Professional Documents

Culture Documents

014 Iccsm2012 S0019

Uploaded by

asstt_dir_pndOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

014 Iccsm2012 S0019

Uploaded by

asstt_dir_pndCopyright:

Available Formats

Lessons from Merger and Acquisition Analysis

Gurkirat Singh

1

, Pankaj Maan

1

and V.B. Khanapuri

2

1

Student, PGDIM, National Institute of Industrial Engineering (N I T I E), Vihar Lake, Mumbai, India

2

Faculty, National Institute of Industrial Engineering (N I T I E), Vihar Lake, Mumbai, India

Abstract. The Merger and Acquisitions (M&As) activity is influenced by a multitude of factors (like

strategic, behavioural, and economic). It is a particular aspect of the M&A process, where the acquirer holds

a vision with its own distinctive competitive strategy, accordingly tries to dictate the future developments in

the post-merger scenario. Consequently, the resulting post-merger entity undergoes evolution and partake

some actions leading to strategic-fit cohesion.

Also, such state of affairs directly affects different entities of the value chain. Developing on these lines,

this paper tries to analyze M&A in different industries and identify the key factors that led to success/failures

of these M&As.

Keywords: Mergers and Acquisitions, Reasons for failures, Business associations

1. Introduction

During the last few decades the business landscape has been deeply impacted by the globalization. Firms

can no longer expand by embracing part-by-part approach for diverse markets, while ignoring the spillover

and transmission effect of the elements constituting the economic scene. The outlook needs to be

comprehensive and prudent for surviving in todays business scene. Furthermore, the existence of

multinational firms along with domestic ones makes the sustenance all the more challenging. Organizations

have options to grow by selecting organic or non-organic approaches to outperform competitors [1]. Under

organic growth strategy, companies work upon their core competencies, which do not diminish, but have

their own life cycles [2]. To accelerate the business growth companies have now accepted the inorganic

growth strategies, where businesses try to align with other businesses, which closely resonate with their core

strategic objectives [3]. At the same time other researchers have highlighted the need for cautious and well-

planned integration strategies which eventually lead to sustainable learning outcomes that holds potential to

unlock desirable synergies between entities. Additionally, the researchers emphasize that the end objectives

and characteristics of the involved entities make each M&As unique [4].

Most of the firms today understand these and therefore following channels have emerged and are widely

accepted as part of companys growth strategy: Mergers, Acquisitions [5], Takeovers - Friendly, Hostile,

Reverse & Back flip [6][7], and Others (like Dawn Raid, Poisson Pill, etc).

Among the various inorganic approaches, a merger involves two equal entities combining into one, and

acquisition involves a company acquiring controlling stake in another. Apart from these routes there exists

another approach i.e. takeover, in which a company makes a bid for a target company. An analysis of the

different M&As across different sectors has been presented in the following section and based on the

understanding key dimension have been identified.

2. Analysis of historic business scenarios

Over the years such activities have taken place across business sectors. In the same light few examples

have been identified, based on the analysis of the facts as published in secondary literature. Various M&As

that seemed feasible and imbued with potential, but failed have been analyzed below.

Corresponding author. Tel.: (9823366492)

E-mail address: (saini.gurkirat@gmail.com)

2012 2nd International Conference on Computer and Software Modeling (ICCSM 2012)

I PCSI T vol. 54 (2012) (2012) I ACSI T Press, Singapore

DOI: 10.7763/IPCSIT.2012.V54.14

80

2.1. Automotive Sector

Daimler Benz/Chrysler [8]: Business leaders felt that within four-to-five years the merged entity will be

among the major three automotive companies in the world. However, this did not happen and the prominent

reasons for failure were cultural clash, different market segments, and mismanagement. The huge rifts in

business practice and management approach stay unchanged. Much of the clash was fundamental to unions

of both the companies, which had dissimilar salary structures, hierarchies and values. Chryslers and

Daimler-Benzs brand images were absolutely opposite. Culture clash exist as much amid products as it

existed among the employees. Such clash coupled with dragging sales and recession worked towards

destabilizing the new alliance. Further, various key members of Chryslers management team left and few

key people looked withdrawn after the merger.

New York Central and Pennsylvania Railroad [9]: Merger took place to adjust to unfavourable

industry trends and to restructure operations and diminish the competition. The prominent reasons for failure

were lack of long term planning, cultural clashes, and poor management even in the face of crisis. The

merged entity failed to keep up with mounting employee costs, regulations, and key cost-cuttings. Strict

regulation constrained companys capability to adjust rates charged to shippers/passengers, enforcing cost-

cutting as the sole way to maintain the bottom line.

2.2. Communications Sector

Sprint (S) and Nextel: It was believed that merging opposite ends of a business spectrum would create a

large communication alliance. But reasons like technological issues, not meeting customer expectations, and

cultural differences proved detrimental for the merged entity. Sprint was bureaucratic, whereas Nextel was

entrepreneurial. Sprint had an awful standing in customer service. Post merger, Nextel executives and

managers objected to the cultural differences and left the company in hordes. Unmatched competition

affected the sales severely and the company had to go for lay-offs. Incompatible wireless technologies also

posed a major hurdle for the merged entity.

2.3. Retail Sector

Sears / Kmart [10]: The goal was to do away with Searss traditional base of shopping malls and

purchase of dozens super Kmart locations were seemed ideal for accelerating that process. Apart from that

cost savings in the supply chain and in administrative overhead seemed achievable. But the prominent

reasons for failure which emerged were absence of long-term strategy, unable to compete with existing

competitors, lack of brand, focus on wrong category of products, failure to integrate successfully, and failure

to anticipate customers needs

Quaker/Snapple [11]: Quaker expected benefits by emerging as the third largest beverage manufacturer

and distributor in the U.S. These visions brought both the companies together to realize significant

synergies.The merged entity didnt conduct the transition properly: two of Snapples three founders left the

company and half of its sales division and many executives were forced out. Quakers faced $ 75 million

losses in 1995 due to delay on its part to implementing marketing, operational, and organizational initiatives.

Snapple didnt react quickly enough to changing market conditions and began to experience inventory

management difficulties. Competitors strengths were not analysed correctly and marketing strategy failed to

position Snapple appropriately.

2.4. Others

Time Warner AOL [12]: Warner merged with AOL to effectively distribute its content via online

channels. Pooling Time Warners broadband systems, media contents, and subscribers together with AOLs

brand image, and internet infrastructure would generate noteworthy synergies. Also increases benefits for

customers, international position enhancement, and revenue growth seemed achievable. AOLs was

overvalued due to Internet bubble and was never an equal entity as compared to Warner. The combined

entity failed to implement its vision and communicate it to all the stakeholders; moreover, it proved

unsuccessful to identify new trends in the industry, which specifically were advent of VoIP and broadband.

The proposed synergies never materialized.

81

EBay Skype [13]: The business integration never worked because for customers communicating via

email was good enough to close a deal. Foremost the cultural differences between the two entities were too

huge to overcome; whereas EBay is particularly conservative Skype is all about democratization of voice.

Additionally, Skype changed its management teams too frequently during its four-year interaction with eBay,

highlighting the tremendous inconsistencies.

Mattel/The Learning Company [14]: Mattel desired to transform into a global children's merchandise

company distancing itself from traditional toy manufacturing. The combined entity envisioned huge sales

over the internet channel. Mattel didnt check the significant management turnover, change in American

demographics and distanced itself from the customer preferences, which left it behind in producing

innovative toys. Problems got complicated along with incompatible cultural dissimilarities amid the old line-

manufacturing company and the new market beginner.

From the above understanding different dimensions leading to failure are presented in table 1

Daimler

Benz/

Chrysler

New York Central /

Pennsylvania

Railroad

Sprint (S)/

Nextel

Sears /

Kmart

Quaker/

Snapple

Time

Warner/

AOL

Ebay/

Skype

Mattel

/ The Learning

Company

Cultural clashes

Unequal partners

Technological issues

Unclear strategy

Dissimilar market positioning

Lack of long term planning

Customer expectations not met

Focus on wrong product category

Failed to implement their visions

Failure to predict market trends

Improper integration planning

Mismanagement

Unable to integrate

Operational issues

Improper communication

Table 1: Snapshot of the merger and acquisition analyzed

As can been seen from table 1, based on the failures of different merger, it is seen that cultural

compatibility precipitates as critical criteria while screening a potential firm for M&A. On the other hand a

successful integration strategy can fetch vital leanings out of the inherent cultural differences, and hence

watching for ideal cultural fit may not be the best option [15]. Simultaneously, the successful integration is

rather feasible between diversified organizational cultures [16]. These researches have highlighted the

benefits that cultural diversity can bring for a combined entity, but the only key is to watch for appropriate

business integration process. At the same time analyzing table 1 underscores the significance and enormity

of cultural issues for firms looking for M&A.

Further, from table 1, in line with the findings of [17][18][19] we can conclude that unclear strategies

can create a climate of uncertainty, which severely hampers the speed and effectiveness of integration. The

retention of personnel, proposed leadership, and management team of the post merger entity are the

important factors for successful integration [20]. Looking at above incidents, it can be surmised that things

dont always draw out as expected. There are M&A occurrences where the alliances were recognized with

much salutation, but they failed miserable due to one or the other reasons. The associated reasons appear

very mundane but were either looked over or were not considered having any significant influence over the

integration of the businesses. Therefore another important facet that needs to be appreciated is to agree upon

all the parameters which hold significance in an M&A scenario [21]. The understanding of the different

dimensions with reinforcement of these dimensions as referred in literature can be summarized as

Cultural clashes, Technological mismatch, Unclear strategy and Improper integration planning.

To explore these issues further a parallel has been extended across the few M&A that have taken place in

the recent past and are presented in the following section.

3. Extending the parallel analysis for recent M&As

Further, few of the top and successful M&As for 2010-2011 are:

82

Indian M&A - International [22]

i. Dr. Reddy's Labs acquired Betapharm: This is with the strategic intent of becoming a mid-sized

global pharmaceutical company with strong presence in all key pharmaceutical markets along with strategic

presence in the European market.

ii. Mahindra& Mahindra (M&M) acquired SsangYong: M&M has been on a diversification spree and

the acquisition is a strategic fit for Mahindra. M&M is expecting benefits by harnessing synergies between

the two companies.

iii. Tata Chemicals acquired British Salt: The acquisition is aligned with Tata Chemicals strategy to

increase its existence in the food & farm sectors and will provide raw material from Brunner Mond

operations.

iv. Airtels acquired Zain in Africa: Bhartis acquisition is in line with its strategy to expand into Africa,

which is one of the fastest growing mobile services markets.

International M&A [23]

i. Wal-Mart-Massmart merger: The rationale behind the merger is to expand into Nigeria, the

Democratic Republic of Congo, Angola and Senegal markets. Further Wal-Mart plans to utilize the

acquisition as a springboard to the rest of Africa.

ii. Microsoft acquired Skype: The acquisition will benefit both consumers and enterprise users by

increasing the accessibility of real-time video and voice communications. This will provide new business

opportunities resulting into more revenues. Microsoft will expand its portfolio of products and services, and

Skype will gain an increased reach.

Indian M&A Domestic [24]

i. Reckitt acquired Paras Pharma: The acquisition is in line with the Reckitts growth strategy in

healthcare market in India, which is one of the promising health care markets in the world.

ii. ACC acquired Encore Cement& Additives: The acquisition will help ACC to strengthen its presence

in the coastal Andhra Pradesh where it had no presence, earlier.

iii. GTL Infrastructure acquired Aircel towers: Strategic growth was the driver for the acquisition by

which GTL increased its tower count across all the telecom circles in India.

In the above M&As the objectives for M&A can be clustered under the following heads [27]:

i. Active investing: Leveraged buy-out companies and private equity firms fit here, where they acquire a

company and attempt running it in a more efficiently and profitably manner.

ii. Growing scale: The main aim is to grow scale in specific business elements and become more

competitive, which is not same as simply becoming larger.

iii. Building adjacencies: To expand into adjacent businesses by expanding to new locations, into new

products, to higher growth markets, or looking for new customers.

iv. Broadening scope: The aim is to broaden the scope by buying specific expertise.

v. Redefining business: For redefining a business in situations where an organizations capability,

knowledge, and resources become outdated, for example, due to a major technological change.

vi. Redefining industry: Strategic acquisitions which holds potential to redefine an entire industry,

changing the competition scenarios, and pushing competitors to reconsider their business models.

In line with the different rationale and the factor that can possibly contribute to a successful M&A can be

analyzed by drawing the Similarities that exist between the below alliances

i. The DaimlerChrysler Merger vs. Mahindra-Ssang Yong

ii. The DaimlerChrysler Merger vs. Tata JLR

iii. Sears / Kmart vs. Walmart-Massmart

iv. EBay / Skype vs Microsoft (Skype)

As an extension to this study, analysis to draw out similarities in business operations and objectives of

historic M&As and few of the recent mergers can be taken up. Further, leanings derived from the published

P

literature can be used to analyze them in the light of the factors that can contribute to successful integration

of the companies involved in M&As and further extend the study to understand the implication of the

different value chain partners of the merged entities.

4. Conclusion

The paper analyzes the past failures in M&As and establishes the importance of the various factors like

cultural clashes, technological mismatch, unclear strategy, and improper integration planning. These factors

if not considered during the establishment of plausible challenges in the post M&A scenario, can lead to

integration complexities or under achievement of desired synergies. Hence in todays business scene where

inorganic approaches have become norms for the future growth, companies must come up with a holistic list

of parameters for successful integration and extend this beyond the merged entities to the different value

chain partners of the merged entities.

5. References

[1] Vermeulen F. and Barkema, H. (2001), Learning through acquisitions, Academy of Management Journal, Vol.

44, pp. 457-77

[2] C.K. Prahalad, and Gary Hamel (2003), The Core Competence of the Corporation, Harvard Business School

Publishing Corporation

[3] Jarrod M., Max C., and Paul D. L. (2005) Planning for a successful merger or acquisition: lessons from an

Australian study Journal of Global Business and Technology, Volume 1, Number 2, Fall 2005

[4] Wayne Holland, Alzira Salama, (2010),"Organisational learning through international M&A integration strategies",

The Learning Organization, Vol. 17 Iss: 3 pp. 268 283

[5] Making the most of growth opportunities: Strategies for success",Strategic Direction,Vol.22 Iss: 8pp. 26-29

[6] Hongbo Pan, Xinping Xia, Minggui Yu, (2006),"Managerial overconfidence and corporate takeovers",

International Journal of Managerial Finance, Vol. 2 Iss: 4 pp. 328 342

[7] Richard Gilman, Peng S. Chan, Mergers and Takeovers, Management Decision, Vol. 28 Iss: 7

[8] http://mba.tuck.dartmouth.edu/pdf/2002-1-0071.pdf

[9] http://www.buyandhold.com/bh/en/education/history/2001/the_collapse_of_penn_central.html

[10] http://www.washingtontimes.com/news/2011/dec/29/sears-kmart-failed-to-anticipate-their-customers-n/?page=all

[11] http://www.nytimes.com/1994/02/24/business/partners-in-a-failed-merger-2-very-different-companies.html

[12] http://news.cnet.com/Case-accepts-blame-for-AOL-Time-Warner-debacle/2100-1030_3-5534519.html

[13] http://www.pcworld.com/article/171267/skype_ebay_divorce_what_went_wrong.html

[14] John W. Torget (2002), Learning from Mattel, Tuck School of Business, Dartmouth

[15] Cartwright, S. and Cooper, C.L. (1993), The role of culture compatibility in successful organizational marriage,

Academy of Management Executive, Vol. 7, pp. 57-70.

[16] Buono, A.F. and Bowditch, J.L. (1989), The Human Side of Mergers and Acquisitions, Jossey-Bass, San

Francisco, CA.

[17] Lynch J.G., Lind B. (2002), "Escaping merger and acquisition madness", Strategy & Leadership, Vol. 30 No.2,

pp.5-12.

[18] Orit Gadiesh, Charles ormiston, and Sam Rovit, (2003), Achieving an M&As strategic goals at maximum speed

for maximum value, Strategy & leadership, Vol. 31 no. 3, pp. 35-41.

[19] Vassilis P. (2007),"Growth through mergers and acquisitions: how it won't be a loser's game", Business Strategy

Series, Vol. 8 Iss: 1 pp. 43 50

[20] Noormala A., Faizah M. K., Raedah S., and Siti J. H.(2011), What drives and crushes merger and acquisition? A

review of merger & acquisition exercise of major companies in Malaysia, 2nd International Conference on

Business and Economic Research (2nd ICBER 2011) proceeding.

[21] Christine T.W. Huang, Brian H. Kleiner, (2004),"New developments concerning managing mergers and

acquisitions", Management Research News, Vol. 27 Iss: 4 pp. 54 62.

[22] http://www.thehindubusinessline.in/2006/02/17/stories/2006021704950100.htm

[23] http://online.wsj.com/article/SB10001424052702303657404576357132239525222.html

[24] Orit Gadiesh and Charles Ormiston, (2002) "Six rationales to guide merger success", Strategy & Leadership, Vol.

30 Iss: 4, pp. 13-18.

84

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Quiz 1 & 2 - MidtermDocument11 pagesQuiz 1 & 2 - MidtermJoshua Cabinas100% (4)

- SSU-Sindh Police Sample PaperDocument14 pagesSSU-Sindh Police Sample Paperasstt_dir_pnd100% (2)

- SSU-Sindh Police Sample PaperDocument14 pagesSSU-Sindh Police Sample Paperasstt_dir_pnd100% (2)

- Problem Set Capital StructureDocument2 pagesProblem Set Capital StructureBaba Nyonya0% (1)

- IB, PE & VC Recommended ResourcesDocument1 pageIB, PE & VC Recommended ResourcesRoll 16 Ritik KumarNo ratings yet

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONBăýŕęm Bęn100% (1)

- Target Copo. Ackman Vs The BoardDocument3 pagesTarget Copo. Ackman Vs The BoardAshutosh K TripathyNo ratings yet

- Micr Biology: Microbial Diseases of The Nervous SystemDocument42 pagesMicr Biology: Microbial Diseases of The Nervous Systemasstt_dir_pndNo ratings yet

- SBP-BSC Assistant Director (OG-3) Sample PaperDocument11 pagesSBP-BSC Assistant Director (OG-3) Sample Paperasstt_dir_pndNo ratings yet

- Contact Us: PEC ProfileDocument7 pagesContact Us: PEC Profileasstt_dir_pndNo ratings yet

- Syed Tanvir AhmedDocument30 pagesSyed Tanvir Ahmedasstt_dir_pndNo ratings yet

- Sample Paper NAT IIPDocument11 pagesSample Paper NAT IIPasstt_dir_pndNo ratings yet

- UMBREENDocument9 pagesUMBREENSaleha AliNo ratings yet

- SC Judgement 12 Jun 2015 PTET PTCL Appeals DismissDocument20 pagesSC Judgement 12 Jun 2015 PTET PTCL Appeals Dismissasstt_dir_pndNo ratings yet

- PILDATLegislativeBrief20 ProtectionofPakistanAct2014Document8 pagesPILDATLegislativeBrief20 ProtectionofPakistanAct2014asstt_dir_pndNo ratings yet

- Sample Paper NAT IIBDocument11 pagesSample Paper NAT IIBasstt_dir_pndNo ratings yet

- NTS GAT Test Sample Paper of PharmacyDocument12 pagesNTS GAT Test Sample Paper of Pharmacyasstt_dir_pndNo ratings yet

- Law Constitution Sample Paper 1Document9 pagesLaw Constitution Sample Paper 1sah108_pk796No ratings yet

- NTS User GuideDocument142 pagesNTS User Guideasstt_dir_pndNo ratings yet

- Sample Paper PVTC: Building Standards in Educational and Professional TestingDocument6 pagesSample Paper PVTC: Building Standards in Educational and Professional Testingsamey21No ratings yet

- GAT Sample Paper CDocument9 pagesGAT Sample Paper Cyampire100% (1)

- Sample Paper State Bank of Pakistan 2014Document7 pagesSample Paper State Bank of Pakistan 2014asstt_dir_pndNo ratings yet

- List of Institute of PGDM With Affddress 05.05.2014Document6 pagesList of Institute of PGDM With Affddress 05.05.2014asstt_dir_pndNo ratings yet

- NTS GAT Test Sample Paper of PharmacyDocument12 pagesNTS GAT Test Sample Paper of Pharmacyasstt_dir_pndNo ratings yet

- Public Policy-Formulation and Implementation: (A Review Is Being Submitted As A Partial Requirement of The Course)Document5 pagesPublic Policy-Formulation and Implementation: (A Review Is Being Submitted As A Partial Requirement of The Course)asstt_dir_pndNo ratings yet

- Modern South AsiaDocument11 pagesModern South Asiaasstt_dir_pndNo ratings yet

- List of Behavioral Interview Qs111Document2 pagesList of Behavioral Interview Qs111asstt_dir_pndNo ratings yet

- LUMS LMAT SampleDocument15 pagesLUMS LMAT Sampleasadiqbal127No ratings yet

- Research Propsal 2fDocument12 pagesResearch Propsal 2fasstt_dir_pndNo ratings yet

- PPP Guidance Manual EnglishDocument62 pagesPPP Guidance Manual EnglishIgnacio TrujjilloNo ratings yet

- In The Name of AllahDocument16 pagesIn The Name of Allahasstt_dir_pndNo ratings yet

- Public Policy Making in PakistanDocument26 pagesPublic Policy Making in Pakistanasstt_dir_pnd75% (16)

- Benazair Bhutto Plus MinsDocument4 pagesBenazair Bhutto Plus Minsasstt_dir_pndNo ratings yet

- Final Report On Mianwali Final FreeDocument19 pagesFinal Report On Mianwali Final Freeasstt_dir_pndNo ratings yet

- Corporate Governance Review: Aw EviewsDocument28 pagesCorporate Governance Review: Aw EviewsNico B. ValderramaNo ratings yet

- TroughDocument23 pagesTroughpujabookNo ratings yet

- ACCTG 124 Chapter 7Document5 pagesACCTG 124 Chapter 7John Vincent A DioNo ratings yet

- HR ITcompanies BengaluruDocument68 pagesHR ITcompanies BengaluruBullzeye Strategy100% (1)

- February 2004,:::::: (Nasdaq)Document5 pagesFebruary 2004,:::::: (Nasdaq)Danish D KovilakathNo ratings yet

- CFA CaseDocument8 pagesCFA CaseAnonymous yBhSg7vdNo ratings yet

- India Secretarial Practice 2020 CDocument28 pagesIndia Secretarial Practice 2020 CHaresh SwaminathanNo ratings yet

- Partnership Dissolution New FormatDocument13 pagesPartnership Dissolution New FormatJarold MatiasNo ratings yet

- GML Investissement Ltée AND Ireland Blyth Limited: Amalgamation ProposalDocument44 pagesGML Investissement Ltée AND Ireland Blyth Limited: Amalgamation Proposalelvis007No ratings yet

- Quiz - Quiz 1 Final AnswersDocument12 pagesQuiz - Quiz 1 Final AnswersShiela MayNo ratings yet

- Balancing SEBI Regulations in Overseas M&ADocument5 pagesBalancing SEBI Regulations in Overseas M&ASatyakam MishraNo ratings yet

- Problem: I - Comprehensive Problem: Goodwill Computation With Contingent ConsiderationDocument5 pagesProblem: I - Comprehensive Problem: Goodwill Computation With Contingent Considerationasdasda100% (4)

- I Am Sharing 'Afar Quiz' With YouDocument20 pagesI Am Sharing 'Afar Quiz' With YouAmie Jane MirandaNo ratings yet

- Shelf ProspectusDocument583 pagesShelf ProspectussohamNo ratings yet

- LLP Form Ix Notice To Partners For Providing Particulars of Ultimate Beneficial OwnersDocument2 pagesLLP Form Ix Notice To Partners For Providing Particulars of Ultimate Beneficial Ownerszeeshan zahidNo ratings yet

- Problem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreDocument17 pagesProblem 1. The Balance Sheet of PX and SV Corporations at Year End 2007 AreMark Angelo BustosNo ratings yet

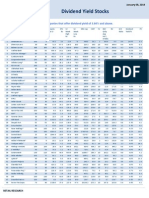

- High Dividend Yield StocksDocument3 pagesHigh Dividend Yield StockskaizenlifeNo ratings yet

- Companies Act 2013Document4 pagesCompanies Act 2013Y TEJASWININo ratings yet

- Classification of CorporationDocument3 pagesClassification of CorporationHazel OnahonNo ratings yet

- TFS New 22Document2,385 pagesTFS New 22darshil thakkerNo ratings yet

- Preliminary Placement Document2018 PDFDocument624 pagesPreliminary Placement Document2018 PDFAnonymous NFkdXNNo ratings yet

- Corporate Governance Codes Around the WorldDocument43 pagesCorporate Governance Codes Around the WorldJohn Edward PangilinanNo ratings yet

- Sterling Bank PLC and Equitorial Trust Bank PLC Sign Transaction Implementation AgreementDocument2 pagesSterling Bank PLC and Equitorial Trust Bank PLC Sign Transaction Implementation AgreementSterling Bank PLCNo ratings yet

- Company LawDocument240 pagesCompany LawVinod GodboleNo ratings yet

- BIWS LBO Quick ReferenceDocument24 pagesBIWS LBO Quick Referenceallrightsreserved21No ratings yet