Professional Documents

Culture Documents

Chap 6.a

Uploaded by

Umer IqbalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 6.a

Uploaded by

Umer IqbalCopyright:

Available Formats

6/21/2014 Macro +3.

2g

http://members.shaw.ca/h-chartrand/Macro%20+%203.3a.htm 1/3

3.3.1 Quick Review

a) Classical

The starting point is the equation of exchange. At any given time there are a certain number (or

volume) of transactions (i.e. T = the number of buy/sells) in the economy. The rate at which the same bills

turnover, that is the number of transactions financed with the same bills, is called the velocity of money

(V). There is also a price index (P) for the huge range of goods and services bought and sold. This is

summed up in the equation of exchange (EE) as:

Eq. 4.1 MV P

T

T or,

- the quantity of money times its velocity is identicalto the price (level) times the volume of transactions.

This presentation of EE (Eq. 4.1) is an identity in that V is derived as a residual, i.e.,

Eq. 4.2 V

T

In this version, however, transactions include not only newly produced goods and services but also

second-hand ones. For only new goods and services corresponding to factor income the EE is:

Eq 4.3 MV PY where Y is current output and P is the price index.

Again EE is an identity if V is calculated as a residual, i.e.,

Eq. 4.4 V

In the Classical (and Keynesian) Model, V is determined exogenously by payment habits and

payment technology. If so then EE ceases to be an identity. With Y fixed in the short run by supply-

factors and V fixed by institutional factors, EE becomes:

Eq. 4.5 or

Eq. 4.6

An alternative interpretation was offered by the Cambridge School known as the Cambridge

approach or the Cambridge cash-balance approach. This approach stressed that people held money (cash

balance) for convenience, compared to other stores of value, in conducting transactions. However holding

cash means that no interest will be earned from investing in productive activities. Accordingly, how much

cash would people hold? In essence the demand for money was a function of their income, i.e.,

Eq. 4.7 M

d

= kPY where

- M

d

= the demand for money;

- k = a proportion of nominal income;

- P = the price level; and,

- Y = real income.

Given, according to the Cambridge approach, that cash was desired due to its usefulness in

transactions and that the volume of transactions was a function of income then the demand for money

varies according to level of income.

In equilibrium, the supply of money (exogenously determined by monetary authorities) would equal

the demand for money, or,

6/21/2014 Macro +3.2g

http://members.shaw.ca/h-chartrand/Macro%20+%203.3a.htm 2/3

Eq. 4.8 M = M

d

= kPY where,

- k is assumed fixed in the short run; and,

- Y is determined, as before, by supply factors.

The Fisher version (Eq 4.5) and theCambridge approach (Eq. 4.7) become roughly the same if V =

1/k. Thus if people hold 1/4th of their nominal income as cash then the number of times the average dollar

is used equals four.

The big change with the Cambridge approach is the formal introduction of the demand for money.

It also allows an assessment of the impact of the quantity of money on the price level (Fig. 4.1). If the

quantity of money increases but output is fixed then people will use the extra cash to consume or invest.

Increased demand for goods raises their prices: too much money chasing too few goods. If Y is fixed as

assumed in the Classical model and k is constant then a new equilibrium will be established at which the

increase in money leads to a proportionate increase in price same output, higher prices, i.e. inflation.

b) Keynesian

Total demand for money in the Keynesian Model or MD = TD + PD + SD where TD and PD

vary positively with income and negatively with respect to interest rate while SD does not vary with

income but negatively with respect to interest rates. Taken together we can say:

(6.3) Md = L(Y, r)

and if we assume the function is linear then

(6.4) Md = co + c1Y c2r where c1 >0, c2 >0 where:

c0 is the minimum amount of cash that must be held;

c1 is the increase in money demanded per unit increase in income; and,

c2 is the decrease in money demanded per unit increase in the interest rate.

Firms borrow money from households to finance investment projects by issuing bonds (a proxy for

all interest generating assets). The price they pay for this money is the interest rate. As previously noted

Keynes assumed firms had an investment schedule that measured the expected profit rate to be earned

from alternative projects mapped against the rate of interest. If the expected profit less the cost of money

was positive, a firm ceterus paribus will undertake the project; if negative, then the project would not be

undertaken. This is called the 'real rate of return'.

If the interest rate rises, then business borrowing declines; if interest falls, borrowing increases

(Fig. 6.1). If investment increases then aggregate expenditure shifts up by the autonomous increase in I.

This increase through the aggregate expenditure multiplier will lead to an even larger increase in income.

Accordingly, the interest sensitivity of aggregate demand is important in determining appropriate monetary

polices.

In effect the interest rate is determined in two distinct markets. The first is the market for

bonds. The second is the market for money itself. Therefore one hold ones wealth (Wh = assets) as

either money or bonds (interest generating assets), i.e.,

(6.1) Wh = M + B

This means that there are two distinct money markets: one for money itself and the other for

investment financing. In the Keynesian Model overall equilibrium is established by the interaction of these

two money markets.

i LM Curve

6/21/2014 Macro +3.2g

http://members.shaw.ca/h-chartrand/Macro%20+%203.3a.htm 3/3

The first is defined by the LM curve (demand for liquidity). Fig. 6.6 demonstrates equilibrium in

the money market given Ms0 and different levels of Y(0, 1, 2). At Y0 equilibrium is achieved at r0. If Y

increases to Y1 then transactional demand increases but with a fixed money supply this increased demand

raises the price of money, i.e., the interest rate increases from r0 to r1. This increase in interest reduces

speculative demand for money and also lowers the transactional demand at any given level of Y

(opportunity cost increases leading to improved cash management practices reducing transactional

demand). Equilibrium is re-established when the increased transaction demand resulting from an increase

in Y is exactly offset by the decline in speculative and transactional demand caused by the increase in

interest rates. By varying Y we can deduce a series of points (A, B, C) where, given a fixed money

supply and increases in Y, a new equilibrium interest rate will exist (ro, r1, r2). These points (Y, r) can then

be plotted to generate the LM curve (Fig. 6.6b) that trace equilibrium conditions in the money market.

ii IS Curve

Assuming, for the moment, that there is no government sector we can simplify the equilibrium

condition as:

(6.9) I(r) = S(Y)

that is, investment as a function of the interest rate (negatively sloped) equals savings (positively sloped) as

a function of income (Fig. 6.12). At a given level of r, there is a corresponding level of investment and for

that level of investment there is a corresponding level of savings associated with a specific level of Y.

Taking r from Fig 6.12(a) and Y from 6.12(b) we can plot the IS curve showing levels of r and Y at which

I(r) = S(Y) as in Fig. 6.12 (c).

iii Equilibrium

Having created the LM curve measuring the liquidity preference equilibrium given changing r and

Y; and the IS curve measuring the savings/investment preference given changing r and Y we can now

determine simultaneous equilibrium in the money and product markers (Fig. 6.17). That it is an equilibrium

towards which it will gravitate (assuming autonomous or exogenous factors are constant) is demonstrated

in Fig. 6.18.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quamto Taxation Law 2017Document34 pagesQuamto Taxation Law 2017Anonymous MCsSDJ100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

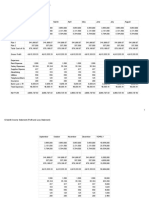

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Document2 pages12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Estates and Trust PDFDocument4 pagesEstates and Trust PDFJustin Robert Roque100% (1)

- All Template Chapter 6 As of September 10 2019Document32 pagesAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- Dow's Answer To Rohm & Haas's LawsuitDocument62 pagesDow's Answer To Rohm & Haas's LawsuitDealBook90% (10)

- Answers, Solutions and Clarifications To Form 6Document5 pagesAnswers, Solutions and Clarifications To Form 6Annie LindNo ratings yet

- Transfer of Property Act - BelDocument36 pagesTransfer of Property Act - Belshaikhnazneen67% (3)

- Inflation's Causes and CostsDocument55 pagesInflation's Causes and CostsSimantoPreeom100% (1)

- Financial Accounting Chapter 9 - 1Document45 pagesFinancial Accounting Chapter 9 - 1Bruku100% (1)

- Listed Companies 2014Document302 pagesListed Companies 2014Umer IqbalNo ratings yet

- Module 1 Packet: College OF CommerceDocument14 pagesModule 1 Packet: College OF CommerceCJ GranadaNo ratings yet

- Unit:6 Introduction To Hadith The Status of Hadith in IslamDocument5 pagesUnit:6 Introduction To Hadith The Status of Hadith in IslamUmer IqbalNo ratings yet

- Undergraduate Admission 2015Document1 pageUndergraduate Admission 2015Umer IqbalNo ratings yet

- Names and Symbols of KSE FirmsDocument22 pagesNames and Symbols of KSE FirmsUmer IqbalNo ratings yet

- Chap 6Document6 pagesChap 6Umer IqbalNo ratings yet

- Listed Companies 2014Document295 pagesListed Companies 2014Umer IqbalNo ratings yet

- CH 5Document7 pagesCH 5Umer IqbalNo ratings yet

- Corporate Finance and Governance Through Transaction Cost LensDocument4 pagesCorporate Finance and Governance Through Transaction Cost LensUmer IqbalNo ratings yet

- Syllabus PDFDocument150 pagesSyllabus PDFAsma SethiNo ratings yet

- University Institute of Management Sciences: Pir Mehr Ali Shah Arid Agriculture University Rawalpindi, PakistanDocument14 pagesUniversity Institute of Management Sciences: Pir Mehr Ali Shah Arid Agriculture University Rawalpindi, PakistanUmer IqbalNo ratings yet

- CH 4Document3 pagesCH 4Umer IqbalNo ratings yet

- Record of Papers ReadingsDocument2 pagesRecord of Papers ReadingsUmer IqbalNo ratings yet

- CH 3Document5 pagesCH 3Umer IqbalNo ratings yet

- CH 04Document4 pagesCH 04Umer IqbalNo ratings yet

- Using FLDocument418 pagesUsing FLshapyNo ratings yet

- Integrated Risk Management FrameworkDocument23 pagesIntegrated Risk Management FrameworkUmer IqbalNo ratings yet

- Ebook - Web Design - How To Build A Complete Website With FlashDocument9 pagesEbook - Web Design - How To Build A Complete Website With FlashShirish PatelNo ratings yet

- Chap 6Document6 pagesChap 6Umer IqbalNo ratings yet

- Excel Formulas ManualDocument8 pagesExcel Formulas ManualVidya NeemuNo ratings yet

- Operating and Financial HighlighteDocument2 pagesOperating and Financial HighlighteUmer IqbalNo ratings yet

- 2011Document50 pages2011Umer IqbalNo ratings yet

- Year Opr Finance Highlight 2007Document1 pageYear Opr Finance Highlight 2007Umer IqbalNo ratings yet

- Ici 01Document197 pagesIci 01Umer IqbalNo ratings yet

- Supply Chain Management of Coca ColaDocument5 pagesSupply Chain Management of Coca ColaUmer IqbalNo ratings yet

- Anual 09Document45 pagesAnual 09Umer IqbalNo ratings yet

- Contract Act PakistanDocument99 pagesContract Act PakistanUmer IqbalNo ratings yet

- TRIAL E Commerce Financial Model Excel Template v.4.0.122020Document68 pagesTRIAL E Commerce Financial Model Excel Template v.4.0.122020DIDINo ratings yet

- F6.TX-irl-j23-d23 Syllabus and Study GuideDocument22 pagesF6.TX-irl-j23-d23 Syllabus and Study GuideJÉSSICA PEREIRA LOPES COSTANo ratings yet

- Taxation Law Question Bank BALLBDocument49 pagesTaxation Law Question Bank BALLBaazamrazamaqsoodiNo ratings yet

- Internship ReportDocument70 pagesInternship ReportVishwaMohan50% (2)

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- Part. and Corp. - OcrDocument30 pagesPart. and Corp. - OcrRosemarie CruzNo ratings yet

- PR CHP 5 - Ex 5-1 - Kelompok 1Document2 pagesPR CHP 5 - Ex 5-1 - Kelompok 1Lucky esteritaNo ratings yet

- Rezoning Proposal For Subdivision PlansDocument186 pagesRezoning Proposal For Subdivision PlansKarly BlatsNo ratings yet

- DXN Marketing Plan: Definition of TermsDocument28 pagesDXN Marketing Plan: Definition of TermsJayKumarNo ratings yet

- The Behavior of Interest RatesDocument39 pagesThe Behavior of Interest RatesAhmad RahhalNo ratings yet

- Duterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyDocument15 pagesDuterte's Ambitious 'Build, Build, Build' Project To Transform The Philippines Could Become His LegacyHannah SantosNo ratings yet

- DuPont analysis assignmentDocument5 pagesDuPont analysis assignmentআশিকুর রহমান100% (1)

- Concepts and Cases: Strategic ManagementDocument58 pagesConcepts and Cases: Strategic ManagementFreddy MurrugarraNo ratings yet

- Chapter 10 - HW SolutionsDocument8 pagesChapter 10 - HW Solutionsa882906No ratings yet

- AFAR QuestionsDocument6 pagesAFAR QuestionsTerence Jeff TamondongNo ratings yet

- EU Greece Assessment Μarch 2012 PPDocument195 pagesEU Greece Assessment Μarch 2012 PPThanasis KatsikisNo ratings yet

- Trade and Capital Flows - GCC and India - Final - May 02 2012Document55 pagesTrade and Capital Flows - GCC and India - Final - May 02 2012aakashblueNo ratings yet

- Full Download Corporate Finance Canadian 3rd Edition Berk Solutions ManualDocument36 pagesFull Download Corporate Finance Canadian 3rd Edition Berk Solutions Manualkisslingcicelypro100% (32)

- Erie Refocused Development Plan For The City of Erie, Pa.Document106 pagesErie Refocused Development Plan For The City of Erie, Pa.MattMartin100% (2)

- Gujranwala Electric Power Company: Say No To CorruptionDocument1 pageGujranwala Electric Power Company: Say No To CorruptionQaswer AbbasNo ratings yet