Professional Documents

Culture Documents

Washington State Department of Revenue Response On Microsoft Royalty Tax

Uploaded by

Jeff ReifmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Washington State Department of Revenue Response On Microsoft Royalty Tax

Uploaded by

Jeff ReifmanCopyright:

Available Formats

from Gowrylow, Mike (DOR)

<MikeG@dor.wa.gov>

to Jeff Reifman

date Fri, Nov 13, 2009 at 10:55 AM

Jeff,

Many

of

your

questions

obviously

relate

to

the

operations

of

a

specific

company

in

the

software

industry.

While

we

could

attempt

to

provide

general

answers

to

these

questions,

you

have

been

applying

our

answers

to

a

specific

company

in

your

blog

postings.

Your

apparent

goal

is

to

narrow

the

line

of

questioning

down

to

a

single

company.

We

regret

that

we

cannot

answer

such

specific

questions

because

of

the

need

to

protect

confidential

taxpayer

information.

We

also

cannot

comment

on

what

we

do

with

any

information

you

provide

to

us

that

may

bear

on

the

taxability

of

a

business.

We

do

act

on

any

information

we

receive.

We

can

assure

you

that

the

Department

regularly

audits

large

taxpayers

in

the

state

to

ensure

full

compliance

with

applicable

tax

laws.

This

includes

examining

transactions

between

affiliate

corporations.

Any

such

activity

would

be

taxable

as

provided

under

the

appropriate

classification

of

the

B&O

tax.

To

go

into

further

detail

about

the

taxability

of

such

transactions

would

risk

violation

of

the

confidentiality

laws.

The

Department

can

only

enforce

taxes

where

they

are

legally

enforceable.

It

cannot

impose

taxes

on

a

company

if

it

reasonably

believes

that

such

enforcement

would

be

overruled

by

the

courts.

This

would

be

a

waste

of

state

resources.

Regarding

legal

protections,

the

parties'

choice

of

which

jurisdiction's

law

will

govern

interpretation

of

a

contract

are

standard

choice-‐of-‐law

clauses.

It

does

not

impact

tax

results,

which

are

determined

according

to

applicable

statutes

and

agency

rules.

Regarding

the

use

of

the

Estep

decision,

The

Department

follows

its

published

determination

in

3

WTD

259.

This

determination

applies

the

Estep

decision's

analysis

on

step

transactions

to

excise

taxes.

We

believe

this

is

an

appropriate

use

of

this

decision.

Mike

You might also like

- Print of Home PageDocument1 pagePrint of Home PageJeff ReifmanNo ratings yet

- Microsoft Reference For Jeff Reifman by Director of Technology Keith RoweDocument1 pageMicrosoft Reference For Jeff Reifman by Director of Technology Keith RoweJeff ReifmanNo ratings yet

- References For Jeff ReifmanDocument3 pagesReferences For Jeff ReifmanJeff ReifmanNo ratings yet

- Microsloth - Microsoft's Sacred Cash CowDocument6 pagesMicrosloth - Microsoft's Sacred Cash CowJeff ReifmanNo ratings yet

- DHHS Guidance On External Review For Group Health Plans and Health Insurance IssuersDocument16 pagesDHHS Guidance On External Review For Group Health Plans and Health Insurance IssuersJeff ReifmanNo ratings yet

- Client Recommendation: CEO Michael Cann, WineCountry MediaDocument1 pageClient Recommendation: CEO Michael Cann, WineCountry MediaJeff ReifmanNo ratings yet

- Reference Letter - GE Research and Development DR William MakuchDocument2 pagesReference Letter - GE Research and Development DR William MakuchJeff ReifmanNo ratings yet

- How To Appeal A Health Care Insurance Decision - OIC 2019Document62 pagesHow To Appeal A Health Care Insurance Decision - OIC 2019Jeff ReifmanNo ratings yet

- Case 412-2010 - Summit Law GroupDocument2 pagesCase 412-2010 - Summit Law GroupJeff ReifmanNo ratings yet

- Redback Travels India Itinerary 2014Document7 pagesRedback Travels India Itinerary 2014Jeff ReifmanNo ratings yet

- Measure 103 - An Ordinance To Limit Corporate Rights in SeattleDocument4 pagesMeasure 103 - An Ordinance To Limit Corporate Rights in SeattleJeff ReifmanNo ratings yet

- Impacts On Washington State EducationDocument11 pagesImpacts On Washington State EducationJeff ReifmanNo ratings yet

- Paid Editorial at Huffington Post: Affordable Green Technology For Your Home - Damon M. BanksDocument6 pagesPaid Editorial at Huffington Post: Affordable Green Technology For Your Home - Damon M. BanksJeff ReifmanNo ratings yet

- Investing For Change - Seattle WeeklyDocument6 pagesInvesting For Change - Seattle WeeklyJeff ReifmanNo ratings yet

- Motion For Discetionary Review - No Coal! Prop2 BellinghamDocument38 pagesMotion For Discetionary Review - No Coal! Prop2 BellinghamJeff ReifmanNo ratings yet

- Motion For Emergency Stay - No Coal! Bellingham Prop 2Document37 pagesMotion For Emergency Stay - No Coal! Bellingham Prop 2Jeff ReifmanNo ratings yet

- Measure 103 - An Ordinance To Limit Corporate Rights in SeattleDocument4 pagesMeasure 103 - An Ordinance To Limit Corporate Rights in SeattleJeff ReifmanNo ratings yet

- End Corporate Rights InitiativeDocument5 pagesEnd Corporate Rights InitiativeJeff ReifmanNo ratings yet

- Launching of The Washington Community Rights NetworkDocument2 pagesLaunching of The Washington Community Rights NetworkJeff ReifmanNo ratings yet

- Order Granting Preliminary InjunctionDocument4 pagesOrder Granting Preliminary InjunctionJeff ReifmanNo ratings yet

- 1A 1st Jul01 Final Asection 01 1Document1 page1A 1st Jul01 Final Asection 01 1Jeff ReifmanNo ratings yet

- Notice of Appeal - Bellingham No Coal Prop 2Document3 pagesNotice of Appeal - Bellingham No Coal Prop 2Jeff ReifmanNo ratings yet

- Certificate of Incorporation For Corporate PersonDocument1 pageCertificate of Incorporation For Corporate PersonJeff ReifmanNo ratings yet

- The Spokane Declaration July 2012Document2 pagesThe Spokane Declaration July 2012Jeff ReifmanNo ratings yet

- Notice of Appeal - Bellingham No Coal Prop 2Document3 pagesNotice of Appeal - Bellingham No Coal Prop 2Jeff ReifmanNo ratings yet

- Ballot Title Appeal For Seattle Initiative Measure 103Document13 pagesBallot Title Appeal For Seattle Initiative Measure 103Jeff ReifmanNo ratings yet

- Lawsuit On Behalf of The Rights of Nature Under The Principle of Universal JurisdictionDocument12 pagesLawsuit On Behalf of The Rights of Nature Under The Principle of Universal JurisdictionJeff ReifmanNo ratings yet

- Mashable Guest Writer AgreementDocument1 pageMashable Guest Writer AgreementJeff ReifmanNo ratings yet

- Political Spending Resolution Seattle Draft-02!28!12Document2 pagesPolitical Spending Resolution Seattle Draft-02!28!12Jeff ReifmanNo ratings yet

- Letter To Microsoft General Counsel and Senior Vice President Brad Smith - Feb 2012Document1 pageLetter To Microsoft General Counsel and Senior Vice President Brad Smith - Feb 2012Jeff ReifmanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Addaday v. Hyper Ice - ComplaintDocument37 pagesAddaday v. Hyper Ice - ComplaintSarah BursteinNo ratings yet

- Chapter Three Business PlanDocument14 pagesChapter Three Business PlanBethelhem YetwaleNo ratings yet

- Expressing Interest in NIBAV LiftsDocument9 pagesExpressing Interest in NIBAV LiftsSetiawan RustandiNo ratings yet

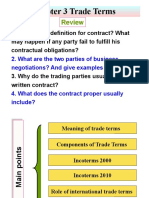

- The Strategy of IB: International Business - Chapter 13Document20 pagesThe Strategy of IB: International Business - Chapter 13Yến Ngô HoàngNo ratings yet

- Marc Sans, Barcelona ActivaDocument17 pagesMarc Sans, Barcelona ActivaPromoting EnterpriseNo ratings yet

- Group analyzes Sunsilk brand auditDocument49 pagesGroup analyzes Sunsilk brand auditinkLLL0% (1)

- Sample Demand LetterDocument3 pagesSample Demand LetterShaniemielle Torres-BairanNo ratings yet

- NCP Ineffective Breathing PatternDocument1 pageNCP Ineffective Breathing PatternMarc Johnuel HumangitNo ratings yet

- Self Improvement Books To ReadDocument13 pagesSelf Improvement Books To ReadAnonymous oTtlhP67% (3)

- IP Dect AP 8340 R150 DatasheetDocument3 pagesIP Dect AP 8340 R150 DatasheetAsnake TegenawNo ratings yet

- Memorandum of AgreementDocument4 pagesMemorandum of AgreementMarvel FelicityNo ratings yet

- Grade6 Integers Multiple Additions Subtractions PDFDocument9 pagesGrade6 Integers Multiple Additions Subtractions PDFEduGainNo ratings yet

- Cereal Partners World Wide (Case Presentation)Document42 pagesCereal Partners World Wide (Case Presentation)Misbah JamilNo ratings yet

- Certificate of IncorporationDocument1 pageCertificate of IncorporationVaseem ChauhanNo ratings yet

- Create Config Files Python ConfigParserDocument8 pagesCreate Config Files Python ConfigParserJames NgugiNo ratings yet

- Practice Ch3Document108 pagesPractice Ch3Agang Nicole BakwenaNo ratings yet

- Announcement: Inter-And Intra-Sectoral Dynamics For Transforming Indian AgricultureDocument8 pagesAnnouncement: Inter-And Intra-Sectoral Dynamics For Transforming Indian AgricultureEnamul HaqueNo ratings yet

- 2 - Brief Report On Logistics Workforce 2019Document39 pages2 - Brief Report On Logistics Workforce 2019mohammadNo ratings yet

- Good Story Company Submission Cheat SheetDocument28 pagesGood Story Company Submission Cheat SheetRoseNo ratings yet

- BS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Document46 pagesBS Iec 61643-32-2017 - (2020-05-04 - 04-32-37 Am)Shaiful ShazwanNo ratings yet

- Comparison Between India and ChinaDocument92 pagesComparison Between India and Chinaapi-3710029100% (3)

- Vytilla Mobility Hub - Thesis ProposalDocument7 pagesVytilla Mobility Hub - Thesis ProposalPamarthiNikita100% (1)

- 32-5-1 - Social ScienceDocument19 pages32-5-1 - Social Sciencestudygirl03No ratings yet

- Chapter 3 Views in ASP - NET CoreDocument23 pagesChapter 3 Views in ASP - NET Coremohammadabusaleh628No ratings yet

- Cau Truc To HopDocument1,258 pagesCau Truc To Hopkhôi trươngNo ratings yet

- Application Letter for Experienced Telecommunications TechnicianDocument5 pagesApplication Letter for Experienced Telecommunications TechnicianRaymondNo ratings yet

- Specifications For Metro Ethernet 13-Sdms-10Document30 pagesSpecifications For Metro Ethernet 13-Sdms-10ashrafNo ratings yet

- Focus ManualDocument597 pagesFocus ManualSabareesan SundarNo ratings yet

- Andhra Pradesh Land Reforms (Ceiling On Agricultural Holdings) (Amendment) Act, 2009Document3 pagesAndhra Pradesh Land Reforms (Ceiling On Agricultural Holdings) (Amendment) Act, 2009Latest Laws TeamNo ratings yet

- SMB GistDocument7 pagesSMB GistN. R. BhartiNo ratings yet