Professional Documents

Culture Documents

Schuette Issues Third Round of Felony Charges Related To Diversified Group Ponzi Scheme

Uploaded by

Michigan News0 ratings0% found this document useful (0 votes)

25 views4 pagesMary Faher, 56, of Stevensville, is accused of defrauding senior citizens out of millions of dollars. The charges come as a result of an Attorney General investigation. "This will not be tolerated," said Attorney General Bill schuette.

Original Description:

Original Title

Schuette Issues Third Round of Felony Charges Related to Diversified Group Ponzi Scheme

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMary Faher, 56, of Stevensville, is accused of defrauding senior citizens out of millions of dollars. The charges come as a result of an Attorney General investigation. "This will not be tolerated," said Attorney General Bill schuette.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views4 pagesSchuette Issues Third Round of Felony Charges Related To Diversified Group Ponzi Scheme

Uploaded by

Michigan NewsMary Faher, 56, of Stevensville, is accused of defrauding senior citizens out of millions of dollars. The charges come as a result of an Attorney General investigation. "This will not be tolerated," said Attorney General Bill schuette.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Schuette Issues Third Round of Felony Charges Related to Diversified

Group Ponzi Scheme

Contact: Joy Yearout 517-373-8060

July 10, 2014

LANSING - Attorney General Bill Schuette today announced felony charges

against a Berrien County woman for her alleged role in an extensive multi-county Ponzi

scheme. Mary Faher, 56, of Stevensville, is accused of defrauding senior citizens out of

millions of dollars. The charges come as a result of an Attorney General investigation.

"Many unassuming Michigan citizens have been cheated out of their life savings

from the criminal actions of scam artists," said Schuette. "This will not be tolerated. We

will take aggressive action against lawbreakers who try to make a quick profit off Michigan

seniors."

Faher was employed as a licensed investment advisor for The Diversified Group

Advisory Firm LLC, an investment company, beginning in 2011. During her tenure with

Diversified, Faher is alleged to have made material misrepresentations of the investments

she marketed and sold to investors. It is purported that Faher falsely claimed that victims'

investments were principle protected, made false guarantees of high rates of return and

offered deceptive assurance that the investors could retrieve their money at any time

when in reality it would take an investor 30 years to realize a profit. It is also alleged that

Faher failed to disclose the risks associated with the actual investment in questiona

highly leveraged real estate investment that could result in the loss of all of the investors'

money. Many investors risked their life savings.

The Attorney General investigation revealed Faher was allegedly funneling

investors' money into a Ponzi Scheme operated by a Saginaw man, Joel Wilson. Wilson

also faces extensive felony criminal charges including Racketeering. Faher allegedly

swindled investors out of more than three million dollars using dishonest tactics of

material misrepresentation and the investigation revealed she took an eight percent

commission, pocketing approximately $240,000 for herself.

Faher was arraigned on July 9, 2014 before Judge Angela Pasula in Berrien

County's 5

th

District Trial Court. Faher pled no contest to four counts of Securities Fraud

and waived her right to a preliminary examination. Faher agreed to pay restitution for all

victims and cooperate in the prosecution of Joel Wilson and other Diversified

employees. Faher is next expected to appear in Berrien County's 5

th

District Trial Court

on September 22, 2014 at 1:30 PM for sentencing.

History of Charges Related to the Diversified Group

Beginning in 2009, Joel Wilson allegedly scammed investors out of $8.5 million

selling unregistered securities through his operation of The Diversified Group Advisory

Fund LLC, an investment company. Wilson allegedly told investors that he would use

their funds to purchase distressed properties in the Saginaw area and Bay City

areas. The properties would later be refurbished and sold for profit, offering a return on

their investment.

As Attorney General Investigators closed in on Wilson's operation in late 2012, he

fled the country for Germany. Schuette filed multiple criminal charges against Wilson in

January 2013 and worked with federal officials to issue a warrant for his arrest in

Europe. On January 20, 2014, Wilson was arrested in Germany by Dresden Police. On

January 21, 2014, Schuette's office received notification from INTERPOL that Wilson had

been arrested by European law enforcement. With support from INTERPOL, the U.S.

Department of Justice, and the U.S. Department of State, Schuette successfully secured

Wilson's extradition from Dresden, Germany on May 15, 2014 and he is currently being

held in Bay County Jail in lieu of a $9 million cash surety bond.

In September 2013, Schuette announced felony charges against Shawn Dicken,

40, of Bay City, for her role as lead salesperson in the Diversified Group Advisory Firm

LLC investment scheme. Dicken failed to disclose the risks associated with the actual

investment in question - a highly leveraged real estate investment that could result in the

loss of all of the investors' money. Many investors risked their life savings. Dicken

swindled investors out of more than two million dollars through dishonest tactics.

Investigation revealed Dicken took an eight percent commission, pocketing approximately

$160,000 for herself.

Dicken was convicted of nine felonies, one count of Criminal Enterprises, one

count of Embezzlement From A Vulnerable Adult, and seven counts of False Pretenses,

in March 2014 and was sentenced on June 19, 2014 to 11 years, eight months to 20 years

in prison by Midland County Circuit Court before Judge Stephen P. Carras. Schuette has

requested more than $1.5 million in restitution for Dicken's victims.

Citizens who believe they may have been victims of Mary Faher, Shawn Dicken,

Joel Wilson or The Diversified Group are encouraged to file complaints with the Attorney

General's Office at www.michigan.gov/ag by clicking "File a Complaint."

A criminal charge is merely an accusation, and the defendants are presumed

innocent unless proven guilty.

Consumer Tips For Safe Investing

Schuette encourages Michigan citizens to exercise caution before investing their

money with those who promise exorbitant returns.

"Do your homework before handing over your hard-earned money," said

Schuette. "Take your time, ask questions, and be sure to confirm your broker is in good

standing with the State before signing on the dotted line."

Key tips to avoid falling victim to a Ponzi scheme or investment fraud include:

Check out your broker or adviser. Confirm that your broker and financial adviser

is registered and in good standing. Contact the Bureau of Commercial Services

with the Department of Licensing and Regulatory Affairs, at 517-241-6345, to

check out your broker or adviser.

Beware of strangers touting strange deals. Trusting strangers is a mistake

anyone can make when it comes to their personal finances. Almost anyone can

sound nice or honest on the telephone. Say "no" to any investment professional

who presses you to make an immediate decision, giving you no opportunity to

check out the salesperson, firm and the investment opportunity itself. Beware of

anyone who suggests investing your money into something you don't understand

or who urges that you leave everything in his or her hands.

Take your time - don't be rushed into investment decisions. Salespersons who

use high-pressure tactics to force an investor into an immediate decision are

almost always pitching frauds. They don't want you to think too carefully or find out

too much because you may figure out that it's a scam.

Keep tabs on your investments. Be wary when a financial planner says "leave

everything to me," or "the plan is too complicated to tell you." Everything should

be clear and explainable to you.

Monitor the activity on your account. Insist on receiving regular statements.

Ask Questions. Never be embarrassed or apologetic about asking questions for

trading activity that looks excessive or unauthorized. It's your money, not your

broker's.

Keep Diligent Records. Keep all of your records relating to your investments,

including notes of conversations you have with brokers, salespeople, and financial

advisers.

Consumers can find helpful advice and a list of questions to consider in Attorney

General Schuette's Consumer Alert for Ponzi Schemes, available on Schuette's website

at http://1.usa.gov/AGPonziAlert. Attorney General Schuette also offers specialized

consumer advice for Michigan seniors on how to avoid investment fraud through his

Senior Brigade consumer protection program, http://1.usa.gov/1qNtPkU.

-30-

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- MPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsDocument2 pagesMPSC Fines DTE Energy $840,000 For Improper Billing, ShutoffsMichigan NewsNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Lincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsDocument2 pagesLincoln Park Man To Pay $45,650 in Restitution For Embezzling Charitable Groups' FundsMichigan NewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shots FiredDocument2 pagesShots FiredMichigan NewsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Schuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesDocument2 pagesSchuette Charges Two in Insurance Fraud Scheme After Joint Investigation With Department of Insurance and Financial ServicesMichigan NewsNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Massage Therapist Summarily Suspended For Criminal Sexual ConductDocument1 pageMassage Therapist Summarily Suspended For Criminal Sexual ConductMichigan NewsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Schuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetDocument1 pageSchuette Files For Reinstatement of Charges Against CMU Sexual Assault Suspect, New Court Date SetMichigan NewsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- To Our Customers: DuMouchellesDocument1 pageTo Our Customers: DuMouchellesMichigan NewsNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- ShootingsDocument4 pagesShootingsMichigan NewsNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Schuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsDocument3 pagesSchuette Seven Current and Former Police Officers Charged With 101 Felony Counts Related To Fraudulent Auto InspectionsMichigan NewsNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- West Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsDocument1 pageWest Michigan Physician Summarily Suspended For Alleged Criminal Sexual Conduct With PatientsMichigan NewsNo ratings yet

- Michigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysDocument1 pageMichigan Liquor Control Commission Suspends Oakland County Gas Station's Liquor License For 102 DaysMichigan NewsNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- $18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsDocument2 pages$18M in Federal Grants Available To Public and Non-Profit Groups To Provide Services To Crime VictimsMichigan NewsNo ratings yet

- Detroit Crime Blotter For Thursday, March 21, 2018Document18 pagesDetroit Crime Blotter For Thursday, March 21, 2018Michigan NewsNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Tuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedDocument2 pagesTuberculosis Exposure at Three Southeast Michigan Healthcare Facilities Being InvestigatedMichigan NewsNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- State Police Motor Carrier Officers Join Forces To Fight Human TraffickingDocument1 pageState Police Motor Carrier Officers Join Forces To Fight Human TraffickingMichigan NewsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

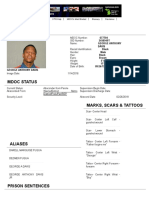

- Offender Tracking Information System (OTIS) - Offender ProfileDocument2 pagesOffender Tracking Information System (OTIS) - Offender ProfileMichigan NewsNo ratings yet

- Lt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderDocument2 pagesLt. Gov. Calley: Nearly 5,700 Naloxone Orders Dispensed in Last Six Months 1,800 Through Standing OrderMichigan NewsNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Detroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudDocument1 pageDetroit Pharmacist Summarily Suspended For $6 Million Health Care and Wire FraudMichigan NewsNo ratings yet

- Prosecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesDocument7 pagesProsecutor Worthy Charges Police Officers With Murder, Misconduct and Other ChargesMichigan NewsNo ratings yet

- Michigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesDocument3 pagesMichigan's Statewide Graduation Rate Hits 80 Percent Graduation Rate Increases 0.53 Percent, Dropout Rate DeclinesMichigan NewsNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Southfield Physician's Controlled Substance License Summarily Suspended For OverprescribingDocument1 pageSouthfield Physician's Controlled Substance License Summarily Suspended For OverprescribingMichigan NewsNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Document3 pages2018 Lake Sturgeon Season On Black Lake Begins Feb. 3 at 8 A.M.Michigan NewsNo ratings yet

- DNR Deer Poaching Investigation Results in Sentencing of Allegan County ManDocument2 pagesDNR Deer Poaching Investigation Results in Sentencing of Allegan County ManMichigan NewsNo ratings yet

- Detroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument1 pageDetroit Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- West Nile Virus Found in Michigan Ruffed GrouseDocument6 pagesWest Nile Virus Found in Michigan Ruffed GrouseMichigan NewsNo ratings yet

- State Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Document2 pagesState Police To Participate in Multi-State Commercial Vehicle Enforcement Operation Involving I-94Michigan NewsNo ratings yet

- Livonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesDocument2 pagesLivonia Pharmacy and Pharmacist Summarily Suspended For Over Dispensing Controlled SubstancesMichigan NewsNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Meijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseDocument2 pagesMeijer Joins Growing Group of Retail Pharmacies To Integrate With MAPS To Prevent Opioid AbuseMichigan NewsNo ratings yet

- Schuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionDocument2 pagesSchuette: Orchard Lake Restaurant Sushi Samurai Sentenced in Tax Embezzlement Scheme, Owners Will Pay Almost $1 Million in RestitutionMichigan NewsNo ratings yet

- Have You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawDocument3 pagesHave You Been The Victim of Sexual Harassment? Consider Filing A Complaint Under Michigan Civil Rights LawMichigan NewsNo ratings yet

- MFI in IndonesiaDocument38 pagesMFI in IndonesiaAgus GunawanNo ratings yet

- Systematic Investment Plan (Sip) : Mutual Funds Post Office BankDocument34 pagesSystematic Investment Plan (Sip) : Mutual Funds Post Office BankKonarPriyaNo ratings yet

- A Comparative Financial Analysis of Commercial Banks in NepalDocument122 pagesA Comparative Financial Analysis of Commercial Banks in NepalPushpa Shree PandeyNo ratings yet

- Proposal For A Design School at Airoli Navi Mumbai by Amit NambiarDocument206 pagesProposal For A Design School at Airoli Navi Mumbai by Amit NambiarFathima NazrinNo ratings yet

- Time Value of MoneyDocument37 pagesTime Value of Moneyansary75No ratings yet

- Goodwill and Its Amortization The Rules and The RealitiesDocument4 pagesGoodwill and Its Amortization The Rules and The RealitiesArun SinghalNo ratings yet

- FM4, Exercises 17, Black-ScholesDocument54 pagesFM4, Exercises 17, Black-Scholeswenhao zhouNo ratings yet

- Idx 3rd-Quarter 2022Document234 pagesIdx 3rd-Quarter 2022Gayeong KimNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Review of Philippine Foreign Policy Under The Ramos AdministrationDocument16 pagesA Review of Philippine Foreign Policy Under The Ramos AdministrationMandeep Singh KohliNo ratings yet

- Goa Growth GuideDocument87 pagesGoa Growth GuidesatyatiwaryNo ratings yet

- World Economic Outlook 2018: Cyclical Upswing, Structural ChangeDocument302 pagesWorld Economic Outlook 2018: Cyclical Upswing, Structural ChangeTiso Blackstar GroupNo ratings yet

- Quiz 1 With Sol KeyDocument5 pagesQuiz 1 With Sol KeySachin Gupta100% (1)

- Coir Spinning Unit AutomaticDocument3 pagesCoir Spinning Unit AutomaticSenthil KumarNo ratings yet

- Acct 11 Chapter18 SolutionsDocument14 pagesAcct 11 Chapter18 SolutionsRich B EzNo ratings yet

- Question of Chapter 2Document7 pagesQuestion of Chapter 2carlos chavesNo ratings yet

- Level 2 Webinar CMT TutorialDocument103 pagesLevel 2 Webinar CMT Tutorialmr_agarwal100% (5)

- Entrep Business Plan ChurrosDocument17 pagesEntrep Business Plan ChurrosBal Ri Mekoleu73% (11)

- How To Allocate Payroll Taxes in QuickBooksDocument13 pagesHow To Allocate Payroll Taxes in QuickBooksfaramos06No ratings yet

- Neuberger Berman StudyDocument10 pagesNeuberger Berman StudyjohnolavinNo ratings yet

- Jawaban P5-6 Intermediate AccountingDocument3 pagesJawaban P5-6 Intermediate AccountingMutia WardaniNo ratings yet

- Problem #10 Two Sole Proprietorship Form A PartnershipDocument2 pagesProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Chapter 9Document20 pagesChapter 9Faisal SiddiquiNo ratings yet

- Chapter 1 of Internship Report WritingDocument4 pagesChapter 1 of Internship Report WritingSazedul Ekab0% (1)

- Investment Analysis and Portfolio Management 2010Document166 pagesInvestment Analysis and Portfolio Management 2010johnsm2010No ratings yet

- ITC VRIO, MKTG MIX, Porters, Pestel, SWOTDocument23 pagesITC VRIO, MKTG MIX, Porters, Pestel, SWOTGemini ManNo ratings yet

- Topic 6 Financial Management in The WorkshopDocument27 pagesTopic 6 Financial Management in The Workshopjohn nderitu100% (1)

- Misa Service Manual 8th Edition en v18Document155 pagesMisa Service Manual 8th Edition en v18HussonNo ratings yet

- Accounting Concepts and ConventionsDocument6 pagesAccounting Concepts and ConventionsAMIN BUHARI ABDUL KHADER100% (6)

- Notice of Revocation of Licences of Insolvent Microcredit CompaniesDocument4 pagesNotice of Revocation of Licences of Insolvent Microcredit CompaniesAnonymous BfJxK4b1No ratings yet

- Prospectus of Beacon PharmaDocument104 pagesProspectus of Beacon Pharmaaditto smgNo ratings yet

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.From EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Rating: 5 out of 5 stars5/5 (45)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodFrom EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodRating: 4.5 out of 5 stars4.5/5 (1798)

- The Bigamist: The True Story of a Husband's Ultimate BetrayalFrom EverandThe Bigamist: The True Story of a Husband's Ultimate BetrayalRating: 4.5 out of 5 stars4.5/5 (104)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenFrom EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenRating: 3.5 out of 5 stars3.5/5 (36)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansFrom EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansRating: 4 out of 5 stars4/5 (17)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryFrom EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryRating: 2.5 out of 5 stars2.5/5 (3)

- Tinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodFrom EverandTinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodNo ratings yet