Professional Documents

Culture Documents

Tax Amnesty Signed Into Law

Uploaded by

masshousegopCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Amnesty Signed Into Law

Uploaded by

masshousegopCopyright:

Available Formats

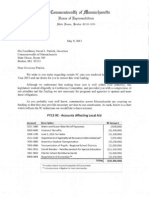

The Commonwealth of Massachusetts

House of Representatives

Sta te House, Boston, MA 0213310!"

BRADLEY H. JONES, JR.

STATE REPRESENTATIVE

MINORITY LEADER

20

TH

MIDDLESEX DISTRICT

READING NORTH READING

LYNNFIELD MIDDLETON

ROOM 124

TEL. (617) 722-2100

Bradley.Jones@MAHouse.gov

FOR IMMEDIATE RELEASE CONTACT: Peter Lorenz

July 11, 2014 1!"!22"2100

#ou$e M%nor%ty Le&'er (r&' Jone$) T&* A+ne$ty Pl&n S%,ne' Into L&-

Commonwealth Poised to Collect Millions in Otherwise Forgone Overdue Tax Liabilities

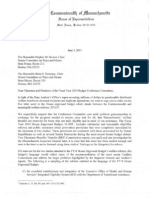

(OSTON The Commonwealth of Massachusetts is now in a position to collect millions of dollars in overdue

tax liabilities which might otherwise be forgone, thanks to a tax amnesty plan offered by House Minority

Leader radley H! "ones, "r! #$%&orth $eading', and signed into law by (overnor )atrick as part of the *iscal

+ear ,-./ budget!

0ffered in advance of debate of the *+./ budget in the House of $epresentatives, the proposal offers tax

amnesty to individuals and businesses that are delin1uent in their payments to the 2epartment of $evenue!

3The repeated success of this tax amnesty program is not by accident, and should serve as proof of the validity

of allowing default taxpayers to remit their obligations to the Commonwealth without penalty,4 said

$epresentative "ones! 3Having offered this amendment in years past and witnessing its resounding success, 5

thank my colleagues in the House and 6enate for being receptive to this necessary and timely measure!4

5n addition to replenishing forgone tax revenue, the amnesty proposal takes a pivotal step in addressing the

ongoing narcotics epidemic facing the Commonwealth! y allocating a maximum of 7/ million toward the

6ubstance 8buse 6ervices *und, the Legislature has indicated to the residents of the Commonwealth its

commitment to eradicate drug abuse and addiction within our state!

The tax amnesty program will be made available to those taxpayers who failed to file a timely tax return or

underreported their income9 failed to pay any outstanding tax liability9 or failed to pay the proper amount on a

re1uired estimated tax payment! Those who come forward and pay their taxes and interest in full within the

designated two%month amnesty period will not be assessed any penalties! *urthermore, the penalty waiver will

not be made available to any individual who is or has been the sub:ect of a tax%related criminal investigation or

prosecution!

)revious tax amnesty proposals offered by House Minority Leader rad "ones during debates on budgets for

*iscal +ears ,--;, ,--<, and ,-.- brought in a collective 7.=>!? million! 5t is estimated that this year@s tax

amnesty program will bring in an estimated 7;/ million in overdue tax liabilities!

AAA

You might also like

- Ronald W. ReaganDocument90 pagesRonald W. ReaganCristi DoniciNo ratings yet

- ScavengeDocument162 pagesScavengeIvan GeiryNo ratings yet

- Sensitivity AnalysisDocument23 pagesSensitivity AnalysisKamrul Hasan0% (1)

- 02 Veterans Federation of The Philippines V ReyesDocument4 pages02 Veterans Federation of The Philippines V ReyesKako Schulze CojuangcoNo ratings yet

- Barangay Magallanes: Republic of The Philippines Province of Southern Leyte Municipality of LimasawaDocument1 pageBarangay Magallanes: Republic of The Philippines Province of Southern Leyte Municipality of LimasawaBai Nilo75% (4)

- Danger Numbers in The NewsroomDocument5 pagesDanger Numbers in The NewsroomMa Luisa Antonio PinedaNo ratings yet

- Introduction To Cost Estimation: Unit 3Document45 pagesIntroduction To Cost Estimation: Unit 3Zubair Syed100% (1)

- Financial Management - PPT - Pgdm2010Document94 pagesFinancial Management - PPT - Pgdm2010Prabhakar Patnaik100% (1)

- The Philippine Monetary System and PolicyDocument43 pagesThe Philippine Monetary System and PolicyArrianne Zeanna77% (13)

- The North Dakota Legislative ReviewDocument7 pagesThe North Dakota Legislative ReviewBrett NarlochNo ratings yet

- Christiana Summer 2011 NewsletterDocument2 pagesChristiana Summer 2011 NewsletterPAHouseGOPNo ratings yet

- Senate Hearing, 114TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2016Document288 pagesSenate Hearing, 114TH Congress - Financial Services and General Government Appropriations For Fiscal Year 2016Scribd Government DocsNo ratings yet

- Senior Expo 2011: Martin CauserDocument4 pagesSenior Expo 2011: Martin CauserPAHouseGOPNo ratings yet

- You're Invited To My Open House: Dear NeighborDocument4 pagesYou're Invited To My Open House: Dear NeighborPAHouseGOPNo ratings yet

- Fed-Postal Pension Letter POTUS 070111Document2 pagesFed-Postal Pension Letter POTUS 070111leejolieNo ratings yet

- FY14 BRA Draft ReportDocument48 pagesFY14 BRA Draft ReportSusie CambriaNo ratings yet

- State of Minnesota: Office of Governor Mark DaytonDocument2 pagesState of Minnesota: Office of Governor Mark DaytonRachel E. Stassen-BergerNo ratings yet

- Jobs, Jobs, Jobs: Follow What's Happening OnDocument4 pagesJobs, Jobs, Jobs: Follow What's Happening OnPAHouseGOPNo ratings yet

- Community Bulletin - April 2013Document9 pagesCommunity Bulletin - April 2013State Senator Liz KruegerNo ratings yet

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationDocument22 pagesPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldNo ratings yet

- Dave Hickernell: Dear NeighborDocument4 pagesDave Hickernell: Dear NeighborPAHouseGOPNo ratings yet

- Brown Week in ReviewDocument3 pagesBrown Week in Reviewapi-215003736No ratings yet

- Rep. Perry Summer 2011 NewsletterDocument4 pagesRep. Perry Summer 2011 NewsletterPAHouseGOPNo ratings yet

- Pederson Week in ReviewDocument2 pagesPederson Week in Reviewapi-215003736No ratings yet

- Resolution Restoring Homestead Rebate and Senior Freeze ProgramsDocument2 pagesResolution Restoring Homestead Rebate and Senior Freeze Programsjmjr30No ratings yet

- SPEECH: Statement, Committee On The Budget, Comments On The President's FY 2010 BudgetDocument4 pagesSPEECH: Statement, Committee On The Budget, Comments On The President's FY 2010 BudgetpedropierluisiNo ratings yet

- Taxation: A. Definition, Purpose and BasisDocument4 pagesTaxation: A. Definition, Purpose and BasisMichelle Mae MabanoNo ratings yet

- 2010 Mayor Ve To MSGDocument8 pages2010 Mayor Ve To MSGParkRidgeUndergroundNo ratings yet

- Reichley Report Summer 2011Document4 pagesReichley Report Summer 2011PAHouseGOPNo ratings yet

- 2013 4 16 Week in ReviewDocument2 pages2013 4 16 Week in Reviewapi-215003736No ratings yet

- 2011 Action AgendaDocument52 pages2011 Action AgendaWFSEc28No ratings yet

- 2011-12 State Budget Is Tough, But Reins in State Spending: For The 144 From State RepresentativeDocument4 pages2011-12 State Budget Is Tough, But Reins in State Spending: For The 144 From State RepresentativePAHouseGOPNo ratings yet

- Ending The ShutdownDocument3 pagesEnding The ShutdownRachel E. Stassen-BergerNo ratings yet

- What Older Adults Need From CongressDocument2 pagesWhat Older Adults Need From CongressIndiana Family to FamilyNo ratings yet

- Dracut 2014 Financial Update For Bond InvestorsDocument88 pagesDracut 2014 Financial Update For Bond InvestorsdracutcivicwatchNo ratings yet

- Downing, Karley - GOV: SentDocument97 pagesDowning, Karley - GOV: SentWisconsinOpenRecordsNo ratings yet

- 2013 5 14 Week in ReviewDocument2 pages2013 5 14 Week in Reviewapi-215003736No ratings yet

- Best Worst 2011Document20 pagesBest Worst 2011Steve CouncilNo ratings yet

- Sessions Issues Opening Statement at Budget Committee Mark-UpDocument4 pagesSessions Issues Opening Statement at Budget Committee Mark-Upapi-127658921No ratings yet

- American Rescue Plan Act - Leg Council SummaryDocument3 pagesAmerican Rescue Plan Act - Leg Council SummaryTyler AxnessNo ratings yet

- Liheap Suppbudget 10152013Document1 pageLiheap Suppbudget 10152013api-245362402No ratings yet

- Dan Moul: Date: Time: LocationDocument4 pagesDan Moul: Date: Time: LocationPAHouseGOPNo ratings yet

- Secwepemc BC Reconciliation Agreement Apr 8 2013Document4 pagesSecwepemc BC Reconciliation Agreement Apr 8 2013Russell Diabo100% (1)

- Mike Tobash: Keep in Touch!Document4 pagesMike Tobash: Keep in Touch!PAHouseGOPNo ratings yet

- TAXATIONDocument3 pagesTAXATIONFhatima Ashra Latip WajaNo ratings yet

- Carta de Lew A RyanDocument2 pagesCarta de Lew A RyanMetro Puerto RicoNo ratings yet

- Press ReleaseDocument9 pagesPress Releaseapi-315529724No ratings yet

- Mayor Bowser Letter To Senate and House Leadership 7-20-20Document2 pagesMayor Bowser Letter To Senate and House Leadership 7-20-20DCOH EditorNo ratings yet

- Weekly Legislative Action Alert From Jackie Cilley 3-14-2011Document7 pagesWeekly Legislative Action Alert From Jackie Cilley 3-14-2011KyleNo ratings yet

- Dear Colleague - COVID 3.5Document3 pagesDear Colleague - COVID 3.5Fox NewsNo ratings yet

- 2021 NYS Legislative AgendaDocument2 pages2021 NYS Legislative AgendaThe Livingston County NewsNo ratings yet

- Top 5 ThingsDocument1 pageTop 5 ThingsMichelle Benson0% (1)

- 05 - 14 - 2020 CRF Mills Delegation LetterDocument4 pages05 - 14 - 2020 CRF Mills Delegation LetterNEWS CENTER MaineNo ratings yet

- Sample Ballot With Selected CandidatesDocument4 pagesSample Ballot With Selected CandidatesDarren BahamNo ratings yet

- Fall 2011: Right To Self-Defense Enacted Into LawDocument4 pagesFall 2011: Right To Self-Defense Enacted Into LawPAHouseGOPNo ratings yet

- A Roadmap To BetterDocument16 pagesA Roadmap To BetterTexas Comptroller of Public AccountsNo ratings yet

- On-Time 2011-12 State Budget Balanced With No Tax Increases & Common Sense Welfare ReformDocument4 pagesOn-Time 2011-12 State Budget Balanced With No Tax Increases & Common Sense Welfare ReformPAHouseGOPNo ratings yet

- House Hearing, 110TH Congress - Budgeting To Fight Waste, Fraud and AbuseDocument76 pagesHouse Hearing, 110TH Congress - Budgeting To Fight Waste, Fraud and AbuseScribd Government DocsNo ratings yet

- Municipal Resolution For CIRDocument2 pagesMunicipal Resolution For CIRBjustb LoeweNo ratings yet

- 2013 House Notes - Week 7Document4 pages2013 House Notes - Week 7RepNLandryNo ratings yet

- (As Enacted) (As Enacted) (As Enacted) (As Enacted)Document15 pages(As Enacted) (As Enacted) (As Enacted) (As Enacted)Michan ConnorNo ratings yet

- Statement of League of Postmasters To Senate Panel 9/6/11Document8 pagesStatement of League of Postmasters To Senate Panel 9/6/11PostalReporter.comNo ratings yet

- Community Bulletin - April 2014Document11 pagesCommunity Bulletin - April 2014State Senator Liz KruegerNo ratings yet

- District Budget Passes Council 052213Document2 pagesDistrict Budget Passes Council 052213Susie CambriaNo ratings yet

- Mandate Letter: British Columbia Ministry of FinanceDocument3 pagesMandate Letter: British Columbia Ministry of FinanceBC New DemocratsNo ratings yet

- April Fools MN House Week in ReviewDocument6 pagesApril Fools MN House Week in ReviewquantataNo ratings yet

- Senate Democratic Conference Introduce The "Clean Up Albany" Legislative PackageDocument6 pagesSenate Democratic Conference Introduce The "Clean Up Albany" Legislative PackageNew York State Senate Democratic ConferenceNo ratings yet

- NAL Legislative Update #7, 112th Congress, 12-1-11Document2 pagesNAL Legislative Update #7, 112th Congress, 12-1-11The Garden Club of AmericaNo ratings yet

- Rep. Jones Calls For Ban On Female Genital MutilationDocument3 pagesRep. Jones Calls For Ban On Female Genital MutilationmasshousegopNo ratings yet

- Baker-Polito Administration Awards $3 Million To Support Critical Water InfrastructureDocument3 pagesBaker-Polito Administration Awards $3 Million To Support Critical Water InfrastructuremasshousegopNo ratings yet

- Rep. Jones Calls For Ban On Female Genital MutilationDocument2 pagesRep. Jones Calls For Ban On Female Genital MutilationmasshousegopNo ratings yet

- 2020 FF Pamphlet Info Flyer - FinalDocument2 pages2020 FF Pamphlet Info Flyer - FinalmasshousegopNo ratings yet

- 2018 EPO FlyerDocument2 pages2018 EPO FlyermasshousegopNo ratings yet

- Rep. Jones Calls For Ban On Female Genital MutilationDocument2 pagesRep. Jones Calls For Ban On Female Genital MutilationmasshousegopNo ratings yet

- Baker-Polito Administration Awards $3 Million To Support Critical Water InfrastructureDocument3 pagesBaker-Polito Administration Awards $3 Million To Support Critical Water InfrastructuremasshousegopNo ratings yet

- Baker-Polito Administration Awards $3 Million To Support Critical Water InfrastructureDocument3 pagesBaker-Polito Administration Awards $3 Million To Support Critical Water InfrastructuremasshousegopNo ratings yet

- Massachusetts Legislature Passes Sweeping Reform To Address Rape Kit ReformDocument2 pagesMassachusetts Legislature Passes Sweeping Reform To Address Rape Kit ReformmasshousegopNo ratings yet

- Relief and Recovery Resources For Puerto RicoDocument4 pagesRelief and Recovery Resources For Puerto RicomasshousegopNo ratings yet

- Rep Will Press For Corporate Tax Amnesty ProgramDocument1 pageRep Will Press For Corporate Tax Amnesty ProgrammasshousegopNo ratings yet

- Health Connector Letter To Conference CommitteeDocument3 pagesHealth Connector Letter To Conference CommitteemasshousegopNo ratings yet

- Massachusetts Lawmaker Says Proposed Amnesty Could Net Up To $20 Million 12-03-14Document2 pagesMassachusetts Lawmaker Says Proposed Amnesty Could Net Up To $20 Million 12-03-14masshousegopNo ratings yet

- Letter To Browns Berger Regarding S Orb CommissionDocument1 pageLetter To Browns Berger Regarding S Orb CommissionmasshousegopNo ratings yet

- Health Connector Cost AnalysisDocument13 pagesHealth Connector Cost AnalysismasshousegopNo ratings yet

- NICS Fix LetterDocument4 pagesNICS Fix LettermasshousegopNo ratings yet

- Amnesty Program - SHNSDocument2 pagesAmnesty Program - SHNSmasshousegopNo ratings yet

- Immigration Detainee SummitDocument1 pageImmigration Detainee SummitmasshousegopNo ratings yet

- Immigration Summit Media AdvisoryDocument1 pageImmigration Summit Media AdvisorymasshousegopNo ratings yet

- Just in A Pelletier Letter To Governor PatrickDocument2 pagesJust in A Pelletier Letter To Governor Patrickmasshousegop100% (1)

- Justina Pelletier Reunification PlanDocument2 pagesJustina Pelletier Reunification PlanmasshousegopNo ratings yet

- Statement On CWLA RecommendationsDocument1 pageStatement On CWLA RecommendationsmasshousegopNo ratings yet

- House Republican Caucus' Transportation Finance ProposalDocument10 pagesHouse Republican Caucus' Transportation Finance ProposalmasshousegopNo ratings yet

- Gov Rick Scott LetterDocument2 pagesGov Rick Scott LettermasshousegopNo ratings yet

- Letter To Governor Regarding 9C CutsDocument4 pagesLetter To Governor Regarding 9C CutsmasshousegopNo ratings yet

- EBTLetter To CCDocument12 pagesEBTLetter To CCmasshousegopNo ratings yet

- Big by Resignation Letter To GovernorDocument2 pagesBig by Resignation Letter To GovernormasshousegopNo ratings yet

- House Republican Caucus' Transportation Finance ProposalDocument10 pagesHouse Republican Caucus' Transportation Finance ProposalmasshousegopNo ratings yet

- Telegram&GazetteEditorial - Bigby Should GoDocument2 pagesTelegram&GazetteEditorial - Bigby Should GomasshousegopNo ratings yet

- 16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostDocument16 pages16 Budgeting - Capital Expenditures, Research & Development Expenditures, and Cash - PERT-CostMarizMatampaleNo ratings yet

- Final Magazine APRIL ISSUE 2016 Final Winth Cover PageDocument134 pagesFinal Magazine APRIL ISSUE 2016 Final Winth Cover PagePrasanna KumarNo ratings yet

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedNo ratings yet

- Myanmar Agriculture Sector ReviewDocument19 pagesMyanmar Agriculture Sector Reviewpoppytrang100% (1)

- Topic 4 Cashflow and Financial PlanningDocument52 pagesTopic 4 Cashflow and Financial PlanningbriogeliqueNo ratings yet

- Clarion 11 FinalDocument2 pagesClarion 11 Finalapi-259871011No ratings yet

- Budgeting CSECDocument4 pagesBudgeting CSECTyanna TaylorNo ratings yet

- Ghana Budget 2012 HighlightsDocument30 pagesGhana Budget 2012 HighlightsNoble Obeng-AnkamahNo ratings yet

- Exam 2014 With Memo PDFDocument46 pagesExam 2014 With Memo PDFTumi Mothusi100% (1)

- CH 22 Various Exercises Setup 27 Ed.Document6 pagesCH 22 Various Exercises Setup 27 Ed.Kearrion BryantNo ratings yet

- Indian Economy - Challenges & Opportunities PDFDocument3 pagesIndian Economy - Challenges & Opportunities PDFDhiraj MeenaNo ratings yet

- 2011 Budget BookDocument428 pages2011 Budget BookAdam ChiaraNo ratings yet

- SumairaDocument32 pagesSumairaAmjad KhanNo ratings yet

- NL 2017 JulDocument12 pagesNL 2017 JulZahid KhanNo ratings yet

- Texans' Homestead Protection ActDocument2 pagesTexans' Homestead Protection ActJennifer HarrisNo ratings yet

- Finance and Administration FunctionsDocument2 pagesFinance and Administration FunctionsElmer Nonesa Casem EstabilloNo ratings yet

- Organigrama Vigente Serpar LimaDocument1 pageOrganigrama Vigente Serpar LimaJohnny CruzNo ratings yet

- Zim Asset SummaryDocument5 pagesZim Asset SummarySolomon ZindomaNo ratings yet

- Income Tax Planning in India With Respectto Individual Assessee Marketing VFN GroupDocument100 pagesIncome Tax Planning in India With Respectto Individual Assessee Marketing VFN GroupRahul Gujjar100% (1)

- Guidance Letter To States Medicaid DirectorDocument5 pagesGuidance Letter To States Medicaid DirectorBeverly TranNo ratings yet

- 2016 Budget Guidelines PDFDocument136 pages2016 Budget Guidelines PDFNYAMEKYE ADOMAKONo ratings yet