Professional Documents

Culture Documents

Nord Performance

Uploaded by

api-2586008500 ratings0% found this document useful (0 votes)

402 views3 pagesOriginal Title

nord performance

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

402 views3 pagesNord Performance

Uploaded by

api-258600850Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

2013 PERFORMANCE:

Nordstroms business strategy is strongly focused on customer centric aspects. By

continuing to make investments in their stores and online as well as enter into new

markets, they can achieve their goal of growth across the board. They believe that their

investments in their customer strategy will help them achieve long term top-quartile

shareholder returns through high-digit total sales growth and

return on invested capital.

The Managements Discussion and Analysis of Financial Condition and Results of

Operations portion on the Annual 10K form provides a lot of insight on the performance

of Nordstrom during 2013 and previous years. Some mentioned milestones achieved

include the following:

Record High in Sales, Earnings Per Diluted Share, and Cash Flow from Operations

Fifth consecutive year generating over one billion dollars from cash flow operations

Return on Investment Capital of 13.6% while increasing Capital Investments by over

50%

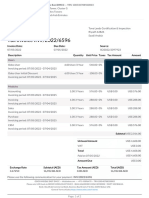

Below is a summary of Nordstroms business over the last three years:

Their total net sales increased 3.4% in 2013 and individual stores sales increased by

2.5%. They believe this growth is attribute resulting from the expansion of stores. With

their expansion of stores came an increase in the number of Nordstrom Rack stores

(discounted merchandise retailer). An inventory turnover rate decrease was the result of

the Rack stores going from 5.37 times in 2012, to 5.07 in 2013.

Nordstrom increased investing activities largely from 2012 to 2013 going from $369

billion to $822. With these investments, they strived to advance in technology, e-

commerce, and new stores.

The retail industry is a competitive industry. Some of Nordstroms main competitors

participating in the New York Stock Trade include the following:

In the retail stores segment, Nordstrom recently made an improvement in market share.

Below illustrates their market share:

STOCK:

Nordstroms stock is publicly traded in the New York Stock Exchange under the symbol

JWN. As of March 10th, 2014 there was 215,000 common stock holders with

189,692,666 shares of common stock outstanding. Below is a chart found on the Annual

10K form with 2012 and 2013s high and low prices and dividends declared for each

quarter:

Next summary represents the fourth quarter share repurchases:

FUTURE GOALS AND PLANS:

Nordstrom shares suggestions of what future years could look like with continuing

current practices and new possibilities including the following:

Continuing customer strategy with expansion into new markets, acquisitions, and

investments

Transforming of business and finical model as investments are increased

Maintain relationships with employees to effectively attract, develop, and retain future

leaders

Utilize data in strategic planning and decision making

Maintain competitive in marketing and advertising

Focus on timing and amounts of share repurchases or share issuances

Use of efficient and proper allocation of capital resources

Ability to safeguard reputation

Some goals for the results for 2014 are presented on the chart below.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 7 Dividend DecisionDocument21 pages7 Dividend DecisionEkta JaiswalNo ratings yet

- Mytest Coba BusinessDocument2 pagesMytest Coba BusinessDigilib Cambridge TazkiaNo ratings yet

- Fun Shots Photo Booth Marketing PlanDocument5 pagesFun Shots Photo Booth Marketing PlanFateNo ratings yet

- Project: Principles of MarketingDocument11 pagesProject: Principles of MarketingtiloooNo ratings yet

- Mari (Eting: Theory and PracticeDocument12 pagesMari (Eting: Theory and PracticeTewodros KassayeNo ratings yet

- Service-Management Solved MCQs (Set-2)Document8 pagesService-Management Solved MCQs (Set-2)Priyanka KalyanamNo ratings yet

- Odoo INV - 2022 - 6596Document2 pagesOdoo INV - 2022 - 6596Khurram ShahzadNo ratings yet

- Magnum PDFDocument11 pagesMagnum PDFHarman Bhullar100% (1)

- Digital Marketing Is The Promotion of ProductsDocument8 pagesDigital Marketing Is The Promotion of ProductsAkshat AgarwalNo ratings yet

- FII Investment Analysis Across Different Sectors of Indian EconomyDocument30 pagesFII Investment Analysis Across Different Sectors of Indian EconomyAmit TiwariNo ratings yet

- Gold Plus SIP-2Document48 pagesGold Plus SIP-2Diksha LathNo ratings yet

- District Manager Retail Sales Operations in Cleveland OH Resume Michael AokiDocument1 pageDistrict Manager Retail Sales Operations in Cleveland OH Resume Michael AokiMichaelAokiNo ratings yet

- 4BS1 01 Que 20190517Document16 pages4BS1 01 Que 20190517ilovefettuccine75% (4)

- PR and Marketing Firms Finial (Recovered)Document520 pagesPR and Marketing Firms Finial (Recovered)MUHAMMAD SHOAIBNo ratings yet

- Lory'S Dried Fish Store: Business Plan ProposalDocument17 pagesLory'S Dried Fish Store: Business Plan ProposalAnn Kempher Viernes NovalNo ratings yet

- SCM TableDocument5 pagesSCM TableRed VelvetNo ratings yet

- Subscription Incentive For Partners FAQ - Partner Version1Document4 pagesSubscription Incentive For Partners FAQ - Partner Version1Manuel SosaNo ratings yet

- Manufacturers, Suppliers, Exporters & Importers From The World's Largest Online B2BDocument1 pageManufacturers, Suppliers, Exporters & Importers From The World's Largest Online B2BVeysel Gökhan YARARNo ratings yet

- L1 Investment SettingDocument30 pagesL1 Investment SettingTh'bo Muzorewa ChizyukaNo ratings yet

- MCQ On Customer RetentionDocument5 pagesMCQ On Customer RetentionSimer Fibers100% (1)

- Market Analysis Tools and Techniques + PDF - Google SearchDocument2 pagesMarket Analysis Tools and Techniques + PDF - Google SearchARUN0% (1)

- Nivea 13 FullDocument4 pagesNivea 13 FullNikhil AlvaNo ratings yet

- 5-Fixed Asset ListDocument3 pages5-Fixed Asset ListFadhlurrahmi JeonsNo ratings yet

- Iridium Case Study InstructionsDocument3 pagesIridium Case Study InstructionsAnkush AgrawalNo ratings yet

- Eco - Module 1 - Unit 3Document8 pagesEco - Module 1 - Unit 3Kartik PuranikNo ratings yet

- FPA SystemDocument21 pagesFPA SystemVicaas VSNo ratings yet

- Polaroid Case StudyDocument4 pagesPolaroid Case Studyrishabi90No ratings yet

- Charminar Afjal: SynopsisDocument3 pagesCharminar Afjal: SynopsisJagdish KatarkarNo ratings yet

- Ent300 Business Model Canvas: Suka Ice DessertDocument10 pagesEnt300 Business Model Canvas: Suka Ice Dessertnatasha eraforceNo ratings yet

- Managing The Marketing ChannelDocument22 pagesManaging The Marketing Channelazeemsam100% (1)