Professional Documents

Culture Documents

Black Diamond (BDE) - ValueX Vail 2014

Uploaded by

VitaliyKatsenelsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Black Diamond (BDE) - ValueX Vail 2014

Uploaded by

VitaliyKatsenelsonCopyright:

Available Formats

Black Diamond Equipment

BDE

Van Wombwell, CFA

19 June 2014

van@wtasset.com

WESTERN TANAGER

ASSET MANAGEMENT, LLC

u8Al1

Disclaimer: this presents an opinion, not advice.

This presentation reflects the opinions and projections of Western Tanager Asset

Management, LLC (WTAM) as of the date of the publication and is subject to

change without notice at any time subsequent to the date of issue.

WTAM does not represent that any opinion or projection will be realized.

While the information presented is believed to be reliable, no representation or

warranty is made concerning the accuracy of any data presented.

All information provided in this presentation is for informational purposes only

and should not be deemed as investment advice or a recommendation to

purchase or sell any specific security.

WTAM has an economic interest in the price movement of the securities

discussed in this presentation, and WTAMs economic interest is subject to

change without notice.

This presentation may not be reproduced without prior written permission from

WTAM.

2 001 BDE 061914 slides

This is what REAL trust in a brand looks like

3

But, is it a value?

5ootce. bup.//oll-tbot-ls-lotetesuoq.com/pottoleJqe-comploq-pboto

001 BDE 061914 slides

Looking for growth, not portfolio rotation!

COMMON PROBLEM

In Mature Industries:

One segment grows, one declines

Total = slow growth at best

Profit trajectory is result of change in:

Tax rate

Foreign exchange

Structural changes

EXAMPLES

Launch Simply Orange to offset

decline in Minute Maid.

Spirits: more brown, less white.

Beer: one region up, one down

Beer: less total beer, but more craft

Non-alc: more still, less carbonated

4

Why not look for a more compelling opportunity, a high probability pure play?

Growing business at a value/fair price.

1 CAC8

001 BDE 061914 slides

The operator asks: what levers can I pull?

!"#$%& ()*)" +#,,)-%.

Slmple ulsLrlbuuon: more accounLs Lasy

Lecuve ulsLrlbuuon: more sLu/accounL very easy

new Channels Can be fun

Ceographlc Lxpanslon LoLs of fun

CosL Savlngs Cngolng baule

8olL-ons: leverage currenL relauonshlps When auracuve

new roducLs lun, lf no cannlballzauon

new CaLegorles Ch, baby. uo LhaL agaln.

lndusLry CrowLh lloaLs all boaLs

5

Note. lts botJ to sctew op o qtowtb loJostty.

001 BDE 061914 slides

Was there a financial crisis in here somewhere? All major

suppliers and retailers have enjoyed continuous growth.

6

5ootces. 5c lllloqs, compooy kepotts

001 BDE 061914 slides

Global Outdoor Retail market: ~ $25 billion, growing ~5%/yr

Revenue: $25 billion

growing about ~5%/yr,

combination of volume & pricing is usually

positive, varies by category

Grew through the financial crisis

REI, largest retailer, 3yr CAGR = 7%

REI revenue has doubled since 2005

Gross margins: average ~43%

Retail & Supplier margins are similar

Major Segments: Apparel, Accessories = 70%

Major Channels: Specialty & Chain = 80%

Internet is growing high single digits

7

5ootces. Nlu Clobol 5potts Motket sumote, vlc pteseotouoo, l1C OotJoot ketoll1kAk,

N5AA kouke eoJ of seosoo sotvey

001 BDE 061914 slides

Three consumer megatrends are providing a steady tailwind.

8

lmoqes. beoltbyllvloqoolloe, wollpopetlo, metcotyoews

Health & Wellness Extreme Sports Social Media

Note. 5elfes = ltee AJvetusloq

001 BDE 061914 slides

Growth = Innovation + Channel Shift + Geographic Expansion

STRATEGIES DRIVING THE INDUSTRY

1. Innovation/Technology:

Rapid change in fabrics, fit & features

New sports = new categories being created

e.g. adventure racing, trail running, stand up paddle,

backcountry & side country skiing

2. Channel Shift: from Wholesale to Direct to Consumer

Owned/Branded stores

eCommerce

3. Geographic Expansion

US companies expanding in Europe, Asia

European brands coming to America

9 001 BDE 061914 slides

Innovation in Features and Fit: from Integrated to Layering

10

Cld School: /012

Warm, buL bulky

new School: /312

And, you sull need layers

Lxample: lnLegraLed !ackeL vs 1echnlcal Shell"

8eal Cld School: rlceless

5ootce. colomblo, Atctetyx, Cooqle lmoqes

001 BDE 061914 slides

Innovation in Fabrics: leading outerwear fabric now comes in

many forms and price points: 2-Layer, 3-Layer, Pro, Lined, etc.

11

5ootce. Cote-1ex

001 BDE 061914 slides

Innovation in Insulation: The hottest new insulation comes in 7 flavors

12

5ootce. ltlmolof

001 BDE 061914 slides

Its all very Technical. Website info > retail clerk info.

13

5ootce. Atctetyx

001 BDE 061914 slides

Innovation in Sports = new categories, gear, apparel

14

45676#8-%"9 : ;<=) +#8-%"9 ;7<<->

?#8-%5<- @"5<-<-> :

A=*)-%8") B56<->

lmoqes. sklloqbosloess, JotooqobetolJ, lleps, 8u, teomsootofe, ootslJeoolloe

8u !euorce Alrbag

$ 1,100

8u Avalung

$ 140

001 BDE 061914 slides

Value Chain: Supplier revenue grows as channel mix shifts

toward Direct-to-Consumer (owned/branded stores, internet sales)

15

lllosttouoo ossomes 4JX ketollet, 5oppllet qtoss motqlo, coosomet ptlce 5100, 8X ulsttlbotot fee.

More Revenue

Suppliers expect Direct-to-Consumer to increase

share of Revenue by ~ 5% over next five years

Much more Gross Margin

Supplier gross profit per item sold can more than

triple when sold DTC vs via 3

rd

Party distributor

Of course, there are additional costs

Store

Online sales & fulfillment

20

23

CDE

FCE

G3E

001 BDE 061914 slides

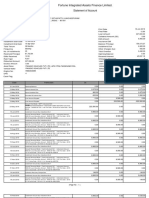

Industry has attractive margins and low CapEx but can have high

working capital requirements; varies with business model.

Notes

REI: Nonprofit, presented as if for profit. CapEx two year avg.

VFC: Rev, GM, OM for Outdoor & Action Sports; WC, Adv & Promo, CapEx total co.

JAH: Rev, OM, CapEx for Outdoor Solutions; GM, WC, Avd & Promo for JAH.

AMER: Rev, OM are for Winter & Outdoor; balance are total company.

16

02HC =5%5 BIJ KL+ MAN +O(? A?IB 4PI

Company 8ev, $ bln $ 2.0 $ 11.4 $ 7.4 $ 1.7 $ 2.8 $ 0.2

P<*<.<#- B)*Q / RS- / 0T2 / GTF / 0T3 / HT3 / HT3 / 2T0

Cross Margln 43 32 29 44 44 38

Cperaung Margln 8 17 7 8 10 -2

uays lnvenLory 109 83 93 134 106 167

Worklng Cap, Sales 13 18 28 34 23 38

Adv & romo, Sales 3.3 3.9 2.3 4.6 10.3 1.7

Cross &L, Sales 47 19 23 36 23 17

CapLx, Sales 4.0 2.8 2.9 4.1 2.0 2.3

8eLurn on CaplLal 16 19 6 12 14 -1

001 BDE 061914 slides

Retail: REI is the largest outdoor retail chain,

can be ~ 10% of sales for any major supplier

Key Statistics

Founded: 1938

Stores Today: 132

Employees: 11,000

Active Members: > 5 million

2013 Results

Sales, $million: $ 2,017

Percent of sales online: ~ 20%

Gross margin 43 %

Operating margin 7.6 %

Revenue growth: 5 %

Same-store sales growth: 3 %

Gross PP&E: $ 956

Patronage Refunds: $ 98

New CEO and President: Jerry Stritzke

Retail Experience:

Coach: President and COO

Victorias Secret Stores, Inc: COO

17

5ootces. kl tepotts, 5eoule 1lmes

001 BDE 061914 slides

Next Years catalog should be awesome.

18

5ootce. kl, vlctotlos 5ectet, wlsbfol tblokloq 001 BDE 061914 slides

TNF continues to be a major growth engine for VF Corp.

Note: In 2000, TNF looked a lot like BDE does today.

History of The North Face

1966: Founded, North Beach, SF, CA

Grateful Dead plays at first store opening

1968: Technical mountaineering gear & apparel

1975: Innovative geodesic tent designs

1980s: Extreme Gear skiwear

1990s: Trekking and Trail Running shoes

2000: Acquired by VF Corp

$ 240 million in sales, losing money

2013: $ 2 billion in net sales

2013 Results

Sales, $million: $ 2,000

Operating margin 17 %

Revenue growth: 7 %

Direct-to-Consumer: ~ 23 %

Direct-to-Consumer growth: 13 %

19

5ootces. 5c flloqs, compooy pteseotouoos

001 BDE 061914 slides

The North Face makes great products and has a

strong financial plan

Growth Strategies

1. Invest in the Brand

2. Grow Direct-to-Consumer

3. Innovate: categories, products

4. Geographic Expansion

Growth Targets, 2012 to 2017

Revenue CAGR = 12%

Direct-to-Consumer = 27% (up from 22%)

Major Categories

Outdoor

Action Sports

Performance Athletic

Youth

20

5ootces. 5c lllloqs, compooy kepotts, compooy webslte

001 BDE 061914 slides

But is the ubiquitous market leader losing some of its cool?

Exhibit A: found spoof images on the internet.

21

5ootces. Cooqle lmoqes

001 BDE 061914 slides

But is the ubiquitous market leader losing some of its cool?

Exhibit B: crampons, or heels?

22

1be vlew ls foboloos.

5ootce. seeo oo tbe stteet, ueovet, cO, lotetoet

001 BDE 061914 slides

Black Diamond Equipment

23

History

Founded, as Chouinard Equipment 1957

Chouinard Equipment bankruptcy,

Metcalf leads acquisition of assets,

Renames Black Diamond &

moves to Salt Lake City, UT 1989

Black Diamond Europe established

Zurich, Switzerland 1996

Black Diamond Asia established

Zhuhai, China 2006

Clarus Corp/Gregory reverse merger w/BD,

With over $200m NOL carryforwards 2010

BDE acquires POC and Pieps 2012

BDE launches Apparel initiative 2013

BDE sells Gregory to Samsonite 2014

5ootces. 5c flloqs, 8u cotpotote lteseotouoo - Motcb 2014, Cteqoty beloq solJ to 5omsoolte.

001 BDE 061914 slides

BD is known, liked and respected in the industry

1. Enormous trust in the BD brand

Consumers life depends on BD

products: climbing, skiing, etc

2. Highly-respected management, well

known throughout the industry

Outdoor industry associations

Land stewardship

3. Global operating platform

Sufficient to double revenue with

minimal capital post-Gregory

4. Clean balance sheet

Revenue: $ 203 m

Gross Margin: 38 %

Operating Margin: nil

24

(#65U#- ;5S). P<.%"<R ?V> B)%5<S

SLC, u1 x x x x

Sweden x x x

SwlLzerland x x

lrance x

AusLrla x x x

!apan x x x

Chlna x x

5ootces. 5c flloqs, 8u cotpotote lteseotouoo - Motcb 2014, ooolyst esumotes, lk Jloloqoe

001 BDE 061914 slides

Management is experienced, sophisticated, highly invested

25

Board BDE Ownership

Warren Kanders, Former Chairman, Armor Holdings 22.0 %

Executive Chairman

Robert Schiller, Former President, Armor Holdings 4.9 %

Executive Vice Chairman, Director

Peter Metcalf Black Diamond Founder 0.3 %

President, CEO, Director SLC Federal Reserve Director

Others: Michael Henning, Donald House, Nicholas Sokolow, Philip Duff 0.8 %

Management

CEO: Peter Metcalf, leader for ~ 30 years

CFO: Aaron Kuhne, promoted from within 0.1 %

Departmental Leads

Apparel Design: Hired from Patagonia, Arcteryx

Engineering, Merchandising: Hired from The North Face

Business Process: Hired from Arcteryx

5ootce. 8u, 5c flloqs

001 BDE 061914 slides

BDE Strategic Focus is now on the BD & POC brands, with

multiple very valuable initiatives underway

26

;%"5%)>9

+#,,)-%. B<.7 K5S8)

;)"*<6) : !"#$ IW<.U->

B)%5<S A66#8-%.

Crow wlLh key reLall parLners, lncludlng 8Ll,

MLC, 8ackcounLry.com, uecaLhlon

Low $$

J-%"#=86) X)$ Y"#=86%

@)6&-#S#><).

LxpecLed conunuauon of double-dlglL

growLh drlven by fuLure producL lnnovauon

Med $$$

!"#$ <-%# X)$

+5%)>#"<).

1echnlcal ouLdoor apparel lall 2013

Cycllng launchlng Sprlng 2014

LlecLronlcs - beacons & alrbags

Low $$$$

4"#5=)- P<.%"<R8U#- :

IS)*5%) 4"5-=.

Large Luropean & Aslan markeL opporLunlLy

8rlng lnLernauonal dlsLrlbuuon ln-house

ulrecL-Lo-consumer, 8eLall

Sell Cregory asseLs Lo fund 8uL, CC growLh

Low $$$$

5ootce. 8u cotpotote lteseotouoo - Motcb 2014, ooolyst esumotes

001 BDE 061914 slides

BD Apparel is the biggest idea. Take the brand into the biggest,

highest-margin category in the industry.

A few samples from the limited launch so far:

27

5ootce. 8u webslte

001 BDE 061914 slides

POC will start with Road collection, then Mountain & Commuter

28

5ootce. lOc webslte

001 BDE 061914 slides

BDE Apparel is building offerings, awareness, availability over time

L5SS

02HC

;Z"<->

02HF

L5SS

02HF

0202

SLyles 23 30 119 xxx

Skus 440 608 1,943 xxxx

uoors 240 400 800 10k"

29

SLyles

ulsLrlbuuon

Apparel Collections & Timing

?)-[. #8%)"$)5"

?)-[. .Z#"%.$)5"

\#,)-[. #8%)"$)5"

\#,)-[. .Z#"%.$)5"

YO+ "#5= 696S<->

YO+ 6#,,8%)" 696S<->

YO+ ,#8-%5<- R<7<->

02HC 02HF 02H1 02HG

Apparel is launching in phases

Deliberately limited at first

Creates buzz at retail

Preserves premium pricing

Adding SKUs, distribution over time

BDE currently sells legacy products to

~ 10,000 retail doors

8evenue

5ootce. 8u eotoloqs pteseotouoos

001 BDE 061914 slides

Scenarios: what do you believe 2020 will look like?

;6)-5"<#

P#$-.<=)

45.) ;%5SS.Q AZZ5")S LS#Z.

IWZ)6%)= ]

?5-5>),)-% +5.)

^Z.<=)

!##= AZZ5")S]+&5--)S.

8ase 8uslness

8evenue CAC8

3

uouble dlglL growLh

(l slow lL Lo 4 over ume)

Plgher due Lo

channel shl

Apparel 8evenue

ln 2020

$ 130 mllllon $230 mllllon $ 400 mllllon

Cross Margln 38 44 44

Cperaung Margln 3 12 13

M & A none none aL Lhls ume 8uy looLwear or Sell 8uL

LnLerprlse value,

$ mllllon

$ 210 $ 323 $ 1,000 +

Share value ~ $ 3.30 ~ $ 13 ~ $ 31 +

30 001 BDE 061914 slides

Base Case: BDE Intrinsic Value ~ $15 vs recent Price ~ $11 - $12.

Assumptions

Existing business growth rate 10%, slows to 4%

(assumes Gregory sale)

2020 Projected

Apparel sales $250 m

Gross Margin 44 %

Operating Margin 12 %

Discount Rate 10 %

Terminal Growth Rate 4 %

31

Current Market Price

Stock Price, 19 June 2014 $ 12.06

Market Capitalization $ 390

Enterprise Value, $m $ 420

Revenue, 2013 $m $ 203

Management Guidance, 2014 $m* $ 240

* wlll cbooqe Joe to Cteqoty sole, 510 to 520 lowet?

001 BDE 061914 slides

BDE is a very attractive firm in a very attractive industry

Risks & Catalysts

Key Man

Dilution

Fashion

Product liability

32

;8,,5"9

lndusLry ! Crew Lhrough Lhe crlsls, sull growlng

8uslness ! Long runway for growLh, many levers Lo pull

ManagemenL ! Lxperlenced, sophlsucaLed, hlghly lnvesLed

valuauon ! rlce volaule, buL oen < value

001 BDE 061914 slides

Summary

33

!

001 BDE 061914 slides

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- VALUEx Vail 2014 - Visa PresentationDocument19 pagesVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- How To Stay Rational in An Irrational World - Vitaliy KatsenelsonDocument37 pagesHow To Stay Rational in An Irrational World - Vitaliy KatsenelsonVitaliyKatsenelson100% (23)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- VALUEx Vail 2014 - Visa PresentationDocument19 pagesVALUEx Vail 2014 - Visa PresentationVitaliyKatsenelson100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- How To Stay Rational in An Irrational World - Vitaliy KatsenelsonDocument37 pagesHow To Stay Rational in An Irrational World - Vitaliy KatsenelsonVitaliyKatsenelson100% (23)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Closed End Funds A Unique OpportunityDocument13 pagesClosed End Funds A Unique OpportunityValueWalkNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Greg Porter Lancashire Holdings Limited - ValueX 2014 Presentation FinalDocument25 pagesGreg Porter Lancashire Holdings Limited - ValueX 2014 Presentation FinalValueWalkNo ratings yet

- Forest Oil (FST) - ValueX Vail 2014Document21 pagesForest Oil (FST) - ValueX Vail 2014VitaliyKatsenelsonNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Investment Case For Blucora - Motiwala CapitalDocument19 pagesInvestment Case For Blucora - Motiwala CapitalCanadianValueNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Active Value Investing Process by Vitaliy Katsenelson, CFADocument16 pagesActive Value Investing Process by Vitaliy Katsenelson, CFAVitaliyKatsenelsonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Nvdia (Nvda) - Valuex Vail 2014Document38 pagesNvdia (Nvda) - Valuex Vail 2014VitaliyKatsenelsonNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- QR Energy Qre Valuex Vail 2014Document3 pagesQR Energy Qre Valuex Vail 2014ValueWalkNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- HealthSouth Presentation Laughing Water CapitalDocument29 pagesHealthSouth Presentation Laughing Water CapitalCanadianValueNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- ValueXVail 2013 - Chris KarlinDocument26 pagesValueXVail 2013 - Chris KarlinVitaliyKatsenelsonNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- ValueXVail 2013 - Vitaliy KatsenelsonDocument16 pagesValueXVail 2013 - Vitaliy KatsenelsonVitaliyKatsenelsonNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- VitaliyDocument6 pagesVitaliyVitaliyKatsenelsonNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- ValueXVail 2013 - Robert MoriDocument18 pagesValueXVail 2013 - Robert MoriVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Ethan BergDocument35 pagesValueXVail 2013 - Ethan BergVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Brian BosseDocument51 pagesValueXVail 2013 - Brian BosseVitaliyKatsenelsonNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- ValueXVail 2013 - Luis AhumadaDocument41 pagesValueXVail 2013 - Luis AhumadaVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - MSDocument21 pagesValueXVail 2013 - MSVitaliyKatsenelson100% (1)

- ValueXVail 2013 - Patrick BrennanDocument45 pagesValueXVail 2013 - Patrick BrennanVitaliyKatsenelsonNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ValueXVail 2013 - Evan TindellDocument26 pagesValueXVail 2013 - Evan TindellVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Erik Kobayashi-SolomonDocument12 pagesValueXVail 2013 - Erik Kobayashi-SolomonVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Michelle LederDocument10 pagesValueXVail 2013 - Michelle LederVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Joe CornellDocument13 pagesValueXVail 2013 - Joe CornellVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Guowei ZhangDocument36 pagesValueXVail 2013 - Guowei ZhangVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Hendrik LeberDocument20 pagesValueXVail 2013 - Hendrik LeberVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Dan FerrisDocument14 pagesValueXVail 2013 - Dan FerrisVitaliyKatsenelsonNo ratings yet

- ValueXVail 2013 - Chris KarlinDocument26 pagesValueXVail 2013 - Chris KarlinVitaliyKatsenelsonNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Agile Consultancy ServicesDocument7 pagesAgile Consultancy ServicesAnkit JainNo ratings yet

- Project Report On Market Survey On Brand EquityDocument44 pagesProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionAnnabeth BrionNo ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- Walmart's $16 Billion Acquisition of FlipkartDocument2 pagesWalmart's $16 Billion Acquisition of FlipkartAmit Dharak100% (1)

- 2 Forex Question CciDocument50 pages2 Forex Question CciRavneet KaurNo ratings yet

- UK House of Lords & Commons Changing Banking For Good Final-report-Vol-IIDocument503 pagesUK House of Lords & Commons Changing Banking For Good Final-report-Vol-IICrowdfundInsiderNo ratings yet

- Moody's - PBC - 79004Document46 pagesMoody's - PBC - 79004Umut UzunNo ratings yet

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDocument11 pagesEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoNo ratings yet

- Critique of PDP 2017-2022 on Monetary and Fiscal PoliciesDocument19 pagesCritique of PDP 2017-2022 on Monetary and Fiscal PoliciesKarlRecioBaroroNo ratings yet

- Public Enterprises Law Proclamation NoDocument18 pagesPublic Enterprises Law Proclamation Notderess100% (5)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IFRS9Document218 pagesIFRS9Hamza AmiriNo ratings yet

- 1.a. PPT1 CR COLL Nature and Functions of CreditDocument41 pages1.a. PPT1 CR COLL Nature and Functions of CreditRoi Martin A. De VeyraNo ratings yet

- Impact of Fundamentals on IPO ValuationDocument21 pagesImpact of Fundamentals on IPO ValuationManish ParmarNo ratings yet

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990No ratings yet

- Form 7Document5 pagesForm 7NagamaheshNo ratings yet

- Finance For Non-Financial Managers Final ReportDocument11 pagesFinance For Non-Financial Managers Final ReportAli ImranNo ratings yet

- Common Transaction SlipDocument1 pageCommon Transaction SlipAmrutaNo ratings yet

- Structuring Your Portfolio of Evidence File: Unit Standard: 116345Document59 pagesStructuring Your Portfolio of Evidence File: Unit Standard: 116345ncedilembokazi23No ratings yet

- Symbiosis International University: Law of ContractsDocument9 pagesSymbiosis International University: Law of ContractsSanmati RaonkaNo ratings yet

- Bajaj Allianz Guarantee Assure Plan SummaryDocument9 pagesBajaj Allianz Guarantee Assure Plan SummaryBhaskarNo ratings yet

- Exam TimetableDocument17 pagesExam Timetableninja980117No ratings yet

- Sriphala Carbons FinancialsDocument16 pagesSriphala Carbons Financials8442No ratings yet

- Chapter 5Document6 pagesChapter 5Timothy Ryan GilbertNo ratings yet

- E-Ticket 7242130546036Document2 pagesE-Ticket 7242130546036VincentNo ratings yet

- Tax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Document2 pagesTax Invoice: de Guzman Randy Sison 64 PUNGGOL WALK #03-31 SINGAPORE 828782 Account No: 3924232952Randy GusmanNo ratings yet

- Statement of Account for Mohansri ADocument2 pagesStatement of Account for Mohansri ASanthosh SehwagNo ratings yet

- 中国经济中长期发展和转型 国际视角的思考与建议Document116 pages中国经济中长期发展和转型 国际视角的思考与建议penweiNo ratings yet

- IITK Parental Income CertificateDocument3 pagesIITK Parental Income CertificateSaket DiwakarNo ratings yet

- Hamilton County Board of Commissioners LetterDocument2 pagesHamilton County Board of Commissioners LetterCincinnatiEnquirerNo ratings yet