Professional Documents

Culture Documents

Ethylene Process

Uploaded by

kapil1979Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ethylene Process

Uploaded by

kapil1979Copyright:

Available Formats

PERP/PERPABSTRACTS2009

Ethylene

Steam Cracking (Naphtha,

Ethane/Propane), MTO, from ethanol

Processes. Developing Technologies:

Gas To Ethylene, FCC, Alkanes To

Alkenes etc. Cost of Producing

Ethylene from Ethane, Propane, E/P,

Butane, Gas Oil, MTO, Naphtha,

Ethanol. Regional Supply/Demand.

PERP 08/09-5

Report Abstract

October 2009

Ethylene

PERP 08/09-5

Report Abstract

October 2009

www.chemsystems.com

The ChemSystems Process Evaluation/Research Planning (PERP) program is recognized globally as

the industry standard source for information relevant to the chemical process and refining industries.

PERP reports are available as a subscription program or on a report by report basis.

Nexant, Inc. (www.nexant.com) is a leading management consultancy to the global energy, chemical, and related industries. For over 38 years,

ChemSystems has helped clients increase business value through assistance in all aspects of business strategy, including business intelligence, project

feasibility and implementation, operational improvement, portfolio planning, and growth through M&A activities. Nexant has its main offices in

San Francisco (California), White Plains (New York), and London (UK), and satellite offices worldwide.

For further information about these reports, please contact the following:

New York, Dr. J effrey S. Plotkin, Vice President and Global Director, PERP Program, phone: +1-914-609-0315, e-mail: jplotkin@nexant.com;

or Heidi J unker Coleman, Multi-client Programs Administrator, phone: +1-914-609-0381, e-mail: hcoleman@nexant.com.

London, Dr. Alexander Coker, Manager, PERP Program, phone: +44-(20)-709-1570, e-mail: acoker@nexant.com.

Bangkok, Maoliosa Denye, Marketing Manager, Energy & Chemicals Consulting: Asia, phone: +66-2793-4612, e-mail: mdenye@nexant.com.

Website: www.chemsystems.com

Copyright by Nexant Inc. 2009. All Rights Reserved.

www.chemsystems.com

CHEMSYSTEMS PERP PROGRAM

Report Abstract Ethylene 08/09-5

1

PERPABSTRACTS2009 00101.0009.4105

Ethylene

INTRODUCTION

Ethylene end use markets are diverse, owing to the wide spectrum of derivatives. These end use

markets include: wire and cable insulation; consumer, industrial and agricultural packaging;

woven fabrics and assorted coverings; pipes, conduits and assorted construction materials;

drums, jars, containers, bottles and the racks in which to hold them; antifreeze; and solvents and

coatings.

Some examples of the major chemicals and polymers that are produced from ethylene include

low, linear low and high density polyethylenes (LDPE, LLDPE and HDPE respectively),

ethylene dichloride (EDC), vinyl chloride (VCM), polyvinyl chloride (PVC) and its copolymers,

alpha-olefins (AO), ethylene oxide (EO) used primarily to make mono ethylene glycol (MEG)

for use in polyester and antifreeze production, vinyl acetate (VAM), ethyl alcohol (ethanol),

ethylene propylene diene monomer (EPDM), a co-monomer for polypropylene, ethylbenzene

(EB), styrene (SM), polystyrene (PS) and its copolymers.

Polymers represent the major end use for ethylene, as exemplified by the Figure below showing

ethylene end-use for the United States.

U.S. Ethylene End-Use Pattern

HDPE

28%

LLDPE

17%

LDPE

13%

EDC

15%

Styrene

5%

Alpha Olefins

6%

Others

2%

VAM

2%

Ethylene Oxide

12%

Q109_00101.0009.4105_charts.xls\F5.1

This PERP report discusses commercial and near commercial technology for producing ethylene,

developing technologies, cost of production estimates for the manufacture of this olefin, and

analysis of the commercial market.

Ethylene

www.chemsystems.com

CHEMSYSTEMS PERP PROGRAM

Report Abstract Ethylene 08/09-5

2

PERPABSTRACTS2009 00101.0009.4105

COMMERCIAL AND NEAR COMMERCIAL TECHNOLOGY

Having originally been developed in refineries in the United States, steam cracking technology

has been around since the 1920s; (heat treatment of crude oil streams was happening previously

to enhance the yield of light components).

Although the cracking process is simple in principle, with no catalysts or initiators needed,

practical application has been constrained by:

Material properties in particular tube temperature limits in the furnaces, limiting

feedstock conversion

Controllability immeasurably improved by the advent of automatic and now computer

control systems

Scale compressors and turbines and now able to efficiently work at the sizes needed for

million ton crackers

Some other specific developments that are helping transform cracker configurations include:

Short residence coils that greatly improve olefin selectivity

Significantly larger furnaces with efficient floor burners allowing crackers with

4-8 furnaces instead of 12 +

Structured packing/high efficiency trays in columns to improve separation efficiency

Integration techniques to reduce specific power consumption

This section discusses the various feeds employed in each region and the conventional

technologies (i.e., steam cracking) employed to produce olefins. In addition, a discussion of

alternative technologies such as methanol-to-olefins (MTO) and ethylene from renewable

sources is included.

Steam Cracking

Naphtha cracking remains the dominant source of ethylene globally; however gas cracking has

been gathering more and more significance. Naphtha crackers took the brunt of the pressure

after overbuilding in the late 1970s, with significant closures in the United States. Ethane

cracking has come from nowhere to be a significant source of ethylene, principally as a result of

capacity developments in the Middle East. The LPG cracker segment (albeit chiefly comprising

ethane/propane crackers) has increased steadily since the late 1980s.

Global ethylene developments are discussed - Nexants capacity database allows us to analyze

ethylene capacity information all the way back to the mid 1970s. Regional capacity split over

the last 30 years, overlaid with a broad description of petrochemical industry profitability (as

portrayed by ChemSystems Cash Margin Index) is given as well as various other analyses

Specifically, North American, European, Asia Pacific and Middle East developments are

discussed.

Process variables - The cracking of a single hydrocarbon or a complex mixture of hydrocarbons

into vastly different compounds involves complex reaction kinetics, which are influenced by a

Ethylene

www.chemsystems.com

CHEMSYSTEMS PERP PROGRAM

Report Abstract Ethylene 08/09-5

3

PERPABSTRACTS2009 00101.0009.4105

number of different process variables. In practice, however, only a few of these are under the

control of the cracking-heater designer. The key parameters that have the greatest effect on

pyrolysis and which the designer can manipulate are discussed in the report

Process description - Steam cracker feeds can be separated into two categories: natural gas

liquids (ethane and LPG) and heavy liquids (i.e., naphtha and gas oils).

Natural gas liquids (NGLs) are composed essentially of ethane, propane and

butanes. The process description and process flow diagrams given in the report

are based on an ethane/propane feedstock.

Full range naphtha (FRN) is thought of as any hydrocarbon that boils in the

gasoline boiling range, which generally means the C

5

-430 F (C

5

-221 C) boiling

range; however, many olefin units operate on lower end-point (e.g., 350 F or 177

C) light naphtha (LVN). In the description given in the report, only the steps

that differ from the NGL flow scheme are discussed.

Gas oils are classified as either atmospheric or vacuum according to their origin,

either from an atmospheric crude tower or a crude bottoms vacuum column.

Atmospheric gas oil material boils in the range 400-800 F (204-427 C); vacuum

gas oil boils at 800-1,000 F (427-538 C) and higher. Since vacuum gas oils are

not cracked commercially to any significant degree, only the processing scheme

for an atmospheric gas oil facility is discussed in relation to naphtha cracking.

A significant amount of licensor time is spent optimizing the recovery section

(i.e., back end) of the ethylene plant. Rearranging and optimizing the tower

configuration is another approach taken by the major licensors of ethylene

technology. The different arrangements fall into three categories depending on

the first fractionation tower in the recovery scheme (i.e., demethanizer-first,

deethanizer-first, or depropanizer-first). In this section, a qualitative analysis of

these three tower configurations is presented for full range naphtha (FRN) feed

case, pertinent process flow diagrams are given.

An efficient means of separating acetylene from the ethylene product is essential

and technology for achieving this is discussed in the report, pertinent process flow

diagrams are also given.

Trends in the ethylene industry and various approaches to dealing with these are discussed in the

report (furnace tube materials, curtailing coke formation etc.).

The report includes a section which addresses flexibility for a demethanizer first configuration

details for other configurations may differ, although overall impacts can be similar (hot end,

cold end).

The global ethylene industry is generally dependent on the expertise and experience of a limited

number of licensors/contractors that own proprietary ethylene technology and have been

responsible for designing and building most of the world ethylene production plants. This topic

is briefly discussed.

Methanol To Olefins (MTO)

Ethylene

www.chemsystems.com

CHEMSYSTEMS PERP PROGRAM

Report Abstract Ethylene 08/09-5

4

PERPABSTRACTS2009 00101.0009.4105

Methanol-to-olefins (MTO) was first developed by Mobil (now ExxonMobil) in the mid-1980s

as part of its methanol-to-gasoline (MTG) process that was developed in New Zealand. The

Mobil workers found that, by altering operating conditions, high levels of ethylene, instead of

gasoline-range hydrocarbons, could be made by passing methanol over a ZSM-5 catalyst. This

technology lay dormant until the mid-1990s, when UOP teamed with Norsk Hydro to build an

MTO pilot plant in Norway. Since then, Lurgi has developed its own version of this process,

methanol-to-propylene (MTP). The Chinese have also been active in this field. Dalian Institute

of Chemical Physics (DICP) has recently developed their own process (DMTO).

Process flow diagrams and descriptions for UOP, ExxonMobil and Dalian Institute of

Chemical Physics (DICP) technologies are given

Ethylene From Renewable Sources

The use of ethanol to make ethylene on a comparatively small scale is well established in

developing countries not having ready access to hydrocarbons. The chemistry of ethylene

production via dehydration of ethanol can be represented by the following reaction:

Process description and process flow diagrams for the use of ethanol to make ethylene are given

in the report.

DEVELOPING TECHNOLOGY

The following developing technologies are discussed in the report:

Gas To Ethylene (GTE)

Olefins Via Enhanced Fluid Catalytic Cracking (FCC)

Syngas To Ethanol Followed By Dehydration To Ethylene

ConocoPhillips Two-Zone Reactor For Converting Alkanes To Alkenes

Olefins Via Catalytic Naphtha Cracking

ECONOMIC ANALYSIS

In this section the costs of ethylene production have been estimated using steam crackers with

the following feedstocks and world scale capacities:

Ethane

Propane

Ethane/Propane (80/20)

n-Butane

i-Butane

Light Naphtha (A-180)

Atmospheric Gas Oil

Ethylene

www.chemsystems.com

CHEMSYSTEMS PERP PROGRAM

Report Abstract Ethylene 08/09-5

5

PERPABSTRACTS2009 00101.0009.4105

In addition, costs of ethylene production have been estimated for the following:

A methanol-to-olefins plant (employing methanol at spot market value)

Ethanol dehydration plant (employing ethanol derived from corn)

Pertinent sensitivity analyses have also been carried out and discussed. Plant flexibility for

handling various feedstocks is also briefly outlined.

COMMERCIAL ANALYSIS

Supply, demand and trade for the United States, Western Europe, and Asia Pacific are

discussed.

Extensive listings detailing plant capacity, specific company, plant location, and

production process employed are given for the regions denoted above are given.

www.chemsystems.com

Nexant, Inc.

San Francisco

London

Tokyo

Bangkok

New York

Washington

Houston

Phoenix

Madison

Boulder

Dusseldorf

Beijing

Shanghai

Paris

You might also like

- Olefins From Conventional and Heavy FeedstocksDocument27 pagesOlefins From Conventional and Heavy FeedstocksTaylorNo ratings yet

- Article - Delayed Coker RevampsDocument13 pagesArticle - Delayed Coker RevampsPlatinium1002No ratings yet

- Delayed CokerDocument3 pagesDelayed Cokerreach_arindomNo ratings yet

- Delayed Coking UnitDocument27 pagesDelayed Coking Unitstunningmanju50% (2)

- 8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case StudyDocument27 pages8 - HEURTEY PETROCHEM Flux Distribution in Fired Heaters A Case Studyfawmer61No ratings yet

- Cracking Furnace Tube Metallurgy Part 1 ADocument21 pagesCracking Furnace Tube Metallurgy Part 1 AKaren Romero100% (1)

- Improve FCCU Operations Using ChemicalDocument7 pagesImprove FCCU Operations Using Chemical3668770No ratings yet

- Cracker SimulationDocument6 pagesCracker Simulationadav1232887No ratings yet

- 06 Delayed CokingDocument39 pages06 Delayed Cokingmujeeb84No ratings yet

- 7 - OligomerizationDocument16 pages7 - OligomerizationAn Lê TrườngNo ratings yet

- Fired Heaters Convection SectionDocument25 pagesFired Heaters Convection Sectionweam nour100% (1)

- Module 3 Steam ReformingDocument33 pagesModule 3 Steam ReformingAfiq AsrafNo ratings yet

- Column Internals For Distillation and AbsorptionDocument30 pagesColumn Internals For Distillation and AbsorptionNidhi SahuNo ratings yet

- Shot CokeDocument9 pagesShot CokeaminNo ratings yet

- Methanol To Gasoline MTG - ExxonmobileDocument12 pagesMethanol To Gasoline MTG - ExxonmobileAkk KolNo ratings yet

- Process Design For The Production of Ethylene From EthanolDocument144 pagesProcess Design For The Production of Ethylene From EthanolJorge RicoNo ratings yet

- Ethylene and Acetylene PlantDocument405 pagesEthylene and Acetylene Plantkatamani temple75% (4)

- A Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsDocument13 pagesA Catalytic Cracking Process For Ethylene and Propylene From Paraffin StreamsMukthiyar SadhullahNo ratings yet

- CrackingDocument20 pagesCrackingNiaz Ali KhanNo ratings yet

- Cracker SafetyDocument37 pagesCracker Safetykhanasifalam100% (1)

- Ethylene Unit Operation Management ConceptsDocument21 pagesEthylene Unit Operation Management ConceptsSaad El-anize100% (2)

- Em FlexicokingDocument8 pagesEm FlexicokingHenry Saenz0% (1)

- Polyethylene Production Technologies PDFDocument81 pagesPolyethylene Production Technologies PDFJelssy Huaringa Yupanqui100% (1)

- Get The Most From Your Fired HeaterDocument6 pagesGet The Most From Your Fired Heateryogitadoda100% (2)

- Pre 2 30 July 2016 160731090013 PDFDocument284 pagesPre 2 30 July 2016 160731090013 PDFridanormaNo ratings yet

- EthyleneDocument59 pagesEthyleneNauman100% (3)

- FCC MANUAL 5-Catalyst RegenerationDocument10 pagesFCC MANUAL 5-Catalyst RegenerationSrinivas MoturiNo ratings yet

- White Paper Gasoline BlendingDocument12 pagesWhite Paper Gasoline BlendingHeniNo ratings yet

- 1989 - 2009 Ethylene Producers'Document142 pages1989 - 2009 Ethylene Producers'David RodriguesNo ratings yet

- Crude Oil RefiningDocument24 pagesCrude Oil RefiningSaranrajPachayappanNo ratings yet

- Honeywell Uop LNG Solutions BrochureDocument8 pagesHoneywell Uop LNG Solutions BrochurethenameNo ratings yet

- Co-Cracking of Mixed C4 S and LPG With N PDFDocument14 pagesCo-Cracking of Mixed C4 S and LPG With N PDFCindy GallosNo ratings yet

- Simulation and Optimization of An Ethylene PlantDocument114 pagesSimulation and Optimization of An Ethylene PlantEvelyne Jahja100% (1)

- FurnaceDocument6 pagesFurnaceChacon Jose WalterNo ratings yet

- Ethylene ProductionDocument14 pagesEthylene ProductionMaria Cecille Sarmiento Garcia100% (1)

- Nicholas Oligomerization PDFDocument16 pagesNicholas Oligomerization PDFTanase DianaNo ratings yet

- Steam Cracker Furnace of OlefinesDocument10 pagesSteam Cracker Furnace of OlefinesEnrique ArceNo ratings yet

- Catalyst Circulation in Pressure BalanceDocument2 pagesCatalyst Circulation in Pressure Balance3668770No ratings yet

- Refining Process-AlkylationDocument20 pagesRefining Process-AlkylationTusenkrishNo ratings yet

- Petrochemical Furnaces PDFDocument45 pagesPetrochemical Furnaces PDFAditya PrajasNo ratings yet

- Coke Formation in The Thermal CrackinDocument7 pagesCoke Formation in The Thermal Crackinfaez100% (1)

- Ethylene Cracker SQEDocument29 pagesEthylene Cracker SQEMohammed AlnefayeiNo ratings yet

- Pyrolysis Furnace Rev 1 PDFDocument11 pagesPyrolysis Furnace Rev 1 PDFKmajdianNo ratings yet

- Coke Formation Mechanisms and Coke Inhibiting Methods in Pyrolysis FurnacesDocument15 pagesCoke Formation Mechanisms and Coke Inhibiting Methods in Pyrolysis Furnaceskarl liNo ratings yet

- Salt Fouling FCCDocument6 pagesSalt Fouling FCCVenkatesh Kumar RamanujamNo ratings yet

- Ethylene Cracking Furnace PDFDocument2 pagesEthylene Cracking Furnace PDFNicole0% (1)

- Composition Gas OilDocument14 pagesComposition Gas OilRavikant KumarNo ratings yet

- Troubleshooting Shell-And-Tube Heat ExchangersDocument2 pagesTroubleshooting Shell-And-Tube Heat ExchangersForcus onNo ratings yet

- Prmary Reformer Catastrophic FailureDocument9 pagesPrmary Reformer Catastrophic FailureRizwan GujjarNo ratings yet

- Chemcad KilnDocument9 pagesChemcad Kilningbarragan87No ratings yet

- Uop Tatoray Process: Antoine Negiz and Thomas J. StoodtDocument10 pagesUop Tatoray Process: Antoine Negiz and Thomas J. StoodtBharavi K SNo ratings yet

- Autothermal Reforming Syngas 2010 PaperDocument20 pagesAutothermal Reforming Syngas 2010 PaperAkmal_Fuadi100% (1)

- Engr. MariamDocument130 pagesEngr. MariamMariam AsgharNo ratings yet

- Dehydration of Ethanol To EthyleneDocument10 pagesDehydration of Ethanol To EthylenewiboonwiNo ratings yet

- Ethylene BasicsDocument53 pagesEthylene Basicskingcobra008100% (5)

- REFORMER Upgrades To Convection Section & Radiant Section at TRINGEN 1 Ammonia Plant, Trinidad X 0Document8 pagesREFORMER Upgrades To Convection Section & Radiant Section at TRINGEN 1 Ammonia Plant, Trinidad X 0David PierreNo ratings yet

- Biomass Gasification ProcessDocument27 pagesBiomass Gasification ProcessTony AppsNo ratings yet

- Fired Heater Presentation - Final97 2003Document40 pagesFired Heater Presentation - Final97 2003Altif Abood100% (2)

- Chemi Properties (Full Permission)Document9 pagesChemi Properties (Full Permission)Vinay BabuNo ratings yet

- OHS Explanation GuideDocument568 pagesOHS Explanation GuideTnarg Ragaw100% (1)

- H2 SafetyDocument2 pagesH2 SafetyMahmoud AbdallahNo ratings yet

- Lighting at Work PDFDocument68 pagesLighting at Work PDFkapil1979100% (1)

- Offi Ce Ergonomics: Practical Solutions For A Safer WorkplaceDocument73 pagesOffi Ce Ergonomics: Practical Solutions For A Safer WorkplaceManas KarnureNo ratings yet

- HSE - Take Care With AcetyleneDocument5 pagesHSE - Take Care With Acetylenesl1828No ratings yet

- Electrica ConstructionDocument45 pagesElectrica Constructionkapil1979No ratings yet

- CranesDocument38 pagesCranesSafetyboss100% (12)

- Handling of Hydrogen172 - 72941 PDFDocument4 pagesHandling of Hydrogen172 - 72941 PDFkapil1979No ratings yet

- Technical Specification FOR Earthwork in Excavation & BackfillingDocument20 pagesTechnical Specification FOR Earthwork in Excavation & Backfillingkapil1979No ratings yet

- ExcavationsDocument31 pagesExcavationsWalt FlowersNo ratings yet

- EnEff Report 2009 01 PDFDocument95 pagesEnEff Report 2009 01 PDFkapil1979No ratings yet

- Technical Specification FOR Earthwork in Excavation & BackfillingDocument20 pagesTechnical Specification FOR Earthwork in Excavation & Backfillingkapil1979No ratings yet

- Kernberg, O. (1991) - A Contemporary Reading of On Narcissism in Freud's On Narcissism An IntroductionDocument10 pagesKernberg, O. (1991) - A Contemporary Reading of On Narcissism in Freud's On Narcissism An IntroductionAngelina Anastasova100% (2)

- Strict and Absolute LiabilityDocument29 pagesStrict and Absolute LiabilityShejal SharmaNo ratings yet

- 7B Form GRA Original - Part499 PDFDocument1 page7B Form GRA Original - Part499 PDFRicardo SinghNo ratings yet

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross Incomericamae saladagaNo ratings yet

- Factors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaDocument12 pagesFactors Associated With Early Pregnancies Among Adolescent Girls Attending Selected Health Facilities in Bushenyi District, UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Grade 11 - Life Science - November Paper 2-1 - MemoDocument8 pagesGrade 11 - Life Science - November Paper 2-1 - MemoJustinCase19910% (1)

- Legg Calve Perthes DiseaseDocument97 pagesLegg Calve Perthes Diseasesivaram siddaNo ratings yet

- Physical Activity and Weight ControlDocument6 pagesPhysical Activity and Weight Controlapi-288926491No ratings yet

- Z0109MN Z9M TriacDocument6 pagesZ0109MN Z9M TriaciammiaNo ratings yet

- Park Agreement LetterDocument2 pagesPark Agreement LetterKrishna LalNo ratings yet

- Cervical Changes During Menstrual Cycle (Photos)Document9 pagesCervical Changes During Menstrual Cycle (Photos)divyanshu kumarNo ratings yet

- TextDocument3 pagesTextKristineNo ratings yet

- Choke Manifold Procedures 3932324 01Document4 pagesChoke Manifold Procedures 3932324 01Saïd Ben Abdallah100% (1)

- JAR Part 66 Examination Mod 03Document126 pagesJAR Part 66 Examination Mod 03Shreyas PingeNo ratings yet

- NASA Corrosion of SS TubingDocument14 pagesNASA Corrosion of SS TubingClaudia Mms100% (1)

- 36 Petroland PD Serie DKDocument7 pages36 Petroland PD Serie DKBayu RahmansyahNo ratings yet

- Nammcesa 000008 PDFDocument197 pagesNammcesa 000008 PDFBasel Osama RaafatNo ratings yet

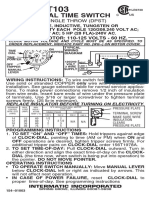

- T103 InstructionsDocument1 pageT103 Instructionsjtcool74No ratings yet

- HandbookDocument6 pagesHandbookAryan SinghNo ratings yet

- Mental Health & TravelDocument18 pagesMental Health & TravelReyza HasnyNo ratings yet

- Red Winemaking in Cool Climates: Belinda Kemp Karine PedneaultDocument10 pagesRed Winemaking in Cool Climates: Belinda Kemp Karine Pedneaultgjm126No ratings yet

- Maternal and Child Health Nursing 7 BulletsDocument4 pagesMaternal and Child Health Nursing 7 BulletsHoneylie PatricioNo ratings yet

- Mrunal Handout 12 CSP20Document84 pagesMrunal Handout 12 CSP20SREEKANTHNo ratings yet

- Protein Metabolism and Urea Recycling in Rodent HibernatorsDocument5 pagesProtein Metabolism and Urea Recycling in Rodent HibernatorsBud Marvin LeRoy RiedeselNo ratings yet

- Economics Half Yearly Question PaperDocument6 pagesEconomics Half Yearly Question PaperBhumika MiglaniNo ratings yet

- 2012 U.S. History End-of-Course (EOC) Assessment Field Test Fact SheetDocument2 pages2012 U.S. History End-of-Course (EOC) Assessment Field Test Fact SheetswainanjanNo ratings yet

- Continuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingDocument44 pagesContinuous Microbiological Environmental Monitoring For Process Understanding and Reduced Interventions in Aseptic ManufacturingTorres Xia100% (1)

- NFPA 25 2011 Sprinkler Inspection TableDocument2 pagesNFPA 25 2011 Sprinkler Inspection TableHermes VacaNo ratings yet

- Bonsai TreesDocument19 pagesBonsai TreesMayur ChoudhariNo ratings yet

- Case Analysis: Beth OwensDocument8 pagesCase Analysis: Beth OwensPhillip CookNo ratings yet