Professional Documents

Culture Documents

Rivero V Chase Receivables FDCPA Answer Robert Arelo

Uploaded by

ghostgrip0 ratings0% found this document useful (0 votes)

25 views6 pagesUNITED STATES DISTRICT of NEW YORK, Eastern District of new york hears Complaint filed by RENY RIVERO. Defendant, CHASE RECEIVABLES, denies allegations set forth in paragraphs 5, 12, 13, 14, 21, 22, 23, 25 and 28 of the Plaintiff's Complaint. Dispute regarding the amount of $1. Is so de minimis as to render the allegations in the Complaint without merit and in contradiction of Congressional intent.

Original Description:

Original Title

Rivero v Chase Receivables FDCPA Answer Robert Arelo

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUNITED STATES DISTRICT of NEW YORK, Eastern District of new york hears Complaint filed by RENY RIVERO. Defendant, CHASE RECEIVABLES, denies allegations set forth in paragraphs 5, 12, 13, 14, 21, 22, 23, 25 and 28 of the Plaintiff's Complaint. Dispute regarding the amount of $1. Is so de minimis as to render the allegations in the Complaint without merit and in contradiction of Congressional intent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views6 pagesRivero V Chase Receivables FDCPA Answer Robert Arelo

Uploaded by

ghostgripUNITED STATES DISTRICT of NEW YORK, Eastern District of new york hears Complaint filed by RENY RIVERO. Defendant, CHASE RECEIVABLES, denies allegations set forth in paragraphs 5, 12, 13, 14, 21, 22, 23, 25 and 28 of the Plaintiff's Complaint. Dispute regarding the amount of $1. Is so de minimis as to render the allegations in the Complaint without merit and in contradiction of Congressional intent.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

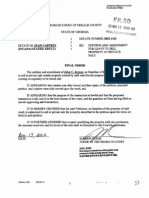

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF NEW YORK

-------------------------------------------------------x CV-13-3312 (ENV)(LB)

RENY RIVERO,

Plaintiff ANSWER

-against-

CHASE RECEIVABLES,

Defendant

------------------------------------------------------x

Defendant, CHASE RECEIVABLES, by its attorney ROBERT L. ARLEO, ESQ., answering

the Plaintiffs Complaint which was filed with the Clerk of the Court on June 10, 2013

(hereinafter Plaintiffs Complaint), sets forth as follows:

1. In regard to the allegations set forth in paragraph 1 of the Plaintiffs Complaint. Admit

that the Complaint alleges violations of the Fair Debt Collection Practices Act (FDCPA)

and New York City Department of Consumer Affairs (NYC DCA) Local Law 15 but

otherwise deny that the Defendant committed any violation(s) of the FDCPA and NYC

DCA Local Law 15.

2. In regard to the allegations set forth in paragraph 3 of the Plaintiffs Complaint, leave to

the Court all determinations in regard to proper jurisdiction and venue.

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 1 of 6 PageID #: 63

3. Admit the allegations set forth in paragraphs 5, 12, 13, 14, 21, 22, 23, 25 and 28 of the

Plaintiffs Complaint.

4. Deny the allegations set forth in paragraphs 2, 27, 29, 38, 35 and 61 of the Plaintiffs

Complaint.

5. In regard to the allegation sets forth in paragraph 19, 20 and 27 of the Plaintiffs Complaint

refer to the documents referenced by the Plaintiff. Nothwithstanding, the dispute regarding

the amount of $1.73 is so de minimis and to render the allegations in the Complaint

without merit and in contradiction of Congressional intent regarding the protections

afforded by the FDCPA.

6. The Defendant is without knowledge or information sufficient to form a belief as to the

truth and veracity of the allegations set in paragraph 12 of the Plaintiffs Complaint.

7. The allegations set forth in paragraph No. 6, 8 and 9 of the Plaintiffs Complaint are legal

conclusions to which no response from the Defendant is required. To the extent a response

is required, the Defendant admits that in some circumstances, it may be considered a debt

collector under 15 U.S.C. 1692a(6).

8. Deny the allegations set forth in paragraph 7 of the Plaintiffs Complaint. The Defendant

is operating under its doing business as name. The Credit Bureau of Napa County, Inc.

d/b/a Chase Receivables is duly licensed by the NYC DCA and has been assigned license

number 1016382-DCA said license having been in effect at all times in regard to the

allegations set forth in the Plaintiffs Complaint.

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 2 of 6 PageID #: 64

9. The allegations set forth in paragraphs 10, 36, 38, 39, 42, 43, 44, 45, 46, 47, 48, 49, 50,

51, 53, 54, 55, 56 and 59 of the Plaintiffs Complaint are alleged recitations of statutory

law to which no response from Defendant is required. Otherwise, refer to each of the

statutory citations set forth in said paragraphs to determine the accuracy of the assertions

set forth in said paragraphs.

10. In regard to the allegations set forth in paragraph 11 of the Plaintiffs Complaint deny said

allegations notwithstanding Exhibit A and Exhibit B attached to the Plaintiffs Complaint.

11. Deny knowledge or information sufficient to form a belief as to the allegations set forth in

paragraphs 15, 16, 17, 22, 30, 31, 32 and 33 of the Plaintiffs Complaint.

12. In regard to the allegations set forth in paragraph 18 of the Plaintiffs Complaint admit

that the Defendant forwarded the letter dated June 11, 2012 which is attached to the

Plaintiffs Complaint. Otherwise, deny that said letter may be characterized as a NOTICE

OF VALIDATION although said letter sets forth the 30 day debt validation/dispute

rights as required by 15 U.S.C. 1692(g).

13. In regard to the allegations set forth in paragraphs 23, 24, 25 and 26 refer to those Exhibits

referenced by the Plaintiff in said paragraphs.

14. In regard to the allegations set forth in paragraphs 34, 37, 40, 41, 52, 55, 57, 58 and 60 of

the Plaintiffs Complaint refer to the contents of the paragraphs set forth heretofore herein

and incorporate same by reference herein.

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 3 of 6 PageID #: 65

15. In regard to each WHEREFORE clause set forth in the Plaintiffs Complaint deny that

the Plaintiff is entitled to the relief set forth in each said WHEREFORE clause.

16. In regard to the content of COUNT VII of the Plaintiffs Complaint deny that the

Defendant engaged in any unconscionable and/or deceptive trade practices nor did the

Defendant harass, oppress or abuse the Plaintiff.

AS AND FOR A FIRST AFFIRMATIVE DEFENSE

17. The Plaintiff failed to mitigate his alleged actual damages.

AS AND FOR A SECOND AFFIRMATIVE DEFENSE

18. The herein action was brought in bad faith and for the purpose of harassment which,

pursuant to 15 U.S.C. 1692k(a)(3), entitles the Defendant to recovery its attorneys fees

and costs incurred in having been compelled to defend this action. The FDCPA is

designed to protect the least sophisticated consumer. However, the Plaintiff in the

herein action is a sophisticated consumer and is well versed in the FDCPA as he has filed

no less than sixteen (16) FDCPA lawsuits from a period encompassing September 30,

2011 through August 26, 2013. It is further likely that the Plaintiff has settled additional

claims of violation of the FDCPA by compelling other debt collectors to pay monies to

him under the threat of the commencement of formal legal action. Reference is made to

the matter of Majerowitz v. Stephen Einstein & Associates, P.C., 2013 U.S. Dist. LEXIS

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 4 of 6 PageID #: 66

115664 (E.D.N.Y. Aug. 15, 2013) wherein Judge I. Leo Glasser of this federal District

Court dismissed an FDPCA claim after finding that the FDCPA claim alleged therein was

frivolous and otherwise referring to extremely sophisticated consumers who take

advantage of the FDPCA for purposes not intended by Congress. The Plaintiff herein is

such a person. Although the Plaintiff has the right to commence actions under the FDCPA

if he has legitimate claims against debt collectors this particular action concerns an alleged

dispute the amount of $1.73. The Plaintiff has attempted to create an FDCPA claim based

upon this de minimis amount of money. Furthermore, the Plaintiff has acted in bad faith

and for the purpose of harassment in making grossly unreasonable, and illegal, settlement

demands in conjunction with attempts by the Defendant to effect a settlement of this

action so as to save the attorneys fees and costs which the Plaintiff has compelled the

Defendant to incur as a result of this action. Thus, the Court should dismiss this action

with prejudice and should otherwise compel this Plaintiff to pay the costs and attorneys

incurred by the Defendant so as to deter this Plaintiff, and any other person intended to

abuse the FDCPA, from any further abuse of the FDCPA.

DATED: November 15, 2013

/ s / Robert L. Arleo____

ROBERT L. ARLEO, ESQ.

(RA 7506)

Attorney for the Defendant

380 Lexington Avenue

17

th

Floor

New York, New York 10168

(212) 551-1115

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 5 of 6 PageID #: 67

TO: RENY RIVERO

131 Silver Lake Road #406

Staten Island, New York 10301

Case 1:13-cv-03312-ENV-LB Document 13 Filed 11/15/13 Page 6 of 6 PageID #: 68

You might also like

- Nicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerDocument3 pagesNicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerghostgripNo ratings yet

- Chase Receivables Collection Agency NoticeDocument2 pagesChase Receivables Collection Agency NoticeghostgripNo ratings yet

- Urspringer V Pizza Luce ADA Discrimination ComplaintDocument10 pagesUrspringer V Pizza Luce ADA Discrimination ComplaintghostgripNo ratings yet

- Unilever Hellman's Survey Questions - Hampton CreekDocument14 pagesUnilever Hellman's Survey Questions - Hampton CreekghostgripNo ratings yet

- Hellmans V Just Mayo - Declaration of Michael MazisDocument14 pagesHellmans V Just Mayo - Declaration of Michael MazisghostgripNo ratings yet

- Scheffler V NCO Financial Systems Inc FDCPA ComplaintDocument5 pagesScheffler V NCO Financial Systems Inc FDCPA ComplaintghostgripNo ratings yet

- Presqriber V Practice Fusion Motion To DismissDocument19 pagesPresqriber V Practice Fusion Motion To DismissghostgripNo ratings yet

- Mitchell V Chase Receivables Inc FDCPADocument5 pagesMitchell V Chase Receivables Inc FDCPAghostgripNo ratings yet

- Pratt V NCO Financial Systems FDCPA Complaint MinnesotaDocument6 pagesPratt V NCO Financial Systems FDCPA Complaint MinnesotaghostgripNo ratings yet

- Reflections of A Career Prosecutor James BackstromDocument6 pagesReflections of A Career Prosecutor James BackstromghostgripNo ratings yet

- Minneapolis Police Officers Federation Contract 2012Document121 pagesMinneapolis Police Officers Federation Contract 2012ghostgrip100% (1)

- Declaration of Michael J Wood Chase ReceivablesDocument3 pagesDeclaration of Michael J Wood Chase ReceivablesghostgripNo ratings yet

- Presqriber LLC V Practice Fusion Inc Motion To DismissDocument2 pagesPresqriber LLC V Practice Fusion Inc Motion To DismissghostgripNo ratings yet

- Presqriber v. Medical Information Technology, Inc. D/b/a MeditechDocument7 pagesPresqriber v. Medical Information Technology, Inc. D/b/a MeditechPriorSmartNo ratings yet

- Dobson Chase Receivables Robert ArleoDocument2 pagesDobson Chase Receivables Robert ArleoghostgripNo ratings yet

- Acosta V Credit Bureau of Napa County Chase ReceivablesDocument13 pagesAcosta V Credit Bureau of Napa County Chase ReceivablesghostgripNo ratings yet

- Conopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintDocument17 pagesConopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintghostgripNo ratings yet

- Declaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoDocument13 pagesDeclaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoghostgripNo ratings yet

- Jay Clifton Kolls DPPA ExhibitsDocument14 pagesJay Clifton Kolls DPPA Exhibitsghostgrip100% (1)

- Diabate V University of Minnesota ComplaintDocument9 pagesDiabate V University of Minnesota ComplaintghostgripNo ratings yet

- Mitchell V Chase Receivables Inc FDCPADocument5 pagesMitchell V Chase Receivables Inc FDCPAghostgripNo ratings yet

- Motion For Class Certification Acosta V Credit Bureau of Napa CountyDocument6 pagesMotion For Class Certification Acosta V Credit Bureau of Napa CountyghostgripNo ratings yet

- Chase Receivables Chase Payment CenterDocument2 pagesChase Receivables Chase Payment CenterghostgripNo ratings yet

- Jay Clifton Kolls V City of Edina Withdrawal of CounselDocument1 pageJay Clifton Kolls V City of Edina Withdrawal of CounselghostgripNo ratings yet

- Grazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaDocument209 pagesGrazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Bien V Stellar Recovery Inc Complaint Caller ID SpoofingDocument15 pagesBien V Stellar Recovery Inc Complaint Caller ID SpoofingghostgripNo ratings yet

- Grazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald MinnesotaDocument72 pagesGrazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald Minnesotaghostgrip100% (1)

- Grazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaDocument34 pagesGrazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Grazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaDocument3 pagesGrazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Michelle MacDonald Complaint Criminal Contempt Dakota CountyDocument3 pagesMichelle MacDonald Complaint Criminal Contempt Dakota CountyghostgripNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Anti Competetive AgreemetsDocument5 pagesAnti Competetive AgreemetsSwathy SonyNo ratings yet

- Fidic Licence AgreementDocument6 pagesFidic Licence AgreementshreemanthsNo ratings yet

- Article 1-12 FinalDocument54 pagesArticle 1-12 FinalMark Christian CadeliñaNo ratings yet

- Berico vs CA: Dispute over land sale and possessionDocument2 pagesBerico vs CA: Dispute over land sale and possessionMartin RegalaNo ratings yet

- Paredes V GopencoDocument2 pagesParedes V Gopencocmv mendozaNo ratings yet

- Order Granting Sale of PropertyDocument2 pagesOrder Granting Sale of PropertyJanet and JamesNo ratings yet

- 5 Nature and Effect of Obligations 3Document5 pages5 Nature and Effect of Obligations 3keuliseutel chaNo ratings yet

- Remedies of The Buyer in International SalesDocument16 pagesRemedies of The Buyer in International SalesBagja AzhariNo ratings yet

- Appeals Court DecisionDocument47 pagesAppeals Court Decisionsunnews820No ratings yet

- Pre-Trial Brief (Plaintiff)Document5 pagesPre-Trial Brief (Plaintiff)Katherine EvangelistaNo ratings yet

- lET REVIEW Republic Act 7877Document22 pageslET REVIEW Republic Act 7877baby100% (1)

- CK1 PDFDocument4 pagesCK1 PDFKatneza Katman MohlalaNo ratings yet

- Edroso v. Sablan G.R. No. 6878, September 13, 1913 FactsDocument7 pagesEdroso v. Sablan G.R. No. 6878, September 13, 1913 FactsKarl Marxcuz ReyesNo ratings yet

- ProxyDocument1 pageProxyKylyns RidgeNo ratings yet

- Feliciano v. PasicolanDocument3 pagesFeliciano v. PasicolanAndotNo ratings yet

- Computer Identics Corporation v. Southern Pacific Company, 756 F.2d 200, 1st Cir. (1985)Document9 pagesComputer Identics Corporation v. Southern Pacific Company, 756 F.2d 200, 1st Cir. (1985)Scribd Government DocsNo ratings yet

- Madarcos v. de La MercedDocument2 pagesMadarcos v. de La MercedChariNo ratings yet

- Phil National Bank Vs CA - 121597 - June 29, 2001 - J PDFDocument4 pagesPhil National Bank Vs CA - 121597 - June 29, 2001 - J PDFMack Hale BunaganNo ratings yet

- 024 Application For Deletion of VesselDocument1 page024 Application For Deletion of VesselAmandeep kaurNo ratings yet

- MIAA Vs Rodriguez - Eminent Domain - Just Compensation - DigestDocument2 pagesMIAA Vs Rodriguez - Eminent Domain - Just Compensation - DigestJen Dee100% (1)

- Lease AgreementDocument2 pagesLease Agreementmonarch_007No ratings yet

- Country Bankers Insurance CorpDocument2 pagesCountry Bankers Insurance CorprengieNo ratings yet

- United States v. Wiggins, 4th Cir. (2007)Document4 pagesUnited States v. Wiggins, 4th Cir. (2007)Scribd Government DocsNo ratings yet

- General Principles of Taxation and Income TaxationDocument79 pagesGeneral Principles of Taxation and Income TaxationJoeban R. Paza100% (2)

- Sangguniang Barangay of Don Mariano Marcos Vs Punong Barangay Severino MartinezDocument9 pagesSangguniang Barangay of Don Mariano Marcos Vs Punong Barangay Severino Martinezpatricia.aniyaNo ratings yet

- How To Brief A CaseDocument16 pagesHow To Brief A CaseAyusman MahantaNo ratings yet

- Martin Burn LTD Vs RN Banerjee 20091957 SCs570081COM159189Document10 pagesMartin Burn LTD Vs RN Banerjee 20091957 SCs570081COM159189shanikaNo ratings yet

- TRADEMARKDocument14 pagesTRADEMARKAshutosh DubeyNo ratings yet

- Basic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Document30 pagesBasic Taxation - CAVSU - Teaching Demo - Feb 5, 2018Renalyn ParasNo ratings yet