Professional Documents

Culture Documents

Aqa Accnting Ansers Jun12

Uploaded by

Luke ShawOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aqa Accnting Ansers Jun12

Uploaded by

Luke ShawCopyright:

Available Formats

V

G

J

A

(

U

Version 1

Genera

June 20

Accou

(Spec

Unit 1

al Certi

012

unting

cificati

: Intro

ficate o

g

ion 21

oduct

of Edu

120)

tion to

F

cation

o Fina

Fina

(A-lev

ancial

al

Mar

vel)

l Acco

rk S

ACCN

ountin

Sche

N1

ng

eme

e

Mark schemes are prepared by the Principal Examiner and considered, together with the

relevant questions, by a panel of subject teachers. This mark scheme includes any

amendments made at the standardisation events which all examiners participate in and is the

scheme which was used by them in this examination. The standardisation process ensures

that the mark scheme covers the candidates responses to questions and that every

examiner understands and applies it in the same correct way. As preparation for

standardisation each examiner analyses a number of candidates scripts: alternative answers

not already covered by the mark scheme are discussed and legislated for. If, after the

standardisation process, examiners encounter unusual answers which have not been raised

they are required to refer these to the Principal Examiner.

It must be stressed that a mark scheme is a working document, in many cases further

developed and expanded on the basis of candidates reactions to a particular paper.

Assumptions about future mark schemes on the basis of one years document should be

avoided; whilst the guiding principles of assessment remain constant, details will change,

depending on the content of a particular examination paper.

Further copies of this Mark Scheme are available from: aqa.org.uk

Copyright 2012 AQA and its licensors. All rights reserved.

Copyright

AQA retains the copyright on all its publications. However, registered centres for AQA are permitted to copy material from this

booklet for their own internal use, with the following important exception: AQA cannot give permission to centres to photocopy

any material that is acknowledged to a third party even for internal use within the centre.

Set and published by the Assessment and Qualifications Alliance.

The Assessment and Qualifications Alliance (AQA) is a company limited by guarantee registered in England and Wales

(company number 3644723) and a registered charity (registered charity number 1073334).

Registered address: AQA, Devas Street, Manchester M15 6EX.

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

3

June 2012 ACCN1

MARK SCHEME

INSTRUCTIONS TO EXAMINERS

You should remember that your marking standards should reflect the levels of performance

of students, mainly 17 years old, writing under examination conditions.

Positive Marking

You should be positive in your marking, giving credit for what is there rather than being too

conscious of what is not. Do not deduct marks for irrelevant or incorrect answers as students

penalise themselves in terms of the time they have spent.

Mark Range

You should use the whole mark range available in the mark scheme. Where the students

response to a question is such that the mark scheme permits full marks to be awarded, full

marks must be given. A perfect answer is not required. Conversely, if the students answer

does not deserve credit, then no marks should be given.

Alternative Answers/Layout

The answers given in the mark scheme are not exhaustive and other answers may be valid.

If this occurs, examiners should refer to their Team Leader for guidance. Similarly, students

may set out their accounts in either a vertical or horizontal format. Both methods are

acceptable.

Own Figure Rule

In cases where students are required to make calculations, arithmetic errors can be made so

that the final or intermediate stages are incorrect. To avoid a student being penalised

repeatedly for an initial error, students can be awarded marks where they have used the

correct method with their own (incorrect) figures. Examiners are asked to annotate a script

with OF where marks have been allocated on this basis. OF always makes the assumption

that there are no extraneous items. Similarly, OF marks can be awarded where students

make correct conclusions or inferences from their incorrect calculations.

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

4

Assessment Objectives (AOs)

The Assessment Objectives are common to AS and A Level. The assessment units will

assess the following Assessment Objectives in the context of the content and skills set out in

Section 3 (Subject Content) of the specification.

Assessment Objectives (AOs)

The Assessment Objectives are common to AS and A Level. The assessment units will

assess the following Assessment Objectives in the context of the content and skills set out in

Section 3 (Subject Content) of the specification.

AO1: Knowledge and Understanding

Demonstrate knowledge and understanding of

accounting principles, concepts and

techniques.

AO2: Application

Select and apply knowledge and understanding

of accounting principles, concepts and

techniques to familiar and unfamiliar situations.

AO3: Analysis and Evaluation

Order, interpret and analyse accounting

information in an appropriate format. Evaluate

accounting information, taking into

consideration internal and external factors to

make reasoned judgements, decisions and

recommendations, and assess alternative

courses of action using an appropriate form and

style of writing.

Quality of Written Communication

(QWC)

In GCE specifications which require students to

produce written material in English, students

must:

ensure that text is legible and that spelling,

punctuation and grammar are accurate so

that meaning is clear

select and use a form and style of writing

appropriate to purpose and to complex

subject matter

organise information clearly and coherently,

using specialist vocabulary when

appropriate.

In this specification, QWC will be assessed in all

units. On each paper, two of the marks for

prose answers will be allocated to quality of

written communication, and two of the marks

for numerical answers will be allocated to

quality of presentation. The sub questions

concerned will be identified on the question

papers.

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

5

1 Total for this question: 12 marks

To record what has happened in the past (1) to enable Helen to produce an income

statement (1) and balance sheet (1). Max 2 marks

Based on what has happened in the past, it will enable Helen to forecast for the future (1)

and produce forecast income statements and balance sheets (1) together with cash

budgets (1). Max 2 marks

It will enable Helen to monitor what has actually happened in the business (1) compared

to what was forecast to happen (1) and take corrective action if necessary (1).

Max 2 marks

To enable HM Revenue and Customs (1) to collect the correct amount of income tax (1)

and value added tax (1). Max 2 marks

To enable fraud to be detected (1) by checking against external records (1) for example

a bank statement, etc. Max 2 marks

To assess performance/to see how successful the business is (1) by reviewing

profitability and liquidity (1). Max 2 marks

To provide evidence to support application for finance (1) and that the business will be

able to repay loan of 10 000 and interest (1). Max 2 marks

To monitor amounts owed by the business (1) and amounts owed to the business (1).

Max 2 marks per reason

Overall max 6 marks

1 (a) Explain three reasons why it is important for Helen to keep accurate

accounting records. (6 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

6

Helens suppliers

To assess whether the business is able to pay for all goods and services supplied (1) within

the agreed terms (1). To gauge the likelihood of obtaining repeat orders (1). Accept continue

as a customer (1). 3 marks

Helens employees

To assess whether the business is able to continue trading (1) and therefore continue to

provide employment (1) and pay wages due (1). To assess the effect that the performance

(1) is likely to have on future wage levels/bonuses (1).

Max 3 marks

1 (b) Explain what interest the following stakeholders will have in Helens financial

statements. (6 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

7

2 Total for this question: 21 marks

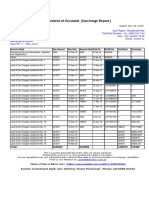

Dr Sales Ledger Control Account Cr

Details Details

Balance B/D 86 212 (1) Discounts allowed 519 (1)

Bank returned cheque 1 244 (1) Returns inwards 2 490 (1)

Discounts allowed 32 (1) Bank 32 194 (1)

Sales 38 213 (1) Bad debt written off 204 (1)

Contra 681 (1)

Discount allowed 56 (1)

Balance C/D 89 557

125 701 125 701

Balance B/D 89 557 (1) OF

The balance on the control account should agree with the totals of the individual accounts in

the sales ledger (1). If these do not agree it indicates an error in either the sales ledger (1) or

the control account (1) or both (1).

2 (b) Explain how this sales ledger control account should be used by Depesh to

verify the balances in the sales ledger. (2 marks)

2 (a) Prepare a sales ledger control account at 30 April 2012 taking into account all

the information on the page opposite and balance the account. Dates are not

required. (11 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

8

provides up-to-date/instant management information (1) of total receivables (debtors) (1)

aiding preparation of financial statements (1)

acts as a check on staff (1) so makes it more difficult for fraud to be committed (1)

because there is a division of responsibility/independent check (1)

assists in the preparation of final accounts (1) saving time (1) by identifying total

receivables (debtors) (1) to be recorded as a current asset on the balance sheet (1).

Max 3 marks for each point

(Plus 2 marks for quality of written communication)

Quality of written communication

Award 2 marks where there is less than 2 spelling/grammatical/punctuation errors.

Award 1 mark where there is more than 2 spelling/grammatical/ punctuation errors but the

content is readable and can be understood.

Award 0 marks where the content cannot be understood.

Overall max 8 marks

2 (c) Explain two other ways in which the sales ledger control account can act as

an aid to managing the business. (8 marks)

(includes 2 marks for quality of written communication)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

9

3 Total for this question: 26 marks

Michelle Kaufman

Extract from the income statement (profit and loss account)

for the year ended 30 April 2012

Gross profit (must be labelled) 82 510 (1)

Discounts received 940 (1)

83 450

Deduct expenses

Discounts allowed 1 390 (1)

Insurance W1 16 860 (2) OF

Motor running expenses 8 310 (1)

Rent and rates W2 25 350 (2) OF

Depreciation W3 3 550 (2 or 0)

55 460

(Net) profit for the year (must be labelled) 27 990 (1) OF

11 marks

Workings

W1

Insurance: 17 520 (1) 660 =16 860 (1) OF

Accept for insurance: 17 520 (1); 18 180 (1); 16860 (2)

W2

Rent and rates: 24 780 (1) +570 =25 350 (1) OF

Accept for rent and rates: 24780 (1); 24210 (1); 25350 (2)

W3

Depreciation (26 500 5 200/6 =3 550 (2 or 0)

3 (a) Complete the extract from the income statement (profit and loss account) for

Michelle Kaufman for the year ended 30 April 2012. (11 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

10

Michelle Kaufman

Balance sheet at 30 April 2012

Non-current (fixed) assets

Motor vehicle cost 26 500

Motor vehicle accumulated depreciation W1 17 750 (1) 8 750 (1) OF

Current assets

Inventory (stock) 46 280

Trade receivables (debtors) 13 550

Prepayments 660 (1) OF

Bank W2 3 630 (2)

64 120

Current liabilities

Trade payables (creditors) 8 280 (1)

Accruals 570 (1) OF

8 850

Net current assets 55 270

64 020

Non-current (long term) liabilities

Bank loan (repayable J uly 2013) (4 600) (1)

59 420

Capital account

Balance at 1 May 2011 54 390 (1)

Capital introduced 10 000 (1)

(Net) profit for the year 27 990 (1) OF

92 380

Deduct drawings 32 960 (1)

59 420

13 marks

(Plus 2 marks for quality of presentation)

1 mark for stating Net current assets; 1 mark for all sub headings and title

Allow statement of financial position or balance sheet in heading

Overall marks: 15 marks

Workings

W1

Motor vehicle provision for depreciation: 14 200 +3 550 =17 750 (1)

W2

Bank: (6 370) (1) +10 000 (1) =3 630 (2)

3 (b) Prepare a balance sheet for Michelle Kaufman at 30 April 2012. (15 marks)

(includes 2 marks for quality of presentation)

(1) for both

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

11

4 Total for this question: 21 marks

Dr Suspense Account Cr

Details Details

General expenses 90 (1) Discount allowed 850 (1)

Purchase returns 200 (1) Carriage inwards 9 (1)

Rents received 450 (1) Sales 1 000 (1)

Opening balance 1 119 (1) OF

1 859 1 859

Add 1 mark for recording a total (OF) on each side of the account totals must be for the

same figure. 8 marks

4 (a) Make any necessary entries in the suspense account to correct these errors.

Clearly show the opening balance on the suspense account and balance the

account. (8 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

12

Details

Increase

net profit by

Reduce

net profit by

No effect on

net profit

()

(1) General expenses 90 (1)

(2) Purchases returns day book 200 (1)

(3) Cheque to A Smith (1)

(4) Discounts allowed 850 (1)

(5) Carriage inwards 9 (1)

(6) Sales 1 000 (1)

(7) Rents received 450 (1)

7 marks

4 (b) Complete the following table to identify the amount, if any, by which the profit

for the year (net profit) of Tom Berridge would be affected by the correction of

the errors (1) to (7) shown opposite. (7 marks)

Mark Scheme General Certificate of Education (A-level) Accounting ACCN1 J une 2012

13

error of omission (1), where a transaction is completely omitted from the books of

account (1)

compensating error (1), where equal and opposite errors cancel each other out (1)

error of commission (1), where an amount is posted to an incorrect account of the

correct type (1)

error of original entry (1), where an error is made transferring an amount from the

source document into the books of original entry (1)

error of principle (1) where an amount is posted to an incorrect class of account (1)

error of reversal (1) where the account that should have been debited is credited and

vice versa (1).

1 mark for identification, one mark for development

Max 2 marks per error

Overall 6 marks

4 (c) State and explain three types of error that will not affect the balancing of the

trial balance. (6 marks)

You might also like

- Advert Clericals and Sec Personnel RevisedDocument2 pagesAdvert Clericals and Sec Personnel RevisedLuke ShawNo ratings yet

- Civil Engineering CourseworkDocument13 pagesCivil Engineering CourseworkLuke ShawNo ratings yet

- Quantitative Methods For ManagersDocument3 pagesQuantitative Methods For ManagersLuke ShawNo ratings yet

- GoK Recurrent Budget 2014-2015Document806 pagesGoK Recurrent Budget 2014-2015Luke ShawNo ratings yet

- Gmail - KASNEB Dec Sec 3 Cpa ResultsDocument2 pagesGmail - KASNEB Dec Sec 3 Cpa ResultsLuke ShawNo ratings yet

- Financial Reporting R.kitDocument344 pagesFinancial Reporting R.kitLuke Shaw100% (3)

- Company Law NOTES UONDocument74 pagesCompany Law NOTES UONLuke Shaw80% (5)

- Foundations in Financial ManagementDocument17 pagesFoundations in Financial ManagementchintengoNo ratings yet

- Eacc Jobs AdvertDocument39 pagesEacc Jobs AdvertLuke ShawNo ratings yet

- 2015 Fee StructureDocument1 page2015 Fee StructureLuke ShawNo ratings yet

- BasicEducationRegulations - Legal Notice No 39 Of2015Document16 pagesBasicEducationRegulations - Legal Notice No 39 Of2015Luke Shaw100% (1)

- Kasneb Syllabus 2015Document5 pagesKasneb Syllabus 2015Luke ShawNo ratings yet

- 2013 Kcse Muhoroni Biology 1Document7 pages2013 Kcse Muhoroni Biology 1Luke ShawNo ratings yet

- Accounting For Non Profit Making Organisations PDFDocument23 pagesAccounting For Non Profit Making Organisations PDFrain06021992No ratings yet

- Financial ManagementDocument302 pagesFinancial ManagementLuke Shaw100% (1)

- Human Resource Management Professional Act No 52 of 2012Document33 pagesHuman Resource Management Professional Act No 52 of 2012Luke ShawNo ratings yet

- Financial ManagementDocument302 pagesFinancial ManagementLuke Shaw100% (1)

- 2013 Kcse Muhoroni Biology 1Document7 pages2013 Kcse Muhoroni Biology 1Luke ShawNo ratings yet

- Financial Accounting Study ManualDocument311 pagesFinancial Accounting Study ManualLuke Shaw100% (3)

- Entrepreneurship NotesDocument20 pagesEntrepreneurship Notesdypdbm91% (86)

- Banking Act 9 of 1989Document65 pagesBanking Act 9 of 1989Luke ShawNo ratings yet

- 19699ipcc Blec Law Vol1 Chapter2Document62 pages19699ipcc Blec Law Vol1 Chapter2Chaitu ChaituNo ratings yet

- Ican Journalsjulysept2014Document24 pagesIcan Journalsjulysept2014Luke ShawNo ratings yet

- Quantitative Techniques Comprehensive Mock ExaminationsDocument15 pagesQuantitative Techniques Comprehensive Mock ExaminationsLuke ShawNo ratings yet

- Assurance EngagementDocument24 pagesAssurance EngagementLuke ShawNo ratings yet

- CPA New Recruitment Brochure Web2Document15 pagesCPA New Recruitment Brochure Web2Luke ShawNo ratings yet

- Keys To Enterprise DevelopmentDocument22 pagesKeys To Enterprise DevelopmentSenelwa AnayaNo ratings yet

- Nigeria Farm AccountingDocument131 pagesNigeria Farm AccountingLuke Shaw100% (1)

- Financial Accounting: Formation 2 Examination - April 2008Document11 pagesFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Indirect TaxDocument3 pagesIndirect TaxRupal DalalNo ratings yet

- RECOGNISED PROFESSIONAL BODIES CONTACT DETAILSDocument17 pagesRECOGNISED PROFESSIONAL BODIES CONTACT DETAILSGD SinghNo ratings yet

- Practice Assignment For Student (Project 1)Document4 pagesPractice Assignment For Student (Project 1)Saibal Dutta75% (4)

- RPH TaxationDocument7 pagesRPH Taxationkimhanna0708100% (1)

- Essential overview of corporate finance fundamentalsDocument3 pagesEssential overview of corporate finance fundamentalsmiguelmendezh940% (1)

- Ramnani vs CA partnership dispute case analysisDocument17 pagesRamnani vs CA partnership dispute case analysisralna_florano1467No ratings yet

- Matthew Whitaker's Financial Disclosure FormDocument10 pagesMatthew Whitaker's Financial Disclosure FormLaw&CrimeNo ratings yet

- Tightening Slows But Risk Premiums Remain LowDocument36 pagesTightening Slows But Risk Premiums Remain LowmontyviaderoNo ratings yet

- Wise & Co., Inc. v. Meer (June 30, 1947)Document13 pagesWise & Co., Inc. v. Meer (June 30, 1947)Crizza RondinaNo ratings yet

- ACCA F9 LSBF Studynotes June2012Document185 pagesACCA F9 LSBF Studynotes June2012Mohammad Kamruzzaman100% (2)

- Domicile Is A Person's Permanent Place of Dwelling. It Is A Legal RelationshipDocument2 pagesDomicile Is A Person's Permanent Place of Dwelling. It Is A Legal RelationshipLhine Kiwalan0% (1)

- Surcharge Report BTKSC-P05164Document1 pageSurcharge Report BTKSC-P05164Nasir Badshah AfridiNo ratings yet

- Trust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)Document40 pagesTrust Preferred CDOs A Primer 11-11-04 (Merrill Lynch)scottrathbun100% (1)

- Rto Process DetailsDocument3 pagesRto Process DetailsAnil DalalNo ratings yet

- Viceroy 2Document18 pagesViceroy 2OinkNo ratings yet

- MCQ PartnershipDocument24 pagesMCQ Partnershiplou-924No ratings yet

- Ca Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraDocument181 pagesCa Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraArun SapkotaNo ratings yet

- Private Clients Pricing GuideDocument41 pagesPrivate Clients Pricing Guidemovali2No ratings yet

- Organization and Management QuizDocument1 pageOrganization and Management QuizAnne MoralesNo ratings yet

- PNB v. GARCIA (2014) PDFDocument2 pagesPNB v. GARCIA (2014) PDFcorky01No ratings yet

- Cost AccountingDocument8 pagesCost Accountingtushar sundriyalNo ratings yet

- Free Trade ZoneDocument3 pagesFree Trade ZoneCatherine JohnsonNo ratings yet

- Accident ReportDocument61 pagesAccident Reportkhalil_marounNo ratings yet

- ACCT 6331 Final Exam Review QuestionsDocument5 pagesACCT 6331 Final Exam Review QuestionsMisha KolosovNo ratings yet

- Financial Accounting Workbook PDFDocument89 pagesFinancial Accounting Workbook PDFDianne Jonnalyn Cuba100% (1)

- BITCOIN HALVING EXPLAINEDDocument11 pagesBITCOIN HALVING EXPLAINEDPieter SteenkampNo ratings yet

- Project Report: Name and Address:-Of The ApplicantDocument10 pagesProject Report: Name and Address:-Of The Applicantakki_6551No ratings yet

- 20ucm2c03 20 05 2021Document3 pages20ucm2c03 20 05 2021VISHAGAN MNo ratings yet

- AnupamDocument61 pagesAnupamviralNo ratings yet

- Atuhaire Pia - Coffee Project Proposal 1Document57 pagesAtuhaire Pia - Coffee Project Proposal 1InfiniteKnowledge91% (32)