Professional Documents

Culture Documents

Michigan Tax Tribunal Updates

Uploaded by

Michigan NewsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michigan Tax Tribunal Updates

Uploaded by

Michigan NewsCopyright:

Available Formats

STATE OF MICHIGAN

RICK SNYDER

GOVERNOR

DEPARTMENT OF LICENSING AND REGULATORY AFFAIRS

MICHIGAN ADMINISTRATIVE HEARING SYSTEM

MICHAEL ZIMMER

EXECUTIVE DIRECTOR

STEVEN ARWOOD

DIRECTOR

LARA is an equal opportunity employer/program.

Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities.

MICHIGAN TAX TRIBUNAL

P.O. BOX 30232 LANSING, MICHIGAN 48909

www.michigan.gov/taxtrib (517) 373-4400

J uly 1, 2014

Dear Tax Tribunal Practitioner:

As most of you know, Kimbal R. Smith III, former Chair and Member of the Tribunal, suffered a

stroke in late October 2013. Although J udge Smiths recovery from his stroke continues, he is

unable to return to work at the Tribunal. Therefore, J udge Smith resigned as a Tribunal Member

on J une 14, 2014. Please join us in thanking J udge Smith for his many years of service to the

Tribunal, the tax community, and the State of Michigan, and in wishing him well in his

continuing recovery.

You should also be aware that J udge Paul McCord has resigned from the Tribunal effective J uly

1, 2014. To replace J udge McCord, Governor Snyder has appointed Dave Marmon to serve the

remainder of J udge McCords term. J udge Marmon practiced law with the Hoffert and

Associates firm and brings many years of tax experience to the Tribunal. J udge Marmons

complete bio can be found on the Tribunals website.

Finally, Governor Snyder has reappointed current Tribunal Chair Steve Lasher for a second four-

year term. J udge Lasher will continue to serve as Chair of the Tribunal.

Caseload/E-Filing

If you paid Tribunal fees with a credit card and are now requesting a full or partial refund, please

be aware that the refund will be credited to your credit card rather than by the issuance of a

check. Also, when requesting a refund of fees paid by credit card, please include your

confirmation of payment or confirmation number with your request.

Recent Court of Appeals Decisions*/Legislation

Public Act 164 of 2014. Signed by Governor Snyder on J une 12, 2014, PA 164 revises MCL

211.34d to provide that effective J anuary 1, 2014, losses for purposes of calculating taxable

value will no longer include decreases in a propertys occupancy rate. Thus, neither occupancy

rate increases nor decreases will be included in the calculation of a propertys taxable value.

*Because of the volume of appellate decisions issued in recent weeks relevant to the Tribunal, a

separate summary/analysis of these cases will be included in a GovDelivery to be issued within

the next two weeks.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Thumbs Up Video Financial StatementsDocument4 pagesThumbs Up Video Financial Statementsamitmehta2980% (5)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AAT Audit and Assurance Course Book 2022Document236 pagesAAT Audit and Assurance Course Book 2022arsenali damuNo ratings yet

- Job Order Costing Syste1 PDFDocument19 pagesJob Order Costing Syste1 PDFgosaye desalegn100% (2)

- 2015 04 28 - Endurance International Group: A Web of DeceitDocument61 pages2015 04 28 - Endurance International Group: A Web of DeceitgothamcityresearchNo ratings yet

- FINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationDocument17 pagesFINAL Examination - Applied Auditing 1 SY 2017-2018: College of Accounting EducationAiron Keith Along100% (1)

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

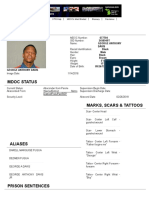

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- Biyani's Think Tank: Business AccountingDocument20 pagesBiyani's Think Tank: Business Accountingdeepakpatni11No ratings yet

- Theory Questions 5 PDF FreeDocument5 pagesTheory Questions 5 PDF FreeSamsung AccountNo ratings yet

- Wk14 Summary Quizzer 2 - Set BDocument5 pagesWk14 Summary Quizzer 2 - Set Bmariesteinsher0No ratings yet

- Problem 1Document10 pagesProblem 1Shannen D. CalimagNo ratings yet

- Monthwise Syllabus Class 12 ComDocument8 pagesMonthwise Syllabus Class 12 ComKritika ModiNo ratings yet

- Auditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryDocument33 pagesAuditing Theory Salosagcol Summary Auditing Theory Salosagcol SummaryMikaNo ratings yet

- Problems On Initial Cost Measurement - IAS 16Document3 pagesProblems On Initial Cost Measurement - IAS 16NagadeepaNo ratings yet

- Value Added ReportingDocument6 pagesValue Added ReportingnindywahyuNo ratings yet

- IFRS 16 Examples, Summary, & How To Transition From IAS 17Document13 pagesIFRS 16 Examples, Summary, & How To Transition From IAS 17Bruce ChengNo ratings yet

- CPA Study Plan and Tips Simandhar EducationDocument6 pagesCPA Study Plan and Tips Simandhar Educationdaljeet singhNo ratings yet

- Qualifying Exam Review Qs Final Answers2Document32 pagesQualifying Exam Review Qs Final Answers2JD DLNo ratings yet

- Quiz 1 Audtheo PDFDocument5 pagesQuiz 1 Audtheo PDFCharlen Relos GermanNo ratings yet

- Labor Cost Code PDFDocument5 pagesLabor Cost Code PDFkarthikaswiNo ratings yet

- 116-Article Text-496-1-10-20201125 (JURNAL 4)Document12 pages116-Article Text-496-1-10-20201125 (JURNAL 4)MYS meyNo ratings yet

- Onerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Document6 pagesOnerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Suzy BaeNo ratings yet

- FM Chapter 3 NotesDocument22 pagesFM Chapter 3 NotesMadesh KuppuswamyNo ratings yet

- Team PRTC 1stPB May 2023 - Key AnswersDocument51 pagesTeam PRTC 1stPB May 2023 - Key Answerskathryn b. fordNo ratings yet

- PWC Vietnam Contact Book 2016 enDocument13 pagesPWC Vietnam Contact Book 2016 enThang Nguyen100% (1)

- 4-Accrual Accounting ConceptsDocument115 pages4-Accrual Accounting Conceptstibip12345100% (5)

- Industrial Training Manual-RevisedDocument30 pagesIndustrial Training Manual-Revisedsuzhen.al1314No ratings yet

- Hira Arshad: ObjectiveDocument2 pagesHira Arshad: ObjectiveNabeel MaqsoodNo ratings yet

- Accounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskDocument38 pagesAccounting The Purpose of Accounting: Michał Suchanek Keifpt, University of GdańskMercio AdozilioNo ratings yet

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- Ambuja Cements: Profit & Loss AccountDocument15 pagesAmbuja Cements: Profit & Loss Accountwritik sahaNo ratings yet