Professional Documents

Culture Documents

EAMF1405 Hugh Hendry

Uploaded by

ValueWalk0 ratings0% found this document useful (0 votes)

1K views2 pagesEAMF1405 Hugh Hendry

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

1K views2 pagesEAMF1405 Hugh Hendry

Uploaded by

ValueWalkYou are on page 1of 2

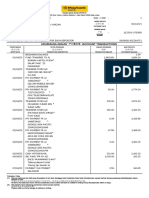

CF Ecl ect i ca

Absol ut e Macro Fund

Monthly Performance Attribution

Internal estimate based on calendar month P&L.

Asset Allocation (% NAV)

* Futures positions are included on a deltad basis. Equity index options are represented as premium.

Fixed Income positions are included on a 10yr adjusted (deltad) basis.

Performance (%) - A shares

1 Month 3 Months YTD Inc.

0.3 -6.9 -9.3 2.5

Past performance is not a guide to future returns.

Calculation on NAV basis with net income reinvested. Shares net of fees and expenses.

Monthly Returns Since Inception (%)

J F M A M J J A S O N D Y

2010 1.2 0.4 -0.5 -0.7 -0.3 -0.2 -1.5 5.4 -0.3 -2.0 0.5 1.7 3.6

2011 -1.8 1.4 -1.7 -0.1 2.8 -0.1 2.1 3.2 1.5 0.2 -0.2 1.1 8.6

2012 -1.0 0.1 -1.9 1.7 1.4 0.7 2.6 -1.0 0.2 -2.2 0.5 -1.4 -0.4

2013 0.9 1.1 2.4 -0.5 -2.3 -1.2 -1.1 0.0 -1.8 0.1 0.7 2.7 0.8

2014 -3.6 1.1 -5.6 -1.7 0.3 -9.3

Performance Summary

The Fund generated a +0.3% return in May, with modest

gains across four out of five themes.

The largest positive contribution came from the Funds

Idiosyncratic trading strategies. A position in the US 30

year bond was the biggest single contributor as yields

continued to fall on mixed economic data and a long position

in the Indian rupee benefited from the post-election rally.

Within the Long DM theme, holdings in internet companies

recovered some of Aprils losses and further gains came

from our European pharmaceutical stocks. Small losses

were incurred on European option packages.

A recovery in Japanese equities resulted in a small gain for

the Funds Long Japan theme, driven by holdings in

property companies and brokers.

Elsewhere, positive price action in Chinese equity markets

led to small losses on relative value positioning in private

companies vs State Owned Enterprises and the Short EM

theme saw further profits from our good versus bad EM FX

trade.

90

95

100

105

110

115

120

D

e

c

-

0

9

M

a

r

-

1

0

J

u

n

-

1

0

S

e

p

-

1

0

D

e

c

-

1

0

M

a

r

-

1

1

J

u

n

-

1

1

S

e

p

-

1

1

D

e

c

-

1

1

M

a

r

-

1

2

J

u

n

-

1

2

S

e

p

-

1

2

D

e

c

-

1

2

M

a

r

-

1

3

J

u

n

-

1

3

S

e

p

-

1

3

D

e

c

-

1

3

M

a

r

-

1

4

Top 10 Holdings - Excluding Options (% NAV)

US 30yr Bond 53.1 Long USD / Short IDR 3.5

Long USD / Short ZAR 13.8 Novartis 2.6

Long USD / Short THB 6.9 Sanofi 2.6

Long USD / Short MYR 6.9 Roche 2.4

Long USD / Short CLP 6.1 EuroStoxx Banks Ftrs (Jun 14) 2.4

Futures/options positions are included on a deltad basis.

Interest rate/bond positions are included on a 10yr adjusted (deltad) basis.

0.7%

0.3%

0.0%

-0.3%

-0.1%

-0.4% -0.2% 0.0% 0.2% 0.4% 0.6% 0.8%

Fixed Income

FX

Commodities

Equities (Net)

Fees

88.2

39.6

53.1

47.4

2.7 1.4

Ftrs*

45.3

0

50

100

FX Equity FI Cash Ftrs Margin Opt Premium

84.9

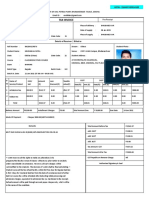

CF Ecl ect i ca

Absol ut e Macro Fund

Current Themes (% VaR)*

Source: EAM. Data as at 10/06/14.

* Aggregate strategy VaR 95/aggregate portfolio VaR 95. Does not account for full effects of diversification.

Long DM 37.4%

Long Japan 24.6%

Short EM 10.0%

Idosyncratic/Hedge 28.0%

Manager Details

Investment Manager Eclectica Asset Management LLP

ACD Capita Financial Services Ltd

Administrator Capita Asset Services Administrators Ltd

Fund Details

Launched 31 December 2009

Fund Manager Hugh Hendry

IMA Sector Targeted Absolute Return

Target Return Annualised 10% on a rolling 3-year basis

Share Classes //$

Structure UCITS IV sub fund of CF Eclectica Funds

Dividends Accumulated

ISA/PEP Eligible Yes

Prospectus & KIID www.capitaassetservices.com

Fund Identifiers

ISIN SEDOL Bloomberg

A share () GB00B2PJSV25 B2PJSV2 CFEGASA LN

A share () GB00B2PJWD21 B2PJWD2 CFEGAEA LN

A share ($) GB00B39WZQ85 B39WZQ8 CFEGADA LN

C share () GB00B3B1N814 B3B1N81 CFEGCSA LN

C share () GB00B3B1NB48 B3B1NB4 CFEGCEA LN

C share ($) GB00B39WZY69 B39WZY6 CFEGCDA LN

Fees, Costs & Redemption Structure

Initial Charges Up to 5% (class A); up to 1% (class C)

Anti-Dilution Levy Up to 0.75% on subs/reds over 5% of NAV

Annual Charges 1.75% (class A); 1.25% (class C)

Performance Fee None

Minimum Investment 5,000 (class A); 20m (class C)

(equivalent for and $)

Dealing Daily at 12pm

Dealing Line 0845 608 0941

Service Providers

Depository BNY Mellon

Auditors Ernst & Young

Accounts Date Financial year-end 31 December

Investor Relations

IR@eclectica-am.com

+44 (0)20 7792 6400

This document is being issued by Eclectica Asset Management LLP ("EAM"), which is authorised and regulated by the Financial Conduct Authority (the FCA"). CF Eclectica Absolute Macro Fund ("the Fund) is a recognised collective

investment scheme in the UK under section 243 of the Financial Services and Markets Act 2000 ("FSMA"). The promotion of the Fund and the distribution of this document however may be restricted by law in other jurisdictions. No

recipient of this document may distribute it to any other person. This communication is directed only at professional clients or eligible counterparties as defined by the Financial Services Authority in the United Kingdom. No representation,

warranty or undertaking, express or implied, is given as to the accuracy or completeness of, and no liability is accepted for, the information or opinions contained in this document by any of EAM, any of the funds managed by EAM or their

respective directors. This does not exclude or restrict any duty or liability that EAM has to its customers under the UK regulatory system. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any

offer to subscribe or purchase, any securities mentioned herein nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for securities

are reminded that any such application may be made solely on the basis of the Full Prospectus and the Key Investor Information Document. Past performance is not a guide to future performance. Values may fall as well as rise and you

may not get back the amount you invested. Income from investments may fluctuate. Changes in rates of exchange may have an adverse effect on the value, price or income of investments. You should obtain professional advice on the

risks of the investment and its tax implications, where appropriate, before proceeding with any investment. All charts are sourced from Eclectica Asset Management LLP. Net Asset Values are as at the date of the document. (c) 2005-14

Eclectica Asset Management LLP; Registration No. OC312442; registered office at 6 Salem Road, London, W2 4BU.

.

Portfolio VaR History

Source: Independent Risk Management Solutions.

-3

-2

-1

0

1

2

3 Return (% NAV) VaR 95*

Portfolio VaR

Total Risk * 16.1

95% Fat Tail ** 1.3

95% Cond VaR ** 1.6

* Ex-ante standard deviation ** Based on 1 day time-horizon Monte Carlo simulation.

Source: Independent Risk Management Solutions.

Top 10 Strategies (% VaR)*

Theme Theme

Japanese Equity JP 15.9 Good vs Bad EM FX EM 8.1

US 30 Year Bond I/H 13.9 Global Internet (Equity) DM 6.9

VIX Puts I/H 10.7 Euro Pharma (Equity) DM 6.7

Nikkei Options JP 8.7 Robots (Equity) DM 4.9

Euro Periphery (Equity) DM 8.2 EuroStoxx Options DM 4.1

Source: EAM. Data as at 10/06/14.

* Strategy VaR 95/aggregate portfolio VaR 95. Does not account for full effects of diversification.

Asset Allocation (% VaR)

Source: Independent Risk Management Solutions.

Long Equity 51.9%

Equity Options 50.2%

Cash 3.6%

Prop FX 3.3%

Fixed Income -9.0%

NAV

$c

p

c

A shares 152.92 91.41 112.11

C shares 155.87 93.99 115.04

AUM 64.8m

You might also like

- IPR2015-00720 (Petition)Document70 pagesIPR2015-00720 (Petition)Markman AdvisorsNo ratings yet

- Why I'm Long SodaStream-Whitney Tilson-10!21!14Document32 pagesWhy I'm Long SodaStream-Whitney Tilson-10!21!14CanadianValueNo ratings yet

- Corsair Capital Management 4Q 2014 LetterDocument7 pagesCorsair Capital Management 4Q 2014 LetterValueWalk100% (1)

- Order GRANTING Defendants' Motion To Dismiss (Docket No. 60)Document14 pagesOrder GRANTING Defendants' Motion To Dismiss (Docket No. 60)theskeptic21No ratings yet

- Marcato Capital 4Q14 Letter To InvestorsDocument38 pagesMarcato Capital 4Q14 Letter To InvestorsValueWalk100% (1)

- Jeff Gundlach - This Time It's DifferentDocument73 pagesJeff Gundlach - This Time It's DifferentCanadianValueNo ratings yet

- Warren Buffet's 1982 Letter To John Dingell Warning About DerivativesDocument4 pagesWarren Buffet's 1982 Letter To John Dingell Warning About DerivativesForbes100% (3)

- Performance Report November 2014Document1 pagePerformance Report November 2014ValueWalkNo ratings yet

- 12.02.14 TheStreet LetterDocument3 pages12.02.14 TheStreet LetterZerohedgeNo ratings yet

- Profiles in Investing - Leon Cooperman (Bottom Line 2004)Document1 pageProfiles in Investing - Leon Cooperman (Bottom Line 2004)tatsrus1No ratings yet

- Fpa International Value TranscriptDocument52 pagesFpa International Value TranscriptCanadianValueNo ratings yet

- Ian Hauge Grants Presentation v61Document13 pagesIan Hauge Grants Presentation v61ValueWalkNo ratings yet

- Denali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicDocument36 pagesDenali Investors - Columbia Business School Presentation 2014.11.11 - Final - PublicValueWalk83% (6)

- 2014 q3 Fpa Crescent TranscriptDocument49 pages2014 q3 Fpa Crescent TranscriptCanadianValueNo ratings yet

- Ame Research Thesis 11-13-2014Document890 pagesAme Research Thesis 11-13-2014ValueWalkNo ratings yet

- The Malone Complex Presentation - 2014.11.19 VPublicDocument43 pagesThe Malone Complex Presentation - 2014.11.19 VPublicValueWalk100% (7)

- Denali Investors - Columbia Business School Presentation 2008 Fall v3Document28 pagesDenali Investors - Columbia Business School Presentation 2008 Fall v3ValueWalkNo ratings yet

- 2014 10 October Monthly Report TPRE v001 s6dl3pDocument1 page2014 10 October Monthly Report TPRE v001 s6dl3pValueWalkNo ratings yet

- Bruce Greenwald Fall 2015Document24 pagesBruce Greenwald Fall 2015ValueWalk100% (1)

- Agn De00028304Document1 pageAgn De00028304ValueWalkNo ratings yet

- Allergan Oct. 28, 2014 v4 - CertifiedDocument16 pagesAllergan Oct. 28, 2014 v4 - Certifiedtheskeptic21No ratings yet

- Sohn Canada Presentation - Oct. 2014Document33 pagesSohn Canada Presentation - Oct. 2014ValueWalk50% (2)

- Agn De00028120Document8 pagesAgn De00028120ValueWalkNo ratings yet

- Agn De00023510Document11 pagesAgn De00023510ValueWalkNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Valuation - Multiples and EV Value DriversDocument27 pagesValuation - Multiples and EV Value DriversstrokemeNo ratings yet

- Bank of Mauritius Act Amended Fa 2022Document57 pagesBank of Mauritius Act Amended Fa 2022Bhavna Devi BhoodunNo ratings yet

- 3174 Bike InsuranceDocument4 pages3174 Bike Insuranceanwar salafiNo ratings yet

- Training Manual Bookkeeping Financial & ManagementDocument81 pagesTraining Manual Bookkeeping Financial & ManagementJhodie Anne Isorena100% (1)

- Executive SummaryDocument2 pagesExecutive SummaryAshlindah KisakuraNo ratings yet

- Indas 2Document28 pagesIndas 2Ranjan DasguptaNo ratings yet

- Components of The Indian Debt MarketDocument3 pagesComponents of The Indian Debt MarketkalaswamiNo ratings yet

- Chapter 23-Week 7Document7 pagesChapter 23-Week 7genessa_nelsonNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinNo ratings yet

- NOVATECH, LTD - Account Overview Relatório 2005Document2 pagesNOVATECH, LTD - Account Overview Relatório 2005RONI SANTOSNo ratings yet

- Redemption of Shares NotesDocument14 pagesRedemption of Shares Notesms.AhmedNo ratings yet

- Business Plan: Silver Bear LodgeDocument28 pagesBusiness Plan: Silver Bear LodgeVaibhav AgarwalNo ratings yet

- RBF Exchane Control BrochureDocument24 pagesRBF Exchane Control BrochureRavineshNo ratings yet

- Sales CasesDocument36 pagesSales Casesknicky Francisco0% (1)

- Project Chapter 1Document62 pagesProject Chapter 1HUMAIR123456No ratings yet

- Final Accounts - Trading, P&L and Balance SheetDocument3 pagesFinal Accounts - Trading, P&L and Balance SheetVivek Singh SohalNo ratings yet

- Chap 004Document30 pagesChap 004Tariq Kanhar100% (1)

- Ibs The Reef, Rawang 1 30/04/23Document3 pagesIbs The Reef, Rawang 1 30/04/23Suhail amdanNo ratings yet

- PrathyushaDocument17 pagesPrathyushaPolamada PrathyushaNo ratings yet

- qX2B PJQN QnBQVKjXZ5LTt1SESnizoMtGkLWWKiEGBSA1QGVCClQblbcx6R8IDXAG3Vjerx0BmmgM9BYqjbD5y5t2A0VunOxcUzgVAa uxWA JEONWcoEwDocument6 pagesqX2B PJQN QnBQVKjXZ5LTt1SESnizoMtGkLWWKiEGBSA1QGVCClQblbcx6R8IDXAG3Vjerx0BmmgM9BYqjbD5y5t2A0VunOxcUzgVAa uxWA JEONWcoEwNurul Hafiza ZazaNo ratings yet

- Exhibit 1 Polaroid Recent Financial Results ($ Millions)Document5 pagesExhibit 1 Polaroid Recent Financial Results ($ Millions)Arijit MajiNo ratings yet

- FDIC Module4Eng PPTDocument23 pagesFDIC Module4Eng PPTBrylle LeynesNo ratings yet

- Ratio Analysis On Dhaka BankDocument8 pagesRatio Analysis On Dhaka Banktoxictouch100% (1)

- Unit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedDocument13 pagesUnit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedArvind RayalwarNo ratings yet

- Statement of Account: HDFC Bank LimitedDocument1 pageStatement of Account: HDFC Bank LimitedPraveen Kumar MNo ratings yet

- Income Tax Case List Exam Related PurposeDocument9 pagesIncome Tax Case List Exam Related PurposeShubham PhophaliaNo ratings yet

- 2312100607329500000Document2 pages2312100607329500000SHRESHTHA COLLEGESNo ratings yet

- Marriott International COPORATE STRATEGYDocument5 pagesMarriott International COPORATE STRATEGYYasir Jatoi100% (1)

- Cost Goods Manufactured Schedule V13Document12 pagesCost Goods Manufactured Schedule V13Osman AffanNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet