Professional Documents

Culture Documents

As Many As 14 Conventional Banks in Pakistan Offer Shariah

Uploaded by

Mohammad BilalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

As Many As 14 Conventional Banks in Pakistan Offer Shariah

Uploaded by

Mohammad BilalCopyright:

Available Formats

As many as 14 conventional banks in Pakistan offer Shariah-compliant banking services through

separate Islamic windows. Although many of these 14 banks are foreign ones, Standard Chartered Bank

Pakistan happens to be the only banking institution with a western pedigree and a truly global presence

across five continents.

And yet, it runs the largest Islamic banking window in Pakistan, only after Bank Alfalah,

with an 8% share in revenues, 8% share in advances and 4% share in deposits of the

entire Islamic banking industry as of December 2012.

We believe that the kind of expertise and Shariah scholars we have for Islamic banking

is far better than other conventional banks, said Azhar Aslam, who heads Islamic

banking at Standard Chartered Bank Pakistan, while speaking to The Express Tribune in a

recent interview.

The fact that Standard Chartered is a foreign bank is more of our strength than

otherwise. Our Shariah scholars are internationally renowned and have a global stature,

he added.

The share of Islamic banking in the overall banking industry in terms of deposits in 2012

was 9.7%. Its share in terms of banking industrys total assets was 8.6% in the same year,

while Islamic financing and investment accounted for 8.1% share in the overall banking

industry.

According to Aslam, one of the key challenges that Pakistans Islamic banking industry

currently faces is managing liabilities because deposits are far higher than the industrys

commercial assets. In simple words, he explains, only 35 paisas out of any additional

rupee that comes into Islamic banking industry get into commercial assets.

And with the recent launch of a nationwide awareness campaign by all banks offering

Shariah-compliant services, the number of customers is likely to go up quickly, leading

to a higher growth rate in Islamic banking deposits.

So just like the overall banking industry, which is struggling due to the lack of quality

commercial assets, banks offering Islamic banking services are also suffering. Its an

industry-wide problem. There are very few quality obligors who you can lend money to.

Thats why banks have been relying on investments in t-bills and Pakistan Investment

Bonds (PIB), he said.

However, Aslam says some progress has been made with regard to a Shariah-compliant,

short-term liquidity instrument. I cant say when, but my feeling is this will happen

sooner rather than later, he said, hinting at the much-anticipated launch of a

government-backed Islamic financial instrument for short-term liquidity management.

So how does Standard Chartered Pakistan do short-term excess liquidity management in

the absence of such an instrument?

Luckily, only one of the 19 banks operating in the Islamic banking industry had its

commercial assets to deposit ratio a key measure of a banks liquidity better than

that of Standard Chartered Pakistan in 2012. It was around 65% for Saadiq, the brand

name under which Standard Chartered Pakistan runs its Islamic operations in the

country, according to Aslam.

Therefore, Saadiq had only 35% of its deposits left after investing 65% of them in

commercial assets in 2012. The central bank requires that a bank with Islamic operations

must keep 19% of its deposits in SLR eligible securities, which account for the amount

of liquid assets, such as cash and precious metal, that a financial institution must

maintain in its reserves. In addition, banks are also supposed to keep another 6% in cash

under the SBP regulations, which means Saadiq is left with roughly 10% of deposits to

manage.

We have a deposit base of Rs30 billion-plus, which means we have just two to three

billion rupees to manage. We manage our balance sheet in a way that we either buy SLR

eligible Sukuks or invest in commercial assets, Aslam said.

He added that in the next three years, he expects the share of Islamic banking within

Standard Chartered Bank Pakistan will increase from 10% to more than 15%.

Published in The Express Tribune, July 28

th

, 2013.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Book of The Five PercentersDocument647 pagesThe Book of The Five PercentersNathaniel Adams86% (125)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Madina Book 3 - English KeyDocument172 pagesMadina Book 3 - English KeyNasrin Akther100% (20)

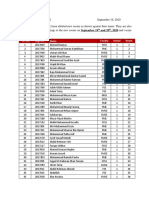

- Room Allotment List of Batch 27, and 28 (2017 and 2018) PDFDocument20 pagesRoom Allotment List of Batch 27, and 28 (2017 and 2018) PDFHasnain KhanNo ratings yet

- HCL Technologies - Anant GuptaDocument6 pagesHCL Technologies - Anant GuptaMohammad BilalNo ratings yet

- Ongc Study MaterialDocument12 pagesOngc Study MaterialMohammad BilalNo ratings yet

- AmexDocument12 pagesAmexMohammad BilalNo ratings yet

- HDFCDocument13 pagesHDFCMohammad BilalNo ratings yet

- HDFC Competition Analysis-CharuDocument99 pagesHDFC Competition Analysis-CharuMohammad BilalNo ratings yet

- Working File MFDocument21 pagesWorking File MFMohammad BilalNo ratings yet

- AmcDocument11 pagesAmcMohammad BilalNo ratings yet

- Synopsis ChocolatesDocument7 pagesSynopsis ChocolatesMohammad BilalNo ratings yet

- What Are The Responsibilities of A Professional ManagerDocument17 pagesWhat Are The Responsibilities of A Professional ManagerMohammad Bilal100% (1)

- PerformanceDocument15 pagesPerformanceMohammad BilalNo ratings yet

- Coal India Limited HiringDocument5 pagesCoal India Limited HiringMohammad BilalNo ratings yet

- The Case StudyDocument3 pagesThe Case StudyMohammad BilalNo ratings yet

- PerformanceDocument15 pagesPerformanceMohammad BilalNo ratings yet

- Steps of Research ProblemDocument4 pagesSteps of Research ProblemTahira KhanNo ratings yet

- E BankingDocument12 pagesE BankingMohammad BilalNo ratings yet

- Our SynopsisDocument7 pagesOur SynopsisMohammad BilalNo ratings yet

- Final Synopsis On Food Adultreation and ControlDocument5 pagesFinal Synopsis On Food Adultreation and ControlMohammad Bilal0% (1)

- What Is Human ResourceDocument19 pagesWhat Is Human ResourceMohammad BilalNo ratings yet

- InstituteDocument14 pagesInstituteMohammad BilalNo ratings yet

- Shortly After TheDocument23 pagesShortly After TheMohammad BilalNo ratings yet

- Organizational Change (Group No.8) ..Document27 pagesOrganizational Change (Group No.8) ..Mohammad BilalNo ratings yet

- Organizational Change (Group No.8)Document41 pagesOrganizational Change (Group No.8)Mohammad Bilal100% (1)

- SB Retail Pricing 120308Document3 pagesSB Retail Pricing 120308Mohammad BilalNo ratings yet

- MARKETING REPORT ON NestléDocument13 pagesMARKETING REPORT ON NestléMohammad BilalNo ratings yet

- Challenges For The Solar Industry IET 180209 - Final JJDocument41 pagesChallenges For The Solar Industry IET 180209 - Final JJMohammad BilalNo ratings yet

- A Cost Benefit Analysis of Utilizing Solar Panels On Bates Nut FaDocument28 pagesA Cost Benefit Analysis of Utilizing Solar Panels On Bates Nut FaMohammad BilalNo ratings yet

- Territory Aug - 2020Document43 pagesTerritory Aug - 2020Mohammed shamiul ShahidNo ratings yet

- Some Important GK MCQs For CSS and PMS ExamDocument29 pagesSome Important GK MCQs For CSS and PMS ExamWeb MastersNo ratings yet

- List of Ayyubid Rulers - WikipediaDocument7 pagesList of Ayyubid Rulers - Wikipediah84698013No ratings yet

- Matkul Absen 20188Document88 pagesMatkul Absen 20188Beni Alpiansyah PanggabeanNo ratings yet

- Middl Le East Architect 201311Document68 pagesMiddl Le East Architect 201311Nguyen BinhNo ratings yet

- Majlis Vol 25 No 03Document12 pagesMajlis Vol 25 No 03KhaliqDawoodNo ratings yet

- NATP Office StaffDocument1 pageNATP Office StaffShahed48bdNo ratings yet

- Quran Tafseer Al-Sadi para 5 UrduDocument126 pagesQuran Tafseer Al-Sadi para 5 Urduapi-37821120% (1)

- Dante Alighieri - "De Monarchia"Document38 pagesDante Alighieri - "De Monarchia"Mariz EreseNo ratings yet

- (Author's Introduction) : in The Name of God, The Compassionate, The MercifulDocument10 pages(Author's Introduction) : in The Name of God, The Compassionate, The MercifulbrizendineNo ratings yet

- ARPEC, AlgeriaDocument4 pagesARPEC, AlgeriaIPSF EMRONo ratings yet

- Ciit Fa23-Bpy-074 Isb@islamiatDocument5 pagesCiit Fa23-Bpy-074 Isb@islamiatfarhatNo ratings yet

- CEO List Karach 2Document6 pagesCEO List Karach 2helping handNo ratings yet

- MWHSPrayer TimetableDocument1 pageMWHSPrayer TimetableSyamil RahmanNo ratings yet

- The Life of An American Jew by Jack BernsteinDocument32 pagesThe Life of An American Jew by Jack Bernsteinsmurfet100% (1)

- ISL202 NEW Highlighted Handouts (LEC 16 To 30) IN ENGLISHDocument114 pagesISL202 NEW Highlighted Handouts (LEC 16 To 30) IN ENGLISHMuhammad Atif ZamanNo ratings yet

- Buddhist History TimelineDocument10 pagesBuddhist History TimelineGaffer9999No ratings yet

- Globalization of ReligionDocument16 pagesGlobalization of ReligionApril BuenoNo ratings yet

- Dalail Khyrat Ayesha Bewley TranslationDocument81 pagesDalail Khyrat Ayesha Bewley TranslationSyed OmarNo ratings yet

- Heritage Sites of Bidar and GulbargaDocument44 pagesHeritage Sites of Bidar and GulbarganaveenyuktaNo ratings yet

- Former Mujahedeen Commander Naser Oric Released After Killing 3500 Christian Serbs inDocument23 pagesFormer Mujahedeen Commander Naser Oric Released After Killing 3500 Christian Serbs inBozidar Bozo DjurdjevicNo ratings yet

- Assignment On QatarDocument18 pagesAssignment On QatarAhmed Imtiaz AlmanNo ratings yet

- Tajweed - Tuhfatul Ghilmaan - TranslationDocument8 pagesTajweed - Tuhfatul Ghilmaan - TranslationNasrin Akther67% (3)

- The Renewal of Islamic LawDocument238 pagesThe Renewal of Islamic Lawwww.alhassanain.org.englishNo ratings yet

- Gunpowder and Empire Article by IA KhanDocument13 pagesGunpowder and Empire Article by IA KhanBIPLAB SINGH100% (3)

- !10th Class English Guess by Taleem CityDocument7 pages!10th Class English Guess by Taleem CityJari BotiNo ratings yet

- Qasaid AnasyidDocument161 pagesQasaid Anasyidtab docomo100% (1)