Professional Documents

Culture Documents

Review Notes-Chapter One Illustrations Follow

Uploaded by

shaggytai0 ratings0% found this document useful (0 votes)

265 views15 pagesAccounting involves the entire process of identifying, recording, and communicating economic events. Illus. 1-1 provides an overview of the accounting process and identifies the major users of accounting information. Ethics are the standards of conduct by which one's actions are judged as right or wrong, honest or dishonest, fair or not fair.

Original Description:

Original Title

Review Notes-chapter One Illustrations Follow

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting involves the entire process of identifying, recording, and communicating economic events. Illus. 1-1 provides an overview of the accounting process and identifies the major users of accounting information. Ethics are the standards of conduct by which one's actions are judged as right or wrong, honest or dishonest, fair or not fair.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

265 views15 pagesReview Notes-Chapter One Illustrations Follow

Uploaded by

shaggytaiAccounting involves the entire process of identifying, recording, and communicating economic events. Illus. 1-1 provides an overview of the accounting process and identifies the major users of accounting information. Ethics are the standards of conduct by which one's actions are judged as right or wrong, honest or dishonest, fair or not fair.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 15

REVIEW NOTES-CHAPTER ONE

ILLUSTRATIONS FOLLOW

A. What Accounting Is.

1. To identify economic events, a company selects the economic

events relevant to its business.

2. Once the company identifies economic events, it records those events

in order to provide a history of the organization’s financial activities.

Recording consists of keeping a systematic, chronological diary of

events, measured in dollars and cents.

3. The company communicates the collected information to interested

users by means of accounting reports which are called financial

statements.

4. A vital element in communicating economic events is the accountant’s

ability to analyze and interpret the reported information. Interpretation

involves explaining the uses, meaning, and limitations of reported

data.

5. Bookkeeping usually involves only the recording of economic events

and is therefore just one part of the accounting process. Accounting

involves the entire process of identifying, recording, and

communicating economic events.

ILLUSTRATION 1-1 provides an overview of the accounting process and

identifies the major users of accounting information.

B. Users and Uses of Accounting.

1. Internal users of accounting information are those individuals

inside a company who plan, organize, and run a business. These

include marketing managers, finance directors, and company

officers.

2. External users are those individuals/organizations outside of the

company who are either:

a. Investors or creditors: Investors use accounting information to

make decisions to buy, hold, or sell stock. Creditors (suppliers

and bankers) use accounting information to evaluate the risks

of granting credit or lending money.

b. Other external users: This includes taxing authorities (Internal

Revenue Service), regulatory agencies (Securities and

Exchange Commission), customers, and labor unions.

C. Ethics in Financial Reporting.

1. Ethics are the standards of conduct by which one’s actions are

judged as right or wrong, honest or dishonest, fair or not fair.

Effective financial reporting depends on sound ethical behavior.

2. In the process of analyzing and solving ethical dilemmas, the

following steps should be applied:

a. Recognize an ethical situation and the ethical issues involved.

b. Identify and analyze the principal elements in the situation.

c. Identify the alternatives, and weigh the impact of each

alternative on various stakeholders.

D. Generally Accepted Accounting Principles.

1. Two organizations are primarily responsible for establishing

generally accepted accounting principles.

a. The Financial Accounting Standards Board (FASB) is a

private organization that establishes broad reporting

standards of general applicability as well as specific

accounting rules.

b. The Securities and Exchange Commission (SEC) is a

governmental agency that requires companies to file financial

reports following generally accepted accounting principles.

2. The cost principle dictates that companies should record assets at

their cost. This is also true over the time the asset is held.

E. Assumptions.

1. Monetary unit assumption.

a. Requires that companies include in the accounting records only

transaction data that can be expressed in terms of money. This

assumption enables accounting to quantify (measure) economic

events.

b. The monetary unit assumption is vital to applying the cost

principle.

2. Economic entity assumption requires that the activities of the entity

be kept separate and distinct from the activities of its owner and all

other economic entities.

a. A business owned by one person is generally a

proprietorship.

b. A business owned by two or more persons associated as

partners is a partnership.

c. A business organized as a separate legal entity under state

corporation law and having ownership divided into

transferable shares of stock is a corporation.

F. The Basic Accounting Equation.

1. Assets = Liabilities + Owner’s Equity.

2. Equality of the equation must be preserved.

Use ILLUSTRATION 1-2 to explain the accounting equation and to define

the terms assets, liabilities, and owner’s equity.

G. Assets, Liabilities, and Owner’s Equity.

1. Assets are resources a business owns. The business uses its

assets in carrying out such activities as production and sales.

2. Liabilities are claims against assets. They are existing debts and

obligations.

3. Owner’s equity is equal to total assets minus total liabilities;

owner’s equity represents the ownership claim on total assets. The

principal subdivisions of owner’s equity are capital, drawings,

revenues, and expenses.

a. Capital is the owner’s investment in the business.

b. Drawings are the withdrawal of cash or other assets from a

proprietorship for the personal use of the owner(s).

4. Revenues are the gross increase in owner’s equity resulting from

business activities entered into for the purpose of earning income.

5. Expenses are the cost of assets consumed or services used in the

process of earning revenue.

H. Using the Basic Accounting Equation.

1. External transactions are economic events between the company

and some outside enterprise.

2. Internal transactions are economic events that occur entirely within

one company.

2. Each transaction must have a dual effect on the accounting

equation.

ILLUSTRATION 1-3 demonstrates the analyzing and recording of

business transactions in terms of the accounting equation. The example also

illustrates how the resulting information can be used to prepare financial

statements.

I. Financial Statements.

1. An income statement presents the revenues and expenses and

resulting net income or net loss for a specific period of time.

2. An owner’s equity statement summarizes the changes in owner’s

equity for a specific period of time.

3. A balance sheet reports the assets, liabilities, and owner’s equity

at a specific date.

4. A statement of cash flows summarizes information about the cash

inflows (receipts) and outflows (payments) for a specific period of

time.

ILLUSTRATION 1-4 is a short exercise to stimulate student thinking

about the dual nature of analyzing transactions in terms of the

accounting equation.

*J. Accounting Career Opportunities.

1. Individuals in public accounting offer expert service to the general

public through the services they perform.

a. Auditing—A certified public accountant (CPA) examines

company financial statements and provides an opinion as to

how accurately the financial statements present the

company’s results and financial position.

b. Taxation—Tax specialists provide tax advice and planning,

prepare tax returns, and represent clients before

governmental agencies.

c. Management Consulting—Management consultants assist in

the installation of basic accounting software and provide support

services for major marketing projects or merger and

acquisition activities.

2. Private accountants are employees of a for-profit company and are

involved in a number of activities including cost accounting, tax

planning and preparation, accounting information system design

and support, and internal auditing.

3. GOVERNMENT ACCOUNTING OPPORTUNITIES

INCLUDE EMPLOYMENT WITH THE INTERNAL

REVENUE SERVICE, FEDERAL BUREAU OF

INVESTIGATION, AND THE SECURITIES AND

EXCHANGE COMMISSION. ILLUSTRATION 1-1

ACCOUNTING PROCESS

ILLUSTRATION 1-2

THE ACCOUNTING EQUATION

ILLUSTRATION 1-3

RECORDING BUSINESS TRANSACTIONS

ILLUSTRATION 1-3 (Continued)

ILLUSTRATION 1-3 (Continued)

ILLUSTRATION 1-3 (Continued)

ILLUSTRATION 1-4

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Top 50 Management Consulting Firms Guide PDFDocument165 pagesTop 50 Management Consulting Firms Guide PDFSunny Naresh ManchandaNo ratings yet

- FIN 073 P1 Exam PDFDocument8 pagesFIN 073 P1 Exam PDFRiamē NonøNo ratings yet

- Nism 8 - Equity Derivatives - Test-1 - Last Day RevisionDocument54 pagesNism 8 - Equity Derivatives - Test-1 - Last Day RevisionAbhijeet Kumar100% (1)

- Exposure Management 2.0 - SAP BlogsDocument8 pagesExposure Management 2.0 - SAP Blogsapostolos thomasNo ratings yet

- Business Finance Module 1Document7 pagesBusiness Finance Module 1Kanton FernandezNo ratings yet

- Kal Atm Software Trends and Analysis 2014 PDFDocument61 pagesKal Atm Software Trends and Analysis 2014 PDFlcarrionNo ratings yet

- 0906 R Quart PDFDocument12 pages0906 R Quart PDFKubik18No ratings yet

- Blackrock Special Report - Inflation-Linked Bonds PrimerDocument8 pagesBlackrock Special Report - Inflation-Linked Bonds PrimerGreg JachnoNo ratings yet

- Tugas Pengantar Akuntansi 1Document5 pagesTugas Pengantar Akuntansi 1Lisa HaryatiNo ratings yet

- A Study On Consumer Satisfaction Towards Dell LaptopsDocument46 pagesA Study On Consumer Satisfaction Towards Dell LaptopsINSTITUTE OF PROFESSIONAL ACCOUNTANTSNo ratings yet

- Ia04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1Document11 pagesIa04E01 - International Accounting - Elective Course Semester IV Credit - 3 - 1mohanraokp2279No ratings yet

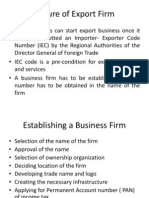

- Formalities of Registration and Export DocumentationDocument10 pagesFormalities of Registration and Export DocumentationAyush GargNo ratings yet

- (Solved) 1.why Is - People, Planet, Profits - A More Media - Friendly... - Course HeroDocument3 pages(Solved) 1.why Is - People, Planet, Profits - A More Media - Friendly... - Course HeroayeshaNo ratings yet

- TRE8X10 Road Transport Costing and Distribution Assignment - Aug 2021Document5 pagesTRE8X10 Road Transport Costing and Distribution Assignment - Aug 2021percyNo ratings yet

- Ship Labour Act 2013Document21 pagesShip Labour Act 2013alexNo ratings yet

- BUS 6070 FinalProjectDocument10 pagesBUS 6070 FinalProjectHafsat Saliu100% (2)

- Techno Mid1Document16 pagesTechno Mid1Graceann GocalinNo ratings yet

- Case Study On LakmeDocument3 pagesCase Study On LakmeSudhir KakarNo ratings yet

- ACIOE Capability Statement UpdatedDocument18 pagesACIOE Capability Statement UpdatedAHMEDNo ratings yet

- FR (Old & New) Imp IND AS Summary 2020Document15 pagesFR (Old & New) Imp IND AS Summary 2020Pooja GuptaNo ratings yet

- Global Marketing and R&DDocument43 pagesGlobal Marketing and R&Djosiah9_5100% (1)

- Labels Vol42 Issue1 2020Document92 pagesLabels Vol42 Issue1 2020Aditya OjhaNo ratings yet

- 25 SAP CRM Interview Questions and AnswersDocument5 pages25 SAP CRM Interview Questions and AnswersHunny BhatiaNo ratings yet

- "Don't Bother Me, I Can't Cope": Activity Activity Time Immediate (Seconds) PredecessorDocument3 pages"Don't Bother Me, I Can't Cope": Activity Activity Time Immediate (Seconds) PredecessorARYA BARANWAL IPM 2018 BatchNo ratings yet

- SWOT Analysis of Amazon - Brand Amazon SWOT AnalysisDocument12 pagesSWOT Analysis of Amazon - Brand Amazon SWOT AnalysisFUNTV5No ratings yet

- TOPIK 1 - IntroductionDocument66 pagesTOPIK 1 - IntroductionkanasanNo ratings yet

- Training Needs Assessment Practices in Corporate Sector of PakistanDocument7 pagesTraining Needs Assessment Practices in Corporate Sector of PakistanWan JaiNo ratings yet

- Lecture Note 3 - Globalization and Role of MNCSDocument64 pagesLecture Note 3 - Globalization and Role of MNCSgydoiNo ratings yet

- Balance of PaymentsDocument4 pagesBalance of PaymentsOsman JallohNo ratings yet

- Five Steps To Effective Corporate GovernanceDocument7 pagesFive Steps To Effective Corporate Governanceneamma0% (1)