Professional Documents

Culture Documents

Legal Accounting Digest

Uploaded by

Paulette Aquino0 ratings0% found this document useful (0 votes)

88 views22 pagescase digest

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcase digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views22 pagesLegal Accounting Digest

Uploaded by

Paulette Aquinocase digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 22

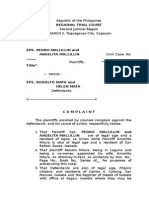

American Bible Society vs. City of Manila, [G.R. No.

L-9637 April 30, 1957]

Facts: Plaintiff-appellant is a foreign, non-stock, non-profit, religious, missionary corporation duly registered

and doing business in the Philippines through its Philippine agency established in Manila in November, 1898.

The defendant appellee is a municipal corporation with powers that are to be exercised in conformity with the

provisions of Republic Act No. 409, known as the Revised Charter of the City of Manila.

During the course of its ministry, plaintiff sold bibles and other religious materials at a very minimal profit.

On May 29 1953, the acting City Treasurer of the City of Manila informed plaintiff that it was conducting the

business of general merchandise since November, 1945, without providing itself with the necessary Mayor's

permit and municipal license, in violation of Ordinance No. 3000, as amended, and Ordinances Nos. 2529, 3028

and 3364, and required plaintiff to secure, within three days, the corresponding permit and license fees, together

with compromise covering the period from the 4th quarter of 1945 to the 2nd quarter of 1953, in the total sum

of P5,821.45 (Annex A).

Plaintiff now questions the imposition of such fees.

Issue: Whether or not the said ordinances are constitutional and valid (contention: it restrains the free exercise

and enjoyment of the religious profession and worship of appellant).

Held: Section 1, subsection (7) of Article III of the Constitution, provides that:

(7) No law shall be made respecting an establishment of religion, or prohibiting the free exercise thereof, and

the free exercise and enjoyment of religious profession and worship, without discrimination or preference, shall

forever be allowed. No religion test shall be required for the exercise of civil or political rights.

The provision aforequoted is a constitutional guaranty of the free exercise and enjoyment of religious profession

and worship, which carries with it the right to disseminate religious information.

It may be true that in the case at bar the price asked for the bibles and other religious pamphlets was in some

instances a little bit higher than the actual cost of the same but this cannot mean that appellant was engaged in

the business or occupation of selling said "merchandise" for profit. For this reason. The Court believe that the

provisions of City of Manila Ordinance No. 2529, as amended, cannot be applied to appellant, for in doing so it

would impair its free exercise and enjoyment of its religious profession and worship as well as its rights of

dissemination of religious beliefs.

With respect to Ordinance No. 3000, as amended, the Court do not find that it imposes any charge upon the

enjoyment of a right granted by the Constitution, nor tax the exercise of religious practices.

It seems clear, therefore, that Ordinance No. 3000 cannot be considered unconstitutional, however inapplicable

to said business, trade or occupation of the plaintiff. As to Ordinance No. 2529 of the City of Manila, as

amended, is also not applicable, so defendant is powerless to license or tax the business of plaintiff Society.

Caltex Philippines v. Court of Appeals

212 SCRA 448

August 10, 1992

Facts:

On various dates, defendant, a commercial banking institution, through its Sucat Branch issued 280 certificates

of time deposit (CTDs) in favor of one Angel dela Cruz who is tasked to deposit aggregate amounts.

One time Mr. dela Cruz delivered the CTDs to Caltex Philippines in connection with his purchased of fuel

products from the latter. However, Sometime in March 1982, he informed Mr. TimoteoTiangco, the

SucatBranch Manger, that he lost all the certificates of time deposit in dispute. Mr. Tiangco advised said

depositor to execute and submit a notarized Affidavit of Loss, as required by defendant bank's procedure, if he

desired replacement of said lost CTDs.

Angel dela Cruz negotiated and obtained a loan from defendant bank and executed a notarized Deed of

Assignment of Time Deposit, which stated, among others, that he surrenders to defendant bank "full control of

the indicated time deposits from and after date" of the assignment and further authorizes said bank to pre-

terminate, set-off and "apply the said time deposits to the payment of whatever amount or amounts may be due"

on the loan upon its maturity.

In 1982, Mr. Aranas, Credit Manager of plaintiff Caltex (Phils.) Inc., went to the defendant bank's Sucat branch

and presented for verification the CTDs declared lost by Angel dela Cruz alleging that the same were delivered

to herein plaintiff "as security for purchases made with Caltex Philippines, Inc." by said depositor.

Mrdela Cruz received a letter from the plaintiff formally informing of its possession of the CTDs in question

and of its decision to pre-terminate the same. ccordingly, defendant bank rejected the plaintiff's demand and

claim for payment of the value of the CTDs in a letter dated February 7, 1983.

The loan of Angel dela Cruz with the defendant bank matured and fell due and on August 5, 1983, the latter set-

off and applied the time deposits in question to the payment of the matured loan. However, the plaintiff filed the

instant complaint, praying that defendant bank be ordered to pay it the aggregate value of the certificates of time

deposit of P1,120,000.00 plus accrued interest and compounded interest therein at 16% per annum, moral and

exemplary damages as well as attorney's fees.

On appeal, CA affirmed the lower court's dismissal of the complaint, and ruled (1) that the subject certificates of

deposit are non-negotiable despite being clearly negotiable instruments; (2) that petitioner did not become a

holder in due course of the said certificates of deposit; and (3) in disregarding the pertinent provisions of the

Code of Commerce relating to lost instruments payable to bearer.

Issues:

a) Whether certificates of time deposit (CTDs) are negotiable instruments?

b) Is the depositor also the bearer of the document?

c) Whether petitioner can rightfully recover on the CTDs?

Held:

The CTDs in question are not negotiable instruments. Section 1 Act No. 2031, otherwise known as the

Negotiable Instruments Law, enumerates the requisites for an instrument to become negotiable, viz:

(a) It must be in writing and signed by the maker or drawer;

(b) Must contain an unconditional promise or order to pay a sum certain in money;

(c) Must be payable on demand, or at a fixed or determinable future time;

(d) Must be payable to order or to bearer; and

(e) Where the instrument is addressed to a drawee, he must be named or otherwise indicated therein with

reasonable certainty.

The accepted rule is that the negotiability or non-negotiability of an instrument is determined from the writing,

that is, from the face of the instrument itself. In the construction of a bill or note, the intention of the parties is to

control, if it can be legally ascertained. While the writing may be read in the light of surrounding circumstances

in order to more perfectly understand the intent and meaning of the parties, yet as they have constituted the

writing to be the only outward and visible expression of their meaning, no other words are to be added to it or

substituted in its stead. The duty of the court in such case is to ascertain, not what the parties may have secretly

intended as contradistinguished from what their words express, but what is the meaning of the words they have

used. What the parties meant must be determined by what they said.

Petitioner's insistence that the CTDs were negotiated to it begs the question. Under the Negotiable Instruments

Law, an instrument is negotiated when it is transferred from one person to another in such a manner as to

constitute the transferee the holder thereof, and a holder may be the payee or indorsee of a bill or note, who is in

possession of it, or the bearer thereof. In the present case, however, there was no negotiation in the sense of a

transfer of the legal title to the CTDs in favor of petitioner in which situation, for obvious reasons, mere

delivery of the bearer CTDs would have sufficed. Here, the delivery thereof only as security for the purchases

of Angel de la Cruz (and we even disregard the fact that the amount involved was not disclosed) could at the

most constitute petitioner only as a holder for value by reason of his lien. Accordingly, a negotiation for such

purpose cannot be effected by mere delivery of the instrument since, necessarily, the terms thereof and the

subsequent disposition of such security, in the event of non-payment of the principal obligation, must be

contractually provided for.

Pepsi-Cola Bottling Co., vs. City of Butuan [August 28, 1968, L-22814]

Facts: Plaintiff, Pepsi-Cola Bottling Company of the Philippines, is a domestic corporation with offices and

principal place of business in Quezon City. Plaintiff's warehouse in the City of Butuan serves as storage for its

products the "Pepsi-Cola" soft drinks for sale to customers in the City of Butuan and all the municipalities in the

Province of Agusan. These "Pepsi-Cola" soft drinks are bottled in Cebu City and shipped to the Butuan City

warehouse of plaintiff for distribution and sale in the City of Butuan and all municipalities of Agusan.

On August 16, 1960, the City of Butuan enacted Ordinance No. 110 which was subsequently amended by

Ordinance No. 122 and effective November 28, 1960. Ordinance No. 110 as amended, imposes a tax on any

person, association, etc., of P0.10 per case of 24 bottles of Pepsi-Cola. The plaintiff paid under protest the

amount of P4.926.63 from August 16 to December 31, 1960 and the amount of P9,250.40 from January 1 to

July 30, 1961.

The plaintiff filed a complaint for the recovery of the total amount of P14,177.03 paid under protest, on the

ground that Ordinance No. 110 as amended of the City of Butuan is illegal, that the tax imposed is excessive

and that it is unconstitutional. The Court of First Instance ruled in favor of the defendant.

Issue: Whether or not the disputed ordinance is void because it is highly unjust and discriminatory

Held: Yes. Even if the burden in question were regarded as a tax on the sale of said beverages, it would still be

invalid, as discriminatory, and hence, violative of the uniformity required by the Constitution and the law, since

only sales by "agents or consignees" of outside dealers would be subject to the tax. Sales by local dealers, not

acting for or on behalf of other merchants, regardless of the volume of their sales, and even if the same

exceeded those made by said agents or consignees of producers or merchants established outside the City of

Butuan, would be exempt from the disputed tax.

It is true that the uniformity essential to the valid exercise of the power of taxation does not require identity or

equality under all circumstances, or negate the authority to classify the objects of taxation. The classification

made in the exercise of this authority, to be valid, must, however, be reasonable and this requirement is not

deemed satisfied unless: (1) it is based upon substantial distinctions which make real differences; (2) these are

germane to the purpose of the legislation or ordinance; (3) the classification applies, not only to present

conditions, but, also, to future conditions substantially identical to those of the present; and (4) the classification

applies equally to all those who belong to the same class.

These conditions are not fully met by the ordinance in question. Indeed, if its purpose was merely to levy a

burden upon the sale of soft drinks or carbonated beverages, there is no reason why sales thereof by dealers

other than agents or consignees of producers or merchants established outside the City of Butuan should be

exempt from the tax.

Hence, decision appealed from is reversed. City of Butuan is sentenced to refund plaintiff and is restrained and

prohibited permanently from enforcing said Ordinance, as amended.

LLADOC VS. COMMISSIONER OF INTERNAL REVENUE [14 SCRA 292; NO.L-19201; 16 JUN

1965]

Facts: Sometime in 1957, M.B. Estate Inc., of Bacolod City, donated 10,000.00 pesos in cash to Fr. Crispin

Ruiz, the parish priest of Victorias, Negros Occidental, and predecessor of Fr. Lladoc, for the construction of a

new Catholic church in the locality. The donated amount was spent for such purpose.

On March 3, 1958, the donor M.B. Estate filed the donor's gift tax return. Under date of April 29, 1960.

Commissioner of Internal Revenue issued an assessment for the donee's gift tax against the Catholic Parish of

Victorias of which petitioner was the parish priest.

Issue: Whether or not the imposition of gift tax despite the fact the Fr. Lladoc was not the Parish priest at the

time of donation, Catholic Parish priest of Victorias did not have juridical personality as the constitutional

exemption for religious purpose is valid.

Held: Yes, imposition of the gift tax was valid, under Section 22(3) Article VI of the Constitution contemplates

exemption only from payment of taxes assessed on such properties as Property taxes contra distinguished from

Excise taxes The imposition of the gift tax on the property used for religious purpose is not a violation of the

Constitution. A gift tax is not a property by way of gift inter vivos.

The head of the Diocese and not the parish priest is the real party in interest in the imposition of the donee's tax

on the property donated to the church for religious purpose.

John Hay Peoples Alternative Coalition v. Lim Case Digest GR No. 119775 Oct. 24, 2003

Facts:

RA No. 7227 created the Bases Conversion and Development Authority (BCDA), which also created the Subic

Special Economic Zone (Subic SEZ). Aside from granting incentives to Subic SEZ, RA 7227 also granted the

President is an express authority to create other SEZs in the areas covered respectively by the Clark military

reservation, the Wallace Air Station in San Fernando, La Union, and Camp John Hay through executive

proclamations. BCDA entered into a MOA and Escrow Agreement with TUNTEX and ASIAWORLD, private

corporations under the laws of the British Virgin Islands, preparatory to the formation of a joint venture for the

development of Poro Point La Union and Camp John Hay as premier tourist destinations and recreation centers.

BCDA, TUNTEX and ASIAWORLD executed a JVA to put up the Baguio International Development and

Management Corporation which would lease areas within Camp John Hay and Poro Point for the attainment of

the tourist and recreation spots in La Union and Camp John Hay. President Ramos issued Proclamation No.

420 which established a SEZ on a portion of Camp John Hay. 2nd sentence of Section 3 of said Proclamation

provided for national and local tax exemption within and granted other economic incentives to the John Hay

Special Economic Zone. Section 3: Investment Climate in John Hay Special Economic Zone.- Pursuant to

Section 5(m) and Section 15 of RA No. 7227, the John Hay Poro Point Development Corporation shall

implement all necessary policies, rules, and regulations governing the zone, including investment incentives, in

consultation with pertinent government departments. Among others, the zone shall have all the applicable

incentives of the Special Economic Zone under Section 12 of Republic Act No. 7227 and those applicable

incentives granted in the Export Processing Zones, the Omnibus Investment Code of 1987, the Foreign

Investment Act of 1991, and new investment laws that may hereinafter be enacted. Petitioners filed this case to

enjoin the respondents from implementing Proc. 420 are unconstitutional on grounds of:

For being illegal and invalid in so far as it grants tax exemptions thus amounting to unconstitutional

exercise of by the President of power granted only to legislature

Limits powers and interferes with the autonomy of the city

Violates rule that all taxes should be uniform and equitable

Issue:

Whether or not Proclamation No. 420 is constitutional by providing for national and local tax exemption within

and granting other economic incentives to the John Hay Special Economic Zone.

Ruling:

No, the 2nd Sentence of SECTION 3 of Proclamation No. 420 is hereby declared NULL and VOID and is

accordingly declared of no legal force and effect. Public respondents are hereby enjoined from implementing

the aforesaid void provision. Proclamation No. 420, without the invalidated portion, remains valid and effective.

Under Section 12 of RA No. 7227 it is clear that ONLY THE SUBIC SEZ which was granted by Congress with

tax exemption, investment incentives and the like. THERE IS NO EXPRESS EXTENSION OF THE SAID

PROVISION IN PRESIDENTIAL PROCLAMATION No. 420. Also found in the deliberations of the Senate, a

confirmation of the exclusivity of the tax and investment privileges to Subic SEZ. It is the legislature, unless

limited by a provision of the state constitution that has full power to exempt any person, corporation or class of

property from taxation, its power to exempt being as broad as its power to tax. Other than the Congress, the

Constitution may itself provide for specific tax exemptions, or local governments may pass ordinances on

exemption only from local taxes. The challenged grant of tax exemption must have concurrence of a majority of

all members of Congress. In same vein, the other kinds of privileges extended to the John Hay SEZ are by

tradition and usage for Congress to legislate upon. Tax exemption cannot be implied as it must be categorically

and unmistakably expressed if it were the intent of the legislature to grant to the John Hay SEZ the same tax

exemption and incentives given to Subic SEZ, it would have so expressly provided in RA 7227. BCDA, under

R.A 7227, is expressly entrusted with broad rights of ownership and administration over Camp John Hay, as the

governing agency of the John Hay SEZ.

COMMISSIONER V TOURS SPECIALIST

183 SCRA 402 | March 21, 1990 | J. Gutierrez, Jr.

Gross receipts subject to tax under the Tax Code do not include monies or receipts entrusted to the taxpayer

which do not belong to them and do not redound to the taxpayers benefit; and it is not necessary that there must

be a law or regulation which would exempt such monies or receipts within the meaning of gross receipts under

the Tax Code

Facts:

The Commissioner of Internal Revenue filed a petition to review on certiorari to the CTA decision which ruled

that the money entrusted to private respondent Tours Specialist (TS), earmarked and paid for hotel room

charges of tourists, travellers and/or foreign travel agencies do not form part of its gross receipt subject to 3%

independent contractors tax.

Tours Specialist derived income from its activities and services as a travel agency, which included booking

tourists in local hotels. To supply such service, TS and its counterpart tourist agencies abroad have agreed to

offer a package fee for the tourists (payment of hotel room accommodations, food and other personal expenses).

By arrangement, the foreign tour agency entrusts to TS the fund for hotel room accommodation, which in turn

paid by the latter to the local hotel when billed.

Despite this arrangement, CIR assessed private respondent for deficiency 3% contractors tax as independent

contractor including the entrusted hotel room charges in its gross receipts from services for years 1974-1976

plus compromise penalty.

During cross-examination, TS General Manager stated that the payment through them is only an act of

accommodation on (its) part and the agent abroad instead of sending several telexes and saving on bank

charges they take the option to send the money to (TS) to be held in trust to be endorsed to the hotel.

Nevertheless, CIR caused the issuance of a warrant of distraint and levy, and had TS bank deposits garnished.

Issue:

W/N amounts received by a local tourist and travel agency included in a package fee from tourists or foreign

tour agencies, intended or earmarked for hotel accommodations form part of gross receipts subject to 3%

contractors tax

Held:

No. Gross receipts subject to tax under the Tax Code do not include monies or receipts entrusted to the taxpayer

which do not belong to them and do not redound to the taxpayers benefit; and it is not necessary that there must

be a law or regulation which would exempt such monies or receipts within the meaning of gross receipts under

the Tax Code. Parenthetically, the room charges entrusted by the foreign travel agencies to the private

respondents do not form part of its gross receipts within the definition of the Tax Code. The said receipts never

belonged to the private respondent. The private respondent never benefited from their payment to the local

hotels. This arrangement was only to accommodate the foreign travel agencies.

Tan vs Del Rosario

G.R. No. 109289, October 3, 1994

FACTS:

These two consolidated special civil actions for prohibition challenge, in G.R. No. 109289, the constitutionality

of Republic Act No. 7496, also commonly known as the Simplified Net Income Taxationn Scheme (SNIT),

amending certain provisions of the National Internal Revenue Regulations No. 293, promulgated by public

respondents pursuant to said law.

Petitioner intimates that Republic Act No. 7496 desecrates the constitutional requirement that taxation shall be

uniform and equitable in that the law would now attempt to tax single proprietorships and professionals

differently from the manner it imposes the tax on corporations and partnerships. Petitioners claim to be

taxpayers adversely affected by the continued implementation of the amendatory legislation.

ISSUES:

1. Is Republic Act No. 7496 a misnomer or, at least, deficient for being merely entitled, Simplified Net Income

Taxation Scheme for the Self-Employed and Professionals Engaged in the Practice of their Profession (Petition

in G.R. No. 109289)

2. Does Republic Act No. 7496 violate the Constitution for imposing taxes that are not uniform and equitable.

3. Did the Secretary of Finance and the BIR Commissioner exceed their rule-making authority in applying

SNIT to general professional partnerships?

HELD:

The Petition is dismissed. Uniformity of taxation, like the kindred concept of equal protection, merely requires

that all subjects or objects of taxation, similarly situated, are to be treated alike both in privileges and liabilities

(Juan Luna Subdivision vs. Sarmiento, 91 Phil. 371). Uniformity does not forfend classification as long as: (1)

the standards that are used therefor are substantial and not arbitrary, (2) the categorization is germane to achieve

the legislative purpose, (3) the law applies, all things being equal, to both present and future conditions, and (4)

the classification applies equally well to all those belonging to the same class (Pepsi Cola vs. City of Butuan, 24

SCRA 3; Basco vs. PAGCOR, 197 SCRA 771).

What may instead be perceived to be apparent from the amendatory law is the legislative intent to increasingly

shift the income tax system towards the schedular approach in the income taxation of individual taxpayers and

to maintain, by and large, the present global treatment on taxable corporations. We certainly do not view this

classification to be arbitrary and inappropriate.

Having arrived at this conclusion, the plea of petitioner to have the law declared unconstitutional for being

violative of due process must perforce fail. The due process clause may correctly be invoked only when there is

a clear contravention of inherent or constitutional limitations in the exercise of the tax power.

CIR vs. BAIER-NICKEL

GR No. 153793 | August 29, 2006 | J. Ynares-Santiago

Facts:

CIR appeals the CA decision, which granted the tax refund of respondent and reversed that of the CTA.

JulianeBaier-Nickel, a non-resident German, is the president of Jubanitex, a domestic corporation engaged in

the manufacturing, marketing and selling of embroidered textile products. Through Jubanitexs general

manager, Marina Guzman, the company appointed respondent as commission agent with 10% sales commission

on all sales actually concluded and collected through her efforts.

In 1995, respondent received P1, 707, 772. 64 as sales commission from w/c Jubanitex deducted the 10%

withholding tax of P170, 777.26 and remitted to BIR. Respondent filed her income tax return but then claimed a

refund from BIR for the P170K, alleging this was mistakenly withheld by Jubanitex and that her sales

commission income was compensation for services rendered in Germany not Philippines and thus not taxable

here.

She filed a petition for review with CTA for alleged non-action by BIR. CTA denied her claim but decision was

reversed by CA on appeal, holding that the commission was received as sales agent not as President and that the

source of income arose from marketing activities in Germany.

Issue: W/N respondent is entitled to refund

Held:

No. Pursuant to Sec 25 of NIRC, non-resident aliens, whether or not engaged in trade or business, are subject to

the Philippine income taxation on their income received from all sources in the Philippines. In determining the

meaning of source, the Court resorted to origin of Act 2833 (the first Philippine income tax law), the US

Revenue Law of 1916, as amended in 1917.

US SC has said that income may be derived from three possible sources only: (1) capital and/or (2) labor;

and/or (3) the sale of capital assets. If the income is from labor, the place where the labor is done should be

decisive; if it is done in this country, the income should be from sources within the United States. If the

income is from capital, the place where the capital is employed should be decisive; if it is employed in this

country, the income should be from sources within the United States. If the income is from the sale of capital

assets, the place where the sale is made should be likewise decisive. Source is not a place, it is an activity or

property. As such, it has a situs or location, and if that situs or location is within the United States the resulting

income is taxable to nonresident aliens and foreign corporations.

The source of an income is the property, activity or service that produced the income. For the source of income

to be considered as coming from the Philippines, it is sufficient that the income is derived from activity within

the Philippines.

The settled rule is that tax refunds are in the nature of tax exemptions and are to be construed strictissimijuris

against the taxpayer. To those therefore, who claim a refund rest the burden of proving that the transaction

subjected to tax is actually exempt from taxation.

In the instant case, respondent failed to give substantial evidence to prove that she performed the incoming

producing service in Germany, which would have entitled her to a tax exemption for income from sources

outside the Philippines. Petition granted.

MADRIGAL VS. RAFFERTY- DIFFERENCE BETWEEN CAPITAL AND INCOME

The essential difference between capital and income is that capital is a fund; income is a flow. A fund of

property existing at an instant of time is called capital. A flow of services rendered by that capital by the

payment of money from it or any other benefit rendered by a fund of capital in relation to such fund through a

period of time is called income. Capital is wealth, while income is the service of wealth.

FACTS:

Vicente Madrigal and Susana Paterno were legally married prior to Januray 1, 1914. The marriage was

contracted under the provisions of law concerning conjugal partnership

On 1915, Madrigal filed a declaration of his net income for year 1914, the sum of P296,302.73

Vicente Madrigal was contending that the said declared income does not represent his income for the year

1914 as it was the income of his conjugal partnership with Paterno. He said that in computing for his additional

income tax, the amount declared should be divided by 2.

The revenue officer was not satisfied with Madrigals explanation and ultimately, the United States

Commissioner of Internal Revenue decided against the claim of Madrigal.

Madrigal paid under protest, and the couple decided to recover the sum of P3,786.08 alleged to have been

wrongfully and illegally assessed and collected by the CIR.

ISSUE: Whether or not the income reported by Madrigal on 1915 should be divided into 2 in computing for the

additional income tax.

HELD:

No! The point of view of the CIR is that the Income Tax Law, as the name implies, taxes upon income and not

upon capital and property.

The essential difference between capital and income is that capital is a fund; income is a flow. A fund of

property existing at an instant of time is called capital. A flow of services rendered by that capital by the

payment of money from it or any other benefit rendered by a fund of capital in relation to such fund through a

period of time is called income. Capital is wealth, while income is the service of wealth.

As Paterno has no estate and income, actually and legally vested in her and entirely distinct from her

husbands property, the income cannot properly be considered the separate income of the wife for the purposes

of the additional tax.

To recapitulate, Vicente wants to half his declared income in computing for his tax since he is arguing that he

has a conjugal partnership with his wife. However, the court ruled that the one that should be taxed is the

income which is the flow of the capital, thus it should not be divided into 2.

Conwi v. Court of Tax Appeals

G.R. Nos. 48532 & 48533, August 31, 1992 | 213 SCRA 83

Keywords: Procter & Gamble, Filipino citizens temporarily working abroad earning in dollars, taxable income

NOTE

This digest was adjusted to meet our needs for the June 29 class.

RATIO DECIDENDI

Income of Filipino citizens temporarily residing in a foreign country, even if totally derived from outside the

Philippines, is subject to tax by virtue of Sec. 21, NIRC, viz: A tax is hereby imposed upon the taxable net

income received x xx from all sources by every individual, whether a citizen of the Philippines residing therein

or abroad x xx (italics mine)

FACTS

Hernando Conwi et al. (Conwi et al.) are employees of Procter & Gamble Philippine Manufacturing

Corporation, a local subsidiary of U.S.-based

Procter & Gamble.

Conwi et al. were temporarily assigned to subsidiaries of Procter & Gamble outside of the Philippines,

where they were paid in U.S. dollars.

It is claimed that they earned and spent their money exclusively abroad, and that they did not remit

money back into the Philippines during the time they were outside of the country earning in dollars.

In the years 1970 and 1971, Conwi et al., since they were earning in U.S. currency, in order to pay their

income tax liabilities in Philippine peso, used the prevailing free market rate of conversion prescribed under a

Bureau of Internal Revenue ruling and two Revenue Memorandum Circulars. However, in 1973, Conwi et al.

filed with the Commissioner of Internal Revenue (CIR) amended income tax returns for the said years, this time

using the par value of the peso as conversion rate. The adjustment caused a disparity between what was initially

paid and what they were now claiming to be their actual tax liabilities. Consequently, they asked for a refund of

the overpayment.

Even before the CIR could rule on the matter, Conwi et al. filed a petition for review before the Court of

Tax Appeals (CTA), which eventually denied their claim for tax refund and/or tax credit.

Aggrieved, Conwi et al., via a petition for review, elevated the matter to the Supreme Court.

ISSUES & ARGUMENTS

W/N the ruling and circulars above apply to Conwi et al.

(Note: Conti et al. argue that since there were no remittances and acceptances of their salaries and wages in U.S.

dollars into the Philippines, they are exempt from the coverage of such ruling and circulars.)

HELD & RATIONALE

YES, the said ruling and circulars apply to Conwi et al.

Income may be defined as an amount of money coming to a person or corporation within a specified

time, whether as payment for services, interest, or profit from investment. x xx Income can also be thought of

as a flow of the fruits of ones labor. (See pages 87-88 of the case)

The dollar earnings of Conwi et al. are fruits of their labor in the foreign subsidiaries of Procter &

Gamble. They were given a definite amount of money which came to them within a specified period of time as

payment for their services.

Sec. 21, NIRC, states: A tax is hereby imposed upon the taxable net income received x xx from all

sources by every individual, whether a citizen of the Philippines residing therein or abroad x xx

As such, their income is taxable even if there were no inward remittances during the time they were

earning in dollars abroad.

The ruling and the circulars are a valid exercise of power on the part of the Secretary of Finance by

virtue of Sec. 338, NIRC, which empowers him to promulgate all needful rules and regulations to effectively

enforce its provisions.

Besides, they have already paid their taxes using the prescribed rate of conversion. There is no need for

the CIR to give them a tax refund and/or credit.

FALLO

Petition of Conwi et al. DENIED. The denial of their claim for tax refund and/or credit by the CTA is

AFFIRMED.

CIR v. PROCTER & GAMBLE PHIL. MFG. CORP. & CTA (1988, J. Paras)

FACTS:

Procter and Gamble Philippine Manufacturing Corporation (PMC-Phil.), a corporation duly organized

andexisting under and by virtue of the Philippine laws, is engaged in business in the Philippines and is awholly

owned subsidiary of Procter and Gamble, USA. (PMC-USA), a non-resident foreign corporation inthe

Philippines, not engaged in trade and business therein.PMC-USA is the sole shareholder or stockholder of

PMC-Phil., as PMC-USA owns wholly or by 100% thevoting stock of PMC Phil. and is entitled to receive

income from PMC-Phil. in the form of dividends, if notrents or royalties. In addition, PMC-Phil has a legal

personality separate and distinct from PMC-USA.For the taxable years ending June 30, 1974 and June 30, 1975,

PMC-Phil. paid income tax of 25%-35%of its taxable net income, as provided for under Sec. 24(a) of the Phil.

Tax Code. Based on the net profit(after taxation), PMC-Phil. declared a dividend in favor of its sole corporate

stockholder and parentcorporation PMC-USA, which amount was subjected to taxation of 35%, as provided for

in Sec. 24(b) of the Phil. Tax Code.In July, 1977 PMC-Phil., invoking the tax-sparing credit provision in Sec.

24(b), as the withholding agentof the Philippine government, with respect to the dividend taxes paid by PMC-

USA, filed a claim with theherein petitioner, CIR, claiming that the applicable rate of withholding tax on the

dividends remitted wasonly 15% (and not 35%).for the refund of the 20 percentage-point portion of the 35

percentage-point whole tax paid, arisingallegedly from the alleged "overpaid withholding tax at source or

overpaid withholding tax in the amountof P4,832,989.00. There being no immediate action by the BIR on

PMC-Phils' letter-claim the latter sought the interventionof the CTA.CTA: PMC-Philsis entitled to the sought

refund or tax credit

ISSUE:

WON PMC-Phil is entitled to the sought refund or tax credit on dividends declared and remittedto its parent

corporation

HELD/RATIO:

NOSec 24 (b) (1) of the Phil. Tax Code states that an ordinary 35% tax rate will be applied to

dividendremittances to non-resident corporate stockholders of a Philippine corporation. This rate goes down

to15% ONLY IF the country of domicile of the foreign stockholder corporation shall allow such

foreigncorporation a tax credit for taxes deemed paid in the Philippines, applicable against the tax payable

tothe domiciliary country by the foreign stockholder corporation. However, such tax credit for taxesdeemed

paid in the Philippines MUST, as a minimum, reach an amount equivalent to 20 percentagepoints which

represents the difference between the regular 35% dividend tax rate and the reduced 15%tax rate. Thus, the test

is if USA shall allow P&G USA a tax credit for taxes deemed paid in thePhilippines applicable against the

US taxes of P&G USA, and such tax credit must reach at least 20percentage points.The tax return of the

disputed 15% is not justified because PMC-Phil failed to meet certain conditions:(1) To show the actual amount

credited by the US Government against the income tax due from PC-USA on the dividends received from

PMC-Phil(2) To present the income tax return of its mother company for 1975(3) To submit any duly

authenticated document showing that the US Government credited the 20% tax

CIR v Wander Philippines Inc.

Facts:

Wander is a domestic corporation which is a wholly-owned subsidiary of Glaro S.A. Ltd.,a Swiss corporation

not engaged in trade/business in the Philippines. In two instances, Wander filed its withholding tax return and

remitted to Glaro (the parent company) dividends (P222,000 in the first instance and P355,200 in the second),

on which 35% tax was withheld and paid to the BIR.

Wander now files a claim for refund of the withheld tax contending that it is liable only to 15% withholding tax

pursuant to Section 24. B.1 of the Tax Code. The BIR did not act upon the claim filed by Wander so the

corporation filed a petition to the Court of Tax Appeals (CTA). The CTA held that the corporation is entitled to

15% withholding tax rate on dividends remitted to Glaro, a non-resident foreign corporation.

Issue:

Whether or not Wander is entitled to the 15% withholding tax rate.

Held:

Yes. According to Sec. 24.B.1 of the Tax Code, the dividends received from a domestic corporation is liable to

a 15% withholding tax, provided that the country in which the foreign corporation is domiciled shall allow a tax

credit (equivalent to 20% which is the difference between the 35% tax due on regular corporations and the 15%

tax due on dividends) against the taxes due to have been paid in the Philippines.

In the case, Switzerland did not impose any tax on the dividends received by Glaro thus it should be considered

as a full satisfaction of the given condition. To deny respondent the privilege to withhold 15% would run

counter to the spirit and intent of the law and will adversely affect the foreign corporations interest and

discourage them from investing capital in our country.

*Petition dismissed for lack of merit.

CIR vs. Mitsubishi Metal Corporation (G.R. No.L-54908. January 22, 1990)

Facts: On April 17, 1970, Atlas Consolidated Mining and Development Corporation entered into a Loan and

Sales Contract with Mitsubishi Metal Corporation, a Japanese corporation licensed to engage in business in the

Philippines, for purposes of the projected expansion of the productive capacity of the former's mines in Toledo,

Cebu. Under said contract, Mitsubishi agreed to extend a loan to Atlas 'in the amount of $20,000,000.00, United

States currency. Atlas, in turn undertook to sell to Mitsubishi all the copper concentrates produced for a period

of fifteen (15) years. Mitsubishi thereafter applied for a loan with the Export-Import Bank of Japan (Eximbank)

for purposes of its obligation under said contract. Its loan application was approved on May 26, 1970 in the

equivalent sum of $20,000,000.00 in United States currency at the then prevailing exchange rate. The records in

the Bureau of Internal Revenue show that the approval of the loan by Eximbank to Mitsubishi was subject to the

condition that Mitsubishi would use the amount as a loan to Atlas and as a consideration for importing copper

concentrates from Atlas, and that Mitsubishi had to pay back the total amount of loan by September 30, 1981.

Pursuant to the contract between Atlas and Mitsubishi, interest payments were made by the former to the latter

totaling P13,143,966.79 for the years 1974 and 1975. The corresponding 15% tax thereon in the amount of

P1,971,595.01 was withheld pursuant to Section 24 (b) (1) and Section 53 (b) (2) of the National Internal

Revenue Code, as amended by Presidential Decree No. 131, and duly remitted to the Government.

Issue: Whether or not the interest income from the loans extended to Atlas by Mitsubishi is excludible from

gross income taxation pursuant to Section 29 of the tax code and, therefore, exempt from withholding tax.

Held: The court ruled in the negative. Eximbank had nothing to do with the sale of the copper concentrates

since all that Mitsubishi stated in its loan application with the former was that the amount being procured would

be used as a loan to and in consideration for importing copper concentrates from Atlas. Such an innocuous

statement of purpose could not have been intended for, nor could it legally constitute, a contract of agency. The

conclusion is indubitable; MITSUBISHI, and NOT EXIMBANK, is the sole creditor of ATLAS, the former

being the owner of the $20 million upon completion of its loan contract with EXIMBANK of Japan. It is settled

a rule in this jurisdiction that laws granting exemption from tax are construed against the taxpayer and liberally

in favor of the taxing power. Taxation is the rule and exemption is the exception. The burden of proof rests

upon the party claiming exemption to prove that it is in fact covered by the exemption so claimed, which the

petitioners have failed to discharge. Significantly, private respondents are not among the entities which, under

Section 29 of the tax code, are entitled to exemption and which should indispensably be the party in interest in

this case.

ABS CBN Broadcasting CorpvsCA

301 SCRA 572 Business Organization Corporation Law Delegation of Corporate Powers Moral

Damages

FACTS:

In 1992, ABS-CBN Broadcasting Corporation, through its vice president Charo Santos-Concio, requested Viva

Production, Inc. to allow ABS-CBN to air at least 14 films produced by Viva. Pursuant to this request, a

meeting was held between Vivas representative (Vicente Del Rosario) and ABS-CBNs Eugenio Lopez

(General Manager) and Santos-Concio was held on April 2, 1992. During the meeting Del Rosario proposed a

film package which will allow ABS-CBN to air 104 Viva films for P60 million. Later, Santos-Concio, in a letter

to Del Rosario, proposed a counterproposal of 53 films (including the 14 films initially requested) for P35

million. Del Rosario presented the counter offer to Vivas Board of Directors but the Board rejected the counter

offer. Several negotiations were subsequently made but on April 29, 1992, Viva made an agreement with

Republic Broadcasting Corporation (referred to as RBS or GMA 7) which gave exclusive rights to RBS to air

104 Viva films including the 14 films initially requested by ABS-CBN.

ABS-CBN now filed a complaint for specific performance against Viva as it alleged that there is already a

perfected contract between Viva and ABS-CBN in the April 2, 1992 meeting. Lopez testified that Del Rosario

agreed to the counterproposal and he (Lopez) even put the agreement in a napkin which was signed and given to

Del Rosario. ABS-CBN also filed an injunction against RBS to enjoin the latter from airing the films. The

injunction was granted. RBS now filed a countersuit with a prayer for moral damages as it claimed that its

reputation was debased when they failed to air the shows that they promised to their viewers. RBS relied on the

ruling in People vsManero and Mambulao Lumber vs PNB which states that a corporation may recover moral

damages if it has a good reputation that is debased, resulting in social humiliation. The trial court ruled in

favor of Viva and RBS. The Court of Appeals affirmed the trial court.

ISSUE:

1. Whether or not a contract was perfected in the April 2, 1992 meeting between the representatives of the

two corporations.

2. Whether or not a corporation, like RBS, is entitled to an award of moral damages upon grounds of

debased reputation.

HELD:

1. No. There is no proof that a contract was perfected in the said meeting. Lopez testimony about the contract

being written in a napkin is not corroborated because the napkin was never produced in court. Further, there is

no meeting of the minds because Del Rosarios offer was of 104 films for P60 million was not accepted. And

that the alleged counter-offer made by Lopez on the same day was not also accepted because theres no proof of

such. The counter offer can only be deemed to have been made days after the April 2 meeting when Santos-

Concio sent a letter to Del Rosario containing the counter-offer. Regardless, there was no showing that Del

Rosario accepted. But even if he did accept, such acceptance will not bloom into a perfected contract because

Del Rosario has no authority to do so.

As a rule, corporate powers, such as the power; to enter into contracts; are exercised by the Board of Directors.

But this power may be delegated to a corporate committee, a corporate officer or corporate manager. Such a

delegation must be clear and specific. In the case at bar, there was no such delegation to Del Rosario. The fact

that he has to present the counteroffer to the Board of Directors of Viva is proof that the contract must be

accepted first by the Vivas Board. Hence, even if Del Rosario accepted the counter-offer, it did not result to a

contract because it will not bind Viva sans authorization.

2. No. The award of moral damages cannot be granted in favor of a corporation because, being an artificial

person and having existence only in legal contemplation, it has no feelings, no emotions, no senses, It cannot,

therefore, experience physical suffering and mental anguish, which call be experienced only by one having a

nervous system. No moral damages can be awarded to a juridical person. The statement in the case of People

vsManero and Mambulao Lumber vs PNB is a mere obiter dictum hence it is not binding as a jurisprudence.

CIR v Castaneda (G.R. No. 96016)

FACTS:

Efren Castaneda retired from govt service as Revenue Attache in the Philippine Embassy, London, England.

Upon retirement, he received benefits such as the terminal leave pay. The Commissioner of Internal Revenue

withheld P12,557 allegedly representing that it was tax income.

Castaneda filed for a refund, contending that the cash equivalent of his terminal leave is exempt from income

tax.

The Solicitor General contends that the terminal leave is based from an employer-employee relationship and

that as part of the services rendered by the employee, the terminal leave pay is part of the gross income of the

recipient.

CTA -> ruled in favor of Castaneda and ordered the refund.

CA -> affirmed decision of CTA.Hence, this petition for review on certiorari.

ISSUE:

Whether or not terminal leave pay (on occasion of his compulsory retirement) is subject to income tax.

HELD:

NO. As explained in Borromeo v CSC, the rationale of the court in holding that terminal leave pays are subject

to income tax is that:

. . commutation of leave credits, more commonly known as terminal leave, is applied for by an officer or

employee who retires, resigns or is separated from the service through no fault of his own. In the exercise of

sound personnel policy, the Government encourages unused leaves to be accumulated. The Government

recognizes that for most public servants, retirement pay is always less than generous if not meager and scrimpy.

A modest nest egg which the senior citizen may look forward to is thus avoided. Terminal leave payments are

given not only at the same time but also for the same policy considerations governing retirement benefits.

A terminal leave pay is a retirement benefit which is NOT subject to income tax.

*Petition denied.

CIR vs CA and YMCA, [298 SCRA 83]

Facts: The main question in this case is: is the income derived from rentals of real property owned by Young

Mens Christian Association of the Philippines (YMCA) established as a welfare, educational and charitable

non-profit corporation subject to income tax under the NIRC and the Constitution? In 1980, YMCA earned

an income of P676,829 from leasing out a portion of its premises to small shop owners, like restaurants and

canteen operators and P44k form parking fees.

Issue: Is the rental income of the YMCA taxable?

Held: Yes. The exemption claimed by the YMCA is expressly disallowed by the very wording of the last

paragraph of then Sec. 27 of the NIRC; court is duty-bound to abide strictly by its literal meaning and to refrain

from resorting to any convoluted attempt at construction. The said provision mandates that the income of

exempt organizations (such as YMCA) from any of their properties, real or personal, be subject to the tax

imposed by the same Code. Private respondent is exempt from the payment of property tax, but nit income tax

on rentals from its property.

CIR V GENERAL FOODSGR No. 143672| April 24, 2003 | J. Corona

Test of Reasonableness

Facts:

Respondent corporation General Foods (Phils), which is engaged in the manufacture of Tang, Calumet and

Kool-Aid, filed its income tax return for the fiscal year ending February 1985 and claimed as deduction,

among other business expenses, P9,461,246 for media advertising for Tang.

The Commissioner disallowed 50% of the deduction claimed and assessed deficiency income taxes of

P2,635,141.42 against General Foods, prompting the latter to file an MR which was denied.

General Foods later on filed a petition for review at CA, which reversed and set aside an earlier decision by

CTA dismissing the companys appeal.

Issue:

W/N the subject media advertising expense for Tang was ordinary and necessary expense fully deductible

under the NIRC

Held:

No. Tax exemptions must be construed in against the taxpayer and liberally in favor of the taxing authority, and

he who claims an exemption must be able to justify his claim by the clearest grant of organic or statute law.

Deductions for income taxes partake of the nature of tax exemptions; hence, if tax exemptions are strictly

construed, then deductions must also be strictly construed.

To be deductible from gross income, the subject advertising expense must comply with the following requisites:

(a) the expense must be ordinary and necessary; (b) it must have been paid or incurred during the taxable year;

(c) it must have been paid or incurred in carrying on the trade or business of the taxpayer; and (d) it must be

supported by receipts, records or other pertinent papers.

While the subject advertising expense was paid or incurred within the corresponding taxable year and was

incurred in carrying on a trade or business, hence necessary, the parties views conflict as to whether or not it

was ordinary. To be deductible, an advertising expense should not only be necessary but also ordinary.

The Commissioner maintains that the subject advertising expense was not ordinary on the ground that it failed

the two conditions set by U.S. jurisprudence: first, reasonableness of the amount incurred and second, the

amount incurred must not be a capital outlay to create goodwill for the product and/or private respondents

business. Otherwise, the expense must be considered a capital expenditure to be spread out over a reasonable

time.

There is yet to be a clear-cut criteria or fixed test for determining the reasonableness of an advertising expense.

There being no hard and fast rule on the matter, the right to a deduction depends on a number of factors such as

but not limited to: the type and size of business in which the taxpayer is engaged; the volume and amount of its

net earnings; the nature of the expenditure itself; the intention of the taxpayer and the general economic

conditions. It is the interplay of these, among other factors and properly weighed, that will yield a proper

evaluation.

The Court finds the subject expense for the advertisement of a single product to be inordinately large.

Therefore, even if it is necessary, it cannot be considered an ordinary expense deductible under then Section 29

(a) (1) (A) of the NIRC.

Advertising is generally of two kinds: (1) advertising to stimulate the current sale of merchandise or use of

services and (2) advertising designed to stimulate the future sale of merchandise or use of services. The second

type involves expenditures incurred, in whole or in part, to create or maintain some form of goodwill for the

taxpayers trade or business or for the industry or profession of which the taxpayer is a member. If the

expenditures are for the advertising of the first kind, then, except as to the question of the reasonableness of

amount, there is no doubt such expenditures are deductible as business expenses. If, however, the expenditures

are for advertising of the second kind, then normally they should be spread out over a reasonable period of time.

The companys media advertising expense for the promotion of a single product is doubtlessly unreasonable

considering it comprises almost one-half of the companys entire claim for marketing expenses for that year

under review. Petition granted, judgment reversed and set aside.

CIR vs. Isabela Cultural Corporation

Facts:Isabela Cultural Corporation (ICC), a domestic corporation received an assessment notice for deficiency

income tax and expanded withholding tax from BIR. It arose from the disallowance of ICCs claimed expense

for professional and security services paid by ICC; as well as the alleged understatement of interest income on

the three promissory notes due from Realty Investment Inc. The deficiency expanded withholding tax was

allegedly due to the failure of ICC to withhold 1% e-withholding tax on its claimed deduction for security

services.

ICC sought a reconsideration of the assessments. Having received a final notice of assessment, it brought the

case to CTA, which held that it is unappealable, since the final notice is not a decision. CTAs ruling was

reversed by CA, which was sustained by SC, and case was remanded to CTA. CTA rendered a decision in favor

of ICC. It ruled that the deductions for professional and security services were properly claimed, it said that

even if services were rendered in 1984 or 1985, the amount is not yet determined at that time. Hence it is a

proper deduction in 1986. It likewise found that it is the BIR which overstate the interest income, when it

applied compounding absent any stipulation.

Petitioner appealed to CA, which affirmed CTA, hence the petition.

Issue: Whether or not the expenses for professional and security services are deductible.

Held: No. One of the requisites for the deductibility of ordinary and necessary expenses is that it must have

been paid or incurred during the taxable year. This requisite is dependent on the method of accounting of the

taxpayer. In the case at bar, ICC is using the accrual method of accounting. Hence, under this method, an

expense is recognized when it is incurred. Under a Revenue Audit Memorandum, when the method of

accounting is accrual, expenses not being claimed as deductions by a taxpayer in the current year when they are

incurred cannot be claimed in the succeeding year.

The accrual of income and expense is permitted when the all-events test has been met. This test requires: 1)

fixing of a right to income or liability to pay; and 2) the availability of the reasonable accurate determination of

such income or liability. The test does not demand that the amount of income or liability be known absolutely,

only that a taxpayer has at its disposal the information necessary to compute the amount with reasonable

accuracy.

From the nature of the claimed deductions and the span of time during which the firm was retained, ICC can be

expected to have reasonably known the retainer fees charged by the firm. They cannot give as an excuse the

delayed billing, since it could have inquired into the amount of their obligation and re

TOLENTINO VS. THE SECRETARY OF FINANCE Case Digest

ARTURO M. TOLENTINO VS. THE SECRETARY OF FINANCE and THE COMMISSIONER OF

INTERNAL REVENUE 1994 Aug 25 G.R. No. 115455 235 SCRA 630

FACTS: The valued-added tax (VAT) is levied on the sale, barter or exchange of goods and properties as well

as on the sale or exchange of services. It is equivalent to 10% of the gross selling price or gross value in money

of goods or properties sold, bartered or exchanged or of the gross receipts from the sale or exchange of services.

Republic Act No. 7716 seeks to widen the tax base of the existing VAT system and enhance its administration

by amending the National Internal Revenue Code.

The Chamber of Real Estate and Builders Association (CREBA) contends that the imposition of VAT on sales

and leases by virtue of contracts entered into prior to the effectivity of the law would violate the constitutional

provision of non-impairment of contracts.

ISSUE: Whether R.A. No. 7716 is unconstitutional on ground that it violates the contract clause under Art. III,

sec 10 of the Bill of Rights.

RULING: No. The Supreme Court the contention of CREBA, that the imposition of the VAT on the sales and

leases of real estate by virtue of contracts entered into prior to the effectivity of the law would violate the

constitutional provision of non-impairment of contracts, is only slightly less abstract but nonetheless

hypothetical. It is enough to say that the parties to a contract cannot, through the exercise of prophetic

discernment, fetter the exercise of the taxing power of the State. For not only are existing laws read into

contracts in order to fix obligations as between parties, but the reservation of essential attributes of sovereign

power is also read into contracts as a basic postulate of the legal order. The policy of protecting contracts

against impairment presupposes the maintenance of a government which retains adequate authority to secure the

peace and good order of society. In truth, the Contract Clause has never been thought as a limitation on the

exercise of the State's power of taxation save only where a tax exemption has been granted for a valid

consideration.

Such is not the case of PAL in G.R. No. 115852, and the Court does not understand it to make this claim.

Rather, its position, as discussed above, is that the removal of its tax exemption cannot be made by a general,

but only by a specific, law.

Further, the Supreme Court held the validity of Republic Act No. 7716 in its formal and substantive aspects as

this has been raised in the various cases before it. To sum up, the Court holds:

(1) That the procedural requirements of the Constitution have been complied with by Congress in the enactment

of the statute;

(2) That judicial inquiry whether the formal requirements for the enactment of statutes - beyond those

prescribed by the Constitution - have been observed is precluded by the principle of separation of powers;

(3) That the law does not abridge freedom of speech, expression or the press, nor interfere with the free exercise

of religion, nor deny to any of the parties the right to an education; and

(4) That, in view of the absence of a factual foundation of record, claims that the law is regressive, oppressive

and confiscatory and that it violates vested rights protected under the Contract Clause are prematurely raised

and do not justify the grant of prospective relief by writ of prohibition.

WHEREFORE, the petitions are DISMISSED.

MANILA BANKING CORP VS. CIR- MINIMUM CORPORATE INCOME TAX (MCIT)

The intent of Congress relative to the minimum corporate income tax(MCIT) is to grant a 4-year suspension of

tax payment to newly formed corporations. Corporations still starting their business operations have to stabilize

their venture in order to obtain a stronghold in the industry.

Facts:

1961- Manila Banking Corp was incorporated. It engaged in the banking industry til 1987.

May 1987- Monetary Board of BangkoSentralngPilipinas (BSP) issued Resolution # 505 {pursuant to the

Central Bank Act (RA 265)} prohibiting Manila Bank from engaging in business by reason of insolvency. So,

Manila Bank ceased operations and its assets and liabilities were placed under charge of a gov.- appointed

receiver.

1998- Comprehensive Tax Reform Act (RA8424) imposed a minimum corporate income tax on domestic and

resident foreign corporations.

o Implementing law: Revenue Regulation # 9-98 stating that the law allows a 4year period from the time the

corporations were registered with the BIR during which the minimum corporate income tax should not be

imposed.

June 23, 1999- BSP authorized Manila Bank to operate as a thrift bank.

o NOTE: June 15, 1999 Revenue Regulation #4-95 (pursuant to Thrift Bank Act of 1995) provides that the

date of commencement of operations shall be understood to mean the date when the thrift bank was registered

with SEC or when Certificate of Authority to Operate was issued by the Monetary Board, whichever comes

LATER.

Dec 1999- Manila Bank wrote to BIR requesting a ruling on whether it is entitled to the 4 year grace period

under RR 9-98.

April 2000- Manila bank filed with BIR annual income tax return for taxable year 1999 and paid 33M.

Feb 2001- BIR issued BIR Ruling 7-2001 stating that Manila Bank is entitled to the 4year grace period. Since

it reopened in 1999, the min. corporate income tax may be imposed not earlier than 2002. It stressed that

although it had been registered with the BIR before 1994, but it ceased operations 1987-1999 due to involuntary

closure.

o Manila Bank, then, filed with BIR for the refund. Due to the inaction of BIR on the claim, it filed with CTA

for a petition for review, which was denied and found that Manila Banks payment of 33M is correct, since its

operations were merely interrupted during 1987-1999. CA affirmed CTA.

Issue: Whether or not Manila Bank is entitled to a refund of its minimum corporate income tax paid to BIR for

1999.

Held: Yes.

CIRs contensions are without merit. He contended that based on RR# 9-98, Manila Bank should pay the min.

corporate income tax beg. 1998 as it did not close its operations in 1987 but merely suspended it. Even if placed

under suspended receivership, its corporate existence was never affected. Thus falling under the category of a

existing corporation recommencing its banking business operations

** Sec. 27 E of the Tax Code provides the Minimum Corporate Income Tax (mcit) on Domestic Corporations.

o (1) Imposition of Tax- MCIT of 2% of gross income as of the end of the taxable year, as defined here in, is

hereby imposed on a corporation taxable under this title, beginning on the 4th taxable year immediately

following the year in which such corp commenced its business operations, when the mcit is greater than the tax

computed under Subsec. A of this section for the taxable year.

o (2) Any excess in the mcit over the normal income tax shall be carried forward and credited against the

normal income tax for the 3 succeeding taxable years.

Let it be stressed that RR 9-98 imposed the mcit on corps, the date when business operations commence is the

year in which the domestic corporation registered with the BIR. But under RR 4-95, the date of commencement

of operations of thrift banks, is the date of issuance of certificate by Monetary Board or registration with SEC,

whichever comes later. Clearly then, RR 4-95 applies to Manila banks, being a thrift bank. 4-year period=

counted from June 1999.

CIR V B.F. GOODRICH PHIL., INC., ET AL GR No. 104171, February 24, 1999

Facts: Private respondent BF Goodrich Philippines Inc. was an American corporation prior to July 3, 1974. As

a condition for approving the manufacture of tires and other rubber products, private respondent was required

by the Central Bank to develop a rubber plantation. In compliance therewith, private respondent bought from

the government certain parcels of land in Tumajubong Basilan, in 1961 under the Public Land Act and the

Parity Amendment to the 1935 constitution, and there developed a rubber plantation.

On August 2, 1973, the Justice Secretary rendered an opinion that ownership rights of Americans over Public

agricultural lands, including the right to dispose or sell their real estate, would be lost upon expiration on July 3,

1974 of the Parity Amendment. Thus, private respondent sold its Basilan land holding to Siltown Realty Phil.

Inc., (Siltown) for P500,000 on January 21, 1974. Under the terms of the sale, Siltown would lease the property

to private respondent for 25 years with an extension of 25 years at the option of private respondent.

Private respondent books of accounts were examined by BIR for purposes of determining its tax liability for

1974. This examination resulted in the April 23, 1975 assessment of private respondent for deficiency income

tax which it duly paid. Siltowns books of accounts were also examined, and on the basis thereof, on October

10, 1980, the Collector of Internal Revenue assessed deficiency donors tax of P1,020,850 in relation to said

sale of the Basilan landholdings.

Private respondent contested this assessment on November 24, 1980. Another assessment dated March 16,

1981, increasing the amount demanded for the alleged deficiency donors tax, surcharge, interest and

compromise penalty and was received by private respondent on April 9, 1981. On appeal, CTA upheld the

assessment. On review, CA reversed the decision of the court finding that the assessment was made beyond the

5-year prescriptive period in Section 331 of the Tax Code.

Issue: Whether or not petitioners right to assess has prescribed.

Held: Applying then Sec. 331, NIRC (now Sec. 203, 1997 NIRC which provides a 3-year prescriptive period

for making assessments), it is clean that the October 16, 1980 and March 16, 1981 assessments were issued by

the BIR beyond the 5-year statute of limitations. The court thoroughly studied the records of this case and found

no basis to disregard the 5-year period of prescription, expressly set under Sec. 331 of the Tax Code, the law

then in force.

For the purpose of safeguarding taxpayers from any unreasonable examination, investigation or assessment, our

tax law provides a statute of limitations in the collection of taxes. Thus, the law or prescription, being a

remedial measure, should be liberally construed in order to afford such protection. As a corollary, the

exceptions to the law on prescription should perforce be strictly construed.

ATLAS CONSOLIDATED MINING DEVT CORP vs. CIR

524 SCRA 73, 103GR Nos. 141104 & 148763, June 8, 2007

"The taxpayer must justify his claim for tax exemption or refund by the clearest grant of organic or statute law

and should not be permitted to stand on vague implications."

"Export processing zones (EPZA) are effectively considered as foreign territory for tax purposes."

FACTS: Petitioner corporation, a VAT-registered taxpayer engaged in mining, production, and sale of various

mineral products, filed claims with the BIR for refund/credit of input VAT on its purchases of capital goods and

on its zero-rated sales in the taxable quarters of the years 1990 and 1992. BIR did not immediately act on the

matter prompting the petitioner to file a petition for review before the CTA. The latter denied the claims on the

grounds that for zero-rating to apply, 70% of the company's sales must consists of exports, that the same were

not filed within the 2-year prescriptive period (the claim for 1992 quarterly returns were judicially filed only on

April 20, 1994), and that petitioner failed to submit substantial evidence to support its claim for refund/credit.

The petitioner, on the other hand, contends that CTA failed to consider the following: sales to PASAR and

PHILPOS within the EPZA as zero-rated export sales; the 2-year prescriptive period should be counted from the

date of filing of the last adjustment return which was April 15, 1993, and not on every end of the applicable

quarters; and that the certification of the independent CPA attesting to the correctness of the contents of the

summary of suppliers invoices or receipts examined, evaluated and audited by said CPA should substantiate its

claims.

ISSUE: Did the petitioner corporation sufficiently establish the factual bases for its applications for

refund/credit of input VAT?

HELD: No. Although the Court agreed with the petitioner corporation that the two-year prescriptive period for

the filing of claims for refund/credit of input VAT must be counted from the date of filing of the quarterly VAT

return, and that sales to PASAR and PHILPOS inside the EPZA are taxed as exports because these export

processing zones are to be managed as a separate customs territory from the rest of the Philippines, and thus, for

tax purposes, are effectively considered as foreign territory, it still denies the claims of petitioner corporation for

refund of its input VAT on its purchases of capital goods and effectively zero-rated sales during the period

claimed for not being established and substantiated by appropriate and sufficient evidence.

Tax refunds are in the nature of tax exemptions. It is regarded as in derogation of the sovereign authority, and

should be construed in against the person or entity claiming the exemption. The taxpayer who claims for

exemption must justify his claim by the clearest grant of organic or statute law and should not be permitted to

stand on vague implications.

You might also like

- Supreme Court Rules on Religious Freedom Case Involving Court Interpreter's Conjugal ArrangementDocument58 pagesSupreme Court Rules on Religious Freedom Case Involving Court Interpreter's Conjugal ArrangementShantle Taciana P. FabicoNo ratings yet

- Succession CasesDocument37 pagesSuccession CasesPaulette AquinoNo ratings yet

- 2013 Commercial Law Exam Essay QuestionsDocument4 pages2013 Commercial Law Exam Essay QuestionsPaulette AquinoNo ratings yet

- Republic of the Philippines Supreme Court rules on constitutionality of appointing elected mayor to government postDocument7 pagesRepublic of the Philippines Supreme Court rules on constitutionality of appointing elected mayor to government postNoelle Therese Gotidoc VedadNo ratings yet

- Spec Pro CaseDocument54 pagesSpec Pro CasePaulette AquinoNo ratings yet

- Civil Law CasesDocument31 pagesCivil Law CasesPaulette AquinoNo ratings yet

- 2013 Commercial Law Exam Essay QuestionsDocument4 pages2013 Commercial Law Exam Essay QuestionsPaulette AquinoNo ratings yet

- Tax 2. Case 2Document59 pagesTax 2. Case 2Paulette AquinoNo ratings yet

- Cajot V ClederaDocument4 pagesCajot V ClederaPaulette AquinoNo ratings yet

- G.R. No. 152923 Third Division Northeastern College Teachers and Employees Association, Represented by Leslie Gumarang, Vs Northeastern College, Inc.Document34 pagesG.R. No. 152923 Third Division Northeastern College Teachers and Employees Association, Represented by Leslie Gumarang, Vs Northeastern College, Inc.Paulette AquinoNo ratings yet

- SC reviews conviction for falsificationDocument7 pagesSC reviews conviction for falsificationPaulette AquinoNo ratings yet

- 21-40 Conflict of LawsDocument153 pages21-40 Conflict of LawsPaulette AquinoNo ratings yet

- Labor Law Set 2 DigestDocument38 pagesLabor Law Set 2 DigestPaulette AquinoNo ratings yet

- Tax 2. Case 2Document59 pagesTax 2. Case 2Paulette AquinoNo ratings yet

- Conflicts 3 ListDocument4 pagesConflicts 3 ListPaulette AquinoNo ratings yet

- Tax 2. Case 2Document59 pagesTax 2. Case 2Paulette AquinoNo ratings yet

- Annulment of TitleDocument4 pagesAnnulment of TitlePaulette Aquino67% (3)

- Insurance Exam QuestionsDocument4 pagesInsurance Exam QuestionsPaulette AquinoNo ratings yet

- WillsDocument10 pagesWillsPaulette AquinoNo ratings yet

- TAX 2. Case 1Document9 pagesTAX 2. Case 1Paulette AquinoNo ratings yet

- TAX 2. Case 1Document9 pagesTAX 2. Case 1Paulette AquinoNo ratings yet

- Annulment of TitleDocument3 pagesAnnulment of TitlePaulette AquinoNo ratings yet

- TAX 2. Case 1Document9 pagesTAX 2. Case 1Paulette AquinoNo ratings yet

- Conflicts of LawDocument2 pagesConflicts of LawPaulette AquinoNo ratings yet

- JENESYS Application FormDocument5 pagesJENESYS Application FormPaulette AquinoNo ratings yet

- 2013 Commercial Law Exam Essay QuestionsDocument4 pages2013 Commercial Law Exam Essay QuestionsPaulette AquinoNo ratings yet

- Supreme Court of the Philippines rules in favor of widow in life insurance accidental death caseDocument202 pagesSupreme Court of the Philippines rules in favor of widow in life insurance accidental death casePaulette AquinoNo ratings yet

- Legal Ethics in WritingDocument84 pagesLegal Ethics in WritingPaulette AquinoNo ratings yet

- Pil Digests 1-24Document21 pagesPil Digests 1-24Paulette AquinoNo ratings yet

- Agrarian Reform Law and JurisprudenceDocument169 pagesAgrarian Reform Law and Jurisprudencejerick16No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)