CULARS

FINDINGS

Among 100 respondents 80 are SBI Customers and have different accounts and have

transactions in SBI Bank.

80% of the customers have got savings account in SBI Bank and remaining 20% of

them use other accounts.

23% of the respondents have deposits in Fixed Deposits. There are fewer respondents

in case of fixed deposit because it is kept for long time which will be fixed.

Only 14% of the respondents have borrowed for Loan for Construction of Home, i.e.

Home Loan.

Few of them i.e. 2% have taken education loan in SBI Bank and remaining have

either deposited or borrowed loan for some other purpose.

There are 71% of the customer who are using Debit cards and 29% of them dont use

Debit card.

There are 24% of the customer who are using Credit cards and 76% of them dont use

other cards.

There are 19% of the customers who are using On-Line Banking and 81% of them

dont use On-Line Banking.

There is good response regarding the rate of return. Many of the respondents have

said that the rate of return is good i.e. 68% and 12% have said it as moderate.

The main factor for some customer is Convenience where 41% of them have said

Very Good, 26% have said Good and remaining i.e. 39% said it Ok and remaining

1% said very badly.

36% Respondents have said that the service is the first factor which made them to

open account in SBI Bank. The other 28% of them have said good for the service

given, 12% have said its Ok, and 4% of them have said Bad.

The Interest rate is Very Good for 25%, 30% have said its Good, 23% have said Ok,

and Remaining 2% have said Bad.

The Loan facility is also the factor, which influenced to transact with SBI Bank, and

39% have said is Ok, 20% respondents have said Good, 18% have said it as Very

Good and remaining 3% have said Bad.

13% of the respondents say that the transactions are Moderate, 63% is quick and

remaining 4% say it as slow.

The Products and Offers of SBI Bank are known through Newspapers which we can

see in the above bar diagram 61%, from News Paper, 7% from Websites, TV

advertisement is 6% and 6% from Any Other i.e. Personal Approach.

35% of the respondents who are having Savings Account in SBI Bank visit weekly

and 45% visit monthly.

14% of the respondents who are having Fixed Deposits in SBI Bank visit to know

about their balance yearly and there are respondent who visit quarterly where the

percentage is 9% respectively.

Some of the respondent who are having Home Loan in SBI Bank said that they will

visit Yearly to pay the interest which is 2%, 6% of the respondent said they will visit

Quarterly and remaining 6% Monthly.

The respondents of Education Loan visit SBI Bank Quarterly or Yearly on the basis

of terms and conditions.

64% respondent who are having Debit Card in SBI Bank use it weekly, 6% of them

use monthly and remaining 1% of them use quarterly.

4 % of SBI customers use Credit Card weekly and 17% of them use monthly and 3%

of them use quarterly.

There are 14% of the customers who are using On-Line Banking weekly and 5% of

them are using monthly.

19% of the respondents say that the interest on Borrowings is Moderate and 61% of

them say interest rate is good.

Among the respondent 99% said they wish to transact or deal with persona ling

products of SBI bank and 1% of them said dont want to open account.

The SBI customer Rank the SBI products as shown in the above chart. 26% of them

say the PERSONAL products of SBI are good, 50% rank them as Best, 3% rank it as

Moderate and remaining 1% rank them as poor.

RECOMMENDATIONS

The costumers are aware of only few products of SBI PERSONAL banking products.

So bank should provide the information regarding the availability of the products.

Disbursement of loans should be quickly done as and when required.

There are many People who dont know about On-Line Banking, so bank should

help to know about the operations and facilities.

The bank should provide information relating to Interest. They should help to

know how floating or fixed rate of interest is charged and the terms and conditions.

CONCLUSION

Most of the customers are aware of few SBI PERSONAL banking products like Home Loan,

Savings Account, Education loan and they are not aware of products like Loan against Shares &

Debentures, Loan against Mortgage of Property. So the bank should help the customers to know

about such products, which they are less aware. They are satisfied on the interest of PERSONAL

Banking products. SBI Bank is providing a good service to the customers and it can be termed as

satisfactory from the respondents (Questioner).

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 50 Years of Teaching PianoDocument122 pages50 Years of Teaching PianoMyklan100% (35)

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- #3011 Luindor PDFDocument38 pages#3011 Luindor PDFcdouglasmartins100% (1)

- Trading As A BusinessDocument169 pagesTrading As A Businesspetefader100% (1)

- Impact of Green Marketing Initiatives On PDFDocument79 pagesImpact of Green Marketing Initiatives On PDFpraful s.gNo ratings yet

- PROF ED 10-ACTIVITY #1 (Chapter 1)Document4 pagesPROF ED 10-ACTIVITY #1 (Chapter 1)Nizelle Arevalo100% (1)

- Postgraduate Notes in OrthodonticsDocument257 pagesPostgraduate Notes in OrthodonticsSabrina Nitulescu100% (4)

- Deg Final - 201911231344-1Document2 pagesDeg Final - 201911231344-1gurjit20No ratings yet

- Originalonedigitalindiaproject 160502065045Document95 pagesOriginalonedigitalindiaproject 160502065045gurjit20No ratings yet

- New ShowGeneralReportDocument1 pageNew ShowGeneralReportgurjit20No ratings yet

- St. Xavier's College Journalism Dept Project ReportDocument1 pageSt. Xavier's College Journalism Dept Project Reportgurjit20No ratings yet

- AcknowledgementDocument1 pageAcknowledgementgurjit20No ratings yet

- List of FiguresDocument3 pagesList of Figuresgurjit20No ratings yet

- Measuring Conversions and Equivalents ChartDocument38 pagesMeasuring Conversions and Equivalents Chartgurjit20No ratings yet

- Certificate BiotechDocument11 pagesCertificate Biotechgurjit20No ratings yet

- IndexDocument1 pageIndexgurjit20No ratings yet

- Table of Contents for Research ProjectDocument1 pageTable of Contents for Research Projectgurjit20No ratings yet

- Form 1282 PDFDocument1 pageForm 1282 PDFgurjit20No ratings yet

- Huma ResumeDocument1 pageHuma Resumegurjit20No ratings yet

- Whomsoever It May Concern: (Batch 2018-2020)Document2 pagesWhomsoever It May Concern: (Batch 2018-2020)gurjit20No ratings yet

- St. Xavier's College Ranchi Certificate Project CompletionDocument1 pageSt. Xavier's College Ranchi Certificate Project Completiongurjit20No ratings yet

- Moti Presentation1Document8 pagesMoti Presentation1gurjit200% (1)

- First Cut-Off Marks For Admission To Intermediate Class XI Session 2017-2019Document1 pageFirst Cut-Off Marks For Admission To Intermediate Class XI Session 2017-2019gurjit20No ratings yet

- HistoryDocument1 pageHistorygurjit20No ratings yet

- CertificateDocument1 pageCertificategurjit20No ratings yet

- Submitted To: Submitted byDocument1 pageSubmitted To: Submitted bygurjit20No ratings yet

- Business IntelligenceDocument6 pagesBusiness Intelligencegurjit20No ratings yet

- Kalyan: Welfare Department, Govt. of JharkhandDocument1 pageKalyan: Welfare Department, Govt. of Jharkhandgurjit20No ratings yet

- Internet Banking Cashless Transaction Need, Importance, Working Objective MethodologyDocument1 pageInternet Banking Cashless Transaction Need, Importance, Working Objective Methodologygurjit20No ratings yet

- ContentDocument7 pagesContentgurjit20No ratings yet

- (F) Purchase Invoice New-0Document2 pages(F) Purchase Invoice New-0gurjit20No ratings yet

- Examination FormDocument2 pagesExamination Formgurjit20No ratings yet

- BibliographyDocument1 pageBibliographygurjit20No ratings yet

- Zee News Headquarters in Noida, Uttar PradeshDocument3 pagesZee News Headquarters in Noida, Uttar Pradeshgurjit20No ratings yet

- Janum Angara, Ranchi: Submitted To: Submitted byDocument1 pageJanum Angara, Ranchi: Submitted To: Submitted bygurjit20No ratings yet

- The Person Is Liable To Pay Service Tax IsDocument3 pagesThe Person Is Liable To Pay Service Tax Isgurjit20No ratings yet

- 2023 Test Series-1Document2 pages2023 Test Series-1Touheed AhmadNo ratings yet

- TWP10Document100 pagesTWP10ed9481No ratings yet

- Reg FeeDocument1 pageReg FeeSikder MizanNo ratings yet

- 5511Document29 pages5511Ckaal74No ratings yet

- Guidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016Document76 pagesGuidelines On Occupational Safety and Health in Construction, Operation and Maintenance of Biogas Plant 2016kofafa100% (1)

- GlastonburyDocument4 pagesGlastonburyfatimazahrarahmani02No ratings yet

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDocument4 pagesData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêNo ratings yet

- 2023-Physics-Informed Radial Basis Network (PIRBN) A LocalDocument41 pages2023-Physics-Informed Radial Basis Network (PIRBN) A LocalmaycvcNo ratings yet

- Obstetrical Hemorrhage: Reynold John D. ValenciaDocument82 pagesObstetrical Hemorrhage: Reynold John D. ValenciaReynold John ValenciaNo ratings yet

- Rohit Patil Black BookDocument19 pagesRohit Patil Black BookNaresh KhutikarNo ratings yet

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliNo ratings yet

- PointerDocument26 pagesPointerpravin2mNo ratings yet

- Budgetary ControlsDocument2 pagesBudgetary Controlssiva_lordNo ratings yet

- NLL - Elementary - Coursebook 2019 PDFDocument24 pagesNLL - Elementary - Coursebook 2019 PDFgilmolto100% (1)

- Nokia MMS Java Library v1.1Document14 pagesNokia MMS Java Library v1.1nadrian1153848No ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- DC Motor Dynamics Data Acquisition, Parameters Estimation and Implementation of Cascade ControlDocument5 pagesDC Motor Dynamics Data Acquisition, Parameters Estimation and Implementation of Cascade ControlAlisson Magalhães Silva MagalhãesNo ratings yet

- DECA IMP GuidelinesDocument6 pagesDECA IMP GuidelinesVuNguyen313No ratings yet

- Neuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisDocument32 pagesNeuropsychological Deficits in Disordered Screen Use Behaviours - A Systematic Review and Meta-AnalysisBang Pedro HattrickmerchNo ratings yet

- Bharhut Stupa Toraa Architectural SplenDocument65 pagesBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNo ratings yet

- April 26, 2019 Strathmore TimesDocument16 pagesApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- Free Radical TheoryDocument2 pagesFree Radical TheoryMIA ALVAREZNo ratings yet

- Malware Reverse Engineering Part 1 Static AnalysisDocument27 pagesMalware Reverse Engineering Part 1 Static AnalysisBik AshNo ratings yet