Professional Documents

Culture Documents

FIN 534 Homework Chapter 6

Uploaded by

Jenna KiragisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 534 Homework Chapter 6

Uploaded by

Jenna KiragisCopyright:

Available Formats

Jenna Kiragis

5/4/2014

FIN 534 Homework Chapter 6

Directions: Answer the following five questions on a separate document. Explain how you

reached the answer or show your work if a mathematical calculation is needed, or both. Submit

your assignment using the assignment link in the course shell. Each question is worth five points

apiece for a total of 25 points for this homework assignment.

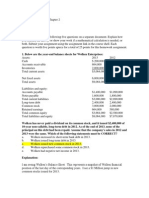

1. You are considering investing in one of the these three stocks:

Stock Standard Deviation Beta

A 20% 0.59

B 10% 0.61

C 12% 1.29

If you are a strict risk minimizer, you would choose Stock ____ if it is to be held in isolation and

Stock ____ if it is to be held as part of a well-diversified portfolio.

a. A; B.

b. B; A.

c. C; A.

d. C; B.

e. A; A.

Explanation:

Risk Aversion is when investors like returns and dislike risk. The higher the perceived

risk, the higher the expected rate of return an investor will demand. In this scenario, I am

looking at the Standard Deviation. The larger the SD means that possible outcomes will

be widely dispersed, whereas a smaller SD means that the outcome will be more tightly

cluster around an expected value. That is why I choose Stock B for isolation and Stock A

for a well-diversified portfolio.

2. Your friend is considering adding one additional stock to a 3-stock portfolio, to form a 4-stock

portfolio. She is highly risk averse and has asked for your advice. The three stocks currently held

all have b = 1.0, and they are perfectly positively correlated with the market. Potential new Stocks

A and B both have expected returns of 15%, are in equilibrium, and are equally correlated with

the market, with r = 0.75. However, Stock A's standard deviation of returns is 12% versus 8% for

Stock B. Which stock should this investor add to his or her portfolio, or does the choice not

matter?

a. Stock A.

b. Stock B.

c. Neither A nor B, as neither has a return sufficient to compensate for risk.

d. Add A, since its beta must be lower.

e. Either A or B, i.e., the investor should be indifferent between the two.

Explanation:

Again, looking at Standard Deviation for my friend. Because she is already highly risk

averse (which means that she dislikes risk), I would choose Stock B because the SD is

8%. This is a safer bet for her low risk portfolio.

3. Which of the following is NOT a potential problem when estimating and using betas, i.e., which

statement is FALSE?

a. Sometimes, during a period when the company is undergoing a change such as toward

more leverage or riskier assets, the calculated beta will be drastically different from the

"true" or "expected future" beta.

b. The beta of an "average stock," or "the market," can change over time, sometimes

drastically.

c. Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for

the future because conditions have changed.

d. All of the statements above are true.

e. The fact that a security or project may not have a past history that can be used as the

basis for calculating beta.

Explanation:

In section 6-7b, we learn that a firm can influence its beta through changes on the

composition of its assets and also through its use of debt: Acquiring riskier assets will

increase beta, as will a change in capital structure that calls for a higher debt ratio. A

companys beta can also change as a result of external factors such as increased

competition in its industry, the expiration of basic patents, and the like. When such

changes lead to a higher or lower beta, the required rate of return will also change

(Brigham & Ehrhardt, 2014).

4. Stock A's beta is 1.7 and Stock B's beta is 0.7. Which of the following statements must be true

about these securities? (Assume market equilibrium.)

a. Stock B must be a more desirable addition to a portfolio than A.

b. Stock A must be a more desirable addition to a portfolio than B.

c. The expected return on Stock A should be greater than that on B.

d. The expected return on Stock B should be greater than that on A.

e. When held in isolation, Stock A has more risk than Stock B.

Explanation:

A stock with a high standard deviation, will tend to have a high beta, which can lead to

a higher rate of return (Brigham & Ehrhardt, 2014). Therefore, with Stock As beta at

1.7, then we should expect a greater rate of return for Stock A compared to Stock B.

5. Which of the following statements is CORRECT?

a. If you found a stock with a zero historical beta and held it as the only stock in your

portfolio, you would by definition have a riskless portfolio.

b. The beta coefficient of a stock is normally found by regressing past returns on a stock

against past market returns. One could also construct a scatter diagram of returns on the

stock versus those on the market, estimate the slope of the line of best fit, and use it as

beta. However, this historical beta may differ from the beta that exists in the future.

c. The beta of a portfolio of stocks is always larger than the betas of any of the individual

stocks.

d. It is theoretically possible for a stock to have a beta of 1.0. If a stock did have a beta of

1.0, then, at least in theory, its required rate of return would be equal to the risk-free

(default-free) rate of return, rRF.

e. The beta of a portfolio of stocks is always smaller than the betas of any of the individual

stocks.

Explanation:

Section 6-6 of our book relates to Answer B for this question. In section 6-6 we learn

how to estimate beta, construct a scatter diagram to help in interpreting beta, and estimate

the slope of the line that best fits beta. In previous answers, we learn that a company can

easily move its own beta up or down with the risk that company takes. Therefore, answer

B seems appropriate for this question.

Brigham, E., & Ehrhardt, M. (2014). Financial management. (14th ed.). Mason, Ohio: Cengage Learning.

You might also like

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocument7 pagesChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNo ratings yet

- Management Accounting - HCA16ge - Ch21Document63 pagesManagement Accounting - HCA16ge - Ch21Corliss Ko100% (1)

- ManajemenDocument12 pagesManajemenM Aldityawan SyahputraNo ratings yet

- TB Ch12Document36 pagesTB Ch12AhmadYaseenNo ratings yet

- Immersion CEUDocument5 pagesImmersion CEUAlizah Lariosa BucotNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- Appendix11A Transfer Pricing Quality Costs and Service Department Cost AllocationDocument29 pagesAppendix11A Transfer Pricing Quality Costs and Service Department Cost AllocationLSNo ratings yet

- Financial Management - Long Term Investment Decision Process and Relevant CashflowsDocument32 pagesFinancial Management - Long Term Investment Decision Process and Relevant CashflowsSoledad Perez100% (4)

- Operations ManagementDocument4 pagesOperations ManagementFarel Abdia HarfyNo ratings yet

- Tutorial 8 AnswerDocument3 pagesTutorial 8 AnswerHaidahNo ratings yet

- Chap 5Document52 pagesChap 5jacks ocNo ratings yet

- I. Facts of The Case: Central Laboratories, IncDocument4 pagesI. Facts of The Case: Central Laboratories, IncJessuel Larn-epsNo ratings yet

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementDewanti Almeera100% (1)

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- Chapter-17-LBO MergerDocument69 pagesChapter-17-LBO MergerSami Jatt0% (1)

- Ch.09 Solution Manual - Funadmentals of Financial ManagementDocument18 pagesCh.09 Solution Manual - Funadmentals of Financial Managementsarahvillalon100% (2)

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- Gitman Ch09 01 StudentDocument42 pagesGitman Ch09 01 StudentFatima AdamNo ratings yet

- 08 11 December 2018 Questions and AnswersDocument26 pages08 11 December 2018 Questions and AnswersMae TomeldenNo ratings yet

- Unit 12 Responsibility Accounting and Performance MeasuresDocument16 pagesUnit 12 Responsibility Accounting and Performance Measuresestihdaf استهدافNo ratings yet

- CH 08Document38 pagesCH 08مريمالرئيسي50% (4)

- Chap 004Document30 pagesChap 004Tariq Kanhar100% (1)

- Additional topics in variance analysisDocument33 pagesAdditional topics in variance analysisAnthony MaloneNo ratings yet

- Rais12 SM ch13Document32 pagesRais12 SM ch13Edwin MayNo ratings yet

- Chapter 13 Managerial AccountingDocument168 pagesChapter 13 Managerial AccountingChandler Schleifs100% (4)

- Capital budgeting decisions and project evaluation techniquesDocument5 pagesCapital budgeting decisions and project evaluation techniquesOrko AbirNo ratings yet

- Group Assignment 1Document5 pagesGroup Assignment 1pushmbaNo ratings yet

- Ch15 Management Costs and UncertaintyDocument21 pagesCh15 Management Costs and UncertaintyZaira PangesfanNo ratings yet

- Activity Based Costing Boosts Building Firm's CompetitivenessDocument20 pagesActivity Based Costing Boosts Building Firm's CompetitivenessMazni HanisahNo ratings yet

- Financial Statement Analysis Chapter 2 SummaryDocument6 pagesFinancial Statement Analysis Chapter 2 SummaryVan Iklil BachdimNo ratings yet

- Real Options and Other Topics in Capital BudgetingDocument24 pagesReal Options and Other Topics in Capital BudgetingAJ100% (1)

- IM Ch14-7e - WRLDocument25 pagesIM Ch14-7e - WRLCharry RamosNo ratings yet

- Chapter Four: Capital StructureDocument28 pagesChapter Four: Capital StructureFantayNo ratings yet

- Chapter 6 The Organization of The FirmDocument2 pagesChapter 6 The Organization of The FirmChristlyn Joy BaralNo ratings yet

- TB Chapter08Document79 pagesTB Chapter08CGNo ratings yet

- SHY Week 1 Assignment SolutionDocument2 pagesSHY Week 1 Assignment Solutionhy_saingheng_7602609No ratings yet

- Chapter 11: Strategic Leadership Leadership - Two Capabilities That Are Marks of A Successful Leadership 1. Overcoming Barriers To ChangeDocument3 pagesChapter 11: Strategic Leadership Leadership - Two Capabilities That Are Marks of A Successful Leadership 1. Overcoming Barriers To ChangecaicaiiNo ratings yet

- FIN 301 B Porter Rachna CH 11-1 Soln.Document1 pageFIN 301 B Porter Rachna CH 11-1 Soln.Nam TranNo ratings yet

- Multiple Choice QuestionsDocument5 pagesMultiple Choice QuestionsJawad Hassan0% (1)

- Abrams Company (Case 5-4)Document12 pagesAbrams Company (Case 5-4)Mhd HeickalNo ratings yet

- Calculating Coefficient of Variation and Standard Deviation of EPSDocument2 pagesCalculating Coefficient of Variation and Standard Deviation of EPSJPNo ratings yet

- Capital Budgeting: Decision Criteria: True-FalseDocument40 pagesCapital Budgeting: Decision Criteria: True-Falsedavid80dcnNo ratings yet

- Fin33 3rdexamDocument3 pagesFin33 3rdexamRonieOlarteNo ratings yet

- Capital Structure Theories ExplainedDocument3 pagesCapital Structure Theories ExplainedshivavishnuNo ratings yet

- Chapter 9 Exercise SolutionsDocument24 pagesChapter 9 Exercise SolutionsQasim Ali100% (2)

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraNo ratings yet

- Charles Ega 3203017162 Case Study Working Capital Management Assessing Roche Publishing Companys Cash Management EfficiencyDocument4 pagesCharles Ega 3203017162 Case Study Working Capital Management Assessing Roche Publishing Companys Cash Management EfficiencyCharles 10No ratings yet

- Bond Valuation ChapterDocument7 pagesBond Valuation ChapterGene Goering IIINo ratings yet

- Hull-OfOD8e-Homework Answers Chapter 03Document3 pagesHull-OfOD8e-Homework Answers Chapter 03Alo Sin100% (1)

- Atkinson Test BankDocument32 pagesAtkinson Test BankRyan James B. AbanNo ratings yet

- Solution Manual Cost Accounting 14th Ed by Carter HLDocument382 pagesSolution Manual Cost Accounting 14th Ed by Carter HLverlyarin100% (1)

- Chapter 7 Bonds and Their ValuationDocument8 pagesChapter 7 Bonds and Their Valuationfarbwn50% (2)

- Assignment 1Document5 pagesAssignment 1sabaNo ratings yet

- Chapter - 9Document4 pagesChapter - 9Nahidul Islam IU100% (1)

- MCQDocument3 pagesMCQPeng GuinNo ratings yet

- Market Risk Answer: B Diff: MDocument5 pagesMarket Risk Answer: B Diff: MLopez, Azzia M.No ratings yet

- Problem Risk Return CAPMDocument12 pagesProblem Risk Return CAPMbajujuNo ratings yet

- Which statement about risk and the SML is correctDocument7 pagesWhich statement about risk and the SML is correctPaodou HuNo ratings yet

- Loma 357 C6Document17 pagesLoma 357 C6May ThirteenthNo ratings yet

- FIN 534 Homework Chapter 11Document3 pagesFIN 534 Homework Chapter 11Jenna KiragisNo ratings yet

- FIN 534 Homework Chapter 10Document3 pagesFIN 534 Homework Chapter 10Jenna KiragisNo ratings yet

- FIN 534 Homework Chapter 5Document3 pagesFIN 534 Homework Chapter 5Jenna KiragisNo ratings yet

- FIN 534 Homework CHP 8Document3 pagesFIN 534 Homework CHP 8Jenna KiragisNo ratings yet

- FIN 534 Homework Chapter 9Document3 pagesFIN 534 Homework Chapter 9Jenna KiragisNo ratings yet

- FIN 534 Chapter 4 HomeworkDocument3 pagesFIN 534 Chapter 4 HomeworkJenna KiragisNo ratings yet

- FIN 534 Homework Chap.3Document3 pagesFIN 534 Homework Chap.3Jenna KiragisNo ratings yet

- FIN 534 Homework Chap.2Document3 pagesFIN 534 Homework Chap.2Jenna KiragisNo ratings yet

- Investment Fundamentals and Concepts ExplainedDocument7 pagesInvestment Fundamentals and Concepts ExplainedPrakash SinghNo ratings yet

- GOV DraftDocument55 pagesGOV Draftnavpreet singhNo ratings yet

- 39 Manajemen Manajemen Resiko 2022Document132 pages39 Manajemen Manajemen Resiko 2022Asep SomantriNo ratings yet

- Management of 21st CenturyDocument8 pagesManagement of 21st CenturyKhandaker Sakib Farhad100% (3)

- Sample HIRADC ToolDocument1 pageSample HIRADC Tooltony s100% (8)

- Part 1: Background: You Should Aim To Complete This Section in 150 - 200 WordsDocument5 pagesPart 1: Background: You Should Aim To Complete This Section in 150 - 200 WordsRemyaNo ratings yet

- Apply WHS Practical AssessmentDocument29 pagesApply WHS Practical AssessmentRRNo ratings yet

- (PM2-03 I TPL v3 0 1) Project - Charter (ProjectName) (Dd-Mm-Yyyy) (VX X)Document12 pages(PM2-03 I TPL v3 0 1) Project - Charter (ProjectName) (Dd-Mm-Yyyy) (VX X)Ana-Maria StasNo ratings yet

- Perceived Risks and Online Purchase Intention of Young Professionals in The Fifth District of CaviteDocument7 pagesPerceived Risks and Online Purchase Intention of Young Professionals in The Fifth District of Caviterain delapazNo ratings yet

- (Recognizing Assessing and Exploiting Opportunity) : Teaching InternDocument9 pages(Recognizing Assessing and Exploiting Opportunity) : Teaching InternGracely CajefeNo ratings yet

- Applying Science-Based Stability StrategiesDocument10 pagesApplying Science-Based Stability StrategiesIsmailNo ratings yet

- Dispositif Maps: Eine Designmethode Zur Visualisierung Komplexer Gesellschaftlicher Probleme Am Beispiel Der EurokriseDocument55 pagesDispositif Maps: Eine Designmethode Zur Visualisierung Komplexer Gesellschaftlicher Probleme Am Beispiel Der EurokriseChristopher WarnowNo ratings yet

- Happiness ExpressDocument3 pagesHappiness ExpressHeni Oktavianti100% (3)

- J Public Health 2010 Rappange 440 7Document8 pagesJ Public Health 2010 Rappange 440 7VanderKum EugeneNo ratings yet

- Understand entity risk assessmentDocument12 pagesUnderstand entity risk assessmentMarjorie BernasNo ratings yet

- 03 Benefits and Risks of Ultrasound in PregnancyDocument6 pages03 Benefits and Risks of Ultrasound in PregnancyDiego Bedón AscurraNo ratings yet

- Wahl (1998)Document72 pagesWahl (1998)Leonardo Faúndez GNo ratings yet

- Biñan Integrated National High School: Table of Specifications Third Quarterly Assessment, SY 2019-2020Document2 pagesBiñan Integrated National High School: Table of Specifications Third Quarterly Assessment, SY 2019-2020Miss RonaNo ratings yet

- Credit Risk Management Lecture 5Document79 pagesCredit Risk Management Lecture 5ameeque khaskheliNo ratings yet

- Learning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceDocument9 pagesLearning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceMatt Yu EspirituNo ratings yet

- MAN Material Number: 11.62008-0791 PSP-element: 015.030.090Document74 pagesMAN Material Number: 11.62008-0791 PSP-element: 015.030.090Onik IslamNo ratings yet

- Nursing Care Plan 1 Risk For Violence, Self DirectedDocument9 pagesNursing Care Plan 1 Risk For Violence, Self Directeddbryant010193% (14)

- Magna Exteriors & Interiors - 076e7Document38 pagesMagna Exteriors & Interiors - 076e7Marcelo VillacaNo ratings yet

- Corporate Governance - Case - Societe Gen PDFDocument37 pagesCorporate Governance - Case - Societe Gen PDFKemala Putri AyundaNo ratings yet

- Introduction To Guidance and Counselling (Lessons 13-15)Document31 pagesIntroduction To Guidance and Counselling (Lessons 13-15)Ja MarceloNo ratings yet

- L & T DetailsDocument18 pagesL & T DetailsathulkannanNo ratings yet

- Case studies on heat stress perceptions in southern India industriesDocument12 pagesCase studies on heat stress perceptions in southern India industriesRiriawan DMNo ratings yet

- FGI Update FunctionalProgram 150307Document6 pagesFGI Update FunctionalProgram 150307ikhlas65No ratings yet

- BSBOPS504 Project Portfolio - PDF - Risk Management - RiskDocument62 pagesBSBOPS504 Project Portfolio - PDF - Risk Management - RiskMaeNo ratings yet

- MaritimeBank EngDocument55 pagesMaritimeBank EngMonkey2111No ratings yet