Professional Documents

Culture Documents

Do We Want To Own The Combined Companies?

Uploaded by

proudofyou29121991Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Do We Want To Own The Combined Companies?

Uploaded by

proudofyou29121991Copyright:

Available Formats

6/16/14

MDT-COV Deal

We currently own 216 shares of Medtronic and 145 shares of Covidien in the Tiger Fund. See above for

more information about the positions and potential arbitrage.

Should we change either of these positions as a result of the merger agreement?

1. Do we want to own the combined companies?

Yes, but at a lower proportion.

2. Do we want to own each company separately until the potential deal closes?

Owning both sides of the deal would double the exposure that we have in this merger and also

double the risk. However, I would not suggest selling either position immediately because the

price of either company seems to be highly volatile at the moment. COV price is moving upward

and there is still possibility for higher prices as the closing price yesterday (Monday) is still

approximately $5 away from the deal price. MDT price is moving slightly downward yesterday,

which reflects the immediate response of investors, but this immediate effect should not last

long. Still, for the time from now until the potential deal closes, I would suggest selling the COV

position when its price increases to the point slightly lower than the deal price (maybe up to $2

away from the deal price) and use the cash to buy the shares of another potential merger

target in the health industry so as to maintain our allocation in the health industry and maintain

the upside potential without risking that the MDT-COV deal may not turn out successful.

If the deal turns out unsuccessful, the gain that we realized from the sale of COV would

potentially more than offset the loss in our MDT position (although MDT prices may not even

decrease at all). If the deal turns out successful, we still share the gain with MDT prices and

maintain our position in the combined company for further consideration.

3. What is the downside risk to owning Covidien?

The downside risk is that the deal will not be completed due to change in tax laws (Medtronic

has the right to cancel the takeover if Congress changes the tax laws in a way that results in the

combined company being considered a US tax payer) or that the deal is not accepted by the

authority.

4. What is the downside risk to owning Medtronic?

The downside risk is that the merger turns out to be not profitable due to various reasons

(failure to account for hidden expenses/liabilities, partial responsibility for the Tycos tax

penalties challenged by IRS, change of Congress tax laws that results in the combined company

still being considered a US tax payer, the potential synergy not achieved, etc.), and the deal

turns out to be a big mistake.

5. What is the upside potential to owning Covidien?

Given that the deal will be completed successfully, Covidien stockholders will receive $93.22 per

shares, composed of $35.19 in cash and 0.956 of a Medtronic share. That deal price presents an

almost 6.6% premium to Covidiens current share price. Furthermore, Covidien shareholders will

also share the upside potential of the synergy by owning 30% of the combined company.

6. What is the upside potential to owning Medtronic?

Owning Medtronic exposes shareholders to the upside potential of the combined company due

to the synergy that the combined company expects to achieve, as well as the tax savings due to

the tax-inversion side of the deal.

7. What change if any should we make to our Medtronic and Covidien positions?

As indicated above, I would suggest selling the COV position only when its price increases to the

point slightly lower than the deal price (maybe up to $2 away from the deal price) and use the

cash to buy the shares of another potential merger target in the health industry so as to

maintain our allocation in the health industry and maintain the upside potential without risking

that the MDT-COV deal may not turn out successful. We will keep our position in MDT so as to

share the gain with MDT prices should the merger turn out successful, and maintain our position

in the combined company for further consideration later on.

You might also like

- FINMAN ReviewerDocument45 pagesFINMAN ReviewerGadfrey Doy-acNo ratings yet

- Capital StructureDocument22 pagesCapital Structurevenance62No ratings yet

- FIN722 Final Term Subjective Solved Mega FileDocument17 pagesFIN722 Final Term Subjective Solved Mega FileAnonymous 7cjaWUzQRw100% (1)

- Corp Finance Assignment 1Document3 pagesCorp Finance Assignment 1AdnanNo ratings yet

- FEDocument20 pagesFEKenadid Ahmed Osman100% (1)

- (Lecture 10 & 11) - Gearing & Capital StructureDocument18 pages(Lecture 10 & 11) - Gearing & Capital StructureAjay Kumar TakiarNo ratings yet

- Strategic Capital Management Write-UpDocument2 pagesStrategic Capital Management Write-UpJosh BrodskyNo ratings yet

- FM CH-9Document17 pagesFM CH-9Mustefa NuredinNo ratings yet

- MM ApproachDocument5 pagesMM ApproachParihar Babita100% (1)

- AC3103 Seminar 6 AnswersDocument4 pagesAC3103 Seminar 6 AnswersKrithika NaiduNo ratings yet

- Transcription Doc - Capital StructureDocument9 pagesTranscription Doc - Capital StructureAnkit SinghNo ratings yet

- Stelian Mock 5Document6 pagesStelian Mock 5Stelian Iana100% (1)

- CaseDocument5 pagesCaseSwapnil KumthekarNo ratings yet

- Name: Registration Number: Assignment: 4 Class: BBA-6 Course: Financial Management Submission On: May 18, 2020 Submit To: Sir Hassan ZadaDocument3 pagesName: Registration Number: Assignment: 4 Class: BBA-6 Course: Financial Management Submission On: May 18, 2020 Submit To: Sir Hassan ZadaNote EightNo ratings yet

- Introduction and Goals of The FirmDocument7 pagesIntroduction and Goals of The FirmNipuna Thushara WijesekaraNo ratings yet

- Fainancial Management AssignmentDocument13 pagesFainancial Management AssignmentSamuel AbebawNo ratings yet

- ExplainDocument2 pagesExplainUSD 654No ratings yet

- Mars Wrigley Case Study SolutionDocument8 pagesMars Wrigley Case Study SolutionDivya Khatter100% (1)

- Forward-Forward Contract and Forward Rate Agreement.Document6 pagesForward-Forward Contract and Forward Rate Agreement.tinotendacarltonNo ratings yet

- Derivatives & Structured Products - SBR 1: Case: Rethinking Saizeriya's Currency Hedging StrategyDocument6 pagesDerivatives & Structured Products - SBR 1: Case: Rethinking Saizeriya's Currency Hedging StrategyPooja JainNo ratings yet

- FINMAN - Exercises - 4th and 5th Requirements - PimentelDocument10 pagesFINMAN - Exercises - 4th and 5th Requirements - PimentelOjuola EmmanuelNo ratings yet

- A Corporate BondDocument2 pagesA Corporate BondMuhammad KhurramNo ratings yet

- Submission2 - General Mills Acquisition of PillsburyDocument10 pagesSubmission2 - General Mills Acquisition of PillsburyAryan AnandNo ratings yet

- Relevance and Irrelevance Theories of DividendDocument4 pagesRelevance and Irrelevance Theories of Dividendptselvakumar0% (1)

- DuPont Corporation - Sale of Performance CoatingsDocument8 pagesDuPont Corporation - Sale of Performance CoatingsPeterNo ratings yet

- Blaine Kitchenware IncDocument9 pagesBlaine Kitchenware Incnandyth100% (3)

- Budget Impact Debt Mutual FundDocument2 pagesBudget Impact Debt Mutual FundnnsriniNo ratings yet

- Notes of Corporate Finance: BBA 8th SemesterDocument10 pagesNotes of Corporate Finance: BBA 8th SemesterÀmc ChaudharyNo ratings yet

- Foreign Exchange Risk ManagementDocument5 pagesForeign Exchange Risk Managementpriya JNo ratings yet

- Practice ProblemsDocument7 pagesPractice ProblemsxxxthejobNo ratings yet

- Chapter 13 - Distribution of Retained Earnings: Dividends and Stock RepurchasesDocument26 pagesChapter 13 - Distribution of Retained Earnings: Dividends and Stock Repurchasesmarcia1416No ratings yet

- M & A Module 3Document10 pagesM & A Module 3karthik kpNo ratings yet

- Taxation Merger and AcquisitionDocument55 pagesTaxation Merger and AcquisitionRajesh ChavanNo ratings yet

- Impact of COVID-19 On M&A TransactionsDocument4 pagesImpact of COVID-19 On M&A Transactionsbeejal ahujaNo ratings yet

- Script 2Document11 pagesScript 2aa4e11No ratings yet

- Appshop Inc Case AnalysisDocument7 pagesAppshop Inc Case AnalysisBashar HaddadNo ratings yet

- Unit 9. Lesson 3Document3 pagesUnit 9. Lesson 3K59 Tran Thi Phuong ThaoNo ratings yet

- M&A NotesDocument13 pagesM&A Notesaspaps123No ratings yet

- CF - 0Document2 pagesCF - 0Harshitha manjunathNo ratings yet

- MM HypothesisDocument2 pagesMM HypothesisShania SainiNo ratings yet

- ACT 15 Finanzas InternacionalesDocument3 pagesACT 15 Finanzas InternacionalesVanessa HuitzNo ratings yet

- Act 15 FiDocument3 pagesAct 15 FiVanessa HuitzNo ratings yet

- Hill Country CaseDocument5 pagesHill Country CaseDeepansh Kakkar100% (1)

- Conceptual QuestionsDocument5 pagesConceptual QuestionsSarwanti PurwandariNo ratings yet

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- Tutorial 5 Q and ADocument5 pagesTutorial 5 Q and ASwee Yi LeeNo ratings yet

- CH 14 - Mini Case - 23845Document11 pagesCH 14 - Mini Case - 23845Aamir KhanNo ratings yet

- Attorney Navpreet Panjrath: DefinitionsDocument16 pagesAttorney Navpreet Panjrath: DefinitionsswetavitaNo ratings yet

- Dividend Policy AssignmentDocument8 pagesDividend Policy Assignmentgeetikag2018No ratings yet

- Mergers and AcquisitionDocument35 pagesMergers and AcquisitionSunanda PandeyNo ratings yet

- The Determinants of Firms' Hedging PoliciesDocument16 pagesThe Determinants of Firms' Hedging PoliciesxxxNo ratings yet

- DealCancellation Terms Bvi Int enDocument4 pagesDealCancellation Terms Bvi Int enSiroNo ratings yet

- CH 2 SSQ Bak - Answers OnlyDocument8 pagesCH 2 SSQ Bak - Answers OnlypkehmerNo ratings yet

- Case 5: Merger Analysis Computer Concepts/computechDocument9 pagesCase 5: Merger Analysis Computer Concepts/computechLouis De MoffartsNo ratings yet

- Chapter 01Document6 pagesChapter 01Krishele GotejerNo ratings yet

- Strategic Financial Management Is Basically About The Identification of The Possible StrategiesDocument5 pagesStrategic Financial Management Is Basically About The Identification of The Possible StrategiesGowthami MogantiNo ratings yet

- Aetna DoJ LetterDocument3 pagesAetna DoJ LetterThe Fiscal TimesNo ratings yet

- The Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsFrom EverandThe Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsRating: 5 out of 5 stars5/5 (1)

- Tutorial 5Document1 pageTutorial 5easoncho29No ratings yet

- Chapter 5Document17 pagesChapter 5Mikel TanNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument35 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinNotesfreeBookNo ratings yet

- Interest Rate Swap DiagramDocument1 pageInterest Rate Swap DiagramTheGreatDealerNo ratings yet

- Chapter 1-3 Notes & ExercisesDocument10 pagesChapter 1-3 Notes & ExercisesHafizah Mat Nawi50% (2)

- Ifrs 17 Reinsurance Contract Held ExampleDocument24 pagesIfrs 17 Reinsurance Contract Held ExampleHesham AlabaniNo ratings yet

- WaerDocument13 pagesWaerdasmaguero4lgNo ratings yet

- Inside The House of MoneyDocument3 pagesInside The House of Moneyvlx82No ratings yet

- Hallmark ScamDocument3 pagesHallmark ScamMiltu TalukderNo ratings yet

- Bridge Course in EconomicsDocument17 pagesBridge Course in EconomicsProfessor Tarun DasNo ratings yet

- Visa Direct General Funds Disbursement Sellsheet PDFDocument2 pagesVisa Direct General Funds Disbursement Sellsheet PDFPablo González de PazNo ratings yet

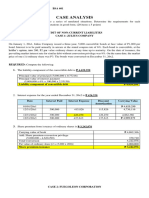

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- JP Morgan PresentationDocument22 pagesJP Morgan PresentationramleaderNo ratings yet

- Factsheet Ton How Do Inflation and The Rise in Interest Rates Affect My MoneyDocument8 pagesFactsheet Ton How Do Inflation and The Rise in Interest Rates Affect My Moneyimhidayat2021No ratings yet

- SS Mar22 PDFDocument8 pagesSS Mar22 PDFuser mrmysteryNo ratings yet

- Fintech in Asean 2022Document52 pagesFintech in Asean 2022Trần Thị Hà MyNo ratings yet

- White PaperDocument11 pagesWhite PaperDavos SavosNo ratings yet

- Pearson VUE Voucher Sales Order: Bill ToDocument1 pagePearson VUE Voucher Sales Order: Bill ToHendra SoenderskovNo ratings yet

- Commercial Transportation Working Analysis HDFC Bank - 2011Document72 pagesCommercial Transportation Working Analysis HDFC Bank - 2011rohitkh28No ratings yet

- Working Capital Definition & ExampleDocument1 pageWorking Capital Definition & Examplebilal rasoolNo ratings yet

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- E BankingDocument18 pagesE BankingHuelien_Nguyen_1121No ratings yet

- Financial Accounting Assignment 1 PDFDocument26 pagesFinancial Accounting Assignment 1 PDFUmair MughalNo ratings yet

- Cuomo Mining Corporation A Public Company Whose Stock Trades On PDFDocument2 pagesCuomo Mining Corporation A Public Company Whose Stock Trades On PDFTaimur TechnologistNo ratings yet

- Depreciation Sample ProblemsDocument12 pagesDepreciation Sample ProblemsMedina BNo ratings yet

- Fin254 Chapter 6Document18 pagesFin254 Chapter 6Wasif KhanNo ratings yet

- Lynxci SCREENDocument25 pagesLynxci SCREENAnonymous 7ijfVbNo ratings yet

- Account STMTDocument4 pagesAccount STMTsreehas sreehasNo ratings yet

- Difference Types of Insurance Companies by Baqir SiddiqueDocument2 pagesDifference Types of Insurance Companies by Baqir Siddiquem.bqairNo ratings yet

- Microfinance Management: Chapter - 1Document251 pagesMicrofinance Management: Chapter - 1sunit dasNo ratings yet