Professional Documents

Culture Documents

Engro Fertilizer Limited

Uploaded by

AsmaIqbal0 ratings0% found this document useful (0 votes)

411 views36 pagesanalysis

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentanalysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

411 views36 pagesEngro Fertilizer Limited

Uploaded by

AsmaIqbalanalysis

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 36

For important disclosure and analyst certification, kindly refer to end of the report

Nov 13, 2013

Engro Fertilizer Li mit ed Chemical s

Much awaited IPO at PKR 20/share Subscribe!

Engro Fertilizers Limited (EFERT) is issuing 75mn ordinary shares, from which

56.25mn shares (75% of the total issue) will be offered through book-building

mechanism at a floor price of PKR 20/share whereas the remaining 18.75mn

(25% of the total issue) will be offered to the general public at the strike price to be

determined through the book-building mechanism. In addition, Engro Corporation

Limited (ENGRO), the parent, aims to divest its existing shareholding up to 30mn

shares in EFERT at the strike price determined by the same book-building.

Offtake expected to jump 4% and 19% in CY14 and CY15 respectively

The companys offtake is expected to increase 4% YoY in CY14, and a massive

19% in CY15, due to better production post long-term gas plan (discussed ahead

in detail). Furthermore, gas diverted from the Guddu power plant is also expected

to keep companys production lifted till Mar-14.

Growth story GP margins to hover around 41%, PAT to soar at 21% CAGR

Gas flows from Guddu along with the long-term gas plan bodes well for the

company, as gross margins are expected to clock in at a CY13-16 average of a

fat 41%. Furthermore, with both of the plants fully operational from 4QCY14

onwards, the PAT of the company is expected to massively jump at a 4-year

CAGR of 21%.

Financial highlight s CY12A CY13E CY14F CY15F CY16F

Net Revenues 30,627 48,842 49,373 58,590 61,401

Net Profit (2,935) 5,019 5,339 7,733 8,935

EPS (PKR) @ 1298mn shares (2.74) 4.10 4.11 5.96 6.89

DPS (PKR) - - - 2.0 3.0

Div yield - - - 10% 15%

P/E (x) n.m 4.87 4.86 3.36 2.90

P/B (x) n.m 1.24 0.90 0.76 0.66

ROE -19% 27% 21% 25% 24%

ROA -3% 5% 5% 8% 10%

Source: Company accounts and AHL Research

Strong cash flow generation ahead dividend expected in CY15F

We foresee strong cash-flow generation amid higher capacity utilization coupled

with stable urea prices. Our analysis suggests, in CY15F, the companys cash

position will be strong enough to declare dividend after fulfilling the IFC

requirement of retiring 33% of its senior debt.

No more worries Debt restructuring approved, gas-related risks mitigated

The companys debt restructuring has been approved with all lenders. The

principle payments of the senior debt, as at J un-12, have been deferred by 2.5

years, which provides the company with enough time cushion to build cash.

Companys Gas Sale Agreements (GSAs) with KPD, Reti Maru and Makori East

are intact. Currently, the company is drawing gas from MARI SML (~20mmcfd),

while Reti Maru (~12mmcfd) flow is expected by end CY13.

Recommendation Subscribe!

Our fair value for EFERT works out to PKR 32.8, translating into a massive

upside potential of 64% (from floor price). The company is expected to be

able to declare cash dividends by CY15. Thus, we recommend Subscribe for

the upcoming IPO.

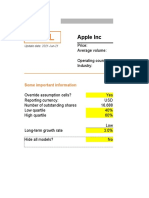

Fair value 32.83

Floor Price 20.0

Upside 64%

KSE Code -

Bloomberg Code -

Market Cap (US$ m) -

Market Cap (PKR m) -

Outstanding Shares (m)

Free Float -

Major Shareholders Engro Corp.

New Equity (mn shares) 75.00

Thr ough book building 56.25

Thr ough initial public off er ing 18.75

Offer for Sale by ENGRO (mn shar es)

Pr ivat e placement 30.0

Total transaction size (mn shar es) 105.00

Floor price (PKR/share) 20.0

Book building time line (Both days incl.)

19-Nov-13 Tuesday

t o

21-Nov-13 Thrusday

Analys t

Tahir Abbas

tahir.abbas@arifhabibltd.com

+92-21-32462589

Subscri be

www.ar ifhabibltd.com

Shar es

1,222

Company inf or mat ion

About the tr as action

Engr o Fer t ilizer s Limited is a public

company incor por ated on June 29, 2009 in

Pak ist an under t he Companies or dinance,

1984 as a wholly owned s ubs idiar y of

Engr o Cor por at ion Limit ed. The pr incipl e

act ivit y of t he company is manuf actur ing,

pur chasing and mar k eting of f er t ilizer .

2

Engro Fertilizer Limited

Page l eft bl ank i ntenti onall y

3

Engro Fertilizer Limited

Contents

CY13 goes green A year of turnaround .......................................................................................................................................................... 5

Operational updates ............................................................................................................................................................................................. 5

Gas availability for EFERT ................................................................................................................................................................................... 5

Fight for the right! Gas at USD 0.7/mmbtu..................................................................................................................................................... 5

Offtake to jump by hefty 19% YoY post long term gas plan .......................................................................................................................... 6

A growth story GP margins to hover around 41%, PAT to jump at 21% CAGR....................................................................................... 6

Product pricing to remain stable ........................................................................................................................................................................ 7

What to expect in CY14? ...................................................................................................................................................................................... 7

Strong cash flow generation ahead dividend expected in CY15F ............................................................................................................. 8

No more worries Debt restructuring approved! ............................................................................................................................................ 8

Risk mitigated Long term plan, gas fumes to be owned by the company................................................................................................ 9

Capex with respect to long term gas plan ........................................................................................................................................................ 9

Valuation ............................................................................................................................................................................................................... 10

S.W.O.T Analysis ................................................................................................................................................................................................. 11

About the Company ............................................................................................................................................................................................ 11

About the Sponsors ............................................................................................................................................................................................ 11

Key risks to the investment case ..................................................................................................................................................................... 12

Financial snapshot.............................................................................................................................................................................................. 14

Regional charm ................................................................................................................................................................................................... 16

Agriculture sector review................................................................................................................................................................................... 17

Fertilizer sector of Pakistan............................................................................................................................................................................... 18

Fertilizer policy, issues & sector performance............................................................................................................................................... 19

Demand drivers ................................................................................................................................................................................................... 20

Supply constraints - gas issues ....................................................................................................................................................................... 22

Gas Infrastructure Development Cess (GIDC)................................................................................................................................................ 25

What is the Long-term gas plan? ..................................................................................................................................................................... 26

Pricing scenario; price cut seems a far cry! ................................................................................................................................................... 27

Outlook ................................................................................................................................................................................................................. 28

Key risks ............................................................................................................................................................................................................... 29

Annexure .............................................................................................................................................................................................................. 31

Abbreviations....................................................................................................................................................................................................... 34

Disclaimer and related information .................................................................................................................................................................. 35

Contact details ..................................................................................................................................................................................................... 36

4

Engro Fertilizer Limited

Engro Fertilizer Li mit ed (EFERT)

EFERT is issuing 75mn ordinary shares, from which 56.25mn shares (75% of the

total issue) will be offered through book-building mechanism at a floor price of PKR

20/share whereas the remaining 18.75mn (25% of the total issue) will be offered to

the general public at the strike price to be determined through the book-building

mechanism. In addition to the aforementioned transaction, Engro Corporation

Limited (ENGRO) aims to divest its existing shareholding up to 30mn shares in

EFERT at the strike price determined by the same book-building.

Biggest urea manufacturer 2.27mn tons of urea capacities

EFERT has two fully integrated fertilizer plants with a nameplate capacity of

producing 2.275mn tons of urea. Both of the companys plants are located in Sindh.

Offtake expected to jump 4% and 19% in CY14 and CY15 respectively

The companys offtake is expected to increase 4% YoY in CY14, and a massive

19% in CY15, due to better production post long-term gas plan (discussed ahead in

detail). Furthermore, gas diverted from the Guddu power plant is also expected to

keep companys production lifted till Mar-14.

Growth story GP margins to hover around 41%, PAT to soar at 21% CAGR

Gas flows from Guddu along with the long-term gas plan bodes well for the

company, as gross margins are expected to clock in at a CY13-16 average of a fat

41%. Furthermore, with both of the plants fully operational from 4QCY14 onwards,

the PAT of the company is expected to massively jump at a 4-year CAGR of 21%.

Fi nancial highli ght s CY12A CY13E CY14F CY15F CY16F

Net Revenues 30,627 48,842 49,373 58,590 61,401

Net Profit (2,935) 5,019 5,339 7,733 8,935

EPS (PKR) @ 1298mn shares (2.74) 4.10 4.11 5.96 6.89

DPS (PKR) - - - 2.0 3.0

Div yield - - - 10% 15%

P/E (x) n.m 4.87 4.86 3.36 2.90

P/B (x) n.m 1.24 0.90 0.76 0.66

ROE -19% 27% 21% 25% 24%

ROA -3% 5% 5% 8% 10%

Source: Company accounts and AHL Research

Strong cash flow generation ahead dividend expected in CY15F

We foresee strong cash-flow generation amid higher capacity utilization coupled

with stable urea prices. Our analysis suggests, in CY15F, the companys cash

position will be strong enough to declare dividend after fulfilling the IFC requirement

of retiring 33% of its senior debt.

No more worries Debt restructuring approved

The companys debt restructuring has been approved with all lenders. The principle

payments of the senior debt, as at J un-12, have been deferred by 2.5 years, which

provides the company with enough time cushion to build cash.

Risk mitigated Long term plan, gas fumes to be owned by the company

Companys Gas Sale Agreements (GSAs) with KPD, Reti Maru and Makori

East are intact. Currently, the company is drawing gas from MARI SML

(~20mmcfd), while Reti Maru (~12mmcfd) flow is expected by end CY13.

Recommendation Subscribe!

Our fair value for EFERT works out to PKR 32.8, translating into a massive upside

potential of 64% (from floor price). The company is expected to be able to declare

cash dividends by CY15. Thus, we recommend Subscribe for the upcoming IPO.

Fair value 32.83

Floor Price 20.0

Upside 64%

KSE Code -

Bloomberg Code -

Market Cap (US$ m) -

Market Cap (PKR m) -

Outstanding Shares (m)

Free Float -

Major Shareholders Engro Corp.

New Equity (mn shares) 75.00

Thr ough book building 56.25

Thr ough initial public off er ing 18.75

Offer for Sale by ENGRO (mn shar es)

Pr ivat e placement 30.0

Total transaction size (mn shar es) 105.00

Floor price (PKR/share) 20.0

Book building time line (Both days incl.)

19-Nov-13 Tuesday

t o

21-Nov-13 Thrusday

Analys t

Tahir Abbas

tahir.abbas@arifhabibltd.com

+92-21-32462589

Subscri be

www.ar ifhabibltd.com

Shar es

1,222

Company inf or mat ion

About the tr as action

Engr o Fer t ilizer s Limited is a public

company incor por ated on June 29, 2009 in

Pak ist an under t he Companies or dinance,

1984 as a wholly owned s ubs idiar y of

Engr o Cor por at ion Limit ed. The pr incipl e

act ivit y of t he company is manuf actur ing,

pur chasing and mar k eting of f er t ilizer .

5

Engro Fertilizer Limited

CY13 goes green A year of turnaround

EFERT remains the key beneficiary with respect to gas availability, as the rota-gas

allocation during 1H13 alongside out-of-blue availability of the Guddu (Mari) gas has

been propping up company profitability. Our industry channels suggest EFERT is

expected to receive gas from Guddu till Mar14. However, we still cannot rule out the

possibility of any early diversion of Guddu gas from EFERT.

Operational updates

Currently, EFERT is operating its new plant, EnVen, on the Mari gas network (gas

diversion from the base plant). Total gas availability to the new plant stands at

93mmcfd. We expect EFERT to operate EnVen till the completion of the long-term gas

plan (end 3QCY14), and the gas price to remain at USD 3.2/mmbtu. Even before the

completion of the long-term gas arrangement plan through a pipeline, while the

company is expected to contend for its original GSA price of USc70/mmbtu, the gas

price contract for the pipeline is believed to have been finalized at USD 4.26/mmbtu

(feed gas at USD 3.75/mmbtu, USD 0.51/mmbtu as tolling charge). EFERT is expected

to operate both of its plants at 85% utilization levels once the pipeline becomes

operational by the end of CY14.

CY12 Market share 9MCY13 Market share

Source: NFDC and AHL Research

Gas availability for EFERT

The ECC has already extended the gas supply diversion from the Mari network to

EnVen till the implementation of long term gas plan. However, as per our discussion

with the industry, the govt is discussing several proposals with the EFERTs request to

supply the gas at a subsidized price of USD 0.7/mmbtu while USD 3.2/mmbtu has been

continued at least for CY13.

Fight for the right! Gas at USD 0.7/mmbtu

EFERTs management is continuously under discussion with the GoP regarding the

concessionary feed stock price of USD 0.7/mmbtu for its new plant. While the chances

of the concessionary feed stock price are quite slim, nevertheless, if the GoP honors the

initial contract for EnVen, it would be a major trigger for the company.

FFC

47%

FFBL

5%

ENGRO

18%

FATIMA

7%

DH

Fertilizer

1%

Agritech

1%

Pak

Arab

0%

NFML

21% FFC

42%

FFBL

4%

ENGRO

24%

FATIMA

6%

DH

Fertilizer

3%

Agritech

4%

Pak Arab

0%

NFML

17%

6

Engro Fertilizer Limited

Offtake to jump by hefty 19% YoY post long term gas plan

The companys offtake is expected to jump 4% YoY in CY14 mainly due to 6-month

operations of base plant (1QCY14 on Guddu gas and 4QCY14 with long term gas plan).

Furthermore offtake is expected to surge by 19% in CY15 due to better production post

long term gas plan (both plants are expected to remain operational at optimal capacity

of 85%). In addition to this, before the long term gas plan materializes, the picture is

expected to remain lucrative as the company would receive 3-month gas diversion from

Guddu in CY14E. In our base-case, we have assumed that EFERT would receive gas

from Guddu till Mar-14 and the long term gas plan would come online by 4QCY14.

Offtake and utilization Production and offtake

Source: AHL Research

A growth story GP margins to hover around 41%, PAT to jump at 21% CAGR

The companys gross margins remained sluggish in the preceding year following

massive gas curtailment resulting in one plant operational capacity. The Guddu gas

flows along with the long term gas plan bodes well for the company, as gross margins

are expected to clock in at CY13-16 average of a huge 41%. Furthermore, with both the

plants fully operational from 4QCY14 onwards, the net sales are anticipated to jump at

a 4-year CAGR of 8%, taking profit after tax of the company to boost at a 5-year CAGR

of 21%!

GP margins maintained at 41% (avg. of CY13-CY16) PAT to grow CAGR of 21%

Source: AHL Research

65%

70%

75%

80%

85%

90%

1,500

1,625

1,750

1,875

2,000

CY14F CY15F CY16F CY17F

Offtake Utilization (RHS)

k tons

40%

45%

50%

55%

60%

65%

70%

75%

80%

85%

90%

800

925

1,050

1,175

1,300

1,425

1,550

1,675

1,800

1,925

CY12A CY13E CY14F CY15F CY16F

Production

Offtake

Utilization (RHS)

k tons

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

20,000

25,000

30,000

35,000

40,000

45,000

50,000

55,000

60,000

65,000

CY12A CY13E CY14F CY15F CY16F

Sales GP Margin (RHS)

PKR mn

10%

11%

12%

13%

14%

15%

4,500

5,500

6,500

7,500

8,500

9,500

CY13E CY14F CY15F CY16F

PAT Net Profit Margin (RHS)

PKR mn

7

Engro Fertilizer Limited

Product pricing to remain stable

As far as product pricing is concerned, EFERT is expected to maintain urea prices at

current levels with little expectation of any price war in CY13 and beyond, with part gas

provision during the year (Guddu gas). We derive our assumption from the demand-

supply gap of urea, which is expected to remain wide as witnessed from regular imports

being made by the govt. The GoP has already approved 0.5mn tons of urea for the

Rabi season (commencing Nov-13 onwards). Even by 4QCY14, when both of EFERTs

plants are expected to be operational, we rule out any significant price cuts provided by

massive increase in contract gas price, especially for EFERT (at USD4.26/mmbtu

instead of EnVens original contract price of USc70/mmbtu), unless the gas price is

revised downward to the original GSA.

Given huge financial burden and inability to absorb significant hike in the feed gas

prices, increase in urea prices can be expected, instead.

What to expect in CY14?

We have run sensitivity on EFERTs earnings assuming various possible scenarios. For

the base-case of CY14, we have assumed base plant to receive gas for 6 months (3

months from Guddu and 3 months from long term gas plan) and EnVen to operate at

85% capacity level (on Mari gas network) till the completion of the long-term gas plan

(expected by end 3QCY14). Thus for CY14, the feed stock (gas) price for EnVen will be

USD 3.2/mmbtu (PKR 320.42/mmtbu same as current level) while for the base plant, it

would be PKR 320.42/mmbtu till 3QCY14 (plant operational for 3 months) and PKR

426/mmbtu for remaining tenure (expected for long term gas plan). In addition to this,

from 4QCY14 onwards, we have assumed EnVen and base plant to operate at 85%

utilization level, post implementation of the long-term gas pipeline plan.

CY14 Earnings Forecast

Capacity Utilisation

EnVen 85% 85% 85%

Base plant 180 days 90 days 0 days

Production (k tons)

ENVEN 1,105 1,105 1,105

Base plant 400 205 -

Total Production 1,505 1,310 1,105

Off take 1,511 1,347 1,143

Urea Prices (PKR/bag) 1,750 1,750 1,750

Gas prices (PKR/mmbtu)

ENVEN (Mari gas network) 320 320 320

Base Plant (Guddu and Long term gas plan) 320 and 426 320 and 426 320 and 426

Earnings (PKR/share)

ENGRO Fertilizer (EPS) @ 1298 mn shares 4.11 3.41 2.02

Impact on Engro Corporation 10.44 8.66 5.13

Source: AHL Research

8

Engro Fertilizer Limited

Strong cash flow generation ahead dividend expected in CY15F

We foresee strong cash flow generation amid higher capacity utilization coupled with

the stable urea prices. As per the companies cash sweep with the IFC, the surplus

cash after adjustment with capex, principle repayment, pipe line capex and others, the

company is expected to earn going forward would be used as prepayment to the IFC.

Our calculation suggests that in CY15F the companys cash flow per share would be

PKR 5.6/share, which gives an idea that the company would be able to declare cash

dividend after fulfilling the IFC requirement of retiring 33% of its senior debt.

Margins outlook EBITDA to Debt servicing

Source: AHL Research

No more worries Debt restructuring approved!

The companys debt restructuring has been approved with its local lenders. Principle

repayments of the senior debt as at J un-12 have been deferred by 2.5 years. We have

assumed debt repayment of PKR 5.6bn, PKR 12bn and PKR 13.5bn in CY13, CY14

and CY15, respectively. Given the strong expected cash flow generation the company

would be able to easily manage its debt servicing, in our view. The EBITDA of the

company is expected to grow at a 4-year CAGR of 3%, to PKR 25bn by CY16.

0%

20%

40%

60%

CY12A CY13E CY14F CY15F CY16F

GP Margin

NP Margin

EBITDA Margins

5,000

10,000

15,000

20,000

25,000

30,000

CY12A CY13E CY14F CY15F CY16F

EBITDA Debt Servicing PKR mn

EBITDA to Current portion

Source: AHL Research

22.0

22.5

23.0

23.5

24.0

24.5

25.0

25.5

5.0

7.5

10.0

12.5

15.0

CY13E CY14F CY15F CY16F

Current Portion

EBITDA (RHS)

PKR bn PKR bn

9

Engro Fertilizer Limited

Risk mitigated Long term plan, gas fumes to be owned by the company

Gas Sale Agreements (GSA) with KPD, Reti Maru and Makori East are intact. The

company is drawing gas from MARI SML (~20mmcfd), while Reti Maru (~12mmcfd) flow

is expected by the end of this year. The Economic Coordination Committee has yet to

reconfirm the long term gas plan. However the management expressed the confidence,

that ECC would shortly confirm the plan, while a delay of 2-3 months cannot be ruled

out in the execution of the aforementioned plan (3QCY14 now vs. 2QCY14 previously).

In addition, the company has signed Gas tolling agreements (GTAs) with SSGC and

SNGP.

EFERT gas availability and growth Long term gas plan (mmcfd)

Source: AHL Research

Capex with respect to long term gas plan

Given its share in the gas allocation, EFERTs share in the long-term gas pipeline plan

stands ~USD 48mn out of total estimated cost of USD 100mn, and we believe that

EFERT will utilize the funds raised from IPO plus the internal cash flow generation.

Furthermore, the capex with respect to Kunnar Pasaki Deep pipeline is on hold as the

company is awaiting the reconfirmation of long term gas plan by the ECC. However

going forward in CY14, we have incorporated USD 48mn KPD capex in our estimates.

0%

10%

20%

30%

40%

50%

60%

70%

-

20

40

60

80

100

120

140

160

180

200

CY12A CY13E CY14F CY15F CY16F

Long term gas plan

Guddu

SNGP

Mari

Growth (RHS)

mmcfd

Engro , 79

Agri, 25

Pak Arab,

58

DH

Fertilizer,

40

10

Engro Fertilizer Limited

Valuation

Our DCF-based fair value for the scrip works out to PKR 32.83/share, translating into a

striking upside potential of 64% from floor price level.

Our valuation is based on the cost of equity 20.6% and 8.5% after tax cost of debt

translating into a WACC of 11.5%. However, as we expect debt to be retired, we have

assumed separate WACC for every year to incorporate the rapidly changing capital

structure. Following strong cash-flow generation, we expect the company to declare

cash dIvidend by the end of CY15F. The stock is currently trading at a lucurative CY14F

PER of 4.9x and PB of 0.9x. Thus, we recommend Subscribe for the IPO.

Dis count ed Cas h Flow Valuation

PKR mn CY13 CY14 CY15 CY16 CY17 CY18 CY19 CY20 Ter minal

EBIT (1-t) 11,683 11,181 12,630 12,997 13,534 13,701 13,834 13,850

Add: Depreciation 5,065 5,351 5,211 5,147 5,083 5,014 4,940 4,923

Add: Changes in Working Capital 6,931 (5,027) (565) 147 145 123 108 148

Less: Capital Expenditure (2,139) (7,490) (2,076) (2,232) (2,353) (2,423) (2,489) (2,562)

Free Cash Flow 21,539 4,014 15,200 16,059 16,410 16,415 16,393 16,359 102,368

WACC 11.5% 12.7% 13.8% 15.2% 16.1% 17.1% 18.1% 19.0%

Present Value 21,539 3,561 11,733 10,501 9,018 7,455 6,041 4,830

Terminal Growth Rate 4.00%

PV of FCFF 74,679

PV of Terminal Value 30,226

Total PV 104,905

Less: Net Debt 62,293

Equity Value 42,612

No. of Shares (mn) 1,298

Fair value (PKR) - Dec-13 32.83

Source: AHL Research

Valuation Mat r ix

2% 3% 4% 5% 6%

11.0% 35.87 37.68 39.74 42.10 44.83

12.8% 29.93 31.30 32.83 34.56 36.53

13.0% 29.28 30.60 32.08 33.75 35.64

14.0% 26.48 27.62 28.89 30.31 31.90

15.0% 23.94 24.93 26.03 27.24 28.60

Source: AHL Research

R

i

s

k

F

r

e

e

R

a

t

e

Ter minal Gr ow th Rat e

WACC Par amet er s

Risk Free Rate 12.8%

Market Return 19.8%

Beta 1.12

Cost of Equity 20.6%

Cost of Debt 13.1%

After tax Cost of Debt 8.5%

WACC (CY13) 11.5%

Source: AHL Research

11

Engro Fertilizer Limited

S.W.O.T Analysis

*Feedstock gas at a fixed rate for ten years

*Fuel efficient plant "EnVen"

*Urea as prime product that stands with relatively inelastic demand

*High entry barriers in the sector amid non availability of natural gas

*High government support to the agri sector

*Opportunity to expand production through de-bottlenecking

*High financial leverage

*Insufficient gas reserves (risk of unavailability of raw material)

*Interest rate volatility (increase)

Source: EFERT IM, AHL Research

T

h

r

e

a

t

s

S.W.O.T Analysis

S

t

r

e

n

g

t

h

s

W

e

a

k

n

e

s

s

e

s

*Limited product mix (mainly Urea maker) to expose company to

risks of varying gov't policies (changing support prices to support

farmer)

*High government support to the agri sector

*Urea has relatively inelastic demand among other fertilizer products

*Local urea prices are considerably lower than international prices

and any surplus can be easily exported

O

p

p

u

r

t

u

n

i

t

i

e

s

About the Company

EFERT is a public company incorporated on J une 29, 2009 in Pakistan under the

Companies Ordinance, 1984, as a wholly owned subsidiary of ENGRO. The principle

activity of the company is manufacturing, purchasing and marketing of fertilizers.

About the Sponsors

EFERT is a 100% owned subsidiary of ENGRO. The holding company is a public listed

company incorporated in Pakistan and its shares are quoted on all the three stock

exchanges of Pakistan I.e; Karachi (KSE), Lahore (LSE), and Islamabad (ISE).

The principal activity of the holding company is to manage investments in subsidiary

companies and joint venture, engaged in fertilizers, PVC resin manufacturing and

marketing, food, energy, exploration, LNG and chemical terminal and storage

businesses.

12

Engro Fertilizer Limited

Key ri sks to the investment case

Discount rate

The heavy debt burden of the company (PKR 62.5bn as of September 2013) makes the

company more vulnerable in the rising interest rate scenario existing in Pakistan.

Hence, any sharp rise in interest rate could dent cash flow and earnings of the

company.

Gas curtailment

Gas is the key input for manufacturing fertilizers. Pakistan is currently facing severe

energy shortages, hence any partial or complete diversion cannot be ruled out. The

major threat could the diversion of gas from long term gas plan to power sector.

Therefore, going forward any such move by the govt could seriously distort the

companys performance.

Lower demand

Due to unforeseeable natural disasters coupled with unavailability of water, the demand

of urea may be lower than estimated. This could reduce the companys earning

substantially.

Gas prices a major dampener? - The 3-scenario analysis

Gas price (feed stock) is expected to play a major role in the short-term for the fertilizer

sector, especially for EFERT and FFC whose sales are solely dependent on urea.

However, we do not foresee any massive gas price hike (i.e. feed equaling fuel). We

see PKR 75-100/mmbtu increase that fertilizer manufacturers would easily pass on to

end consumer (PKR 110-125/bag). Additionally, we have made three scenarios with

respect to the gas prices increase. These include:

Feed stock would raise by 300%

Feed stock price hike would be around PKR 76.67/mmbtu (by reducing subsidy to

PKR 200/bag from the current subsidy of PKR 308/bag, the subsidy per bag due to

the differential of feed and fuel stock prices), and

Feed stock price would surge by 100% excluding GIDC

The govt is yet to finalize gas prices, though the cause of delay is the fear of fertilizer

price hike (substantial in case of equating feed and fuel) due to the aforementioned

increase. The govt is working on different proposals to facilitate farmers (direct farm

subsidy).

13

Engro Fertilizer Limited

Feed stock price (PKR/mmbtu)

Currentfeed stock 320.42

Expected increase in feed stock 246.84

Expected r evised f eed stock 567.26

Source: AHL Estimates

Subsidy (PKR/bag)

Currentsubsidy 308.00

Revised subsidy 200.00

Feed stock price (PKR/mmbtu)

Currentfeed stock 320.42

Expected increase in feed stock 76.67

Expected revised feed stock 397.09

Source: AHL Estimates

Feed stock price (PKR/mmbtu)

Currentfeed stock 320.42

Expected increase in feed stock 123.42

Expect ed revi sed f eed stock 443.84

Source: AHL Estimates

1) 300% increase in the current feed stock prices

One of the assumptions is to increase gas prices (feed stock) to 300% from the current

levels. Incorporating this, we expect PKR 246.8/mmbtu increase in the feed stock prices

(see table 01 alongside). Furthermore, in table 02, we have calculated the expected

annualized after-tax EPS impact on our fertilizer universe earnings, and per bag price

that would be required to be passed on to nullify the impact.

FFC 293 343 (6.05) 15.37 -39%

FFBL 332 388 (1.40) 6.67 -21%

Efert 272 318 (4.28) 4.10 -104%

Source: AHL Estimates

Gas prices increase impact on fertilizer companies

Company

Per bag

(pass-on)

Per bag incl.

GST (pass-on)

EPS impact

(no-pass on)

CY13E

EPS

%

2) Reducing subsidy to PKR 200/bag from the current subsidy of PKR 308/bag

As per meeting of the ECC dated Aug 15, 2013, the officials said that the amount of

subsidy on each bag of the fertilizer would be around PKR 200/bag post gas tariff

increase. Currently subsidy per bag stood at PKR 308. We have estimated the

expected gas price hike (feed stock) by reducing the per bag subsidy to PKR 200. In the

second table alongside, we have calculated the expected annualized after-tax EPS

impact on AHL Researchs fertilizer universe, and per bag price that is required to be

passed on to nullify the said impact.

FFC 91 107 (1. 88) 15.37 -12%

FFBL 103 120 (0. 43) 6.67 -7%

Efert 84 99 (1. 33) 4.10 -32%

Source: AHL Estimates

Gas prices increase impact on fertilizer companies

Company

Per bag

(pass-on)

Per bag incl.

GST (pass-on)

EPS impact

(no-pass on)

CY13E

EPS

%

3) 100% increase in the current feed stock prices excluding GIDC

The last scenario is the expected 100% increase in the current feed stock prices. As per

our estimates, the expected hike is PKR 123/mmbtu in the aforementioned scenario

(see the RHS table). In the second table, we have calculated the expected annualized

after-tax EPS impact on AHLs fertilizer universe, and per bag price that is expected to

increase to nullify the impact.

FFC 162 190 (3.35) 15.37 -22%

FFBL 179 210 (0.76) 6.67 -11%

Efert 148 174 (2.34) 4.10 -57%

Source: AHL Estimates

Gas prices increase impact on fertilizer companies

Company

Per bag

(pass-on)

Per bag incl.

GST (pass-on)

EPS impact

(no-pass on)

CY13E

EPS

%

14

Engro Fertilizer Limited

Financi al snapshot

Volumes to boost revenues Downward trajectory finance cost and debt to equity

Decliningfinancial charges and borrowings Fallingdebt to equity

Earnings and distribution Flourishingnet margins

Sources; Company Financials, NFDC, AHL Research

-

500

1,000

1,500

2,000

2,500

20,000

25,000

30,000

35,000

40,000

45,000

50,000

55,000

60,000

65,000

CY12A CY13E CY14F CY15F CY16F

Net revenues

Total Volumes (RHS)

PKR mn k tons

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5,500

6,250

7,000

7,750

8,500

9,250

10,000

CY13E CY14F CY15F CY16F

Interest expense

Debt to equity (RHS)

PKR mn (x)

5,000

5,500

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

10,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

55,000

60,000

CY13E CY14F CY15F CY16F

Long term Borrowings

Financial Charges (RHS)

PKR mn PKR mn

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

15,000

20,000

25,000

30,000

35,000

40,000

45,000

50,000

CY13E CY14F CY15F CY16F

Equity Debt to Equity (RHS)

PKR mn (x)

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

3.50

4.00

4.50

5.00

5.50

6.00

6.50

7.00

CY13E CY14F CY15F CY16F

EPS DPS (RHS)

PKR/share PKR/share

10%

11%

12%

13%

14%

15%

4,500

5,500

6,500

7,500

8,500

9,500

CY13E CY14F CY15F CY16F

PAT Net Profit Margin (RHS)

PKR mn

15

Engro Fertilizer Limited

Financi al Summar y, Forecasts and Key Rati os

PKR mn

Income Stat ement CY10A CY11A CY12A CY13E CY14F CY15F CY16F

Net Sales 19,018 31,353 30,627 48,842 49,373 58,590 61,401

Gr oss pr of it 8,910 16,733 9,861 21,012 20,816 23,766 24,542

Gross margins 47% 53% 32% 43% 42% 41% 40%

EBITDA mar gin 38% 55% 40% 47% 46% 42% 41%

Oper at ing Pr of i t 6,615 13,938 6,778 16,961 16,438 18,525 19,040

Other income 458 1,164 379 916 1,041 1,236 1,295

Financial charges 1,351 7,644 10,703 9,363 8,772 7,278 5,974

PAT 3,730 4,588 (2,935) 5,019 5,339 7,733 8,935

Net mar gi ns 20% 15% n.m 10% 11% 13% 15%

Ear nings per Shar e - (PKR) (Adjust ed f or 1298 mn shar es) 2.87 3.54 (2.74) 4.10 4.11 5.96 6.89

DPS (PKR) - - - - - 2.00 3.00

Balance Sheet CY10A CY11A CY12A CY13E CY14F CY15F CY16F

Total Shareholders' Equity 13,640 18,617 15,798 20,967 28,805 34,068 39,110

Non Cur r ent Liabi li t ies

Long TermLoan 62,660 56,398 48,482 53,879 41,879 28,379 22,703

Total Non Current Liabilities 68,205 64,571 55,459 60,857 48,857 35,357 29,681

Cur r ent Liabil it i es

Trade and Other Payables 3,911 5,153 7,960 13,253 8,159 8,706 9,215

Total Current Liabilities 16,209 17,689 26,250 22,664 23,927 26,274 19,273

Tot al Liabili t ies and Equi t y 98,053 100,877 97,508 104,488 101,588 95,700 88,064

Assets

Non Current Assets 84,631 86,540 83,123 80,198 82,338 79,203 76,288

Current Assets 13,423 14,337 14,385 24,290 19,250 16,496 11,777

Tot al As set s 98,053 100,877 97,508 104,488 101,588 95,700 88,064

Cash Flow St at ement CY10A CY11A CY12A CY13E CY14F CY15F CY16F

Cashflow fromoperating activities 4,360 9,279 6,371 17,014 5,662 12,379 14,229

Cash used in investing activities (14,654) (3,517) (1,857) (2,139) (7,490) (2,076) (2,232)

Cashflow fromfinancing activities 12,903 (4,589) (4,920) (3,331) (3,145) (14,169) (17,079)

Net i ncr eas e/(decr eas e i n cash & equi val ent s 2,609 1,173 (406) 11,544 (4,973) (3,866) (5,082)

Cash 3,318 4,491 2,449 16,442 23,012 14,174 5,227

Anal ysis per s har e CY10A CY11A CY12A CY13E CY14F CY15F CY16F

EPS 2.87 3.54 (2.74) 4.10 4.11 5.96 6.89

DPS - - - - - 2.00 3.00

BVPS 10.51 14.35 12.17 16.16 22.20 26.25 30.14

Pr of i t abil it y r at i os CY10A CY11A CY12A CY13E CY14F CY15F CY16F

Gross margins 47% 53% 32% 43% 42% 41% 40%

EBITDA margins 38% 55% 40% 47% 46% 42% 41%

Net margins 20% 15% n.m 10% 11% 13% 15%

Coverage ratio 4.90 1.82 0.63 1.81 1.87 2.55 3.19

P/E (x) 6.96 5.66 n.m 4.87 4.86 3.36 2.90

P/B (x) 1.90 1.39 n.m 1.24 0.90 0.76 0.66

Div yield 0% 0% 0% 0% 0% 10% 15%

Debt to equity 6.19 4.42 5.17 3.98 2.53 1.81 1.25

Debt to assets 0.86 0.82 0.84 0.80 0.72 0.64 0.56

Ret ur n on capi t al CY10A CY11A CY12A CY13E CY14F CY15F CY16F

ROA 4% 5% n.m 5% 5% 8% 10%

ROE 27% 28% n.m 27% 21% 25% 24%

Source: Company accounts and AHL Research

16

Engro Fertilizer Limited

Regi onal charm

0.00

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

18.00

20.00

E

F

E

R

T

D

P

M

V

N

T

C

C

C

T

B

0

0

0

4

2

2

C

H

T

T

C

H

I

N

Price to Earning

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

0

0

0

4

2

2

C

H

T

T

C

H

I

N

E

F

E

R

T

D

P

M

V

N

T

C

C

C

T

B

Price to Book

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

D

P

M

V

N

T

C

C

C

T

B

E

F

E

R

T

T

T

C

H

I

N

0

0

0

4

2

2

C

H

Return on Assets

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

T

C

C

C

T

B

E

F

E

R

T

D

P

M

V

N

0

0

0

4

2

2

C

H

T

T

C

H

I

N

Return on Equity

17

Engro Fertilizer Limited

Agri cul ture sector review

The Agriculture sector alone is of immense importance to Pakistan economy; it is one of

the sectors that provide maximum value addition by converting raw gas into urea

granules and benefitting the country in terms of food availability, balance of payment,

poverty reduction, economic growth and transformation towards industrialization. Even

though this sector is one of the most competitive sectors, it still faces many gas

curtailment issues and excess demand over supply.

Pakistan is an agrarian country as its prime exports consist of agriculture good; apart

from ensuring food security, it contributes 21% to GDP and provides employment to

45% of Pakistani population. For sustainable agricultural growth, a prospering fertilizer

industry is extremely crucial.

GDP and Agricultural growth Agricultural share in GDP

Source: Economic Survey 2012-13, AHL Research

5.0%

0.4%

2.6%

3.7%

4.4%

3.6%

1.8%

3.5%

0.2%

2.0%

3.5%

3.3%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

GDP growth Agriculture growth

22%

23%

22%

22%

22%

21%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

21%

21%

22%

22%

23%

23%

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Agriculture Share in GDP

GDP growth (RHS)

18

Engro Fertilizer Limited

Fertili zer sector of Paki stan

The fertilizer sector has a total market capitalization of PKR 333.2bn (USD 3.1bn) and

the market capitalization of our sample companies (FFC, FFBL and ENGRO) stood at

PKR 247.2bn (USD 2.3bn). The index weight of total chemical sector is around ~12.6%

in KSE100 index while our sample companies (FFC, FFBL and ENGRO) comprise

~10.2% of the KSE100 index.

Pakistan fertilizer sector comprises seven companies (see table below). The prime

product of the sector is urea, seconded by DAP. The major players of the sectors

include Fauji Fertilizer Company Limited and Engro Fertilizer having total capacities of

2.05mn tons and 2.3mn tons per annum respectively and contributes 68% of countrys

total capacity. Fauji Fertilizer Bin Qasim Limited is the countrys sole producer of DAP

having capacity of 0.6mn tons per annum. In addition to this FFBL urea capacity stands

at 0.5mn tons per annum. The snapshot of Pakistans fertilizer sector is summarized

below in the table:

FFC Goth Macchi, Punjab and Ghotki, Sindh 2.05 2.46 120% Mari gas Operational Urea

ENGRO (Base) Ghotki, Sindh 0.98 0.91 93% Guddu gas (Mari) Operational Urea

ENGRO (Enven) Ghotki, Sindh 1.30 0.12 9% Mari gas (diversion) Operational Urea

FFBL Bin Qasim, Sindh 0.50 0.28 56% SSGC Operational DAP

FATIMA Rahimyar khan, Punjab 0.50 0.34 68% Mari gas Operational NP,CAN

PAK Arab Multan, Punjab 0.09 - 0% SNGP Rotational basis NP,CAN

Agritech Mianwali and Haripur 0.47 0.09 19% SNGP Rotational basis Urea

Dawood Hercules Sheikupura, Punjab 0.45 0.07 16% SNGP Rotational basis Urea

6. 34

4. 28

68%

3. 54

74%

Operati onal Urea capaci ty i n 9MCY13 (mn tons)

Total Capaci ty uti l i zati on i n CY12

Source: AHL Research

Paki stan's Ferti l i zer Sector Snapshot

Company Locati on

Total Urea Capaci ty (mn tons)

Operati onal Urea capaci ty i n CY12 (mn tons)

Urea

capaci ty

(mn tons)

CY12 Urea

producti on

(mn tons)

CY12

Uti l i zati on

Gas suppl i er Current status

Pri mary

products

Total Capaci ty uti l i zati on i n 9MCY13

19

Engro Fertilizer Limited

Fertili zer pol icy, i ssues & sector performance

Fertilizer policy was announced taking effect from 1st J uly 2001. The policy was initially

operational for ten years and aimed for an estimated investment of USD 1.2bn in the

sector meanwhile. However, it has completed its tenor and a new policy is awaited. The

basic objective of this policy was to attract investment in the sector, support farmers

through provision of fertilizer products at an affordable price and to ensure best optimal

price and supply of gas to keep the plants utilization at max. The policy has brought

fruitful results in the form of USD 2.0bn investment through green field projects and

BMR activities but the rationalization of gas subsidy as envisioned in the Policy has not

yet been materialized.

Investments through fertilizer policy

EFERT expansion took place with the addition of 1.3mn tons of urea plant coupled with

the 0.5mn tons of new plant set up by Fatima Fertilizer Company (FATIMA). In line with

the fertilizer policy the GoP approved subsidized feed stock for both of the companies at

USD 0.7/mmbtu for the tenure of 10 years. Conversely, the govt failed to honor its

sovereign guarantee resulting substantial gas curtailment for EFERT and its new plant

only received gas for 45 days in CY12.

However, to this date the problem has been cater as the Economic Coordination

Committee (ECC) of the Cabinet has decided to revert the 60mn cubic feet per day

(mmcfd) previously diverted gas back from Guddu Power Plant to Engro Fertilizer after

which the plant will be able to operate on 80-85% of its installed capacity.

Historical urea and Dap capacities Urea demand/supply trend

Source: NFDC and AHL Research

3,000

3,500

4,000

4,500

5,000

5,500

6,000

6,500

7,000

7,500

C

Y

0

5

C

Y

0

6

C

Y

0

7

C

Y

0

8

C

Y

0

9

C

Y

1

0

C

Y

1

1

C

Y

1

2

C

Y

1

3

DAP

Urea

k tons

-

200

400

600

800

1,000

1,200

1,400

1,600

3,500

4,000

4,500

5,000

5,500

6,000

6,500

7,000

C

Y

0

8

C

Y

0

9

C

Y

1

0

C

Y

1

1

C

Y

1

2

Urea Production

Urea Demand

Deficit (RHS)

k tons k tons

20

Engro Fertilizer Limited

Demand dri vers

Pakistan is an agricultural country thus need of fertilizers for agri growth and its

contribution in the GDP is significant. There are numerous factors following demand of

fertilizer products in Pakistan. The major demand drivers include increasing cultivatable

area and guaranteed offtake (5 year average of 5.5mn ton) amid govt support to

farmers through the mechanism of different subsidies. Apart from these, other demand

drivers include commodity support prices, water availability, fertilizer prices and growing

population.

Cultivatable area

Cultivatable area is the major aspect in determining fertilizer demand. The higher area

would lead towards growth in the fertilizer offtake and crops production. Despite being

the disaster caused by the major floods back in CY10, the total cultivatable area of

Pakistan showed a modest growth of 0.5% CAGR of 10 years. Likewise, urea offtake

increased by 10-year CAGR of 2% for the same period. As a result, cumulative wheat

and cotton production jumped by CAGR of 2.3% and 3.2% respectively in the last 10

years. Fertilizer offtake and total cropped area remained at its peak in CY09 and stood

at 6.2mn tons and 23.8mn hector, respectively. Therefore, given lower flood-related

devastations in the recent years, the total cultivatable area and fertilizer offtake is

expected to grow going forward, in our view.

Urea offtake and Wheat and cotton production Cropped area and urea offtake

Source: Economic survey and AHL Research

Guaranteed offtake

Pakistans urea demand stood at a 5-year average of 5.5mn tons with the installed

capacity of 6.4mn tons (operational capacity of 4.9mn tons excl. Pakarab, DH fertilizer

and Agritech). The situation shows guaranteed offtake as the local manufacturers

historically managed to sell all of the locally produced urea during a year. Furthermore

the wide demand supply gas is catered through import of urea by the govt to ensure

any short fall of the commodity in the market.

-20.0%

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

Urea offtake (k tons)

Wheat Production (mn Tonnes)

Cotton Producti on (mn Bal es)

4,000

4,500

5,000

5,500

6,000

6,500

21.0

21.5

22.0

22.5

23.0

23.5

24.0

24.5

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

Total Cropped Area

Urea offtake (RHS)

Mn

Hect

.

k tons

Production and local offtake

Source: NFDC and AHL Research

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

CY10 CY11 CY12

Total offtake Production Local offtake

K tons

21

Engro Fertilizer Limited

Govt support to farmers

Traditionally, support prices for commodities have played a vital role to boosting up the

fertilizer offtake. As an agrarian country, the govt always tends to support farmers

through every possible mode including higher support prices. Wheat support prices are

directly proportional to the fertilizer offtake. We have witnessed an upward trend in

wheat support price since FY11. At present, wheat support price stands at PKR

1200/maund, which is expected to revise upward in the current month.

Wheat support prices

Source: Economic survey and AHL Research

900

950

1000

1050

1100

1150

1200

1250

FY09 FY10 FY11 FY12 FY13

PKR/maund

22

Engro Fertilizer Limited

Suppl y constraints - gas i ssues

Pakistan has always been rich in natural gas but increasing demand and limited

exploration activities in the past have resulted in a limit on the availability of this

resource. Currently, the country is facing seasonal outages typically during the winter.

The situation may aggravate in the future as the countrys energy requirements and

industrial growth potential will require a much higher availability of fertilizer resource

when its import bill is already under oil shocks. In this case, the fertilizer sector, which

already consumes 16% of total gas, has limited potential to induce further investors.

CY12 an ailing year for the fertilizer industry

Currently the Industry is facing a major issue in the form of gas curtailment which is

affecting the overall fertilizer production of the country. The 'Year 2012' resulted as the

most challenging year for the industry as due to continuous unannounced gas

shortages the industry was only able to produce 4.9mn tons of urea against an installed

capacity of 6.4mn tons which was 33% lower than its productive capacity.

Plants on SNGPL network face the most severe

As discussed above, one of the biggest reasons of this severe under productivity has

been the widespread gas shortage in Pakistan. Due to this, the fertilizer plants operating

on the Sui Northern Gas Pipeline Ltds network faced the biggest wrath, as they could

only achieve a mere 20% of their productive capacity during CY12.

Due to such gas crisis, fertilizer plants such as Pakarab Fertilizers, Dawood Hercules

(DH) Fertilizer, Agritech and EFERT have produced far below the envisaged level of

production. DH Fertilizer could only manage to produce 17% of its installed capacity i.e.

an accumulated 75k tons of urea production. Similarly, Agritech and EFERTs new

plant production also stood at a disappointing 17% and 20% respectively (CY12).

Sector gas supply on declining trend

Severe gas curtailment has been observed since CY10TD and the gas consumption of

fertilizer sector from SSGC and SNGP network has declined by 5% and 2%

respectively. Conversely, the dedicated MARI gas field showed 5 year CAGR increase

of 4%. However, cumulative gas consumption by the fertilizer sector dropped 7% YoY in

CY12.

Gas supply for fertilizer sector Gas consumption by sectors

Source: EYB and AHL Research

-

50,000

100,000

150,000

200,000

250,000

2

0

0

6

-

0

7

2

0

0

7

-

0

8

2

0

0

8

-

0

9

2

0

0

9

-

1

0

2

0

1

0

-

1

1

2

0

1

1

-

1

2

Total SNGPL

SSGCL Mari Gas Field

mmcfd

Gen.

Industry,

23.0%

Cement,

0.1%

Fertilizer

(feedstock

),13.1%

Fertilizer

(fuel),

3.3% Commerci

al, 3.1%

Domestic,

20.3%

Transport

(CNG),

9.2%

Power,

27.8%

Urea production

Source: NFDC and AHL Research

3,800

4,000

4,200

4,400

4,600

4,800

5,000

5,200

5,400

CY08 CY09 CY10 CY11 CY12

K tons

23

Engro Fertilizer Limited

Gas prices Upward trajectory continues

Feed gas is the basic raw material for making fertilizer especially urea. Initially with the

low consumption of gas in the fertilizer sector amid lower capacity installed, gas prices

were competent as compared with the other sectors, industries and international gas

prices. However, with the incremental capacities coupled with depleting reserve of gas,

the feed and fuel stock prices surged with 5-year CAGR of 34% and 13%, respectively.

However, fertilizer manufactures easily managed to pass on this gas prices impact as

urea prices jumped 5-year CAGR at 25% historically. This showed the ability of the

manufactures to easily pass on the impact of gas prices increase to the end consumers.

Even though, this massive passed to the consumers, local urea is still available at a

discount of 22% to the international urea.

Gas and Fertilizer prices Historical Urea and DAP prices

Source: NFDC and AHL Research

0

100

200

300

400

500

600

180

380

580

780

980

1180

1380

1580

1780

1980

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Urea

Feed stock

Fuel stock

PKR/bag PKR/mmbtu

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

C

Y

0

7

C

Y

0

8

C

Y

0

9

C

Y

1

0

C

Y

1

1

C

Y

1

2

C

Y

1

3

T

D

Urea DAP

PKR/bag

24

Engro Fertilizer Limited

Imported urea and its cost to the national exchanger

Moreover the country is facing problem of imported urea which consequently affects the

import bill and costs heavily to the government. It is estimated that Government of

Pakistan (GoP) has borne a subsidy of PKR 50bn on imported urea and PKR 47bn on

natural gas for feedstock purpose (un-budgeted) by the fertilizer industry during FY13.

Moreover, the problem of imported urea is posing a major challenge to the domestic

market because imported urea is sold on a subsidy lower than local urea so local

producers are forced to cut down their prices which is costly.

To make the problem even worse, there is a presence of plants that make inefficient

usage of gas leading to shortages and, hence, an increase in fertilizer prices in peak

seasons results in reduced product offtake.

Local and international Urea comparison Local and international DAP comparison

Source: Bloomberg, NFDC and AHL Research

0%

10%

20%

30%

40%

50%

60%

70%

400

900

1,400

1,900

2,400

2,900

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

PKR/bag

Local urea

Imported urea

Discount (RHS)

-60%

-40%

-20%

0%

20%

40%

60%

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

PKR/bag

Local DAP

Imported DAP

Premium (RHS)

25

Engro Fertilizer Limited

Gas Infrastructure Devel opment Cess (GIDC)

In CY12, the Federal govt applied Gas Infrastructure Development Cess (GIDC) to all

the gas consumers including fertilizer companies, which led gas prices to surge by a

massive PKR 197/mmtbu, translating into a hefty jump of 207% YoY. Following the

imposition of the GIDC, the average urea price per bag went straight up 20% YoY in

CY12. FATIMA and EFERT were the key beneficiaries of the abovementioned Cess

due to their long-term agreements in place with the GoP at subsidized feed-stock price

for ten years. However, only FATIMA enjoyed the aforesaid benefit as EFERT (EnVen

plant) was facing fatal gas curtailment due to shortage of gas on the SNGPL network.

Revision in the GIDC

As per the Budgetary Document for FY13, and the Finance Bill 2012, the govt had

already approved the maximum price of GIDC, i.e PKR 300/mmbtu. However, GIDC for

CY13TD remained intact at PKR 197/mmbtu, which is expected to be the same for the

rest of CY13 as well. Our discussion with the industry reveals that urea manufacturers

are not in a position to bear such a massive hike in gas prices (+52% from current

levels) and, thus, passing on this impact in the urea prices, once increased, would be

the eventual reality.

GIDC termed illegal

On the other hand, the Lahore High court has issued the stay order on GIDC, terming it

illegal. Though the sectors are still paying GIDC but the govt is not allowed to utilize

these funds amid court stay order on the same.

IMF Extended Funds Facility: gas levy on the cards?

To recall, in its Letter of Intent with the IMF, the govt is principally agreed to raise 0.4%

of GDP, ~PKR 105bn, as gas levy. The govt could easily raise this amount by replacing

GIDC to the proposed gas levy. The table below summarizes the collection of GIDC

during FY12, which shows that govt could easily manage and raise PKR 111bn from

this surcharge.

Domestic 261,915 256,676,700 - -

Commercial 39,627 38,834,460 - -

Gen. Industries 286,055 280,333,900 50 14,016,695,000

Pakistan Steel Mills 10,125 9,922,500 - -

Cement 1,266 1,240,680 50 62,034,000

Fertilizer (as Feedstock) 168,694 165,320,120 197 32,568,063,640

Fertilizer (as Fuel use) 43,134 42,271,320 50 2,113,566,000

Power 358,381 351,213,380 100 35,121,338,000

Transport (CNG) 119,000 116,620,000 232 27,030,183,600

Tot al 1,288,197 1,262,433,060 110,911,880,240

Source: EYB, AHL Research

Nat ur al Gas Cons umpt ion By Sect or

2011-12

mmcf t mmbt u

GIDC

(PKR/mmbt u)

Collection fr om

GIDC (PKR)

Sector

Gas prices trend for fertil izer sector

Source: EYB and AHL Research

0

100

200

300

400

500

600

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Feed stock Fuel stock

GIDC

PKR/mmbtu

26

Engro Fertilizer Limited

What is the Long-term gas plan?

The govt has approved long term gas plan for fertilizer consortium, from which all the

companies on the SNGPL network would receive gas from dedicated gas fields. The

companies includes, Engro Fertilizer Limited (79mmcfd), Dawood Herculus Fertilizer

(40 mmcfd), PakArab Fertilizer Limited (58mmcfd) and Agritech Limited (25 mmcfd).

Whats in store for EFERT?

EFERT would receive 79 mmcfd of gas from long term gas plan. The breakup of the

aforesaid plan is given below in the tables. Furthermore, The ECC has already

approved the diversion of allocated gas from EFERT's old plant to its new plant till the

implementation of long term gas plan. However, the long-term plan is scheduled to take

around 11 months for completion (operational from 4QCY14).

GSAs with the field operators

As per the KSE notice, the Gas Sale Agreement (GSA) between EFERT and the two

fields i.e. Kunnar Pasaki Deep and Reti Maru has been signed while the term sheet has

been signed between EFERT and Mari SML. Furthermore, the company is drawing

~22mmcfd from Mari SML while Reti Maru is expected to come online by the end of

CY13. As far as gas price is concerned, the weighted average gas price would be

~USD 4.0/mmbtu ~USD 4.5/mmbtu.

Long term plan

Fields mmcfd Availability Timeframe

Kunnar Pasaki Deep 130 Oct-14

Mari SML 22 EFERT drawing

Bahu 15 NA

Reti Maru 10 Dec-13

Markori East 25 J an-14

Total 202

Source: A HL Research

Short term plan

Fields mmcfd Availability Timeframe

Mari SML 22 EFERT drawing

Reti Maru 10 Dec-13

Sara West - NA

Total 32

Source: AHL Research

Companies mmcfd

Engro Fertilizer 79

DH Fertilizer 40

Pak Arab Fertilizer 58

Agritech Limited 25

Total 202

Source: AHL Research

Long term gas plan break up

27

Engro Fertilizer Limited

Pricing scenario; price cut seems a far cry!

On the product pricing side, we rule out any price cuts in CY13 and CY14 (post long

term gas plan) mainly due to unavailability of gas on an immediate basis coupled with

higher gas pricing scenario in long term gas plan. Instead, bright possibility exists for

urea price augmentation (to pass on price to consumer), when OGRA is expected to

increase gas sale prices expected soon.

Other side of the story post long-term gas plan

With the successful implementation of the long-term gas arrangement plan assuming

gas price, for plants operating on the SNGPL network, at USD 5.0/mmbtu or ~PKR

535/mmbtu (excluding EFERT, FFC ad FFBL), we expect urea price to rather be raised

from 4QCY14 onwards.

In this regard, as per our calculations, the price for the 17% of the total urea production

(or 0.9mn tons) should be increased by PKR 221/bag (see table below). Particularly, the

cost for EFERTs EnVen could jump by PKR 392/bag or 509% post gas-price increase

(from USc70/mmbtu to USD4.26/mmbtu). However, weighted average gas cost for

EFERT should lead to a hike of PKR 224/bag post long-term plan.

Hence, after the proposed scenario, cost of 34% of total urea production (~2.1mn tons)

is expected to increase by an average PKR 224/bag. Conclusively, going forward, we

do not expect any price reduction from fertilizer companies, hence as analysis shows on

average urea prices are expected to increase by PKR 224/bag once the long-term plan

is in place primarily on account of increase in gas costs. The table further elaborates:

FFC and FATIMA stand as key beneficiaries of price hike

FFC and FATIMA would remain major beneficiaries with respect to any increase in urea

prices ahead, post long-term gas plan. FFC being the major player in the industry is

expected to enjoy windfall gains in this regard while FATIMA would benefit the most

courtesy its subsidized gas agreement with MARI Gas at USc 70/mmbtu.

Gas Pri ce (PKR/mmbtu) Producti on

New Ol d New Ol d mn tons New Ol d

FFC 320 320 24.00 7,680 7,680 2.04 120% 2.45 18,819 18,819

ENGRO (Old) 320 320 23.50 7,520 7,520 0.98 90% 0.88 6,599 6,599

ENGRO (Enven) 426 70 22.00 9,372 1,540 1.30 90% 1.17 10,965 1,802

FFBL 320 320 24.50 7,840 7,840 0.50 50% 0.25 1,960 1,960

FATIMA 70 70 21.00 1,470 1,470 0.50 90% 0.45 662 662

PAK Arab 500 320 24.50 12,250 7,840 0.09 90% 0.08 1,014 649

Agritech 500 320 24.50 12,250 7,840 0.47 90% 0.42 5,149 3,295

Dawood Herculis 500 320 24.50 12,250 7,840 0.45 90% 0.40 4,906 3,140

6.10 50,074 36,925

Gas Cost (PKR mn)

Company

Per ton Feed Gas Cost

Uti l i sati on Capaci ty Conversi on

Urea pricing in CY13TD

Source: NFDC and Bloomberg

1,600

1,800

2,000

2,200

2,400

2,600

2,800

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

Imported Local PKR/bag

PKR/ton PKR/bag

Increase in Feed gas cost for plants on SNGP excluding ENGRO 4,410

221

Increase in Feed gas cost for ENGRO's ENVEN 7,832

392

Weighted Avg. increase in Feed Stock Cost for Efert 4,475

224

Source: AHL Research

28

Engro Fertilizer Limited

Outl ook

Macro outlook

For the economy of Pakistan to prosper, it is important for agricultural yields to go up

which is only possible through the application of fertilizers in the right quantity at the

right time. However given the current situation of the Pakistan economy, the importance

of fertilizers cannot be overlooked considering it has a direct impact on the growth,

output and economic activity of the agriculture sector. Hence, the govt is making

continuous efforts to tackle gas shortage issues through new exploration projects.

However, at this point in time gas shortage and import threat continue to pose a major

challenge to the entire sector.

Sector prospects

As far as sector outlook is concerned, we expect the sectors urea offtake to grow by

5% YoY in CY13. Our assumption with respect to growth in urea offtake mainly stems

from: 1) increase in Wheat Support Price to PKR 1200/maund, 2) low interest rates to

provide farmers with cheap agri-loans, and 3) better demand due to increased

cultivatable areas with improving yields amid favorable weather conditions last year

(absence of massive floods).

Urea production and offtake DAP production and offtake

Source: NFDC and AHL Research

Impact of the long-term gas plan

As far as the long-term gas plan goes (gas pipeline to SNGPL network), we expect its

materialization from 4QCY14 onwards and the impact on the companies earnings from

there onwards. Product prices may then be interesting to track as we expect a notch-up

given higher gas prices along with pipeline expenditures incurred by the beneficiaries.

2.0

2.5

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

2

0

0

7

A

2

0

0

8

A

2

0

0

9

A

2

0

1

0

A

2

0

1

1

A

2

0

1

2

A

2

0

1

3

E

mn tons

Production Offtake

0.20

0.40

0.60

0.80

1.00

1.20

1.40

1.60

1.80

2

0

0

7

A

2

0

0

8

A

2

0

0

9

A

2

0

1

0

A

2

0

1

1

A

2

0

1

2

A

2

0

1

3

E

mn tons

Production Local Offtake

29

Engro Fertilizer Limited

Key ri sks

Gas unavailability

The key risk remains the unavailability of gas to the fertilizer plants, especially on the

SNGPL network. In this regard, the materialization of the long-term plan and its timings

are very crucial for the plants operating on the SNGPL network.

Price reduction

Alongside, pricing risk prevails, as the govt may pressurize the manufacturers to cut

urea prices due to the plants utilizing its optimal capacities once the govt fulfils its

commitment for the dedicated gas supply to all the companies operating on the SNGPL

network. However, we believe the probability of this risk is low, as the govt is assuring

gas supply to all the plants on SNGPL but at a significantly higher gas rate (56% higher

than current levels) than the industry.

Imported urea

Additionally, the imported urea could be a threat to local manufacturers due to its

subsidized price. The difference between the subsidized and the local prices is

negatively related to the local sales. The GoP has already approved import of 0.5mn

tons of urea for the upcoming Rabi season. This remains a threat in the short term.

Political risk / GoP priority

Political instability coupled with govt stance and how it prioritizes gas allocation to the

fertilizer sector would clarify the future of the fertilizer sector. However, with the long-

term gas plan already approved, chances of gas curtailment would minimize as the

plants operating on the SNGPL network would receive gas from the dedicated fields.

30

Engro Fertilizer Limited

Page l eft bl ank i ntenti onall y

31

Engro Fertilizer Limited

Annexure

Essentially, Fertilizer products are variations of three primary soil nutrients, namely

nitrogen (N), phosphorous (P) and potassium (K). It is the suitability of a nutrient for

crop that determines the usage of a particular fertilizer product. Pakistans soil is

deficient in nitrogen and phosphate; thereby an optimal combination of these nutrients is

necessary to achieve higher yield levels. There are three types of fertilizer available in

the market namely, nitrogenous fertilizers, phosphorous fertilizers and potash fertilizers.