Professional Documents

Culture Documents

01 State Investment House Inc Vs CA

Uploaded by

reseljan0 ratings0% found this document useful (0 votes)

43 views7 pagesNegotiable Instruments Law

Original Title

01 State Investment House Inc vs CA

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNegotiable Instruments Law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views7 pages01 State Investment House Inc Vs CA

Uploaded by

reseljanNegotiable Instruments Law

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

LDM Nov 2013

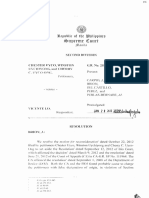

Republic of the Philippines

SUPREME COURT

Manila

FIRST DIVISION

G.R. No. 101163 January 11, 1993

STATE INVESTMENT HOUSE, INC., petitioner,

vs.

COURT OF APPEALS and NORA B. MOULIC, respondents.

Escober, Alon & Associates for petitioner.

Martin D. Pantaleon for private respondents.

BELLOSILLO, J.:

The liability to a holder in due course of the drawer of checks issued to another

merely as security, and the right of a real estate mortgagee after extrajudicial

foreclosure to recover the balance of the obligation, are the issues in this Petition for

Review of the Decision of respondent Court of Appeals.

Private respondent Nora B. Moulic issued to Corazon Victoriano, as security for

pieces of jewelry to be sold on commission, two (2) post-dated Equitable Banking

Corporation checks in the amount of Fifty Thousand Pesos (P50,000.00) each, one

dated 30 August 1979 and the other, 30 September 1979. Thereafter, the payee

negotiated the checks to petitioner State Investment House. Inc. (STATE).

MOULIC failed to sell the pieces of jewelry, so she returned them to the payee

before maturity of the checks. The checks, however, could no longer be retrieved as

they had already been negotiated. Consequently, before their maturity dates,

MOULIC withdrew her funds from the drawee bank.

Upon presentment for payment, the checks were dishonored for insufficiency of

funds. On 20 December 1979, STATE allegedly notified MOULIC of the dishonor of

the checks and requested that it be paid in cash instead, although MOULIC avers

that no such notice was given her.

On 6 October 1983, STATE sued to recover the value of the checks plus attorney's

fees and expenses of litigation.

LDM Nov 2013

In her Answer, MOULIC contends that she incurred no obligation on the checks

because the jewelry was never sold and the checks were negotiated without her

knowledge and consent. She also instituted a Third-Party Complaint against

Corazon Victoriano, who later assumed full responsibility for the checks.

On 26 May 1988, the trial court dismissed the Complaint as well as the Third-Party

Complaint, and ordered STATE to pay MOULIC P3,000.00 for attorney's fees.

STATE elevated the order of dismissal to the Court of Appeals, but the appellate

court affirmed the trial court on the ground that the Notice of Dishonor to MOULIC

was made beyond the period prescribed by the Negotiable Instruments Law and that

even if STATE did serve such notice on MOULIC within the reglementary period it

would be of no consequence as the checks should never have been presented for

payment. The sale of the jewelry was never effected; the checks, therefore, ceased

to serve their purpose as security for the jewelry.

We are not persuaded.

The negotiability of the checks is not in dispute. Indubitably, they were negotiable.

After all, at the pre-trial, the parties agreed to limit the issue to whether or not

STATE was a holder of the checks in due course.

1

In this regard, Sec. 52 of the Negotiable Instruments Law provides

Sec. 52. What constitutes a holder in due course. A holder in due

course is a holder who has taken the instrument under the following

conditions: (a) That it is complete and regular upon its face; (b) That he

became the holder of it before it was overdue, and without notice that it

was previously dishonored, if such was the fact; (c) That he took it in

good faith and for value; (d) That at the time it was negotiated to him he

had no notice of any infirmity in the instrument or defect in the title of

the person negotiating it.

Culled from the foregoing, a prima facie presumption exists that the holder of a

negotiable instrument is a holder in due course.

2

Consequently, the burden of

proving that STATE is not a holder in due course lies in the person who disputes the

presumption. In this regard, MOULIC failed.

The evidence clearly shows that: (a) on their faces the post-dated checks were

complete and regular: (b) petitioner bought these checks from the payee, Corazon

Victoriano, before their due dates;

3

(c) petitioner took these checks in good faith and

for value, albeit at a discounted price; and, (d) petitioner was never informed nor

made aware that these checks were merely issued to payee as security and not for

value.

LDM Nov 2013

Consequently, STATE is indeed a holder in due course. As such, it holds the

instruments free from any defect of title of prior parties, and from defenses available

to prior parties among themselves; STATE may, therefore, enforce full payment of

the checks.

4

MOULIC cannot set up against STATE the defense that there was failure or

absence of consideration. MOULIC can only invoke this defense against STATE if it

was privy to the purpose for which they were issued and therefore is not a holder in

due course.

That the post-dated checks were merely issued as security is not a ground for the

discharge of the instrument as against a holder in due course. For the only grounds

are those outlined in Sec. 119 of the Negotiable Instruments Law:

Sec. 119. Instrument; how discharged. A negotiable instrument is

discharged: (a) By payment in due course by or on behalf of the

principal debtor; (b) By payment in due course by the party

accommodated, where the instrument is made or accepted for his

accommodation; (c) By the intentional cancellation thereof by the

holder; (d) By any other act which will discharge a simple contract for

the payment of money; (e) When the principal debtor becomes the

holder of the instrument at or after maturity in his own right.

Obviously, MOULIC may only invoke paragraphs (c) and (d) as possible grounds for

the discharge of the instrument. But, the intentional cancellation contemplated under

paragraph (c) is that cancellation effected by destroying the instrument either by

tearing it up,

5

burning it,

6

or writing the word "cancelled" on the instrument. The act

of destroying the instrument must also be made by the holder of the instrument

intentionally. Since MOULIC failed to get back possession of the post-dated checks,

the intentional cancellation of the said checks is altogether impossible.

On the other hand, the acts which will discharge a simple contract for the payment of

money under paragraph (d) are determined by other existing legislations since Sec.

119 does not specify what these acts are, e.g., Art. 1231 of the Civil Code

7

which

enumerates the modes of extinguishing obligations. Again, none of the modes

outlined therein is applicable in the instant case as Sec. 119 contemplates of a

situation where the holder of the instrument is the creditor while its drawer is the

debtor. In the present action, the payee, Corazon Victoriano, was no longer

MOULIC's creditor at the time the jewelry was returned.

Correspondingly, MOULIC may not unilaterally discharge herself from her liability by

the mere expediency of withdrawing her funds from the drawee bank. She is thus

liable as she has no legal basis to excuse herself from liability on her checks to a

holder in due course.

LDM Nov 2013

Moreover, the fact that STATE failed to give Notice of Dishonor to MOULIC is of no

moment. The need for such notice is not absolute; there are exceptions under Sec.

114 of the Negotiable Instruments Law:

Sec. 114. When notice need not be given to drawer. Notice of

dishonor is not required to be given to the drawer in the following

cases: (a) Where the drawer and the drawee are the same person; (b)

When the drawee is a fictitious person or a person not having capacity

to contract; (c) When the drawer is the person to whom the instrument

is presented for payment: (d) Where the drawer has no right to expect

or require that the drawee or acceptor will honor the instrument; (e)

Where the drawer had countermanded payment.

Indeed, MOULIC'S actuations leave much to be desired. She did not retrieve the

checks when she returned the jewelry. She simply withdrew her funds from her

drawee bank and transferred them to another to protect herself. After withdrawing

her funds, she could not have expected her checks to be honored. In other words,

she was responsible for the dishonor of her checks, hence, there was no need to

serve her Notice of Dishonor, which is simply bringing to the knowledge of the

drawer or indorser of the instrument, either verbally or by writing, the fact that a

specified instrument, upon proper proceedings taken, has not been accepted or has

not been paid, and that the party notified is expected to pay it.

8

In addition, the Negotiable Instruments Law was enacted for the purpose of

facilitating, not hindering or hampering transactions in commercial paper. Thus, the

said statute should not be tampered with haphazardly or lightly. Nor should it be

brushed aside in order to meet the necessities in a single case.

9

The drawing and negotiation of a check have certain effects aside from the transfer

of title or the incurring of liability in regard to the instrument by the transferor. The

holder who takes the negotiated paper makes a contract with the parties on the face

of the instrument. There is an implied representation that funds or credit are

available for the payment of the instrument in the bank upon which it is

drawn.

10

Consequently, the withdrawal of the money from the drawee bank to avoid

liability on the checks cannot prejudice the rights of holders in due course. In the

instant case, such withdrawal renders the drawer, Nora B. Moulic, liable to STATE, a

holder in due course of the checks.

Under the facts of this case, STATE could not expect payment as MOULIC left no

funds with the drawee bank to meet her obligation on the checks,

11

so that Notice of

Dishonor would be futile.

The Court of Appeals also held that allowing recovery on the checks would

constitute unjust enrichment on the part of STATE Investment House, Inc. This is

error.

LDM Nov 2013

The record shows that Mr. Romelito Caoili, an Account Assistant, testified that the

obligation of Corazon Victoriano and her husband at the time their property

mortgaged to STATE was extrajudicially foreclosed amounted to P1.9 million; the

bid price at public auction was only P1 million.

12

Thus, the value of the property

foreclosed was not even enough to pay the debt in full.

Where the proceeds of the sale are insufficient to cover the debt in an extrajudicial

foreclosure of mortgage, the mortgagee is entitled to claim the deficiency from the

debtor.

13

The step thus taken by the mortgagee-bank in resorting to an extra-judicial

foreclosure was merely to find a proceeding for the sale of the property and its

action cannot be taken to mean a waiver of its right to demand payment for the

whole debt.

14

For, while Act 3135, as amended, does not discuss the mortgagee's

right to recover such deficiency, it does not contain any provision either, expressly or

impliedly, prohibiting recovery. In this jurisdiction, when the legislature intends to

foreclose the right of a creditor to sue for any deficiency resulting from foreclosure of

a security given to guarantee an obligation, it so expressly provides. For instance,

with respect to pledges, Art. 2115 of the Civil Code

15

does not allow the creditor to

recover the deficiency from the sale of the thing pledged. Likewise, in the case of a

chattel mortgage, or a thing sold on installment basis, in the event of foreclosure, the

vendor "shall have no further action against the purchaser to recover any unpaid

balance of the price. Any agreement to the contrary will be void".

16

It is clear then that in the absence of a similar provision in Act No. 3135, as

amended, it cannot be concluded that the creditor loses his right recognized by the

Rules of Court to take action for the recovery of any unpaid balance on the principal

obligation simply because he has chosen to extrajudicially foreclose the real estate

mortgage pursuant to a Special Power of Attorney given him by the mortgagor in the

contract of mortgage.

17

The filing of the Complaint and the Third-Party Complaint to enforce the checks

against MOULIC and the VICTORIANO spouses, respectively, is just another means

of recovering the unpaid balance of the debt of the VICTORIANOs.

In fine, MOULIC, as drawer, is liable for the value of the checks she issued to the

holder in due course, STATE, without prejudice to any action for recompense she

may pursue against the VICTORIANOs as Third-Party Defendants who had already

been declared as in default.

WHEREFORE, the petition is GRANTED. The decision appealed from is

REVERSED and a new one entered declaring private respondent NORA B.

MOULIC liable to petitioner STATE INVESTMENT HOUSE, INC., for the value of

EBC Checks Nos. 30089658 and 30089660 in the total amount of P100,000.00,

P3,000.00 as attorney's fees, and the costs of suit, without prejudice to any action

for recompense she may pursue against the VICTORIANOs as Third-Party

Defendants.

LDM Nov 2013

Costs against private respondent.

SO ORDERED.

Cruz and Grio-Aquino, JJ., concur.

Padilla, J., took no part.

# Footnotes

1 Rollo, pp. 13-14.

2 State Investment House, Inc. v. Court of Appeals, G.R. No. 72764, 13

J uly 1989; 175 SCRA 310.

3 Per Deeds of Sale of 2 J uly 1979 and 25 J uly 1979,

respectively; Rollo, p. 13.

4 Salas v. Court of Appeals, G.R. No. 76788, 22 J anuary 1990; 181

SCRA 296.

5 Montgomery v. Schwald, 177 Mo App 75, 166 SW 831; Wilkins v.

Shaglund, 127 Neb 589, 256 NW 31.

6 See Henson v. Henson, 268 SW 378.

7 Art. 1231. Obligations are extinguished: (1) By payment or

performance; (2) By the loss of the thing due; (3) By the condonation or

remission of the debt; (4) By the confusion or merger of the rights of

creditor and debtor; (5) By compensation; (6) By novation . . . . .

8 Martin v. Browns, 75 Ala 442.

9 Reinhart v. Lucas, 118 W Va 466, 190 SE 772.

10 11 Am J ur 589.

11 See Agbayani, Commercial Laws of the Philippines, Vol. 1, 1984

Ed., citing Ellenbogen v. State Bank, 197 NY Supp 278.

12 TSN, 25 April 1985, pp. 16-17.

LDM Nov 2013

13 Philippine Bank of Commerce v. de Vera, No. L-18816, 29

December 1962;

6 SCRA 1029.

14 Medina v. Philippine National Bank, 56 Phil 651.

15. Art. 2115. The sale of the thing pledged shall extinguish the

principal obligation, whether or not the proceeds of the sale are equal

to the amount of the principal obligation, interest and expenses in a

proper case. . . . If the price of the sale is less, neither shall the creditor

be entitled to recover the deficiency, notwithstanding any stipulation to

the contrary.

16 Art. 1484 [3] of the Civil Code.

17 See Note 14.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- How to add Primary TradelinesDocument18 pagesHow to add Primary Tradelinesmatt96% (81)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Contract of AntichresisDocument3 pagesContract of AntichresisIelBarnachea100% (1)

- Changes Under The Customs Modernization and Tariff ActDocument20 pagesChanges Under The Customs Modernization and Tariff ActreseljanNo ratings yet

- COA - C2017-001 - Expenses Below 300 Not Requiring ReceiptsDocument2 pagesCOA - C2017-001 - Expenses Below 300 Not Requiring ReceiptsJuan Luis Lusong100% (3)

- MERALCO Recognizes Land Owners' Possession RightsDocument117 pagesMERALCO Recognizes Land Owners' Possession RightsreseljanNo ratings yet

- Lordofwar Ocr Part3Document721 pagesLordofwar Ocr Part3Ky HendersonNo ratings yet

- Statement DEC2022 265757521Document6 pagesStatement DEC2022 265757521Ranjit LengureNo ratings yet

- Prime BrokerageDocument118 pagesPrime BrokerageStelu OlarNo ratings yet

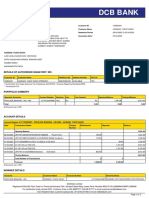

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccounthasnainNo ratings yet

- Garbemco StoryDocument4 pagesGarbemco Storyᜇᜎᜄ ᜁᜄᜉNo ratings yet

- Paternity and Filiation Summary 09.06.2016Document4 pagesPaternity and Filiation Summary 09.06.2016reseljanNo ratings yet

- New Police RanksDocument1 pageNew Police RanksreseljanNo ratings yet

- Criminal Procedure Forms GuideDocument2 pagesCriminal Procedure Forms GuideBeboy EvardoNo ratings yet

- Banking and Other Allied Laws OutlineDocument1 pageBanking and Other Allied Laws OutlinereseljanNo ratings yet

- SMI-ED Vs CIR (PEZA Registered)Document19 pagesSMI-ED Vs CIR (PEZA Registered)reseljanNo ratings yet

- Negotiable Instruments Law NotesDocument2 pagesNegotiable Instruments Law NotesreseljanNo ratings yet

- TOS RFBT RevisedDocument4 pagesTOS RFBT RevisedmadbolivarNo ratings yet

- Husband Child Remedy: LDM Notes - PFRDocument4 pagesHusband Child Remedy: LDM Notes - PFRreseljanNo ratings yet

- Court Forms ListDocument3 pagesCourt Forms ListEuodia HodeshNo ratings yet

- Regulations on Income Tax for Foreign Currency Deposits and Offshore BankingDocument2 pagesRegulations on Income Tax for Foreign Currency Deposits and Offshore BankingmatinikkiNo ratings yet

- Senior Citizen Discount.Document2 pagesSenior Citizen Discount.Nora LupebaNo ratings yet

- Philippines Supreme Court Rules Surviving Brother May Seek Declaration of Deceased Brother's Null MarriageDocument9 pagesPhilippines Supreme Court Rules Surviving Brother May Seek Declaration of Deceased Brother's Null MarriageMarvin CeledioNo ratings yet

- ABS CBN V Gozon GR 195956 11 March 2015Document81 pagesABS CBN V Gozon GR 195956 11 March 2015reseljanNo ratings yet

- Doctrines in Remedial LawDocument7 pagesDoctrines in Remedial LawreseljanNo ratings yet

- VAT TableDocument1 pageVAT TablereseljanNo ratings yet

- Philippine Tax FactsDocument9 pagesPhilippine Tax FactsAizel MaronillaNo ratings yet

- 01 Sindico Vs Diaz General COnceptsDocument4 pages01 Sindico Vs Diaz General COnceptsreseljanNo ratings yet

- Act No 3135Document2 pagesAct No 3135Rommel TottocNo ratings yet

- DECS Vs San Diego (1989)Document3 pagesDECS Vs San Diego (1989)Jen DioknoNo ratings yet

- Mighty Corporation Vs Gallo WineryDocument94 pagesMighty Corporation Vs Gallo WineryreseljanNo ratings yet

- 30 Uyco Vs LoDocument6 pages30 Uyco Vs LoreseljanNo ratings yet

- 2013 Bar Syllabus - Civil LawDocument9 pages2013 Bar Syllabus - Civil LawddcrisostomoNo ratings yet

- 79) Torres, Jr. v. CA, 278 SCRA 793 (1997)Document22 pages79) Torres, Jr. v. CA, 278 SCRA 793 (1997)LucioJr AvergonzadoNo ratings yet

- 194307Document11 pages194307The Supreme Court Public Information OfficeNo ratings yet

- Grl19550 Stonehill Vs DioknoDocument7 pagesGrl19550 Stonehill Vs DioknonikkaremullaNo ratings yet

- RMC 19-2015Document9 pagesRMC 19-2015reseljanNo ratings yet

- RMC 19-2015Document9 pagesRMC 19-2015reseljanNo ratings yet

- Products and Services Offered by Islamic Banks.Document6 pagesProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniNo ratings yet

- IBPS Clerk Main 2016 Capsule by AffairscloudDocument91 pagesIBPS Clerk Main 2016 Capsule by AffairscloudMadhu SekharNo ratings yet

- TE040 Test Script APDocument28 pagesTE040 Test Script APphoganNo ratings yet

- International Banking For A New Century (2015, Routledge)Document269 pagesInternational Banking For A New Century (2015, Routledge)Tuấn ĐinhNo ratings yet

- THE TRUTH ABOUT THE CASE BONDDocument5 pagesTHE TRUTH ABOUT THE CASE BONDrhouse_1100% (4)

- UBS Global Real Estate Bubble IndexDocument24 pagesUBS Global Real Estate Bubble IndexKiva DangNo ratings yet

- IMC Project State Bank of IndiaDocument18 pagesIMC Project State Bank of IndiaRinni Shukla0% (1)

- Art em Is Capital Currency NoteDocument35 pagesArt em Is Capital Currency NoteBen SchwartzNo ratings yet

- DVXDocument2 pagesDVXirsadNo ratings yet

- Repo AccountingDocument11 pagesRepo AccountingRohit KhandelwalNo ratings yet

- MarchDocument7 pagesMarchRohama TullaNo ratings yet

- Master Guide For BNPL Centres PDFDocument17 pagesMaster Guide For BNPL Centres PDFAnand JagtapNo ratings yet

- Department of Labor: 96 22717Document11 pagesDepartment of Labor: 96 22717USA_DepartmentOfLaborNo ratings yet

- EF1B2 HDT NPA BadLoans BASEL PCB8 RAFTAARDocument32 pagesEF1B2 HDT NPA BadLoans BASEL PCB8 RAFTAARAditya DwivediNo ratings yet

- RecoveriesDocument45 pagesRecoveriesSona ElvisNo ratings yet

- The Prons and Cons of Internet and World Wide WebDocument6 pagesThe Prons and Cons of Internet and World Wide WebMohamad Razali RamdzanNo ratings yet

- Cebu International Finance Corporation V CA AlegreDocument4 pagesCebu International Finance Corporation V CA AlegreJANE MARIE DOROMALNo ratings yet

- DK SFR Fak Fos 0005272232 05297528 815645287 20151031Document5 pagesDK SFR Fak Fos 0005272232 05297528 815645287 20151031Anonymous lqamnugdWNo ratings yet

- .Practice Set Ibps Cwe Po-IVDocument18 pages.Practice Set Ibps Cwe Po-IVsurendra3818No ratings yet

- Baglihar Hep Stage-I: Annual Revenue Requirement (ARR) Tariff Petition FY 2009-10 FY 2010-11Document48 pagesBaglihar Hep Stage-I: Annual Revenue Requirement (ARR) Tariff Petition FY 2009-10 FY 2010-11najonwayNo ratings yet

- OSP#16078878Document6 pagesOSP#16078878Guhanadh PadarthyNo ratings yet

- Deed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014Document9 pagesDeed of Assignment: This Deed of Assignment Is Made at Pune On This TH Day of The Month of July 2014mukund100% (1)

- Customer Services of ICICI and HDFC BankDocument64 pagesCustomer Services of ICICI and HDFC BankShahzad Saif100% (1)