Professional Documents

Culture Documents

Schneider Electric Infrastructure LTD

Uploaded by

Shruti Das0 ratings0% found this document useful (0 votes)

122 views22 pages1

Original Title

Schneider Electric Infrastructure Ltd

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

122 views22 pagesSchneider Electric Infrastructure LTD

Uploaded by

Shruti Das1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 22

Schneider Electric Infrastructure Ltd

Parent Company Schneider Electric

Category Electrical Equipment

Sector Energy Power and Industrial Equipment

Tagline/ Slogan

The global specialist in energy management/Make the most of your

energy

USP

It has a unique vision; Makes high quality infrastructure based on green

technology

STP

Segment

Power Generation and Infrastructure, Green Buildings, Water, Marine, Oil

and Gas

Target Group

Electrical distribution (utilities) and Power generation companies, Electro-

intensive industry,Water & waste treatment plants, Public-sector

investors, Oil & gas infrastructure, Marine sector

Positioning

Global specialist in energy management; Aims to make energy safe,

reliable, efficient, productive and green

SWOT Analysis

Strength

1. Global presence all over the world with 31 manufacturing units spread

across many countries

2. Pioneer in green energy, it has diversified into green energy segment

3. Schneider electric has size advantages which lower its risks. Large size

has ensured Schneider electric gets more resources to pursue new markets

and defend themselves

4. Schneider is a very strong brand. This has enabled it to charge premium

price as its customers place high value the quality which is reflected by

brand

5. High investments in R & D and Superior technology has allowed

Schneider electric to better meet the needs of their customers in unique

ways that rivalscannot simulate

Weakness

1. Schneider made few bad acquisitions. These can increase their costs

and reduce the value of their combined businesses. They can also affect

the core business and merge cultures that are incompatible which can

lower the productivity

2.On the back of shortage of liquidity, the margin is not improving in the

shorter term

3. Bad debts and Financial difficulties with customers have increased the

debtor's provisions affecting profit

Opportunity

1. Incorporating new services and new customized products can help

Schneider electric to better meet their customers needs. Also these can

expand Schneider electrics business and customer base

2.Relaxation of regulations will allow Schneider electric to perform in a

way that is most advantages for them and their customers

Threats

1. A bad economy may slow down its growth and curtail its green

initiatives

2. The dynamic political scenario can increase risk, as governments can

change business rules that may have negative affect Schneider electrics

business

Competition

Competitors

1.ABB

2.Siemens

3.Emerson

Peer Comparison

Company

Market Cap

(Rs. in Cr.)

P/E

(TTM)

(x)

P/BV

(TTM)

(x)

EV/EBIDTA

(x)

ROE

(%)

ROCE

(%)

D/E

(x)

B H E L 58,179.45 16.79 1.76 3.53 23.7 23.4 0.03

Siemens 32,182.54 174.13 7.99 32.11 4.4 5.2 0.00

A B B 21,109.48 112.31 7.88 30.47 6.7 12.5 0.18

Havells India 14,275.66 29.82 6.70 16.30 23.9 28.4 0.08

Crompton Greaves 12,465.62 23.93 3.73 8.27 15.6 21.2 0.00

Suzlon Energy 8,711.43 0.00 3.12 0.00 0.0 0.0 2.09

Alstom T&D India 7,801.84 66.67 6.25 13.06 8.0 13.7 0.57

ALSTOM India 3,320.15 21.44 4.17 5.98 24.8 36.0 0.00

Schneider Elect. 2,993.53 0.00 26.36 65.60 0.0 0.0 0.91

Triveni Turbine 2,981.30 43.65 16.46 9.83 102.7 122.3 0.17

V-Guard Inds. 1,642.94 23.42 5.16 12.77 26.7 26.5 0.58

Techno Elec. 1,547.98 22.08 2.44 8.82 11.0 12.0 0.36

Matra Kaushal 1,169.86 0.00 56.86 0.00 0.0 0.0 0.01

TD Power Sys. 1,167.56 34.34 2.40 9.66 8.0 12.3 0.07

Honda Siel Power 890.14 35.95 3.03 7.64 7.6 11.3 0.00

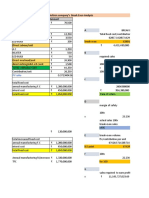

Schneider Electric Infrastructure- Key Fundamentals

Market Cap (Rs Cr.):2,994

EPS - TTM (Rs):-3.66

P/E Ratio (x):-33.61

Face Value (Rs):2.00

Latest Div. (%):20.00

Div. Yield (%):N.A.

Book Value / sh. (Rs) :4.75

P/B Ratio (x):26.36

Schneider Electric Infrastructure- Financials

Q4 / 2014 Ann 2013

Total Income Cr. 304 1,317

EBIT Cr. -7 14

PAT Cr. -36 -28

EPS (Rs.) -1.50 -1.19

Profit & Loss - Schneider Electric Infrastructure Ltd.Rs (in Crores)

Mar'13 Mar'12 Mar'11

12Months 12Months 12Months

INCOME:

Sales Turnover 1310.41 1349.19 .00

Excise Duty .00 .00 .00

NET SALES 1310.41 1349.19 .00

Other Income 0 0 0

TOTAL INCOME 1317.24 1353.50 .00

EXPENDITURE:

Manufacturing Expenses 7.09 6.68 .00

Material Consumed 902.62 959.11 .00

Personal Expenses 148.27 122.44 .00

Selling Expenses .00 .00 .00

Administrative Expenses 219.54 166.63 .02

Expenses Capitalised .00 .00 .00

Provisions Made .00 .00 .00

TOTAL EXPENDITURE 1277.53 1254.86 .02

Operating Profit 32.89 94.33 -.02

EBITDA 39.72 98.64 -.02

Depreciation 25.95 21.50 .00

Other Write-offs .00 .00 .00

EBIT 13.77 77.14 -.02

Interest 31.83 15.85 .00

EBT -18.07 61.29 -.02

Taxes .39 21.53 -.00

Profit and Loss for the Year -18.46 39.76 -.02

Non Recurring Items -10.00 .00 .00

Other Non Cash Adjustments .00 .00 .00

Other Adjustments .00 .00 .00

REPORTED PAT -28.46 39.76 -.02

KEY ITEMS

Preference Dividend .00 .00 .00

Equity Dividend .00 8.01 .00

Equity Dividend (%) .00 16.75 .00

Shares in Issue (Lakhs) 2391.04 2391.04 5.00

EPS - Annualised (Rs) -1.19 1.66 -.32

ACTIVITY

Global Leader In The Field Of Electrical Distribution, Industrial Control & Automation.

Manufacturers & Exporters of Merlin Gerin C60-MCB, Protec-MCB, CG Range-ACB, MCCB,

Contractors, Switch-Disconnecter Fuse Units And LV Switch Boards, Starters, Merlin Gerin - SM6

Switch And Fuse Combination Panels, Package Substation Ring Master Typer MV.

GENERAL INFORMATION

Year Established:1995

www :http://www.schneider-electric.co.in

Type of company :Headquarters

CERTIFICATIONS

Type:ISO 9000

Type:ISO 9001

Type:ISO 14000

BRAND/TRADENAMES

CLIPSAL

MERLIN GERIN

SQUARE D

T.A.C.

TELEMECANIQUE

IMPORT / EXPORT REGIONS

Import regions :

Export regions :

Central/East Europe

Schneider Electric SA is a France-based company that specializes in electricity distribution, automation

management and produces installation components for energy management. The Company has five

divisions organized by business: Energy and Infrastructure, which includes medium and low voltage,

installation systems and control, renewable energies and includes customer segments in Utilities, Marine,

residential and oil & gas sector; Industry, which includes automation & control which includes water

treatment and mining, minerals & metals industries; Buildings, which includes building automation and

security, whose customers are hotels, hospitals, office and retail buildings; Data centres and networks, and

Residential which is engaged in solutions for saving electricity bills by combining lighting and heating

control features. In January 2014, it acquired Invensys PLC. In April 2014, it announced that the

divestiture of IT consulting activities of Telvent Global Services is completed.

Office Location

SCHNEIDER ELECTRIC INDIA (P) (LTD)

9TH FLOOR, DLF BUILDING NO. 10, TOWER C,

DLF CYBER CITY, PHASE II,

GURGAON - 122002

HARYANA, INDIA

TEL: +91 124 3940 400

FAX: +91 124 4222 036

www.schneider-electric.co.in

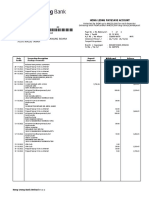

Financing treasury:

Main Group Rules KICs

Cash

Scarcity

Financial

Cost

Risk

Exposure

Financial

Soundness

1. Centralize Cash Csh.04

2. Establish Banking Relations with Preferred

Bank Partners

Csh.06

3. Dividend is equal to the Net Income

4. Set up a Standard Credit Management

Organization

Crt.

01-07

5. Use the Risk Assessment Template for Projects PS.01

6. Carry out Cost Efficiency Actions (Tenders,

Payment Factory)

7. Centralize Foreign Exchange (Forex)

Operations

Csh.05

8. Centralize Metal Hedging

9. Centralize Long Term Debt Management

10. Enforce Mandatory Double Signature Csh.01

11. Enforce Power Delegation Limit

12. Minimum Rating for Cash Investments

Centralize Cash

Rules

o Cash pooling

o Remuneration rates

o Excess cash and Excess cash

o Intra-Group loans

o Netting - General rules

o Netting - Cash flows to be netted

Procedures

o Zero balance account

o Notional cash pool

Key Internal Controls (KIC)

Csh.04

Entities must join the Corporate Treasury cash pooling system. Only because of stringent legal

considerations will entities remain outside the cash pooling mechanism, after approval from Corporate

Treasury.

When in the cash pool mechanism, entities can make daily transfers for amounts as small as 100k. If

cash pool is not possible, cash must be invested in strong currency with banks with a short term rating of

at least A1. Investments in structured products or derivatives are forbidden. Investments above 1 year

must by approved by Corporate Treasury.

Establish Banking Relations with Preferred Bank Partners

Rules

o Privileged bank partners

o Corporate treasury VS Group

companies (Who does what?)

o Counterparty risk

o Joint account - Authorised

signatures

Procedures

o Joint account - Opening

o Joint account - Closing

o Joint account - Monitoring fund

movements and bank balances

Key Internal Controls (KIC)

Csh.06

Opening and closing of bank accounts are performed according to a detailed procedure aligned with Chart

of Authority and involving Corporate Treasury.

Dividend is equal to the Net Income

Rules and Procedures

o Dividends allocation

o Dividends distribution - Exchange rates risks

Set up a Standard Credit Management Organization

Rules

o Group standard organisation of

credit management

o Preventing risk (5 rules)

Procedures

o Opening an account

o Preventing risk

o Managing credit

o Managing credit (4 rules)

o Collecting the cash (3 rules)

o Responsabilities of operational

entities and corporate credit

management

o Collecting the cash

o Opening an account

o Risk control

o Decision on risk taking

o Debt collection

Key Internal Controls (KIC)

Crt.01-07

Click here to read the 7 KICs about Credit Management

Use the Risk Assessment Template (RAT) for Projects

Rules

o General rules

Procedures

o Document to fill in for each project

(download)

Key Internal Controls (KIC)

PS.01

Risk Assessment Template (RAT) to be enforced by Finance as the mandatory control in project selection

phase (bid no bid decision) and for contractual negotiation (for projects above 500k).

Risk Assessment

The Risk Assessment Template (or "the Template") is a Group Procedure including Group Rules

& Questions to deal with before making any final commitment (binding offer, conclusion of

contract...) in relation with sales or projects which are not governed by our General Sales Terms

and Conditions.

The objectives are

To limit the risks and secure the profitability of SE contracts

Homogeneous SE analysis and cover of contracts

To build up SE experience and to share it.

4 fields constitute the Template

Commercial Environment of the Project

Execution & Performance of the Contract

Contractual & Legal Risks

Financial Risks

The Risk Assessment Template is a Group Management Tool

to be aware of the content of our decision in contracting, under the responsibility of the

signatories thereof

to ensure SE commitment is in relation with SE know-how

to refuse SE exposure & liability on part of project not executed by SE.

Its use is mandatory : RAT has to be filled in for each project, the amount of which exceeds 500 kEUR.

Its use is nevertheless recommended when aforementioned limit is not exceeded. The final bid and

contractual documents as well as the Template must remain available for consultation until the project is

completed and all commitments are either fulfilled or waived. The Template is complemented with a list

of Contacts and a Glossary.

Cash pooling

Rules

Cash pooling is the centralisation of the cash positions of subsidiaries.

1. It is mandatory for a company majority-owned (above 50%) by the Group, be it directly or indirectly,

to manage its cash position through the cash pooling system.

2. The selection of the process is up to the Corporate Treasury Dept and may change over time, according

to local regulations.

The Corporate Treasury uses three types of processes:

n Current Account

n Notional Cash Pool

n IG Loans

It is the Corporate Treasury Dept that chooses the process according to legal, fiscal and financial criteria.

Objectives

For Group Companies:

- benefit from interest rates that are lower than those proposed on the market,

- leave the search for financing and investment to Corporate Treasury.

For the Group:

- reduce group debt (and thus improve our rating)

- cut down on banking costs.

Zero blnce ac

Current Account - ZBA

Cash Pooling through Current Account - Zero Balance Account

Agreement through which a subsidiary entrusts its cash management to Boissire Finances.

Minimum balance to be cash pooled

Any need/excess of cash of at least 150 kEUR (or equivalent) should be requested from/transferred to

Boissire Finances. If justified, this minimum amount can be reduced. Depending on the situation,

Corporate Treasury could cap specific current accounts i.e. set a ceiling on a maximum level.

Manual vs. automatic

1. On a Manual Basis

The subsidiaries concerned determine their cash balance on a daily basis. They then either request

the needed funds to Boissire or inform Boissire of the excess funds that will be transferred.

2. On an Automatic Basis (ZBA - Zero Balance Account)

This system works only if Boissire Finances (BF) has opened a bank account (cash pool master

account) with the same bank as the one where the subsidiary's main account is maintained. On an

automatic basis, the subsidiary's balance is set to zero each night, either transferring the needed

funds from BF's account or transferring the excess funds to BF's account. Debit/Credit interests

are charged/credited to the relevant bank accounts according to the terms and conditions

negociated with the bank when the cash pooling system was set up. This system is aimed at

alleviating the subsidiary's cash management burden.

Procedure

Weekly Cash Forecast

Regardless of the system (i.e. manual or automatic), the person in charge of the country cash pool

reports each week (at the latest on Friday), either by fax or Lotus Notes to Corporate Treasury, a

daily cash forecast for the following week.

Bank transfer

Any transfer from/to Corporate Treasury is to be reported in KTP, at 11:00 am (Paris time) at the

latest.

Value Date : equal or higher than the transfer date (no retroactivity)

Interest Rate : determined by the Current Account Agreement.

For French Subsidiaries only

When calling Corporate Treasury to request a transfer, an index is given to the transfer. This

index, that changes the first three digits of the amount to be transferred, identifies and confirms

the transfer.

The first 2 digits identify the number of the transaction and the last one identifies the direction (0

transfer to Sub and 5 : transfer to BF).

Charging the interests

Account Statement

Corporate Treasury prepares each month a provisory statement with all movements, current

account balances and credit/debit interests. This statement can be accessed in KTPWeb. The

statement is sent by mail only to subsidiaries that are not connected to the SWEBI.

Interests

Crediting/Debiting the interests is done on a monthly basis. The relevant interests are posted on

the subsidiary's current account with BF on the 1st working day of the following month.

Notional cash pooling

Notional Cash Pool

Cash Pooling through Notional Account

Notional Cash Pooling is a process whereby different bank account balances are pooled for interest

calculation purposes. Actual bank transfers are not necessary for the process to operate. Debit balances

will offset credit balances before interests are charged or credited to the master account.

Operations concerned

All flows regardless of the balances.

Implementation

Corporate Treasury opens an account (in foreign currency) in the same bank as where the subsidiary's

main current account is maintained.

The terms and conditions of the notional cash pool are negociated by Corporate Treasury directly with the

bank.

How does it work?

Cash Forecast

The person in charge of the country cash pool reports each week (at the latest on Friday), either

by fax or Lotus Notes to Corporate Treasury, a daily cash forecast for the following week

Movement Confirmation

Any movement on the notional account of the subsidiary should be reported through KTP by

10:00 am (Paris time) of the same day at the latest

Charging the interests

Account Statement

The bank counterpart prepares each month a statement of debit/credit accrued interests.

Interests

The interests are credited/debited to the subsidiary's bank account on the first working day of the

following quarter

Ig

Intra-Group Loan

Cash Pooling through Intra-Group Loans

Granting a loan (from Boissire Finance to the subsidiary or the other way around) will take place in one

of the following cases :

Funding of an investment project

Structural need or excess cash

Impossibility to implement either a Current Account or Notional Cash Pool

The decision is up to the Corporate Finance and Treasury Dept. The objective is to reduce the financial

costs.

For more detail, please refer to the Financial Control site.

Excess Cash

Objective

To maintain a level of cash strictly sufficient to enable a smooth functioning of the company.

Principles

Excess cash should be avoided.

n Cash on hand is to be set to a level just high enough to cover the immediate cash outflows and transfers of funds.

n Cash Management aims at keeping a close-to-zero balance on all bank accounts. This requires the negotiation of overdraft facility high enough to avoid the

situation of non-remunerated cash excesses.

n The first source of financing is the excess cash available in group subsidiaries. One should avoid concurrently drawing on lines of credit in one subsidiary

while having cash on hand in another one.

n No exception to this rule is allowed on the investment of excess cash.

Rules

1. A company belonging to the netting centre must declare all its intra-

group flows carried out with netted companies.

-

2.

In the event of a difference in declaration between the Selling Company

and the Buying Company, the Corporate Treasury will choose

the selling Company's position.

Please note that due to legal restrictions, some entities use the buyer's

rule. It will reject any declaration coming from an entity using the

seller's rule or will cancel it if both entities are using the buyer's rule and

have differences between their declarations.

-

3.

The Corporate Treasury will under no circumstances arbitrate in case of

disagreement.

Rules

Bank Relationships

A Group subsidiary (majority owned i.e. > 50%) is allowed to maintain banking relationships with AA-

rated banks only. Any exception to this principle is subject to explicit approval by Financing & Treasury

Dept (FTD).

It is strictly prohibited to open offshore bank accounts without the exceptional and written consent of the

Senior VP Financing & Treasurer. An offshore bank account is any account held outside of the country

where the Schneider Electric subsidiary is incorporated.A Group bank is a bank that supports Schneider

Electric by providing significant funding at better-than-average conditions.

Grouped according to the total amount financed, these banks are :

TIER I CACIB

BOTM

BNP P

BARCLAYS

BANK OF AMERICA

CIC

DEUTSCHE BANK

HSBC

JP MORGAN

RBS

SANTANDER

SOCIETE GENERALE

NATIXIS

TIER II ANZ

CITI

BBVA

ICBC

ING

NORDEA

STAND.CHARTERED

Dividend allocation

Rules for Determination and Payment

Dividend Payment Date - Rule

Rule

To pay out 100 % of the net profit as dividend while taking into account the legal, tax and financing

constraints of the subsidiary.

Principles

After year-end closing, the subsidiary communicates to DFT the net statutory result after tax, the retained

earnings available for distribution, the maximum dividend that can be distributed and hence the resulting

residual retained earnings. It will indicate the possible tax effects of such a distribution. It will also

indicate the earliest possible date for the payment of the dividends.

DFT is the key decision-maker for dividend management and is responsible for

Decisions and modifications agreed upon during the Financial Review Meetings on the amount as

well as the payment date

Hedging and managing the forex risk related to the dividend to be received

Coordinating with :

The Tax Dpt,which monitors the application and compliance with possible deductions,

withholding tax and possible tax credits

The Corporate Accounting Dpt, which properly posts the operations.

Remark about the Withholding TaxIn most cases, the presentation of a Certificate of Domicile allows

the group company to avoid the withholding of a tax on the dividend by relying on the tax treaty between

France and the country where the subsidiary is incorporated.

Steps

1. In first quarter of each year, DFT contacts the subsidiary to confirm the exact amount of

dividends to be distributed based on the final statutory net result of the preceding year and the

decisions made in the financial review meeting.

2. The Board of Directors passes a resolution to authorise the distribution. The actual transfer of

funds is coordinated with the Central Treasury.

3.

1. Wherever it is not forbidden by local law, the dividend should be paid at the latest on the

day following the shareholders assembly which decided the distribution.

2. In the countries where there is a foreign exchange control, the shareholders assemblys

decision of dividend distribution should mention that the decision is subject to the

approval of the countrys central bank or foreign control administration. The dividend is

then effectively paid, at the latest, on the day following the reception of such approval.

( download the attached rule or read it on the related page)

Links

http://www.constructionweekonline.com/article-20973-schneider-electric-pushes-ecostruxure-

system/1/print/

Swebi.schneider-electric.com (intranet)

You might also like

- Casey Loop's Whistleblower Lawsuit vs. The CTADocument18 pagesCasey Loop's Whistleblower Lawsuit vs. The CTAChadMerdaNo ratings yet

- Maintenance - Invoice - Q4 2017 PDFDocument1 pageMaintenance - Invoice - Q4 2017 PDFArunNo ratings yet

- Sap FicaDocument34 pagesSap Ficahoney_213289% (9)

- CommunitiesDocument182 pagesCommunitiesNIPASHUNo ratings yet

- Business Plan Led LightingDocument115 pagesBusiness Plan Led LightingAARON HUNDLEYNo ratings yet

- Strategic Evaluation and ControlDocument26 pagesStrategic Evaluation and ControlShruti DasNo ratings yet

- SAP FI Sensitive T Codes List: General LedgerDocument5 pagesSAP FI Sensitive T Codes List: General Ledgerprakash_kumNo ratings yet

- Cowgirl ChocolatesDocument5 pagesCowgirl ChocolatesAlex Ibarra100% (1)

- Hunter Business GroupDocument2 pagesHunter Business GroupPratyushGarewalNo ratings yet

- A Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaDocument18 pagesA Project Report ON A Study of Promotion Strategy and Customer Perception of MC Donalds in IndiaShailav SahNo ratings yet

- Solution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt, Ireland, HoskissonDocument28 pagesSolution Manual For Strategic Management Concepts and Cases Competitiveness and Globalization 11th Edition Hitt, Ireland, Hoskissona7978571040% (1)

- Penetration of Automobiles in Rural Markets in IndiaDocument105 pagesPenetration of Automobiles in Rural Markets in IndiaANUVRAT DUTTANo ratings yet

- Ogonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsDocument1 pageOgonquit Enterprises Prepares Annual Financial Statements and Adjusts Its AccountsMiroslav GegoskiNo ratings yet

- Guidelines SebiDocument19 pagesGuidelines SebiDylan WilcoxNo ratings yet

- Asian PaintsDocument13 pagesAsian PaintsGOPS000No ratings yet

- Universal Print System LTD.: Vrushank Raut Rahul Satpute Milind Thakur Swapnil WaghDocument15 pagesUniversal Print System LTD.: Vrushank Raut Rahul Satpute Milind Thakur Swapnil WaghMilind ThakurNo ratings yet

- Uv2973 PDF EngDocument15 pagesUv2973 PDF EngAnonymous FARuJreNo ratings yet

- Integrated Logistics SystemDocument11 pagesIntegrated Logistics SystemDivakaran100% (1)

- Team No. 11 Section 3 NAB - THE PLANNING TEMPLATEDocument11 pagesTeam No. 11 Section 3 NAB - THE PLANNING TEMPLATEPRAVESH TRIPATHINo ratings yet

- Pestel Analysis of Royal EnfieldDocument10 pagesPestel Analysis of Royal EnfieldMohanrajNo ratings yet

- Tektronix, Inc.: Global Erp ImplementationDocument30 pagesTektronix, Inc.: Global Erp Implementationjeelani KarimNo ratings yet

- ME15 - Unit 3Document59 pagesME15 - Unit 3Bharathi RajuNo ratings yet

- Ques 1. How Hard Do You Think Installing Otisline Was in 1990?Document1 pageQues 1. How Hard Do You Think Installing Otisline Was in 1990?Rashmi RanjanNo ratings yet

- Micorsoft TransformationDocument7 pagesMicorsoft Transformationlena lesley urusaroNo ratings yet

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalNo ratings yet

- Jakson Evolution of A Brand - Section A - Group 10Document4 pagesJakson Evolution of A Brand - Section A - Group 10RAVI RAJNo ratings yet

- Neewee Intro Solution 2021-04-06 HCHDocument79 pagesNeewee Intro Solution 2021-04-06 HCHtelegenicsNo ratings yet

- Bajaj Lockout Case StudyDocument4 pagesBajaj Lockout Case StudyJayesh RuchandaniNo ratings yet

- Case Analysis: Prithvi ElectricalsDocument4 pagesCase Analysis: Prithvi ElectricalsOishik BanerjiNo ratings yet

- Kingfisher Vs Fosters With Porters Five ForcesDocument32 pagesKingfisher Vs Fosters With Porters Five Forcesvenkataswamynath channa100% (5)

- Endeavour Twoplise LTDDocument4 pagesEndeavour Twoplise LTDHafiz WaqasNo ratings yet

- Zomato Annual Report 2022 1659701415938Document5 pagesZomato Annual Report 2022 1659701415938Mahak SarawagiNo ratings yet

- 612f7302a3a18 Colgate Transcend 2021 Case BriefDocument17 pages612f7302a3a18 Colgate Transcend 2021 Case BriefQuo EtaNo ratings yet

- SM AssignesDocument8 pagesSM AssignesYugandhar MakarlaNo ratings yet

- Writeup-Individual Assignment - 1Document10 pagesWriteup-Individual Assignment - 1Minu kumariNo ratings yet

- Castrol India Limited: An Innovative Distribution Channel - Case SolutionDocument5 pagesCastrol India Limited: An Innovative Distribution Channel - Case SolutionBhaskar SahaNo ratings yet

- Group 13 AirtelDocument53 pagesGroup 13 AirtelShilpa Ravindran100% (1)

- DSCM Cia 1Document62 pagesDSCM Cia 1Albert Davis 2027916No ratings yet

- Turnaround Plan For Linens N ThingsDocument15 pagesTurnaround Plan For Linens N ThingsTinakhaladze100% (1)

- BRM Group Assignment Dettol Group7Document3 pagesBRM Group Assignment Dettol Group7Darpan MahajanNo ratings yet

- DWDG Case 1 - MewDocument3 pagesDWDG Case 1 - MewJAY BHAVIN SHETH (B14EE014)No ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Maruti Suzuki's Manesar Plant - Brief Write-UpDocument2 pagesMaruti Suzuki's Manesar Plant - Brief Write-UpNEERAJ KUMAR KESHARBANINo ratings yet

- SM Simulation Group7 Bright SideDocument18 pagesSM Simulation Group7 Bright SideAvishek PanigrahiNo ratings yet

- Flexcon 1Document2 pagesFlexcon 1api-534398799100% (1)

- Marketing Research On Positioning of Hero Honda Bikes in India - Updated - 2011Document54 pagesMarketing Research On Positioning of Hero Honda Bikes in India - Updated - 2011Piyush SoniNo ratings yet

- Mi Summit 2020 PDFDocument3 pagesMi Summit 2020 PDFKuber SoodNo ratings yet

- Timeshare Resorts and Exchanges, Inc.: BUAD 311 Operation Management Case Analysis 1Document8 pagesTimeshare Resorts and Exchanges, Inc.: BUAD 311 Operation Management Case Analysis 1Anima SharmaNo ratings yet

- Deltron Company's Break Even Analysis Particulars Amount: PV RatioDocument7 pagesDeltron Company's Break Even Analysis Particulars Amount: PV RatiorajyalakshmiNo ratings yet

- BG CaseDocument23 pagesBG CaseTarun SinghNo ratings yet

- Explain Why Strategies FailDocument5 pagesExplain Why Strategies FailTasneem Aferoz100% (1)

- PGP12101 B Akula Padma Priya DADocument20 pagesPGP12101 B Akula Padma Priya DApadma priya akulaNo ratings yet

- Castrol India Limited Group 8Document11 pagesCastrol India Limited Group 8santun kumar SINCE 1997100% (1)

- PPG-Self Directed Workforce Company OverviewDocument3 pagesPPG-Self Directed Workforce Company OverviewKrishNo ratings yet

- By The Sea Biscuit Presentation (Edited by Himanish)Document11 pagesBy The Sea Biscuit Presentation (Edited by Himanish)Himanish BhandariNo ratings yet

- SRM Cases - 34rd BatchDocument17 pagesSRM Cases - 34rd Batchishrat mirzaNo ratings yet

- Phuket Beach HotelDocument7 pagesPhuket Beach Hotelapi-371968733% (3)

- MGEC Session10 SeqandRepGamesDocument61 pagesMGEC Session10 SeqandRepGamesjohn abacusNo ratings yet

- Legal Aspects of Business: Guarantee or Indemnity Catalyst Business Finance Limited V Very Tangy Television LimitedDocument29 pagesLegal Aspects of Business: Guarantee or Indemnity Catalyst Business Finance Limited V Very Tangy Television LimitedAditya PrasadNo ratings yet

- Toon Eneco PDFDocument4 pagesToon Eneco PDFDHEEPIKANo ratings yet

- A1 10BM60005Document13 pagesA1 10BM60005amit_dce100% (2)

- HCL TechnologiesDocument3 pagesHCL Technologiesmcamcamba100% (1)

- Presented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulDocument13 pagesPresented by - Kshitiz Deepanshi Bhanu Pratap Singh Manali Aditya AnjulBhanu NirwanNo ratings yet

- Case: Better Sales Networks by Tuba Ustuner and David GodesDocument16 pagesCase: Better Sales Networks by Tuba Ustuner and David GodesShailja JajodiaNo ratings yet

- 49615Document17 pages49615Deepak ChiripalNo ratings yet

- Schneider Electric Annual Report 2010Document292 pagesSchneider Electric Annual Report 2010denver2kNo ratings yet

- Schneider Electric Annual Report 2012Document320 pagesSchneider Electric Annual Report 2012senthilkumar99No ratings yet

- CBTD Panel Recommends 14 Tax Accounting Standards: ProsDocument5 pagesCBTD Panel Recommends 14 Tax Accounting Standards: ProsKalyan SaikiaNo ratings yet

- Global Competitiveness and Strategic Alliances: DescriptionDocument36 pagesGlobal Competitiveness and Strategic Alliances: DescriptionShruti DasNo ratings yet

- Commodity Boards Unit1Document20 pagesCommodity Boards Unit1Shruti DasNo ratings yet

- Marketing Strategy of Bajaj AutomobilesDocument57 pagesMarketing Strategy of Bajaj AutomobilesShruti Das57% (7)

- Corporation BankDocument31 pagesCorporation BankShruti Das50% (2)

- Satisfaction Level of Employees in WiproDocument74 pagesSatisfaction Level of Employees in WiproShruti Das57% (7)

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikNo ratings yet

- LICENSES Full Documentation STDDocument511 pagesLICENSES Full Documentation STDffssdfdfsNo ratings yet

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- ACCT3004Document8 pagesACCT3004visio2004No ratings yet

- Dimensional Modeling PDFDocument14 pagesDimensional Modeling PDFAnilKumar ReddyNo ratings yet

- Differences Between QuickBooks Pro Premier and EnterpriseDocument7 pagesDifferences Between QuickBooks Pro Premier and Enterpriseathancox5837No ratings yet

- Cost-Volume-Profit Analysis: Additional Issues: Summary of Questions by LearningDocument53 pagesCost-Volume-Profit Analysis: Additional Issues: Summary of Questions by LearningHero CourseNo ratings yet

- Lesson 5 - UNDERSTANDING BASIC ACCOUNTING PRINCIPLEDocument6 pagesLesson 5 - UNDERSTANDING BASIC ACCOUNTING PRINCIPLEMayeng MonayNo ratings yet

- ICON Brochure Low ResDocument4 pagesICON Brochure Low ResLuis Adrian Gutiérrez MedinaNo ratings yet

- Jensen Shoes Jane Kravitz's StoryDocument8 pagesJensen Shoes Jane Kravitz's StoryMayur AlgundeNo ratings yet

- From Pillai's Institute of Management Studies and ResearchDocument45 pagesFrom Pillai's Institute of Management Studies and ResearchfkkfoxNo ratings yet

- Aula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IDocument16 pagesAula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IfelippeavlisNo ratings yet

- HLB Receipt-2023-03-08Document2 pagesHLB Receipt-2023-03-08zu hairyNo ratings yet

- Oval Private Clients BrochureDocument4 pagesOval Private Clients Brochuremark_leyland1907No ratings yet

- Bilal PDF DissertationDocument115 pagesBilal PDF DissertationkamilbismaNo ratings yet

- Estimation and Quantity Surveying 111Document70 pagesEstimation and Quantity Surveying 111Siu EricNo ratings yet

- MECO 121-Principles of Macroeconomics-Daud A DardDocument5 pagesMECO 121-Principles of Macroeconomics-Daud A DardHaris AliNo ratings yet

- I Look Forward To Your Quick Response - Sample LettersDocument6 pagesI Look Forward To Your Quick Response - Sample LettersAzeem ChaudhryNo ratings yet

- Overview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityDocument30 pagesOverview of SME: Rowshonara Akter Akhi Lecturer Jahangirnagar UniversityMehedi HasanNo ratings yet

- A Study On Customer Satisfaction of Santoor Soap Virudhunagar TownDocument2 pagesA Study On Customer Satisfaction of Santoor Soap Virudhunagar Townvishnuvishnu07100No ratings yet

- Hire Purchase and LeasingDocument30 pagesHire Purchase and LeasingShreyas Khanore100% (1)

- Bank CodesDocument2,094 pagesBank CodeskoinsuriNo ratings yet