Professional Documents

Culture Documents

Property Cases

Uploaded by

Emma Schultz0 ratings0% found this document useful (0 votes)

289 views201 pages1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

289 views201 pagesProperty Cases

Uploaded by

Emma Schultz1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 201

PROPERTY CASES

G.R. No. L-55729 March 28, 1983

ANTONIO PUNSALAN, JR., petitioner,

vs.

REMEDIOS VDA. DE LACSAMANA and THE HONORABLE JUDGE RODOLFO A. ORTIZ,

respondents.

Benjamin S. Benito & Associates for petitioner.

Expedito Yummul for private respondent.

MELENCIO-HERRERA, J .:

The sole issue presented by petitioner for resolution is whether or not respondent Court erred in

denying the Motion to Set Case for Pre-trial with respect to respondent Remedios Vda. de

Lacsamana as the case had been dismissed on the ground of improper venue upon motion of co-

respondent Philippine National Bank (PNB).

It appears that petitioner, Antonio Punsalan, Jr., was the former registered owner of a parcel of land

consisting of 340 square meters situated in Bamban, Tarlac. In 1963, petitioner mortgaged said land

to respondent PNB (Tarlac Branch) in the amount of P10,000.00, but for failure to pay said amount,

the property was foreclosed on December 16, 1970. Respondent PNB (Tarlac Branch) was the

highest bidder in said foreclosure proceedings. However, the bank secured title thereto only on

December 14, 1977.

In the meantime, in 1974, while the properly was still in the alleged possession of petitioner and with

the alleged acquiescence of respondent PNB (Tarlac Branch), and upon securing a permit from the

Municipal Mayor, petitioner constructed a warehouse on said property. Petitioner declared said

warehouse for tax purposes for which he was issued Tax Declaration No. 5619. Petitioner then

leased the warehouse to one Hermogenes Sibal for a period of 10 years starting January 1975.

On July 26, 1978, a Deed of Sale was executed between respondent PNB (Tarlac Branch) and

respondent Lacsamana over the property. This contract was amended on July 31, 1978, particularly

to include in the sale, the building and improvement thereon. By virtue of said instruments,

respondent - Lacsamana secured title over the property in her name (TCT No. 173744) as well as

separate tax declarations for the land and building.

1

On November 22, 1979, petitioner commenced suit for "Annulment of Deed of Sale with Damages" against herein

respondents PNB and Lacsamana before respondent Court of First Instance of Rizal, Branch XXXI, Quezon City,

essentially impugning the validity of the sale of the building as embodied in the Amended Deed of Sale. In this connection,

petitioner alleged:

xxx xxx xxx

22. That defendant, Philippine National Bank, through its Branch Manager ... by virtue of the request of

defendant ... executed a document dated July 31, 1978, entitled Amendment to Deed of Absolute Sale ...

wherein said defendant bank as Vendor sold to defendant Lacsamana the building owned by the plaintiff

under Tax Declaration No. 5619, notwithstanding the fact that said building is not owned by the bank

either by virtue of the public auction sale conducted by the Sheriff and sold to the Philippine National

Bank or by virtue of the Deed of Sale executed by the bank itself in its favor on September 21, 1977 ...;

23. That said defendant bank fraudulently mentioned ... that the sale in its favor should likewise have

included the building, notwithstanding no legal basis for the same and despite full knowledge that the

Certificate of Sale executed by the sheriff in its favor ... only limited the sale to the land, hence, by selling

the building which never became the property of defendant, they have violated the principle against

'pactum commisorium'.

Petitioner prayed that the Deed of Sale of the building in favor of respondent Lacsamana be declared null and void and

that damages in the total sum of P230,000.00, more or less, be awarded to him.

2

In her Answer filed on March 4, 1980,-respondent Lacsamana averred the affirmative defense of lack of cause of action in

that she was a purchaser for value and invoked the principle in Civil Law that the "accessory follows the principal".

3

On March 14, 1980, respondent PNB filed a Motion to Dismiss on the ground that venue was improperly laid considering

that the building was real property under article 415 (1) of the New Civil Code and therefore section 2(a) of Rule 4 should

apply.

4

Opposing said Motion to Dismiss, petitioner contended that the action for annulment of deed of sale with damages is in

the nature of a personal action, which seeks to recover not the title nor possession of the property but to compel payment

of damages, which is not an action affecting title to real property.

On April 25, 1980, respondent Court granted respondent PNB's Motion to Dismiss as follows:

Acting upon the 'Motion to Dismiss' of the defendant Philippine National Bank dated March 13, 1980,

considered against the plaintiff's opposition thereto dated April 1, 1980, including the reply therewith of

said defendant, this Court resolves to DISMISS the plaintiff's complaint for improper venue considering

that the plaintiff's complaint which seeks for the declaration as null and void, the amendment to Deed of

Absolute Sale executed by the defendant Philippine National Bank in favor of the defendant Remedios T.

Vda. de Lacsamana, on July 31, 1978, involves a warehouse allegedly owned and constructed by the

plaintiff on the land of the defendant Philippine National Bank situated in the Municipality of Bamban,

Province of Tarlac, which warehouse is an immovable property pursuant to Article 415, No. 1 of the New

Civil Code; and, as such the action of the plaintiff is a real action affecting title to real property which,

under Section 2, Rule 4 of the New Rules of Court, must be tried in the province where the property or

any part thereof lies.

5

In his Motion for Reconsideration of the aforestated Order, petitioner reiterated the argument that the action to annul does

not involve ownership or title to property but is limited to the validity of the deed of sale and emphasized that the case

should proceed with or without respondent PNB as respondent Lacsamana had already filed her Answer to the Complaint

and no issue on venue had been raised by the latter.

On September 1, 1980,.respondent Court denied reconsideration for lack of merit.

Petitioner then filed a Motion to Set Case for Pre-trial, in so far as respondent Lacsamana was concerned, as the issues

had already been joined with the filing of respondent Lacsamana's Answer.

In the Order of November 10, 1980 respondent Court denied said Motion to Set Case for Pre-trial as the case was already

dismissed in the previous Orders of April 25, 1980 and September 1, 1980.

Hence, this Petition for Certiorari, to which we gave due course.

We affirm respondent Court's Order denying the setting for pre-trial.

The warehouse claimed to be owned by petitioner is an immovable or real property as provided in article 415(l) of the Civil

Code.

6

Buildings are always immovable under the Code.

7

A building treated separately from the land on which it stood is

immovable property and the mere fact that the parties to a contract seem to have dealt with it separate and apart from the

land on which it stood in no wise changed its character as immovable property.

8

While it is true that petitioner does not directly seek the recovery of title or possession of the property in question, his

action for annulment of sale and his claim for damages are closely intertwined with the issue of ownership of the building

which, under the law, is considered immovable property, the recovery of which is petitioner's primary objective. The

prevalent doctrine is that an action for the annulment or rescission of a sale of real property does not operate to efface the

fundamental and prime objective and nature of the case, which is to recover said real property. It is a real action.

9

Respondent Court, therefore, did not err in dismissing the case on the ground of improper venue (Section 2, Rule 4)

10

,

which was timely raised (Section 1, Rule 16)

11

.

Petitioner's other contention that the case should proceed in so far as respondent Lacsamana is concerned as she had

already filed an Answer, which did not allege improper venue and, therefore, issues had already been joined, is likewise

untenable. Respondent PNB is an indispensable party as the validity of the Amended Contract of Sale between the former

and respondent Lacsamana is in issue. It would, indeed, be futile to proceed with the case against respondent

Lacsamana alone.

WHEREFORE, the petition is hereby denied without prejudice to the refiling of the case by petitioner Antonio Punsalan,

Jr. in the proper forum.

Costs against petitioner.

SO ORDERED.

G.R. No. L-50008 August 31, 1987

PRUDENTIAL BANK, petitioner,

vs.

HONORABLE DOMINGO D. PANIS, Presiding Judge of Branch III, Court of First Instance of Zambales and Olongapo City;

FERNANDO MAGCALE & TEODULA BALUYUT-MAGCALE, respondents.

PARAS, J.:

This is a petition for review on certiorari of the November 13, 1978 Decision * of the then Court of First Instance of

Zambales and Olongapo City in Civil Case No. 2443-0 entitled "Spouses Fernando A. Magcale and Teodula Baluyut-

Magcale vs. Hon. Ramon Y. Pardo and Prudential Bank" declaring that the deeds of real estate mortgage executed by

respondent spouses in favor of petitioner bank are null and void.

The undisputed facts of this case by stipulation of the parties are as follows:

... on November 19, 1971, plaintiffs-spouses Fernando A. Magcale and Teodula Baluyut Magcale secured a loan in the

sum of P70,000.00 from the defendant Prudential Bank. To secure payment of this loan, plaintiffs executed in favor of

defendant on the aforesaid date a deed of Real Estate Mortgage over the following described properties:

l. A 2-STOREY, SEMI-CONCRETE, residential building with warehouse spaces containing a total floor area of 263 sq.

meters, more or less, generally constructed of mixed hard wood and concrete materials, under a roofing of cor. g. i.

sheets; declared and assessed in the name of FERNANDO MAGCALE under Tax Declaration No. 21109, issued by the

Assessor of Olongapo City with an assessed value of P35,290.00. This building is the only improvement of the lot.

2. THE PROPERTY hereby conveyed by way of MORTGAGE includes the right of occupancy on the lot where the above

property is erected, and more particularly described and bounded, as follows:

A first class residential land Identffied as Lot No. 720, (Ts-308, Olongapo Townsite Subdivision) Ardoin Street, East

Bajac-Bajac, Olongapo City, containing an area of 465 sq. m. more or less, declared and assessed in the name of

FERNANDO MAGCALE under Tax Duration No. 19595 issued by the Assessor of Olongapo City with an assessed value

of P1,860.00; bounded on the

NORTH: By No. 6, Ardoin Street

SOUTH: By No. 2, Ardoin Street

EAST: By 37 Canda Street, and

WEST: By Ardoin Street.

All corners of the lot marked by conc. cylindrical monuments of the Bureau of Lands as visible limits. ( Exhibit "A, "

also Exhibit "1" for defendant).

Apart from the stipulations in the printed portion of the aforestated deed of mortgage, there appears a rider typed at

the bottom of the reverse side of the document under the lists of the properties mortgaged which reads, as follows:

AND IT IS FURTHER AGREED that in the event the Sales Patent on the lot applied for by the Mortgagors as herein

stated is released or issued by the Bureau of Lands, the Mortgagors hereby authorize the Register of Deeds to hold

the Registration of same until this Mortgage is cancelled, or to annotate this encumbrance on the Title upon authority

from the Secretary of Agriculture and Natural Resources, which title with annotation, shall be released in favor of the

herein Mortgage.

From the aforequoted stipulation, it is obvious that the mortgagee (defendant Prudential Bank) was at the outset

aware of the fact that the mortgagors (plaintiffs) have already filed a Miscellaneous Sales Application over the lot,

possessory rights over which, were mortgaged to it.

Exhibit "A" (Real Estate Mortgage) was registered under the Provisions of Act 3344 with the Registry of Deeds of

Zambales on November 23, 1971.

On May 2, 1973, plaintiffs secured an additional loan from defendant Prudential Bank in the sum of P20,000.00. To

secure payment of this additional loan, plaintiffs executed in favor of the said defendant another deed of Real Estate

Mortgage over the same properties previously mortgaged in Exhibit "A." (Exhibit "B;" also Exhibit "2" for defendant).

This second deed of Real Estate Mortgage was likewise registered with the Registry of Deeds, this time in Olongapo

City, on May 2,1973.

On April 24, 1973, the Secretary of Agriculture issued Miscellaneous Sales Patent No. 4776 over the parcel of land,

possessory rights over which were mortgaged to defendant Prudential Bank, in favor of plaintiffs. On the basis of the

aforesaid Patent, and upon its transcription in the Registration Book of the Province of Zambales, Original Certificate

of Title No. P-2554 was issued in the name of Plaintiff Fernando Magcale, by the Ex-Oficio Register of Deeds of

Zambales, on May 15, 1972.

For failure of plaintiffs to pay their obligation to defendant Bank after it became due, and upon application of said

defendant, the deeds of Real Estate Mortgage (Exhibits "A" and "B") were extrajudicially foreclosed. Consequent to

the foreclosure was the sale of the properties therein mortgaged to defendant as the highest bidder in a public

auction sale conducted by the defendant City Sheriff on April 12, 1978 (Exhibit "E"). The auction sale aforesaid was

held despite written request from plaintiffs through counsel dated March 29, 1978, for the defendant City Sheriff to

desist from going with the scheduled public auction sale (Exhibit "D")." (Decision, Civil Case No. 2443-0, Rollo, pp. 29-

31).

Respondent Court, in a Decision dated November 3, 1978 declared the deeds of Real Estate Mortgage as null and void

(Ibid., p. 35).

On December 14, 1978, petitioner filed a Motion for Reconsideration (Ibid., pp. 41-53), opposed by private

respondents on January 5, 1979 (Ibid., pp. 54-62), and in an Order dated January 10, 1979 (Ibid., p. 63), the Motion for

Reconsideration was denied for lack of merit. Hence, the instant petition (Ibid., pp. 5-28).

The first Division of this Court, in a Resolution dated March 9, 1979, resolved to require the respondents to comment

(Ibid., p. 65), which order was complied with the Resolution dated May 18,1979, (Ibid., p. 100), petitioner filed its

Reply on June 2,1979 (Ibid., pp. 101-112).

Thereafter, in the Resolution dated June 13, 1979, the petition was given due course and the parties were required to

submit simultaneously their respective memoranda. (Ibid., p. 114).

On July 18, 1979, petitioner filed its Memorandum (Ibid., pp. 116-144), while private respondents filed their

Memorandum on August 1, 1979 (Ibid., pp. 146-155).

In a Resolution dated August 10, 1979, this case was considered submitted for decision (Ibid., P. 158).

In its Memorandum, petitioner raised the following issues:

1. WHETHER OR NOT THE DEEDS OF REAL ESTATE MORTGAGE ARE VALID; AND

2. WHETHER OR NOT THE SUPERVENING ISSUANCE IN FAVOR OF PRIVATE RESPONDENTS OF MISCELLANEOUS SALES

PATENT NO. 4776 ON APRIL 24, 1972 UNDER ACT NO. 730 AND THE COVERING ORIGINAL CERTIFICATE OF TITLE NO. P-

2554 ON MAY 15,1972 HAVE THE EFFECT OF INVALIDATING THE DEEDS OF REAL ESTATE MORTGAGE. (Memorandum

for Petitioner, Rollo, p. 122).

This petition is impressed with merit.

The pivotal issue in this case is whether or not a valid real estate mortgage can be constituted on the building erected

on the land belonging to another.

The answer is in the affirmative.

In the enumeration of properties under Article 415 of the Civil Code of the Philippines, this Court ruled that, "it is

obvious that the inclusion of "building" separate and distinct from the land, in said provision of law can only mean

that a building is by itself an immovable property." (Lopez vs. Orosa, Jr., et al., L-10817-18, Feb. 28, 1958; Associated

Inc. and Surety Co., Inc. vs. Iya, et al., L-10837-38, May 30,1958).

Thus, while it is true that a mortgage of land necessarily includes, in the absence of stipulation of the improvements

thereon, buildings, still a building by itself may be mortgaged apart from the land on which it has been built. Such a

mortgage would be still a real estate mortgage for the building would still be considered immovable property even if

dealt with separately and apart from the land (Leung Yee vs. Strong Machinery Co., 37 Phil. 644). In the same manner,

this Court has also established that possessory rights over said properties before title is vested on the grantee, may be

validly transferred or conveyed as in a deed of mortgage (Vda. de Bautista vs. Marcos, 3 SCRA 438 [1961]).

Coming back to the case at bar, the records show, as aforestated that the original mortgage deed on the 2-storey

semi-concrete residential building with warehouse and on the right of occupancy on the lot where the building was

erected, was executed on November 19, 1971 and registered under the provisions of Act 3344 with the Register of

Deeds of Zambales on November 23, 1971. Miscellaneous Sales Patent No. 4776 on the land was issued on April 24,

1972, on the basis of which OCT No. 2554 was issued in the name of private respondent Fernando Magcale on May

15, 1972. It is therefore without question that the original mortgage was executed before the issuance of the final

patent and before the government was divested of its title to the land, an event which takes effect only on the

issuance of the sales patent and its subsequent registration in the Office of the Register of Deeds (Visayan Realty Inc.

vs. Meer, 96 Phil. 515; Director of Lands vs. De Leon, 110 Phil. 28; Director of Lands vs. Jurado, L-14702, May 23, 1961;

Pena "Law on Natural Resources", p. 49). Under the foregoing considerations, it is evident that the mortgage

executed by private respondent on his own building which was erected on the land belonging to the government is to

all intents and purposes a valid mortgage.

As to restrictions expressly mentioned on the face of respondents' OCT No. P-2554, it will be noted that Sections 121,

122 and 124 of the Public Land Act, refer to land already acquired under the Public Land Act, or any improvement

thereon and therefore have no application to the assailed mortgage in the case at bar which was executed before

such eventuality. Likewise, Section 2 of Republic Act No. 730, also a restriction appearing on the face of private

respondent's title has likewise no application in the instant case, despite its reference to encumbrance or alienation

before the patent is issued because it refers specifically to encumbrance or alienation on the land itself and does not

mention anything regarding the improvements existing thereon.

But it is a different matter, as regards the second mortgage executed over the same properties on May 2, 1973 for an

additional loan of P20,000.00 which was registered with the Registry of Deeds of Olongapo City on the same date.

Relative thereto, it is evident that such mortgage executed after the issuance of the sales patent and of the Original

Certificate of Title, falls squarely under the prohibitions stated in Sections 121, 122 and 124 of the Public Land Act and

Section 2 of Republic Act 730, and is therefore null and void.

Petitioner points out that private respondents, after physically possessing the title for five years, voluntarily

surrendered the same to the bank in 1977 in order that the mortgaged may be annotated, without requiring the bank

to get the prior approval of the Ministry of Natural Resources beforehand, thereby implicitly authorizing Prudential

Bank to cause the annotation of said mortgage on their title.

However, the Court, in recently ruling on violations of Section 124 which refers to Sections 118, 120, 122 and 123 of

Commonwealth Act 141, has held:

... Nonetheless, we apply our earlier rulings because we believe that as in pari delicto may not be invoked to defeat

the policy of the State neither may the doctrine of estoppel give a validating effect to a void contract. Indeed, it is

generally considered that as between parties to a contract, validity cannot be given to it by estoppel if it is prohibited

by law or is against public policy (19 Am. Jur. 802). It is not within the competence of any citizen to barter away what

public policy by law was to preserve (Gonzalo Puyat & Sons, Inc. vs. De los Amas and Alino supra). ... (Arsenal vs. IAC,

143 SCRA 54 [1986]).

This pronouncement covers only the previous transaction already alluded to and does not pass upon any new

contract between the parties (Ibid), as in the case at bar. It should not preclude new contracts that may be entered

into between petitioner bank and private respondents that are in accordance with the requirements of the law. After

all, private respondents themselves declare that they are not denying the legitimacy of their debts and appear to be

open to new negotiations under the law (Comment; Rollo, pp. 95-96). Any new transaction, however, would be

subject to whatever steps the Government may take for the reversion of the land in its favor.

PREMISES CONSIDERED, the decision of the Court of First Instance of Zambales & Olongapo City is hereby MODIFIED,

declaring that the Deed of Real Estate Mortgage for P70,000.00 is valid but ruling that the Deed of Real Estate

Mortgage for an additional loan of P20,000.00 is null and void, without prejudice to any appropriate action the

Government may take against private respondents.

SO ORDERED.

G.R. No. L-11658 February 15, 1918

LEUNG YEE, plaintiff-appellant,

vs.

FRANK L. STRONG MACHINERY COMPANY and J. G. WILLIAMSON, defendants-appellees.

Booram and Mahoney for appellant.

Williams, Ferrier and SyCip for appellees.

CARSON, J .:

The "Compaia Agricola Filipina" bought a considerable quantity of rice-cleaning machinery company from the

defendant machinery company, and executed a chattel mortgage thereon to secure payment of the purchase

price. It included in the mortgage deed the building of strong materials in which the machinery was installed,

without any reference to the land on which it stood. The indebtedness secured by this instrument not having

been paid when it fell due, the mortgaged property was sold by the sheriff, in pursuance of the terms of the

mortgage instrument, and was bought in by the machinery company. The mortgage was registered in the chattel

mortgage registry, and the sale of the property to the machinery company in satisfaction of the mortgage was

annotated in the same registry on December 29, 1913.

A few weeks thereafter, on or about the 14th of January, 1914, the "Compaia Agricola Filipina" executed a

deed of sale of the land upon which the building stood to the machinery company, but this deed of sale,

although executed in a public document, was not registered. This deed makes no reference to the building

erected on the land and would appear to have been executed for the purpose of curing any defects which might

be found to exist in the machinery company's title to the building under the sheriff's certificate of sale. The

machinery company went into possession of the building at or about the time when this sale took place, that is

to say, the month of December, 1913, and it has continued in possession ever since.

At or about the time when the chattel mortgage was executed in favor of the machinery company, the

mortgagor, the "Compaia Agricola Filipina" executed another mortgage to the plaintiff upon the building,

separate and apart from the land on which it stood, to secure payment of the balance of its indebtedness to the

plaintiff under a contract for the construction of the building. Upon the failure of the mortgagor to pay the

amount of the indebtedness secured by the mortgage, the plaintiff secured judgment for that amount, levied

execution upon the building, bought it in at the sheriff's sale on or about the 18th of December, 1914, and had

the sheriff's certificate of the sale duly registered in the land registry of the Province of Cavite.

At the time when the execution was levied upon the building, the defendant machinery company, which was in

possession, filed with the sheriff a sworn statement setting up its claim of title and demanding the release of the

property from the levy. Thereafter, upon demand of the sheriff, the plaintiff executed an indemnity bond in

favor of the sheriff in the sum of P12,000, in reliance upon which the sheriff sold the property at public auction

to the plaintiff, who was the highest bidder at the sheriff's sale.

This action was instituted by the plaintiff to recover possession of the building from the machinery company.

The trial judge, relying upon the terms of article 1473 of the Civil Code, gave judgment in favor of the

machinery company, on the ground that the company had its title to the building registered prior to the date of

registry of the plaintiff's certificate.

Article 1473 of the Civil Code is as follows:

If the same thing should have been sold to different vendees, the ownership shall be transfer to the

person who may have the first taken possession thereof in good faith, if it should be personal property.

Should it be real property, it shall belong to the person acquiring it who first recorded it in the registry.

Should there be no entry, the property shall belong to the person who first took possession of it in good

faith, and, in the absence thereof, to the person who presents the oldest title, provided there is good faith.

The registry her referred to is of course the registry of real property, and it must be apparent that the annotation

or inscription of a deed of sale of real property in a chattel mortgage registry cannot be given the legal effect of

an inscription in the registry of real property. By its express terms, the Chattel Mortgage Law contemplates and

makes provision for mortgages of personal property; and the sole purpose and object of the chattel mortgage

registry is to provide for the registry of "Chattel mortgages," that is to say, mortgages of personal property

executed in the manner and form prescribed in the statute. The building of strong materials in which the rice-

cleaning machinery was installed by the "Compaia Agricola Filipina" was real property, and the mere fact that

the parties seem to have dealt with it separate and apart from the land on which it stood in no wise changed its

character as real property. It follows that neither the original registry in the chattel mortgage of the building and

the machinery installed therein, not the annotation in that registry of the sale of the mortgaged property, had any

effect whatever so far as the building was concerned.

We conclude that the ruling in favor of the machinery company cannot be sustained on the ground assigned by

the trial judge. We are of opinion, however, that the judgment must be sustained on the ground that the agreed

statement of facts in the court below discloses that neither the purchase of the building by the plaintiff nor his

inscription of the sheriff's certificate of sale in his favor was made in good faith, and that the machinery

company must be held to be the owner of the property under the third paragraph of the above cited article of the

code, it appearing that the company first took possession of the property; and further, that the building and the

land were sold to the machinery company long prior to the date of the sheriff's sale to the plaintiff.

It has been suggested that since the provisions of article 1473 of the Civil Code require "good faith," in express

terms, in relation to "possession" and "title," but contain no express requirement as to "good faith" in relation to

the "inscription" of the property on the registry, it must be presumed that good faith is not an essential requisite

of registration in order that it may have the effect contemplated in this article. We cannot agree with this

contention. It could not have been the intention of the legislator to base the preferential right secured under this

article of the code upon an inscription of title in bad faith. Such an interpretation placed upon the language of

this section would open wide the door to fraud and collusion. The public records cannot be converted into

instruments of fraud and oppression by one who secures an inscription therein in bad faith. The force and effect

given by law to an inscription in a public record presupposes the good faith of him who enters such inscription;

and rights created by statute, which are predicated upon an inscription in a public registry, do not and cannot

accrue under an inscription "in bad faith," to the benefit of the person who thus makes the inscription.

Construing the second paragraph of this article of the code, the supreme court of Spain held in its sentencia of

the 13th of May, 1908, that:

This rule is always to be understood on the basis of the good faith mentioned in the first paragraph;

therefore, it having been found that the second purchasers who record their purchase had knowledge of

the previous sale, the question is to be decided in accordance with the following paragraph. (Note 2, art.

1473, Civ. Code, Medina and Maranon [1911] edition.)

Although article 1473, in its second paragraph, provides that the title of conveyance of ownership of the

real property that is first recorded in the registry shall have preference, this provision must always be

understood on the basis of the good faith mentioned in the first paragraph; the legislator could not have

wished to strike it out and to sanction bad faith, just to comply with a mere formality which, in given

cases, does not obtain even in real disputes between third persons. (Note 2, art. 1473, Civ. Code, issued

by the publishers of the La Revista de los Tribunales, 13th edition.)

The agreed statement of facts clearly discloses that the plaintiff, when he bought the building at the sheriff's sale

and inscribed his title in the land registry, was duly notified that the machinery company had bought the

building from plaintiff's judgment debtor; that it had gone into possession long prior to the sheriff's sale; and

that it was in possession at the time when the sheriff executed his levy. The execution of an indemnity bond by

the plaintiff in favor of the sheriff, after the machinery company had filed its sworn claim of ownership, leaves

no room for doubt in this regard. Having bought in the building at the sheriff's sale with full knowledge that at

the time of the levy and sale the building had already been sold to the machinery company by the judgment

debtor, the plaintiff cannot be said to have been a purchaser in good faith; and of course, the subsequent

inscription of the sheriff's certificate of title must be held to have been tainted with the same defect.

Perhaps we should make it clear that in holding that the inscription of the sheriff's certificate of sale to the

plaintiff was not made in good faith, we should not be understood as questioning, in any way, the good faith and

genuineness of the plaintiff's claim against the "Compaia Agricola Filipina." The truth is that both the plaintiff

and the defendant company appear to have had just and righteous claims against their common debtor. No

criticism can properly be made of the exercise of the utmost diligence by the plaintiff in asserting and exercising

his right to recover the amount of his claim from the estate of the common debtor. We are strongly inclined to

believe that in procuring the levy of execution upon the factory building and in buying it at the sheriff's sale, he

considered that he was doing no more than he had a right to do under all the circumstances, and it is highly

possible and even probable that he thought at that time that he would be able to maintain his position in a

contest with the machinery company. There was no collusion on his part with the common debtor, and no

thought of the perpetration of a fraud upon the rights of another, in the ordinary sense of the word. He may have

hoped, and doubtless he did hope, that the title of the machinery company would not stand the test of an action

in a court of law; and if later developments had confirmed his unfounded hopes, no one could question the

legality of the propriety of the course he adopted.

But it appearing that he had full knowledge of the machinery company's claim of ownership when he executed

the indemnity bond and bought in the property at the sheriff's sale, and it appearing further that the machinery

company's claim of ownership was well founded, he cannot be said to have been an innocent purchaser for

value. He took the risk and must stand by the consequences; and it is in this sense that we find that he was not a

purchaser in good faith.

One who purchases real estate with knowledge of a defect or lack of title in his vendor cannot claim that he has

acquired title thereto in good faith as against the true owner of the land or of an interest therein; and the same

rule must be applied to one who has knowledge of facts which should have put him upon such inquiry and

investigation as might be necessary to acquaint him with the defects in the title of his vendor. A purchaser

cannot close his eyes to facts which should put a reasonable man upon his guard, and then claim that he acted in

good faith under the belief that there was no defect in the title of the vendor. His mere refusal to believe that

such defect exists, or his willful closing of his eyes to the possibility of the existence of a defect in his vendor's

title, will not make him an innocent purchaser for value, if afterwards develops that the title was in fact

defective, and it appears that he had such notice of the defects as would have led to its discovery had he acted

with that measure of precaution which may reasonably be acquired of a prudent man in a like situation. Good

faith, or lack of it, is in its analysis a question of intention; but in ascertaining the intention by which one is

actuated on a given occasion, we are necessarily controlled by the evidence as to the conduct and outward acts

by which alone the inward motive may, with safety, be determined. So it is that "the honesty of intention," "the

honest lawful intent," which constitutes good faith implies a "freedom from knowledge and circumstances

which ought to put a person on inquiry," and so it is that proof of such knowledge overcomes the presumption

of good faith in which the courts always indulge in the absence of proof to the contrary. "Good faith, or the

want of it, is not a visible, tangible fact that can be seen or touched, but rather a state or condition of mind

which can only be judged of by actual or fancied tokens or signs." (Wilder vs. Gilman, 55 Vt., 504, 505; Cf.

Cardenas Lumber Co. vs. Shadel, 52 La. Ann., 2094-2098; Pinkerton Bros. Co. vs. Bromley, 119 Mich., 8, 10,

17.)

We conclude that upon the grounds herein set forth the disposing part of the decision and judgment entered in

the court below should be affirmed with costs of this instance against the appellant. So ordered.

G.R. No. L-40411 August 7, 1935

DAVAO SAW MILL CO., INC., plaintiff-appellant,

vs.

APRONIANO G. CASTILLO and DAVAO LIGHT & POWER CO., INC., defendants-appellees.

Arsenio Suazo and Jose L. Palma Gil and Pablo Lorenzo and Delfin Joven for appellant.

J.W. Ferrier for appellees.

MALCOLM, J .:

The issue in this case, as announced in the opening sentence of the decision in the trial court and as set forth by

counsel for the parties on appeal, involves the determination of the nature of the properties described in the

complaint. The trial judge found that those properties were personal in nature, and as a consequence absolved

the defendants from the complaint, with costs against the plaintiff.

The Davao Saw Mill Co., Inc., is the holder of a lumber concession from the Government of the Philippine

Islands. It has operated a sawmill in the sitio of Maa, barrio of Tigatu, municipality of Davao, Province of

Davao. However, the land upon which the business was conducted belonged to another person. On the land the

sawmill company erected a building which housed the machinery used by it. Some of the implements thus used

were clearly personal property, the conflict concerning machines which were placed and mounted on

foundations of cement. In the contract of lease between the sawmill company and the owner of the land there

appeared the following provision:

That on the expiration of the period agreed upon, all the improvements and buildings introduced and

erected by the party of the second part shall pass to the exclusive ownership of the party of the first part

without any obligation on its part to pay any amount for said improvements and buildings; also, in the

event the party of the second part should leave or abandon the land leased before the time herein

stipulated, the improvements and buildings shall likewise pass to the ownership of the party of the first

part as though the time agreed upon had expired: Provided, however, That the machineries and

accessories are not included in the improvements which will pass to the party of the first part on the

expiration or abandonment of the land leased.

In another action, wherein the Davao Light & Power Co., Inc., was the plaintiff and the Davao, Saw, Mill Co.,

Inc., was the defendant, a judgment was rendered in favor of the plaintiff in that action against the defendant in

that action; a writ of execution issued thereon, and the properties now in question were levied upon as

personalty by the sheriff. No third party claim was filed for such properties at the time of the sales thereof as is

borne out by the record made by the plaintiff herein. Indeed the bidder, which was the plaintiff in that action,

and the defendant herein having consummated the sale, proceeded to take possession of the machinery and

other properties described in the corresponding certificates of sale executed in its favor by the sheriff of Davao.

As connecting up with the facts, it should further be explained that the Davao Saw Mill Co., Inc., has on a

number of occasions treated the machinery as personal property by executing chattel mortgages in favor of third

persons. One of such persons is the appellee by assignment from the original mortgages.

Article 334, paragraphs 1 and 5, of the Civil Code, is in point. According to the Code, real property consists of

1. Land, buildings, roads and constructions of all kinds adhering to the soil;

x x x x x x x x x

5. Machinery, liquid containers, instruments or implements intended by the owner of any building or

land for use in connection with any industry or trade being carried on therein and which are expressly

adapted to meet the requirements of such trade of industry.

Appellant emphasizes the first paragraph, and appellees the last mentioned paragraph. We entertain no doubt

that the trial judge and appellees are right in their appreciation of the legal doctrines flowing from the facts.

In the first place, it must again be pointed out that the appellant should have registered its protest before or at

the time of the sale of this property. It must further be pointed out that while not conclusive, the characterization

of the property as chattels by the appellant is indicative of intention and impresses upon the property the

character determined by the parties. In this connection the decision of this court in the case of Standard Oil Co.

of New York vs. Jaramillo ( [1923], 44 Phil., 630), whether obiter dicta or not, furnishes the key to such a

situation.

It is, however not necessary to spend overly must time in the resolution of this appeal on side issues. It is

machinery which is involved; moreover, machinery not intended by the owner of any building or land for use in

connection therewith, but intended by a lessee for use in a building erected on the land by the latter to be

returned to the lessee on the expiration or abandonment of the lease.

A similar question arose in Puerto Rico, and on appeal being taken to the United States Supreme Court, it was

held that machinery which is movable in its nature only becomes immobilized when placed in a plant by the

owner of the property or plant, but not when so placed by a tenant, a usufructuary, or any person having only a

temporary right, unless such person acted as the agent of the owner. In the opinion written by Chief Justice

White, whose knowledge of the Civil Law is well known, it was in part said:

To determine this question involves fixing the nature and character of the property from the point of

view of the rights of Valdes and its nature and character from the point of view of Nevers & Callaghan

as a judgment creditor of the Altagracia Company and the rights derived by them from the execution

levied on the machinery placed by the corporation in the plant. Following the Code Napoleon, the Porto

Rican Code treats as immovable (real) property, not only land and buildings, but also attributes

immovability in some cases to property of a movable nature, that is, personal property, because of the

destination to which it is applied. "Things," says section 334 of the Porto Rican Code, "may be

immovable either by their own nature or by their destination or the object to which they are applicable."

Numerous illustrations are given in the fifth subdivision of section 335, which is as follows:

"Machinery, vessels, instruments or implements intended by the owner of the tenements for the

industrial or works that they may carry on in any building or upon any land and which tend directly to

meet the needs of the said industry or works." (See also Code Nap., articles 516, 518 et seq. to and

inclusive of article 534, recapitulating the things which, though in themselves movable, may be

immobilized.) So far as the subject-matter with which we are dealing machinery placed in the plant

it is plain, both under the provisions of the Porto Rican Law and of the Code Napoleon, that

machinery which is movable in its nature only becomes immobilized when placed in a plant by the

owner of the property or plant. Such result would not be accomplished, therefore, by the placing of

machinery in a plant by a tenant or a usufructuary or any person having only a temporary right.

(Demolombe, Tit. 9, No. 203; Aubry et Rau, Tit. 2, p. 12, Section 164; Laurent, Tit. 5, No. 447; and

decisions quoted in Fuzier-Herman ed. Code Napoleon under articles 522 et seq.) The distinction rests,

as pointed out by Demolombe, upon the fact that one only having a temporary right to the possession or

enjoyment of property is not presumed by the law to have applied movable property belonging to him so

as to deprive him of it by causing it by an act of immobilization to become the property of another. It

follows that abstractly speaking the machinery put by the Altagracia Company in the plant belonging to

Sanchez did not lose its character of movable property and become immovable by destination. But in the

concrete immobilization took place because of the express provisions of the lease under which the

Altagracia held, since the lease in substance required the putting in of improved machinery, deprived the

tenant of any right to charge against the lessor the cost such machinery, and it was expressly stipulated

that the machinery so put in should become a part of the plant belonging to the owner without

compensation to the lessee. Under such conditions the tenant in putting in the machinery was acting but

as the agent of the owner in compliance with the obligations resting upon him, and the immobilization of

the machinery which resulted arose in legal effect from the act of the owner in giving by contract a

permanent destination to the machinery.

x x x x x x x x x

The machinery levied upon by Nevers & Callaghan, that is, that which was placed in the plant by the

Altagracia Company, being, as regards Nevers & Callaghan, movable property, it follows that they had

the right to levy on it under the execution upon the judgment in their favor, and the exercise of that right

did not in a legal sense conflict with the claim of Valdes, since as to him the property was a part of the

realty which, as the result of his obligations under the lease, he could not, for the purpose of collecting

his debt, proceed separately against. (Valdes vs. Central Altagracia [192], 225 U.S., 58.)

Finding no reversible error in the record, the judgment appealed from will be affirmed, the costs of this instance

to be paid by the appellant.

G.R. No. L-17870 September 29, 1962

MINDANAO BUS COMPANY, petitioner,

vs.

THE CITY ASSESSOR & TREASURER and the BOARD OF TAX APPEALS of Cagayan de Oro City,

respondents.

Binamira, Barria and Irabagon for petitioner.

Vicente E. Sabellina for respondents.

LABRADOR, J .:

This is a petition for the review of the decision of the Court of Tax Appeals in C.T.A. Case No. 710 holding that

the petitioner Mindanao Bus Company is liable to the payment of the realty tax on its maintenance and repair

equipment hereunder referred to.

Respondent City Assessor of Cagayan de Oro City assessed at P4,400 petitioner's above-mentioned equipment.

Petitioner appealed the assessment to the respondent Board of Tax Appeals on the ground that the same are not

realty. The Board of Tax Appeals of the City sustained the city assessor, so petitioner herein filed with the

Court of Tax Appeals a petition for the review of the assessment.

In the Court of Tax Appeals the parties submitted the following stipulation of facts:

Petitioner and respondents, thru their respective counsels agreed to the following stipulation of facts:

1. That petitioner is a public utility solely engaged in transporting passengers and cargoes by motor

trucks, over its authorized lines in the Island of Mindanao, collecting rates approved by the Public

Service Commission;

2. That petitioner has its main office and shop at Cagayan de Oro City. It maintains Branch Offices

and/or stations at Iligan City, Lanao; Pagadian, Zamboanga del Sur; Davao City and Kibawe, Bukidnon

Province;

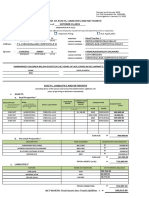

3. That the machineries sought to be assessed by the respondent as real properties are the following:

(a) Hobart Electric Welder Machine, appearing in the attached photograph, marked Annex "A";

(b) Storm Boring Machine, appearing in the attached photograph, marked Annex "B";

(c) Lathe machine with motor, appearing in the attached photograph, marked Annex "C";

(d) Black and Decker Grinder, appearing in the attached photograph, marked Annex "D";

(e) PEMCO Hydraulic Press, appearing in the attached photograph, marked Annex "E";

(f) Battery charger (Tungar charge machine) appearing in the attached photograph, marked

Annex "F"; and

(g) D-Engine Waukesha-M-Fuel, appearing in the attached photograph, marked Annex "G".

4. That these machineries are sitting on cement or wooden platforms as may be seen in the attached

photographs which form part of this agreed stipulation of facts;

5. That petitioner is the owner of the land where it maintains and operates a garage for its TPU motor

trucks; a repair shop; blacksmith and carpentry shops, and with these machineries which are placed

therein, its TPU trucks are made; body constructed; and same are repaired in a condition to be

serviceable in the TPU land transportation business it operates;

6. That these machineries have never been or were never used as industrial equipments to produce

finished products for sale, nor to repair machineries, parts and the like offered to the general public

indiscriminately for business or commercial purposes for which petitioner has never engaged in, to

date.1awphl.nt

The Court of Tax Appeals having sustained the respondent city assessor's ruling, and having denied a motion

for reconsideration, petitioner brought the case to this Court assigning the following errors:

1. The Honorable Court of Tax Appeals erred in upholding respondents' contention that the questioned

assessments are valid; and that said tools, equipments or machineries are immovable taxable real

properties.

2. The Tax Court erred in its interpretation of paragraph 5 of Article 415 of the New Civil Code, and

holding that pursuant thereto the movable equipments are taxable realties, by reason of their being

intended or destined for use in an industry.

3. The Court of Tax Appeals erred in denying petitioner's contention that the respondent City Assessor's

power to assess and levy real estate taxes on machineries is further restricted by section 31, paragraph

(c) of Republic Act No. 521; and

4. The Tax Court erred in denying petitioner's motion for reconsideration.

Respondents contend that said equipments, tho movable, are immobilized by destination, in accordance with

paragraph 5 of Article 415 of the New Civil Code which provides:

Art. 415. The following are immovable properties:

x x x x x x x x x

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an

industry or works which may be carried on in a building or on a piece of land, and which tend directly to

meet the needs of the said industry or works. (Emphasis ours.)

Note that the stipulation expressly states that the equipment are placed on wooden or cement platforms. They

can be moved around and about in petitioner's repair shop. In the case of B. H. Berkenkotter vs. Cu Unjieng, 61

Phil. 663, the Supreme Court said:

Article 344 (Now Art. 415), paragraph (5) of the Civil Code, gives the character of real property to

"machinery, liquid containers, instruments or implements intended by the owner of any building or land

for use in connection with any industry or trade being carried on therein and which are expressly

adapted to meet the requirements of such trade or industry."

If the installation of the machinery and equipment in question in the central of the Mabalacat Sugar Co.,

Inc., in lieu of the other of less capacity existing therein, for its sugar and industry, converted them into

real property by reason of their purpose, it cannot be said that their incorporation therewith was not

permanent in character because, as essential and principle elements of a sugar central, without them the

sugar central would be unable to function or carry on the industrial purpose for which it was

established. Inasmuch as the central is permanent in character, the necessary machinery and equipment

installed for carrying on the sugar industry for which it has been established must necessarily be

permanent. (Emphasis ours.)

So that movable equipments to be immobilized in contemplation of the law must first be "essential and principal

elements" of an industry or works without which such industry or works would be "unable to function or carry

on the industrial purpose for which it was established." We may here distinguish, therefore, those movable

which become immobilized by destination because they are essential and principal elements in the industry for

those which may not be so considered immobilized because they are merely incidental, not essential and

principal. Thus, cash registers, typewriters, etc., usually found and used in hotels, restaurants, theaters, etc. are

merely incidentals and are not and should not be considered immobilized by destination, for these businesses

can continue or carry on their functions without these equity comments. Airline companies use forklifts, jeep-

wagons, pressure pumps, IBM machines, etc. which are incidentals, not essentials, and thus retain their movable

nature. On the other hand, machineries of breweries used in the manufacture of liquor and soft drinks, though

movable in nature, are immobilized because they are essential to said industries; but the delivery trucks and

adding machines which they usually own and use and are found within their industrial compounds are merely

incidental and retain their movable nature.

Similarly, the tools and equipments in question in this instant case are, by their nature, not essential and

principle municipal elements of petitioner's business of transporting passengers and cargoes by motor trucks.

They are merely incidentals acquired as movables and used only for expediency to facilitate and/or improve

its service. Even without such tools and equipments, its business may be carried on, as petitioner has carried on,

without such equipments, before the war. The transportation business could be carried on without the repair or

service shop if its rolling equipment is repaired or serviced in another shop belonging to another.

The law that governs the determination of the question at issue is as follows:

Art. 415. The following are immovable property:

x x x x x x x x x

(5) Machinery, receptacles, instruments or implements intended by the owner of the tenement for an

industry or works which may be carried on in a building or on a piece of land, and which tend directly to

meet the needs of the said industry or works; (Civil Code of the Phil.)

Aside from the element of essentiality the above-quoted provision also requires that the industry or works be

carried on in a building or on a piece of land. Thus in the case of Berkenkotter vs. Cu Unjieng, supra, the

"machinery, liquid containers, and instruments or implements" are found in a building constructed on the land.

A sawmill would also be installed in a building on land more or less permanently, and the sawing is conducted

in the land or building.

But in the case at bar the equipments in question are destined only to repair or service the transportation

business, which is not carried on in a building or permanently on a piece of land, as demanded by the law. Said

equipments may not, therefore, be deemed real property.

Resuming what we have set forth above, we hold that the equipments in question are not absolutely essential to

the petitioner's transportation business, and petitioner's business is not carried on in a building, tenement or on a

specified land, so said equipment may not be considered real estate within the meaning of Article 415 (c) of the

Civil Code.

WHEREFORE, the decision subject of the petition for review is hereby set aside and the equipment in question

declared not subject to assessment as real estate for the purposes of the real estate tax. Without costs.

So ordered.

G.R. No. L-58469 May 16, 1983

MAKATI LEASING and FINANCE CORPORATION, petitioner,

vs.

WEAREVER TEXTILE MILLS, INC., and HONORABLE COURT OF APPEALS, respondents.

Loreto C. Baduan for petitioner.

Ramon D. Bagatsing & Assoc. (collaborating counsel) for petitioner.

Jose V. Mancella for respondent.

DE CASTRO, J .:

Petition for review on certiorari of the decision of the Court of Appeals (now Intermediate Appellate

Court) promulgated on August 27, 1981 in CA-G.R. No. SP-12731, setting aside certain Orders later

specified herein, of Judge Ricardo J. Francisco, as Presiding Judge of the Court of First instance of

Rizal Branch VI, issued in Civil Case No. 36040, as wen as the resolution dated September 22, 1981

of the said appellate court, denying petitioner's motion for reconsideration.

It appears that in order to obtain financial accommodations from herein petitioner Makati Leasing and

Finance Corporation, the private respondent Wearever Textile Mills, Inc., discounted and assigned

several receivables with the former under a Receivable Purchase Agreement. To secure the

collection of the receivables assigned, private respondent executed a Chattel Mortgage over certain

raw materials inventory as well as a machinery described as an Artos Aero Dryer Stentering Range.

Upon private respondent's default, petitioner filed a petition for extrajudicial foreclosure of the

properties mortgage to it. However, the Deputy Sheriff assigned to implement the foreclosure failed to

gain entry into private respondent's premises and was not able to effect the seizure of the

aforedescribed machinery. Petitioner thereafter filed a complaint for judicial foreclosure with the Court

of First Instance of Rizal, Branch VI, docketed as Civil Case No. 36040, the case before the lower

court.

Acting on petitioner's application for replevin, the lower court issued a writ of seizure, the enforcement

of which was however subsequently restrained upon private respondent's filing of a motion for

reconsideration. After several incidents, the lower court finally issued on February 11, 1981, an order

lifting the restraining order for the enforcement of the writ of seizure and an order to break open the

premises of private respondent to enforce said writ. The lower court reaffirmed its stand upon private

respondent's filing of a further motion for reconsideration.

On July 13, 1981, the sheriff enforcing the seizure order, repaired to the premises of private

respondent and removed the main drive motor of the subject machinery.

The Court of Appeals, in certiorari and prohibition proceedings subsequently filed by herein private

respondent, set aside the Orders of the lower court and ordered the return of the drive motor seized

by the sheriff pursuant to said Orders, after ruling that the machinery in suit cannot be the subject of

replevin, much less of a chattel mortgage, because it is a real property pursuant to Article 415 of the

new Civil Code, the same being attached to the ground by means of bolts and the only way to remove

it from respondent's plant would be to drill out or destroy the concrete floor, the reason why all that

the sheriff could do to enfore the writ was to take the main drive motor of said machinery. The

appellate court rejected petitioner's argument that private respondent is estopped from claiming that

the machine is real property by constituting a chattel mortgage thereon.

A motion for reconsideration of this decision of the Court of Appeals having been denied, petitioner

has brought the case to this Court for review by writ of certiorari. It is contended by private

respondent, however, that the instant petition was rendered moot and academic by petitioner's act of

returning the subject motor drive of respondent's machinery after the Court of Appeals' decision was

promulgated.

The contention of private respondent is without merit. When petitioner returned the subject motor

drive, it made itself unequivocably clear that said action was without prejudice to a motion for

reconsideration of the Court of Appeals decision, as shown by the receipt duly signed by respondent's

representative.

1

Considering that petitioner has reserved its right to question the propriety of the Court of Appeals'

decision, the contention of private respondent that this petition has been mooted by such return may not be sustained.

The next and the more crucial question to be resolved in this Petition is whether the machinery in suit is real or personal

property from the point of view of the parties, with petitioner arguing that it is a personality, while the respondent claiming

the contrary, and was sustained by the appellate court, which accordingly held that the chattel mortgage constituted

thereon is null and void, as contended by said respondent.

A similar, if not Identical issue was raised in Tumalad v. Vicencio, 41 SCRA 143 where this Court, speaking through

Justice J.B.L. Reyes, ruled:

Although there is no specific statement referring to the subject house as personal property, yet by ceding,

selling or transferring a property by way of chattel mortgage defendants-appellants could only have meant

to convey the house as chattel, or at least, intended to treat the same as such, so that they should not

now be allowed to make an inconsistent stand by claiming otherwise. Moreover, the subject house stood

on a rented lot to which defendants-appellants merely had a temporary right as lessee, and although this

can not in itself alone determine the status of the property, it does so when combined with other factors to

sustain the interpretation that the parties, particularly the mortgagors, intended to treat the house as

personality. Finally, unlike in the Iya cases, Lopez vs. Orosa, Jr. & Plaza Theatre, Inc. & Leung Yee vs.

F.L. Strong Machinery & Williamson, wherein third persons assailed the validity of the chattel mortgage, it

is the defendants-appellants themselves, as debtors-mortgagors, who are attacking the validity of the

chattel mortgage in this case. The doctrine of estoppel therefore applies to the herein defendants-

appellants, having treated the subject house as personality.

Examining the records of the instant case, We find no logical justification to exclude the rule out, as the appellate court

did, the present case from the application of the abovequoted pronouncement. If a house of strong materials, like what

was involved in the above Tumalad case, may be considered as personal property for purposes of executing a chattel

mortgage thereon as long as the parties to the contract so agree and no innocent third party will be prejudiced thereby,

there is absolutely no reason why a machinery, which is movable in its nature and becomes immobilized only by

destination or purpose, may not be likewise treated as such. This is really because one who has so agreed is estopped

from denying the existence of the chattel mortgage.

In rejecting petitioner's assertion on the applicability of the Tumalad doctrine, the Court of Appeals lays stress on the fact

that the house involved therein was built on a land that did not belong to the owner of such house. But the law makes no

distinction with respect to the ownership of the land on which the house is built and We should not lay down distinctions

not contemplated by law.

It must be pointed out that the characterization of the subject machinery as chattel by the private respondent is indicative

of intention and impresses upon the property the character determined by the parties. As stated in Standard Oil Co. of

New York v. Jaramillo, 44 Phil. 630, it is undeniable that the parties to a contract may by agreement treat as personal

property that which by nature would be real property, as long as no interest of third parties would be prejudiced thereby.

Private respondent contends that estoppel cannot apply against it because it had never represented nor agreed that the

machinery in suit be considered as personal property but was merely required and dictated on by herein petitioner to sign

a printed form of chattel mortgage which was in a blank form at the time of signing. This contention lacks persuasiveness.

As aptly pointed out by petitioner and not denied by the respondent, the status of the subject machinery as movable or

immovable was never placed in issue before the lower court and the Court of Appeals except in a supplemental

memorandum in support of the petition filed in the appellate court. Moreover, even granting that the charge is true, such

fact alone does not render a contract void ab initio, but can only be a ground for rendering said contract voidable, or

annullable pursuant to Article 1390 of the new Civil Code, by a proper action in court. There is nothing on record to show

that the mortgage has been annulled. Neither is it disclosed that steps were taken to nullify the same. On the other hand,

as pointed out by petitioner and again not refuted by respondent, the latter has indubitably benefited from said contract.

Equity dictates that one should not benefit at the expense of another. Private respondent could not now therefore, be

allowed to impugn the efficacy of the chattel mortgage after it has benefited therefrom,

From what has been said above, the error of the appellate court in ruling that the questioned machinery is real, not

personal property, becomes very apparent. Moreover, the case of Machinery and Engineering Supplies, Inc. v. CA, 96

Phil. 70, heavily relied upon by said court is not applicable to the case at bar, the nature of the machinery and equipment

involved therein as real properties never having been disputed nor in issue, and they were not the subject of a Chattel

Mortgage. Undoubtedly, the Tumalad case bears more nearly perfect parity with the instant case to be the more

controlling jurisprudential authority.

WHEREFORE, the questioned decision and resolution of the Court of Appeals are hereby reversed and set aside, and the

Orders of the lower court are hereby reinstated, with costs against the private respondent.

SO ORDERED.

G.R. No. L-50466 May 31, 1982

CALTEX (PHILIPPINES) INC., petitioner,

vs.

CENTRAL BOARD OF ASSESSMENT APPEALS and CITY ASSESSOR OF PASAY, respondents.

AQUINO, J .:

This case is about the realty tax on machinery and equipment installed by Caltex (Philippines) Inc. in

its gas stations located on leased land.

The machines and equipment consists of underground tanks, elevated tank, elevated water tanks,

water tanks, gasoline pumps, computing pumps, water pumps, car washer, car hoists, truck hoists, air

compressors and tireflators. The city assessor described the said equipment and machinery in this

manner:

A gasoline service station is a piece of lot where a building or shed is erected, a water

tank if there is any is placed in one corner of the lot, car hoists are placed in an adjacent

shed, an air compressor is attached in the wall of the shed or at the concrete wall fence.

The controversial underground tank, depository of gasoline or crude oil, is dug deep

about six feet more or less, a few meters away from the shed. This is done to prevent

conflagration because gasoline and other combustible oil are very inflammable.

This underground tank is connected with a steel pipe to the gasoline pump and the

gasoline pump is commonly placed or constructed under the shed. The footing of the

pump is a cement pad and this cement pad is imbedded in the pavement under the

shed, and evidence that the gasoline underground tank is attached and connected to

the shed or building through the pipe to the pump and the pump is attached and affixed

to the cement pad and pavement covered by the roof of the building or shed.

The building or shed, the elevated water tank, the car hoist under a separate shed, the

air compressor, the underground gasoline tank, neon lights signboard, concrete fence

and pavement and the lot where they are all placed or erected, all of them used in the

pursuance of the gasoline service station business formed the entire gasoline service-

station.

As to whether the subject properties are attached and affixed to the tenement, it is clear

they are, for the tenement we consider in this particular case are (is) the pavement

covering the entire lot which was constructed by the owner of the gasoline station and

the improvement which holds all the properties under question, they are attached and

affixed to the pavement and to the improvement.

The pavement covering the entire lot of the gasoline service station, as well as all the

improvements, machines, equipments and apparatus are allowed by Caltex

(Philippines) Inc. ...

The underground gasoline tank is attached to the shed by the steel pipe to the pump, so

with the water tank it is connected also by a steel pipe to the pavement, then to the

electric motor which electric motor is placed under the shed. So to say that the gasoline

pumps, water pumps and underground tanks are outside of the service station, and to

consider only the building as the service station is grossly erroneous. (pp. 58-60, Rollo).

The said machines and equipment are loaned by Caltex to gas station operators under an

appropriate lease agreement or receipt. It is stipulated in the lease contract that the operators, upon

demand, shall return to Caltex the machines and equipment in good condition as when received,

ordinary wear and tear excepted.

The lessor of the land, where the gas station is located, does not become the owner of the machines

and equipment installed therein. Caltex retains the ownership thereof during the term of the lease.

The city assessor of Pasay City characterized the said items of gas station equipment and machinery

as taxable realty. The realty tax on said equipment amounts to P4,541.10 annually (p. 52, Rollo). The

city board of tax appeals ruled that they are personalty. The assessor appealed to the Central Board

of Assessment Appeals.

The Board, which was composed of Secretary of Finance Cesar Virata as chairman, Acting Secretary

of Justice Catalino Macaraig, Jr. and Secretary of Local Government and Community Development

Jose Roo, held in its decision of June 3, 1977 that the said machines and equipment are real

property within the meaning of sections 3(k) & (m) and 38 of the Real Property Tax Code, Presidential

Decree No. 464, which took effect on June 1, 1974, and that the definitions of real property and

personal property in articles 415 and 416 of the Civil Code are not applicable to this case.

The decision was reiterated by the Board (Minister Vicente Abad Santos took Macaraig's place) in its

resolution of January 12, 1978, denying Caltex's motion for reconsideration, a copy of which was

received by its lawyer on April 2, 1979.

On May 2, 1979 Caltex filed this certiorari petition wherein it prayed for the setting aside of the

Board's decision and for a declaration that t he said machines and equipment are personal property

not subject to realty tax (p. 16, Rollo).

The Solicitor General's contention that the Court of Tax Appeals has exclusive appellate jurisdiction

over this case is not correct. When Republic act No. 1125 created the Tax Court in 1954, there was

as yet no Central Board of Assessment Appeals. Section 7(3) of that law in providing that the Tax

Court had jurisdiction to review by appeal decisions of provincial or city boards of assessment

appeals had in mind the local boards of assessment appeals but not the Central Board of

Assessment Appeals which under the Real Property Tax Code has appellate jurisdiction over

decisions of the said local boards of assessment appeals and is, therefore, in the same category as

the Tax Court.

Section 36 of the Real Property Tax Code provides that the decision of the Central Board of

Assessment Appeals shall become final and executory after the lapse of fifteen days from the receipt

of its decision by the appellant. Within that fifteen-day period, a petition for reconsideration may be

filed. The Code does not provide for the review of the Board's decision by this Court.

Consequently, the only remedy available for seeking a review by this Court of the decision of the

Central Board of Assessment Appeals is the special civil action of certiorari, the recourse resorted to

herein by Caltex (Philippines), Inc.

The issue is whether the pieces of gas station equipment and machinery already enumerated are

subject to realty tax. This issue has to be resolved primarily under the provisions of the Assessment

Law and the Real Property Tax Code.

Section 2 of the Assessment Law provides that the realty tax is due "on real property, including land,

buildings, machinery, and other improvements" not specifically exempted in section 3 thereof. This

provision is reproduced with some modification in the Real Property Tax Code which provides:

SEC. 38.Incidence of Real Property Tax. There shall be levied, assessed and

collected in all provinces, cities and municipalities an annual ad valorem tax on real

property, such as land, buildings, machinery and other improvements affixed or

attached to real property not hereinafter specifically exempted.

The Code contains the following definitions in its section 3:

k) Improvements is a valuable addition made to property or an amelioration in its

condition, amounting to more than mere repairs or replacement of waste, costing labor

or capital and intended to enhance its value, beauty or utility or to adapt it for new or

further purposes.

m) Machinery shall embrace machines, mechanical contrivances, instruments,

appliances and apparatus attached to the real estate. It includes the physical facilities

available for production, as well as the installations and appurtenant service facilities,

together with all other equipment designed for or essential to its manufacturing,

industrial or agricultural purposes (See sec. 3[f], Assessment Law).

We hold that the said equipment and machinery, as appurtenances to the gas station building or shed

owned by Caltex (as to which it is subject to realty tax) and which fixtures are necessary to the

operation of the gas station, for without them the gas station would be useless, and which have been

attached or affixed permanently to the gas station site or embedded therein, are taxable

improvements and machinery within the meaning of the Assessment Law and the Real Property Tax

Code.

Caltex invokes the rule that machinery which is movable in its nature only becomes immobilized when

placed in a plant by the owner of the property or plant but not when so placed by a tenant, a

usufructuary, or any person having only a temporary right, unless such person acted as the agent of

the owner (Davao Saw Mill Co. vs. Castillo, 61 Phil 709).

That ruling is an interpretation of paragraph 5 of article 415 of the Civil Code regarding machinery that

becomes real property by destination. In the Davao Saw Mills case the question was whether the

machinery mounted on foundations of cement and installed by the lessee on leased land should be

regarded as real property for purposes of execution of a judgment against the lessee. The sheriff

treated the machinery as personal property. This Court sustained the sheriff's action. (Compare with

Machinery & Engineering Supplies, Inc. vs. Court of Appeals, 96 Phil. 70, where in a replevin case

machinery was treated as realty).

Here, the question is whether the gas station equipment and machinery permanently affixed by

Caltex to its gas station and pavement (which are indubitably taxable realty) should be subject to the

realty tax. This question is different from the issue raised in the Davao Saw Mill case.

Improvements on land are commonly taxed as realty even though for some purposes they might be

considered personalty (84 C.J.S. 181-2, Notes 40 and 41). "It is a familiar phenomenon to see things

classed as real property for purposes of taxation which on general principle might be considered

personal property" (Standard Oil Co. of New York vs. Jaramillo, 44 Phil. 630, 633).