Professional Documents

Culture Documents

RR 3-2002

Uploaded by

rfylanan0 ratings0% found this document useful (0 votes)

136 views2 pagesrevenue regulation

Original Title

RR_3-2002

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrevenue regulation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

136 views2 pagesRR 3-2002

Uploaded by

rfylananrevenue regulation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

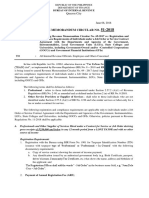

REVENUE REGULATIONS NO.

3-2002 issued on March 27, 2002 amends certain

provisions of RR No. 2-98, as amended, relative to the submission of the Alphabetical

Lists of Employees/Payees in diskette form and the substituted filing of Income Tax

returns of payees/employees receiving purely compensation income from only one

employer for one taxable year whose tax due is equal to tax withheld and individual-

payees whose compensation income is subject to Final Withholding Tax.

An individual whose sole income has been subjected to Final Withholding Tax

shall not be required to file an Income Tax return. For purposes of documentation, as may

be required by other government agencies, as well as to establish the financial capacity of

said individual for bank loans or credit card applications and other purposes, the BIR

Form No. 2306 duly signed by the employer and the employee shall suffice.

Individual taxpayers receiving purely compensation income (regardless of

amount) from only one employer in the Philippines for the calendar year, the Income Tax

of which has been withheld correctly by the said employer (tax due equals tax withheld),

shall not be required to file Income Tax return (BIR Form No. 1700). The Annual

Information Return of Income Taxes Withheld on Compensation and Final Withholding

Taxes (BIR form No. 1604-CF) filed by the respective employers with the BIR shall be

tantamount to the substituted filing of Income Tax returns by said employees.

The following individuals, however, are not qualified for substituted filing and are

therefore, still required to file BIF Form No. 1700: 1) individuals deriving compensation

from two or more employers concurrently or successively during the taxable year; 2)

employees deriving compensation income, regardless of the amount, whether, from a

single employer or several employers during the calendar year, the Income Tax of which

has not been withheld correctly resulting to collectible or refundable return; 3) employees

whose monthly gross compensation income does not exceed Five Thousand Pesos (P

5,000.00) or the statutory minimum wage, whichever is higher, and opted for non-

withholding of tax on said income; 4) individuals deriving other non-business, non-

profession-related income in addition to compensation income not otherwise subject to a

final tax; 5) individuals receiving purely compensation income from a single employer,

although the Income Tax of which has been correctly withheld, but whose spouse is not

qualified for substituted filing (only one tax return shall be filed); and 6) non-resident

aliens engaged in trade or business in the Philippines deriving purely compensation

income or compensation income and other non-business, non-profession-related income.

The employee who is qualified for substituted filing of Income Tax return and the

employer shall issue a joint certification to the effect that the employers filing of BIR

Form No. 1604-CF shall be considered a substituted filing of the employees Income Tax

return, to the extent that the amount of compensation and tax withheld appearing in BIR

Form No. 1604-CF (filed with the BIR) is consistent with the corresponding amounts

indicated in BIR Form No. 2316 and the certification. For taxable year 2001, the joint

certification shall be executed on or before April 15, 2002 (copies to be retained by both

employer and employee), and subsequently on or before January 31 of the following

year, together with BIR Form No. 2316.

The joint certification shall serve the same purpose as if a BIR Form No. 1700

had been filed, such as proof of financial capacity for purposes of loan, credit card, or

other applications, or for the purpose of availing tax credit in the employee's home

country and for other purposes with various government agencies. This may also be used

for purposes of securing travel exemption, when necessary.

Non-filing of BIR Form No. 1700 for employees who are qualified for substituted

filing shall be optional for the taxable year 2001. Thereafter, substituted filing, where

applicable, shall be mandatory.

In addition to the submission of manually prepared alphabetical list of employees and

list of payees who are recipients of income payments subjected to creditable and final

withholding taxes (which form part of the Annual Information Returns - BIR Form Nos.

1604-CF/1604-E), the withholding agent may, at his option, submit 3.5 inch floppy

diskettes, containing the said list.

Taxpayers whose number of employees or income payees are ten (10) or more are,

however, mandatorily required to submit the said lists in 3.5 inch floppy diskettes, using

the existing CSV data file format, together with the manually prepared alphabetical list.

You might also like

- Payrol and Corresponding Tax ComplianceDocument2 pagesPayrol and Corresponding Tax ComplianceJoyceNo ratings yet

- Tax Compliance On PayrollDocument2 pagesTax Compliance On PayrollJoyceNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- Returns and Payment of TaxDocument12 pagesReturns and Payment of TaxHelaena Bueno Delos SantosNo ratings yet

- Reflection Papertax Compliance On PayrollDocument1 pageReflection Papertax Compliance On PayrollJoyceNo ratings yet

- Income TaxDocument19 pagesIncome TaxJustine BartolomeNo ratings yet

- Income TaxDocument292 pagesIncome TaxynnadadenipNo ratings yet

- Income TaxDocument15 pagesIncome TaxJessNo ratings yet

- Withholding Tax Requirements and ProceduresDocument5 pagesWithholding Tax Requirements and ProceduresStevenkyNo ratings yet

- Income Tax Description: IndividualsDocument13 pagesIncome Tax Description: IndividualsJAYAR MENDZNo ratings yet

- BIR 2019 Income Tax DescriptionDocument20 pagesBIR 2019 Income Tax DescriptionRiselle Ann SanchezNo ratings yet

- Income Tax Filing RequirementsDocument17 pagesIncome Tax Filing RequirementsMichael Olmedo NeneNo ratings yet

- BIR Form 0605 UsesDocument4 pagesBIR Form 0605 UsesCykee Hanna Quizo LumongsodNo ratings yet

- INCOME TAX - PDFDocument19 pagesINCOME TAX - PDFPhia CustodioNo ratings yet

- Index For Income TaxDocument20 pagesIndex For Income TaxMark Joseph BajaNo ratings yet

- Description: (Return To Index)Document27 pagesDescription: (Return To Index)Dura LexNo ratings yet

- 1902 For Employee'sDocument8 pages1902 For Employee'sbirtaxinfoNo ratings yet

- Who Are Not Required To File Income Tax ReturnsDocument2 pagesWho Are Not Required To File Income Tax ReturnsCarolina VillenaNo ratings yet

- How To File Your Income Tax Return in The Philippines-COMPENSATIONDocument10 pagesHow To File Your Income Tax Return in The Philippines-COMPENSATIONmiles1280No ratings yet

- O o o o o o O: IndividualsDocument17 pagesO o o o o o O: IndividualsDustin GonzalezNo ratings yet

- RR 3-02Document6 pagesRR 3-02matinikkiNo ratings yet

- BIR FormsDocument30 pagesBIR FormsRoma Sabrina GenoguinNo ratings yet

- Individuals Required To File ITRDocument27 pagesIndividuals Required To File ITRDura LexNo ratings yet

- Individual Income Tax Filing RequirementsDocument4 pagesIndividual Income Tax Filing RequirementsRoseanneNo ratings yet

- RR 19-02Document1 pageRR 19-02saintkarriNo ratings yet

- Filing Tax ReturnsDocument10 pagesFiling Tax ReturnsSamNo ratings yet

- 1702-EX June 2013 GuidelinesDocument4 pages1702-EX June 2013 GuidelinesAnonymous m6sKy4100% (1)

- 8) Who Are Not Required To File Income Tax Returns?Document1 page8) Who Are Not Required To File Income Tax Returns?Deopito BarrettNo ratings yet

- Bacore 3 Course Packet 2Document15 pagesBacore 3 Course Packet 2Jenifer Borja BacayoNo ratings yet

- TAX PAYER GUIDE: BIR Compliance for BusinessesDocument7 pagesTAX PAYER GUIDE: BIR Compliance for BusinessesLevi Lazareno EugenioNo ratings yet

- Notes On Withholding Tax and Income Tax FilingDocument20 pagesNotes On Withholding Tax and Income Tax FilingnengNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- REVENUE REGULATIONS NO. 1-2006 Issued On January 5, 2006 Amends SectionsDocument1 pageREVENUE REGULATIONS NO. 1-2006 Issued On January 5, 2006 Amends SectionsJm CruzNo ratings yet

- TAX-CPAR Lecture Filing and Penalties Version 2Document23 pagesTAX-CPAR Lecture Filing and Penalties Version 2YamateNo ratings yet

- BIR Form 1700 filing guideDocument72 pagesBIR Form 1700 filing guidemiles1280No ratings yet

- Income TaxDocument19 pagesIncome TaxKitch GamillaNo ratings yet

- BIR Ir TAXDocument37 pagesBIR Ir TAXMarky De AsisNo ratings yet

- Administrative Provisions For Individual Income TaxDocument20 pagesAdministrative Provisions For Individual Income Taxramosolaarni0No ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- txtn502 Part2Document21 pagestxtn502 Part2Sandra Mae Cabuenas100% (1)

- Digest RR 14-2018Document1 pageDigest RR 14-2018Carlota Nicolas VillaromanNo ratings yet

- CPAR Filing, Penalties, and Remedies (Batch 89) HandoutDocument25 pagesCPAR Filing, Penalties, and Remedies (Batch 89) HandoutlllllNo ratings yet

- Individual Tax ReturnDocument4 pagesIndividual Tax ReturnmacNo ratings yet

- Returns and Payment of TaxDocument14 pagesReturns and Payment of TaxJanna Grace Dela CruzNo ratings yet

- Janina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Document3 pagesJanina Louise Caliboso Bsa 3A: Tax Reform For Acceleration and Inclusion (TRAIN) "Ja CalibosoNo ratings yet

- Income TaxationDocument13 pagesIncome TaxationKyzy LimsiacoNo ratings yet

- Payroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverDocument2 pagesPayroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverJuline CisnerosNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- BIR Form No GuidlineDocument11 pagesBIR Form No GuidlineFernando OrganoNo ratings yet

- Revenue Regulations No. 2-2011Document3 pagesRevenue Regulations No. 2-2011Jose IbarraNo ratings yet

- Notes On Registration of Book of AccountsDocument3 pagesNotes On Registration of Book of AccountsDenzel Edward CariagaNo ratings yet

- RMC No 51-2008Document7 pagesRMC No 51-2008Yasser MangadangNo ratings yet

- Revenue Memorandum 23-2012Document2 pagesRevenue Memorandum 23-2012Ruth CepeNo ratings yet

- Individual CitizenDocument2 pagesIndividual CitizenSky LeeNo ratings yet

- 1700 Guide Nov 2011Document1 page1700 Guide Nov 2011Danilo Dela ReaNo ratings yet

- Bir Form 1702Document16 pagesBir Form 1702Christine Ann GamboaNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Document2 pagesGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNo ratings yet

- RMC 47-2019Document2 pagesRMC 47-2019RichardNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

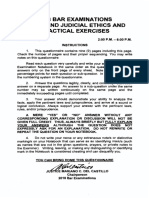

- 2018 Bar Examinations Practical Exercises: Legal and Judicial Ethics andDocument9 pages2018 Bar Examinations Practical Exercises: Legal and Judicial Ethics andrfylananNo ratings yet

- Court upholds mother's right as guardianDocument5 pagesCourt upholds mother's right as guardianrfylananNo ratings yet

- Application Form Rev 4Document4 pagesApplication Form Rev 4MARK ANTHONY TIONGSONNo ratings yet

- Eagle Clarc Shipping Phils., Inc.: Application For Shipboard EmploymentDocument2 pagesEagle Clarc Shipping Phils., Inc.: Application For Shipboard EmploymentrfylananNo ratings yet

- Liturgical Calendar 2017Document45 pagesLiturgical Calendar 2017Jhonna AmutanNo ratings yet

- Cebu Pacific - Print ItineraryDocument4 pagesCebu Pacific - Print ItineraryrfylananNo ratings yet

- Cebu Pacific - Print ItineraryDocument4 pagesCebu Pacific - Print ItineraryrfylananNo ratings yet

- Application Form Rev 4Document3 pagesApplication Form Rev 4rfylananNo ratings yet

- Violation of Rules On Notarial PracticeDocument7 pagesViolation of Rules On Notarial PracticeEszle Ann L. Chua100% (1)

- Violation of Rules On Notarial PracticeDocument7 pagesViolation of Rules On Notarial PracticeEszle Ann L. Chua100% (1)

- Waiver v. DesistanceDocument1 pageWaiver v. DesistancerfylananNo ratings yet

- TRAIN Law ExplainDocument14 pagesTRAIN Law ExplainCharley Yap90% (10)

- Cebu Pacific - Itinerary (Tiya Pina) PDFDocument4 pagesCebu Pacific - Itinerary (Tiya Pina) PDFrfylananNo ratings yet

- Atty. J. Oswald B. LorenzoDocument116 pagesAtty. J. Oswald B. LorenzoLeolaida AragonNo ratings yet

- TRAIN Law ExplainDocument14 pagesTRAIN Law ExplainCharley Yap90% (10)

- PDFDocument51 pagesPDFJan DumanatNo ratings yet

- BSP Circular No. 799, Series of 2013Document1 pageBSP Circular No. 799, Series of 2013j531823No ratings yet

- PAO Revised Citizen's CharterDocument13 pagesPAO Revised Citizen's CharterJet OrtizNo ratings yet

- Pagasa ReviewDocument1 pagePagasa ReviewrfylananNo ratings yet

- Higher Algebra - Hall & KnightDocument593 pagesHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- 3 O'clock PrayerDocument1 page3 O'clock PrayerrfylananNo ratings yet

- Legal WritingDocument473 pagesLegal Writingrfylanan100% (11)

- Hubert Webb Case (FULL TEXT)Document131 pagesHubert Webb Case (FULL TEXT)Rule Amethyst OportoNo ratings yet

- AD MAH FOUNDATION NOTES TO FINANCIAL STATEMENTSDocument12 pagesAD MAH FOUNDATION NOTES TO FINANCIAL STATEMENTSElla LawanNo ratings yet

- Chapter 8 Stock ValuationDocument27 pagesChapter 8 Stock ValuationaseppahrudinNo ratings yet

- CFA Level II Mock Exam 6 - Questions (PM)Document32 pagesCFA Level II Mock Exam 6 - Questions (PM)Sardonna FongNo ratings yet

- Polytechnic University of The Philippines College of Accountancy and Finance ManilaDocument10 pagesPolytechnic University of The Philippines College of Accountancy and Finance ManilaKatsu Mi100% (1)

- Brazil GAAP vs. IFRS - Ernst YoungDocument20 pagesBrazil GAAP vs. IFRS - Ernst YoungGOLATTARINo ratings yet

- Sale and Leaseback Problem Solving MCDocument4 pagesSale and Leaseback Problem Solving MCTeresa RevilalaNo ratings yet

- Red Ink FlowsDocument2 pagesRed Ink FlowsRafi DevianaNo ratings yet

- A STDocument19 pagesA STpadmajachithanya0% (1)

- Cost-Volume-Profit & Breakeven Analysis QuizDocument7 pagesCost-Volume-Profit & Breakeven Analysis QuizNaddieNo ratings yet

- SBBL Organization Profile and ServicesDocument27 pagesSBBL Organization Profile and ServicesEklo Newar100% (1)

- Lugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesDocument78 pagesLugo Z. Accounting Cycle Adjusting Entries, Financial Statements, Closing Entries, Reversing EntriesCar Mela50% (2)

- The Art of The Start The Time Tested Battle Hardened Guide For Anyone Starting Anything.9781591840565.49363Document10 pagesThe Art of The Start The Time Tested Battle Hardened Guide For Anyone Starting Anything.9781591840565.49363Vijaygopal Rengarajan100% (2)

- Nestle IndiaDocument15 pagesNestle IndiaCHITRANSH SINGH33% (3)

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocument19 pagesBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Cooke Company Has The Following Post Closing Trial Balance On DecemberDocument2 pagesCooke Company Has The Following Post Closing Trial Balance On DecemberAmit PandeyNo ratings yet

- Modified Wey - AP - 8e - Ch06 - RevisedDocument45 pagesModified Wey - AP - 8e - Ch06 - RevisedTanvirNo ratings yet

- Hindalco vs. Novelis A Case On AcquisitionDocument20 pagesHindalco vs. Novelis A Case On AcquisitionSanghavi Ankit100% (2)

- Accounting Equation Explained - Assets, Liabilities & Owner's EquityDocument43 pagesAccounting Equation Explained - Assets, Liabilities & Owner's Equitythella deva prasadNo ratings yet

- Manappuram Chairman On CNBCDocument3 pagesManappuram Chairman On CNBCRaghu.GNo ratings yet

- Dalmia Bharat Sugar and Industries Ltd.Document19 pagesDalmia Bharat Sugar and Industries Ltd.Shweta GargNo ratings yet

- Private Foundations Tax GuideDocument48 pagesPrivate Foundations Tax GuideKyu Chang HanNo ratings yet

- CapstoneDocument3,306 pagesCapstoneVan Sj TYnNo ratings yet

- Earl Jhune P. Amoranto: Address: #2 Nielo St. 1 Contact No: (63) 9204010099/ 9653421055 Email AddressDocument2 pagesEarl Jhune P. Amoranto: Address: #2 Nielo St. 1 Contact No: (63) 9204010099/ 9653421055 Email Addressearl AmorantoNo ratings yet

- FMT Tafi Federal LATESTDocument62 pagesFMT Tafi Federal LATESTsyamputra razaliNo ratings yet

- War Is A Racket by Major General Smedley ButlerDocument14 pagesWar Is A Racket by Major General Smedley ButlerKt LeeNo ratings yet

- Accounts For Clubs and SocietiesDocument4 pagesAccounts For Clubs and SocietiesSimba Muhonde100% (2)

- Playing To Win: in The Business of SportsDocument8 pagesPlaying To Win: in The Business of SportsAshutosh JainNo ratings yet

- Johnny Rockets Pakistan's Strategic Mistakes and Opportunity in A Growing MarketDocument22 pagesJohnny Rockets Pakistan's Strategic Mistakes and Opportunity in A Growing MarketSamiullah SarwarNo ratings yet

- RM EegDocument3 pagesRM Eegrohit kumarNo ratings yet

- F6MWI 2014 Dec ADocument9 pagesF6MWI 2014 Dec AangaNo ratings yet