Professional Documents

Culture Documents

All Inclusive States Investor Profile AI - Rev 07017013 Fillable PDF

Uploaded by

vezayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All Inclusive States Investor Profile AI - Rev 07017013 Fillable PDF

Uploaded by

vezayCopyright:

Available Formats

Page 1 of 6 KC Rev_070113 Final

Alternative Investments Investor Profile Questionnaire

The following paperwork should be completed for each investor that you are recommending an investment into a Direct

Participation Program, or DPP. Many alternative investments are considered DPPs and henceforth are subject to more

stringent suitability and concentration guideline limits by the states (some more than others), and therefore the following

paperwork is meant to aid you in your discovery process of the types of investments that your client currently holds in

accounts that are with you, as well as any that may be held away at another firm through a different advisor.

To help in documenting your conversations with clients and to help you with your respective state requirements, as well as

comply with FINRAs Know Your Customer Rule, these forms should be viewed as a tool to be used in your fact finding

meeting with new clients, as well as with existing clients to whom you recommend alternative investments.

Please Note: Investors who are residents of Kansas, Maine, Massachussets, New Jersey or Ohio are subject to more

scrutiny by their respective states and therefore, it is important that you carefully complete pages 2-3 & 5 in their entirety and

submit with any new business paperwork for non-traded REIT and/or Business Development Company (BDC) business.

Residents of these states are prohibited from particitating in any DRIP program:

Iowa Nebraska

Kansas Ohio

Kentucky Oregon

Maine Pennsylvania

Massachusetts

Michigan

Missouri

New Jersey

New Mexico

Page 2 of 6 KC Rev_070113 Final

Alternative Investment - Investor Profile

Client Information:

To help the government fight the funding of terrorism, Federal law requires that Kalos Capital verify your identity by obtaining the information listed below before your requested transaction can be

completed. Your request may be denied if Kalos Capital cannot verify this information. Kalos Capital will not be responsible for any losses or damages (including but not limited to, lost

opportunities) resulting from any failure to provide this information in a timely manner, or from our refusal of your requested transaction.

Type of Account: Individual Joint Retirement Trust Other: ______________________

Individual / Entity Information Owners Name_______________________________________________________________

ID Number ________________________________ Issued by _________ Issue Date ____________ Exp Date_____________

SSN _____________________________________ Citizenship ______________________ Date of Birth __________________

Employed YES NO Occupation _____________________________ Employer ____________________________

Employer Address: ________________________________________ City ____________________ ST ______ Zip ________

Joint / Trustee or Fiduciary Information Jt. Owners Name ____________________________________________________

ID Number ________________________________ Issued by _________ Issue Date ____________ Exp Date_____________

SSN _____________________________________ Citizenship ______________________ Date of Birth __________________

Employed YES NO Occupation ________________________ Employer ____________________________

Employer Address: ________________________________________ City ____________________ ST ______ Zip ________

Owner(s) Legal Address (PO Box Not acceptable): _________________________________________________________________

City _____________________________________________________________ ST _______ Zip _______________________

Phone Number _______________________________________ Email Address _________________________________________

Financial Information & Investment Objectives: Federal Income Tax Bracket: (%) ______________

Gross Annual Household Income: $_______________________

Net worth (excluding residence): $________________________

Risk Tolerance: Moderate Moderately Aggressive Aggressive

Investment Objectives:

Income/Moderate Growth Growth/Income Growth Aggressive Growth

Time Horizon: Short (0-5 years) Intermediate (6-10 yrs) Long (10+ yrs)

Investment Product Knowledge: N = None L = Limited G = Good E = Extensive

_____ Stocks _____ Bonds _____Mutual Funds _____Options _____ Variable Ann _____ Alt. Inv.

Questionnaire:

Is client employed or affiliated with FINRA, a FINRA member firm or registered stock exchange? Yes No

Is clients age: Less than 70 70 to 79 80-85 Over 85 (exception Ltr. Required)

Is client considered to be an Accredited Investor(s)? (see page 3 for definition) Yes No

Enter formula percentage that Alternative Investments (new and current) will make-up of the portfolio? % (B+C / A+B)

A = Current Liquid Net Worth: $ (see page 3 for definition)

If the Client already owns Alternative Investments, please list the name and amount of current alternative positions (see p.6 worksheet if needed)

B = Current ALT Investments:

C = NEWALT Investments:

AcknowledgementofRisksandIlliquidityofInvestment:

Initial Initial

Owner Co-Owner

These are illiquid investments and redemptions are subject to holding periods and/or discretion of the Management or Board.

Distribution payments are subject to change i.e. increase, decrease or be eliminated at the discretion of Management, and could

consist of one or a combination of the following: cash flow from the assets, a return of capital, and/or borrowings.

Share price stability does not indicate stability in the value of the underlying assets, which will fluctuate and may be worth more or less

than Management of the program initially paid.

Any dates specified for a liquidity event are not guaranteed and could be changed or delayed at the Managements discretion.

Rep Code _________

If investor

lives in

OH, NJ,

MA, ME

or KS.

Page 5

must be

completed

in addition

to this

page

NFS Account #: ______________________

Page 3 of 6 KC Rev_070113 Final

I have reviewed the above information with my Representative and agree the provided information is accurate. I have read and understand the

Arbitration Clause listed on page two of this form. I have received Kalos Capitals Business Continuity Plan and Privacy Notice. I have received

and understand the Investor Kit required by the Issuer(s) regarding the products prior to purchase.

Client Signature Date

Joint Account Holder Signature (if applicable) Date

A signature guarantee is required on the attached transfer paperwork and the estimated value of the transfer will be $

I, __________________________ (Rep Name), attest the signature was genuine; the signer was the appropriate person to endorse or originate the instruction, or if the signature is by an

agent, the agent had actual authority to act on behalf of the appropriate person; the signer had legal capacity to sign; the photo and signature of signer was visually confirmed from the

signers state drivers license.

Representatives Signature Date

Kalos Capital Principal Signature Date

DEFINITIONS:

LIQUID NET WORTH (General Definition): Liquid Assets are easily converted to cash subject to no more that a 10% penalty/loss. Assets include

structured products, Cash, CDs, Stocks, MF, Bonds, Retirement Accounts, Variable Annuities and Fixed Index Annuities. Do not include real estate or

business equity, personal property and automobiles, expected inheritances or funds already earmarked for other purposes

ACCREDITED INVESTOR : A natural person who has individual net worth, or joint net worth with the persons spouse, that exceeds $1 million at the time of

the purchase (excluding personal residence); a natural person with income exceeding $200,000 in each of the two most recent years or joint income with

a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year; or a trust with assets in excess of

$5 million, not formed to acquire the securities offered, whose purchases a sophisticated person makes.

INCOME / MODERATE GROWTH: Seeks to generate income from investments and experience some growth of capital. Interested in investments with low

or moderate historical risk of loss of principal.

GROWTH AND INCOME: Seeks to grow principal value over time and generate some income from investments. Interested in investments with moderate

historical risk of loss of principal.

GROWTH: Seeks to grow principal value over time. Willing to invest in securities with moderate to above-average historical risk of principal.

AGGRESSIVE GROWTH: Seeks a significant increase in principal over time. Willing to accept a greater degree of risk by investing in securities with high

historical risk of loss of principal.

ARBITRATION CLAUSE:

I agree that all controversies that may arise between me and Kalos Capital, Inc., including, but not limited to those arising out of any transaction or any

agreement between us, whether entered into prior, on, or subsequent to the date hereof, shall be determined by arbitration. Any arbitration under this clause

shall be conducted before, and pursuant to, the arbitration procedure then in effect of the Financial Industry Regulatory Authority. Any award the arbitrator

makes will be final, and judgment on it may be entered in any court having jurisdiction. This arbitration provision shall be enforced and interpreted exclusively

in accordance with applicable federal law, including the Federal Arbitration Act.

I understand that:

Arbitration is final and binding on the parties.

The parties are waiving their right to seek remedies in court, including the right to a jury trial.

Pre-arbitration discovery is generally more limited than and different from court proceedings.

The arbitrators' award is not required to include factual findings or legal reasoning and any party's right to appeal or to seek modification of the

rulings of the arbitrators is strictly limited.

The panel of arbitrators may include a minority of arbitrators who were or are affiliated with the securities industry.

No person shall bring a putative or certified class action to arbitration, nor seek to enforce any pre-dispute arbitration agreement against any

person who has initiated in court a putative class action or who is a member of a putative class who has not opted out of the class with respect to

any claims encompassed by the putative class action until: (i) the class certification is denied; or (ii) the class is decertified; or (iii) the customer is

excluded from the class by the court. Such forbearance to enforce an agreement to arbitrate shall not constitute a waiver of any right under this

agreement except to the extent stated herein.

BUSINESS CONTINUITY PLAN & KALOS CAPITAL PRIVACY POLICY - Both documents can be obtained by visiting our website.

www.kalosfinancial.com

Confirmed NFS

N/A

Page 4 of 6 KC Rev_070113 Final

Investor Suitability & Concentration Standards for Ohio, Kansas, Massachusetts, Maine

and New Jersey Residents Investing in Non-traded REITs and/or BDCs

Several states have established suitability requirements that are more stringent than the standards that we have established as a firm. Shares

will be sold to investors in these states only if they meet the special suitability standards set forth below. In order to determine the investors

liquid net worth these special suitability standards exclude from the calculation of net worth the value of the investors home, home

furnishings and automobiles.

General Suitability Standards for all Investors unless your state below defines differently:

Investors must have either (a) a net worth of at least $250,000 or(b) an annual gross income of $70,000 and a minimum net worth

of $70,000.

Below are descriptions for specific states that apply a more strict application for determining how much an investor may invest. Please note

that investors in these states may NOT participate in the DRIP program of ANY offering.

Massachusetts & Ohio

An investors aggregate investment in any non-traded REIT shares, shares of an affiliate, and in other non-traded real estate investment

programs may not exceed ten percent (10%) of his or her liquid net worth. Liquid net worth is defined as that portion of net worth (total

assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily

marketable securities that can be converted to cash under ordinary and routine business conditions within 10 calendar days. Note that

investors cannot participate in the DRIP feature that reinvests distributions into subsequent affiliated programs.

New Jersey

A New Jersey investor must have either (a) a minimum liquid net worth of $100,000 and an annual gross income of $85,000 or (b) a

minimum liquid net worth of $350,000. In addition, a New Jersey investors total investment in a non-traded REIT offering and in other non-

traded REITs shall not exceed 10% of his or her liquid net worth. Liquid net worth is defined as that portion of net worth (total assets

exclusive of home, home furnishings and automobiles, minus total liabilities) that is comprised of cash, cash equivalents and readily

marketable securities.

Maine

The Maine Office of Securities recommends that an investors aggregate investment in any non-traded REIT offering and similar direct

participation investments should not exceed 10% of the investors liquid net worth. For this purpose, liquid net worth is defined as that

portion of net worth that consists of cash, cash equivalents and readily marketable securities. Note that Maine investors cannot participate

in the DRIP feature that reinvests distributions into subsequent affiliated programs.

Kansas

In addition to the general suitability requirements described above, it is recommended that investors should invest no more than 10% of their

liquid net worth, in the aggregate, in any real estate investment trust(s). Liquid net worth is defined as that portion of net worth (total assets

minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities.

Page 5 of 6 KC Rev_070113 Final

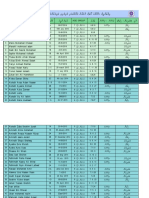

Suitability and Concentration Limits in Non-traded REIT / BDC for residents of KS, MA, ME, NJ, & OH

Below are Direct Participation Program (DPP) investments that would be considered illiquid, meaning investment for which there is not a readily

active market that I/we own in other investment accounts held at another financial institution. Investment accounts include non-qualified (non-IRA)

and qualified accounts (IRA), qualified employer sponsored plans (401(k), 403(b), etc.), & Trust accounts. Check all that apply and indicate the

percentage that each represents of your present liquid net worth.

Percentage Percentage

Non-traded REITs Equipment Leasing Funds

Non-traded BDC Commodity Pools

Private Equity/Venture Capital Funds Oil & Gas DPP Programs (not Reg D)

Other (include percentages):

I/We hereby agree that I/we have listed the illiquid assets above and that I/we do not have other undeclared investments in Direct

Participation Programs held at another firmthat would alter or change the concentration limits as stipulated by my respective states guidelines

outlined in the prospectus which I have received prior to investing.

_________________________________

Print Name Individual/Trust/Beneficial Account Owner Signature

_________________________________

Print Name J oint Owner/Co-Trustee Signature

Date Signed

SECTION 3:

SECTION 2:

SECTION 1:

Use the following formula to help determine allowable amount to be invested in any Direct Participation Program:

Concentration Formula

Total Assets Net Worth (A+B) / C 10%

Minus Primary Residence minus all net assets other thancash,

Minus Home Furnishings cash equivalents, and readily

Minus Automobiles marketable securities or other

Minus total liabilities holdings that can be converted

= Net Worth to cash as defined by your

particular state.

= Liquid Net Worth

Residents in the following states are prohibited from

participating in the DRIP program: IA, KS, KY, ME, MA, MI,

MO, NJ, NM, NE, OH, OR, PA.

A = investors current aggregate investment in securities of the Issuer,

affiliates or the Issuer, and other similar non-traded DPPs;

B = amt. of the prospective addl. purchase of securities of the Issuer,

Affiliates of the Issuer, or other similar non-traded DPPs;

C = investors Liquid Net Worth immediately prior to the purchase of B.

It may be unsuitable for an investors aggregate investment in shares of

the Issuer, Affiliates of the Issuer, and in other non-traded DPP programs

similar to the one being recommended, to exceed 10%of his/her liquid

net worth or net worth depending on your state.

( + )

$

Enter results here % (must 10%)

Please complete this formfor each of the clients non-traded REIT & BDC purchase(s).

Page 6 of 6 KC Rev_070113 Final

AlternativeInvestmentsWorksheet(optional)

CLIENT NAME: Date:

ClientsTotalPortfolioValue(excludingResidence):$ LiquidNetWorth:$

PleaselistcurrentalternativeInvestmentsandthedollaramounts:

NontradedREITs:

$ $

$ $

$ $

$ $

TOTALREITs $ %ofTotalPortfolio %

EquipmentLeasing/Finance:

$ $

$ $

TotalEquip.Leasing/Finance $ %ofTotalPortfolio %

BusinessDevelopmentCompanies(BDC)

$ $

$ $

$ $

$ $

TOTALBDCs $ %ofTotalPortfolio %

PrivateEquity/VentureCapital:

$ $

$ $

TOTALPE/VC $ %ofTotalPortfolio %

EnergyPrograms(Drilling/Royaltyorotherincomegeneratingprograms):

$ $

$ $

$ $

TOTALEnergy $ %ofTotalPortfolio %

OtherAlternativeInvestments/Reg.Dprograms:

$ $

$ $

$ $

TOTALOtherALTs $ %ofTotalPortfolio %

Total%ofPortfolioValueAllocatedtoAlternativeInvestments %

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Business Research Methods Unit 2Document35 pagesBusiness Research Methods Unit 2vezayNo ratings yet

- DecisionTreePrimer 4Document14 pagesDecisionTreePrimer 4Andrew Drummond-Murray100% (1)

- QuestionnaireDocument7 pagesQuestionnairevezayNo ratings yet

- Did You Know: by VijayDocument30 pagesDid You Know: by VijayvezayNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- How To Claim Your VAT RefundDocument5 pagesHow To Claim Your VAT Refundariffstudio100% (1)

- PPG Melc 4Document17 pagesPPG Melc 4Jov EstradaNo ratings yet

- Union Bank of The Philippines V CADocument2 pagesUnion Bank of The Philippines V CAMark TanoNo ratings yet

- RwservletDocument2 pagesRwservletsallyNo ratings yet

- General Concepts and Principles of ObligationsDocument61 pagesGeneral Concepts and Principles of ObligationsJoAiza DiazNo ratings yet

- Jurnal SejarahDocument19 pagesJurnal SejarahGrey DustNo ratings yet

- BCLTE Points To ReviewDocument4 pagesBCLTE Points To Review•Kat Kat's Lifeu•No ratings yet

- UFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Document51 pagesUFC 3-270-01 Asphalt Maintenance and Repair (03!15!2001)Bob VinesNo ratings yet

- Open Quruan 2023 ListDocument6 pagesOpen Quruan 2023 ListMohamed LaamirNo ratings yet

- TO 1C-130H-2-33GS-00-1: Lighting SystemDocument430 pagesTO 1C-130H-2-33GS-00-1: Lighting SystemLuis Francisco Montenegro Garcia100% (1)

- Facts:: Topic: Serious Misconduct and Wilfull DisobedienceDocument3 pagesFacts:: Topic: Serious Misconduct and Wilfull DisobedienceRochelle Othin Odsinada MarquesesNo ratings yet

- Surahduha MiracleDreamTafseer NoumanAliKhanDocument20 pagesSurahduha MiracleDreamTafseer NoumanAliKhanspeed2kxNo ratings yet

- Kaalabhiravashtakam With English ExplainationDocument2 pagesKaalabhiravashtakam With English ExplainationShashanka KshetrapalasharmaNo ratings yet

- D Matei About The Castra in Dacia and THDocument22 pagesD Matei About The Castra in Dacia and THBritta BurkhardtNo ratings yet

- Philippine ConstitutionDocument17 pagesPhilippine ConstitutionLovelyn B. OliverosNo ratings yet

- Essentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFDocument30 pagesEssentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFsilas.wisbey801100% (11)

- Notice - Carte Pci - Msi - Pc54g-Bt - 2Document46 pagesNotice - Carte Pci - Msi - Pc54g-Bt - 2Lionnel de MarquayNo ratings yet

- Before The Judge - Roger EDocument26 pagesBefore The Judge - Roger ELexLuther1776100% (4)

- Daniel Salazar - PERSUASIVE ESSAYDocument2 pagesDaniel Salazar - PERSUASIVE ESSAYDaniel SalazarNo ratings yet

- EthicsDocument11 pagesEthicsFaizanul HaqNo ratings yet

- The Approach of Nigerian Courts To InterDocument19 pagesThe Approach of Nigerian Courts To InterMak YabuNo ratings yet

- Jurnal AJISDocument16 pagesJurnal AJISElsa AugusttenNo ratings yet

- "If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsDocument21 pages"If It Ain't Cheap, It Ain't Punk": Walter Benjamin's Progressive Cultural Production and DIY Punk Record LabelsIsadora Mandarino OteroNo ratings yet

- Chapter 1 Introduction To Quranic Studies PDFDocument19 pagesChapter 1 Introduction To Quranic Studies PDFtaha zafar100% (3)

- Section 7 4 Part IVDocument10 pagesSection 7 4 Part IVapi-196193978No ratings yet

- Is Modern Capitalism Sustainable? RogoffDocument107 pagesIs Modern Capitalism Sustainable? RogoffAriane Vaz Dinis100% (1)

- Q1Document16 pagesQ1satyamNo ratings yet

- Who Is He? Where Is He? What Does He Do?Document3 pagesWho Is He? Where Is He? What Does He Do?David Alexander Pacheco Morales100% (1)

- Ch.6 TariffsDocument59 pagesCh.6 TariffsDina SamirNo ratings yet

- Trifles Summary and Analysis of Part IDocument11 pagesTrifles Summary and Analysis of Part IJohn SmytheNo ratings yet