Professional Documents

Culture Documents

Derivatives Strategy

Uploaded by

Vanessa DavisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Strategy

Uploaded by

Vanessa DavisCopyright:

Available Formats

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai 400 042, Maharashtra. Tel: 022 - 61150000. BSE Cash-INB011073351; F&O-

INF011073351; NSE INB/INF231073330; CD - INE231073330; MCX Stock Exchange: CD - INE261073330 DP: NSDL-IN-DP-NSDL-

233-2003; CDSL-IN-DP-CDSL-271-2004; PMS INP000000662; Mutual Fund: ARN 20669. Sharekhan Commodities Pvt. Ltd.: MCX-

10080; (MCX/TCM/CORP/0425); NCDEX -00132; (NCDEX/TCM/CORP/0142)

View:

The September series witnessed a weak start and the index

continued to slide further downwards over domestic

concern such as CAGs report on coal mines allocation and

policy inaction followed by global events. The rollover in

Nifty stood at 64.09%, which is below its 3-month and 6-

month average rollover of 65.75% and 65.84% respectively

followed by decrease in the rollover cost indicating

majority of the positions have been rolled on the short

side. The Nifty is trading below its volume weighted

average price (VWAP) and has multiple resistances above

5400 levels. On the contra side strike of 5200 put option

stands with highest number of shares in open interest (OI)

and in the August series we have seen that 5200 acted as a

good support. So unless and until Nifty is holding above

5200 levels we think that market may rebound. Hence we

are forming Butterfly Spread Strategy in Nifty with a

negligible risk appetite.

Strategy Pay-off & Explanation

Sailing sideways

Visit us at www.sharekhan.com September 06, 2012

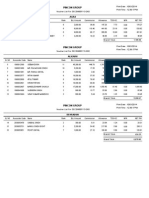

Strategy stats

Scrip Name Nifty

Future Price 5245

View Range Contraction

Strategy Name Butterfly Spread

Potential Profit (Rs) 8,410

Potential Loss (Rs) -1,590

Timeframe September Expiry

Risk: Reward 0.19

Margin Requirement (Approx.) 31,180

Return On Investment 26.97%

Loss On Investment -5.10%

continued on page 2

Butterfly Spread:

A Butterfly Spread is created with a combination of buying

and selling of options. It is limited risk and limited profit

strategy with favorable risk: reward ratio. A long butterfly

spread is generally formed when market/stock is

expected to contract its range. Long butterfly spread

can be constructed by buying slightly out the money call

option followed by buying of higher strike call option

and selling double quantity of mid strike call option to

that of purchased call options.

Date Scrip Action Rate Quantity Outflow

6-SEP-12 NIFTY CE 5300 BUY 54.60 100

6-SEP-12 NIFTY CE 5400 SELL 23.25 200 15.90

6-SEP-12 NIFTY CE 5500 BUY 7.80 100

Strategy note:

Strategy has an initial outflow of 15.90 points in Nifty,

which amounts to Rs. 1,590 (15.90*100), which is also

maximum risk in the strategy. The maximum profit

potential in the strategy amounts to Rs. 8,410 (84.10*100)

which can be incurred if Nifty expiry at 5400 levels. Higher

BEP in the strategy is 5484.10 & lower BEP is 5315.90

above & below which strategy will incur maximum loss

that is Rs. 1,590.

Please refer the payoff chart on page 2 for better

explanation of profit & loss

(*) For any clarification you can mail to

nandish@sharekhan.com

2 Sharekhan

Home Next July 30, 2012

sharekhan derivatives ideas

Payoff chart

Disclaimer

This document has been prepared by Sharekhan Ltd.(SHAREKHAN) This Document is subject to changes without prior notice and is intended only for the person or entity to which it is addressed to and may contain confidential and/or

privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document does not constitute an offer or solicitation for the purchase or sale of any financial

instrument or as an official confirmation of any transaction.

Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is from publicly available data or other sources believed to be reliable. While we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated

companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and

affiliates from doing so. We do not represent that information contained herein is accurate or complete and it should not be relied upon as such. This document is prepared for assistance only and is not intended to be and must not alone

betaken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent

evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment

discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all

jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

SHAREKHAN & affiliates may have used the information set forth herein before publication and may have positions in, may from time to time purchase or sell or may be materially interested in any of the securities mentioned or related

securities. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates

or any third party involved in, or related to, computing or compiling the information have any liability for any damages of any kind. Any comments or statements made herein are those of the analyst and do not necessarily reflect those

of SHAREKHAN.

PAYOFF DIAGRAM

-40

-20

0

20

40

60

80

100

5

0

0

0

5

0

5

0

5

1

0

0

5

1

5

0

5

2

0

0

5

2

5

0

5

3

0

0

5

3

5

0

5

4

0

0

5

4

5

0

5

5

0

0

5

5

5

0

5

6

0

0

5

6

5

0

5

7

0

0

5

7

5

0

P

R

O

F

I

T

/

L

O

S

S

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- TMA Divergence Indicator Script For Trading ViewDocument5 pagesTMA Divergence Indicator Script For Trading ViewKrish Karaniya50% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Task 3 - Model AnswerDocument1 pageTask 3 - Model Answernipun sharmaNo ratings yet

- Case 3 Lehman BrothersDocument19 pagesCase 3 Lehman BrothersYusuf UtomoNo ratings yet

- Fund Barometer: Mutual Fund Returns by CategoryDocument134 pagesFund Barometer: Mutual Fund Returns by CategoryVanessa DavisNo ratings yet

- Business Standard 27.03.2014Document1 pageBusiness Standard 27.03.2014Vanessa DavisNo ratings yet

- Quiz 1Document2 pagesQuiz 1Vanessa DavisNo ratings yet

- MarketWatch-0 20170206 150048Document5 pagesMarketWatch-0 20170206 150048Vanessa DavisNo ratings yet

- Plan UTSAV 2014 cultural and competitive eventsDocument3 pagesPlan UTSAV 2014 cultural and competitive eventsVanessa DavisNo ratings yet

- ObjectiveDocument3 pagesObjectiveVanessa DavisNo ratings yet

- Eureka - in Standared - 07 - Science Content ListDocument11 pagesEureka - in Standared - 07 - Science Content ListVanessa DavisNo ratings yet

- Fund Barometer 1Document162 pagesFund Barometer 1Vanessa DavisNo ratings yet

- CBSE Biology Content ListDocument13 pagesCBSE Biology Content ListVanessa DavisNo ratings yet

- Travel E-Point ProposalDocument8 pagesTravel E-Point ProposalVanessa DavisNo ratings yet

- Eureka - in Standared - 06 Content ListDocument23 pagesEureka - in Standared - 06 Content ListVanessa DavisNo ratings yet

- 7 BankerGÇÖs RightsDocument4 pages7 BankerGÇÖs RightsVanessa DavisNo ratings yet

- Eureka - in Standared - 07 - Mathematics Content ListDocument14 pagesEureka - in Standared - 07 - Mathematics Content ListVanessa DavisNo ratings yet

- Doon Business School Lecture Plan GuideDocument2 pagesDoon Business School Lecture Plan GuideSachin KumarNo ratings yet

- Pincon Group: 1 0060014836 Saurabh Singh Rawat 6 6,000.00 110.40 441.60 22.08 253.92 0.00Document1 pagePincon Group: 1 0060014836 Saurabh Singh Rawat 6 6,000.00 110.40 441.60 22.08 253.92 0.00Vanessa DavisNo ratings yet

- Pincon Group: Voucher List For DECEMBER 13-2NDDocument1 pagePincon Group: Voucher List For DECEMBER 13-2NDVanessa DavisNo ratings yet

- RbiDocument19 pagesRbiVanessa DavisNo ratings yet

- Evolution of Banking in IndiaDocument17 pagesEvolution of Banking in IndiaVanessa DavisNo ratings yet

- " Yad Bhavam Tat Bhavati": We Become What We ThinkDocument21 pages" Yad Bhavam Tat Bhavati": We Become What We ThinkNeeraj MehlaNo ratings yet

- IRDA Contact Details for Portal and Exam QueriesDocument1 pageIRDA Contact Details for Portal and Exam QueriesVanessa DavisNo ratings yet

- FCCBDocument14 pagesFCCBVanessa DavisNo ratings yet

- Education Is An Ornament in Prosperity and A Refuge in Adversity AristotleDocument23 pagesEducation Is An Ornament in Prosperity and A Refuge in Adversity AristotleVanessa DavisNo ratings yet

- Financial IntermediationDocument45 pagesFinancial IntermediationVanessa DavisNo ratings yet

- Study Material Commercial BankingDocument171 pagesStudy Material Commercial BankingprateekramchandaniNo ratings yet

- Non Banking Financial InstitutionsDocument53 pagesNon Banking Financial InstitutionsVanessa DavisNo ratings yet

- Financial DerivativesDocument140 pagesFinancial DerivativesgeethkeetsNo ratings yet

- Green Shoe Options in IndiaDocument32 pagesGreen Shoe Options in IndiaRajeev AroraNo ratings yet

- Managing Operational RiskDocument14 pagesManaging Operational RiskVanessa DavisNo ratings yet

- 1292926908940Document82 pages1292926908940ruchisinghnovNo ratings yet

- IIPMAStudyonthe Impactof Macroeconomic FactorsonDocument8 pagesIIPMAStudyonthe Impactof Macroeconomic FactorsonshahidafzalsyedNo ratings yet

- #37 PDFDocument64 pages#37 PDFmanjuypNo ratings yet

- Chapters 10 14Document72 pagesChapters 10 14Aqsa Jawed KhatriNo ratings yet

- How to Trade Against the Herd Using FXSSI IndicatorsDocument46 pagesHow to Trade Against the Herd Using FXSSI IndicatorsstowfankNo ratings yet

- Stock Market and Stock ExchangesDocument9 pagesStock Market and Stock ExchangesMaithreyi JntuNo ratings yet

- Assignment 02 Group No. 03 Mini CaseDocument11 pagesAssignment 02 Group No. 03 Mini CaseMuhammad Tamzeed Amin 2115209660No ratings yet

- Модуль чотири бізнес і фінансиDocument48 pagesМодуль чотири бізнес і фінансиbakymNo ratings yet

- Richard Fuld Punched in Face in Lehman Brothers GymDocument21 pagesRichard Fuld Punched in Face in Lehman Brothers GymAkash saxenaNo ratings yet

- What Is The Philippine Stock Exchange, Inc.?Document2 pagesWhat Is The Philippine Stock Exchange, Inc.?Genelle SorianoNo ratings yet

- Bhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Document4 pagesBhel Balance Sheet: Balance Sheet of Bharat Heavy Electricals - in Rs. Cr.Shavya RastogiNo ratings yet

- Kranav Kapur Investment Project 019Document18 pagesKranav Kapur Investment Project 019Angna DewanNo ratings yet

- Best Unit Trust Investment Plans in Malaysia - Compare & ApplyDocument5 pagesBest Unit Trust Investment Plans in Malaysia - Compare & Applysara finaNo ratings yet

- LN01 - Smart3075419 - 13 - FI - C07 - Analyzing Common StocksDocument62 pagesLN01 - Smart3075419 - 13 - FI - C07 - Analyzing Common StocksNhung HồngNo ratings yet

- Herens Holdco Term Loan B Amendment Adds SFr621MDocument2 pagesHerens Holdco Term Loan B Amendment Adds SFr621MOthman Alaoui Mdaghri BenNo ratings yet

- Practical Relative-Value Volatility Trading: Stephen Blyth, Managing Director, Head of European Arbitrage TradingDocument23 pagesPractical Relative-Value Volatility Trading: Stephen Blyth, Managing Director, Head of European Arbitrage TradingArtur SilvaNo ratings yet

- Trading Candlestick Patterns Ron WilliamDocument26 pagesTrading Candlestick Patterns Ron Williamgilar_dino86100% (3)

- Investments: An Introduction to Types, Returns, Taxes and the Investment ProcessDocument51 pagesInvestments: An Introduction to Types, Returns, Taxes and the Investment Processqian liuNo ratings yet

- Empirical Regularity IPODocument38 pagesEmpirical Regularity IPOAntora HoqueNo ratings yet

- SFM - Important Questions Nov 22 - May 23Document14 pagesSFM - Important Questions Nov 22 - May 23SrihariNo ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Asset Liability Management in BanksDocument47 pagesAsset Liability Management in BanksHeema Nimbeni100% (3)

- FM Project Report PDFDocument24 pagesFM Project Report PDFChandan MishraNo ratings yet

- Kotak Stratgy Whose Wealth Report PDFDocument5 pagesKotak Stratgy Whose Wealth Report PDFmittleNo ratings yet

- AML - KYC Compliance Officer CertificationDocument0 pagesAML - KYC Compliance Officer CertificationVskills Certification0% (1)

- Financial Ratios Ho PDFDocument34 pagesFinancial Ratios Ho PDFOnilusNo ratings yet

- Financial Crisis in The PhilippinesDocument11 pagesFinancial Crisis in The PhilippinesApril ManjaresNo ratings yet

- Microsoft Certification Exam Voucher PricesDocument12 pagesMicrosoft Certification Exam Voucher PricesTomas Rodriguez RamirezNo ratings yet