Professional Documents

Culture Documents

Form 16 651746

Uploaded by

Arslan1112Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 651746

Uploaded by

Arslan1112Copyright:

Available Formats

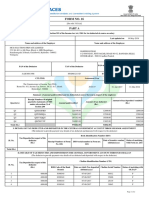

FORM NO.

16

[See rule 31(1)(a)]

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Name and address of the Employer

FIRSTSOURCE SOLUTIONS LIMITED

5TH FLOOR, PARADIGM, 'B' WING, MINDSPCE , LINK ROAD,,

MALAD ( WEST), MUMBAI - 400064

Maharashtra

+(91)22-66660815

dinesh.jain@firstsource.com

Name and address of the Employee

MOHAMMAD ARSLAN MOHAMMAD IQBAL SHAIKH

A-2 AL SAFA 504, MILLAT NGR, OSHIWARA, ANDHERI W,

MUMBAI - 400053 Maharashtra

PAN of the Deductor

AAACI8904N

TAN of the Deductor

MUMI04720C

PAN of the Employee

EWSPS6840A

Assessment Year

2014-15

CIT (TDS)

The Commissioner of Income Tax (TDS)

Room No. 900A, 9th Floor, K.G. Mittal Ayurvedic Hospital

Building, Charni Road , Mumbai - 400002

Period with the Employer

To

31-Mar-2014

From

01-Apr-2013

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Amount of tax deducted

(Rs.)

Amount of tax deposited / remitted

(Rs.) Amount paid/credited

Q1 LPPXXLJC 0.00 0.00 62243.00

Q2 DLWXEECG 961.00 961.00 62593.00

Q3 QASIASPF 437.00 437.00 62968.00

Q4 QQQCRGIE 200.00 200.00 61718.00

Total (Rs.) 1598.00 1598.00 249522.00

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Book Identification Number (BIN)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher

(dd/mm/yyyy)

Status of matching

with Form no. 24G

Total (Rs.)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

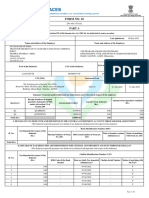

1 0.00 - 07-05-2013 - F

2 0.00 - 07-06-2013 - F

3 0.00 - 06-07-2013 - F

4 648.00 6390340 07-08-2013 17417 F

PART A

Certificate No. RIZIPIH Last updated on 29-May-2014

Employee Reference No.

provided by the Employer

(If available)

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Page 1 of 2

Certificate Number: RIZIPIH TAN of Employer: MUMI04720C PAN of Employee: EWSPS6840A Assessment Year: 2014-15

I, DINESH JAIN, son / daughter of ROOP CHAND JAIN working in the capacity of CFO (designation) do hereby certify that a sum of Rs.1598.00 [Rs. One Thousand

Five Hundred and Ninety Eight Only (in words)] has been deducted and a sum of Rs.1598.00 [Rs. One Thousand Five Hundred and Ninety Eight Only] has been

deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of

account, documents, TDS statements, TDS deposited and other available records.

Verification

Place

Date (Signature of person responsible for deduction of Tax)

MUMBAI

30-May-2014

CFO Designation: Full Name:DINESH JAIN

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

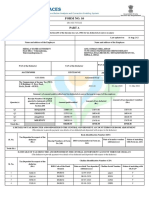

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited

(dd/mm/yyyy)

Challan Serial Number Status of matching with

OLTAS*

5 0.00 - 07-09-2013 - F

6 313.00 6390340 07-10-2013 20448 F

7 177.00 6390340 07-11-2013 19422 F

8 130.00 6390340 07-12-2013 03228 F

9 130.00 6390340 07-01-2014 16274 F

10 71.00 6390340 07-02-2014 20579 F

11 38.00 6390340 07-03-2014 22761 F

12 91.00 6390340 30-04-2014 08137 F

Total (Rs.) 1598.00

Legend used in Form 16

* Status of matching with OLTAS

Legend Description Definition

U Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

P Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

O Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

F Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Page 2 of 2

Digitally signed by JAIN DINESH

Date: 2014.05.31 16:09:25 +05:30

Reason: Form 16 Digital Signature

Signature Not Verified

PAN: EWSPS6840A

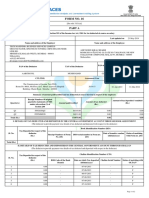

PART B (Refer Note 1)

Details of Salary paid and any other income and tax deducted

===============================================================================================

1 Gross Salary

a. Salary as per provisions contained in sec 17(1) Rs. 249522.00

b. Value of perquisites u/s 17(2) (as per Rs. 0.00

Form No. 12BA, wherever applicable)

c. Profits in lieu of salary u/s 17(3) (as Rs. 0.00

per Form No. 12BA, wherever applicable) -------------

d. Total Rs. 249522.00

2 Less:Allowance to the extent exempt under section 10

Rs. 0.00

3 Balance (1-2) Rs. 249522.00

4 Deductions :

a) Entertainment allowance Rs. 0.00

b) Tax on employment Rs. 2500.00

5 Aggregate of 4 (a) and (b) Rs. 2500.00

6 Income chargeable under the head 'salaries' (3-5) Rs. 247022.00

7 Add: Any other income reported by the employee

Housing Loan Interest Rs. 0.00

8 Gross Total Income (6+7) Rs. 247022.00

9 Deduction under Chapter VIA

(A) Sections 80C,80CCC and 80CCD

(a) section 80C Gross Deductible

Amount Amount

(i) Provident Fund 11520.00

(b) Section 80CCC 0.00

(c) Section 80CCD 0.00

11520.00 11520.00

(B) Other sections (for e.g. 80E,80G,80TTA etc.) under Chapter VIA

Gross Qualifying Deductible

amount amount amount

10 Aggregate of deductible amount under Chapter VI-A Rs. 11520.00

11 Total Income (8-10) Rs. 235502.00

12 Tax on total income Rs. 3550.00

13 Less Section 87A Rs. 2000.00

14 Surcharge Rs. 0.00

15 Education Cess @ 3% (on tax computed at S.No.12-13+14) Rs. 47.00

16 Tax payable (12-13+14+15) Rs. 1597.00

17 Less: Relief under section 89 ( attach details ) Rs. 0.00

18 Tax payable (16-17) Rs. 1597.00

-----------------------------------------------------------------------------------------------

Verification

-----------------------------------------------------------------------------------------------

I, DINESH JAIN, Son of ROOP CHAND JAIN working in the capacity of CFO do hereby certify that

the information given above is true, complete and correct and is based on the books of

account, documents, TDS statement and other available records.

Signature of the person responsible for deduction of tax

Place : MUMBAI Full Name : DINESH JAIN

Date : 30/05/2014 Designation : CFO

-----------------------------------------------------------------------------------------------

Emp. No. : 651746 PAN: EWSPS6840A

FORM NO. 12BA

[See Rule 26A(2)(b)]

Statement showing particulars of perquisites, other fringe benefits or amenities and profits in

lieu of salary with value thereof

-----------------------------------------------------------------------------------------------

1. Name & address of employer : FIRSTSOURCE SOLUTIONS LIMITED

: 5TH FLOOR, PARADIGM, 'B' WING,

: MINDSPACE, LINK ROAD,

: MALAD (WEST),

: MUMBAI - 400064

2.TAN : MUMI04720C

3.TDS Assessment Range of the employer : CIT (TDS)

4.Name,designation and PAN of employee : ARSLAN SHAIKH/ EWSPS6840A

5.Is the employee a director or a person : NO

with substantial interest in the company:

(where the employer is a company) :

6.Income under the head "Salaries" of the : 249522

employee (other than from perquisites) :

7.Financial year : 2013-2014

8.Valuation of Perquisites :

-----------------------------------------------------------------------------------------------

Sr Nature of perquisites Value of Amount,if Amount of

No. (see rule 3) perquisite any,recovered perquisite

as per rules from the chargeable

employee to tax(3-4)

(1) (2) (3) (4) (5)

-----------------------------------------------------------------------------------------------

1.Accommodation

2.Cars/Other automotive

3.Sweeper, gardener, watchman or personal attendant

4.Gas, electricity, water

5.Interest free or concessional loans

6.Holiday expenses

7.Free or concessional travel

8.Free meals

9.Free education

10.Gifts, vouchers, etc.

11.Credit card expenses

12.Club expenses

13.Use of movable assets by employees

14.Transfer of assets to employees

15.Value of any other benefit/amenity/service/privilege

16.Stock options (non-qualified options)

17.Other benefits or amenities

18.Total value of perquisites

19.Total value of Profit in lieu of salary as per 17(3)

-----------------------------------------------------------------------------------------------

9.Details of Tax, -

(a) Tax deducted from salary of the employee u/s 192(1) : As per Form-16

(b) Tax paid by employer on behalf of the employee u/s 192(1A) : NIL

(c) Total tax Paid : As per Form-16

(d) Date of payment into Government treasury : As per Form-16

-----------------------------------------------------------------------------------------------

DECLARATION BY EMPLOYER

I, DINESH JAIN, Son of ROOP CHAND JAIN working as CFO do hereby declare on behalf of

FIRSTSOURCE SOLUTIONS LIMITED that the information given above is based on the books of

account, documents and other relevant records or information available with us and the details

of value of each such perquisite are in accordance with Sec.17 and rules framed thereunder and

that such information is true and correct.

Signature of the person responsible for deduction of tax

Place : MUMBAI Full Name : DINESH JAIN

Date : 30/05/2014 Designation : CFO

-----------------------------------------------------------------------------------------------

Emp. No. : 651746 PAN: EWSPS6840A

You might also like

- Form 16 - TCSDocument3 pagesForm 16 - TCSBALANo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- FS51853 KPMG PDFDocument9 pagesFS51853 KPMG PDFAman AgrawalNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bmukulgusain2407No ratings yet

- Form No. 16: Part ADocument9 pagesForm No. 16: Part ArakehsNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form No. 16 Part B (2020)Document3 pagesForm No. 16 Part B (2020)Dharmendra ParmarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSagar Kumar GuptaNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- 3bdbf6dd-6c71-49c2-a618-4c7251a260cfDocument2 pages3bdbf6dd-6c71-49c2-a618-4c7251a260cfadilsgr0% (1)

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form16 PDFDocument9 pagesForm16 PDFHarish KumarNo ratings yet

- PAYSLIPDocument11 pagesPAYSLIPSaran ManiNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AFuture ArtistNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Apqpa0045n 2018Document4 pagesApqpa0045n 2018samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruPradeep NegiNo ratings yet

- Form 16 FYbilDocument8 pagesForm 16 FYbilBilalNo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- Form16 2012 AAXPE4654P 2023-24Document2 pagesForm16 2012 AAXPE4654P 2023-24Srinivas EtikalaNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountindhar666No ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Form 16 FormatDocument2 pagesForm 16 FormatParthVanjaraNo ratings yet

- Form 16Document3 pagesForm 16Bijay TiwariNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Form 16 in Excel Format For AY 2020 21Document8 pagesForm 16 in Excel Format For AY 2020 21Vikas PattnaikNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- The Telangana Minimum Wages Rules, 1960: Chapter - IDocument36 pagesThe Telangana Minimum Wages Rules, 1960: Chapter - IKirthika RajaNo ratings yet

- Yap vs. Thenamaris Ship's Management, GR No. 179532, 30 May 2011Document1 pageYap vs. Thenamaris Ship's Management, GR No. 179532, 30 May 2011Alyanna BarreNo ratings yet

- HR AssignmentDocument27 pagesHR AssignmentAlexis ChooNo ratings yet

- Industrial and Organizational PsychologyDocument13 pagesIndustrial and Organizational PsychologyBipin SaxenaNo ratings yet

- Employer Statement Template Intake 2020 Final 2Document2 pagesEmployer Statement Template Intake 2020 Final 2elefachewNo ratings yet

- Weekend Perform HR FunctionDocument6 pagesWeekend Perform HR FunctionTesfamariam Setargew MesfinNo ratings yet

- AccentureDocument6 pagesAccentureVijaybhaskar ReddyNo ratings yet

- Research Proposal Chapter 1 3Document22 pagesResearch Proposal Chapter 1 3Raissa Almojuela Del ValleNo ratings yet

- Compliance Notice From Fair Work OmbudsmanDocument5 pagesCompliance Notice From Fair Work OmbudsmanInsight on SBSNo ratings yet

- Canada Pie ChartsDocument4 pagesCanada Pie ChartsPascal GerminoNo ratings yet

- Solved in Chapter 8 We Analyzed A Minimum Wage in TheDocument1 pageSolved in Chapter 8 We Analyzed A Minimum Wage in TheM Bilal SaleemNo ratings yet

- A1 Procedure - General 2Document2 pagesA1 Procedure - General 2Birou HR MarimarNo ratings yet

- Job Analysis: Suruchi PandeyDocument87 pagesJob Analysis: Suruchi PandeyPrerna KhoslaNo ratings yet

- Transformational and Authentic LeadershipDocument9 pagesTransformational and Authentic LeadershipAdeel KhanNo ratings yet

- Chapter 5 Motivation at WORK Teacher Resources Nqimch05Document20 pagesChapter 5 Motivation at WORK Teacher Resources Nqimch05janesmith99964No ratings yet

- Wenphil Serrano Agabon Doctrine DistinguishedDocument6 pagesWenphil Serrano Agabon Doctrine Distinguishedfrank japos100% (1)

- Article 87. Overtime Work. Work May Be Performed Beyond Eight Hours A Day Provided ThatDocument4 pagesArticle 87. Overtime Work. Work May Be Performed Beyond Eight Hours A Day Provided ThatMoises A. AlmendaresNo ratings yet

- Edcil (India) Limited (A Government of India Enterprise) : Requirement of Manpower On Contract BasisDocument4 pagesEdcil (India) Limited (A Government of India Enterprise) : Requirement of Manpower On Contract Basisrishi_positive1195No ratings yet

- 167-Cruz v. BPI G.R. No. 173357 February 13, 2013Document7 pages167-Cruz v. BPI G.R. No. 173357 February 13, 2013Jopan SJNo ratings yet

- Erection of Steel Structures Rev 0ADocument13 pagesErection of Steel Structures Rev 0Apigfly2012100% (1)

- Module 5C International Business Strategy - Managing Managers in APACDocument19 pagesModule 5C International Business Strategy - Managing Managers in APACĐỗ Thị QuyênNo ratings yet

- Kulas Ideas & Creations, Gil Francis Maningo and Ma. Rachel Maningo, vs. Juliet and Flordeliza Arao-AraoDocument2 pagesKulas Ideas & Creations, Gil Francis Maningo and Ma. Rachel Maningo, vs. Juliet and Flordeliza Arao-AraodasfghkjlNo ratings yet

- Organizational Behavior: University of Hargeisa College of Business and Public AdministrationDocument119 pagesOrganizational Behavior: University of Hargeisa College of Business and Public AdministrationMustafe MohamedNo ratings yet

- Sumit Final Project of Work Life BalanceDocument108 pagesSumit Final Project of Work Life BalanceTejas ParekhNo ratings yet

- DOH Medical Scholarship Application FormDocument2 pagesDOH Medical Scholarship Application FormChristeen Angela Pascua-BinasoyNo ratings yet

- Notes Labor LawDocument11 pagesNotes Labor Lawdavid fosterNo ratings yet

- Job Satisfaction and Human BehaviorDocument22 pagesJob Satisfaction and Human BehaviorEdgardo M. delacruz100% (2)

- Zeta Phi Beta Sorority IncDocument41 pagesZeta Phi Beta Sorority Incapi-24069626850% (2)

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 8 (Training and Development) - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 8 (Training and Development) - 31191022307Ng. Minh ThảoNo ratings yet

- Batson SuitDocument29 pagesBatson SuitNews-PressNo ratings yet