Professional Documents

Culture Documents

Joint Cost

Uploaded by

Rachit Pradhan0 ratings0% found this document useful (0 votes)

31 views4 pagesJoint Cost

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJoint Cost

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views4 pagesJoint Cost

Uploaded by

Rachit PradhanJoint Cost

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Sistemi di controllo - Analisi economiche per le decisioni aziendali 3/ed

Analisi dei costi 2/ed

Robert N. Anthony, David F. Hawkins, Diego M. Macr, Kenneth A. Merchant

Copyright 2008 The McGraw-Hill Companies srl

CAPITOLO 7

COSTI STD, SISTEMI A COSTI VARIABILI, COSTI DELLA

QUALIT E COSTI CONGIUNTI

Approach

One of the advantages of standard costs is that a standard cost system requires less recordkeeping than

does an actual cost system. Students have difficulty in accepting this fact. To learn about standard costs

requires an additional intellectual effort on their part, and they equate this effort with the physical effort of

operating a standard cost system. The text explains why the saving in recordkeeping occurs, but the

explanation may well require reinforcement by the instructor.

We have omitted a discussion of waste and spoilage on the grounds that it is inappropriate for a first

course. This is an important, but difficult, topic in practice. Some instructors may wish to add a treatment

of it on their own initiative.

The Black Meter Company description provides a useful vehicle for understanding a standard cost

system; and it may be desirable to discuss it in considerable detail. The description in the text does not

cover every number, but it should be adequate so that the students can deduce for themselves where each

number on the exhibits comes from, and in particular how one exhibit relates to others.

We are sometimes criticized for not being advocates of variable costing systems, as some authors seem to

be. Aside from the fact that we dont view our role as being advocates of particular techniques, we feel

that variable costing finds far more favor in textbooks than in practice. The technique appeared in the

literature over 60 years ago, yet relatively few companies use it today. We interpret this fact not as a

matter of company ignorance or inertia, but rather that companies do not find the system useful enough to

justify the costs of implementing it, which are nontrivial costs. Any company having a flexible budget for

overhead costs can combine the variable portion of the overhead rate with direct labor and material costs

to get an adequate approximation of short-term costs for certain short-term decisions, without

implementing a formal variable costing system. The increased use of investment centers also leads

companies to want to value inventories at full costs (in some companies, full replacement costs) for

management reporting purposes. We have tried to maintain a balanced presentation on this topic, so that

our students upon graduation dont assume that their new employer is ignorant or in the Dark Ages when

they find no variable costing system in that particular organization.

The cost of quality is an evolving topic. Students should be aware of the concepts and related

terminology, but there are no specific techniques to describe as yet. Similarly, students should have

awareness of the issues in joint and by-product costing even if the alternative costing procedures are not

pursued.

1

Sistemi di controllo - Analisi economiche per le decisioni aziendali 3/ed

Analisi dei costi 2/ed

Robert N. Anthony, David F. Hawkins, Diego M. Macr, Kenneth A. Merchant

Copyright 2008 The McGraw-Hill Companies srl

Cases

Landau Company contrasts variable costing and full absorption costing.

Problems

Problem 7-1: Limpresa Veronica

a. Overhead rate =

hours

=

labor direct Estimated

overhead Estimated

hours

20,000

$180,000

=$9 per direct labor hour

b. J obs

G H

Direct material .................................................................................... $10,000 $10,000

Direct labor......................................................................................... 28,000 32,000

Overhead............................................................................................. 21,600* 25,200+

Total production costs........................................................................ $59,600 $67,200

*2,400 hours @ $9 =$21,600

+2,800 hours @ $9 =$25,200

c. J ob G J ob H

Production cost................................................................................... $ 59,600 $ 67,200

Selling price (180%)........................................................................... $107,280 $120,960

Problem 7-2: Vt. Sciroppi srl

a. Selling price of sugar1,000 @ $2.00............................................... $2,000.00

Traceable costs (after split-off)........................................................... 280.00

Gross margin....................................................................................... $1,720.00

Total syrup cost:

Process costs ($12,280 +$100,000) ............................................... $112,280

Less sugar gross margin.................................................................. 1720

Cost allocated to syrup.................................................................... $110,560

2

Sistemi di controllo - Analisi economiche per le decisioni aziendali 3/ed

Analisi dei costi 2/ed

Robert N. Anthony, David F. Hawkins, Diego M. Macr, Kenneth A. Merchant

Copyright 2008 The McGraw-Hill Companies srl

b. J oint product costs:

Syrup Sugar

Sales value.......................................................................................... $300,000 $2,000

Less costs after split-off ..................................................................... 12,000 280

Adjusted sales value........................................................................... $288,000 $1,720

Cost allocation:

Syrup: 288,000/289,720 x 100,000 = $ 99,406

$99,406 +$12,000 = $111,406

Sugar: 1,720/289,720 x 100,000 = $594

594 +280 = $874

3

Sistemi di controllo - Analisi economiche per le decisioni aziendali 3/ed

Analisi dei costi 2/ed

Robert N. Anthony, David F. Hawkins, Diego M. Macr, Kenneth A. Merchant

Copyright 2008 The McGraw-Hill Companies srl

4

Problem 7-3: Monrad Spa

Dati di input:

Costo del venduto (al costo variabile) 750.000

Rimanenze di prodotti finiti (al costo variabile) 75.000

Costi di produzione indiretti non variabili 462.000

Costo del venuto (h di mod) ----> 30.000

Rimanenze p.f. (h di mod) ----> 3.000

Soluzione domanda a:

Coefficiente allocazione (/h mod) 14,0

Rettifica al costo del venduto 420.000

Rettifica alle rimanenze di p.f. 42.000

Soluzione domanda b:

Costi di competenza con il Variable costing:

Costo del venduto (al costo variabile) 750.000

Costi di produzione indiretti non variabili 462.000

1.212.000

Costi di competenza con il Full costing:

Costo del venduto al costo pieno (750000 + 420000) 1.170.000

Differenza fra i due sistemi 42.000

Il sistema Full costing rinvia al futuro (capitalizza) la quota parte di

costi fissi di produzione presente fra le rimanenze di p.f.

Soluzione domanda c:

Costo pieno rimanenze p.f. con il full costing (75000 + 42000) 117.000

You might also like

- DominionDocument2 pagesDominionRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM010Document3 pagesPGP2 Nict 2013PGPM010Rachit PradhanNo ratings yet

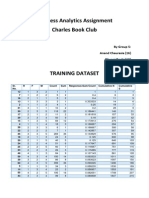

- Business Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiDocument4 pagesBusiness Analytics Assignment Charles Book Club: by Group 5: Anand Chaurasia (16) Dhyani DoshiRachit PradhanNo ratings yet

- NICT at a crossroads: To diversify or consolidateDocument3 pagesNICT at a crossroads: To diversify or consolidateRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM007Document1 pagePGP2 Nict 2013PGPM007Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM049Document3 pagesPGP2 Nict 2013PGPM049Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM009Document1 pagePGP2 Nict 2013PGPM009Rachit PradhanNo ratings yet

- Pgp1 Wac Grp10 Thomas GreenDocument8 pagesPgp1 Wac Grp10 Thomas GreenRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM043Document2 pagesPGP2 Nict 2013PGPM043Rachit PradhanNo ratings yet

- Library - Due Date SlipDocument1 pageLibrary - Due Date SlipRachit PradhanNo ratings yet

- NICT Should Take Up PBI Offer for Fixed Income and Scale (39Document2 pagesNICT Should Take Up PBI Offer for Fixed Income and Scale (39Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM017Document3 pagesPGP2 Nict 2013PGPM017Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM050Document2 pagesPGP2 Nict 2013PGPM050Rachit PradhanNo ratings yet

- UGG - Valuation Stand Alone and With Synergies PDFDocument7 pagesUGG - Valuation Stand Alone and With Synergies PDFRachit PradhanNo ratings yet

- Natureview Farm Case Revenue Growth StrategyDocument3 pagesNatureview Farm Case Revenue Growth StrategyRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM001Document2 pagesPGP2 Nict 2013PGPM001Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM019Document2 pagesPGP2 Nict 2013PGPM019Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM014Document3 pagesPGP2 Nict 2013PGPM014Rachit PradhanNo ratings yet

- Senat Bank (B)Document4 pagesSenat Bank (B)Rachit PradhanNo ratings yet

- Submitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following AdvantagesDocument2 pagesSubmitted By: Vikrant Singh Pawar Roll No: 57.: Q1: According To Me Taking Up PBI Offer Had Following AdvantagesRachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM004Document2 pagesPGP2 Nict 2013PGPM004Rachit PradhanNo ratings yet

- Sm-II Course Wrap UpDocument27 pagesSm-II Course Wrap UpRachit PradhanNo ratings yet

- PGP2 AMR Assignment Group08Document6 pagesPGP2 AMR Assignment Group08Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM016Document2 pagesPGP2 Nict 2013PGPM016Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM039Document5 pagesPGP2 Nict 2013PGPM039Rachit PradhanNo ratings yet

- PGP2 Nict 2013PGPM039Document5 pagesPGP2 Nict 2013PGPM039Rachit PradhanNo ratings yet

- Technical Analysis of SAPM Using MA, MACD and RSIDocument1 pageTechnical Analysis of SAPM Using MA, MACD and RSIRachit PradhanNo ratings yet

- SHRMDocument13 pagesSHRMRachit Pradhan100% (1)

- Sm-II Course Wrap UpDocument27 pagesSm-II Course Wrap UpRachit PradhanNo ratings yet

- Joint CostDocument4 pagesJoint CostRachit PradhanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Risk Management Dissertation PDFDocument8 pagesRisk Management Dissertation PDFHelpWithCollegePaperWritingUK100% (1)

- Supervisory Management - Planning and ControlDocument9 pagesSupervisory Management - Planning and ControlArilesere SodeeqNo ratings yet

- Recruitment Process for Salesperson Position at BIBICA CorporationDocument32 pagesRecruitment Process for Salesperson Position at BIBICA CorporationPhan Thao Nguyen (FGW CT)No ratings yet

- Unit 2 Financial PlanningDocument10 pagesUnit 2 Financial PlanningMalde KhuntiNo ratings yet

- Osabadell: Deposits in Your AccountsDocument7 pagesOsabadell: Deposits in Your Accounts张灿No ratings yet

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDocument19 pagesTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatNo ratings yet

- Group 2 Housing Development and ManagementDocument29 pagesGroup 2 Housing Development and ManagementTumwesigye AllanNo ratings yet

- Emirates - Porter's 5Document3 pagesEmirates - Porter's 5smba0802994% (18)

- Invitation To Attend COSH Seminar WorkshopDocument1 pageInvitation To Attend COSH Seminar WorkshopOliver Sumbrana100% (1)

- The End of Ownership 2020Document37 pagesThe End of Ownership 2020Hugo Cocoletzi A100% (1)

- 19 KPIsDocument54 pages19 KPIsNadia QuraishiNo ratings yet

- CW QuizDocument3 pagesCW QuizLorene bby100% (1)

- CENECO vs. Secretary of Labor and CURE - Employees' right to withdraw membershipDocument1 pageCENECO vs. Secretary of Labor and CURE - Employees' right to withdraw membershipเจียนคาร์โล การ์เซียNo ratings yet

- ON Dry Fish Business: Submitted byDocument6 pagesON Dry Fish Business: Submitted byKartik DebnathNo ratings yet

- Commercial Contractor Business PlanDocument35 pagesCommercial Contractor Business PlanAMANUEL BABBANo ratings yet

- Gujarat Socio-Economic Review 2017-18Document190 pagesGujarat Socio-Economic Review 2017-18KishanLaluNo ratings yet

- Test Bank Chapter 2Document31 pagesTest Bank Chapter 2Hala TarekNo ratings yet

- Financial Accounting and Reporting EllioDocument181 pagesFinancial Accounting and Reporting EllioThủy Thiều Thị HồngNo ratings yet

- Options, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankDocument6 pagesOptions, Futures, and Other Derivatives Chapter 9 Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Price MechanismDocument10 pagesPrice MechanismRyan ThomasNo ratings yet

- Who Blows The Whistle On Corporate FraudDocument41 pagesWho Blows The Whistle On Corporate FraudDebNo ratings yet

- Agricultural FinanceDocument22 pagesAgricultural Financeamit100% (3)

- SMA - Role ProfileDocument5 pagesSMA - Role ProfilePrakriti GuptaNo ratings yet

- ITL TutorialDocument14 pagesITL TutorialSadhvi SinghNo ratings yet

- Anheuser Busch and Harbin Brewery Group of ChinaDocument17 pagesAnheuser Busch and Harbin Brewery Group of Chinapooja87No ratings yet

- For A New Coffe 2 6Document2 pagesFor A New Coffe 2 6Chanyn PajamutanNo ratings yet

- Summer Training Report of Bhel Co.Document74 pagesSummer Training Report of Bhel Co.chiragagarwal198780% (5)

- Full Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloDocument72 pagesFull Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloJean Ira Gasgonia Aguila100% (1)

- HUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESDocument71 pagesHUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESviper9930950% (2)

- Chapter 4 Market Equilibrium (ECO162)Document41 pagesChapter 4 Market Equilibrium (ECO162)AldrinNyandangNo ratings yet