Professional Documents

Culture Documents

Mapi JPM

Uploaded by

PandhuDewanto0 ratings0% found this document useful (0 votes)

68 views31 pagesriset

Original Title

mapi jpm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentriset

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views31 pagesMapi JPM

Uploaded by

PandhuDewantoriset

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 31

l Equity Research l

Important disclosures can be found in the Disclosures Appendix

All rights reserved. Standard Chartered Bank 2014 http://research.standardchartered.com

Asia l Emerging Companies 30 May 2014

Double in 3, Triple in 5

ASEAN, Issue 53 Goodpack, Mitra Adiperkasa and Thaicom

Performance by market (22-29 May): ASEAN small caps increased

0.7%, outperforming large caps by 1.2ppt. The Singapore small-

cap market was the best performer (+1.5%), while the Philippines

was the worst performer (-1.6%).

Performance by sector (22 - 29 May): Industrials was the best

performer among small caps (+2.0%), while Telecom Services

performed the worst (-1.4%).

Valuations: The Philippines is the cheapest small-cap market at

14.6x 2014E PER, followed by Thailand at 15.7x. Singapore and

Indonesia are the most expensive at 18.5x and 16.2x, respectively.

Top picks

Company name Ticker

Share price

(LC)

Price target

(LC)

+/-

(%)

Ace Hardware ACES IJ 885 1,049 +18.5

Matahari Dept Store LPPF IJ 14,375 17,105 +19.0

Major Cineplex MAJOR TB 17.10 22.43 +31.2

MK Restaurant M TB 57.75 65.90 +14.1

OSIM International OSIM SP 2.80 3.57 +27.5

Siloam Int. Hospitals SILO IJ 13,200 13,982 +5.9

Universal Robina URC PM 150.00 195.60 +30.4

Share price as of 29 May 2014

Source: FactSet

Top 5 winners and losers: Past week

Source: Bloomberg

Upcoming corporate access

Upcoming corporate access

Company Location Type Date

Double in 3, Triple in 5 United Kingdom Conference 2-3 Jun

Double in 3, Triple in 5 USA Conference 5-6 Jun

KrisEnergy Singapore Lunch 23-Jun

OSIM Singapore Lunch 1-Aug

Double in 3, Triple in 5 Hong Kong Conference 3-4 Nov

Double in 3, Triple in 5 Singapore Conference 6-7 Nov

Source: Standard Chartered Research

Recent company meetings/calls

Recent company meetings / calls

Company Country Type Date

Workpoint Thailand Call 28-May

Mitra Adiperkasa Indonesia Call 28-May

Selamat Sempurna Indonesia Call 28-May

Eu Yang Sang Singapore Meeting 29-May

Courts Asia Singapore Meeting 30-May

LMRT Singapore Call 30-May

Pakuwon Jati Indonesia Call 30-May

Singapore Post Singapore Call 30-May

Source: Standard Chartered Research

Upcoming company meetings/calls

Upcoming company meetings / calls

Company Country Type Date

Sarana Menara Nusantara Indonesia Meeting 3-Jun

Ace Hardware Indonesia Call 4-Jun

Mitra Adiperkasa Indonesia Call 4-Jun

MC group Thailand Call 4-Jun

Parkson Retail Asia Singapore Call 4-Jun

Bangkok dusit medical Thailand Call 5-Jun

Berjaya Food Malaysia Call 5-Jun

Overseas Education Singapore Meeting 5-Jun

Source: Standard Chartered Research

Stock highlights Key ideas and initiations

Coverage highlight Goodpack (GPACK SP, OP): Goodpack

announced that US-based private equity firm KKR has offered to

acquire the company at SGD 2.50/share. The price is close to the

estimated offer price of SGD 2.51 in our leveraged-buyout (LBO)

analysis and represents a 23% premium to the closing price prior to the

announcement. We are disappointed by the offer price and surprised

that the Lam family would sell the company at this level, as we value

Goodpack at SGD 2.71/share. We believe the Lam family's willingness

to sell at this price raises questions about Goodpack's growth

prospects, including the potential for breaking into the autoparts

industry. The offer is via a scheme of arrangement and requires 75%

shareholder approval. According to Bloomberg, the five largest

institutional shareholders in Goodpack hold 23% of the shares.

(Momentum is still strong, 29 May 2014)

Coverage highlight Mitra Adiperkasa (MAPI IJ, OP): Everstone

Capital, a Singapore-based private equity firm, is buying a 51% stake in

Dominos Pizza Indonesia (DPI). MAPI will not book any divestment

gain, as this transaction is structured as a capital injection by Everstone

into DPI. We expect the divestment to yield a 30bps increase in EBIT

margin and there could be 80bps further upside if MAPI divests Burger

King (BK). Both DPI and BK contributed to an EBIT loss of IDR 60bn in

2013. MAPI is trading at 15.7x 2015E PER, a 12% discount to peers.

(Waiting for expansion into new brands, 29 May 2014)

Visit note Thaicom PCL (THCOM TB, NR): THAICOM is the only

satellite service operator in Thailand. It was granted a 30-year BTO

agreement by the government and became a monopoly business in

1991. To support growing demand from the launch of digital TV in

Thailand and rising internet usage, THAICOM plans to launch two

satellites, in July 2014 and 2H16, to add to its three current satellites.

THAICOM trades at 19.5x 2015E PER, with a 2.6% dividend yield,

based on Bloomberg consensus. (Thaicom PCL, 29 May 2014)

-10%

-5%

0%

5%

10%

15%

20%

25%

I

T

D

T

B

C

K

T

B

Y

I

N

G

L

I

S

P

E

A

T

B

T

K

T

B

U

O

A

D

M

K

B

R

P

T

I

J

E

E

I

P

M

E

C

I

I

I

J

J

G

S

P

M

%

c

h

a

n

g

e

i

n

1

w

e

e

k

Stephen Hui

+65 6596 8514

Equity Research

Standard Chartered Bank, Singapore Branch

Alvin Witirto

+65 6596 8530

Equity Research

Standard Chartered Bank, Singapore Branch

Rashad Latheef

+65 6596 8505

Equity Research

Standard Chartered Bank, Singapore Branch

Munchuga Khajornkowit

+65 6596 8504

Equity Research

Standard Chartered Bank, Singapore Branch

J eremy Sutch, CFA

+852 3983 8533

Equity Research

Standard Chartered Bank (HK) Limited

J eremy Sutch, CFA

+852 3983 8533

Equity Research

Standard Chartered Bank (HK) Limited

Stephen Hui

Stephen.Hui@sc.com

+65 6596 8514

Pauline Lee

Pauline-Hwee-Chen.Lee@sc.com

+65 6596 8505

Alvin

Witirto

Alvin.Witirto

@sc.com

+65 6596

Alvin Witirto

Alvin.Witirto@sc.com

+65 6596 8530

Jeremy Sutch

Jeremy.Sutch@sc.com

+852 3983 8533

Jeremy Sutch

Jeremy.Sutch@sc.com

+852 3983 8533

Equity Research l Double in 3, Triple in 5

30 May 2014 2

Contents

Bottom-up: Top picks 3

Goodpack 7

Mitra Adiperkasa 8

THAICOM Public Company 9

Top-down view 10

Country focus Singapore 13

Country focus Malaysia 15

Country focus Indonesia 17

Country focus Thailand 19

Country focus The Philippines 21

ASEAN emerging companies: Coverage universe valuation table 28

ASEAN emerging companies: Coverage universe financials table 29

Equity Research l Double in 3, Triple in 5

30 May 2014 3

Bottom-up: Top picks

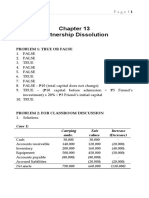

Figure 1: Top picks

Company name Ticker

Mkt cap

(USD mn)

6-month AD

Liq. (USD

mn)

Share

price

(LC)

Price

target

(LC)

+/-

(%)

PER

FY1E

PER

FY2E

PBR

FY1E

EV/

EBITDA

FY1E

Div.

yield

FY1E

ROCE

FY1E

14D

RSI

Ace Hardware ACES IJ 1,306 1.27 885 1,049 +18.5 24.3 20.0 6.3 17.1 0.8 34.8 66

Matahari Dept Store LPPF IJ 3,609 3.80 14,375 17,105 +19.0 25.5 18.9 10.1 17.2 1.6 45.5 47

Major Cineplex MAJOR TB 465 1.12 17.10 22.43 +31.2 15.8 13.7 2.5 8.2 5.4 12.9 30

MK Restaurant M TB 1,599 2.42 57.75 65.90 +14.1 23.0 21.0 4.0 14.0 3.0 18.9 61

OSIM International OSIM SP 1,656 2.84 2.80 3.57 +27.5 18.3 15.8 4.8 11.4 2.5 30.8 51

Siloam Int. Hospitals SILO IJ 1,190 8.86 13,200 13,982 +5.9 127.3 85.4 8.7 30.0 0.1 8.5 77

Universal Robina URC PM 7,459 7.65 150.00 195.60 +30.4 27.6 24.2 6.0 18.0 2.4 24.9 53

Share prices as of 29 May 2014.

Sources: Bloomberg, Companies, Standard Chartered Research estimates

ACE Hardware

Dominant home-improvement retailer: Ace Hardware is Indonesias dominant home improvement retailer with 95 stores at

end-2013. In contrast, its closest competitor, Pongs Do It Best, has only 16 stores.

Stabilising and potentially improving margins: Ace Hardwares EBIT margins declined to 15.5% in 2013 from 16.2% in

2012, but margins appear to have stabilised, with 1Q14 EBIT margin of 16%.

SSSG may accelerate: Ace Hardwares SSSG decelerated to 4.9% in 2013 from 10.7% in 2012, but we see signs that

demand may improve. SSSG ouside Java accelerated to 10.1% in 3M14 versus 4.3% in 2013. Stores outside Java were the

key growth driver in 2011 and 2012, with the fastest SSSG of 30% and 16%, respectively.

Matahari Department Store

Market leadership: Matahari Department Store (MDS) pioneered the department store concept in Indonesia and had a

leading 31% share of sector sales in 2011, based on Euromonitor estimates.

Limited direct competition: MDS targets the middle-income segment, while the second- and third-largest department store

operators, Ramayana and Mitra Adiperkasa, target the lower and mid-to-upper income segments, respectively.

Robust profitability: MDS had one of the highest ROCEs (48%) and EBIT margins (14%) among ASEAN department store

operators in 2013.

Major Cineplex

Dominant: Major Cineplex is the dominant cinema operator in Thailand, with 479 cinema screens at end-2013, and over 80%

of the cinema screens in Thailand.

Growth: Majors business has strong operating leverage in increasing its concession-to-box office sales ratio, as the

concession segment has a higher gross margin (69%) than box office (16%). We forecast 2013-16 revenue/net profit CAGRs

of 8%/16%.

Attractive valuation: Majors valuations are appealing, in our view, given its growth outlook and high dividend yield.

MK Restaurants

Dominant Suki brand: At end-2013, MK Restaurants (MK) had 381 MK Suki restaurants in Thailand, making it by far the

largest suki chain in the country. We regard MK as a top brand associated with clean, healthy food and quality family dining.

Scalable network: MK has its own central kitchens, staff training school and supply chain. It opened a new central kitchen in

February 2014, doubling its restaurant capacity to 1,000 (as of end-2013, it operated 506 restaurants).

Equity Research l Double in 3, Triple in 5

30 May 2014 4

Underpenetrated network: We believe there is still room for MK to expand in Thailand, and the companys second brand,

Yayoi, is underpenetrated, with only 113 restaurants as of end-2013. We believe MK can add new brands, given its expertise

in restaurant operations and infrastructure.

OSIM International

Strong brand: OSIM is Asias leading massage-chair brand, with leading market shares in Hong Kong, Taiwan, Singapore

and China.

Robust profitability and cash flow: OSIM has a high ROCE and strong cash flow.

Upside from TWG Tea: OSIM increased its stake in TWG Tea to 70% in January 2014. We expect TWG to contribute

significantly to OSIMs growth. TWG Tea is a strong brand with robust growth potential, in our view.

Siloam Internasional Hospitals

Market leader: Siloam International Hopsitals is the largest private hospital player in Indonesia with a 7.4% market share by

bed capacity in 2012. Its capacity is more than double the second-largest operator, Mitra Keluarga (3.0% share), according to

Frost & Sullivan. As of end-2013, Siloam operated 16 hospitals with 3,700 beds.

Robust growth outlook for 2013-16E: By end-2017, Siloam plans to triple its hospital network to 40 hospitals with 10,000

beds. We forecast 2013-16 revenue and earnings CAGRs of 44% and 86%, respectively, driven by volume growth and

operating leverage, as new hospitals take three-to-five years to mature.

Attractive valuation: Siloam trades at EV/EBITDA multiples similar to regional hospital peers, but offers an EBITDA CAGR

of 63% for 2013-16E, compared to only 14-17% for peers.

Universal Robina

Strong regional brand: Universal Robina (URC) is a leading F&B brand in Southeast Asia with a dominant position in its

domestic market, the Philippines. It is also the number-one biscuit and wafer brand in Thailand, and the number-two ready-to-

drink tea brand in Vietnam.

Multi-product portfolio: We like URCs strong multi-product portfolio, which contrasts with many leading ASEAN F&B

brands that specialise in a particular product. We believe the companys strength across different product segments provides

significant room to innovate and grow.

Top-class management: We believe URC has one of the strongest management teams in Southeast Asia.

5

E

q

u

i

t

y

R

e

s

e

a

r

c

h

l

D

o

u

b

l

e

i

n

3

,

T

r

i

p

l

e

i

n

5

3

0

M

a

y

2

0

1

4

Figure 2: Team coverage by sector

Company name Ticker Rec

Mkt cap

(USD

mn)

6-month

AD liq.

(USD mn)

Share

price

(LCY)

Price

target

(LCY)

"+/-"

(%)

%

Change

1W

%

Change

YTD

%

Change

12M FYE

PER

FY1E

(x)

PER

FY2E

(x)

EPS

CAGR

(FY0-

FY2E)

PEG

(x)

PBR

FY1E

(x)

Price to

sales

FY1E

(x)

EV/

EBITDA

FY1E

(x)

Div

yield

FY1E

(%)

ROCE

FY1E

(%)

RoE

FY1E

(%)

Consumer discretionary

Ace Hardware ACES IJ OP 1,306 1.26 885 1,049 19 4 50 -1 Dec-13 24.3 20.0 24.5 0.8 6.3 3.2 17.1 0.8 34.8 29.0

Eu Yan Sang Intl. EYSAN SP OP 296 0.17 0.84 1.03 23 1 -3 14 Jun-13 17.5 15.8 15.8 1.0 2.3 1.0 9.9 3.1 12.3 13.4

Home Product Cnt. HMPRO TB IL 2,667 5.13 9.15 9.28 1 5 12 -26 Dec-13 25.9 21.7 14.7 1.5 5.8 1.9 14.6 1.2 19.0 24.2

Matahari Dept Store LPPF IJ OP 3,609 3.77 14,375 17,105 19 3 31 7 Dec-13 25.5 18.9 40.5 0.5 10.1 4.9 17.2 1.6 45.5 46.0

Mitra Adiperkasa MAPI IJ OP 743 1.11 5,200 6,206 19 -3 -5 -44 Dec-13 27.4 15.7 29.5 0.5 3.3 0.7 9.1 0.6 17.1 12.4

OSIM Intl. OSIM SP OP 1,638 2.85 2.80 3.57 28 1 22 37 Dec-13 18.1 15.6 22.4 0.7 4.8 2.9 11.3 2.5 30.8 32.3

Parkson Retail Asia PRA SP OP 485 0.07 0.90 1.28 42 -2 -7 -42 Jun-13 16.4 12.9 12.4 1.0 2.4 1.3 7.4 6.1 16.6 14.6

Ramayana Lestari RALS IJ IL 757 0.28 1,240 1,238 0 2 17 -16 Dec-13 17.8 15.0 22.7 0.7 2.5 1.4 10.4 2.8 15.1 14.5

Robinson Dept. St. ROBINS TB IL 1,935 1.36 57.50 51.36 -11 10 20 -25 Dec-13 31.8 25.6 12.1 2.1 5.1 2.3 16.0 1.6 19.0 16.8

Aggregate 24.1 18.9 19.4 1.0 24.1 2.2 7.8 1.7

Consumer staples

Mayora Indah MYOR IJ IL 2,219 0.11 28,825 27,895 -3 1 11 -7 Dec-13 22.9 18.8 30.8 0.6 5.1 1.8 13.4 1.0 19.8 24.1

MK Restaurants M TB OP 1,579 2.41 58 66 14 4 13 NA Dec-13 22.7 20.7 11.3 1.8 3.9 3.5 13.7 3.1 18.9 17.7

Super Group SUPER SP IL 1,328 2.27 1.48 2.09 41 3 -22 -38 Dec-13 18.2 16.0 12.5 1.3 3.3 2.7 12.7 2.7 20.7 18.7

Universal Robina URC PM OP 7,479 7.70 150.00 195.60 30 -2 34 19 Sep-13 27.7 24.3 21.2 1.1 6.0 3.5 18.1 2.4 24.9 22.5

Aggregate 25.5 22.0 15.6 1.4 25.5 2.9 12.8 2.2

Healthcare

KPJ Healthcare KPJ MK OP 1,051 1.13 3.31 3.62 9 -1 -15 -21 Dec-13 31.6 27.6 9.0 3.1 3.0 1.3 17.4 1.6 7.6 9.8

Raffles Medical RFMD SP OP 1,632 1.05 3.67 4.16 13 3 18 9 Dec-13 27.9 24.9 13.2 1.9 4.0 5.4 20.1 1.6 16.4 15.5

Siloam Int. Hospitals SILO IJ OP 1,190 8.80 13,200 13,982 6 1 39 NA Dec-13 127.3 85.4 80.2 1.1 8.7 4.2 30.0 0.1 8.5 7.1

Tempo Scan Pacific TSPC IJ OP 1,094 0.22 2,825 3,878 37 3 -13 -38 Nov-13 18.2 15.2 14.7 1.0 3.0 1.6 11.2 3.0 19.5 17.3

Aggregate 30.7 25.9 13.4 1.9 30.7 2.4 10.3 1.5

Industrials

AKR Corporindo AKRA IJ OP 1,490 3.11 4,460 6,050 36 2 2 -17 Dec-13 17.4 13.0 29.3 0.4 2.8 0.6 7.0 2.3 20.6 34.5

Arwana Citramulia ARNA IJ OP 626 0.32 990 983 -1 5 21 27 Dec-13 26.0 20.4 23.2 0.9 8.1 4.2 22.3 1.9 41.9 34.9

Boustead Singapore BOCS SP OP 783 0.70 1.86 2.02 9 0 10 36 Mar-14 16.7 14.9 -11.9 -1.2 3.0 1.8 10.2 2.7 18.5 18.2

CWT CWT SP OP 855 0.87 1.79 1.95 9 3 32 1 Dec-13 10.4 8.9 6.6 1.4 1.5 0.1 9.2 1.7 12.5 14.9

Goodpack GPACK SP OP 1,088 1.46 2.46 2.71 10 3 26 50 Jun-13 19.6 17.6 11.9 1.5 2.8 5.1 12.0 2.6 12.8 15.4

Aggregate 15.9 13.0 11.7 1.1 15.9 0.5 6.0 2.3

Media

BEC World BEC TB IL 3,057 3.55 49.50 51.68 4 -3 -2 -24 Dec-13 17.5 15.8 6.7 2.3 10.1 5.1 9.4 5.2 57.5 60.4

Global Mediacom BMTR IJ IL 2,524 2.05 2,095 2,599 24 -4 10 -16 Dec-13 15.1 11.8 37.1 0.3 2.2 2.3 5.5 1.7 19.4 16.1

Major Cineplex MAJOR TB OP 465 1.10 17.10 22.43 31 -3 -2 -29 Dec-13 15.8 13.7 18.3 0.7 2.5 1.8 8.2 5.4 12.9 15.7

Media Nusantara MNCN IJ OP 3,279 2.59 2,720 3,185 17 4 4 -16 Dec-13 16.5 13.7 20.7 0.7 3.8 4.5 11.6 3.2 33.1 27.0

MNC Sky Vision MSKY IJ OP 1,274 0.16 2,095 3,039 45 0 5 -26 Dec-13 26.5 18.7 104.8 0.2 5.9 3.7 9.3 1.3 16.8 24.0

Surya Citra Media SCMA IJ OP 3,989 1.89 3,170 3,961 25 1 21 6 Dec-13 27.3 22.2 26.7 0.8 12.2 10.3 18.8 2.6 58.7 52.0

Aggregate 19.1 15.6 18.9 0.8 19.1 4.3 2.6 3.1

Resources

Sri Trang Agro STA TB IL 548 1.42 14.00 14.71 5 5 8 -8 Dec-13 9.1 7.1 17.7 0.4 0.9 0.2 10.9 3.3 10.5 9.8

Aggregate 8.9 7.0 56.1 0.1 8.9 0.2 10.8 3.4

Share prices as of 29 May 2014.

Sources: Bloomberg, Companies, Standard Chartered Research estimates

6

E

q

u

i

t

y

R

e

s

e

a

r

c

h

l

D

o

u

b

l

e

i

n

3

,

T

r

i

p

l

e

i

n

5

3

0

M

a

y

2

0

1

4

Figure 3: Team coverage by country

Company name Ticker Rec

Mkt cap

(USD

mn)

6-month

AD liq.

(USD mn)

Share

price

(LCY)

Price

target

(LCY)

"+/-"

(%)

%

Change

1W

%

Change

YTD

%

Change

12M FYE

PER

FY1E

(x)

PER

FY2E

(x)

EPS

CAGR

(FY0-

FY2E)

PEG

(x)

PBR

FY1E

(x)

Price to

sales

FY1E

(x)

EV/

EBITDA

FY1E

(x)

Div

yield

FY1E

(%)

ROCE

FY1E

(%)

RoE

FY1E

(%)

Singapore

Boustead Singapore BOCS SP OP 783 0.70 1.86 2.02 9 0 10 36 Mar-14 16.7 14.9 -11.9 -1.2 3.0 1.8 10.2 2.7 18.5 18.2

CWT CWT SP OP 855 0.87 1.79 1.95 9 3 32 1 Dec-13 10.4 8.9 6.6 1.4 1.5 0.1 9.2 1.7 12.5 14.9

Eu Yan Sang Intl. EYSAN SP OP 296 0.17 0.84 1.03 23 1 -3 14 Jun-13 17.5 15.8 15.8 1.0 2.3 1.0 9.9 3.1 12.3 13.4

Goodpack GPACK SP OP 1,088 1.46 2.46 2.71 10 3 26 50 Jun-13 19.6 17.6 11.9 1.5 2.8 5.1 12.0 2.6 12.8 15.4

OSIM Intl. OSIM SP OP 1,638 2.85 2.80 3.57 28 1 22 37 Dec-13 18.1 15.6 22.4 0.7 4.8 2.9 11.3 2.5 30.8 32.3

Parkson Retail Asia PRA SP OP 485 0.07 0.90 1.28 42 -2 -7 -42 Jun-13 16.4 12.9 12.4 1.0 2.4 1.3 7.4 6.1 16.6 14.6

Raffles Medical RFMD SP OP 1,632 1.05 3.67 4.16 13 3 18 9 Dec-13 27.9 24.9 13.2 1.9 4.0 5.4 20.1 1.6 16.4 15.5

Super Group SUPER SP IL 1,328 2.27 1.48 2.09 41 3 -22 -38 Dec-13 18.2 16.0 12.5 1.3 3.3 2.7 12.7 2.7 20.7 18.7

Aggregate 18.0 15.4 11.9 1.3 18.0 0.9 11.7 2.5

Malaysia

KPJ Healthcare KPJ MK OP 1,051 1.13 3.31 3.62 9 -1 -15 -21 Dec-13 31.6 27.6 9.0 3.1 3.0 1.3 17.4 1.6 7.6 9.8

Aggregate 31.3 26.9 9.5 2.8 31.3 1.3 17.4 1.6

Indonesia

Ace Hardware ACES IJ OP 1,306 1.26 885 1,049 19 4 50 -1 Dec-13 24.3 20.0 24.5 0.8 6.3 3.2 17.1 0.8 34.8 29.0

Arwana Citramulia ARNA IJ OP 626 0.32 990 983 -1 5 21 27 Dec-13 26.0 20.4 23.2 0.9 8.1 4.2 22.3 1.9 41.9 34.9

AKR Corporindo AKRA IJ OP 1,490 3.11 4,460 6,050 36 2 2 -17 Dec-13 17.4 13.0 29.3 0.4 2.8 0.6 7.0 2.3 20.6 34.5

Global Mediacom BMTR IJ IL 2,524 2.05 2,095 2,599 24 -4 10 -16 Dec-13 15.1 11.8 37.1 0.3 2.2 2.3 5.5 1.7 19.4 16.1

Matahari Dept Store LPPF IJ OP 3,609 3.77 14,375 17,105 19 3 31 7 Dec-13 25.5 18.9 40.5 0.5 10.1 4.9 17.2 1.6 45.5 46.0

Mayora Indah MYOR IJ IL 2,219 0.11 28,825 27,895 -3 1 11 -7 Dec-13 22.9 18.8 30.8 0.6 5.1 1.8 13.4 1.0 19.8 24.1

Media Nusantara MNCN IJ OP 3,279 2.59 2,720 3,185 17 4 4 -16 Dec-13 16.5 13.7 20.7 0.7 3.8 4.5 11.6 3.2 33.1 27.0

Mitra Adiperkasa MAPI IJ OP 743 1.11 5,200 6,206 19 -3 -5 -44 Dec-13 27.4 15.7 29.5 0.5 3.3 0.7 9.1 0.6 17.1 12.4

MNC Sky Vision MSKY IJ OP 1,274 0.16 2,095 3,039 45 0 5 -26 Dec-13 26.5 18.7 104.8 0.2 5.9 3.7 9.3 1.3 16.8 24.0

Ramayana Lestari RALS IJ IL 757 0.28 1,240 1,238 0 2 17 -16 Dec-13 17.8 15.0 22.7 0.7 2.5 1.4 10.4 2.8 15.1 14.5

Siloam Int. Hospitals SILO IJ OP 1,190 8.80 13,200 13,982 6 1 39 NA Dec-13 127.3 85.4 80.2 1.1 8.7 4.2 30.0 0.1 8.5 7.1

Surya Citra Media SCMA IJ OP 3,989 1.89 3,170 3,961 25 1 21 6 Dec-13 27.3 22.2 26.7 0.8 12.2 10.3 18.8 2.6 58.7 52.0

Tempo Scan Pacific TSPC IJ OP 1,094 0.22 2,825 3,878 37 3 -13 -38 Nov-13 18.2 15.2 14.7 1.0 3.0 1.6 11.2 3.0 19.5 17.3

Aggregate 22.3 17.3 23.5 0.7 22.3 2.4 0.4 1.8

Thailand

BEC World BEC TB IL 3,057 3.55 49.50 51.68 4 -3 -2 -24 Dec-13 17.5 15.8 6.7 2.3 10.1 5.1 9.4 5.2 57.5 60.4

Home Product Centre HMPRO TB IL 2,667 5.13 9.15 9.28 1 5 12 -26 Dec-13 25.9 21.7 14.7 1.5 5.8 1.9 14.6 1.2 19.0 24.2

Major Cineplex MAJOR TB OP 465 1.10 17.10 22.43 31 -3 -2 -29 Dec-13 15.8 13.7 18.3 0.7 2.5 1.8 8.2 5.4 12.9 15.7

MK Restaurants M TB OP 1,579 2.41 57.75 65.90 14 4 13 NA Dec-13 22.7 20.7 11.3 1.8 3.9 3.5 13.7 3.1 18.9 17.7

Robinson Dept. St. ROBINS TB IL 1,935 1.36 57.50 51.36 -11 10 20 -25 Dec-13 31.8 25.6 12.1 2.1 5.1 2.3 16.0 1.6 19.0 16.8

Sri Trang Agro STA TB IL 548 1.42 14.00 14.71 5 5 8 -8 Dec-13 9.1 7.1 17.7 0.4 0.9 0.2 10.9 3.3 10.5 9.8

Aggregate 20.5 17.7 11.3 1.6 20.5 1.5 11.9 3.0

Philippines

Universal Robina URC PM OP 7,479 7.70 150.00 195.60 30 -2 34 19 Sep-13 27.7 24.3 21.2 1.1 6.0 3.5 18.1 2.4 24.9 22.5

Aggregate 27.9 24.3 18.5 1.3 27.9 3.5 18.1 2.3

Share prices as of 29 May 2014.

Sources: Bloomberg, Companies, Standard Chartered Research estimates

Equity Research l Double in 3, Triple in 5

30 May 2014 7

This note was originally published on 29 May 2014. Click here to view the full report

Goodpack

Disappointing offer price

Goodpack announced on 27 May 2014 that private equity

firm Kohlberg Kravis Roberts (KKR) offered to acquire the

company at SGD 2.50/share.

The offer price represents a 7% premium to Goodpacks

share price on 23 May 2014 (last traded price prior to the

announcement) and a 23% premium to the close price on 18

March 2014 (prior to the announcement of a possible offer).

We are disappointed by the offer price, as we value

Goodpack at SGD 2.71/share, 8% above the offer price.

The offer is via a scheme of arrangement and requires 75%

shareholder approval.

OUTPERFORM (unchanged)

Benchmarking the offer price. We estimate that the offer price

translates to 17.9x 2015E PER, while our DCF-based price target

for Goodpack translates to 19.4x 2015E PER. The offer price

translates to a 10% discount to Brambles on 2015E PER and an

11% premium on 2015E EV/EBITDA. We analysed two deals

Brambles acquisition of Pallecon (2012) and China Merchants

Groups (CMG) acquisition of Loscam (2010) to compare

valuations. These deals were carried out at 7.4-11.7x historical

EV/EBITDA (the offer price translates to 11x 2015E EV/EBITDA).

Surprised by the deal. The offer price is close to our estimated

offer price of SGD 2.51/share in our leveraged-buyout (LBO)

analysis (please see LBO analysis shows a high offer price is

unlikely, dated 25 April 2014). We are surprised that the Lam

family is selling the company for SGD 2.50/share, as it represents

only a 6% premium to Goodpacks share price of SGD 2.35 on 12

January 2011. Fundamentally, we view the offer price as low, and

believe the Lam family's willingness to sell at this price raises

questions about Goodpack's growth prospects, such as the

potential to break into the auto-parts industry.

Deal may not proceed smoothly. As KKRs offer is via a scheme

of arrangement, the deal requires 75% shareholder approval. In

the event of a competing offer, KKR also has the option to switch

to a voluntary conditional cash offer which will require 50%

approval. We note that the Lam family owns 32% of Goodpack, but

given our view that the offer price is low, we anticipate some

shareholders may reject the offer. According to Bloomberg, the five

largest institutional shareholders hold 23.2% of shares. We also

believe there may be potential counter offers, as CMG (unlisted)

and Brambles (BXB AU, NR) have aligned business strategies.

Source: Company, Standard Chartered Research estimates

Share price performance

Source: Company, FactSet

PRICE as of 28 May 2014

SGD 2.44

PRICE TARGET

SGD 2.71

Bloomberg code Reuters code

GPACK SP GPAK.SI

Market cap 12-month range

SGD 1,367mn (USD 1,088mn) SGD 1.43 - 2.51

EPS adj. est. change 2014E - 2015E -

Year-end: June 2013 2014E 2015E 2016E

Sales (USD mn) 191 215 245 276

EBITDA (USD mn) 84 95 108 121

EBIT (USD mn) 66 75 86 97

Pre-tax profit (USD mn) 60 65 74 85

Net profit adj. (USD mn) 48 54 62 72

FCF (USD mn) (43) (4) 10 26

EPS adj. (USD) 0.09 0.10 0.11 0.13

DPS (USD) 0.05 0.05 0.06 0.06

Book value/share (USD) 0.64 0.68 0.74 0.81

EPS growth adj. (%) 7.3 7.3 16.1 14.9

DPS growth (%) 0.0 -0.7 11.9 14.9

EBITDA margin (%) 43.8 44.4 44.1 43.9

EBIT margin (%) 34.8 35.1 35.1 35.3

Net margin adj. (%) 25.1 25.0 25.5 26.0

Div. payout (%) 52.4 49.9 49.9 49.9

Net gearing (%) 19.8 24.6 26.8 25.6

ROE (%) 16.3 15.4 15.7 16.5

ROCE (%) 12.5 12.8 13.8 14.7

EV/sales (x) 4.4 5.3 4.9 4.4

EV/EBITDA (x) 10.0 12.0 11.2 10.1

PBR (x) 2.0 2.8 2.6 2.4

PER adj. (x) 16.3 19.6 17.6 15.4

Dividend yield (%) 3.4 2.6 2.8 3.2

1.4

2.0

2.6

May-13 Aug-13 Nov-13 Feb-14 May-14

Goodpack STRAITS TIMES INDEX(rebased)

Share price (%) -1 mth -3 mth -12 mth

Ordinary shares 4 33 46

Relative to index 3 26 52

Relative to sector - - -

Major shareholder Goodpack Holdings Pte Ltd (30.5%)

Free float 53%

Average turnover (USD) 1,160,961

Rashad Latheef

+65 6596 8505

Equity Research

Standard Chartered Bank, Singapore Branch

Stephen Hui

+65 6596 8514

Equity Research

Standard Chartered Bank, Singapore Branch

GPACK SP

SGD 2.44 SGD 2.71

Equity Research l Double in 3, Triple in 5

30 May 2014 8

This note was originally published on 29 May 2014. Click here to view the full report

Mitra Adiperkasa

One step in the right direction

MAPI recently announced that Everstone Capital is buying a

51% stake in Dominos Pizza (DPI). Management said it is in

talks with potential buyers for its Burger King franchise.

We maintain our Outperform rating and raise our 2015-16E

earnings estimates by 4-5% to reflect a higher EBIT margin

post-divestment of its loss-making F&B businesses. We

assume that Burger King (BK) is divested in 2H14.

We cut our price target to IDR 6,206 (from IDR 6,879) to

factor in MAPIs higher working capital needs and the

absence of divestment gains from DPI and BK in 2014.

MAPI is trading at 15.7x 2015E PER, a 12% discount to

Indonesian discretionary retailers. Our price target implies a

reasonable target multiple of 18.7x 2015E PER.

OUTPERFORM (unchanged)

Divestment of Dominos Pizza. Everstone Capital, a Singapore-

based private equity firm, is buying a 51% stake in DPI. MAPI will

not book any divestment gain from this transaction, as it is

structured as a capital injection by Everstone into DPI. This will

dilute MAPIs stake in DPI to 49% from 100% in 2013. MAPI

cannot undertake a 100% divestment, as Indonesia restricts

foreign ownership in foodservices to 51%.

Margins could improve in 2015. We estimate that the divestment

of DPI could yield a 30bps improvement in EBIT margin and there

could be a further 80bps upside after a potential divestment of BK.

We expect this margin upside to occur largely in 2015, as the

transactions are likely to be completed only in 2H14. The two

business units contributed IDR 60bn of EBIT loss in 2013.

Caveat emptor. While we see this divestment as a positive, there

are still downside risks for MAPI in this consolidation year: (1)

weaker-than-expected sales growth in the next six months, (2)

margin weakness beyond 2Q14 if discounting continues, and (3)

delays in addressing inventory management issues. We cut our

2014E earnings by 9% to reflect lower gross profit margin due to

ongoing discounting to reduce excess inventory.

High risk, high returns. MAPIs share price has corrected 25%

since February. On a 12-month forward PER basis, MAPIs trading

premium to Ramayana has narrowed to 28%, compared to a three-

year historical average of 55%. MAPI is trading at 15.7x 2015E

PER and our price target implies 19% potential upside.

Source: Company, Standard Chartered Research estimates

Share price performance

Source: Company, FactSet

Alvin Witirto

+65 6596 8530

Equity Research

Standard Chartered Bank, Singapore Branch

Stephen Hui

+65 6596 8514

Equity Research

Standard Chartered Bank, Singapore Branch

PRICE as of 28 May 2014

IDR 5,200

PRICE TARGET

IDR 6,206

Bloomberg code Reuters code

MAPI IJ MAPI.JK

Market cap 12-month range

IDR 8,632.0bn (USD 746mn) IDR 4,050 - 9,300

EPS adj. est. change 2014E -8.9% 2015E 5.3%

Year-end: December 2013 2014E 2015E 2016E

Sales (IDR bn) 9,734 11,707 13,690 16,494

EBITDA (IDR bn) 1,215 1,226 1,585 1,930

EBIT (IDR bn) 751 728 1,103 1,403

Pre-tax profit (IDR bn) 485 434 757 1,044

Net profit adj. (IDR bn) 328 315 550 758

FCF (IDR bn) (767) (218) (88) (35)

EPS adj. (IDR) 197 190 331 457

DPS (IDR) 54 31 55 75

Book value/share (IDR) 1,463 1,599 1,898 2,300

EPS growth adj. (%) -24.3 -3.8 74.3 37.9

DPS growth (%) 25.7 -42.0 74.3 37.9

EBITDA margin (%) 12.5 10.5 11.6 11.7

EBIT margin (%) 7.7 6.2 8.1 8.5

Net margin adj. (%) 3.4 2.7 4.0 4.6

Div. payout (%) 27.4 16.5 16.5 16.5

Net gearing (%) 99.1 97.3 86.4 74.6

ROE (%) 14.3 12.4 18.9 21.8

ROCE (%) 21.1 17.1 21.6 23.2

EV/sales (x) 1.4 1.0 0.8 0.7

EV/EBITDA (x) 10.8 9.1 7.2 5.9

PBR (x) 3.8 3.3 2.7 2.3

PER adj. (x) 34.2 27.4 15.7 11.4

Dividend yield (%) 0.8 0.6 1.1 1.4

4,000

7,000

10,000

May-13 Aug-13 Nov-13 Feb-14 May-14

Mitra Adiperkasa JAKARTA COMPOSITE INDEX(rebased)

Share price (%) -1 mth -3 mth -12 mth

Ordinary shares -14 -25 -42

Relative to index -17 -30 -40

Relative to sector - - -

Major shareholder PT Satya Mulia Gema Gemilang (56.0%)

Free float 40%

Average turnover (USD) 1,095,952

Equity Research l Double in 3, Triple in 5

30 May 2014 9

This note was originally published on 29 May 2014. Click here to view the full report

THAICOM Public Company

NOT RATED

NON-COVERED COMPANY VISIT NOTE

Standard Chartered Equity Research does not cover this company

and nothing herein should be interpreted to be a recommendation

or price target with respect to the company.

PRICE as of 28 May 2014

THB 38.50

Key points

Monopoly business: THAICOM is the only satellite service

operator in Thailand and it operates the only broadband

satellite in Asia-Pacific.

Growth driver: Management expects the launch of digital

TV in Thailand and rising internet usage to drive demand

for their broadcast and broadband satellites. They believe

the number of HD channels in Thailand will increase from

54 at end-2013 to c.470 by 2020.

Expanding capacity: THAICOM currently operates three

satellites and plans to launch a new broadcast satellite

(THAICOM 7) in July 2014, and another in 2H16 (THAICOM

8) to support growing demand.

Bloomberg code: THCOM TB PER historical (x) 37.4

Mkt cap (USD mn) 1,291 Yield historical (%) 1.2

12M range (THB) 27.75-43.75 P/B historical (x) 2.7

3M value traded (USD mn) 3.80 ROE (%) 7.3

No. of shares (m) 1,096 Net gearing (%) 40.8

Est. free float (%) 46.4 Net debt (cash) (THB mn) 6,363

Established 1991 Historical EPS (THB) 1.03

Listed 1994 EPS 3Y CAGR (%) -2.12

Secondary placement NA EPS 7Y CAGR (%) NA

Auditors, since KPMG, 2013 Historical DPS (THB) 0.45

Year-end December DPS 3Y CAGR (%) NA

Major shareholder Shin Corporation 41.14%

Source: Annual report

What THAICOM does (and why)

THAICOM is a satellite company in Thailand. It operates satellite and

related services, as well as telephone, internet access and media

services. Its business involves domestic and international customers

in Asia, Africa and Australia.

Why we visited THAICOM

THAICOM was established in 1991 by Shin Corporation. It was

granted a 30-year domestic Communication Satellite Operating

Agreement by the Ministry of Information and Communication

Technology (MICT) and became the countrys sole satellite service

provider.

Valuations and share price performance

THAICOM trades at 19.5x 2015 PER, with 2.6% dividend yield, based

on Bloomberg consensus. The stock is down 5% YTD, while the SET

has risen 8%.

Did you know

Broadcast satellites rotate at the same speed as the Earth, which

keeps their transmissions stable

Share price performance (Bt)

Source: FactSet

Revenue breakdown, 2013

Source: Company

22

24

26

28

30

32

34

36

38

40

May-13 Aug-13 Nov-13 Feb-14 May-14

THAICOM Public Company STOCK EXCH OF THAI INDEX (Rebased)

88%

7%

5%

Satellite service

Oversea telephone

service

Internet and media

service

Munchuga Khajornkowit

+65 6596 8504

Equity Research

Standard Chartered Bank, Singapore Branch

Stephen Hui

+65 6596 8514

Equity Research

Standard Chartered Bank, Singapore Branch

Equity Research l Double in 3, Triple in 5

30 May 2014 10

Top-down view

Price performance

Figure 4: Price performance by market

Price performance ADVT

Past week

YTD

2 wk/1M

1M/6M

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

ASEAN 0.7% -0.6% 1.2%

10.4% 7.5% 3.0% 1.2 1.1 0.1

1.1 1.0 0.1

Singapore 1.5% 0.5% 1.0%

6.1% 1.3% 4.8% 1.2 0.9 0.3

1.2 1.1 0.1

Malaysia 0.2% -0.2% 0.4%

3.7% 2.6% 1.1% 1.1 1.1 0.0

0.8 0.9 0.0

Indonesia -0.4% -0.8% 0.5%

25.3% 26.8% -1.5% 1.0 1.2 -0.2

1.1 1.0 0.0

Thailand 1.0% -2.0% 3.0%

14.4% 6.8% 7.6% 1.2 1.1 0.0

1.2 1.1 0.1

Philippines -1.6% -3.1% 1.5%

18.2% 16.4% 1.8% 0.9 1.0 -0.1

1.2 1.0 0.2

Source: Bloomberg, Standard Chartered Research

Figure 5: Price performance by sector

Price performance Change in ADVT

Past week

YTD

2 week change

2wk vs 6m ADVT

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Consumer discretionary 0.6% -0.8% 1.4%

6.8% 4.9% 1.9%

1.1 0.8 0.3

-53.0 -13.6 -39.3

Consumer staples 0.9% -0.3% 1.2%

10.0% 7.8% 2.3%

1.0 1.1 -0.1

-30.9 -55.7 24.7

Energy 0.8% -3.7% 4.5%

2.8% -4.7% 7.5%

1.2 1.1 0.0

-33.6 -10.1 -23.4

Financials 0.5% -0.5% 1.0%

11.8% 8.7% 3.1%

1.1 1.1 0.0

-79.8 -184.3 104.4

Healthcare -0.9% -0.2% -0.7%

6.5% 24.7% -18.2%

1.3 NA NA

-15.5 NA NA

Industrials 2.0% -0.6% 2.5%

13.2% 4.0% 9.2%

1.3 1.1 0.2

-93.0 18.3 -111.2

Information technology 0.3% -0.5% 0.8%

8.1% 9.6% -1.5%

0.9 1.1 -0.2

-17.6 -15.5 -2.1

Materials -0.2% -0.3% 0.1%

15.9% 2.6% 13.3%

0.9 1.1 -0.2

-12.6 -42.3 29.7

Telecom services -1.4% -0.5% -1.0%

10.8% 9.6% 1.2%

0.9 1.1 -0.2

21.6 -15.5 37.1

Utilities -0.7% -0.5% -0.1%

14.2% 11.9% 2.3%

1.2 1.1 0.0

1.1 -40.7 41.8

Source: Bloomberg, Standard Chartered Research

Valuation

Figure 6: Valuation by country

PER PBR ROE

2013 2014E 2013 2014E 2013

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

ASEAN 17.5 15.2 2.3 16.5 14.9 1.6 1.4 2.2 -0.7 1.5 2.1 -0.6 8.2% 14.2% -5.9%

Singapore 19.0 14.8 4.1 18.5 14.4 4.1 1.1 1.5 -0.3 1.2 1.5 -0.3 6.2% 10.0% -3.8%

Malaysia 18.1 17.3 0.8 15.8 16.8 -1.0 1.6 2.3 -0.7 1.5 2.2 -0.7 8.4% 13.3% -4.8%

Indonesia 17.2 15.9 1.3 16.2 15.8 0.4 1.8 3.7 -1.9 1.7 3.4 -1.8 10.3% 23.0% -12.7%

Thailand 16.0 11.9 4.1 15.7 11.6 4.1 1.8 2.0 -0.2 1.8 1.9 0.0 11.0% 16.7% -5.7%

Philippines 15.6 19.2 -3.6 14.6 19.3 -4.6 1.3 3.2 -1.9 1.5 2.8 -1.4 8.4% 16.5% -8.1%

Source: Bloomberg, Standard Chartered Research

Equity Research l Double in 3, Triple in 5

30 May 2014 11

Figure 7: Valuation by sector

PER PBR ROE

2013 2014E 2013 2014E 2013

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Small

caps

Large

caps SC-LC

Consumer discretionary 19.6 16.8 2.8 19.4 15.8 3.6 1.8 2.2 -0.4 1.7 2.2 -0.5 9.0% 13.2% -4.2%

Consumer staples 19.6 22.9 -3.3 15.6 21.2 -5.5 2.2 3.0 -0.8 2.1 3.0 -0.8 11.6% 13.0% -1.4%

Energy 32.5 10.9 21.6 22.6 9.6 12.9 1.5 1.5 0.0 1.6 1.4 0.2 4.6% 14.2% -9.6%

Financials 12.1 12.8 -0.7 12.8 12.8 0.0 1.1 1.7 -0.6 1.1 1.7 -0.5 9.2% 13.6% -4.4%

Healthcare 22.3 NA NA 21.6 NA NA 2.8 NA NA 2.7 NA NA 12.7% NA NA

Industrials 53.6 17.9 35.6 31.3 17.7 13.6 1.5 2.0 -0.5 1.6 1.9 -0.3 2.6% 10.9% -8.4%

Information technology 15.8 14.3 1.5 13.6 13.1 0.5 1.7 2.6 -1.0 1.7 2.3 -0.6 11.8% 18.5% -6.8%

Materials 21.5 18.0 3.4 22.9 18.4 4.5 1.0 3.8 -2.7 1.1 3.9 -2.8 5.6% 20.8% -15.2%

Telecom services 17.9 15.4 2.6 17.8 15.7 2.1 3.5 2.5 1.0 3.3 2.4 0.9 19.4% 16.1% 3.4%

Utilities 14.5 14.5 0.0 13.2 13.2 0.0 1.4 1.4 0.0 1.7 1.7 0.0 9.6% 9.6% 0.0%

Source: Bloomberg, Standard Chartered Research

Top and bottom performers

Figure 8: Top performers past week Figure 9: Bottom performers past week

Source: Bloomberg Source: Bloomberg

Figure 10: Top performers YTD Figure 11: Bottom performers YTD

Source: Bloomberg Source: Bloomberg

22%

20%

19%

18%

17%

15%

14%

13% 13%

12%

0%

2%

5%

7%

9%

12%

14%

16%

18%

21%

23%

I

T

D

T

B

C

K

T

B

Y

I

N

G

L

I

S

P

E

A

T

B

T

K

T

B

U

M

I

T

B

B

A

F

S

T

B

Y

O

M

A

S

P

S

T

E

C

T

B

T

H

A

I

T

B

-5%

-5%

-5%

-5%

-5%

-6% -6%

-6%

-6%

-8%

-4%

0%

B

E

L

P

M

M

D

J

M

K

P

E

T

R

M

K

P

X

P

P

M

B

I

G

S

P

O

I

S

H

I

T

B

P

S

L

T

B

U

O

A

D

M

K

E

E

I

P

M

114% 111%

92%

91%

81% 80%

79%

75%

73% 72%

0%

20%

40%

60%

80%

100%

120%

D

O

I

D

I

J

A

D

H

I

I

J

E

A

T

B

C

T

R

S

I

J

N

I

K

L

P

M

A

I

S

A

I

J

W

S

K

T

I

J

O

F

M

T

B

M

K

H

M

K

K

N

M

G

M

K

-25%

-33%

-42% -42%

-43%

-48%

-61% -62%

-65% -72%

-64%

-56%

-48%

-40%

-32%

-24%

-16%

-8%

0%

E

A

R

T

H

T

B

C

N

K

O

I

J

M

A

S

M

K

G

A

M

A

I

J

W

E

B

P

M

L

I

G

O

S

P

I

N

N

S

P

A

C

A

P

S

P

B

L

U

M

S

P

Equity Research l Double in 3, Triple in 5

30 May 2014 12

Historical view

Figure 12: Historical PER band MSCI ASEAN

Based on forward PER, the MSCI ASEAN small-cap index is

trading at 1.64x SD above its historical seven-year average

Figure 13: MSCI ASEAN PER SC premium/discount to LC

Based on forward PER, the MSCI ASEAN small-cap index is

trading at a 6% premium to the large-cap index

Source: MSCI Source: MSCI

Figure 14: Historical PBR band chart MSCI ASEAN

Based on forward PBR basis, the MSCI ASEAN small-cap

index is trading at 0.01x SD above its historical seven-year

average

Figure 15: MSCI ASEAN PBR SC premium/discount to LC

Based on forward PBR basis, the MSCI ASEAN small-cap

index is trading at a 30% discount to the large-cap index.

Source: MSCI Source: MSCI

-50%

-40%

-30%

-20%

-10%

0%

10%

4

6

8

10

12

14

16

18

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

E

R

Small Cap Mean +/- 1 SD

Large Cap Discount

-45%

-40%

-35%

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

Aug-06 Sep-07 Oct-08 Nov-09 Dec-10 Jan-12 Feb-13 Mar-14

P

r

e

m

i

u

m

(

d

i

s

c

)

Discount Mean +/- 1 SD

-60%

-50%

-40%

-30%

-20%

-10%

0%

0.5

1.0

1.5

2.0

2.5

3.0

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

B

R

Small Cap Mean +/- 1 SD

Large Cap Discount

-60%

-50%

-40%

-30%

-20%

-10%

0%

Aug-06 Sep-07 Oct-08 Nov-09 Dec-10 Jan-12 Feb-13 Mar-14

P

r

e

m

i

u

m

(

d

i

s

c

)

Discount Mean +/- 1 SD

Equity Research l Double in 3, Triple in 5

30 May 2014 13

Country focus Singapore

Historical view

Figure 16: Historical PER band chart MSCI Singapore

Based on PER forward, the MSCI Singapore small cap index

is trading at 1.36x SD above its historical seven-year average

Figure 17: Historical PBR band chart MSCI Singapore

Based on PBR forward, the MSCI Singapore small cap index

is trading at 0.61xSD below its historical seven-year average

Source: MSCI Source: MSCI

Top and bottom performers

Figure 18: Top performers past week Figure 19: Bottom performers past week

Source: Bloomberg Source: Bloomberg

Figure 20: Top performers YTD Figure 21: Bottom performers YTD

Source: Bloomberg Source: Bloomberg

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

30%

4

6

8

10

12

14

16

18

20

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

E

R

Small Cap Mean +/- 1 SD

Large Cap Discount

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

0.5

1.0

1.5

2.0

2.5

3.0

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

B

R

Small Cap Mean +/- 1 SD

Large Cap Discount

19%

13%

11%

10%

9%

9%

8%

8%

7% 7%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

Y

I

N

G

L

I

S

P

Y

O

M

A

S

P

H

F

C

S

P

A

C

A

P

S

P

I

N

N

S

P

S

I

L

V

S

P

T

G

R

S

P

S

P

O

S

T

S

P

G

G

L

S

P

B

L

U

M

S

P

-2% -2%

-2%

-2% -2% -2%

-3%

-4%

-4%

-5% -6%

-5%

-4%

-3%

-2%

-1%

0%

R

T

R

Y

S

P

B

R

E

A

D

S

P

A

R

A

S

P

P

R

A

S

P

A

S

L

S

P

L

I

G

O

S

P

I

F

A

R

S

P

T

I

H

S

P

R

H

T

S

P

B

I

G

S

P

48%

33% 33%

32% 32%

30%

29% 29%

27% 27%

0%

10%

20%

30%

40%

50%

60%

B

R

E

A

D

S

P

A

S

T

S

P

H

F

C

S

P

C

W

T

S

P

U

E

M

S

P

V

A

R

D

S

P

B

A

L

S

P

G

L

L

S

P

M

R

T

S

P

S

P

O

S

T

S

P

-22% -23% -23% -23%

-24%

-25%

-48%

-61% -62%

-65%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

S

U

P

E

R

S

P

T

I

H

S

P

E

Z

R

A

S

P

C

S

E

S

P

F

E

H

S

P

O

T

M

L

S

P

L

I

G

O

S

P

I

N

N

S

P

A

C

A

P

S

P

B

L

U

M

S

P

Equity Research l Double in 3, Triple in 5

30 May 2014 14

Watch list

Figure 22: Singapore watch list

Company name Ticker Rec

Mkt cap

(USD

mn)

6-

month

AD liq.

(USD

mn)

Share

price

(LCY)

Price

target

(LCY)

"+/-"

(%)

%

Change

1W

%

Change

YTD

%

Change

12M FYE

PER

FY1E

(x)

PER

FY2E

(x)

EPS

CAGR

(FY0-

FY2E)

PEG

(x)

PBR

FY1E

(x)

Price to

sales

FY1E

(x)

EV/

EBITDA

FY1E

(x)

Div

yield

FY1E

(%)

ROCE

FY1E

(%)

RoE

FY1E

(%)

Consumer discretionary

Courts Asia Ltd COURTS SP NR 237 0.29 0.54 NA NA 3 -13 -49 Mar-13 9.6 8.2 -9.0 -0.9 1.0 0.3 8.0 3.0 29.6 10.2

Eu Yan Sang Intl. EYSAN SP OP 296 0.17 0.84 1.03 23 1 -3 14 Jun-13 17.5 15.8 15.8 1.0 2.3 1.0 9.9 3.1 12.3 13.4

Hour Glass Ltd. HG SP NR 339 0.13 1.81 NA NA 6 8 -2 Mar-14 NA NA NA NA NA NA NA NA 17.7 NA

OSIM Intl. OSIM SP OP 1,638 2.85 2.80 3.57 28 1 22 37 Dec-13 18.1 15.6 22.4 0.7 4.8 2.9 11.3 2.5 30.8 32.3

Parkson Retail Asia PRA SP OP 485 0.07 0.90 1.28 42 -2 -7 -42 Jun-13 16.4 12.9 12.4 1.0 2.4 1.3 7.4 6.1 16.6 14.6

Aggregate 18.3 15.3 -0.2 -82.8 18.3 1.6 11.4 2.9

Consumer Staples

Breadtalk Group BREAD SP NR 299 0.47 1.33 NA NA -2 48 37 Dec-13 23.8 19.9 17.8 1.1 NA 0.6 6.1 1.6 19.7 15.1

Del Monte Pacific DELM SP NR 610 0.89 0.59 NA NA 5 -3 -34 Dec-13 15.2 11.2 84.0 0.1 2.2 1.1 9.9 3.0 17.4 15.0

Food Empire Hldg. FEH SP NR 174 0.05 0.41 NA NA 1 -24 -39 Dec-13 NA NA NA NA NA NA NA NA 14.8 NA

JB Foods JBF SP NR 94 0.03 0.25 NA NA 0 -18 -44 Dec-13 NA NA NA NA NA NA NA NA 27.5 NA

Petra Foods Ltd PETRA SP OP 1,864 0.84 3.92 4.00 2 -1 23 -6 Dec-13 27.3 24.0 15.9 1.5 5.7 3.5 15.1 0.9 31.6 21.9

Sheng Siong Group SSG SP NR 684 0.35 0.62 NA NA 1 2 -6 Dec-13 19.4 18.2 10.0 1.8 5.4 1.2 12.6 4.7 21.7 28.4

Sino Grandness SFGI SP NR 321 1.23 0.69 NA NA 5 -6 -10 Dec-13 4.1 3.5 17.8 0.2 1.0 0.7 3.3 1.5 32.4 28.8

Super Group SUPER SP IL 1,328 2.27 1.48 2.09 41 3 -22 -38 Dec-13 18.2 16.0 12.5 1.3 3.3 2.7 12.7 2.7 20.7 18.7

Yeo Hiap Seng YHS SP NR 1,007 0.07 2.20 NA NA 0 -8 -21 Dec-13 NA NA NA NA NA NA NA NA 14.8 4.0

Aggregate 20.0 17.7 2.2 8.2 20.0 2.0 12.4 1.7

Healthcare

Biosensors Intl. BIG SP NR 1,292 3.57 0.96 NA NA -5 14 -18 Mar-14 23.1 20.0 26.4 0.8 1.1 3.9 12.1 0.9 NA 5.1

IHH Healthcare IHH SP NR 10,470 0.12 1.61 NA NA -1 7 -1 Dec-13 43.4 36.5 NA NA 1.8 NA 19.6 0.4 6.6 4.1

Raffles Medical RFMD SP OP 1,632 1.05 3.67 4.16 13 3 18 9 Dec-13 27.9 24.9 13.2 1.9 4.0 5.4 20.1 1.6 16.4 15.5

Aggregate 38.7 32.6 18.5 1.8 38.7 4.4 17.7 0.6

Industrials

Amtek Engineering AMTK SP OP NA 0.00 0.48 NA NA -1 23 18 Jun-13 NA NA NA NA NA NA NA NA NA NA

ASL Marine Hldg. ASL SP IL NA 0.00 0.69 NA NA -2 -4 -3 Jun-13 NA NA NA NA NA NA NA NA NA NA

Boustead Singapore BOCS SP OP 783 0.70 1.86 2.02 9 0 10 36 Mar-14 16.7 14.9 -11.9 -1.2 3.0 1.8 10.2 2.7 18.5 18.2

China XLX Fertiliser CXLX SP UP 307 0.13 0.39 0.28 -27 0 1 -8 Dec-13 6.2 6.3 50.1 0.1 0.9 0.4 5.8 3.8 10.4 14.9

CWT CWT SP OP 855 0.87 1.79 1.95 9 3 32 1 Dec-13 10.4 8.9 6.6 1.4 1.5 0.1 9.2 1.7 12.5 14.9

Ezion Holdings EZI SP OP 2,285 10.75 2.19 2.70 23 1 -1 8 Dec-13 10.8 9.0 28.2 0.3 1.9 4.0 10.5 0.0 12.6 21.7

Ezra Holdings EZRA SP IL 814 5.26 1.06 1.05 -1 1 -23 10 Aug-13 19.4 10.6 NA NA 0.7 0.5 12.5 0.0 4.8 5.2

Goodpack GPACK SP OP 1,088 1.46 2.46 2.71 10 3 26 50 Jun-13 19.6 17.6 11.9 1.5 2.8 5.1 12.0 2.6 12.8 15.4

Hi-P International HIP SP OP NA 0.00 0.68 1.00 48 5 -3 -32 Dec-13 NA NA NA NA NA 0.3 NA 0.0 19.0 13.0

Hyflux Limited HYF SP IL 813 0.75 1.20 1.70 42 1 2 -11 Dec-13 10.5 NA NA NA 0.8 1.3 7.9 6.4 5.5 8.4

KS Energy Services KST SP IL NA 0.00 0.78 NA NA 5 -9 11 Dec-13 NA NA NA NA NA NA NA NA NA NA

Marco Polo Marine MPM SP NR 102 0.07 0.38 NA NA 6 -4 -5 Sep-13 8.3 6.0 -2.3 -2.6 NA 1.0 7.0 3.2 16.7 11.5

Midas Holdings MIDAS SP UP 441 1.75 0.46 0.36 -21 2 -11 -7 Dec-13 19.6 16.3 128.9 0.1 0.9 2.0 9.5 1.7 5.0 4.7

Neptune Orient Lines NOL SP IL 2,014 2.11 0.99 1.00 2 1 -12 -11 Dec-13 nm 16.5 NA NA 1.0 0.2 17.6 -0.5 0.3 -2.9

Otto Marine OTML SP IL 179 2.50 0.07 0.05 -23 4 -25 -13 Dec-13 nm NA NA NA 0.6 0.4 376.9 0.0 0.3 -4.3

Pan-United Corp PAN SP NR 466 0.19 1.04 NA NA 6 8 3 Dec-13 12.2 11.4 6.7 1.7 2.0 0.7 6.3 4.3 13.8 16.8

PEC PEC SP NR 111 0.03 0.55 NA NA 1 -2 -9 Jun-13 NA NA NA NA NA NA NA NA 2.8 NA

Tat Hong Holdings TAT SP NR 429 0.40 0.86 NA NA 6 -5 -42 Mar-14 12.4 12.2 17.2 0.7 0.8 0.8 7.6 2.9 10.8 6.6

Tiger Airways Hldg. TGR SP IL 334 0.44 0.45 0.41 -9 8 -12 -31 Mar-14 nm nm NA NA 1.5 0.6 nm 0.0 -8.3 -93.4

World Precision BWPM SP NR 113 0.01 0.36 NA NA -1 -4 -12 Dec-13 NA NA NA NA NA NA NA NA 7.2 NA

Aggregate 16.7 13.3 26.8 0.5 16.7 0.5 12.1 1.5

Media

Asiatravel.com Hold. AST SP NR 65 0.11 0.28 NA NA 6 33 41 Sep-13 NA NA NA NA NA NA NA NA NA NA

Kingsmen Creatives KMEN SP NR 144 0.03 0.93 NA NA -1 0 -3 Dec-13 9.3 8.5 9.3 0.9 NA 0.6 5.8 4.3 26.5 20.8

Aggregate 13.5 12.6 8.3 1.5 13.5 0.8 8.2 3.0

Property

ARA Asset Mngmt. ARA SP OP 1,198 0.46 1.76 2.10 19 -2 -5 -9 Dec-13 17.1 9.8 42.4 0.2 4.7 9.6 15.4 2.9 28.2 29.5

Second Chance Prop. SCE SP NR 243 0.10 0.45 NA NA 0 -2 2 Aug-13 NA NA NA NA NA NA NA NA 11.2 NA

Yoma Strategic Hold. YOMA SP NR 747 2.74 0.81 NA NA 13 8 -5 Mar-14 73.6 57.9 0.0 NA 2.5 9.9 41.1 0.6 7.5 3.7

Aggregate 27.1 16.1 7.2 2.2 27.1 11.0 22.3 1.8

Resources

GMG Global GGL SP IL NA 0.00 0.11 NA NA 7 -12 -23 Dec-13 NA NA NA NA NA NA NA NA NA NA

Indofood Agri Res. IFAR SP OP 1,151 1.38 1.01 1.23 22 -3 14 -3 Dec-13 11.6 8.9 -98.3 -0.1 0.9 0.1 4.9 1.3 9.3 7.9

Sri-Trang Agro Ind. STA SP IL NA 0.00 0.55 0.56 3 4 7 -13 Dec-13 0.4 0.3 502.3 0.0 0.0 0.2 6.1 84.3 10.3 9.9

Aggregate 11.8 9.6 11.1 0.9 11.8 0.8 6.6 2.0

Tech/Telecom

M1 M1 SP OP 2,603 1.95 3.53 4.00 13 1 10 14 Dec-13 19.4 18.5 4.9 3.8 7.4 3.2 10.5 4.3 27.1 39.8

Silverlake Axis SILV SP NR 1,789 1.23 1.00 NA NA 9 14 28 Jun-13 23.7 20.8 15.3 1.4 11.5 10.8 20.4 3.2 62.5 39.3

Venture Corp VMS SP IL NA 0.00 7.68 7.15 -7 2 -5 0 Dec-13 NA NA NA NA NA 0.8 NA 0.0 8.3 8.5

Aggregate 13.4 12.3 9.2 1.3 13.4 1.5 8.4 6.3

Share prices as of 29 May 2014; Bloomberg estimates for NR stocks.

Source: Bloomberg, Companies, Standard Chartered Research estimates

Equity Research l Double in 3, Triple in 5

30 May 2014 15

Country focus Malaysia

Historical view

Figure 23: Historical PER band chart MSCI Malaysia

Based on PER forward, the MSCI Malaysia small cap index is

trading at 1.26x SD above its historical seven-year average

Figure 24: Historical PBR band chart MSCI Malaysia

Based on PBR forward, the MSCI Malaysia small cap index is

trading at 0.11x SD above the historical seven-year average

Source: MSCI Source: MSCI

Top and bottom performers

Figure 25: Top performers past week Figure 26: Bottom performers past week

Source: Bloomberg Source: Bloomberg

Figure 27: Top performers YTD Figure 28: Bottom performers YTD

Source: Bloomberg Source: Bloomberg

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

4

6

8

10

12

14

16

18

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

E

R

Small Cap Mean +/- 1 SD

Large Cap Discount

-50%

-45%

-40%

-35%

-30%

-25%

-20%

-15%

-10%

-5%

0%

0.5

1.0

1.5

2.0

2.5

3.0

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

B

R

Small Cap Mean +/- 1 SD

Large Cap Discount

10%

8%

7%

7%

6%

5%

5%

4%

3% 3%

0%

2%

4%

6%

8%

10%

12%

E

A

S

T

M

K

P

O

S

M

M

K

M

K

H

M

K

P

E

T

D

M

K

M

A

S

M

K

K

N

M

G

M

K

I

J

M

L

D

M

K

P

R

E

S

S

M

K

M

P

R

M

K

S

T

A

R

M

K

-3%

-3%

-3%

-3%

-4%

-4%

-4%

-5%

-5%

-6%

-7%

-6%

-5%

-4%

-3%

-2%

-1%

0%

P

H

R

M

M

K

E

V

S

D

M

K

P

A

R

M

K

T

H

P

M

K

H

I

B

I

M

K

S

O

P

M

K

U

N

I

M

K

M

D

J

M

K

P

E

T

R

M

K

U

O

A

D

M

K

73% 72%

55%

50%

43%

41% 41%

31% 31%

27%

0%

10%

20%

30%

40%

50%

60%

70%

80%

M

K

H

M

K

K

N

M

G

M

K

P

R

E

S

S

M

K

M

P

I

M

K

C

O

C

O

M

K

C

B

P

M

K

C

M

S

M

K

E

A

S

T

M

K

B

H

B

M

K

U

N

I

M

K

-15% -15%

-15%

-16% -16%

-16%

-17%

-18%

-20%

-42%

-45%

-40%

-35%

-30%

-25%

-20%

-15%

-10%

-5%

0%

K

P

J

M

K

M

D

J

M

K

D

R

B

M

K

G

U

I

N

M

K

T

O

P

G

M

K

L

L

B

M

K

B

C

M

K

H

A

R

T

M

K

P

E

T

D

M

K

M

A

S

M

K

Equity Research l Double in 3, Triple in 5

30 May 2014 16

Watch list

Figure 29: Malaysia watch list

Company name Ticker Rec

Mkt cap

(USD

mn)

6-

month

AD liq.

(USD

mn)

Share

price

(LCY)

Price

target

(LCY)

"+/-"

(%)

%

Change

1W

%

Change

YTD

%

Change

12M FYE

PER

FY1E

(x)

PER

FY2E

(x)

EPS

CAGR

(FY0-

FY2E)

PEG

(x)

PBR

FY1E

(x)

Price

to

sales

FY1E

(x)

EV/

EBITDA

FY1E

(x)

Div

yield

FY1E

(%)

ROCE

FY1E

(%)

RoE

FY1E

(%)

Consumer discretionary

Aeon Co. AEON MK NR 1,674 0.77 3.83 NA NA 1 9 -15 Dec-13 21.3 19.8 8.3 2.4 2.9 1.4 9.3 1.5 15.9 14.4

Asia Brands ABB MK NR 98 0.11 3.99 NA NA 2 0 17 Mar-14 9.7 8.3 10.9 0.8 1.4 0.6 NA 1.3 NA 15.9

Bonia Corp BON MK NR 318 0.44 5.08 NA NA 2 35 131 Jun-13 16.7 14.1 32.5 0.4 2.9 1.5 8.7 1.2 20.0 18.5

DKSH Hold. DKSH MK NR 400 1.31 8.16 NA NA 3 27 54 Dec-13 NA NA NA NA NA NA NA NA 21.4 NA

Padini Hldg. PAD MK NR 412 1.20 2.01 NA NA 0 11 -7 Jun-13 14.0 12.5 11.4 1.1 3.4 1.5 7.4 5.4 23.3 24.3

Parkson Hldg. PKS MK NR 859 1.50 2.61 NA NA -2 1 -26 Jun-13 17.3 15.4 -9.7 -1.6 1.0 0.8 4.3 3.4 12.2 5.5

Aggregate 20.5 18.3 -10.6 -1.7 20.5 1.3 7.7 2.2

Consumer staples

Berjaya Food BFD MK NR 124 0.14 1.45 NA NA -5 -10 -15 Apr-13 17.7 14.2 11.7 1.2 2.1 2.7 15.6 2.7 30.6 13.5

Carlsberg Brewery CAB MK NR 1,158 0.49 12.10 NA NA 0 -1 -25 Dec-13 19.4 18.3 5.0 3.7 13.3 2.3 13.7 5.1 72.3 68.0

Cocoaland Holdings COLA MK NR 109 0.04 2.05 NA NA -5 -4 -18 Dec-13 17.1 15.8 0.6 27.1 1.6 1.4 9.5 3.3 10.9 9.8

Guiness Anchor GUIN MK NR 1,267 0.33 13.48 NA NA 0 -16 -35 Jun-13 21.1 19.9 -3.1 -6.4 10.8 2.5 14.2 4.5 43.2 51.5

Hup Seng Industries HSI MK NR 286 0.29 1.15 NA NA -1 20 95 Dec-13 NA NA NA NA NA NA NA NA 21.0 NA

NTPM Holdings NTPM MK NR 297 0.24 0.85 NA NA 1 13 63 Apr-13 15.2 14.7 14.9 1.0 2.8 1.8 9.7 3.5 15.7 17.3

Oldtown Bhd OTB MK NR 303 0.46 2.15 NA NA -1 3 -14 Dec-12 17.6 16.2 11.1 1.5 2.9 2.2 10.3 2.8 28.6 15.8

Power Root PWRT MK NR 205 0.20 2.17 NA NA 1 10 10 Feb-14 NA NA NA NA NA NA NA NA 17.4 NA

Aggregate 13.6 10.9 20.0 0.5 13.6 1.6 10.0 2.9

Diversified

Berjaya Corp. BC MK NR 636 1.27 0.49 NA NA -1 -17 -21 Apr-13 NA NA NA NA NA NA NA NA 7.3 NA

Boustead Hldg. BOUS MK NR 1,706 0.55 5.30 NA NA -2 -6 -3 Dec-13 12.9 11.9 -2.0 -6.1 1.0 0.5 12.1 5.6 19.2 8.5

Aggregate 17.7 16.3 -9.7 -1.7 17.7 0.7 23.2 4.1

Healthcare

Caring Pharmacy Caring MK NR 146 0.26 2.15 NA NA 1 9 NA May-13 21.5 17.2 NA NA 3.7 NA 11.4 1.6 NA 17.4

Hartalega Hldg. HART MK NR 1,384 1.26 5.95 NA NA 0 -18 7 Mar-14 18.0 18.1 2.3 7.9 4.9 3.9 11.8 2.5 32.9 28.8

IHH Healthcare IHH MK NR 10,590 5.15 4.17 NA NA -2 8 4 Dec-13 43.9 36.9 20.5 1.8 1.8 4.4 19.8 0.4 6.6 4.1

Karex KAREX MK NR 378 0.82 3.00 NA NA -4 8 NA Jun-13 23.6 16.9 -80.3 -0.2 6.0 0.0 18.1 0.9 24.1 27.9

Kossan Rubber KRI MK NR 794 1.36 3.99 NA NA 2 -8 85 Dec-13 14.5 12.1 22.3 0.5 3.1 1.6 9.2 2.5 17.1 22.8

KPJ Healthcare KPJ MK OP 1,051 1.13 3.31 3.62 9 -1 -15 -21 Dec-13 31.6 27.6 9.0 3.1 3.0 1.3 17.4 1.6 7.6 9.8

Pharmaniaga Bhd PHRM MK NR 373 0.23 4.63 NA NA -3 4 2 Dec-13 14.0 13.0 29.0 0.4 2.3 0.6 7.2 3.9 22.9 16.3

Supermax Corp SUCB MK NR 503 1.99 2.38 NA NA 1 -14 19 Dec-13 10.8 9.5 15.1 0.6 1.6 1.2 9.2 2.6 18.6 15.3

Top Glove Corp TOPG MK NR 916 1.82 4.74 NA NA 1 -16 -22 Aug-13 14.6 13.5 5.0 2.7 2.0 1.2 8.6 3.4 15.3 14.3

Aggregate 29.0 25.2 14.9 1.7 29.0 2.6 14.9 1.1

Industrials

AirAsia AIRA MK OP 2,216 6.22 2.56 2.90 13 0 16 -19 Dec-13 8.8 7.2 19.5 0.4 1.2 1.2 8.3 2.3 8.2 15.1

Favelle Favco FFB MK NR 234 0.18 3.49 NA NA 0 11 36 Dec-13 10.3 9.4 8.2 1.2 NA 0.9 6.5 4.0 22.1 17.2

Muhibbah Eng. MUHI MK NR 367 1.19 2.79 NA NA 1 22 91 Dec-13 10.3 8.7 24.8 0.4 1.8 0.6 8.7 2.1 NA 18.6

Asia File Corp AF MK NR 254 0.13 6.96 NA NA -3 59 99 Mar-14 13.7 11.3 8.7 1.3 1.9 2.2 9.9 4.0 18.4 14.3

Aggregate 9.6 7.8 16.9 0.5 9.6 1.1 8.0 2.5

Media

Asia Media AMGB MK NR 28 0.11 0.09 NA NA 0 0 -40 Dec-13 NA NA NA NA NA NA NA NA 4.8 NA

Astro Malaysia ASTRO MK NR 5,614 2.27 3.47 NA NA 2 16 11 Jan-14 39.4 31.8 12.6 2.5 29.9 3.8 12.6 2.2 22.9 81.6

Jobstreet Corp JOBS MK NR 486 0.76 2.42 NA NA -1 -2 32 Dec-13 22.0 18.6 15.6 1.2 NA NA NA NA 75.5 29.7

Media Prima MPR MK NR 870 0.95 2.53 NA NA 3 -3 -17 Dec-13 12.5 11.6 5.7 2.0 1.6 1.6 6.0 5.9 15.7 13.7

Star Publication STAR MK NR 586 0.52 2.55 NA NA 3 16 -1 Dec-13 13.6 12.3 3.7 3.4 1.6 1.8 6.8 6.0 19.7 11.1

Aggregate 30.1 25.5 3.8 6.6 30.1 3.3 9.9 2.8

Resources

Genting Plantations GENP MK UP 2,665 1.05 11.36 9.37 -18 0 3 31 Dec-13 22.9 18.4 37.1 0.5 2.4 5.4 16.3 5.2 10.0 10.8

Petronas PETD MK NR 7,761 5.00 25.10 NA NA 7 -20 1 Dec-13 28.5 23.7 13.8 1.7 4.9 0.7 15.8 2.6 17.8 18.1

QL Resouces QLG MK NR 1,255 0.58 3.23 NA NA 2 14 44 Mar-14 23.8 20.4 7.0 2.9 3.5 1.6 16.1 1.1 14.4 14.9

Sarawak Oil Palms SOP MK NR 900 0.36 6.59 NA NA -4 1 17 Dec-13 16.7 12.8 52.2 0.2 NA 1.2 8.6 0.6 13.4 12.6

TDM Bhd TDM MK NR 445 0.87 0.97 NA NA -2 2 22 Dec-13 13.2 11.2 67.6 0.2 NA 3.5 9.5 2.9 13.1 7.1

TH Plantations THP MK NR 574 0.22 2.09 NA NA -3 11 11 Dec-13 22.0 18.7 25.0 0.7 1.5 3.2 13.8 2.2 14.6 5.8

TSH Resources TSH MK NR 966 0.77 3.46 NA NA 1 15 50 Dec-13 19.9 17.4 5.5 3.2 2.5 2.4 14.8 1.0 17.5 13.3

United Plantations UPL MK UP 1,784 0.26 27.42 21.28 -22 -2 7 2 Dec-13 20.8 17.1 15.1 1.1 2.5 5.5 12.3 3.7 14.7 12.4

Aggregate 24.1 19.8 19.3 1.0 24.1 1.2 14.7 2.8

Share prices as of 29 May 2014; Bloomberg estimates for NR stocks.

Sources: Bloomberg, Companies, Standard Chartered Research estimates

Equity Research l Double in 3, Triple in 5

30 May 2014 17

Country focus Indonesia

Historical view

Figure 30: Historical PER band chart MSCI Indonesia

Based on PER forward, the MSCI Indonesia small cap index is

trading at 1.53x SD above its historical seven-year average

Figure 31: Historical PBR band chart MSCI Indonesia

Based on PBR forward, the MSCI Indonesia small cap index is

trading at 0.42x SD below the historical seven-year average

Source: MSCI Source: MSCI

Top and bottom performers

Figure 32: Top performers past week Figure 33: Bottom performers past week

Source: Bloomberg Source: Bloomberg

Figure 34: Top performers YTD Figure 35: Bottom performers YTD

Source: Bloomberg Source: Bloomberg

-80%

-60%

-40%

-20%

0%

20%

40%

4

6

8

10

12

14

16

18

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

E

R

Small Cap Mean +/- 1 SD

Large Cap Discount

-80%

-60%

-40%

-20%

0%

20%

40%

60%

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

Aug-06 Feb-08 Aug-09 Feb-11 Aug-12 Feb-14

P

B

R

Small Cap Mean +/- 1 SD

Large Cap Discount

15%

10%

9% 9%

8%

8%

6%

6% 6% 6%

0%

2%

4%

6%

8%

10%

12%

14%

16%

S

T

T

P

I

J

I

N

D

Y

I

J

C

S

A

P

I

J

K

B

L

V

I

J

B

O

R

N

I

J

J

P

F

A

I

J

A

I

S

A

I

J

K

A

E

F

I

J

C

N

K

O

I

J

D

O

I

D

I

J

-2%

-2%

-3%

-3%

-3%

-3%

-4%

-5%

-6%

-6%

-7.0%

-6.0%

-5.0%

-4.0%

-3.0%

-2.0%

-1.0%

0.0%

T

E

L

E

I

J

S

C

M

A

I

J

P

W

O

N

I

J

B

B

K

P

I

J

E

N

R

G

I

J

M

A

P

I

I

J

A

B

B

A

I

J

B

M

T

R

I

J

B

R

P

T

I

J

E

C

I

I

I

J

210%

114%

111%

100%

91%

80% 79%

76%

72% 72%

0%

50%

100%

150%

200%

250%

K

B

L

V

I

J

D

O

I

D

I

J

A

D

H

I

I

J

S

T

T

P

I

J

C

T

R

S

I

J

A

I

S

A

I

J

W

S

K

T

I

J

K

A

E

F

I

J

C

S

A

P

I

J

L

P

C

K

I

J

-12%

-13%

-15%

-19%

-20%

-25%

-25%

-26%

-33%

-42%

-45%

-40%

-35%

-30%

-25%

-20%

-15%

-10%

-5%

0%

M

D

R

N

I

J

T

S

P

C

I

J

K

K

G

I

I

J

T

M

P

I

I

J

A

B

B

A

I

J

E

C

I

I

I

J

B

O

R

N

I

J

B

R

P

T

I

J

C

N

K

O

I

J

G

A

M

A

I

J

Equity Research l Double in 3, Triple in 5

30 May 2014 18

Watch list

Figure 36: Indonesia watch list

Company name Ticker Rec

Mkt

cap

(USD

mn)

6-

month

AD liq.

(USD

mn)

Share

price

(LCY)

Price

target

(LCY)

"+/-"

(%)

%

Change

1W

%

Change

YTD

%

Change

12M FYE

PER

FY1E

(x)

PER

FY2E

(x)

EPS

CAGR

(FY0-

FY2E)

PEG

(x)

PBR

FY1E

(x)

Price

to

sales

FY1E

(x)

EV/

EBITDA

FY1E

(x)

Div

yield

FY1E

(%)

ROCE

FY1E

(%)

RoE

FY1E

(%)

Consumer discretionary

Ace Hardware ACES IJ OP 1,306 1.26 885 1,049 19 4 50 -1 Dec-13 24.3 20.0 24.5 0.8 6.3 3.2 17.1 0.8 34.8 29.0

Catur Sentosa CSAP IJ NR 77 0.04 310 NA NA 13 72 35 Dec-13 NA NA NA NA NA NA NA NA 16.3 NA

Electronic City ECII IJ NR 239 0.06 2,085 NA NA -9 -25 NA Dec-13 8.1 5.2 50.8 0.1 1.4 0.0 4.9 2.0 20.4 NA

Erajaya Swasembada ERAA IJ NR 334 1.93 1,340 NA NA 3 34 -61 Dec-13 10.2 9.1 10.7 0.9 1.2 0.0 7.8 3.2 23.7 13.4

Matahari Dept Store LPPF IJ OP 3,609 3.77 14,375 17,105 19 3 31 7 Dec-13 25.5 18.9 40.5 0.5 10.1 4.9 17.2 1.6 45.5 46.0

Mitra Adiperkasa MAPI IJ OP 743 1.11 5,200 6,206 19 -3 -5 -44 Dec-13 27.4 15.7 29.5 0.5 3.3 0.7 9.1 0.6 17.1 12.4

Ramayana Lestari RALS IJ IL 757 0.28 1,240.00 1,238.00 0 2 17 -16 Dec-13 17.8 15.0 22.7 0.7 2.5 1.4 10.4 2.8 15.1 14.5

Selamat Sempurna SMSM IJ NR 486 0.08 3,920 NA NA -10 14 62 Dec-13 18.0 15.4 9.0 1.7 6.2 0.0 10.5 3.0 32.2 35.7

Sepatu Bata BATA IJ NR 107 0.00 960 NA NA 4 -9 13 Dec-13 NA NA NA NA NA NA NA NA 11.9 NA

Trikomsel Oke TRIO IJ NR 508 0.00 1,240 NA NA 0 -4 -30 Dec-13 11.1 9.9 11.2 0.9 NA 0.0 NA NA 28.5 23.8

Trisula International TRIS IJ NR 35 0.23 390 NA NA 3 -3 -20 Dec-13 NA NA NA NA NA NA NA NA 19.3 NA

Aggregate 20.6 15.9 17.6 0.9 20.6 1.5 3.9

Consumer staples

Fastfood Indon. FAST IJ NR 379 0.01 2,205 NA NA -2 16 -27 Dec-13 NA NA NA NA NA NA NA NA 25.2 NA

Hero Supermarket HERO IJ NR 972 0.05 2,700 NA NA 5 11 -32 Dec-13 NA NA NA NA NA NA NA NA 12.1 NA

Indofood Sukses Makmur INDF IJ OP 5,139 6.08 6,800 8,521 25 0 3 -7 Dec-13 13.1 9.8 56.0 0.2 2.3 0.9 6.0 3.8 17.4 18.3

Matahari Putra Prima MPPA IJ NR 1,326 8.12 2,865 NA NA 1 48 21 Dec-13 38.8 28.8 9.7 3.0 6.3 0.0 17.9 0.8 18.9 12.7

Mayora Indah MYOR IJ IL 2,219 0.11 28,825 27,895 -3 1 11 -7 Dec-13 22.9 18.8 30.8 0.6 5.1 1.8 13.4 1.0 19.8 24.1

Midi Utama MIDI IJ NR 127 0.00 510 NA NA 1 -4 -27 Dec-13 NA NA NA NA NA NA NA NA 26.9 NA

Modern Intl. MDRN IJ NR 242 0.06 675 NA NA 5 -12 -32 Dec-13 45.9 30.4 23.7 1.3 2.6 0.0 13.1 0.4 10.2 6.1

Nippon Indosari ROTI IJ IL 523 0.31 1,200 1,225 2 1 18 -32 Dec-13 4.6 3.7 186.2 0.0 1.2 2.8 4.4 5.5 16.7 29.2

Siantar Top STTP IJ NR 350 0.00 3,100 NA NA 3 100 65 Dec-13 NA NA NA NA NA NA NA NA 18.7 NA

Sumber Alfaria AMRT IJ NR 1,624 0.09 500 NA NA 2 11 -27 Dec-13 30.6 24.2 20.4 1.2 7.0 0.0 10.1 1.4 32.7 24.9

Supra Boga Lestari RANC IJ NR 83 0.05 620 NA NA 0 -6 -40 Dec-13 19.8 16.5 29.2 0.6 2.3 0.0 10.6 1.0 11.3 12.0

Tiga Pilar Food AISA IJ NR 650 0.88 2,580 NA NA 11 80 76 Dec-13 18.4 14.3 30.4 0.5 3.2 0.0 9.6 0.6 18.0 16.9

Ultrajaya ULTJ IJ NR 1,040 0.11 4,185 NA NA 0 -7 -8 Dec-13 24.5 18.9 40.4 0.5 NA 0.0 14.9 NA 19.1 NA

Wismilak Inti Makmur WIIM IJ NR 113 0.11 625 NA NA 0 -7 -37 Dec-13 9.4 8.6 7.3 1.2 1.5 0.0 6.1 3.0 19.0 17.3

Aggregate 21.6 16.5 21.3 0.8 21.6 1.1 4.8 1.9

Healthcare

Kalbe Farma Tbk PT KLBF IJ NR 6,515 6.89 1,615 NA NA -2 29 6 Dec-13 32.8 27.0 20.8 1.3 8.0 0.0 22.3 1.3 27.1 25.1

Kimia Farma Persero KAEF IJ NR 497 0.36 1,040 NA NA 14 76 9 Dec-13 24.4 19.4 17.9 1.1 3.2 0.0 16.1 0.7 14.1 13.1

Siloam Int. Hospitals SILO IJ OP 1,190 8.80 13,200 13,982 6 1 39 NA Dec-13 127.3 85.4 80.2 1.1 8.7 4.2 30.0 0.1 8.5 7.1

Sido Muncul SIDO IJ NR 1,065 2.12 825 NA NA 4 18 NA Dec-13 26.9 23.2 14.7 1.6 5.0 0.0 16.8 1.6 21.2 19.5

Tempo Scan Pacific TSPC IJ OP 1,094 0.22 2,825 3,878 37 3 -13 -38 Nov-13 18.2 15.2 14.7 1.0 3.0 1.6 11.2 3.0 19.5 17.3

Aggregate 31.6 25.9 13.4 1.9 31.6 3.2 13.8 1.4

Industrials

Adhi Karya ADHI IJ NR 495 6.53 3,190 NA NA 1 111 -15 Dec-13 13.0 10.1 18.3 0.6 3.1 0.0 5.5 1.9 20.4 24.5

AKR Corporindo AKRA IJ OP 1,490 3.11 4,460 6,050 36 2 2 -17 Dec-13 17.4 13.0 29.3 0.4 2.8 0.6 7.0 2.3 20.6 34.5

Arwana Citramulia ARNA IJ OP 626 0.32 990 983 -1 5 21 27 Dec-13 26.0 20.4 23.2 0.9 8.1 4.2 22.3 1.9 41.9 34.9

Astra Otoparts AUTO IJ NR 1,576 0.39 3,800 NA NA 3 4 -11 Dec-13 13.5 11.5 21.4 0.5 1.8 0.0 14.7 3.1 27.1 14.2

Berlina Tbk BRNA IJ NR 35 0.01 590 NA NA 3 30 2 Dec-13 NA NA NA NA NA NA NA NA 19.2 NA

Cardig Aero Services CASS IJ NR 167 0.04 930 NA NA -1 13 12 Dec-13 15.2 11.1 26.2 0.4 NA 0.0 5.1 2.5 80.0 34.2

Citra Marga Nusa CMNP IJ NR 678 0.17 3,580 NA NA 2 7 90 Dec-13 NA NA NA NA NA NA NA NA 31.0 NA

Express Transindo Utama TAXI IJ NR 244 1.71 1,320 NA NA 2 -10 -15 Dec-13 19.3 16.0 15.5 1.0 3.1 0.0 7.0 1.0 13.8 17.3

Hexindo Adiperkasa HEXA IJ NR 278 0.11 3,850 NA NA 1 19 -25 Mar-13 10.4 8.3 -29.3 -0.3 1.3 NA 9.0 8.8 33.2 14.8

Indomobil Sukses IMAS IJ NR 1,166 0.09 4,900 NA NA 4 0 -7 Dec-13 14.8 11.7 47.4 0.2 2.1 0.0 17.6 1.1 NA 15.0

Jasa Marga Persero JSMR IJ NR 3,511 3.88 6,000 NA NA 0 27 -11 Dec-13 24.7 21.7 18.6 1.2 4.0 0.0 12.5 1.5 NA 16.3

Mitra Pinasthika Mustika MPMX IJ NR 499 0.18 1,300 NA NA 6 2 -11 Dec-13 8.9 7.5 5.3 1.4 1.2 0.0 6.5 3.2 27.5 13.4

Selemat Sempurna SMSM IJ NR 486 0.08 3,920 NA NA -10 14 62 Dec-13 18.0 15.4 9.0 1.7 6.2 0.0 10.5 3.0 32.2 35.7

Total Bangun Persada TOTL IJ NR 247 0.92 840 NA NA 1 68 -42 Dec-13 14.7 12.3 9.3 1.3 3.4 0.0 9.5 3.9 29.5 26.2

Aggregate 18.4 15.0 9.3 1.6 18.4 1.1 9.5 2.1

Media

Dyandra Media Int. DYAN IJ NR 79 0.03 215 NA NA 0 -9 -39 Dec-13 NA NA NA NA NA NA NA NA 9.1 14.9

Elang Mahkota EMTK IJ NR 2,767 0.01 5,700 NA NA 0 3 -7 Dec-13 21.0 NA NA NA 4.6 0.0 10.4 1.0 21.4 23.9

First Media KBLV IJ NR 270 0.01 1,800 NA NA 11 210 140 Dec-13 NA NA NA NA NA NA NA NA 2.0 NA

Global Mediacom BMTR IJ IL 2,524 2.05 2,095 2,599 24 -4 10 -16 Dec-13 15.1 11.8 37.1 0.3 2.2 2.3 5.5 1.7 19.4 16.1

Intermedia Capital MDIA IJ NR 641 0.22 1,900 NA NA 2 NA NA Dec-13 NA NA NA NA NA NA NA NA 6.0 NA

Mahaka Media ABBA IJ NR 19 0.01 80 NA NA -4 -20 -10 Dec-13 NA NA NA NA NA NA NA NA 23.9 NA

Media Nusantara MNCN IJ OP 3,279 2.59 2,720 3,185 17 4 4 -16 Dec-13 16.5 13.7 20.7 0.7 3.8 4.5 11.6 3.2 33.1 27.0

MNC Sky Vision MSKY IJ OP 1,274 0.16 2,095 3,039 45 0 5 -26 Dec-13 26.5 18.7 104.8 0.2 5.9 3.7 9.3 1.3 16.8 24.0