Professional Documents

Culture Documents

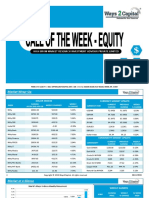

Equity Report by Ways2Capital 07 July 2014

Uploaded by

Ways2Capital0 ratings0% found this document useful (0 votes)

7 views8 pagesWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views8 pagesEquity Report by Ways2Capital 07 July 2014

Uploaded by

Ways2CapitalWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

Web: www.ways2capital.com | Mail: info@ways2capital.

com | Call: 0731-655125

WEEKLY EQUITY REPORT

TECHNICAL VIEW

MOVING AVERAGE 21 DAYS 50 DAYS 100 DAYS 200 DAYS

NIFTY 7615 731! 6!12 6537

BANK NIFTY 1532 1755 13307 12113

NIFTY PIVOT REPORT

DAILY R2 R1 PP S1 S2

"0!6 7"67 7752 763" 70"

WEEKLY R2 R1 PP S1 S2

"05 7!1 770! 777 7013

MONTHLY R2 R1 PP S1 S2

"1!" 7"!2 773! 75"6 72"0

BANK NIFTY PIVOT REPORT

DAILY R2 R1 PP S1 S2

16567 15!17 155!2 15267 1617

WEEKLY R2 R1 PP S1 S2

170"6 160 15523 15002 13!60

MONTHLY R2 R1 PP S1 S2

16622 15!2" 155"1 1523 150

NSE EQUITY DAILY LEVELS

COMPANY NAME R3 R2 R1 PP S1 S2 S3

#CC $% 15"5 151! 1"5 153 11" 13"6 1320

#&'( $% 1! 15 12 10 13" 135 130

#M')*#C$M $% 23" 231 227 22 220 216 20!

#+,#- .#,-/ $% 606 5!7 5!3 5"" 5" 57! 570

#0,+'#-( $% 1!!5 1!6 1!50 1!33 1!1! 1!02 1"72

'#*#*-#)/1 $% 235 2325 2312 22!6 22"3 2267 223"

'#-('213# $% !15 "!3 "" "71 "62 "50 "2"

'#-(,-3,# $% 321 312 30" 302 2!" 2!3 2"3

'4$& $% 27 267 265 261 25" 25 2"

'4#2/,#2/& $% 356 3" 33 30 336 332 325

C,.&# $% 71 5! 5 7 2 36 2

C1#&,-3,# $% 11 02 3!" 3!3 3"! 3" 375

3&5 $% 227 222 220 217 215 212 207

322$336 $% 277! 2725 2701 2671 267 2617 2563

7#,& $% "6 7 6! 63 5" 51 3!

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

72#+,M $% 352 367 32" 33!1 3353 3316 320

4C&/$C4 $% 150! 1!36 1!7 177 171 161 16

435C $% 1053 1030 1021 1007 !!! !"5 !62

435C'#-( $% "!7 "7 "65 "50 "1 "26 "02

4$21M1/1C1 $% 26"! 260 2612 25!2 2563 253 2!5

4,-3#&C1 $% 17! 176 17 172 171 16! 165

4,-3)-,&82 $% 67 636 630 62 61! 612 601

,C,C,'#-( $% 151" 1"6 17 15 12 122 13!0

,/C $% 33 337 335 332 330 327 322

,-3)+,-3 '#-( $% 60! 5"" 57! 56" 55" 57 526

,-56 $% 3351 32!3 326! 323 3211 3176 311"

*,-3#&+/$& $% 35 335 330 326 320 315 306

*.#++1C,#/ $% 7" 75 7 72 71 6! 66

(1/#('#-( $% !1! !02 "!2 "" "7 "67 "!

&/ $% 1"16 177! 1761 173 172 1706 1670

M9M $% 1275 1250 120 122 121 11!! 1173

M25 $% 2556 215! 23!50 23761 23553 2336 22!66

M#2)/, $% 2713 2675 265" 2637 2621 2600 2562

1-7C $% 32 26 1! 1 06 3!3

12,$-/'#-( $% 31 332 327 322 317 312 302

2#-'#06 $% 553 53 53" 533 52" 523 513

2C1M $% 153 1" 15 13 10 13" 133

2$&C#.,/#& $% 6! 673 66 653 6 633 613

2$&,#-C$ $% 10!1 1057 10 102 1022 !!0 !57

2$&,-52# $% "5 "17 "0 7"! 776 760 732

2.1W$2 $% 115 111 110 10" 106 10 101

+',- $% 27!" 27 2721 26!0 2667 2636 25"2

+$+#71# $% 31! 313 30! 306 302 2!! 2!3

+)-.4#2M# $% 727 71" 71 70! 705 700 6!1

/#/#M1/12+ $% "5 77 73 70 65 62 5

/#/#.1W$2 $% 11 110 10" 106 10 102 !!

/#/#+/$$& $% 565 551 5 537 530 523 510

)-,1-'#-( $% 2 236 232 22" 22 220 212

NSE WEEKLY NEWS UPDATE

RBI uses fewer banks to buy foreign exchange

The Reserve Bank of India (RBI) has changed its intervention strategy in the foreign

exchange market for meeting the dollar requirements of state-run oil marketing

companies, as well as for building up its reserves.According to currency dealers, a few

months ago, five to seven state-run nationalised banks used to intervene in the market

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

on a day-to-day basis. Now, a couple of banks intervene, that too, at a level set by RBI.

The same strategy is followed when it comes to selling dollars.

THE RIGHT MOVE

The volatility in the rupee has reduced substantially since September after Raghuram

Rajan took over as the Reserve Bank governor. The changed strategy has benefited the

foreign exchange market. Currency experts believe this strategy may be continued by

the central bank his changed strategy has benefited the foreign exchange market. It is

easier for RBI to manage one or two banks intervening in the market, rather than five

or six banks. Besides, it also helps limit volatility in the market,

Shriram Transport Finance NCD: Lock in for attractive returns

Shriram Transport Finance has come out with a public issue of non-convertible

debentures (NCDs), offering an 11-11.5 per cent interest rate for individuals. Due to

high investor interest, the issue is likely to close today, way ahead of the original close

date of July 22. Investors can subscribe to this NCD to lock into higher fixed returns

before the rate cycle starts to reverse over the next year. For a minimum investment

of ?10,000, the company is offering both cumulative and non-cumulative options across

all tenures.The three-year option offers 11 per cent interest, whereas the five-year and

seven-year option offers 11.25 per cent and 11.5 per cent. The issue has been rated

AA/stable by CRISIL. This implies a high degree of safety regarding timely servicing of

financial obligations and very low credit risk.

Sahara gets Rs 4,860 crore tax demand

The income tax department on Thursday raised an interim demand of Rs 4,860 crore

on the Sahara group even as it is busy selling off assets and mopping up bank accounts

to arrange for Rs 10,000 crore to secure the release of chairman Subrata Roy and two

directors, detained in jail since March 4.

RBI to issue guidelines for bank licences this year

The Reserve Bank of India (RBI) will issue the guidelines that will be used to grant on-

tap and differentiated banking licenses later this year, deputy governor R Gandhi told

reporters on the sidelines of an event on Friday.

India overtakes Germany as Coca-Cola's 6th largest market

India has become the sixth largest market for Coca-Cola by volume sales, overtaking

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

Germany as low price points and wider distribution helped the world's largest

beverages maker increase sales in the second-most populous country. Coca-Cola India

now trails the US, Mexico, China, Brazil and Japan after overtaking 13 global markets

since 2006 when it was ranked 19th, Coca-Cola has posted on its website. Coca-Cola

India now contributes 12% of the company's Asia- Pacific region volume sales.

RBI eases overseas investment norms for Indian corporates

The Reserve Bank today relaxed norms for overseas investment by Indian corporates by

raising their borrowing limit. "It has, however, been decided that any financial

commitment exceeding USD 1 billion (or its equivalent) in a financial year would

require prior approval of the Reserve Bank even when the total financial commitment

of the Indian Party is within the eligible limit under the automatic route...," RBI said in

a notification.

GMR Infrastructure, JP Associates to raise $550 million via QIP

Two infrastructure companies, GMR Infrastructure and JP Associates, hit the capital

markets on Wednesday to raise a total of $550 million (around Rs 3,300 crore) through

the qualified institutional placement (QIP) route which entrails selling equity

instruments to institutional investors. Both issues were primarily intended to repay

debt.

HR Khan back as RBI Deputy Governor

The Government on Thursday re-appointed Harun Rashid Khan as the Deputy Governor

of the Reserve Bank of India. The appointment has been made for two years with effect

from July 4, 2014 or until further orders, whichever is earlier, RBI said. Khan was

appointed deputy governor in July 2011 for a three-year term, which was set to expire

on July 3. As deputy governor, Khan looks after the foreign exchange department and

internal debt management, among others.

Top thermal deal: JSW Energy set to buy Lanco's project for Rs 5,700 crore

JSW Energy Ltd, part of the $11-billion Mumbai-based Sajjan Jindal Group, is set to

acquire Lanco Infratech's 1,200 mw Udupi Power in coastal Karnataka for about Rs

5,700 crore, inclusive of Rs 4,500 crore debt and equity value of Rs 1,200 crore, two

persons familiar with the development told ET. This would be the first acquisition of

such magnitude in the thermal power space in which a domestic firm is acquiring

another fully commissioned power project.

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

SBI targets Rs 2 lakh crore business in Ahmedabad by 2016-17

tate Bank of India (SBI) is targeting business of Rs 2 lakh crore by 2016-17 in

Ahmedabad circle. In 2013-14, SBI did a business of over Rs 1.5 lakh crore with the

deposits and advances growing by over Rs 9000 crore and Rs 7000 crore year-on-year

respectively.

RIL loses appeal against Sebi's consent denial

The Securities Appellate Tribunal (SAT) on Monday dismissed an appeal by Reliance

Industries (RIL) against market regulator Sebi, which had rejected the company's plea

for a consent proceeding in an insider trading case involving shares of Reliance

Petroleum (RPL) in 2007. RPL has since merged with RIL. The case relates to an

alleged act of insider trading in Reliance Petroleum by RIL just before its merger with

RIL. Sebi investigations found that RIL had created a short position in RPL and,

subsequently, sold about 20 crore shares (4.1%) of RPL in the cash segment. This

helped RIL make an "illegal" profit of Rs 513 crore in its short position, and a total

profit of Rs 3.8 crore after taking into consideration the losses it took by selling RPL

shares in the cash segment. Sebi had sent a showcause notice to RIL about the alleged

insider trading. Subsequent to the showcause notice, RIL moved a consent application

in Sebi which, at that time, had allowed the consenting party to neither accept nor

deny any wrongdoing, but pay a fine and settle the charges.

India to implement US foreign tax compliance act: RBI

RBI has said India and the US have agreed to implement a foreign tax compliance law

and asked banks and financial institutions to register by this year-end to report

accounts and assets held by US citizens. India and the US have agreed to implement

Foreign Accounts Tax Compliance Act (FATCA), a US law that targets tax non-

compliance by US taxpayers with foreign accounts. The Inter-Governmental Agreement

(IGA) on FATCA, which came into effect on April 11, will be signed only after Cabinet

approval.

India's forex reserves rise by $1.38 billion

India's foreign exchange (forex) reserves rose by $1.38 billion to $314.92 billion for the

week ended June 20, led by a sharp jump in overseas currency assets, the Reserve Bank

of India (RBI) data showed. The reserves had increased by $950.9 million to $313.53

billion for the week ended June 13. According to the RBI's weekly statistical

supplement, foreign currency assets, the biggest component of the forex reserves,

jumped by $1.37 billion to $287.96 billion.

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

Aban Offshore raises Rs 750 crore by diluting 25 % equity

Aban Offshore, a Chennai-based offshore drilling rig services company, has raised Rs

750 crore through Qualified Institutional Placement (QIP) of equity shares. The

company has diluted 25% of equity and it's shares were oversubscribed by 2.5 times,

according to market experts. In an announcement to BSE, the company said that its

capital Issue committee approved the issuance of 10,783,608 equity shares of face

value of Rs 2 to Qualified Institutional Buyers at an issue price of Rs 695.50 per equity

share, which is at a discount of Rs 36.47 per share to the Floor Price Rs 731.97 per

equity share.

Jain Irrigation gains on Rs 100 cr HP govt order

Jain Irrigation Systems has moved higher by 4% to Rs 126 after the company said it has

been issued a Letter of Intent (LoI) for project by Himachal Pradesh (HP) government

involving an outlay of approximately Rs 100 crore. The project is a unique concept of

integrated micro irrigation system in hilly terrain and will be a one of its kind project in

the world, improving water use efficiency in canal command areas through conduit

distribution and on farm management through micro irrigation systems, using

pressurized HDPE piping network to irrigate command area of 11,900 acres, Jain

Irrigation Systems said in a statement. The stock opened at Rs 120 and hit a high of Rs

128 on National Stock Exchange. A combined 6.77 million shares changed hands on

the counter so far on the NSE and BSE.

Bharti Airtel gains, RBI allows increase in FII limit

Shares in Bharti Airtel Ltd gain after the Reserve Bank of India (RBI) increases limit for

overseas investors to buy shares in the company. Foreign institutional investors can

now invest up to 74% in Bharti Airtel under the portfolio investment scheme, the RBI

said in a statement late on Thursday.

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

This Document has been prepared by Ways2Capital (A Division of High Brow Market

Research Investment Advisory Pvt Ltd). The information, analysis and estimates

contained herein are based on Ways2Capital Equity/Commodities Research assessment

and have been obtained from sources believed to be reliable. This document is meant

for the use of the intended recipient only. This document, at best, represents

Ways2Capital Equity/Commodities Research opinion and is meant for general

information only. Ways2Capital Equity/Commodities Research, its directors, officers or

employees shall not in any way to be responsible for the contents stated herein.

Ways2Capital Equity/Commodities Research expressly disclaims any and all liabilities

that may arise from information, errors or omissions in this connection. This document

is not to be considered as an offer to sell or a solicitation to buy any securities or

commodities.

All information, levels & recommendations provided above are given on the basis of

technical & fundamental research done by the panel of expert of Ways2Capital but we

do not accept any liability for errors of opinion. People surfing through the website

have right to opt the product services of their own choices.

Any investment in commodity market bears risk, company will not be liable for any loss

done on these recommendations. These levels do not necessarily indicate future price

moment. Company holds the right to alter the information without any further notice.

Any browsing through website means acceptance of disclaimer.

Web: www.ways2capital.com | Mail: info@ways2capital.com | Call: 0731-655125

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 14 Audit of The Sales and Collection CycleDocument8 pagesChapter 14 Audit of The Sales and Collection CycleAaqib HossainNo ratings yet

- Chapter 7 Choosing A Source of Credit The Costs of Credit AlternativesDocument40 pagesChapter 7 Choosing A Source of Credit The Costs of Credit Alternativesgyanprakashdeb302No ratings yet

- Sap FiDocument229 pagesSap FiBeema Rao100% (3)

- Streamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221Document4 pagesStreamline Unlimited Account: Closing Balance $3,265.34 CR Enquiries 13 2221jo220171No ratings yet

- Agent Name, License No & IRDA URN ListDocument20 pagesAgent Name, License No & IRDA URN ListHarshad BhirudNo ratings yet

- Unit 4 Payment Systems PDFDocument48 pagesUnit 4 Payment Systems PDFmuskanNo ratings yet

- Current Account StatementDocument4 pagesCurrent Account StatementLilia75% (4)

- Equity Research Report 26 December 2018 Ways2CapitalDocument17 pagesEquity Research Report 26 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 06 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 06 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 21 January 2019 Ways2CapitalDocument13 pagesCommodity Research Report 21 January 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 12 March 2019 Ways2CapitalDocument13 pagesCommodity Research Report 12 March 2019 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 21 January 2019 Ways2CapitalDocument17 pagesEquity Research Report 21 January 2019 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 18 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 18 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 26 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 26 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 31 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 31 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 20 November 2018 Ways2CapitalDocument13 pagesCommodity Research Report 20 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 18 December 2018 Ways2CapitalDocument17 pagesEquity Research Report 18 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 11 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 11 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 18 September 2018 Ways2CapitalDocument17 pagesEquity Research Report 18 September 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 03 December 2018 Ways2CapitalDocument13 pagesCommodity Research Report 03 December 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 27november 2018 Ways2CapitalDocument13 pagesCommodity Research Report 27november 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 16 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 13 November 2018 Ways2CapitalDocument13 pagesCommodity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 06 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 06 November 2018 Ways2CapitalDocument13 pagesCommodity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 23 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 23 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 30 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 30 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 23 October 2018 Ways2CapitalDocument17 pagesEquity Research Report 23 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 16 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 30 October 2018 Ways2CapitalDocument17 pagesEquity Research Report 30 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 16 October 2018 Ways2CapitalDocument17 pagesEquity Research Report 16 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 09 October 2018 Ways2CapitalDocument17 pagesEquity Research Report 09 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Commodity Research Report 09 October 2018 Ways2CapitalDocument13 pagesCommodity Research Report 09 October 2018 Ways2CapitalWays2CapitalNo ratings yet

- Asher Rapp BioDocument1 pageAsher Rapp BioarappmemNo ratings yet

- Certificate PDFDocument28 pagesCertificate PDFRecordTrac - City of OaklandNo ratings yet

- Zachary Paul Greek ResumeDocument3 pagesZachary Paul Greek Resumeapi-351871253No ratings yet

- E-banking services explainedDocument12 pagesE-banking services explainedSaniya MhateNo ratings yet

- Fannie Updates To Foreclosure Time FramesDocument3 pagesFannie Updates To Foreclosure Time FramesForeclosure FraudNo ratings yet

- Competitive Study of LIC Vs Private Players in Life Insurance SectorDocument53 pagesCompetitive Study of LIC Vs Private Players in Life Insurance Sectordarshit100% (1)

- Satorp Sukuk Main en Prospectus v.23 Web Final Part1 R6Document316 pagesSatorp Sukuk Main en Prospectus v.23 Web Final Part1 R6jhon ceanNo ratings yet

- EB Rainer wl11 IIS3 WM PDFDocument580 pagesEB Rainer wl11 IIS3 WM PDFran_chanNo ratings yet

- RECONCILE BANK & CASH BOOK BALANCESDocument16 pagesRECONCILE BANK & CASH BOOK BALANCESMichael AsieduNo ratings yet

- Plastene India Ltd.Document326 pagesPlastene India Ltd.Ganesh100% (1)

- Banking Case DigestDocument6 pagesBanking Case DigestIsaac David GatchalianNo ratings yet

- The Reasons of This Question: 2. Levels of Career GoalsDocument17 pagesThe Reasons of This Question: 2. Levels of Career GoalsRaviraj ZalaNo ratings yet

- Study On Credit PolicyDocument12 pagesStudy On Credit PolicyVaibhav GawandeNo ratings yet

- Customer Satisfaction IndexDocument25 pagesCustomer Satisfaction IndexPrateek DeepNo ratings yet

- 1558035837508gtwf3RUDP4SoBRDQ PDFDocument1 page1558035837508gtwf3RUDP4SoBRDQ PDFEmba MadrasNo ratings yet

- Analysis of Audit Report of HindalcoDocument16 pagesAnalysis of Audit Report of HindalcoYogesh SahaniNo ratings yet

- Insurance BQDocument62 pagesInsurance BQanna aysonNo ratings yet

- Other STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksDocument4 pagesOther STRBI Table No 15. Bank Group-Wise Classification of Loan Assets of Scheduled Commercial BanksAman SinghNo ratings yet

- Feasibility Report on Establishing Microfinance in Port MoresbyDocument164 pagesFeasibility Report on Establishing Microfinance in Port MoresbyterrancekuNo ratings yet

- Performance Appraisal System of AB Bank LTDDocument67 pagesPerformance Appraisal System of AB Bank LTDMahmud Abdullah100% (1)

- Finance Current Affairs January Week IiDocument24 pagesFinance Current Affairs January Week IiBhav MathurNo ratings yet

- PradipchowdhuryDocument2 pagesPradipchowdhurybiswa chakrabortyNo ratings yet

- Bank RakyatDocument18 pagesBank RakyatnurulkhalidaNo ratings yet