Professional Documents

Culture Documents

Introduction To IBF (UMT Sample)

Uploaded by

AbdulAzeem0 ratings0% found this document useful (0 votes)

11 views6 pagesIntroduction to Islamic Banking and Finance (IB-600) Credit Hours 03 Duration 15 weeks (15 sessions) Prerequisites N / A Resource Person Combined Faculty Counseling Timing (room# 1N-12) Contact The course is divided into 5 modules which are being taught by 5 different resource persons.

Original Description:

Original Title

Introduction to IBF (UMT Sample)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIntroduction to Islamic Banking and Finance (IB-600) Credit Hours 03 Duration 15 weeks (15 sessions) Prerequisites N / A Resource Person Combined Faculty Counseling Timing (room# 1N-12) Contact The course is divided into 5 modules which are being taught by 5 different resource persons.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesIntroduction To IBF (UMT Sample)

Uploaded by

AbdulAzeemIntroduction to Islamic Banking and Finance (IB-600) Credit Hours 03 Duration 15 weeks (15 sessions) Prerequisites N / A Resource Person Combined Faculty Counseling Timing (room# 1N-12) Contact The course is divided into 5 modules which are being taught by 5 different resource persons.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Course Outline Page 1

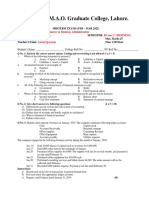

University of Management and Technology

Course Outline

Course Code: IB - 600 Course Title: Introduction to Islamic Banking and Finance

Program

MS Islamic Banking and Finance (MS IBF)

Credit Hours

03

Duration

15 weeks (15 sessions)

Prerequisites

N/A

Resource Person

Combined Faculty*

Counseling Timing

(Room# 1N-12)

Contact

*The course is divided into 5 modules which are being taught by 5 different resource

persons

Chairman/Director signature.

Deans signature Date.

Course Outline Page 2

Grade Evaluation Criteria

Following is the criteria for the distribution of marks to evaluate final grade in

a semester.

Marks Evaluation Marks in percentage

Quizzes 20

Assignments 20

Mid Term 20

Attendance & Class Participation 10

Term Project 20

Presentations 10

Final exam 00

Total 100

Recommended Text Books:

Books are recommended at the end of each faculty member course outline.

Reference Books:

Reference books are recommended at the end of each faculty member course outline.

Course Outline Page 3

Course Outline Page 4

Course Outline Page 5

Introduction to Islamic Banking and Finance (IB-600)

(Module # 03)

Course Outline

Resource Person: Mufti M. Ifthikhar Baig

Main Theme Topic: Comparative Fiqh

Sr. # Topics Date

1

An Introduction to the Subject,

Meaning of Shariah ,

Sources of Shariah,

Fiqh & Shariah

21 Dec, 2013

2

Definition of Fiqh and its Scope,

Difference between Law & Fiqh,

Different Schools of Fuqaha

28 Dec, 2013

3

Some Case Studies on Comparative

Fiqh

04 Jan, 2014

Course Outline Page 6

Introduction to Islamic Banking (Takaful, IB-600 Module-IV)

Mr. Tariq Saeed Chaudhry

To recognize the importance of and the need for Shariah compliant approaches to risk management

Objectives - Learners will be able to:

1. Describe various risk management tools and techniques

2. Describe conventional insurance & its products, and Takaful & its products

3. Differentiate between conventional insurance and Takaful

Sessions Topic

1 Basic understanding of risk and Shariah perspective on risk

Conventional risk management tools and techniques

Conventional insurance

- Definition and introduction

- History

- Classification of insurance contracts

- Products (life, general, investment-linked, endowment, etc)

2 Core Shariah concepts for Takaful

- Waqf (definition, conditions)

Takaful

- Definition

- Background

- Shariah basis for Takaful

o Conditional gifts

o Undertaking of Tabarru

o Waqf

3 Takaful contd

- Comparison with conventional insurance

- Re-Takaful

- Takaful products and services (including structures, pricing, distribution

channels)

- Regulatory regime

o Domestic: SECP rules 2005

o International: AAOIFI, IFSB

Global Market for Takaful

VALUES (to be reinforced through targheeb o tarheeb, anecdotes, brief 3-5 minute talk at the start

or the end of the session)

Halal Rizq

Razzaq

Commitment to ethics/values/Shariah compliance in letter and spirit

Professionalism adoption of global best practices

REFERENCE BOOKS

1. Takaful ki Sharai Haisiyat by Mufti Dr. Ismatullah

2. Takaful by Sohail Jafar

You might also like

- 1st Semester - Financial Accounting Mid TermDocument1 page1st Semester - Financial Accounting Mid TermAbdulAzeemNo ratings yet

- 7th - Corporate FinanceDocument2 pages7th - Corporate FinanceAbdulAzeemNo ratings yet

- Bba 3 Semester Financial Management OutlineDocument5 pagesBba 3 Semester Financial Management OutlineAbdulAzeemNo ratings yet

- 2020 - Directors With Foreign ExperienceDocument28 pages2020 - Directors With Foreign ExperienceAbdulAzeemNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8No ratings yet

- 201302a PDFDocument7 pages201302a PDFAbdul BasitNo ratings yet

- 1st - Financial AccountingDocument2 pages1st - Financial AccountingAbdulAzeemNo ratings yet

- IAPM-Feb.2013 Investment Analysis and Portfolio Management examDocument4 pagesIAPM-Feb.2013 Investment Analysis and Portfolio Management examAbdulAzeemNo ratings yet

- Chand Bagh School: Pakistan Studies DepartmentDocument11 pagesChand Bagh School: Pakistan Studies DepartmentAbdulAzeemNo ratings yet

- w10471 PDFDocument41 pagesw10471 PDFAlineRieNo ratings yet

- 2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceDocument28 pages2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceAbdulAzeemNo ratings yet

- Guide Creating A Posting File Batch and Journals 1.0Document13 pagesGuide Creating A Posting File Batch and Journals 1.0AbdulAzeemNo ratings yet

- Nber Working Paper SeriesDocument32 pagesNber Working Paper SeriesApriana RahmawatiNo ratings yet

- 2019 - Corporate Tax Avoidance - Is Tax Transparency The SolutionDocument20 pages2019 - Corporate Tax Avoidance - Is Tax Transparency The SolutionAbdulAzeemNo ratings yet

- Fishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingDocument68 pagesFishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingAbdulAzeemNo ratings yet

- Short term decision making test solution analyzedDocument1 pageShort term decision making test solution analyzedAbdulAzeemNo ratings yet

- 2015 - Determinant of Tax EvasionDocument21 pages2015 - Determinant of Tax EvasionAbdulAzeemNo ratings yet

- Nber Working Paper SeriesDocument32 pagesNber Working Paper SeriesApriana RahmawatiNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- Course Content Schedule For SBL by Sir Muhammad Ashraf RehmanDocument8 pagesCourse Content Schedule For SBL by Sir Muhammad Ashraf RehmanAbdulAzeemNo ratings yet

- Investment Interest FactorsDocument16 pagesInvestment Interest FactorsAbdulAzeemNo ratings yet

- 2017 - Determinants of Profit Reinvestment Undertaken by SMEs in The Small Island Countries - Base ArticleDocument36 pages2017 - Determinants of Profit Reinvestment Undertaken by SMEs in The Small Island Countries - Base ArticleAbdulAzeemNo ratings yet

- Short Term Decision Making: Question No. 1Document2 pagesShort Term Decision Making: Question No. 1AbdulAzeemNo ratings yet

- Determinants of Tax Avoidance Evidence On Profit Tax Paying Companies in RomaniaDocument24 pagesDeterminants of Tax Avoidance Evidence On Profit Tax Paying Companies in RomaniaAbdulAzeemNo ratings yet

- Relegiousity and Tax Avoidance - 196 CitationDocument32 pagesRelegiousity and Tax Avoidance - 196 CitationAbdulAzeemNo ratings yet

- w10471 PDFDocument41 pagesw10471 PDFAlineRieNo ratings yet

- SBL by Sir Ashraf RehmanDocument1 pageSBL by Sir Ashraf RehmanAbdulAzeemNo ratings yet

- P5 Home Country Tax System 308 CitationsDocument31 pagesP5 Home Country Tax System 308 CitationsAbdulAzeemNo ratings yet

- Long-Run Corporate Tax Avoidance: Prevalence and CharacteristicsDocument48 pagesLong-Run Corporate Tax Avoidance: Prevalence and CharacteristicsAbdulAzeemNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Gogol and WomenDocument163 pagesGogol and WomenkinetographNo ratings yet

- From Ancient Israel To Modern Judaism - Intellect in Quest of Understanding Essays in Honor of Marvin Fox Volume 3Document296 pagesFrom Ancient Israel To Modern Judaism - Intellect in Quest of Understanding Essays in Honor of Marvin Fox Volume 3David Bailey100% (1)

- Sciences of Hadith Course OverviewDocument90 pagesSciences of Hadith Course Overviewmohammad100% (1)

- My Hero1Document3 pagesMy Hero1manazar hussainNo ratings yet

- Jia, The Hongzhou School of Chan Buddhism - in Eighth Through Tenth Century ChinaDocument238 pagesJia, The Hongzhou School of Chan Buddhism - in Eighth Through Tenth Century Chinatheinfamousgentleman100% (2)

- Modern Muslim Koran InterpretationDocument146 pagesModern Muslim Koran Interpretationivan a gargurevich100% (1)

- Protestantism in El Salvador: Conventional Wisdom vs Survey EvidenceDocument23 pagesProtestantism in El Salvador: Conventional Wisdom vs Survey Evidencemtz20_952484668No ratings yet

- Clear The EnergyDocument11 pagesClear The EnergyTi SanchezNo ratings yet

- ဒဂုန္ေ႐ႊမ်ား - သေဘၤာပ်က္ခရီးသည္ခုႏွစ္ေယာက္ Seven TravellersDocument14 pagesဒဂုန္ေ႐ႊမ်ား - သေဘၤာပ်က္ခရီးသည္ခုႏွစ္ေယာက္ Seven Travellersapi-3708601No ratings yet

- Teacher Subject Student Class PBL Submission ReportDocument7 pagesTeacher Subject Student Class PBL Submission ReportArmorzeus IyszxNo ratings yet

- Southern Seminary DissertationsDocument7 pagesSouthern Seminary DissertationsPaperWritersForCollegeCanada100% (1)

- Magkamag-Anak (Consanguineal or Affinal Relations), Magkapitbahay (NeighboringDocument10 pagesMagkamag-Anak (Consanguineal or Affinal Relations), Magkapitbahay (NeighboringKristina Pauline Obra67% (3)

- Nagarjuna PDFDocument190 pagesNagarjuna PDFYaselaNo ratings yet

- Laws of The East (5016) PDFDocument298 pagesLaws of The East (5016) PDFRob Krol67% (3)

- Christmas Humphreys - BuddhismUCDocument134 pagesChristmas Humphreys - BuddhismUCJayNo ratings yet

- Date Sheet For MA-MSc B-Ed Annual Exam 2014 For Private CondidatesDocument4 pagesDate Sheet For MA-MSc B-Ed Annual Exam 2014 For Private CondidatesFaheemKhan88No ratings yet

- Unlicensed To Kill-Online VersionDocument202 pagesUnlicensed To Kill-Online VersionMuhammad Haniff Hassan100% (1)

- DLSL 2012 Exam ResultDocument4 pagesDLSL 2012 Exam ResultPTCRadmissionNo ratings yet

- Adjectives Describing Feelings and EmotionsDocument12 pagesAdjectives Describing Feelings and EmotionsAldea Simona100% (1)

- School Form Checking Report SFCRDocument10 pagesSchool Form Checking Report SFCRRene Rey B. SulapasNo ratings yet

- Dhikr Is The Greatest Obligation and A Perpetual Divine OrderDocument42 pagesDhikr Is The Greatest Obligation and A Perpetual Divine Ordermrpahary100% (1)

- The Contribution of Native Ethiopian Philosophers - Zara Yacob and Wolde Hiwot - To Ethiopian Philosophy by Tassew AsfawDocument17 pagesThe Contribution of Native Ethiopian Philosophers - Zara Yacob and Wolde Hiwot - To Ethiopian Philosophy by Tassew Asfawillumin7No ratings yet

- M. Fethullah Gulen - Questions and Answers About Islam (Vol.1)Document183 pagesM. Fethullah Gulen - Questions and Answers About Islam (Vol.1)Razman RazuwanNo ratings yet

- Historical Context: Rizal Law (Republic Act 1425)Document5 pagesHistorical Context: Rizal Law (Republic Act 1425)Aldrick PascuaNo ratings yet

- Understanding Consumerism and CreativityDocument28 pagesUnderstanding Consumerism and Creativityalok singhNo ratings yet

- Expanding Our Horizons Through SagittariusDocument6 pagesExpanding Our Horizons Through SagittariusReiki MasterNo ratings yet

- Crisis and Renewal: Successorship in Modern Sant MatDocument58 pagesCrisis and Renewal: Successorship in Modern Sant MatDr. Neil Tessler100% (2)

- Biography of Imam Muhammad Bin Ali (A.s.) (Al-Taqi) - M.M. Dungersi PH.D - XKPDocument47 pagesBiography of Imam Muhammad Bin Ali (A.s.) (Al-Taqi) - M.M. Dungersi PH.D - XKPIslamicMobility100% (1)

- Introductory LessonDocument21 pagesIntroductory LessonJerome PagsolinganNo ratings yet